The Hanover Insurance Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Hanover Insurance Company

STATEMENT AS OF MARCH 31, 2021 OF THE HANOVER INSURANCE COMPANY STATEMENT AS OF MARCH 31, 2021 OF THE HANOVER INSURANCE COMPANY ASSETS Current Statement Date 4 1 2 3 December 31 Net Admitted Assets Prior Year Net Assets Nonadmitted Assets (Cols. 1 - 2) Admitted Assets 1. Bonds 5,185,382,667 0 5,185,382,667 5,036,994,855 2. Stocks: 2.1 Preferred stocks 9,218,188 0 9,218,188 5,049,999 2.2 Common stocks 1,739,274,441 794,531 1,738,479,910 1,649,356,734 3. Mortgage loans on real estate: 3.1 First liens 126,033,452 0 126,033,452 116,077,893 3.2 Other than first liens 0 0 0 0 4. Real estate: 4.1 Properties occupied by the company (less $ 0 encumbrances) 43,921,808 0 43,921,808 44,788,154 4.2 Properties held for the production of income (less $ 0 encumbrances) 0 0 0 0 4.3 Properties held for sale (less $ 0 encumbrances) 0 0 0 0 5. Cash ($ (58,953,827) ), cash equivalents ($ 85,711 ) and short-term investments ($ 1,338,630 ) (57,529,486) 0 (57,529,486) (57,030,013) 6. Contract loans (including $ 0 premium notes) 0 0 0 0 7. Derivatives 0 0 0 0 8. Other invested assets 584,566,780 0 584,566,780 597,101,836 9. Receivables for securities 26,293,966 0 26,293,966 3,579,716 10. Securities lending reinvested collateral assets 0 0 0 0 11. Aggregate write-ins for invested assets 0 0 0 0 12. -

31534 CITIZENS INSURANCE COMPANY of AMERICA Original Filing Quarter 1 Original Filing

STATEMENT AS OF MARCH 31, 2021 OF THE CITIZENS INSURANCE COMPANY OF AMERICA STATEMENT AS OF MARCH 31, 2021 OF THE CITIZENS INSURANCE COMPANY OF AMERICA ASSETS Current Statement Date 4 1 2 3 December 31 Net Admitted Assets Prior Year Net Assets Nonadmitted Assets (Cols. 1 - 2) Admitted Assets 1. Bonds 1,189,351,828 0 1,189,351,828 1,151,394,902 2. Stocks: 2.1 Preferred stocks 0 0 0 0 2.2 Common stocks 155,134,960 0 155,134,960 146,509,455 3. Mortgage loans on real estate: 3.1 First liens 0 0 0 0 3.2 Other than first liens 0 0 0 0 4. Real estate: 4.1 Properties occupied by the company (less $ 0 encumbrances) 4,034,852 0 4,034,852 4,195,752 4.2 Properties held for the production of income (less $ 0 encumbrances) 0 0 0 0 4.3 Properties held for sale (less $ 0 encumbrances) 0 0 0 0 5. Cash ($ (14,470,209) ), cash equivalents ($ 7,837 ) and short-term investments ($ 0 ) (14,462,372) 0 (14,462,372) (15,369,562) 6. Contract loans (including $ 0 premium notes) 0 0 0 0 7. Derivatives 0 0 0 0 8. Other invested assets 85,366,909 0 85,366,909 82,848,895 9. Receivables for securities 5,624,209 0 5,624,209 100,000 10. Securities lending reinvested collateral assets 0 0 0 0 11. Aggregate write-ins for invested assets 0 0 0 0 12. Subtotals, cash and invested assets (Lines 1 to 11) 1,425,050,387 0 1,425,050,387 1,369,679,443 13. -

Vanguard Russell 1000 Index Funds Annual Report August 31, 2020

Annual Report | August 31, 2020 Vanguard Russell 1000 Index Funds Vanguard Russell 1000 Index Fund Vanguard Russell 1000 Value Index Fund Vanguard Russell 1000 Growth Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. -

