Simply Unsustainable! the EU’S Energy Projects with Israel

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The New Energy Triangle of Cyprus-Greece-Israel: Casting a Net for Turkey?

THE NEW ENERGY TRIANGLE OF CYPRUS-GREECE-ISRAEL: CASTING A NET FOR TURKEY? A long-running speculation over massive natural gas reserves in the tumultuous area of the Southeastern Mediterranean became a reality in December 2011 and the discovery's timing along with other grave and interwoven events in the region came to create a veritable tinderbox. The classic “Rubik's cube” puzzle here is in perfect sync with the realities on the ground and how this “New Energy Triangle” (NET) of newfound and traditional allies' actions (Cyprus, Greece and Israel) towards Turkey will shape and inevitably affect the new balance of power in this crucial part of the world. George Stavris* *George Stavris is a visiting researcher at Dundee University's Centre for Energy, Petroleum and Mineral Law and Policy working on the geostrategic repercussions in the region of the “New Energy Alliance” (NET) of Cyprus, Greece and Israel. 87 VOLUME 11 NUMBER 2 GEORGE STAVRIS long-running speculation over massive natural gas reserves in the tumultuous area of the Southeastern Mediterranean and in Cyprus’s Exclusive Economic Zone (EEZ) became a reality in A December 2011 when official reports of the research and scoping were released. Nearby, Israel has already confirmed its own reserves right next to Cyprus’ EEZ. However the location of Cypriot reserves with all the intricacies of the intractable “Cyprus Problem” and the discovery’s timing along with other grave and interwoven events in the region came to create a veritable tinderbox. A rare combination of the above factors and ensuing complications have created not just a storm in the area but almost, indisputably, the rare occasion of a “Perfect Storm” in international politics with turbulence reaching far beyond the shores of the Mediterranean “Lake”. -

W O R K I N G P a P E R Natural Gas Import and Export

W ORKING P APER Working Paper No26 July 2019 NATURAL GAS IMPORT AND EXPORT ROUTES IN SOUTH-EAST EUROPE AND TURKEY Gina Cohen Lecturer & Consultant on Natural Gas ΙΕΝΕ Working Paper No26 NATURAL GAS IMPORT AND EXPORT ROUTES IN SOUTH-EAST EUROPE AND TURKEY Author Gina Cohen, Lecturer & Consultant on Natural Gas Institute of Energy for SE Europe (IENE) 3, Alexandrou Soutsou, 106 71 Athens, Greece tel: 0030 210 3628457, 3640278 fax: 0030 210 3646144 web: www.iene.gr, e-mail: [email protected] Copyright ©2019, Institute of Energy for SE Europe All rights reserved. No part of this study may be reproduced or transmitted in any form or by any means without the prior written permission of the Institute of Energy for South East Europe. Please note that this publication is subject to specific restrictions that limit its use and distribution. [2] ACRONYMS AERS - Energy Agency of the Republic of Serbia AIIB - Asian Infrastructure Investment Bank BCM - Billion cubic meters BOTAS - Boru Hatlari Ile Petroleum Tasima Anonim Sirketi (Petroleum Pipeline Corporation) BRUA - Bulgaria-Romania-Hungary-Austria BRUSKA- Bulgaria-Romania-Hungary-Slovakia-Austria EBRD - European Bank for Reconstruction and Development EITI - Exctractive Industries Transparency Initiative EPDK - Enerji Piyasasi Duzenleme Kurumu (Energy Market Regulatory Authority) EU - European Union FGSZ - Foldgazszallito Zrt. (Hungarian Gas Transmission System Operator) FSRU – Floating Storage and Regasification unit GWh - Gigawatt hour HAG - Hungaria-Austria-Gasleitung (Hungary-Austria Interconnector) -

