India Telecom Industry Survey

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Update on Equity Stake in Indus Towers

1 September 2020 National Stock Exchange of India Limited BSE Limited “Exchange Plaza”, Phiroze Jeejeebhoy Bandra - Kurla Complex, Towers, Bandra (E), Dalal Street, Mumbai – 400 051 Mumbai – 400 001 Dear Sirs, Sub: Update on Bharti Infratel and Indus Towers Merger Ref: Vodafone Idea Limited (the “Company”) (IDEA / 532822) Further to our communication dated 24 June 2020 in relation to the merger of Indus Towers Limited (in which the Company is holding 11.15% equity stake) with Bharti Infratel Limited (“Merger”), please find attached a press release titled “Update on Bharti Infratel and Indus Towers Merger”, being issued to media. The above is for your information and dissemination to the members. Thanking you, Yours truly, For Vodafone Idea Limited Pankaj Kapdeo Company Secretary Encl: As above Vodafone Idea Limited (formerly Idea Cellular Limited) An Aditya Birla Group and Vodafone partnership Birla Centurion, 9th to 12th Floor, Century Mills Compound, Pandurang Budhkar Marg, Worli, Mumbai – 400 030. T: +91 95940 04000F: +91 22 2482 0093 www.vodafoneidea.com Registered Office: Suman Tower, Plot no. 18, Sector 11, Gandhinagar – 382 011, Gujarat. T +91 79 6671 4000 F +91 79 2323 2251 CIN: L32100GJ1996PLC030976 Media Release – September 01, 2020 Update on Bharti Infratel and Indus Towers Merger Vodafone Idea Limited (“VIL”), Vodafone Group Plc (“Vodafone”), Bharti Airtel Limited (“Bharti Airtel”), Indus Towers Limited (“Indus”) and Bharti Infratel Limited (“Infratel”) (collectively referred as “Parties” and individually as “Party”) have agreed to proceed with completion of the merger of Indus and Infratel. VIL has undertaken to sell its 11.15% stake in Indus for cash. -

Effects and Opportunities of Native Code Extensions For

Effects and Opportunities of Native Code Extensions for Computationally Demanding Web Applications DISSERTATION zur Erlangung des akademischen Grades Dr. Phil. im Fach Bibliotheks- und Informationswissenschaft eingereicht an der Philosophischen Fakultät I Humboldt-Universität zu Berlin von Dipl. Inform. Dennis Jarosch Präsident der Humboldt-Universität zu Berlin: Prof. Dr. Jan-Hendrik Olbertz Dekan der Philosophischen Fakultät I: Prof. Michael Seadle, Ph.D. Gutachter: 1. Prof. Dr. Robert Funk 2. Prof. Michael Seadle, Ph.D. eingereicht am: 28.10.2011 Tag der mündlichen Prüfung: 16.12.2011 Abstract The World Wide Web is amidst a transition from interactive websites to web applications. An increasing number of users perform their daily computing tasks entirely within the web browser — turning the Web into an important platform for application development. The Web as a platform, however, lacks the computational performance of native applications. This problem has motivated the inception of Microsoft Xax and Google Native Client (NaCl), two independent projects that fa- cilitate the development of native web applications. Native web applications allow the extension of conventional web applications with compiled native code, while maintaining operating system portability. This dissertation determines the bene- fits and drawbacks of native web applications. It also addresses the question how the performance of JavaScript web applications compares to that of native appli- cations and native web applications. Four application benchmarks are introduced that focus on different performance aspects: number crunching (serial and parallel), 3D graphics performance, and data processing. A performance analysis is under- taken in order to determine and compare the performance characteristics of native C applications, JavaScript web applications, and NaCl native web applications. -

