IMPORTANT You Must Read the Following Before Continuing. the Following Applies to the Preliminary Offering Circular (The Prelimi

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pakistan's Institutions

Pakistan’s Institutions: Pakistan’s Pakistan’s Institutions: We Know They Matter, But How Can They We Know They Matter, But How Can They Work Better? Work They But How Can Matter, They Know We Work Better? Edited by Michael Kugelman and Ishrat Husain Pakistan’s Institutions: We Know They Matter, But How Can They Work Better? Edited by Michael Kugelman Ishrat Husain Pakistan’s Institutions: We Know They Matter, But How Can They Work Better? Essays by Madiha Afzal Ishrat Husain Waris Husain Adnan Q. Khan, Asim I. Khwaja, and Tiffany M. Simon Michael Kugelman Mehmood Mandviwalla Ahmed Bilal Mehboob Umar Saif Edited by Michael Kugelman Ishrat Husain ©2018 The Wilson Center www.wilsoncenter.org This publication marks a collaborative effort between the Woodrow Wilson International Center for Scholars’ Asia Program and the Fellowship Fund for Pakistan. www.wilsoncenter.org/program/asia-program fffp.org.pk Asia Program Woodrow Wilson International Center for Scholars One Woodrow Wilson Plaza 1300 Pennsylvania Avenue NW Washington, DC 20004-3027 Cover: Parliament House Islamic Republic of Pakistan, © danishkhan, iStock THE WILSON CENTER, chartered by Congress as the official memorial to President Woodrow Wilson, is the nation’s key nonpartisan policy forum for tackling global issues through independent research and open dialogue to inform actionable ideas for Congress, the Administration, and the broader policy community. Conclusions or opinions expressed in Center publications and programs are those of the authors and speakers and do not necessarily reflect the views of the Center staff, fellows, trustees, advisory groups, or any individuals or organizations that provide financial support to the Center. -

D I S R U P T I N G T H E F U T U R E

Ministry of Planning Development & Reforms D i s r u p t i n g t h e F u t u r e The LEADERS IN ISLAMABAD Business Summit is providing an extravagant atmosphere, a dynamic mix of individuals, a gathering of vibrant strategists and business Featuring Innovators, thinkers, futurists, innovators, ministers, and Leaders & Future Thinkers a show of some of the most pulsating corporates and distinguished academicians. Strategic Partners: The summit allows leading business figures from around the world to present their ideas and effective business strategies in a discussion to address leadership and business concerns crucial to today's world decision makers. March 14 & 15, 2018 - 0830 hours to 1700 hours - Serena Hotel, Islamabad Platinum Sponsor: Gold Sponsors: Gold Sponsors: Knowledge Partners: Featuring Innovators, Leaders & Future Thinkers D i s r u p t i n g t h e F u t u r e SPEAKERS & PANELISTS – OVERSEAS: H. E. Manuel Salvador Quevedo Fernandez, People's Minister of Petroleum, Venezuela S. A. George De Lama, Global President, Eisenhower Fellowships, USA Dr. Daniel S. Markey, Senior Research Professor of International Relations, John Hopkins University, USA Eric Jolliffe, Chief of York Region Police, Canada Jerome C. Glenn, Co-founder & CEO, The Millennium Project, USA Maria Sarungi Tsehai, Founder, ChangeTanzania & CEO, Kwanza TV & Compass Communications, Africa Wendy Hogan, Customer Experience & Marketing Strategy Director, ORACLE Corporation – APAC Region Jonathan Tavss, Adjunct Professor Media Ventures, Boston University, USA Dean Donaldson, Managing Partner, Kaleidoko, UK Raymond So, Chairman, Asian Federation of Advertising Associations Harris Thajeb, Chairman, Dentsu Indonesia Peter Large, Executive Director Governance, ACCA Assem Khalaili, Executive Vice President Middle East, Siemens LLC Juan Jose de la Torre, IBM's Digital Transformation Leader Middle East, Africa, Pakistan & Turkey Bharat Avalani, CEO, Connecting the Dots, Malaysia Maged Wassim, Vice President Cloud, IBM Middle East & Africa Dr. -

