Kadaluru DPR.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

District Census Handbook, Mandya, Part X-A, B, Series-14,Mysore

CENSUS OF INDIA 1971 S E R I E S-14 MYSORE DISTRICT CENSUS HANDBOOK MANDYA DISTRICT PART X-A: TOWN AND VILLAGE DIRECTORY PART X-B: PRIMARY CENSUS ABSTRACT P. PAD MAN A B H A OF THE INDIAN ADMINISTRATIVE SERVICE DIRECTOR OF CENSUS OPERATIONS MYSORE 24 12 0 24 ... 72 MILES m1f~CD)U -·!~.r-~=.~~~~!~~==~!;;If"!~ : iii: 20 0 20 40 60 eo 100 klt.OM£TRES ADMINISTRATIVE DIVISIONS, 1971 STA TE BOUNDARY DISTRICT " TALUk " STATE CAPITAL * OISTRICT HEADQUARTERS @ TALUk o T. Naulput - ThirumaI<udIu Naulpur Ho-Hoopct H-HubU ANDHRA PRADESH CHELUVANARA YANA TEMPLE, MELKOTE (Mot{f on the cover) The illustration on the cover page represents the temple dedicated to Krishna as CheluVG Pulle-Raya at Melkote town in Mandya district. The temple is a square building of great dimensions but very plain in design. The original name of the principal deity is said to .have been Rama Priya. According to tradition, Lord Narayana of Melkote appeared in a dream to Sri Ramanuja (the 12th century Vaishnava Saint and propounder of the philosophy of Visishtadvait(!) and said to him that He was awaiting him on Yadugiri Hill. Thereupon, v,:ith the assistance of .Hoysala King Vishnu vardhana (who had received tapta-mudra from Ramanuja and embraced Vaishnavism) he discovered the idol which lay covered by an ant-hill which he excavated and worshipped. This incident is said to have occurred in the month of Tai in Bahudharaya year. A temple \.vas erected for Lord Narayana over the ant-hill and the installation of tlle image took place in 1100 A.D. -

Sl No Name of the Village Total Population SC Population % ST

POPULATION PROFILE OF Mandya Dist AS PER 2011 CENSUS Total SC ST Sl No Name of the Village % % Population Population Population 1 Mandya 1805769 265294 14.69 22402 1.24 2 Mandya 1497407 221943 14.82 17361 1.16 3 Mandya 308362 43351 14.06 5041 1.63 4 Krishnarajpet 260479 33726 12.95 6050 2.32 5 Krishnarajpet 234533 29691 12.66 5620 2.40 6 Krishnarajpet 25946 4035 15.55 430 1.66 7 Gondihalli 925 100 10.81 0 0.00 8 Madapuranala 62 49 79.03 0 0.00 9 Madapura 1509 61 4.04 139 9.21 10 Halemadapura 356 9 2.53 0 0.00 11 Ganadahalli 277 21 7.58 0 0.00 12 Gudehosahalli 1059 66 6.23 0 0.00 13 Kadahemmige 1126 33 2.93 1 0.09 14 Bolamaranahalli 912 61 6.69 4 0.44 15 Anegola 1164 6 0.52 45 3.87 16 Doddatharahalli 1571 79 5.03 0 0.00 17 Chikkatharahalli 888 175 19.71 0 0.00 18 Anchebeeranahalli 1134 151 13.32 1 0.09 19 Mandalekanahalli 515 300 58.25 0 0.00 20 Ooginahalli 821 6 0.73 66 8.04 21 Echaluguddekaval 97 0 0.00 0 0.00 22 Chinnenahalli 736 23 3.13 0 0.00 23 Kotahalli 686 89 12.97 2 0.29 24 Dananahalli 312 14 4.49 0 0.00 25 Bidaranalli 345 6 1.74 0 0.00 26 Margonahalli 1112 150 13.49 0 0.00 27 Govindanahalli 2227 39 1.75 15 0.67 28 Uddinamallanahosur 520 3 0.58 0 0.00 29 Tholasi 965 155 16.06 4 0.41 30 Ikanahalli 1509 64 4.24 0 0.00 31 Sasalu 1310 101 7.71 22 1.68 32 Yeladahalli 1067 233 21.84 0 0.00 33 Devarahalli 527 0 0.00 0 0.00 34 Bhadranakoppalu 348 27 7.76 0 0.00 35 Ankanahalli 617 6 0.97 0 0.00 36 Vaddarahalli 262 45 17.18 0 0.00 37 Basavanahalli 535 149 27.85 0 0.00 38 Laxmipura 1707 2 0.12 0 0.00 39 Mariyanahosur 113 0 0.00 0 0.00 40 -

