View Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Asx Clear – Acceptable Collateral List 28

et6 ASX CLEAR – ACCEPTABLE COLLATERAL LIST Effective from 20 September 2021 APPROVED SECURITIES AND COVER Subject to approval and on such conditions as ASX Clear may determine from time to time, the following may be provided in respect of margin: Cover provided in Instrument Approved Cover Valuation Haircut respect of Initial Margin Cash Cover AUD Cash N/A Additional Initial Margin Specific Cover N/A Cash S&P/ASX 200 Securities Tiered Initial Margin Equities ETFs Tiered Notes to the table . All securities in the table are classified as Unrestricted (accepted as general Collateral and specific cover); . Specific cover only securities are not included in the table. Any securities is acceptable as specific cover, with the exception of ASX securities as well as Participant issued or Parent/associated entity issued securities lodged against a House Account; . Haircut refers to the percentage discount applied to the market value of securities during collateral valuation. ASX Code Security Name Haircut A2M The A2 Milk Company Limited 30% AAA Betashares Australian High Interest Cash ETF 15% ABC Adelaide Brighton Ltd 30% ABP Abacus Property Group 30% AGL AGL Energy Limited 20% AIA Auckland International Airport Limited 30% ALD Ampol Limited 30% ALL Aristocrat Leisure Ltd 30% ALQ ALS Limited 30% ALU Altium Limited 30% ALX Atlas Arteria Limited 30% AMC Amcor Ltd 15% AMP AMP Ltd 20% ANN Ansell Ltd 30% ANZ Australia & New Zealand Banking Group Ltd 20% © 2021 ASX Limited ABN 98 008 624 691 1/7 ASX Code Security Name Haircut APA APA Group 15% APE AP -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

ASX Limited Annual Report ASX Limited ABN 98 008 624 691 Who We Are

2009 ASX Limited Annual Report ASX Limited ABN 98 008 624 691 Who We Are ASX Limited (ASX) was created by the merger of the Australian Stock Exchange and SFE Corporation, holding company for the Sydney Futures Exchange, in July 2006. ASX operates under the brand name Australian Securities Exchange and is one of the world’s top-10 listed exchange groups measured by market capitalisation. ASX is a multi-asset class, vertically integrated exchange group. Its activities span the primary market and capital formation process, secondary market trading and price discovery, central counterparty risk transfer, and securities settlement for both the equities and fixed income (including over-the-counter) markets. ASX functions as a market operator, supervisor, clearing house and payments system facilitator. It promotes good corporate governance among Australia’s listed companies and helps educate retail investors. The diverse domestic and international customer base of ASX includes issuers (such as corporations and trusts) of a variety of listed securities, investment and trading banks, fund managers, hedge funds, commodity trading advisers, proprietary and retail traders, and retail investors. Underpinning ASX’s activities as a market operator is the quality of the supervision performed by its wholly-owned subsidiary, ASX Markets Supervision (ASXMS). The long-term sustainability of ASX as a market operator is inextricably linked to operating markets of maximum integrity. Quality supervision is critical to market confidence and the maintenance of fair, orderly and transparent markets. ASX’s commitment to supervision is deeper than the fulfilment of a licence obligation. Confidence in the integrity of ASX markets and its clearing and settlement facilities is reinforced by the regulatory oversight of the Australian Securities and Investments Commission (ASIC) and the Reserve Bank of Australia (RBA). -

Aon Non Executive Director Survey Participating Organisations (Pdf, 181.66Kb)