STATE of CIVIL-MILITARY RELATIONS in PAKISTAN a Study of 5 Years: 2013-2018

STATE OF CIVIL-MILITARY RELATIONS IN PAKISTAN A Study of 5 Years: 2013-2018 Pakistan Institute of Legislative Development And Transparency STATE OF CIVIL-MILITARY RELATIONS IN PAKISTAN A Study of 5 Years: 2013-2018 Pakistan Institute of Legislative Development And Transparency PILDAT is an independent, non-partisan and not-for-profit indigenous research and training institution with the mission to strengthen democracy and democratic institutions in Pakistan. PILDAT is a registered non-profit entity under the Societies Registration Act XXI of 1860, Pakistan. Copyright © Pakistan Institute of Legislative Development And Transparency - PILDAT All Rights Reserved Printed in Pakistan Published: January 2019 ISBN: 978-969-558-734-8 Any part of this publication can be used or cited with a clear reference to PILDAT. Pakistan Institute of Legislative Development And Transparency Islamabad Office: P. O. Box 278, F-8, Postal Code: 44220, Islamabad, Pakistan Lahore Office: P. O. Box 11098, L.C.C.H.S, Postal Code: 54792, Lahore, Pakistan E-mail: [email protected] | Website: www.pildat.org P I L D A T State of Civil-Military Relations in Pakistan A Study of 5 Years: 2013-2018 CONTENTS Preface 05 List of Abbreviations and Acronyms 07 Executive Summary 09 Introduction 13 State of Civil-military Relations in Pakistan: June 2013-May 2018 13 Major Irritants in Civil-Military Relations in Pakistan 13 i. Treason Trial of Gen. (Retd.) Pervez Musharraf 13 ii. The Islamabad Sit-in 14 iii. Disqualification of Mr. Nawaz Sharif 27 iv. 21st Constitutional Amendment and the Formation of Military Courts 28 v. Allegations of Election Meddling 30 vi. -

PAKISTAN NEWS DIGEST a Selected Summary of News, Views and Trends from Pakistani Media

February 2017 PAKISTAN NEWS DIGEST A Selected Summary of News, Views and Trends from Pakistani Media Prepared by Dr Ashish Shukla & Nazir Ahmed (Research Assistants, Pakistan Project, IDSA) PAKISTAN NEWS DIGEST FEBRUARY 2017 A Select Summary of News, Views and Trends from the Pakistani Media Prepared by Dr Ashish Shukla & Nazir Ahmed (Pak-Digest, IDSA) INSTITUTE FOR DEFENCE STUDIES AND ANALYSES 1-Development Enclave, Near USI Delhi Cantonment, New Delhi-110010 Pakistan News Digest, February (1-15) 2017 PAKISTAN NEWS DIGEST, FEBRUARY 2017 CONTENTS ....................................................................................................................................... 0 ABBREVIATIONS ..................................................................................................... 2 POLITICAL DEVELOPMENTS ............................................................................. 3 NATIONAL POLITICS ....................................................................................... 3 THE PANAMA PAPERS .................................................................................... 7 PROVINCIAL POLITICS .................................................................................... 8 EDITORIALS AND OPINION .......................................................................... 9 FOREIGN POLICY ............................................................................................ 11 EDITORIALS AND OPINION ........................................................................ 12 MILITARY AFFAIRS ............................................................................................. -

February 2018 Volume 09 Issue 02 Promoting Bilateral Relations | Current Affairs | Trade & Economic Affairs | Education | Technology | Culture & Tourism ABC Certified

Monthly Magazine on National & International Political Affairs, Diplomatic Issues February 2018 Volume 09 Issue 02 Promoting Bilateral Relations | Current Affairs | Trade & Economic Affairs | Education | Technology | Culture & Tourism ABC Certified “Publishing from Pakistan, United Kingdom/EU & will be soon from UAE , Central Africa, Central Asia & Asia Pacific” Member APNS Central Media List A Largest, Widely Circulated Diplomatic Magazine | www.diplomaticfocus.org | www.diplomaticfocus-uk.com | Member Diplomatic Council /diplomaticfocusofficial /DFocusOfficial will benefit President of Indonesia H.E. Ir. H. Joko Widodo February 2018 Volume 09 Issue 02 “Publishing from Pakistan, United Kingdom/EU & will be soon from UAE ” 08 18 24 40 08 Conflicts & wars will benefit no one: President Mamnoon Hussain and President of Indonesia Ir. President of Indonesia H. Joko Widodo have agreed to work together for peace in Afghanistan and said that peace in Afghanistan is necessary for the development and progress of the region. Both countries will work together in this regard 18 Nishan-i-Imtiaz (Military) to Commander On the occasion, the President said that Pakistan and Saudi Royal Saudi Naval Forces Vice Admiral Arabia are the closest friends and the depth of their relationship Fahad Bin Abdullah Al-Ghofaily is difficult to describe in words. 24 CPEC most important initiative of our Prime Minister Shahid Khaqan said that the China Pakistan generation: PM Abbasi Economic Corridor (CPEC) is the most important initiative of our generation. “This is perhaps the most important initiative of our generation and the most visible part of the Belt and Road Initiative,” he said while addressing the inauguration ceremony of the first-ever International Gwadar Expo. -