October 2017 1

1 OCTOBER 2017 1 2 The EuroAsia Interconnector A Bridge of Friendship and Prosperity Unitizing Networks The EuroAsia Interconnector offers the creation of a reliable energy transfer alternative for Europe, extending the energy market beyond its borders. It is a major energy infrastructure project aiming to establish itself as one of the most ambitious interconnector schemes. Furthermore, being the first energy bridge between Europe and Asia it unifies electricity networks in the two continents. The electrical systems of Israel, Cyprus and Greece (via Crete) will be connected through sub-marine High Voltage Direct Current (HVDC) cables of capacity in the order of 2000 MW. Voltage Source Converter (VSC) stations will be located in each terminal in order to aid in assimilating the power into the respective countries in the form of alternating current. The complexity resulting from the great depth and long distances as well as the nature of the link will put into practice the latest technological advancements when it comes to cable and electrical infrastructure developments. 2 3 Project History and Key Drivers The Perception of the Idea While the Mediterranean region displays a great diversity of cultures and populations it nevertheless is a place of convergence. Furthermore, the energy sector in this geographical area has a high degree of interdependence both for electricity and gas. It is thus incomprehensible for Cyprus to remain electrically isolated from the rest of the European Energy Network as an energy island, similar to Israel and Crete. Adding, the EU’s Renewable energy directive sets a binding target of 20% final energy consumption from renewable energy sources by 2020 and for that reason each member country has to adopt action plans for the implementation of changes to meet these targets. -

The Moscow-Ankara Energy Axis and the Future of EU-Turkey Relations

September 2017 FEUTURE Online Paper No. 5 The Moscow-Ankara Energy Axis and the Future of EU-Turkey Relations Nona Mikhelidze, IAI Nicolò Sartori, IAI Oktay F. Tanrisever, METU Theodoros Tsakiris, ELIAMEP Online Paper No. 5 “The Moscow-Ankara Energy Axis and the Future of EU -Turkey Relations ” ABSTRACT The Turkey-Russia-EU energy triangle is a relationship of interdependence and strategic compromise. However, Russian support for secessionism and erosion of state autonomy in the Caucasus and Eurasia has proven difficult to reconcile for western European states despite their energy dependence. Yet, Turkey has enjoyed an enhanced bilateral relationship with Russia, augmenting its position and relevance in a strategic energy relationship with the EU. The relationship between Ankara and Moscow is principally based on energy security and domestic business interests, and has largely remained stable in times of regional turmoil. This paper analyses the dynamics of Ankara-Moscow cooperation in order to understand which of the three scenarios in EU –Turkey relations – conflict, cooperation or convergence – could be expected to develop bearing in mind that the partnership between Turkey and Russia has become unpredictable. The intimacy of Turkish-Russia energy relations and EU-Russian regional antagonism makes transactional cooperation on energy demand the most likely of future scenarios. A scenario in which both Brussels and Ankara will try to coordinate their relations with Russia through a positive agenda, in order to exploit the interdependence emerging within the “triangle”. ÖZET Türkiye Rusya ve AB arasındaki enerji üçgeni bir karşılıklı bağımlılık ve stratejik uzlaşma ilişkisidir. Ancak, her ne kadar Rusya’ya enerji bağımlılıkları olsa da, Batı Avrupalı devletler için Rusya’nın Kafkasya ve Avrasyadaki ayrılıkçılığa ve devlet özerkliğinin erozyonuna verdiği desteğin kabullenilmesinin zor olduğu ortaya çıkmıştır. -

Delivering the Energy Transition Through a Strategic Focus on Gas in the East Med Mathios Rigas, Energean Group CEO IP Week London, 25Th February 2020