Proprietary and Confidential Constituent Organisations . Abacus Property Group . Bendigo and Adelaide Bank Limited . Accent Group Limited . BHP Group Limited . Adelaide Brighton Ltd. Bingo Industries Ltd. Afterpay Touch Group Limited . Blackmores Limited . AGL Energy Limited . Blue Sky Alternative Investments Ltd. Alacer Gold Corp. Bluescope Steel Limited . ALS Ltd. Boral Limited . Altium Limited . Brambles Limited . Altura Mining Ltd. Bravura Solutions Limited . Alumina Ltd. Breville Group Limited . AMA Group Ltd. Brickworks Ltd. amaysim Australia Ltd. Bubs Australia Ltd. Amcor Plc . BWX Ltd. AMP Ltd. Caltex Australia Ltd. Ansell Limited . Cardno Limited . APA Group . Carnarvon Petroleum Limited . APN Industria REIT . Carsales.Com Limited . Appen Ltd. Cedar Woods Properties Limited . ARB Corp. Ltd. Centuria Capital Group . Ardent Leisure Group Ltd. Challenger Limited . Arena REIT . Champion Iron Ltd. Aristocrat Leisure Limited . Charter Hall Group . Arq Group Ltd. Charter Hall Long WALE REIT . Asaleo Care Ltd. Charter Hall Retail REIT . ASX Limited . Chorus Ltd. Atlas Arteria . CIMIC Group Ltd. AUB Group Limited . Class Ltd. (Australia) . Auckland International Airport Ltd. Clean Teq Holdings Limited . Audinate Group Ltd. Cleanaway Waste Management Ltd. Aurelia Metals Limited . Clinuvel Pharmaceuticals Limited . Aurizon Holdings Ltd. Coca-Cola Amatil Ltd. AusNet Services Ltd. Cochlear Limited . Austal Limited . Codan Limited . Australia & New Zealand Banking Group . Coles Group Ltd. Ltd. Collins Foods Limited . Australian Agricultural Co. Ltd. Commonwealth Bank of Australia . Australian Pharmaceutical Industries Ltd. Computershare Limited . Australian Scholarships Group . Cooper Energy Limited . Automotive Holdings Group Ltd. Coopers Brewery Ltd . Avanti Finance Limited . Corporate Travel Management Limited . Aventus Group . Costa Group Holdings Ltd. Aveo Group . Credit Corp. Group Ltd. Avita Medical Ltd. Cromwell Property Group . Baby Bunting Group Ltd. -

Appendix 4E and Annual Report for the Financial Period Ended 30 September 2017

13 November 2017 Appendix 4E and Annual Report for the Financial Period Ended 30 September 2017 Elders Limited (ASX: ELD) today reports its results for the financial year ended 30 September 2017. Attached is the Appendix 4E (Results for announcement to the market), and Annual Report for the 12 month financial period ended 30 September 2017. Peter Hastings Company Secretary For personal use only 1 ELDERS LIMITED — APPENDIX 4E (RULE 4.3A) FINAL FINANCIAL REPORT RESULTS FOR ANNOUNCEMENT TO THE MARKET For the year ended 30 September 2017 Attached is the final report for the year ended 30 September 2017. The consolidated profit after tax and non-controlling interests was $116.0 million (2016: $51.6 million). Additional Appendix 4E disclosure requirements and further details on the results and operations are included in the Annual Report provided to the Australian Securities Exchange. Result $000 Revenue from continuing operations up 6% to 1,603,137 Profit from continuing operations after tax attributable to members up 79% 111,459 Profit from discontinued operations after tax attributable to members n/m* 4,536 Profit after tax for the year attributable to members up 125% to 115,995 * percentage movement in result not meaningful Dividends Amount per Franked amount security per security 2017 Final dividend 7.5 cents 7.5 cents Special dividend 7.5 cents 7.5 cents Interim dividend Nil n/a 2016 Final dividend Nil n/a Special dividend Nil n/a Interim dividend Nil n/a The record date for both the final and special dividend is 21 November 2017; and payable on 15 December 2017. -

View Annual Report

Our clients and their needs are our central focus ~ all day, every day. Elders is an Australian company whose principal business is rural services. Australian and New Zealand primary producers are the central focus of our business. Elders provides the physical, financial and service inputs for them to achieve the most successful production and sales from their efforts. Our trading operations and joint ventures work to add value and achieve premium prices for Australian agricultural produce in world markets. Elders also operates leading businesses in forestry and automotive component manufacture. Front cover: Elders’ clients (top left clockwise): Russell Hall, the Butterick family, Glen Ford and his grandson, Alec Moore and his wife Jo Moore. 1 Elders’ four Strategic Cornerstones Elders is building its future on four strategic cornerstones identified as being essential for the achievement of the excellence that our shareholders and clients desire: Generating improved returns for Procuring and moving our clients and shareholders by the right product at the right being the best at understanding time most efficiently. and serving client needs. High Supply performance chain sales excellence capability Cost and Superior service- capital effective management technology Developing and applying Managing the Company’s technology to improve financial resources to advantage outcomes while meeting cost efficient operation and improve and service quality standards. shareholder value. 2 Our Business Rural Services Forestry Futuris Automotive • 338 Australian -

