Joint Employment Land Review Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Chatter~ Whitfield Mm Mining Museum

Chatter~ Whitfield mm Mining Museum By Car The colliery is approx 2 miles from Tunstall on the A527 to Biddulph and Congleton . • By Train From Stoke Station PMT (Red) buses 3/4/7/24/25/46 go to Hanley. From Congleton Station, Crosville (Green) buses 96/97/198 go to Biddulph . • By Bus From Hanley PMT route 6 to Biddulph. From Newcastle or Tunstall route 17 to Biddulph . • By Canal The colliery is approx 2 miles from the Caldan canal and 3 miles from the Trent and Mersey. Taxi service is available from your mooring. Tel: Stoke-on-Trent 534927 Chatterley Whitfield Mining Museum Trust Challerley Whitfield Colliery Tunstall . Stoke-on.Trent ST6 8UN Telephone: 0782 84221 Telephone: 0782 813337 (alter May 1979) Ch",Ueriey Whilhcld MmmQ MUSl'um Tru5t tf'Sf'rV"" Ih" nqhl to ••• tuse ",dml5$IOn lor Whdl ••vt .• purpos<'. Stoke-an-Trent is famous for its pottery, The Museum but the mining of coal has been an Saturday 26th May 1979 important industry in North Staffordshire Guided tours of the underground for many centuries. Coal could fire bottle workings begin on 26th May. ovens, drive steam engines and reduce Displays in the Holly Lane seam 700 feet iron are. It was an essential ingredient of below ground show the development of the Industrial Revolution. mining technology from hand working to modern machinery. North Staffordshire coal was collected from outcrops as early as the 13th century. Various pits existed at Whitfield • by 1800 but in 1900 Chatledey Whitfield Guided tours begin in the lamproom Colliery had grown to be the first in which offers an exhibition, museum shop Britain to win 1 million tons of coal a year. -

Industrial Heritage, Tourism and Old Industrial Buildings: Charting the Difficult Path from Redundancy to Heritage Attraction

RESEARCH Cutting Edge 1997 Industrial heritage, tourism and old industrial buildings: charting the difficult path from redundancy to heritage attraction Rick Ball, Staffordshire University ISBN 0-85406-864-3 INDUSTRIAL HERITAGE, TOURISM AND OLD INDUSTRIAL BUILDINGS: CHARTING THE DIFFICULT PATH FROM REDUNDANCY TO HERITAGE ATTRACTION Dr. Rick Ball Division of Geography Staffordshire University Leek Road Stoke-on-Trent ST4 2DF UK Abstract This exploratory paper considers the processes, problems and constraints involved in the transition of old industrial buildings, often those prone to vacancy, into heritage and tourism- linked uses. It discusses the heritage-property nexus with regard to industrial buildings, and builds an empirical picture of such relationships in a specific local property arena. The discussion is partly based on research projects completed in a number of localities within the British West Midlands. In particular, it draws on work on the evaluation of European Commission Community Initiatives in the West Midlands that have targetted tourism development, as well as on EPSRC funded research focused on vacant industrial buildings in Stoke-on-Trent. As such, in scene-setting style, a structure is developed for the evaluation of heritage-property links with the emphasis on the small number of specific local projects that have at least partly sought to bring buildings back into use with some, perhaps extensive, degree of heritage activity in mind. 1. Heritage and the property domain - some introductory comments The background to this paper is the apparent reassertion of industrial heritage as a flavour of tourism in the late 1990s (Goodall, 1996), a process pursued with vigour in the quest for the renaissance of the urban industrial economy (see Ball and Stobart, 1996). -