Delivering the Energy Transition Through a Strategic Focus on Gas in the East Med Mathios Rigas, Energean Group CEO IP Week London, 25th February 2020 Το σχέδιο ανάπτυξης του κοιτάσματος υδρογονανθράκων στο Δυτικό Κατάκολο Δρ. Κωνσταντίνος Νικολάου, Τεχνικός Σύμβουλος Energean Δημοτικό Συμβούλιο Πύργου, 14 Νοεμβρίου 2019 1 Key questions 1. Is there a role for independent E&P players in today’s market? 2. What is the role of the East Med in delivering the energy transition? 2 1 Energean at a glance Creating the leading independent, gas-focused, sustainable E&P company in the Eastern Mediterranean 820 MMboe ~130 kboed 80% FTSE 250 2P reserves and Production gas-weighted The Largest 2C resources by 2022* portfolio independent E&P ESG & HSE ESG action Focused 1st E&P to commit A rating MSCI to net zero by 2050 *Edison E&P reserve estimates as of 31.10.2018, excludes UK, Norway and Algeria. 3 *Energean Israel reserve estimates as of 30.06.2019 CPR. Energean reserve estimates are pending finalisation of 2019 CPR. 2 *2022 production excludes UK, Norway and Algeria. Taking Action on Environmental Issues Through Focus on Gas Leaders in ESG Carbon Intensity Reduction Plan 80 80% gas-weighted portfolio Energean today 70 First E&P company to commit 60 to net zero by 2050 50 40 Targeting 70% reduction in carbon Energean intensity 2020-22 + Edison 30 E&P Energean + Edison Executive pay linked to ESG goals 20 E&P + from 2020 Israel 10 Committed to transparency and 0 adherence to the UN SDG’s 2019 2021 2022 Carbon intensity scope 1 & 2 (kgCO2/boe) 4 3 -

A Shaping Factor for Regional Stability in the Eastern Mediterranean?

DIRECTORATE-GENERAL FOR EXTERNAL POLICIES POLICY DEPARTMENT STUDY Energy: a shaping factor for regional stability in the Eastern Mediterranean? ABSTRACT Since 2010 the Eastern Mediterranean region has become a hotspot of international energy discussions due to a series of gas discoveries in the offshore of Israel, Cyprus and Egypt. To exploit this gas potential, a number of export options have progressively been discussed, alongside new regional cooperation scenarios. Hopes have also been expressed about the potential role of new gas discoveries in strengthening not only the regional energy cooperation, but also the overall regional economic and political stability. However, initial expectations largely cooled down over time, particularly due to delays in investment decision in Israel and the downward revision of gas resources in Cyprus. These developments even raised scepticism about the idea of the Eastern Mediterranean becoming a sizeable gas- exporting region. But initial expectations were revived in 2015, after the discovery of the large Zohr gas field in offshore Egypt. Considering its large size, this discovery has reshaped the regional gas outlook, and has also raised new regional cooperation prospects. However, multiple lines of conflict in the region continue to make future Eastern Mediterranean gas activities a major geopolitical issue. This study seeks to provide a comprehensive analysis of all these developments, with the ultimate aim of assessing the realistic implications of regional gas discoveries for both Eastern Mediterranean countries and the EU. EP/EXPO/B/AFET/2016/03 EN June 2017 - PE578.044 © European Union, 2017 Policy Department, Directorate-General for External Policies This paper was requested by the European Parliament's Committee on Foreign Affairs. -

Gas Infrastructure Map of the Mediterranean Region

Empowering Mediterranean regulators for a common energy future. Working Group on Gas (GAS WG) GAS INFRASTRUCTURE MAP OF THE MEDITERRANEAN REGION MED17-24GA -5.4.2 FINAL REPORT Luogo, data MEDREG is co-funded by the European Union MEDREG – Association of Mediterranean Energy Regulators Corso di Porta Vittoria 27, 20122 Milan, Italy - Tel + 39 02 655 65 537 - Fax +39 02 655 65 562 [email protected] – www.medreg-regulators.org Ref: MED17-24GA -5.4.2 Gas Infrastructure Map of the Mediterranean region Table of content 1. Introduction ................................................................................................................................... 4 2. Work’s methodology description .................................................................................................. 6 3. Analysis of the Results ................................................................................................................... 8 3.1 TPA regimes in a nutshell ...................................................................................................... 8 3.2 A growing trend: LNG and FSRUs .......................................................................................... 8 3.3 Benefits and impacts of the investments .............................................................................. 9 3.4 Implementation barriers ...................................................................................................... 9 3.5 Key performance indicators ............................................................................................... -

Euroasia Interconnector - Final Detailed Studies ENERGY Prior to Project Implementation