Correction to Appendix 4D for the Period Ended 31 March 2021

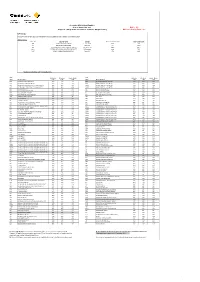

17 May 2021 Correction to Appendix 4D for the Period Ended 31 March 2021 Elders Limited (ASX:ELD) advises the Appendix 4D released earlier this morning contained an error. The 2021 interim dividend franked amount per security is 4 cents (i.e. a franking rate of 20%). Attached is the revised Appendix 4D and Financial Statements correcting the error. Further Information: Mark Allison, Managing Director & Chief Executive Officer, 0439 030 905 Authorised by: Peter Hastings, Company Secretary Elders Limited ABN 34 004 336 636. Registered Office: Level 10, 80 Grenfell Street, Adelaide SA Australia 5000 Elders Limited ABN 34 004 336 636 HALF YEAR REPORT APPENDIX 4D 31 MARCH 2021 ELDERS LIMITED APPENDIX 4D (RULE 4.2) RESULTS FOR ANNOUNCEMENT TO THE MARKET FOR THE HALF YEAR ENDED 31 MARCH 2021 Attached is the report for the half year ended 31 March 2021. The consolidated profit after tax attributable to parent entity shareholders was $68.2 million (2020: $52.0 million). Additional Appendix 4D disclosure requirements can be found in the Directors’ Report and the 31 March 2021 half year financial statements. It is recommended that the half year financial report be read in conjunction with the annual report for the year ended 30 September 2020 and considered together with public announcements made by Elders Limited during the half year ended 31 March 2021 in accordance with the continuous disclosure obligations of the ASX listing rules. 6 months March 2021 Result $000 Revenue up 22% to 1,100,502 Profit after tax for the half year attributable to -

PART 1: Core Menu PART 2: Full Menu Pooled Investment Options Pooled Investment Options

Investment Menu 9 August 2021 This Investment Menu provides you with up-to-date listing of the Investment Options available through Australian Practical Superannuation. You should read the relevant disclosure documentation or seek appropriate professional advice before making an investment decision. The information in this Investment Menu refers to the Australian Practical Superannuation Product Disclosure Statement dated 1 December 2020. PART 1: Core Menu PART 2: Full Menu Pooled Investment Options Pooled Investment Options NAME NAME Enhanced Cash Enhanced Cash 50/50 50/50 Passive Balanced Passive Balanced High Growth High Growth Passive High Growth Passive High Growth Managed Funds Managed Funds Holding Limits on certain Managed Funds investments are noted in Holding Limits on certain Managed Funds investments are noted in the menu table. the menu table. HOLDING HOLDING NAME CODE NAME CODE LIMIT LIMIT Janus Henderson Tactical Income IOF0145AU 20% AAP0007AU Ausbil MicroCap State Street Australian Cash Trust SST0003AU Ausbil Australian Emerging Leaders AAP0104AU State Street Multi-Asset Builder SST0052AU Ausbil Active Dividend Income State Street Global Equity SST0050AU Wholesale AAP3656AU AllianceBernstein Managed Volatility Equities ACM0006AU Term Deposits Fairview Equity Partners Holding limits do not apply to Term Deposits. Emerging Companies ANT0002AU NAME TYPE APN AREIT APN0008AU AMP BANK Smallco Investment ASC0001AU ANZ BANK Smallco Broadcap ASC0003AU BANK OF QUEENSLAND BANK Platypus Australian Equities Trust Wholesale AUS0030AU -