Gresty Lane, Crewe

Mr Stephen Bell Our Ref: APP/R0660/A/13/2209335 GVA Your Ref: Norfolk House 7 Norfolk Street Manchester 19 January 2015 M2 1DW Dear Sir, TOWN AND COUNTRY PLANNING ACT 1990 – SECTION 78 APPEAL BY HIMOR GROUP LIMITED LAND BOUNDED BY GRESTY LANE, ROPE LANE, CREWE ROAD AND A500, CREWE - APPLICATION REF: 13/2874N 1. I am directed by the Secretary of State to say that consideration has been given to the report of the Inspector, Geoffrey Hill BSc DipTP MRTPI, who held a public local inquiry between 22 July and 27 August 2014 into your clients’ appeal against the failure of Cheshire East Council (“the Council”) to give notice within the prescribed period of a decision on an application for outline permission for residential development, retirement/care village, local centre, community building, primary school, public open space, allotments, structural landscaping, access arrangements and demolition of existing structures in accordance with application ref: 13/2874N, dated 12 July 2013. 2. The appeal was recovered for the Secretary of State’s determination on 17 December 2013, in pursuance of section 79 of, and paragraph 3 of Schedule 6 to, the Town and Country Planning Act 1990 because it involves a proposal for residential development of over 150 units which would significantly impact on the Government’s objective to secure a better balance between housing demand and supply and create high quality, sustainable, mixed and inclusive communities. Inspector’s recommendation and summary of the decision 3. The Inspector recommended that the appeal be dismissed, and planning permission refused. For the reasons given below, the Secretary of State agrees with the Inspector’s recommendation. -

Records of Wolverton Carriage and Wagon Works

Records of Wolverton Carriage and Wagon Works A cataloguing project made possible by the Friends of the National Railway Museum Trustees of the National Museum of Science & Industry Contents 1. Description of Entire Archive: WOLV (f onds level description ) Administrative/Biographical History Archival history Scope & content System of arrangement Related units of description at the NRM Related units of descr iption held elsewhere Useful Publications relating to this archive 2. Description of Management Records: WOLV/1 (sub fonds level description) Includes links to content 3. Description of Correspondence Records: WOLV/2 (sub fonds level description) Includes links to content 4. Description of Design Records: WOLV/3 (sub fonds level description) (listed on separate PDF list) Includes links to content 5. Description of Production Records: WOLV/4 (sub fonds level description) Includes links to content 6. Description of Workshop Records: WOLV/5 (sub fonds level description) Includes links to content 2 1. Description of entire archive (fonds level description) Title Records of Wolverton Carriage and Wagon Works Fonds reference c ode GB 0756 WOLV Dates 1831-1993 Extent & Medium of the unit of the 87 drawing rolls, fourteen large archive boxes, two large bundles, one wooden box containing glass slides, 309 unit of description standard archive boxes Name of creators Wolverton Carriage and Wagon Works Administrative/Biographical Origin, progress, development History Wolverton Carriage and Wagon Works is located on the northern boundary of Milton Keynes. It was established in 1838 for the construction and repair of locomotives for the London and Birmingham Railway. In 1846 The London and Birmingham Railway joined with the Grand Junction Railway to become the London North Western Railway (LNWR). -