STATE OWNED ENTITIES (Soes)

FEDERAL FOOTPRINT n STATE OWNED ENTITIES (SOEs) PERFORMANCE REVIEW FY2014-15 FEDERAL FOOTPRINT: STATE OWNED ENTITIES PERFORMANCE OVERVIEW FY 2014-15 TABLE OF CONTENTS List of Abbreviations .............................................................................................................. ii List of Tables .......................................................................................................................... iii DASHBOARD ........................................................................................................................ iv EXECUTIVE SUMMARY .................................................................................................... 1 INTRODUCTION .................................................................................................................. 4 Assumptions and Limitations:....................................................................................................... ..6 SECTION I: STATE OWNED ENTITIES MAPPING ...................................................... 8 A. Categorical Classification ....................................................................................................... 9 B. Administrative Classification ............................................................................................... 14 C. Sectoral Classification ........................................................................................................... 20 SECTION II: STATE OWNED ENTITIES PERFORMANCE OVERVIEW .............. 26 1. Performance Overview: -

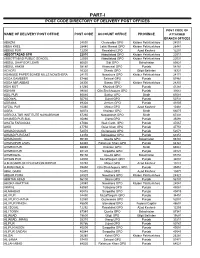

Part-I: Post Code Directory of Delivery Post Offices

PART-I POST CODE DIRECTORY OF DELIVERY POST OFFICES POST CODE OF NAME OF DELIVERY POST OFFICE POST CODE ACCOUNT OFFICE PROVINCE ATTACHED BRANCH OFFICES ABAZAI 24550 Charsadda GPO Khyber Pakhtunkhwa 24551 ABBA KHEL 28440 Lakki Marwat GPO Khyber Pakhtunkhwa 28441 ABBAS PUR 12200 Rawalakot GPO Azad Kashmir 12201 ABBOTTABAD GPO 22010 Abbottabad GPO Khyber Pakhtunkhwa 22011 ABBOTTABAD PUBLIC SCHOOL 22030 Abbottabad GPO Khyber Pakhtunkhwa 22031 ABDUL GHAFOOR LEHRI 80820 Sibi GPO Balochistan 80821 ABDUL HAKIM 58180 Khanewal GPO Punjab 58181 ACHORI 16320 Skardu GPO Gilgit Baltistan 16321 ADAMJEE PAPER BOARD MILLS NOWSHERA 24170 Nowshera GPO Khyber Pakhtunkhwa 24171 ADDA GAMBEER 57460 Sahiwal GPO Punjab 57461 ADDA MIR ABBAS 28300 Bannu GPO Khyber Pakhtunkhwa 28301 ADHI KOT 41260 Khushab GPO Punjab 41261 ADHIAN 39060 Qila Sheikhupura GPO Punjab 39061 ADIL PUR 65080 Sukkur GPO Sindh 65081 ADOWAL 50730 Gujrat GPO Punjab 50731 ADRANA 49304 Jhelum GPO Punjab 49305 AFZAL PUR 10360 Mirpur GPO Azad Kashmir 10361 AGRA 66074 Khairpur GPO Sindh 66075 AGRICULTUR INSTITUTE NAWABSHAH 67230 Nawabshah GPO Sindh 67231 AHAMED PUR SIAL 35090 Jhang GPO Punjab 35091 AHATA FAROOQIA 47066 Wah Cantt. GPO Punjab 47067 AHDI 47750 Gujar Khan GPO Punjab 47751 AHMAD NAGAR 52070 Gujranwala GPO Punjab 52071 AHMAD PUR EAST 63350 Bahawalpur GPO Punjab 63351 AHMADOON 96100 Quetta GPO Balochistan 96101 AHMADPUR LAMA 64380 Rahimyar Khan GPO Punjab 64381 AHMED PUR 66040 Khairpur GPO Sindh 66041 AHMED PUR 40120 Sargodha GPO Punjab 40121 AHMEDWAL 95150 Quetta GPO Balochistan 95151 -

Pld 2017 Sc 70)

