The Most Important Current Affairs January 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Staff Selection Commission (SR) Chennai CONSTABLE(GD)

Staff Selection Commission (SR) Chennai CONSTABLE(GD) IN CAPFs, NIA & SSF AND RIFLEMAN(GD) IN ASSAM RIFLES EXAMINATION 2015 - Result for Male Candidates to be called for Medical Examination List-1 - Male Candidates of Southern Region qualified against State-wise vacancies Sl. No Roll Number Name of the Candidate Cat1 Cat2 Cat3 1 8002000065 BANKI PRAVEEN 6 2 8002000097 DUGGA LINGA PRATAP REDDY 3 8002000121 NEETIPILLI PURUSHOTTAM 6 4 8002000207 GADDAM LAKSHMI NARAYANA 6 5 8002000223 ALLEM PRASHANTH 2 6 8002000273 R RAMESH 2 7 8002000332 BUTTI PRASHANTH KUMAR 1 8 8002000347 RACHIPOGULA SUDHAKAR 1 9 8002000389 RAMAVATH RAJA NAIK 2 10 8002000413 VELPULA RAJESH 1 11 8002000492 PATAKOTI RAJU 1 12 8002000530 NAGIREDDY NARAYANAREDDY 13 8002000548 S BALA SWAMY NAIK 2 14 8002000555 JAKKULA SUBHASH 6 15 8002000675 BAIRAVAPOGU CHANDRA 1 16 8002000681 NARMETA RANJITH KUMAR 6 17 8002000700 ANJILAPPA 6 18 8002000763 KANAGANTI CHANDRA SHEKER 6 19 8002000791 ARIGALI ASHOK KUMAR 1 20 8002000955 PANEM RAMAKOTI REDDY 21 8002000994 GONE LAXMAN KUMAR 6 22 8002000999 G SRINIVAS 6 23 8002001064 BUKYA REDYA 2 24 8002001076 RANDI SRIKANTH 6 25 8002001105 JUKANTI HAREESH 6 26 8002001207 RAMAVAT SOMLA NAIK 2 27 8002001226 MITTA DEVAIAH 6 28 8002001234 AJMEERA RAJU 2 29 8002001252 KONCHADA SURESH 6 30 8002001257 CHIRISATI SIVAKUMAR 1 31 8002001428 BILLA HARI PRASAD 6 32 8002001444 GARULLE JEJERAM 2 33 8002001550 BUSAPURAM GIRICHARY 6 34 8002001583 LAVUDYA MADAN 2 35 8002001623 MALOTHU DEVILAL 2 36 8002001670 BAKI RAJU 1 37 8002001683 AREE PRASHANTH 1 38 8002001685 -

Parliamentary Bulletin

RAJYA SABHA Parliamentary Bulletin PART-II Nos.:54546-54548] MONDAY, AUGUST 31, 2015 No.54546 M.A. Section Local address of Shri Amar Shankar Sable, MP Local address of Shri Amar Shankar Sable, M.P. would be as follows:- Flat no. 4, Meena Bagh, New Delhi - 110011. Members may kindly note for information. ____________ No.54547 Committee Section (Subordinate Legislation) Statutory Orders laid on the Table of the Rajya Sabha during the period August 10 - 13, 2015 (236th Session) The following Statutory Rules and Orders made under the delegated powers of legislation and published in the Gazette were laid on the Table of the Rajya Sabha during the period August 10 - 13, 2015. The Orders will be laid on the Table for a period of 30 days, which may be comprised in one session or in two or more successive sessions. Members can move a motion for modification/annulment before the expiry of the session, immediately, following the session in which the laying period of 30 days is completed. 3 Sl. Number and date Brief Subject Date on Provision of the Statute under No. of Rule/Order which laid which laid 1 2 3 4 5 MINISTRY OF CORPORATE AFFAIRS 1 G.S.R. 438 (E), The Companies (Registration Offices 11.08.2015 Section 469 (4) of the dated the 30th May, and Fees) Second Amendment Rules, Companies Act, 2013. 2015. 2015. 2 G.S.R. 440 (E), The Companies (Registration of -do- -do- dated the 30th May, Charges) Amendment Rules, 2015. 2015. 3 G.S.R. 441 (E), The Companies (Declaration and -do- -do- dated the 30th May, Payment of Dividend) Second 2015. -