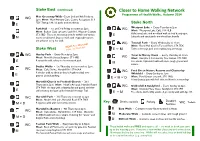

Closer to Home Walking Network

Stoke East (continued) Closer to Home Walking Network Programme of Health Walks, Autumn 2014 Meir Greenway Walk - Every 2nd and 4th Friday at WC 2pm Meet: Meir Primary Care Centre Reception, ST3 7DY Taking in Meir’s parks and woodlands. Stoke North E Westport Lake - Every Tuesday at 2pm Park Hall - 1st and 3rd Friday in month at 2pm WC Meet: Westport Lake Café, ST6 4LB Meet: Bolton Gate car park, Leek Rd., Weston Coyney, A flat canal, lake and woodland walk at local beauty spot. ST3 5BD This is an interesting area for wildlife and various E Lakeside and canal paths are wheelchair friendly. M routes are followed. Dogs on leads with responsible owners are welcome to try this walk. WC Tunstall Park - Every Wednesday at 11am Hartshill NEW! Four Meet: Floral Hall Café in Tunstall Park, ST6 7EX Stoke West walks on Thursdays E or M Takes in heritage park and neighbouring greenways. Hanley Park - Every Monday at 2pm WC WC Trent & Mersey Canal - Every Thursday at 11am Meet: Norfolk Street Surgery, ST1 4PB Meet: Sandyford Community Fire Station, ST6 5BX A canalside walk, taking in the renovated park. E M Free drinks. A pleasant walk with some rough ground and inclines. Stubbs Walks - 1st Thursday in the month at 2pm WC Meet: Cafe Divine, Hartshill Rd. ST4 6AA WC Ford Green Nature Reserve and Chatterley A circular walk of about an hour’s length on fairly level Whitfield - Every Sunday at 1pm E ground. Limited parking. E or M or D Meet: Ford Green car park, ST6 1NG A local beauty spot with hall, lake and historic surroundings. -

Economic Needs Assessment Newcastle-Under-Lyme & Stoke-On-Trent

Economic Needs Assessment Newcastle-under-Lyme & Stoke-on-Trent June 2020 Contents Executive Summary i 1. Introduction 1 2. National Policy and Guidance 4 3. Economic and Spatial Context 8 4. Local Economic Health-check 19 5. Overview of Employment Space 40 6. Commercial Property Market Review 59 7. Review of Employment Sites 81 8. Demand Assessment 93 9. Demand / Supply Balance 120 10. Strategic Sites Assessment 137 11. Summary and Conclusions 148 Appendix 1: Site Assessment Criteria Appendix 2: Site Assessment Proformas Appendix 3: Sector to Use Class Matrix Our reference NEWP3004 This report was commissioned in February 2020, and largely drafted over the period to June in line with the original programme for the Joint Local Plan. Discrete elements of the analysis, purely relating to supply, were completed beyond this point due to the limitations of lockdown. Executive Summary 1. This Economic Needs Assessment has been produced by Turley – alongside a separate but linked Housing Needs Assessment (HNA) – on behalf of Newcastle-under-Lyme Borough Council and Stoke-on-Trent City Council (‘the Councils’). It is intended to update their employment land evidence, last reviewed in 20151, and comply with national planning policy that has since been revised2. It provides evidence to inform the preparation of a Joint Local Plan, while establishing links with ambitious economic strategies that already exist to address local and wider priorities in this area. 2. It should be noted at the outset that while this report takes a long-term view guided by trends historically observed over a reasonable period of time, it has unfortunately been produced at a time of exceptional economic volatility. -

PRESS RELEASE New Lease of Life for Burslem School Of

PRESS RELEASE New lease of life for Burslem School of Art Burslem School of Art, in the heart of the Mothertown, will soon be embarking on a new chapter in its illustrious history. From September 2016, 200 students from Haywood Sixth Form Academy will move into the newly refurbished grade II listed building to enjoy purpose-built facilities. A state-of-the-art design enterprise suite will be used for engineering product design and textiles. A specialist photography suite will house its own dark room and Apple Macs to enable students to learn digital photography skills. An ICT ‘window on the world’ room and specialist computing laboratory will provide students with leading-edge computer equipment and there will also be a specialist science lab and language lab. Students will develop their artistic talents in the magnificent art room, with its huge windows and perfect lighting for artwork, following in the footsteps of the Burslem School of Art’s prestigious alumni, including Clarice Cliff, Susie Cooper and William Moorcroft. The Burslem School of Art Trust carried out a refurbishment of the building in 2000 and has developed and delivered many arts events, projects and activities over the past fifteen years, working with diverse communities and artists. Now, Haywood Sixth Form Academy is working closely with the Trust to form a partnership that will build on its fantastic work and secure the future of this beautiful building. Carl Ward, Executive Headteacher, said: “Haywood Sixth Form Academy is becoming as popular as I had hoped when many parents and students asked if we would consider opening, just a few years ago. -