District Census Handbook, Mandya, Part XII-B, Series-11

CENSUS OF INDIA 1991 Serit'~ - II KARNATAKA DISTRICT CENSUS HANDBOOK MANDYA DISTRICT PART XII - B VILLAGE AND TOWN WISE PRIMARY CENSUS ABSTRACT "\OBII \ N-\l\1BISr\N Din'dor of Cl'lI~lI~ Opl'ralioll!<., Ka"lIalaka 77' KARNATAKA ADMINISTRA TIVE DIVISIONS 1991 leO Ie' Where the name of the district I taluk differs from that of its headquarters town name the former appears within brackets. ARABIAN 5£A Bansalore is the headquarters for 8angalore North und Bangalore South taluks lind also (or BlfnBlllore lind BlIngliJore Rurlll Districts. T·Tumkur o 13. " .. BOUNDARIES :- STATE .. DISTRICT. TALUK .. HEADQUARTERS :- 12 STATE .. DISTRICT. @ TALUK .. *o K1LOMETRES 60 :zp 'PY )0 4f I 74° East of Greenwict'l 77' Based upon Survey of Indio map with the permission of the S.rveyor General 0 f India. © Government of Indio Copyright, 1994. The terrilorlal water. of Indio ••tend into lhe sea to a distonce of lwelve naulical miles mellSured from the appropriate bose lin •. CONTENTS F< m.EWORD \ 1 PREF/\('E \'11 \,111 1)\11'( mTANT STATISTICS 1:1. - Xli ,\i'\ALYTICAL NOTE .:',"\ PRL\IARY (_'ENSLI~ ABSTRACT E\pl.lIlalory Nolc~ 31 - 34 A. Dj~l riel Primary Ce 11~1l" Ah~l ract 3(1 - .+7 {i) Villagc.Tll\\n Priman ('cn~lI~ Ah~tr,lct /\lph;thetical Li~( llJ VilLtge:-, Kri"hn;1I ;Ijpcl CD. Billd, 51 ."i:-: Prinldn l'ell:-'ll~ />..h-'(I ael 1...:.1 i"hnarailll'l (·.f).Rlnd (.1) ()() Alph<thetical Li:-,( oj Village~ - i\laddur C.D.Blnd, 10., 11)7 Primary Cen"u'-. Ah"tract - l\laddur C.D.Block I()~ - 1.:'7 Alphahetical Li:-,( of Village:-, l\Lt1a\ alii CD.Block 131 - 1.1,5 Primary ('en:-L1:- Ah:-.lract - l\1ala\alli CD.B1ock 1.1,() - 15') t\lphahetical Li:-,( of Villa!!e~ - I\lall((\'a ('.D.Block Ih.~ - HI7 Primary (\;n~L1" Ab"tral·t ;VLtndya (',D.BI(iCk 1(,1' II) I Alphabetical Li:-t of Village~ N;tg;lInang;lla CD. -

Heritage of Mysore Division

HERITAGE OF MYSORE DIVISION - Mysore, Mandya, Hassan, Chickmagalur, Kodagu, Dakshina Kannada, Udupi and Chamarajanagar Districts. Prepared by: Dr. J.V.Gayathri, Deputy Director, Arcaheology, Museums and Heritage Department, Palace Complex, Mysore 570 001. Phone:0821-2424671. The rule of Kadambas, the Chalukyas, Gangas, Rashtrakutas, Hoysalas, Vijayanagar rulers, the Bahamanis of Gulbarga and Bidar, Adilshahis of Bijapur, Mysore Wodeyars, the Keladi rulers, Haider Ali and Tipu Sultan and the rule of British Commissioners have left behind Forts, Magnificient Palaces, Temples, Mosques, Churches and beautiful works of art and architecture in Karnataka. The fauna and flora, the National parks, the animal and bird sanctuaries provide a sight of wild animals like elephants, tigers, bisons, deers, black bucks, peacocks and many species in their natural habitat. A rich variety of flora like: aromatic sandalwood, pipal and banyan trees are abundantly available in the State. The river Cauvery, Tunga, Krishna, Kapila – enrich the soil of the land and contribute to the State’s agricultural prosperity. The water falls created by the rivers are a feast to the eyes of the outlookers. Historical bakground: Karnataka is a land with rich historical past. It has many pre-historic sites and most of them are in the river valleys. The pre-historic culture of Karnataka is quite distinct from the pre- historic culture of North India, which may be compared with that existed in Africa. 1 Parts of Karnataka were subject to the rule of the Nandas, Mauryas and the Shatavahanas; Chandragupta Maurya (either Chandragupta I or Sannati Chandragupta Asoka’s grandson) is believed to have visited Sravanabelagola and spent his last years in this place. -