Padma Vibhushan Padma Bhushan

Padma Vibhushan Name Field State/Country Public Affairs Bihar 1. George Fernandes (Posthumous) Public Affairs Delhi 2. Arun Jaitley (Posthumous) Sir Anerood Jugnauth Public Affairs Mauritius 3. M. C. Mary Kom Sports Manipur 4. Chhannulal Mishra Art Uttar Pradesh 5. Public Affairs Delhi 6. Sushma Swaraj (Posthumous) Others-Spiritualism Karnataka 7. Sri Vishveshateertha Swamiji Sri Pejavara Adhokhaja Matha Udupi (Posthumous) Padma Bhushan Name Field State/Country SN M. Mumtaz Ali (Sri M) Others-Spiritualism Kerala 8. Public Affairs Bangladesh 9. Syed Muazzem Ali (Posthumous) 10. Muzaffar Hussain Baig Public Affairs Jammu and Kashmir Ajoy Chakravorty Art West Bengal 11. Manoj Das Puducherry 12. Literature and Education Balkrishna Doshi Others-Architecture Gujarat 13. Krishnammal Jagannathan Social Work Tamil Nadu 14. S. C. Jamir Public Affairs Nagaland 15. Anil Prakash Joshi Social Work Uttarakhand 16. Dr. Tsering Landol Medicine Ladakh 17. Anand Mahindra Trade and Industry Maharashtra 18. Public Affairs Kerala 19. Neelakanta Ramakrishna Madhava Menon (Posthumous) Public Affairs Goa 20. Manohar Gopalkrishna Prabhu Parrikar (Posthumous) Prof. Jagdish Sheth USA 21. Literature and Education P. V. Sindhu Sports Telangana 22. Venu Srinivasan Trade and Industry Tamil Nadu 23. Padma Shri Name Field State/Country S.N. Guru Shashadhar Acharya Art Jharkhand 24. Dr. Yogi Aeron Medicine Uttarakhand 25. Jai Prakash Agarwal Trade and Industry Delhi 26. Jagdish Lal Ahuja Social Work Punjab 27. Kazi Masum Akhtar Literature and Education West Bengal 28. Ms. Gloria Arieira Literature and Education Brazil 29. Khan Zaheerkhan Bakhtiyarkhan Sports Maharashtra 30. Dr. Padmavathy Bandopadhyay Medicine Uttar Pradesh 31. Dr. Sushovan Banerjee Medicine West Bengal 32. Dr. Digambar Behera Medicine Chandigarh 33. -

Awards & Honours January 2020

FREE eBooks oliveboard AWARDS AND HONOURS January 2020 1 FOR BANK, SSC, INSURANCE & RAILWAY EXAMS Awards & Honours January 2020 Free static GK e-book General Awareness is a very prominent section in almost every Bank/Insurance/SSC/Railways and other Government Exams and staying up to date with the latest happenings around the world is direly needed. GK can be divided in two parts that is static and dynamic. In this e-book we will be covering the dynamic GK topic of major Awards and Honours distributed in the month of January 2020. Sample Questions Q) Who among the following has been awarded Tyler Prize 2020? A. Pawan Sukhdev B. Ishwar Sharma C. Sucheta Satish D. None of the above Correct Answer: “A” Q) Who among the following won the Padma Vibhushan award in the field of Public Affairs? A. Shri Arun Jaitley B. Shri Manoj Das C. Shri Muzaffar Hussain Baig D. Shri Manohar Gopal Krishna Correct Answer: “A” Awards & Honours January 2020 Free static GK e-book Awards and Honours January 2020 Padma Vibhushan Award Winners Name Field State/Country Shri George Fernandes Public Affairs Bihar Shri Arun Jaitley Public Affairs Delhi Sir Anerood Jugnauth GCSK Public Affairs Mauritius Smt. M. C. Mary Kom Sports Manipur Shri Chhannulal Mishra Art Uttar Pradesh Smt. Sushma Swaraj Public Affairs Delhi Sri Vishvesha Theertha Swamiji, Sri Pejavara Adhokhaja Others-Spiritualism Karnataka Matha Udupi (Posthumous) Padma Bhushan Award Winners Name Field State/Country Shri M. Mumtaz Ali (Sri M) Others-Spiritualism Kerala Shri Syed Muazzem Public Affairs Bangladesh Ali (Posthumous) Jammu & Shri Muzaffar Hussain Baig Public Affairs Kashmir Shri Ajoy Chakrabarty Art West Bengal Shri Manoj Das Literature & Education Puducherry Shri Balkrishna Doshi Others- Architecture Gujarat Ms. -