Companies Referred to in the Ceramic and Allied Trades Union Collection

Companies referred to in the Ceramic and Allied Trades Union Collection Note - The following is a list of the companies which can be clearly identified in the CATU archive without any risk of confusion, the evidence coming from headed letter paper or something equally unassailable. This list is for information only. We can not retrieve documents from the collection from this list as the documents are spread throughout the collection in different files and have not been indexed. Many documents in the archive are much less clear cut (hand written notes, surveys etc) and it is not always easy to identify precisely which company is being referred to. One frequent potential source of confusion is that potbanks often had their own names, and these may sometimes look like company names. In practice, potbanks could change hands or be divided between more than one company. List of Companies in alphabetical order A B C D E F G H I J K L M N O P R S T V W A Wm. Adams & Sons Ltd Greenfield Pottery/ Greengates Pottery, Tunstall Adderleys Ltd Daisy Bank, Longton Alcock, Lindley & Bloore Ltd Shelton Alexandra Pottery Burslem Allertons Ltd Longton C. Amison & Co Ltd Longton Armitage Shanks Ltd Barrhead; Kilmarnock Armitage Ware Ltd Armitage Sanitary Pottery Geo. L. Ashworth & Bros Ltd Hanley Ault Potteries Ltd Swadlincote Ault & Tunnicliff Ltd Swadlincote H. Aynsley & Co Ltd Longton John Aynsley & Sons Ltd Longton Top of page B Barker Bros Ltd Meir Works, Longton Barlows (Longton) Ltd Belleek Pottery Ltd Belleek, Co. Fermanagh Beswick & Sons Longton Biltons (1912) Ltd Stoke Blythe Colour Works Ltd Cresswell, Stoke Blythe Porcelain Co Longton T. -

(South) Environmental Statement Volume 2, Main Statement Crewe Green Link Road South Crewe, Cheshire

Highways Crewe Green Link Road (South) Environmental Statement Volume 2, Main Statement Crewe Green Link Road South Crewe, Cheshire October 2012 B1772401/OD/38 Highways Page Not Used B1772401-OD38 ES final for approval .doc Highways Originated by Checked by Reviewed by Approved by ORIGINAL NAME NAME NAME NAME Simon Bird Elinor Phillips Elinor Phillips Rosie Simon DATE 18/10/12 INITIALS INITIALS INITIALS INITIALS Draft Document Status REVISION NAME NAME NAME NAME DATE INITIALS INITIALS INITIALS INITIALS Document Status REVISION NAME NAME NAME NAME DATE INITIALS INITIALS INITIALS INITIALS Document Status REVISION NAME NAME NAME NAME DATE INITIALS INITIALS INITIALS INITIALS Document Status Jacobs U.K. Limited This document has been prepared by a division, subsidiary or affiliate of Jacobs U.K. Limited (“Jacobs”) in its professional capacity as consultants in accordance with the terms and conditions of Jacobs’ contract with the commissioning party (the “Client”). Regard should be had to those terms and conditions when considering and/or placing any reliance on this document. No part of this document may be copied or reproduced by any means without prior written permission from Jacobs. If you have received this document in error, please destroy all copies in your possession or control and notify Jacobs. Any advice, opinions, or recommendations within this document (a) should be read and relied upon only in the context of the document as a whole; (b) do not, in any way, purport to include any manner of legal advice or opinion; (c) are based upon the information made available to Jacobs at the date of this document and on current UK standards, codes, technology and construction practices as at the date of this document. -

High Speed Rail 2 (Phase Two) in Staffordshire Response to The

High Speed Rail 2 (Phase Two) in Staffordshire Response to the Phase Two Route Consultation CONTENTS INTRODUCTION ......................................................................................................................... 1 QUESTION ONE ......................................................................................................................... 2 QUESTION TWO ...................................................................................................................... 17 QUESTION THREE .................................................................................................................. 19 QUESTION FOUR .................................................................................................................... 23 QUESTION FIVE ....................................................................................................................... 24 QUESTION SIX ......................................................................................................................... 25 QUESTION SEVEN .................................................................................................................. 26 QUESTION EIGHT .................................................................................................................... 33 QUESTION NINE ...................................................................................................................... 36 High Speed Rail 2 in Staffordshire Route Consultation Response Phase Two INTRODUCTION This is a joint response -