Margin Lending

Margin Lending Acceptable Securities List (ASL) Equities Effective from 08 May 2020 The information in this document forms part of the BankSA Margin Lending Product Disclosure Statement; the eWrap Margin Lending Product Disclosure Statement; and the St.George Margin Lending Product Disclosure Statement, each of which are issued by St.George Bank - A Division of Westpac Banking Corporation ABN 33 007 457 141 AFSL 233714. 1. Inclusion of equities in the attached list is not a recommendation to purchase or sell and does not constitute investment advice. 2. The Approved Investments and Lending Ratios (LVR) are subject to change at any time. ASX ASX Security Name LVR Security Name LVR Code Code A200 BetaShares Australia 200 ETF 75% BENPF Cnv Pref 6-Bbsw+4.00% Perp Non-Cum Red T-06-21 70% A2M The a2 Milk Company Limited 50% BENPG Cnv Pref 3-Bbsw+3.75% Perp Non-Cum Red T-06-24 70% AAA BetaShares Australian High Interest Cash ETF 75% BFG Bell Financial Group Limited 45% ABC Adelaide Brighton Limited 60% BGA Bega Cheese Limited 55% ABP Abacus Property Group 60% BHP BHP Group 75% ACDC ETFS Battery Tech & Lithium ETF 50% BILL iShares Core Cash ETF 75% ADI APN Industria REIT 40% BIN Bingo Industries Limited 45% AFG Australian Finance Group Limited 40% BKI BKI Investment Company Limited 60% AFI Australian Foundation Investment Company Limited 75% BKL Blackmores Limited 45% AGG AngloGold Ashanti Limited 50% BKW Brickworks Limited 65% AGL AGL Energy Limited 75% BLD Boral Limited 60% AHY Asaleo Care Limited 45% BLX Beacon Lighting Group Limited ** 40% -

Australian Listed Equities: Weekly Share Market Wrap

Australian Listed Equities: Weekly Share Market Wrap Total Shareholder Returns as at 06 November 2020 Price 1 week 1 month 6 months 1 year 2 years 3 years 5 years 10 years 10 years Ticker Stock Name $ % % % % % p.a. % p.a. % p.a. % p.a. ranking A2M The A2 Milk Company 13.71 0.29 -3.18 -26.05 21.22 18.95 24.23 80.78 - - ABC Adelaide Brighton 3.21 13.43 3.22 31.88 -0.68 -22.02 -16.89 -1.37 2.99 101 ABP Abacus Property Grp 3.09 11.55 5.82 29.82 -15.59 1.33 -2.85 4.75 8.31 66 AFI Australian Foundat 6.75 3.69 6.97 19.62 3.86 9.23 7.94 6.33 6.12 77 AGL AGL Energy Limited 12.85 2.96 -6.20 -18.93 -29.55 -9.16 -13.97 0.97 3.28 99 AIA Auckland Internation 6.69 2.29 -1.33 21.86 -20.55 2.02 8.37 8.31 16.73 26 ALD Ampol Limited 25.66 -1.08 6.65 6.63 -4.38 0.22 -6.14 -1.02 10.27 54 ALL Aristocrat Leisure 31.67 10.62 3.03 28.90 3.53 9.37 11.25 28.62 24.93 13 ALQ ALS Limited 9.61 2.78 3.33 43.27 19.34 12.22 7.65 15.79 6.61 74 ALU Altium Limited 38.19 2.72 7.88 8.73 23.10 32.83 46.59 53.36 73.72 1 ALX Atlas Arteria 6.05 7.27 -5.47 5.30 -20.09 -1.37 3.62 12.17 17.27 23 AMC Amcor PLC 16.07 8.51 4.42 22.17 17.51 14.04 6.48 6.99 12.99 40 AMP AMP Limited 1.70 11.11 26.39 30.89 -4.24 -17.11 -25.12 -14.26 -2.56 119 ANN Ansell Limited 41.70 3.76 10.93 42.45 50.12 37.22 21.91 17.84 13.18 38 ANZ ANZ Banking Grp Ltd 19.60 4.20 9.56 22.53 -20.58 -7.76 -7.10 0.21 3.61 96 APA APA Group 10.89 3.81 3.03 -1.33 0.98 11.62 11.31 7.69 14.16 33 APE AP Eagers Limited 12.65 16.48 19.45 178.02 2.51 36.55 19.79 5.46 19.44 19 APT Afterpay Touch 100.50 3.94 20.39 152.51 287.43 178.04 -