Canara Bank. 2. Atanu Kumar Das - Bank of India 3

Current Affairs - Jan 2020 Month All Type All 143 Current Affairs were found in Period - January 11 - 20, 2020 for Type - All Appointments 1. Govt appointed Chiefs (MD and CEO) of 3 PSU Banks - 1. L V Prabhakar - Canara Bank. 2. Atanu Kumar Das - Bank of India 3. Sanjiv Chadha - Bank of Baroda 4. Government Also appointed Challa Sreenivasulu Setty as managing director of State Bank of India for 3 years. 2. Robert Abela has been appointed new prime minister of Malta (Southern European island country). 3. Tsai Ing-wen won Taiwan presidential elections, winning her second term as Taiwan president. 4. Arjun Munda has been elected as new President of Archery Association of India (AAI), to serve term of 4 years. 1. World Archery had appointed Kazi Rajib Uddin Ahmed Chapol as observer for elections of Archery Association of India (AAI), to be held in January 2020. Observer will submit report on his observations and based on report, World Archery will consider 'conditional lifting' of suspension on Indian Archery Federation, which was put in July 2019. 5. Government appointed Nripendra Misra as chairperson of executive council of Nehru Memorial Museum and Library (NMML), with A Surya Prakash as vice-chairperson. 6. India's Bipul Bihari Saha has been elected as a bureau member of the IUPAC (International Union of Pure and Applied Chemistry) for 2020-23. Saha is second Indian after Bharat Ratna Professor CNR Rao, to be elected (1979) for this position in largest global organization of Chemistry professionals. 7. Indian Advocate Harish Salve has been appointed as Queen's Counsel (QC) for courts of England and Wales. -

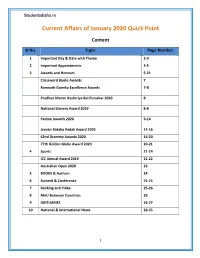

Current Affairs of January 2020 Quick Point

Studentsdisha.in Current Affairs of January 2020 Quick Point Content SI No. Topic Page Number 1 Important Day & Date with Theme 2-3 2 Important Appointments 3-5 3 Awards and Honours 5-21 Crossword Books Awards 7 Ramnath Goenka Excellence Awards 7-8 Pradhan Mantri Rashtriya Bal Puraskar 2020 8 National Bravery Award 2019 8-9 Padma Awards 2020 9-14 Jeevan Raksha Padak Award 2020 14-16 62nd Grammy Awards 2020 16-20 77th Golden Globe Award 2020 20-21 4 Sports 21-24 ICC Annual Award 2019 21-22 Australian Open 2020 22 5 BOOKS & Authors 24 6 Summit & Conference 24-25 7 Ranking and Index 25-26 8 MoU Between Countries 26 9 OBITUARIES 26-27 10 National & International News 28-35 1 Studentsdisha.in January 2020 Quick Point Important Day & Date with Theme of January 2020 Day Observation/Theme 1st Jan Global Family Day World Peace Day 4th Jan World Braille Day 6th Jan Journalists’ Day in Maharashtra 6th Jan The World Day of War Orphans 7th Jan Infant Protection Day 8th Jan African National Congress Foundation Day 9th Jan Pravasi Bharatiya Divas/NRI Day( 16th edition) 10thJan “World Hindi Day” 10thJan World Laughter Day 12th Jan National Youth Day or Yuva Diwas. Theme:"Channelizing Youth Power for Nation Building". 14th Jan Indian Armed Forces Veterans Day 15thJan Indian Army Day(72nd) 16thJan Religious Freedom day 18th Jan 15th Raising Day of NDRF(National Disaster Response Force) 19th Jan National Immunization Day (NID) 21st Jan Tripura, Manipur &Meghalaya 48th statehood day 23rdJan Subhash Chandra Bose Jayanti 24th to 30th National Girl Child Week Jan 24thJan National Girl Child Day Theme:‘Empowering Girls for a Brighter Tomorrow’. -