Connecting Europe Facility EuroAsia Interconnector - Final Detailed Studies ENERGY Prior to Project Implementation 3.10.1-0004-CYEL-S-M-16 Member States involved: Part of Cluster of the Projects of Common Interest 3.10 Cyprus, Greece Non-EU country: Israel Implementation schedule Start date: June 2017 End date: December 2020 Budget: Estimated total cost of the action: €29,000,000 Maximum EU contribution: €14,500,000 Percentage of EU support: 50% Beneficiary: EuroAsia Interconnector Limited http://www.euroasia- interconnector.com Additional information: European Commission http://ec.europa.eu/energy/infrastructu re/index_en.htm The Action contributes to the implementation of the cluster of projects of common interest 3.10. The EuroAsia Interconnector consists of a 500 kV DC Innovation and Networks Executive underwater electric cable and associated equipment for interconnecting the Agency (INEA) Cypriot, Israeli and Greek transmission networks. The first phase of the http://inea.ec.europa.eu interconnector will have a capacity of 1,000 MW and a total length of around 1,518 km. Agency for the Cooperation of Energy Regulators (ACER) Building upon the preparatory studies financed under CEF Action 3.10.1- http://www.acer.europa.eu 0028-CY-S-M-14, the objective of this Action is to finalise the design of the interconnector and to procure the associated works contracts. The scope European Network of Transmission entails the Detailed Geophysical and Geotechnical Route Study; the System Operators for Electricity Submarine Power Cable Installation Study; the Territorial Civil Works Study; (ENTSO-E) the Front End Engineering Design Study; and procurement consultancy http://www.entsoe.eu services. -

Policy Brief

EUROPEAN COUNCIL ON FOREIGN BRIEF POLICY RELATIONS ecfr.eu PIPELINES AND PIPEDREAMS HOW THE EU CAN SUPPORT A REGIONAL GAS HUB IN THE EASTERN MEDITERRANEAN Tareq Baconi There has been a great deal of excitement over the past few years around newly-discovered gas reserves in the eastern SUMMARY Mediterranean, and rightly so. With confirmed reserves • Large natural gas discoveries in the eastern reaching close to 100 billion cubic metres (bcm) of gas, and the Mediterranean have raised hopes that the region possibility of more discoveries to come, the Levantine Deep could serve EU energy needs, helping it to fulfil its Marine Basin has the potential to offer two things of value to goals of energy diversification, security, and resilience. the European Union: energy security, and an improvement in regional cooperation between Middle Eastern countries. • But there are commercial and political hurdles in the way. Cyprusʼs reserves are too small to be The diversification of Europe’s gas supply has long been a commercially viable and Israel needs a critical mass priority for the European Union. With gas wars taking place of buyers to begin full-scale production. Regional between Russia and EU member states in 2006 and 2009, and cooperation – either bilaterally or with Egypt – is a major escalation of diplomatic tension following Russia’s the only way the two countries will be able to export. annexation of Crimea in 2014, efforts to address this issue have accelerated in recent years.1 The prospect of reducing the EU’s • Egypt is the only country in the region that could dependency on Russian gas by securing supplies from within export gas to Europe independently because Europe’s geographical vicinity could help the EU build energy of the size of its reserves and its existing export resilience – a stated goal of its Energy Union strategy. -

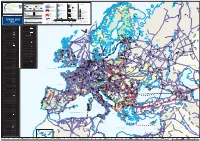

TYNDP 2017 FID Status (Final Investment Decision) White Sea PCI Status (Project of Common Interest) Submission