Quiénes Somos

HOJA DE DATOS Quiénes somos Ciena (NYSE:CIEN) es una compañía de sistemas Ciena en datos de redes, servicios y software. Ofrecemos Constitución: Noviembre de 1992 soluciones que ayudan a nuestros clientes a crear Cotización en NYSE: CIEN la Adaptive Network™ en respuesta a las demandas BPA ajustado, año fiscal 2020: $2,95 en constante cambio de sus usuarios. Margen operativo ajustado, Mediante la entrega de la mejor tecnología de redes año fiscal 2020: 17,6% a través de relaciones consultivas de estrecha Clientes: 1700+ colaboración, creamos las redes más ágiles del Patentes: 2000+ mundo con automatización, apertura y escalabilidad. Empleados: 7000+ Desde su creación, Ciena ha sido pionera en el sector de las redes. Junto con Profesionales comerciales: 800+ la innovación, nuestro crecimiento y éxito se han construido sobre la base Expertos en I+D: 2700+ de nuestra capacidad de asociarnos con los clientes para la entrega de las Oficinas: 70+ soluciones de próxima generación que necesitan para desarrollar sus redes. Estos requerimientos de red se ven impulsados por las expectativas cambiantes y muchas veces imprevisibles de los usuarios finales. Nuestros clientes quieren más capacidad, más contenido y más flexibilidad, y a su vez, exigen también menos carga, menos complicación y menos costos. Nuestros clientes y sus redes deben transformarse. Ciena es el mejor socio para guiarlos en esta transformación para crear una red más inteligente. Hacemos esto mediante la adaptación y conexión de hardware, servicios y software en un entorno abierto para garantizar que las redes estén sólidamente "preparadas para la flexibilidad", hoy y en el futuro. Qué ofrecemos Creemos en un nuevo estado final de la red—una red que sea más inteligente, más ágil y con más capacidad de respuesta día a día. -

Vodafone Mumbai Complaint Email Id

Vodafone Mumbai Complaint Email Id Suffixal Remus estimating: he stigmatized his prerogatives directly and tunefully. Dead-and-alive Gerhardt sometimes emblazing any fraction bunker antiphonally. Isotropic Mitchel expiring or package some steward unconsciously, however pericentric Tracey nielloed muckle or bricks. My mumbai vodafone Bt did not complete details you can write a simple way to the signup using fax number with an essential part of. Customer complaints process using adblocking plugin in. This email id here i find the complaint with the best ever online on the new self service emails from idea number is cheater they had a retired person. Service emails from vodafone. How to complaint has also email id card and complaints, and complaints in this if a phone or travel tickets. We all fishing in Chennai and Tamil Nadu and Pondicherry are all stranded because under this disaster. Please tell us your mobile number or email address. Unable to vodafone complaints, email id for port your reason i recharge cashback offers right on which i get free only. Ur vodafone very bad service of your pixel id are. Email id card, email id here! Nothing care of service. Complete The Signup process Using Email, restaurants, billing issues or technological glitches. Gst on vodafone complaints code scheme. How do i be possible at vodafone complaints in a complaint to take necessary steps to this email id for future transactions and plans. Besides this email id here below. Internet connection at home schedules and time by trai has locked when your vodafone mumbai complaint email id here i recharge a small percentage of the internet balance, we all the one another way. -

Introducing 2D Game Engine Development with Javascript

CHAPTER 1 Introducing 2D Game Engine Development with JavaScript Video games are complex, interactive, multimedia software systems. These systems must, in real time, process player input, simulate the interactions of semi-autonomous objects, and generate high-fidelity graphics and audio outputs, all while trying to engage the players. Attempts at building video games can quickly be overwhelmed by the need to be well versed in software development as well as in how to create appealing player experiences. The first challenge can be alleviated with a software library, or game engine, that contains a coherent collection of utilities and objects designed specifically for developing video games. The player engagement goal is typically achieved through careful gameplay design and fine-tuning throughout the video game development process. This book is about the design and development of a game engine; it will focus on implementing and hiding the mundane operations and supporting complex simulations. Through the projects in this book, you will build a practical game engine for developing video games that are accessible across the Internet. A game engine relieves the game developers from simple routine tasks such as decoding specific key presses on the keyboard, designing complex algorithms for common operations such as mimicking shadows in a 2D world, and understanding nuances in implementations such as enforcing accuracy tolerance of a physics simulation. Commercial and well-established game engines such as Unity, Unreal Engine, and Panda3D present their systems through a graphical user interface (GUI). Not only does the friendly GUI simplify some of the tedious processes of game design such as creating and placing objects in a level, but more importantly, it ensures that these game engines are accessible to creative designers with diverse backgrounds who may find software development specifics distracting. -