Counseling Date&Venue-Teaching Staff,PCI,LIB for Parent Cadre

Annexture-1A PROFORMA-5 [See rule 11 (3)(c)] Final merit list for Counselling The Commissioner for Collegiate Education vide Rule 11 (1) (g) publishes the final merit list of teaching staff prepared vide rule 11 (3) of the Karnataka Civil Services (Regulation of Transfers of Staff of department of Collegiate Education) Rules, 2014. Sl. Name of the Applicant Subject/Cadre Place of working No. 1 2 3 4 Physically challenged COMMERCE & Govt. First Grade College, Bhadravathi - 577 1 Dr.MANJULA Y MANAGMENT 301. Govt. First Grade College, Shidlaghatta - 562 2 Dr. A. ETHIRAJULU NAIDU ECONOMICS 106. 3 MALLIKARJUNA A M POLITICAL SCIENCE Govt. First Grade College, Honnali - 577 217 COMMERCE & Smt. Indiragandhi Govt. First Grade College 4 YASHODA MANAGMENT for Women, Sagar - 577 401. Govt. First Grade College for Women, K.R.Pet 5 PRAKASH. N HISTORY - 571 426 Govt. First Grade College, Kittur 591 115, 6 PROMOD F Halemani HISTORY Bylahongala Tq: Govt. First Grade College, Ramanagara - 571 7 Dr.VEENA.K.R SOCIOLOGY 511. Govt. First Grade College, Naregal - 582 119, 8 Prof. Basavaraj B MATHEMATICS Ron Tq. 9 SREENIVASAIAH K N ECONOMICS Govt. College, Mulbagal - 563 131. Govt. First Grade College, MCC B Block, 10 JYOTHI T B SOCIOLOGY Davanagere - 577 004 Govt. First Grade College, Ramanagara - 571 11 VASANTHAKUMARI.C HISTORY 511. COMMERCE & Govt. First Grade College, Napoklu, Madikeri 12 KANNIKA D MANAGMENT Tq Govt. Home Science College for Women, N. 13 Ravi N C KANNADA E. Basic School, Rangoli Halla, Hassan - 573 201 (Co-ED) 14 SUMANGALA R K POLITICAL SCIENCE Govt. First Grade College, Gubbi - 572 216. -

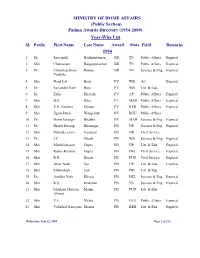

(Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl

MINISTRY OF HOME AFFAIRS (Public Section) Padma Awards Directory (1954-2009) Year-Wise List Sl. Prefix First Name Last Name Award State Field Remarks 1954 1 Dr. Sarvapalli Radhakrishnan BR TN Public Affairs Expired 2 Shri Chakravarti Rajagopalachari BR TN Public Affairs Expired 3 Dr. Chandrasekhara Raman BR TN Science & Eng. Expired Venkata 4 Shri Nand Lal Bose PV WB Art Expired 5 Dr. Satyendra Nath Bose PV WB Litt. & Edu. 6 Dr. Zakir Hussain PV AP Public Affairs Expired 7 Shri B.G. Kher PV MAH Public Affairs Expired 8 Shri V.K. Krishna Menon PV KER Public Affairs Expired 9 Shri Jigme Dorji Wangchuk PV BHU Public Affairs 10 Dr. Homi Jehangir Bhabha PB MAH Science & Eng. Expired 11 Dr. Shanti Swarup Bhatnagar PB UP Science & Eng. Expired 12 Shri Mahadeva Iyer Ganapati PB OR Civil Service 13 Dr. J.C. Ghosh PB WB Science & Eng. Expired 14 Shri Maithilisharan Gupta PB UP Litt. & Edu. Expired 15 Shri Radha Krishan Gupta PB DEL Civil Service Expired 16 Shri R.R. Handa PB PUN Civil Service Expired 17 Shri Amar Nath Jha PB UP Litt. & Edu. Expired 18 Shri Malihabadi Josh PB DEL Litt. & Edu. 19 Dr. Ajudhia Nath Khosla PB DEL Science & Eng. Expired 20 Shri K.S. Krishnan PB TN Science & Eng. Expired 21 Shri Moulana Hussain Madni PB PUN Litt. & Edu. Ahmed 22 Shri V.L. Mehta PB GUJ Public Affairs Expired 23 Shri Vallathol Narayana Menon PB KER Litt. & Edu. Expired Wednesday, July 22, 2009 Page 1 of 133 Sl. Prefix First Name Last Name Award State Field Remarks 24 Dr. -