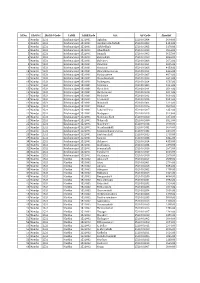

Sub Centre List As Per HMIS SR

Sub Centre list as per HMIS SR. DISTRICT NAME SUB DISTRICT FACILITY NAME NO. 1 Bagalkote Badami ADAGAL 2 Bagalkote Badami AGASANAKOPPA 3 Bagalkote Badami ANAVALA 4 Bagalkote Badami BELUR 5 Bagalkote Badami CHOLACHAGUDDA 6 Bagalkote Badami GOVANAKOPPA 7 Bagalkote Badami HALADURA 8 Bagalkote Badami HALAKURKI 9 Bagalkote Badami HALIGERI 10 Bagalkote Badami HANAPUR SP 11 Bagalkote Badami HANGARAGI 12 Bagalkote Badami HANSANUR 13 Bagalkote Badami HEBBALLI 14 Bagalkote Badami HOOLAGERI 15 Bagalkote Badami HOSAKOTI 16 Bagalkote Badami HOSUR 17 Bagalkote Badami JALAGERI 18 Bagalkote Badami JALIHALA 19 Bagalkote Badami KAGALGOMBA 20 Bagalkote Badami KAKNUR 21 Bagalkote Badami KARADIGUDDA 22 Bagalkote Badami KATAGERI 23 Bagalkote Badami KATARAKI 24 Bagalkote Badami KELAVADI 25 Bagalkote Badami KERUR-A 26 Bagalkote Badami KERUR-B 27 Bagalkote Badami KOTIKAL 28 Bagalkote Badami KULAGERICROSS 29 Bagalkote Badami KUTAKANAKERI 30 Bagalkote Badami LAYADAGUNDI 31 Bagalkote Badami MAMATGERI 32 Bagalkote Badami MUSTIGERI 33 Bagalkote Badami MUTTALAGERI 34 Bagalkote Badami NANDIKESHWAR 35 Bagalkote Badami NARASAPURA 36 Bagalkote Badami NILAGUND 37 Bagalkote Badami NIRALAKERI 38 Bagalkote Badami PATTADKALL - A 39 Bagalkote Badami PATTADKALL - B 40 Bagalkote Badami SHIRABADAGI 41 Bagalkote Badami SULLA 42 Bagalkote Badami TOGUNSHI 43 Bagalkote Badami YANDIGERI 44 Bagalkote Badami YANKANCHI 45 Bagalkote Badami YARGOPPA SB 46 Bagalkote Bagalkot BENAKATTI 47 Bagalkote Bagalkot BENNUR Sub Centre list as per HMIS SR. DISTRICT NAME SUB DISTRICT FACILITY NAME NO. -

Evijaya IFSC and MICR.Xlsx

BANK NAME SOL ID BRANCH NAME IFSC code ‐Old IFSC code ‐NEW Old MICR code New MICR code City DISTRICT STATE eVIJAYA BANK 73460 SCIENCE CITY VIJB0007346 BARB0VJSCIE 380029017 380012204 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73360 SOLA CROSS ROAD VIJB0007336 BARB0VJSOCR 380029014 380012205 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73260 BODAKDEV VIJB0007326 BARB0VJBODA 380029010 380012196 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73060 NAVRANGPURA VIJB0007306 BARB0VJNAVP 380029006 380012192 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73020 AMBAWADI VIJB0007302 BARB0VJAMBW 380029007 380012195 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73290 SATELLITE AREA VIJB0007329 BARB0VJSATE 380029013 380012198 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73150 ASHRAM ROAD VIJB0007315 BARB0VJASHR 380029008 380012191 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73370 CHANDKHEDA VIJB0007337 BARB0VJCHKH 380029015 380012210 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73960 MOTERA VIJB0007396 BARB0VJMOTE 380029029 380012188 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73520 PALADI,AHMEDABAD VIJB0007352 BARB0VJPAAH 380029021 380012189 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73610 SANAND VIJB0007361 BARB0VJSANA 380029023 380012213 SANAND AHMEDABAD GUJARAT eVIJAYA BANK 73510 GOTA‐SAYANA CITY VIJB0007351 BARB0VJGOTA 380029020 380012206 AHMEDABAD AHMEDABAD GUJARAT eVIJAYA BANK 73730 GIDC HANSALPUR SARESHVAR VIJB0007373 BARB0VJGIDC 380029024 380012207 HANSALPUR SERESHVAR AHMEDABAD GUJARAT eVIJAYA BANK 73770 THALTEJ‐HNI VIJB0007377 BARB0VJTTEJ 380029026 380012203 AHMEDABAD AHMEDABAD -