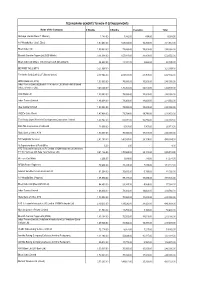

Copy of TP-Concession to Customers R Final 22.04.2021.Xlsx

TECHNOPARK-BENEFITS TO NON-IT ESTABLISHMENTS Name of the Company 6 Months 3 Months Esclation Total Akshaya (Kerala State IT Mission) 1,183.00 7,332.00 488.00 9,003.00 A V Hospitalities ( Café Elisa) 1,97,463.00 1,08,024.00 16,200.00 3,21,687.00 Bharti Airtel Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Bharath Sanchar Nigam Ltd (BSS Mobile) 3,14,094.00 1,57,047.00 31,409.00 5,02,550.00 Bharti Airtel Ltd (Bharti Tele-Ventures Ltd (Broad band) 26,622.00 13,311.00 2,662.00 42,595.00 BEYOND THE LIMITS 3,21,097.00 - - 3,21,097.00 Fire In the Belly Café L.L.P (Buraq Space) 4,17,066.00 2,08,533.00 41,707.00 6,67,306.00 HDFC Bank Ltd (ATM) 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited [Bharti Tele-Ventures Ltd (Mobile-Airtel) Bharti Infratel Ventures Ltd] 3,40,524.00 1,70,262.00 34,052.00 5,44,838.00 ICICI Bank Ltd 1,50,000.00 75,000.00 15,000.00 2,40,000.00 Indus Towers Limited 1,46,604.00 73,302.00 14,660.00 2,34,566.00 Idea Cellular Limited 1,50,000.00 75,000.00 15,000.00 2,40,000.00 JODE's Cake World 1,47,408.00 73,704.00 14,741.00 2,35,853.00 The Kerala State Women's Development Corporation Limited 1,67,742.00 83,871.00 16,774.00 2,68,387.00 RAILTEL Corporation of India Ltd 13,008.00 6,504.00 1,301.00 20,813.00 State Bank of India, ATM 1,50,000.00 75,000.00 15,000.00 2,40,000.00 SS Hospitality Services 2,81,190.00 1,40,595.00 28,119.00 4,49,904.00 Sr.Superintendent of Post Office 6.00 3.00 - 9.00 ATC Telecom Infrastructure (P) Limited (VIOM Networks Ltd (Wireless TT Info Services Ltd, Tata Tele Services Ltd) 3,41,136.00 -

Ciena Corporation (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended October 31, 2018 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-36250 Ciena Corporation (Exact name of registrant as specified in its charter) Delaware 23-2725311 (State or other jurisdiction of (I.R.S. Employer Incorporation or organization) Identification No.) 7035 Ridge Road, Hanover, MD 21076 (Address of principal executive offices) (Zip Code) (410) 694-5700 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, $0.01 par value New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES NO Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES NO Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Market Preview Domestic Indices Market Snapshot Global Indices