CURRENT EVENTS and ANALYSIS (January 2020)

CURRENT EVENTS AND ANALYSIS (January 2020) Editor R.C. Reddy R.C. REDDY IAS STUDY CIRCLE H.No. 3-6-275, Opp. Telangana Tourism Development Corporation, Near Telugu Academy, Himayatnagar, Hyderabad - 500 029. Phone No. : 040-23228513; 040-27668513; 040-27612673; 9346882593; 9573462587 Email : [email protected] CURRENT EVENTS AND ANALYSIS CONTENTS Topic Page No. ECONOMY MACROVIEW OF INDIAN ECONOMY: Economic Survey 2019-20 1 FISCAL POLICY: Union Budget 2020-21 11 BANKING: SBI Launches New Home Loan Scheme with Completion Guarantee to Buyers 32 INDUSTRY: Coal: Coal Mining Regulations Relaxed through Ordinance 32 Jewellery: Hallmarking Made Mandatory for Gold Jewellery 33 E-commerce: Amazon to Create 1 Million New Jobs in India by 2025 34 INFRASTRUCTURE: Oil & Gas: Rs 5,500 crore Viability Gap Funding for setting up the North East Natural Gas Pipeline Grid 35 Environmental Clearance Exemption for Onshore and Offshore Oil and Gas Exploration 36 WORLD ECONOMY - GLOBAL REPORTS: UNCTAD Report: India Among Top 10 FDI Recipients with $49 billion Inflows in 2019: UN Report 36 World Bank Report: ‘Global Economic Prospects Report’ of World Bank Projects 5 Per cent Growth of India 37 IMF Report: IMF Cuts India’s Growth Estimate to 4.8 Per cent in 2019-20 39 NATIONAL POLITY Anti-defection Law: Supreme Court’s Verdict on Anti-Defection Law 40 Election Funding: Vice President Calls for Effective Laws Against Huge Election Expenditure by Parties and Populist Spending by Governments 42 Republic Day: President’s Address on the Eve of Republic -

Weekly Beebooster 9Th to 15Th Jan 2020 Regular Banking

Weekly BeeBooster 9th Jan to 15th Jan 2020 Finance and Banking RBI amends KYC norms, allows banks to use V-CIP The RBI has amended the KYC norms allowing banks and other lending institutions regulated by it to use Video based Customer Identification Process (V-CIP), a move which will help them onboard customers remotely. • The Reserve Bank has decided to permit video based Customer Identification Process (V- CIP) as a consent based alternate method of establishing the customer's identity, for customer onboarding with a view to leveraging the digital channels for Customer Identification Process (CIP) by regulated entities (REs). • Live location of the customer (Geotagging) shall also be captured to ensure that customer is physically present in India. In a first, HDFC Bank launches myApps to boost digital payments HDFC Bank launched myApps application to boost digital payments in India. myApps is a unique customised suite of banking products to benefit urban local bodies, housing societies, local clubs and gymkhanas and religious institutions. • In a first, HDFC bank is helping organisations to entirely digitise their ecosystem through myApps. At present HDFC Bank is offering four types of applications — mySociety, myClub, myPrayer and myCity. • myApps will enable the organisation to get easy access to reports on payments, facilities booked by members, requests and complaints registered by users. • This initiative is a part of the HDFC Bank’s strategy to take digitisation to the next level by focusing on providing value beyond basic banking services RBI chalks out financial inclusion strategy for 2024 The Reserve Bank of India (RBI) has chalked out an ambitious strategy for financial inclusion for 2019-2024, in which it aims to strengthen the ecosystem for various modes of digital financial services in all Tier-II to Tier-VI centers to create the necessary infrastructure to move towards a less-cash society by March 2022. -