Legend Hallidasanahalli

Village Map of Mandya District, Karnataka µ Siddapura Bannadhahalli Chandhanahalli M.Koodahalli Kanchanahalli Manchanahalli Honnenahalli Chunchanahalli Kokkarana Hosahalli Byaladhakere Chabbanahalli Arini Mainuyuru Mudigere Byadara Hosahalli Mylanahalli Yalachikere G.Nagathihalli Bettadhakote Anakanahalli Shibaranahalli Thigalanahalli Bananahalli Belagundha Thondahalli Ambala Jeerahalli Srirangapura Ganasandra Jogipura Adakanahalli Hullenahalli Lakshmipura Byrasandra Devara Mavinakere Chakenahalli Nagalapura Yariganahalli Belluru Vaddarahalli Hatna Yele Koppa BELLURU Mankanahalli Kare Jeerahalli Gondhihalli Dhyavasamudra Iruchanahalli Cholenahalli Alisandra Varahsandra Sanaba Agachahalli Beechanahalli Devihalli Javaranahalli Tavarekere Chennapura Kadhabahalli GowdarahalliThirumalapura Kannaghatta KarabayaluKanchinakote Kalinganahalli Nagathihalli.A Bommanahalli Honnadevanahalli Chikkonallipura Chamalapura Halalu Avverahalli Dhadaga Govindaghatta Nelligere Thittinallihosuru MaradevanahalliDoddaghatta Yaladhahalli Thore Mavinakere Bommenahalli Metimellahalli Suranahalli Vaderahalli Chikkonallipura Kuchahalli Kaval Doddenahalli Hadenahalli D.Kodihalli HampapuraKadumanchenahalli Bommenahalli Lalanakere Moodala Mellahalli Doddaguni Gondenahalli CholasandraSheegehalli Karu Ankanahalli Kavalagundi Kamadihalli Halladha Hosahalli Kabbanakere Hosahalli Shivanahalli Haralahalli Kuchahalli Doddajatka Doddenahalli Kennehalli Dhummasandra Moogathgundhi Chattanahalli Vaderapura Katriguppe Bitagonahalli Valagerepura Mallasandra BallavahalliG.Channapura -

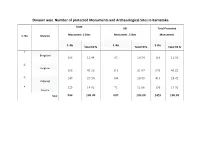

Division Wise Number of Protected Monuments and Archaeological Sites in Karnataka

Division wise Number of protected Monuments and Archaeological Sites in Karnataka State ASI Total Protected S. No Division Monument / Sites Monument / Sites Monuments S. No S. No S. No Total TO % Total TO % Total TO % 1 Bangalore 105 12.44 63 10.34 168 11.56 2 Belgaum 365 43.25 311 51.07 676 46.52 3 249 29.50 164 26.93 413 28.42 Kalgurugi 4 125 14.81 71 11.66 196 13.51 Mysore Total 844 100.00 609 100.00 1453 100.00 Division wise Number of protected Monuments and Archaeological Sites in Karnataka Bangalore Division Serial Per Total No. of Overall pre- Name of the District Number Total No. of cent Per protected protected ASI Total No. of Monument / Sites cent % Monument / protected Monument / Sites % Sites monuments 1 Bangalore City 7 2 9 2 Bangalore Rural 9 5 14 3 Chitradurga 8 6 14 4 Davangere 8 9 17 5 Kolara 15 6 21 6 Shimoga 12 26 38 7 Tumkur 29 6 35 8 Chikkaballapur 4 2 6 9 Ramanagara 13 1 14 Total 105 12.44 63 10.34 168 11.56 Division wise Number of protected Monuments and Archaeological Sites in Karnataka Belgaum Division Total No. of Overall pre- Serial Per Name of the District Total No. of Per protected protected Number cent ASI Total No. of Monument / Sites cent % Monument / protected % Monument / Sites Sites monuments 10 Bagalkot 22 110 132 11 Belgaum 58 38 96 12 Vijayapura 45 96 141 13 Dharwad 27 6 33 14 Gadag 44 14 58 15 Haveri 118 12 130 16 Uttara Kannada 51 35 86 Total 365 43.25 311 51.07 676 46.52 Division wise Number of protected Monuments and Archaeological Sites in Karnataka Kalburagi Division Serial Per Total protected -