Commsec Margin Lending Approved Securities List

Accepted ASX Listed Equities as at 21 September 2021 Buffer - 5% Subject to change at the discretion of CommSec Margin Lending Maximum Gearing Ratio - 90% LVR Changes Changes since the last Approved Securities List was published are outlined in the below table: ASX Securities ASX Code Security Name Change Previous Portfolio LVR New Portfolio LVR AST AUSNET SERVICES LIMITED Capped LVR 75% 75% BGL BELLEVUE GOLD LIMITED New LVR 0% 40%* SXL SOUTHERN CROSS MEDIA GROUP LIMITED Uncapped LVR 40%* 40%* QLTY BETASHARES GLOBAL QUALITY LEADERS ETF LVR Increase 65% 70% CLNE VANECK GLOBAL CLEAN ENERGY ETF New LVR 0% 65% *Available via facilities with PLVR enabled only ASX Portfolio Standard Single Stock ASX Portfolio Standard Single Stock Code Security Name LVR LVR LVR Code Security Name LVR LVR LVR A200 BETASHARES AUSTRALIA 200 ETF 80% 75% 70% BNKS BETASHARES GLOBAL BANKS ETF 70% 65% 60% A2M THE A2 MILK COMPANY LIMITED 55% 50% 45% BOQ BANK OF QUEENSLAND LIMITED 70% 65% 60% AAA BETASHARES AUSTRALIAN HIGH INTEREST CASH ETF 90% 85% 80% BOQPE BANK OF QUEENSLAND LIMITED 70% 65% 60% AAC AUSTRALIAN AGRICULTURAL COMPANY LIMITED 50% 45% 40% BOQPF BANK OF QUEENSLAND LIMITED 70% 65% 60% ABA AUSWIDE BANK LTD 50% 45% 40% BPT BEACH ENERGY LIMITED 50% 45% 40% ABC ADELAIDE BRIGHTON LIMITED 60% 55% 50% BRG BREVILLE GROUP LIMITED 65% 60% 55% ABP ABACUS PROPERTY GROUP 65% 60% 55% BSL BLUESCOPE STEEL LIMITED 70% 65% 60% ACDC ETFS BATTERY TECH & LITHIUM ETF 60% 55% 50% BVS BRAVURA SOLUTIONS LIMITED 45% 40% 35% AD8 AUDINATE GROUP LIMITED 40% 0% 0% BWP BWP TRUST 70% 65% 60% ADH ADAIRS LIMITED 45% 40% 35% BWX BWX LIMITED 45% 40% 35% ADI APN INDUSTRIA REIT 60% 55% 50% BXB BRAMBLES LIMITED 80% 75% 70% AEF AUSTRALIAN ETHICAL INVESTMENT LIMITED 40% 35% 30% CAJ CAPITOL HEALTH LIMITED 40% 0% 0% AFG AUSTRALIAN FINANCE GROUP LTD 40% 35% 30% CAR CARSALES.COM LIMITED. -

Addition of Somnomed to Australian All Ordinaries Index

INDEX ANNOUNCEMENT S&P Dow Jones Indices Announces March 2015 Quarterly Rebalance of the S&P/ASX Indices Sydney, March 6, 2015: S&P Dow Jones Indices announced today the changes in the S&P/ASX indices, effective after the close of trading on March 20, 2015 as a result of the March quarterly review. At this rebalance the entire S&P/ASX index hierarchy is reviewed, including All Ordinaries. S&P/ASX 20 – No change. S&P/ASX 50 Index – March 20, 2015 After Market Close Action Code Company Addition MPL Medibank Private Limited Addition SEK Seek Limited Removal ILU Iluka Resources Limited Removal WOR WorleyParsons Limited S&P/ASX 100 Index – March 20, 2015 After Market Close Action Code Company Addition MFG Magellan Financial Group Limited Addition MPL Medibank Private Limited Removal MIN Mineral Resources Limited Removal MND Monadelphous Group Limited S&P/ASX 200 Index – March 20, 2015 After Market Close Action Code Company Addition AAC Australian Agricultural Company Limited Addition CTD Corporate Travel Management Limited Addition DSH Dick Smith Holdings Limited Addition EHE Estia Health Limited McGRAW-HILL S&P DOW JONES INDICES INDEX ANNOUNCEMENT Addition REG Regis Healthcare Limited Addition SYR Syrah Resources Limited Removal AGO Atlas Iron Limited Removal BCI BC Iron Limited Removal BDR Beadell Resources Limited Removal HZN Horizon Oil Limited Removal LYC Lynas Corporation Limited Removal MGX Mount Gibson Iron Limited S&P/ASX 300 Index – March 20, 2015 After Market Close Action Code Company Addition AFJ Affinity Education Group Limited