VETRII IAS STUDY CIRCLE TNPSC Current Affairs JANUARY - 2020

VETRII IAS STUDY CIRCLE TNPSC CURRENT AFFAIRS JANUARY - 2020 An ISO 9001 : 2015 Institution | Providing Excellence Since 2011 Head Office Old No.52, New No.1, 9th Street, F Block, 1st Avenue Main Road, (Near Istha siddhi Vinayakar Temple), Anna Nagar East – 600102. Phone: 044-2626 5326 | 98844 72636 | 98844 21666 | 98844 32666 Branches SALEM KOVAI No.189/1, Meyanoor Road, Near ARRS Multiplex, (Near Salem New No.347, D.S.Complex (3rd floor), Nehru Street,Near Gandhipuram bus Stand), Opp. Venkateshwara Complex, Salem - 636004. Central Bus Stand, Ramnagar, Kovai - 9 0427-2330307 | 95001 22022 75021 65390 Educarreerr Location Vivekanandha Educational Institutions for Women, Elayampalayam, Tiruchengode - TK Namakkal District - 637 205. 04288 - 234670 | 91 94437 34670 Patrician College of Arts and Science, 3, Canal Bank Rd, Gandhi Nagar, Opposite to Kotturpuram Railway Station, Adyar, Chennai - 600020. 044 - 24401362 | 044 - 24426913 Sree Saraswathi Thyagaraja College Palani Road, Thippampatti, Pollachi - 642 107 73737 66550 | 94432 66008 | 90951 66009 www.vetriias.com My Dear Aspirants, Greetings to all of you! “What we think we become” Gautama Buddha. We all have dreams. To make dreams come into reality it takes a lot of determination, dedication, self discipline and continuous effort. We at VETRII IAS Study Circle are committed to provide the right guidance, quality coaching and help every aspirants to achieve his or her life’s cherished goal of becoming a civil servant. The class room coaching at VETRII IAS Study Circle is meticulously planned to equip the aspirants with all the relevant facts and fundamentals of the subjects. Further the VETRII IAS Study Circle Study materials aim to support the candidate by providing the most relevant study material in a comprehensive manner. -

Padma Awards 2020 Winner List Padma Vibhushan-7 Persons

Padma Awards 2020 winner list Padma Awards 2020 winner list released by Government of India at official website on 25th January 2020 Padma Awards are conferred by the President of India at ceremonial functions of Republic Day (26th January) which are held at Rashtrapati Bhawan every year. There are three Padma Awards given on Republic Day (26th January) every year. a) Padma Vibhushan b) Padma Bhushan c) Padma Shri This year the President has approved conferment of 141 Padma Awards including 4 duo cases (in a duo case, the Award is counted as one) as per list below. The list comprises 7 Padma Vibhushan, 16 Padma Bhushan and 118 Padma Shri Awards. Padma Vibhushan-7 persons Padma Bhushan-16 persons Padma Shri-118 persons Total-141 persons women awardees -33 persons Foreigners/NRI/PIO/OCI -18 persons Posthumous awardees-12 persons Padma Vibhushan-7 persons SI.No Name Field State/Country 1. Shri George Fernandes Public Affairs Bihar (Posthumous) 2. Shri Arun Jaitley Public Affairs Delhi (Posthumous) 3. Sir Anerood Jugnauth GCSK Public Affairs Mauritius 4. Smt. M. C. Mary Kom Sports Manipur 5. Shri Chhannulal Mishra Art Uttar Pradesh 6. Smt. Sushma Swaraj Public Affairs Delhi (Posthumous) 7. Sri Vishveshateertha Swamiji Sri Pejavara Others Spiritualism Karnataka Adhokhaja Matha Udupi (Posthumous) Padma Bhushan-16 persons SI.No Name Field State/Country 1 Shri M. Mumtaz Ali (Sri M) Others Spiritualism Kerala 2 Shri Syed Muazzem Ali (Posthumous) Public Affairs Bangladesh 3 Shri Muzaffar Hussain Baig Public Affairs Jammu and Kashmir 4 Shri Ajoy Chakravorty Art West Bengal 5 Shri Manoj Das Literature and Puducherry Education 6 Shri Balkrishna Doshi Architecture Gujarat 7 Ms.