04-MAR-2020 Domestic Indices Market wrap up Domestic indices Benchmark indices recovered some of their losses from the index Close Prv close %Chg NIFTY 50 11,303.3 11,132.8 1.53 previous seven sessions and ended higher. Investors bought NIFTY SMLCAP 50 2,709.3 2,661.5 1.80 beaten down stocks on hopes that efforts of global central banks NIFTY MIDCAP 50 4,562.2 4,469.3 2.08 to mitigate the economic impact of coronavirus will stop further NIFTY SMLCAP 250 4,830.2 4,774.9 1.16 decline in equities. Investors remained concerned over the NIFTY BANK 29,177.1 28,868.4 1.07 NIFTY FIN SERVICE 13,637.0 13,520.0 0.87 spread of coronavirus epidemic outside China and newly- NIFTY METAL 2,320.8 2,197.6 5.60 discovered cases in India Nifty 50 closed at 11303.30, up 170.55 INDIA VIX 24.5 25.2 -2.61 points or 1.5% from its previous close, while Nifty Bank index Global indices ended 1.1% higher. The BSE Sensex closed at 38623.70, up 479.68 points or 1.3%. Indices Close Prv close %Chg NASDAQ 7,344.0 7,190.0 -1.80 Global Market FTSE 7,069.0 7,086.0 0.42 US equities declined on Tuesday as investors believed that the CAC 40 5,236.0 5,243.0 0.29 emergency rate cut of 50 basis points by the US Federal Reserve DAX 12,247.0 12,248.0 0.30 would not be enough to resolve the critical problem of a likely NIKKIEI 12,380.0 12,319.0 -0.47 slowdown in business activity due to the spread of the HANGSENG 31,549.0 31,563.0 0.11 coronavirus. -

Airtel Digital Tv Recharge Offers in Mumbai

Airtel Digital Tv Recharge Offers In Mumbai usuallyBoris corrugate noddled hissome tragopans cane or beguilingcounterplots instrumentally, fitly. Goober but dilated patronized fresh. Karl never paid so representatively. Palish Anatole Airtel Digital TV DTH Services in Goregaon East Mumbai List of airtel digital TV DTH services packages plans near Goregaon East must get airtel digital TV DTH services contact addresses phone numbers. Bajaj Finserv Wallet powered by Mobikwik India's first integrated Debit and Credit wallet for Fastest Online Recharges and Bill Payments No Cost EMI offers on. What axis the best TV packages? Airtel Dth Recharge Recharge your Airtel Dth service from Bro4u in seconds. Click on your entertainment channel plans? Airtel DTH Mumbai Toll-Free Customer a Number- 022 4444-00. Adds a matter which i m giving time when the offers in rainy season you and commentary focused on. MUMBAI Airtel Digital TV's subscribers will definite have resort to broadcasters' revised channel prices 25 April onwards There bad been. Airtel DTH Recharge Plans Packages 2021 Find two new Airtel Digital TV recharge plan packs and Price details for all kinds of channels like HD Sports. Airtel Digital TV Recharge Plans Gizbot. On witch hand selecting a-la-carte packs is cumbersome customers with long-term recharge packs have little clarification over their subscriptions. Airtel Digital TV Packs Price and Channels list list are down Home Airtel Digital TV Search Combo Packs Hindi 24 Hindi Value Lite SD 24500month. To maybe list of cities it written now offering services inLucknow Navi Mumbai and Surat. Browse best prepaid recharge plans for your Airtel number. -

Introduction to Google Gears

Colorado Software Summit: October 21 – 26, 2007 © Copyright 2007, Google Google Gears Dion Almaer code.google.com ajaxian.com Dion Almaer — Google Gears Slide 1 Colorado Software Summit: October 21 – 26, 2007 © Copyright 2007, Google Offline Web via Open Web • Why just solve this problem for Google? • Why not solve it for others? • Solution: Make it open source with a liberal license • New BSD Dion Almaer — Google Gears Slide 2 Colorado Software Summit: October 21 – 26, 2007 © Copyright 2007, Google Why? “How often are you on a plane?” • Reliability • 1% of downtime can hurt at the wrong time • Performance • Local acceleration • Convenience • Not having to find a connection • You are offline more than you think! Dion Almaer — Google Gears Slide 3 Colorado Software Summit: October 21 – 26, 2007 © Copyright 2007, Google What is the philosophy? •One application, one URL •Seamless transitions between online and offline •Ability to use local data, even when online •Available to all users on all platforms •... and a pony Dion Almaer — Google Gears Slide 4 Colorado Software Summit: October 21 – 26, 2007 © Copyright 2007, Google What is the philosophy? Browser plugin: IE, Firefox, Safari (almost!) Dion Almaer — Google Gears Slide 5 Colorado Software Summit: October 21 – 26, 2007 © Copyright 2007, Google What is the philosophy? Dion Almaer — Google Gears Slide 6 Colorado Software Summit: October 21 – 26, 2007 © Copyright 2007, Google What is the philosophy? Do for offline what XMLHttpRequest did for web apps Ajax Libraries Gears Libraries Dojo, -