Large Cap Value Fiduciary Services Hancock Horizon Investments

Large Cap Value Fiduciary Services Hancock Horizon Investments Style: US Large Cap Value Year Founded: 1998 Sub-Style: Relative Value GIMA Status: Approved One Hancock Plaza, 3rd floor Firm AUM: $5.4 billion Firm Ownership: Hancock Holding Company Gulfport, Mississippi 39501 Firm Strategy AUM: $396.8 million Professional-Staff: 114 PRODUCT OVERVIEW TARGET PORTFOLIO CHARACTERISTICS PORTFOLIO STATISTICS * Hancock Horizon Investments' (Hancock) Large Cap Value strategy Number of stock holdings: 60 to 75 ---------------03/16------ 09/15 utilizes a highly disciplined quantitative approach. Hancock's focus is on ---------- Average dividend yield: Similar to the S&P 500 Hancock Index*** Hancock high quality stocks that they believe may possess favorable relative value. Hancock's goal is to produce enhanced return while reducing risk. P/E ratio: Similar to/Below the S&P 500 Number of stock holdings 95 684 91 While Hancock's investment philosophy employs a quantitative Cash level over market cycle: 0 to 3% Wtd avg dividend yield 2.2% 2.6% 2.1% approach, a fundamental review also plays an important part. Portfolio characteristics include high financial quality, a high level of market Risk (standard deviation): Similar to the S&P 500 Wtd avg P/E ratio ¹ — 16.90x 12.30x liquidity, lower price to earnings ratio, and, historically speaking, return Average turnover rate: 60 to 80% Wtd avg portfolio beta ——— volatility equal to or below that of the broad market. Hancock's investment process may, at times, result in portfolios that will be Use ADRs: No Mega capitalization ⁺ 0.0% 38.7% 0.0% over/underweighted in particular sectors/industries versus the S&P 500 Large, Medium and Small Capitalization: Large capitalization 0.0% 42.8% 0.0% Index. -

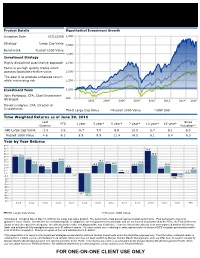

For One-On-One Client Use Only

Product Details Hypothetical Investment Growth Inception Date 5/31/2000 4,000 Strategy Large Cap Value 3,500 Benchmark Russell 1000 Value 3,000 Investment Strategy Highly disciplined quantitative approach 2,500 Focus is on high quality stocks which possess favorable relative value 2,000 The goal is to produce enhanced return while minimizing risk 1,500 Investment Team 1,000 John Portwood, CFA, Chief Investment Strategist 500 2002 2004 2006 2008 2010 2012 2014 2016 David Lundgren, CFA, Director of Investments HHI Large Cap Value Russell 1000 Value S&P 500 Time Weighted Returns as of June 30, 2016 Last Since YTD 1 year 3 year* 5 year* 7 year* 10 year* 15 year* Quarter Inception* HHI Large Cap Value -1.5 0.5 -5.7 7.0 8.8 12.5 5.7 8.1 8.3 Russell 1000 Value 4.6 6.3 2.9 9.9 11.4 14.5 6.1 6.4 6.3 Year by Year Returns 50.0 45.0 39.9 40.0 35.0 32.5 29.5 30.0 30.0 24.7 25.0 22.2 20.0 19.7 20.0 17.5 16.5 17.0 15.5 15.0 12.7 13.5 13.4 13.5 9.8 10.0 7.1 8.3 6.3 5.0 1.8 0.4 0.5 0.0 -0.2 -5.0 -3.8 -10.0 -5.5 -15.0 -20.0 -25.0 -30.0 -35.0 -34.1 -40.0 -36.8 -45.0 -50.0 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 YTD HHI Large Cap Value Russell 1000 Value *Annualized.