Colourful Clarice Cliff Kicks Off Sunday Sales and Decorative Arts Series at South Kensington

For Immediate Release 22 December 2004 Contact: Zoe Schoon 020 7752 3121 [email protected] COLOURFUL CLARICE CLIFF KICKS OFF SUNDAY SALES AND DECORATIVE ARTS SERIES AT SOUTH KENSINGTON Decorative Art Sales 2005 Christie’s South Kensington London – An extensive selection of Clarice Cliff opens Christie’s 2005 Decorative Arts sales in South Kensington. The bumper 300-lot sale on 20 February is a must for collectors of the designer’s colourful ceramics. The Clarice Cliff sale is the very first to be held on a Sunday at Christie’s South Kensington. Christie’s is the worldwide market leader in 20th Century Decorative Arts, and the South Kensington series of sales will feature ceramics, glass, sculpture, lighting, furniture and metalworks from all the key art movements of the late 19th and early 20th centuries. Whether seeking to decorate a home or simply interested in the decorative arts, shoppers in South Kensington will be able to browse, place bids, seek valuations and advice from specialists 10-4pm on both Saturday and Sunday. CLARICE CLIFF Sunday 20 February 2005 The first ever Sunday Sale at Christie’s South Kensington, the Clarice Cliff sale features an extensive single-owner collection of over 180 lots, including sugar sifters, preserve pots, novelty wares, vases, jugs, tea and coffee wares, candlesticks, chargers, bookends and table wares. A rermarkable range of patterns on offer includes the sought-after Applique range including Palermo, Lugano, Avignon and Idyll, as well as abstract, landscape, flower, fruit and geometric designs. There are a staggering array of over 20 lotus jugs in varying patterns. -

Strategic Flood Risk Assessment Executive Summary

North Staffordshire Strategic Flood Risk Assessment for Local Development Framework Level 1 Executive Summary July 2008 Halcrow Group Limited North Staffordshire Strategic Flood Risk Assessment for Local Development Framework Level 1 Executive Summary July 2008 Halcrow Group Limited Halcrow Group Limited Lyndon House 62 Hagley Road Edgbaston Birmingham B16 8PE Tel +44 (0)121 456 2345 Fax +44 (0)121 456 1569 www.halcrow.com Halcrow Group Limited has prepared this report in accordance with the brief from Gloucestershire County Council, for their sole and specific use. Any other persons who use any information contained herein do so at their own risk. © Halcrow Group Limited 2008 North Staffordshire Strategic Flood Risk Assessment for Local Development Framework Level 1 Executive Summary Contents Amendment Record This report has been issued and amended as follows: Issue Revision Description Date Signed 1 0 Executive Summary 08/07/2008 RD Prepared by: Caroline Mills Final: 08/07/08 Checked by: Beccy Dunn Final: 08/07/08 Approved by: John Parkin Final: 08/07/08 Level 1 Strategic Flood Risk Assessment: Executive Summary Gloucestershire County Council This page is left intentionally blank Level 1 Strategic Flood Risk Assessment: Executive Summary Gloucestershire County Council 1 Executive Summary 1.1 Background In September 2007 Stoke-on-Trent City Council and Newcastle-under-Lyme Borough Council commissioned Halcrow to produce a Level 1 Strategic Flood Risk Assessment (SFRA). Figure 1: North Staffordshire SFRA Study Area The SFRA has been prepared to support the application of the Sequential Test (by the Councils) outlined in Planning Policy Statement 25: Development and Flood Risk (PPS25), and to provide information and advice in relation to land allocations and development control.