Sl.No. District District Code Taluk Taluk Code GP GP Code Amount

Sl.No. District District Code Taluk Taluk Code G.P. GP Code Amount 1 Mandya 1521 Krishnarajpet 1521001 Aghalaya 1521001004 3664.00 2 Mandya 1521 Krishnarajpet 1521001 Agrahara Bachahalli 1521001002 4151.00 3 Mandya 1521 Krishnarajpet 1521001 Akkihebbalu 1521001003 3170.00 4 Mandya 1521 Krishnarajpet 1521001 Albadikavle 1521001019 2564.00 5 Mandya 1521 Krishnarajpet 1521001 Anagola 1521001005 3655.00 6 Mandya 1521 Krishnarajpet 1521001 Balenahalli 1521001020 3846.00 7 Mandya 1521 Krishnarajpet 1521001 Ballekere 1521001006 2672.00 8 Mandya 1521 Krishnarajpet 1521001 Bandihole 1521001021 3099.00 9 Mandya 1521 Krishnarajpet 1521001 Beeruvalli 1521001008 4133.00 10 Mandya 1521 Krishnarajpet 1521001 Bharathipuracross 1521001022 3446.00 11 Mandya 1521 Krishnarajpet 1521001 Bookanakere 1521001007 4071.00 12 Mandya 1521 Krishnarajpet 1521001 Chowdenahalli 1521001023 3691.00 13 Mandya 1521 Krishnarajpet 1521001 Dabbegatta 1521001024 3787.00 14 Mandya 1521 Krishnarajpet 1521001 Ganjigere 1521001009 4224.00 15 Mandya 1521 Krishnarajpet 1521001 Haralahalli 1521001011 2514.00 16 Mandya 1521 Krishnarajpet 1521001 Hariharapura 1521001010 4041.00 17 Mandya 1521 Krishnarajpet 1521001 Hirikalale 1521001012 3934.00 18 Mandya 1521 Krishnarajpet 1521001 Ichanahalli 1521001025 3251.00 19 Mandya 1521 Krishnarajpet 1521001 Ikanahalli 1521001001 2224.00 20 Mandya 1521 Krishnarajpet 1521001 Kikkeri 1521001026 3507.00 21 Mandya 1521 Krishnarajpet 1521001 Lakshmi Pura 1521001027 2351.00 22 Mandya 1521 Krishnarajpet 1521001 Madapura 1521001029 3213.00 23 Mandya 1521 -

Individual Irrigation Borewell

INDIVIDUAL IRRIGATION BOREWELL SL.NO FILE NO PARTICULARS CHIKKASIDDAIAH S/O//W/O KSCTDC/IIBW/200227184096/2001- CHIKKASIDDAIAH VILLAGE : PALYA : 12413 02/1973 TALUK KOLLEGAL : DISTRICT CHAMARAJA NAGARA JAGADISHNAIK S/O//W/O RAJUNAIK KSCTDC/IIBW/200227184127/2001- VILLAGE : MUKANAPALYA : TALUK 12414 02/1974 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA SAROJAMMA S/O//W/O RANGASWAMY KSCTDC/IIBW/200227184128/2001- VILLAGE : YANAGANHALLY : TALUK 12415 02/1975 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA NANJAIAH S/O//W/O MADIAH VILLAGE KSCTDC/IIBW/200227184129/2001- : HARADANAHALLI : TALUK 12416 02/1976 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA SHIVANNANAIK S/O//W/O DODDANAIK KSCTDC/IIBW/200227184131/2001- VILLAGE : YANAGANAHALLI : TALUK 12417 02/1977 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA BASAMMA S/O//W/O APPAIAH VILLAGE KSCTDC/IIBW/200227184132/2001- : BAANAVADI : TALUK 12418 02/1978 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA RAVINDRANATH S/O//W/O KYATHIAH KSCTDC/IIBW/200227184133/2001- VILLAGE : AMACHAVADI : TALUK 12419 02/1979 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA MUDDAIAH S/O//W/O DODDAMADAIAH KSCTDC/IIBW/200227184137/2001- VILLAGE : BEDAGOLAPURA : TALUK 12420 02/1980 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA VENKATAIAH S/O//W/O PUTTAIAH KSCTDC/IIBW/200227184138/2001- VILLAGE : UDIGALA : TALUK 12421 02/1981 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA LINGAIAH S/O//W/O NANJAIAH KSCTDC/IIBW/200227184139/2001- VILLAGE : HARVE : TALUK 12422 02/1982 CHAMARAJANAGAR : DISTRICT CHAMARAJA NAGARA MAHESHA S/O//W/O S.MADAIAH KSCTDC/IIBW/200227184183/2001- -