IN THE SUPREME COURT OF PAKISTAN (Original Jurisdiction) PRESENT: Mr. Justice Asif Saeed Khan Khosa Mr. Justice Ejaz Afzal Khan Mr. Justice Gulzar Ahmed Mr. Justice Sh. Azmat Saeed Mr. Justice Ijaz ul Ahsan Constitution Petition No. 29 of 2016 (Panama Papers Scandal) Imran Ahmad Khan Niazi Petitioner versus Mian Muhammad Nawaz Sharif, Prime Minister of Pakistan / Member National Assembly, Prime Minister’s House, Islamabad and nine others Respondents For the petitioner: Syed Naeem Bokhari, ASC Mr. Sikandar Bashir Mohmad, ASC Mr. Fawad Hussain Ch., ASC Mr. Faisal Fareed Hussain, ASC Ch. Akhtar Ali, AOR with the petitioner in person Assisted by: Mr. Yousaf Anjum, Advocate Mr. Kashif Siddiqui, Advocate Mr. Imad Khan, Advocate Mr. Akbar Hussain, Advocate Barrister Maleeka Bokhari, Advocate Ms. Iman Shahid, Advocate, For respondent No. 1: Mr. Makhdoom Ali Khan, Sr. ASC Mr. Khurram M. Hashmi, ASC Mr. Feisal Naqvi, ASC Assisted by: Mr. Saad Hashmi, Advocate Mr. Sarmad Hani, Advocate Mr. Mustafa Mirza, Advocate For the National Mr. Qamar Zaman Chaudhry, Accountability Bureau Chairman, National Accountability (respondent No. 2): Bureau in person Mr. Waqas Qadeer Dar, Prosecutor- Constitution Petition No. 29 of 2016, 2 Constitution Petition No. 30 of 2016 & Constitution Petition No. 03 of 2017 General Accountability Mr. Arshad Qayyum, Special Prosecutor Accountability Syed Ali Imran, Special Prosecutor Accountability Mr. Farid-ul-Hasan Ch., Special Prosecutor Accountability For the Federation of Mr. Ashtar Ausaf Ali, Attorney-General Pakistan for Pakistan (respondents No. 3 & Mr. Nayyar Abbas Rizvi, Additional 4): Attorney-General for Pakistan Mr. Gulfam Hameed, Deputy Solicitor, Ministry of Law & Justice Assisted by: Barrister Asad Rahim Khan Mr. -

70 YEARS of DEVELOPMENT: the WAY FORWARD Research & News Bulle�N Contents

OCTOBER - DECEMBER 2017 SDC SPECIAL BULLETIN Vol 24 No. 4 70 YEARS OF DEVELOPMENT: THE WAY FORWARD Research & News Bullen Contents SDPI's 20th Sustainable Development Conference ............................................................................................... 01 PLENARY TITLE: Development Beyond 70 and the Way Forward ...................................................................... 03 Session A-1: Improving Connectivity and Regional Integration in Central and South Asia .................................... 05 Session A2: Women's Access to Justice: Ending Violence Against Women (VAW) ................................................. 07 Session A-3: Challenges and Potential of SME Sector Financing in Pakistan: Way Forward through CPEC .......... 10 Session A-4: Political Economy of South Asia: Stories From Pakistan, India & Bangladesh .................................. 13 Session A-5: Harnessing private sector role in sustainable development .................................................................. 15 Session A-6: Pakistan @100: Envisioning Reforms to Accelerate and Sustain Inclusive Growth ........................... 17 Session A-7: Challenges of Moving from Diversity to Pluralism ............................................................................. 19 Session A-8: Structural Inequalities in South Asia: Issues, Challenges and Policy Solutions .................................. 22 Session A-9: Sustainable Development Goals: Keeping the Promise Alive ............................................................. -