SHTOKMAN SNØHVIT Pechora Sea ASKELADD MELKØYA KEYS ALBATROSS Hammerfest Salekhard Cross-border points / intra-country or intra balancing zone points Transport by pipeline LNG Import Terminals Storage facilities Compressor stations Barents KILDIN N Acquifer Sea 1ACross-border interconnection point Cross-border interconnection point Pipeline diameters : LNG Terminals’ entry point within Europe within Europe Diameter < 600 mm intro transmission system Salt cavity - cavern or export point to non-EU country or export point to non-EU country Operational Under construction or Planned Diameter 600 - 900 mm Depleted (Gas) eld on shore / oshore MURMAN Diameter > 900mm Other type Unknown Cross-border interconnection point Cross-border third country (import) with third country (import) Under construction or Planned Pomorskiy Project categories : Project categories : Project categories : Project categories : Strait Intra-country or Murmansk Third country cross-border FID projects FID projects FID projects intra balancing zone points interconnection point FID projects Non-FID, advanced projects Non-FID, advanced projects Non-FID, advanced projects REYKJAVIK Non-FID, advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Non-FID, non-advanced projects Gas Reserve areas Countries Non-FID, non-advanced projects ENTSOG Member Countries ICELAND Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Project is part of 2nd PCI list : Drilling platform ENTSOG Associated Partner P ENTSOG -

Euroasia Interconnector Congratulates Partner Countries Signing East Med Gas Forum Charter

ANNOUNCEMENT EuroAsia Interconnector congratulates partner countries signing East Med Gas Forum charter Photos: At left, Energy Minister of Greece, Kostis Hatzidakis signing the charter in Athens. At right, Cyprus Energy Minister Natasa Pilides signing the charter in Nicosia. Nicosia, September 23, 2020 – EuroAsia Interconnector, project developer of the European Union Project of Common Interest (PCI3.10), interconnecting the electricity grids of Israel and Europe, through Cyprus and Greece (Crete), congratulates the seven energy ministers who signed the charter turning the East Med Gas Forum into an international body. This historic event, with the ministers of Egypt, Greece, Israel, Cyprus, Italy, Jordan and the Palestinian Authority signing the charter during a virtual ceremony, paves the way to cooperating on infrastructure and facilitating development of regional energy markets. In Nicosia, the charter was signed by Cyprus Energy Minister Natasa Pilidou, in the presence of the ambassadors of Jordan, Italy, Egypt, Israel and the United States. “We congratulate the leaders of the partner countries who had the vision to establish this platform that will develop a sustainable regional gas market,” said EuroAsia Interconnector Strategic Council Chairman and former Cyprus Foreign Minister Dr. Ioannis Kasoulides. Page 1 of 3 The East Med Gas Forum was originally founded in 2018 following the discoveries of large natural gas deposits near Egypt and Israel. It was officially established as an international body on January 16, 2020 and it was agreed that the headquarters be located in Cairo, Egypt. The Forum’s aim is to serve as a platform that brings together gas producers, consumers and transit countries to create a shared vision and establish a structured systematic policy dialogue on natural gas through cooperation in the technical and economic fields. -

Energy Discoveries in the Eastern Mediterranean: Impact of the Cyprus Issue and Relevance for the Eu Energy Security

CENTRE INTERNATIONAL DE FORMATION EUROPEENNE SCHOOL OF GOVERNMENT INSTITUT EUROPEEN · EUROPEAN INSTITUTE ENERGY DISCOVERIES IN THE EASTERN MEDITERRANEAN: IMPACT OF THE CYPRUS ISSUE AND RELEVANCE FOR THE EU ENERGY SECURITY BY Beliz Küçükosman A thesis submitted for the Joint Master degree in Global Economic Governance & Public Affairs (GEGPA) Academic year 2019 – 2020 July 2020 Supervisor: Giulio Venneri Reviewer: Lorenzo Liso PLAGIARISM STATEMENT I certify that this thesis is my own work, based on my personal study and/or research and that I have acknowledged all material and sources used in its preparation. I further certify that I have not copied or used any ideas or formulations from any book, article or thesis, in printed or electronic form, without specifically mentioning their origin, and that the complete citations are indicated in quotation marks. I also certify that this assignment/report has not previously been submitted for assessment in any other unit, except where specific permission has been granted from all unit coordinators involved, and that I have not copied in part or whole or otherwise plagiarized the work of other students and/or persons. In accordance with the law, failure to comply with these regulations makes me liable to prosecution by the disciplinary commission and the courts of the French Republic for university plagiarism. 1 Table of Contents Glossary of Acronyms .................................................................................................................. 3 Introduction ................................................................................................................................