Chapter-1 Mandya Dist Gaz 2009.Pdf

General 1 CHAPTER I GENERAL Mandya district, located in the southern plain of Karnataka State is mostly covered by greenery. Till the beginning of the 20th Century, this district was a dry area. After the construction of Krishnarajasagar dam, it got extensive irrigational facilities leading to the economic progress of the district. Since sugarcane and paddy are extensively cultivated in this district, it has been given the epithet ‘Sugar and paddy bowl” of Karnataka. The hydroelectric power project of Shivasamudram which was commenced in 1902 in this district has the distinction of being the second Electric Power Station in Asia. All the seven taluks of the districts are covered by the Command Area Development Authority, Cauvery Basin. Sericulture being a profitable occupation has resulted in wide spread mulberry cultivation throughout this district and is widespread in all the taluks. All the towns, villages and hamlets of the district have been electrified. The district has a good network of transport and communication. The Bangalore - Mysore rail line and highway passes through the district. The educational progress of the district has been impressive. Since the last two decades, many educational centres including a Post Graduation centre of the Mysore University and a College of Agriculture under the jurisdiction of the University of Agricultural Sciences, Bangalore have been established here. The district has also distinguished itself in the field of literature and culture. 2 Mandya District Gazetteer The district has many tourist spots and places of historical importance in its vicinity. Shrirangapattana which enjoyed the status of the capital of Mysore Province between 1610 and 1799, Shivasamudram with its Gaganachukki and Barachukki waterfalls of Cauvery, Shimsha falls near Dhanagur, the charming Brindavan gardens of Krishnarajasagar are renowned tourist places. -

Tank Information System Map of Krishnarajpet Taluk, Mandya District. Μ 1:85,800

Tank Information System Map of Krishnarajpet Taluk, Mandya District. µ 1:85,800 KA22010270 KA22010080 Adavanahalli Anegola KA22010245 KA22010100 KA22010099 KA22010108 KA22010101 Chikkatharahalli KA22010109 Chottanahalli DoddakyathanahalliKA22010238 KA22010173 Hubbanahalli KA22010098 KA22010102 Anchebeeranahalli Ramanakoppalu KA22010102 KA22010272 KA22010237 Kadahemmige KA22010271 Narayanapura KA22010074 KA22010291 KA22010071 AmachahalliKA22010073 KA22010075 Cholamaranahalli Aikanahalli KA22010104 KA22010096 Lokanahalli KA22010076 KA22010131 Nayasinganahalli KA22010163 Nagaraghatta KA22010077 KA22010277 AgalekavalHosahalli Santhe Bachahalli KA22010095 Goodehosahalli Mandlikanahalli KA22010157 Kodagihalli KA22010081 Gondhihalli Agale KA22010079 Hoginahalli Tholasi KA22010273 Sasalu KA22010078 KA22010079 HalemadhapuraGanadhahalli KA22010091 KA22010279 Bhadrana Koppalu SingapuraMalaguru KA22010086 Yaladhahalli Doddasomanahalli Madhapura Huddhanamallanahosur Halasanahalli KA22010083 KA22010085 KA22010114 KA22010281 Ankanahalli KA22010084 Appanahalli KA22010244 KA22010176 KA22010139 KA22010233 Chinnenahalli KA22010280 Ankanahalli KA22010052 KA22010044 Madhapura Nala Halehatthiguppe KA22010090 KA22010288 Adrihalli (Adhihalli)KA22010243 Nayakanahalli Ichalagudde Kaval Basavanahalli Devarahalli DoddaharanahalliKA22010089 KA22010053 KA22010067 Chinnenahalli Vaddarahalli KA22010088 Achhamanahalli KA22010088 Somanahalli KA22010140 KA22010236 KA22010216 Govindanahalli Madhihalli KA22010082 KA22010212 LakshmipuraBhoovanahalli KA22010234 Halagehosahalli