Sanjrani Wins Senate Chairman Slot With

VOLUME 16 | N o 72 Lahore Regd No. CPI 251 LAHORE 6P3 INTERNATIONAL 6P7 Buzdar The Eye on China, announces Biden holds huge funds for first summit new projects An English Daily published simultaneously from Lahore and Faisalabad with Japan, India, Australia PAGES 08 | R s 15 Buwww.thesbusineiss.cnom.pk eRsajab-ul-sMuraj 28 1442 Saturday, March 13 , 2021 g Afridi (54 votes) secures Senate deputy seat, Haideri receives 44 Sanjrani wins Senate Chairman slot with (48) votes, Gilani (42) loses From Our Staff Correspondent Syed Muzaffar Hussain Shah as the Earlier today, the newly-elected 48 Faraz, Liaquat Khan Tarakai, Faisal Presiding Officer. The polling members of the Upper House of the Saleem Rehman, Zeeshan Khan ISLAMABAD: The members of process continued from 03:00 pm Winner Defeated Parliament, Senate took oath during Zada, Dost Muhammad Khan, Upper House of the Parliament on to 05:00 pm without any interval. the specially convened session in Is - Muhammad Hamayun Mohmand, Friday elected by a majority vote The members of Upper House of lamabad. Senator Muzaffar Hussain Sania Nishtar, Falak Naz, Gurdeep the government-backed Sadiq San - the Parliament on Friday elected by Shah, nominated as presiding officer Singh, ANP’s Hidayatullah Khan jrani as Chairman Senate. a majority vote the government- by President Arif Alvi, chaired the and JUI-F’s Atta-ur-Rehman. From Under the Senate election rules, backed Muhammad Mirza Afridi as session and administered the oath to Balochistan, the 12 elected mem - the Upper House of Parliament deputy chairman. Ex-FATA the members-elect. The senators also bers included BAP’s Prince Ahmed elects the chairman by secret ballot. -

Public Sector Development Programme 2021-22

GOVERNMENT OF PAKISTAN PUBLIC SECTOR DEVELOPMENT PROGRAMME 2021-22 PLANNING COMMISSION MINISTRY OF PLANNING, DEVELOPMENT & SPECIAL INITIATIVES June, 2021 PREFACE Public Sector Development Programme (PSDP) is an important policy instrument aiming to achieve sustainable economic growth and socioeconomic objectives of the government. The outgoing fiscal year PSDP was made with a particular focus on strengthening the health sector and creating economic opportunities to combat widespread disruptions caused by COVID-19 pandemic. As a result of efficient and well-coordinated management of the pandemic, the economy showed signs of recovery and economic growth stood at 3.94% during FY 2020-21. In the upcoming year 2021-22, the priority of the Government is to further spur economic activities. Therefore, the PSDP in 2021-22 has been enhanced by 38% from Rs 650 billion in FY 2020-21 to Rs. 900 billion (including foreign aid of Rs 100 billion). The focus of PSDP 2021-22 is on improving transport and communication facilities with special emphasis on inter-provincial and regional connectivity, investment on building large dams and water conservation systems as per the National Water Policy, augmenting and strengthening health sector infrastructure and service delivery, improving access to higher education, social protection, increasing employment and livelihood opportunities, reducing regional disparities, mitigating effects of climate change, building knowledge economy, enhancing agricultural productivity & ensuring food security and supporting Public Private Partnership initiatives through providing Viability Gap funding. Special Development Packages have been initiated under the Regional Equalization Programme to ensure the development of the deprived areas to bring them at par with other developed regions of the country. -

IMPORTANT You Must Read the Following Before Continuing . The

IMPORTANT You must read the following before continuing. The following applies to the preliminary offering circular (the Preliminary Offering Circular) following this page, and you are therefore required to read this carefully before reading, accessing or making any other use of the Preliminary Offering Circular. In accessing the Preliminary Offering Circular, you agree to be bound by the following terms and conditions, including any modifications to them any time you receive any information from us as a result of such access. THE FOLLOWING PRELIMINARY OFFERING CIRCULAR MAY NOT BE FORWARDED OR DISTRIBUTED OTHER THAN AS PROVIDED BELOW AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. THIS PRELIMINARY OFFERING CIRCULAR MAY ONLY BE DISTRIBUTED OUTSIDE THE UNITED STATES IN ACCORDANCE WITH REGULATION S UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE SECURITIES ACT) AND WITHIN THE UNITED STATES TO “QUALIFIED INSTITUTIONAL BUYERS” (QIBs) AS DEFINED IN AND PURSUANT TO RULE 144A UNDER THE SECURITIES ACT (RULE 144A). ANY FORWARDING, DISTRIBUTION OR REPRODUCTION OF THIS DOCUMENT IN WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS DIRECTIVE MAY RESULT IN A VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS. NOTHING IN THIS ELECTRONIC TRANSMISSION CONSTITUTES AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN ANY JURISDICTION. THE SECURITIES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE SECURITIES ACT OR WITH ANY SECURITIES REGULATORY AUTHORITY OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES AND MAY NOT BE OFFERED OR SOLD WITHIN THE UNITED STATES EXCEPT TO QIBs PURSUANT TO RULE 144A.