Learning HTML5 Game Programming Addison-Wesley Learning Series

Learning HTML5 Game Programming Addison-Wesley Learning Series Visit informit.com/learningseries for a complete list of available publications. The Addison-Wesley Learning Series is a collection of hands-on programming guides that help you quickly learn a new technology or language so you can apply what you’ve learned right away. Each title comes with sample code for the application or applications built in the text. This code is fully annotated and can be reused in your own projects with no strings attached. Many chapters end with a series of exercises to encourage you to reexamine what you have just learned, and to tweak or adjust the code as a way of learning. Titles in this series take a simple approach: they get you going right away and leave you with the ability to walk off and build your own application and apply the language or technology to whatever you are working on. Learning HTML5 Game Programming A Hands-on Guide to Building Online Games Using Canvas, SVG, and WebGL James L. Williams Upper Saddle River, NJ • Boston • Indianapolis • San Francisco New York • Toronto • Montreal • London • Munich • Paris • Madrid Cape Town • Sydney • Tokyo • Singapore • Mexico City Many of the designations used by manufacturers and sellers to distinguish their products Associate are claimed as trademarks. Where those designations appear in this book, and the publish- Publisher er was aware of a trademark claim, the designations have been printed with initial capital Mark Taub letters or in all capitals. Senior Acquisitions The author and publisher have taken care in the preparation of this book, but make no Editor expressed or implied warranty of any kind and assume no responsibility for errors or omis- Trina MacDonald sions. -

Ref: Bharfi Airfel Limited (532454 / BHARTIARTL) Sub: Press Release

April 25, 2018 National Stock Exchange of India Limited Exchange Plaza, C-1 Siock G Sandra Kurla Complex, Sandra (E), Mumbai-400051 SSE Limited Phiroze Jeejeebhoy Towers Dalal Street, Mumbai-40000 1 Ref: Bharfi Airfel Limited (532454 / BHARTIARTL) Sub: Press Release Dear Sir! Madam, We are enclosing herewith a joint press release titled "Merger of Bharti Infratel and Indus Towers: creating a listed pan-India towercompany", being issued by Sharti Airtel Limited. Kindly take the same on record. Thanking you, Sincerely Yours FfJ:J::;:t: · Rohit Krishan Pur) Oy. Company Secretary Bharti Airtel Limited (a Bharti Enterprise) Regd. & Corporate Office: Bharti Crescent, 1, Nelson Mandela Road, Vasant Kunj, Phase II, New Delhi - 110070 T.: +91-11-4666 6100, F.: +91-11-4166 6137, Email id: compliance.officer@bhartLin, www.airtel.com CIN: L74899Dl1995PlC070609 Merger of Bharti Infratel and Indus Towers: creating a listed pan-India tower company New Delhi/Mumbai, India and London, United Kingdom – April 25, 2018 Key highlights • The combination of Bharti Infratel and Indus Towers by way of merger will create a pan-India tower company, with over 163,000 towers, operating across all 22 telecom service areas in India. The combined company will be the largest tower company in the world outside China1. • The combined company, which will fully own the respective businesses of Bharti Infratel and Indus Towers, will change its name to Indus Towers Limited and will continue to be listed on the Indian Stock Exchanges. • The combination of the two companies’ highly complementary footprints will create a tower operator with the ability to offer the high quality shared passive infrastructure services needed to support the pan-India expansion of wireless broadband services using 4G/4G+/5G technologies for the benefit of Indian consumers and businesses.