GME - Q3 2016 Gamestop Corp Earnings Call

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Esports High Impact and Investable

Needham Insights: Thought Leader Series Laura A. Martin, CFA & CMT – [email protected] / (917) 373-3066 September 5, 2019 Dan Medina – [email protected] / (626) 893-2925 eSports High Impact and Investable For the past decade, eSports has been growing on the main stage in Asia and in stealth mode in the US. This report addresses questions we get most often from investors about eSports: ➢ What is eSports? Definitions differ. Our definition of eSports is “players competing at a video game in front of a live audience while being live-streamed.” By implication, viewing, attendance, and playing time are linked, and each creates revenue streams for eSports. ➢ How big is eSports? Globally, one out of every three (ie, 33%) 18-25 year olds spent more than an hour a day playing video games, 395mm people watched eSports, and 250mm people played Fortnite in 2018. eSports revenue will be $1.1B in 2019, up 26% y/y. ➢ Should investors care about eSports? We would argue “yes”, owing to: a) global scale; b) time spent playing and viewing; c) compelling demographics; d) eSports vs traditional sports trends; e) revenue growth; and, f) sports betting should supercharge US eSports. ➢ Is eSports a fad? We would argue “no”, owing to: a) many US Universities now offer Varsity eSports scholarships; b) new special purpose eSports stadiums are proliferating; c) billionaires are investing to make eSports successful; d) audience growth; and, e) Olympics potential. ➢ Why have you never heard of eSports? Because zero of the top 30 earning players in the world were from the US in 2018. -

Resilient Podcast, Episode 2, May 2016.Docx

Episode 13: Paul Raines, GameStop CEO, on getting ahead of disruption Transcript Mike Kearney: I have two boys—Tyler, who is 16, almost 17, and Cayden, who is 8. And I have been to GameStop over 100 times in my life. You know, listen, it’s probably actually more like 200 times. It seems like we would go there once or twice a week, especially about a year or two ago. And I'll tell you, they love looking at all of the new games. They especially love looking at all of the used games. And it’s amazing how much time they can spend given the fact that the footprint of the store isn't actually that big. If you look at the GameStop story, just the GameStop piece of their business, you can say, "Well that's an organization or a company that is on the brink of disruption." But that is not the story of GameStop. And what I think you're going to find out, what’s fascinating about them, is how they really have diversified their business over the last five years. And an interesting stat that I heard is that in the next few years, only 50 percent of GameStop's revenue is going to come from traditional gaming. Think about that. Most of you probably think of GameStop as going and buying a console, going and buying a physical game. But in only a few years, only 50 percent of their revenue is going to come from that. They have done an incredible job diversifying their business. -

Ukázka Knihy Z Internetového Knihkupectví OBSAH ÚVODNÍ SLOVO TÉMA Šéfredaktora S Březnem Přišlo Konečně Jaro a S Ním I Konec Dlouhých Ted Price

BŘEZEN - DUBEN 2018 14 CENA: 49 KČ / 1,90 EUR AGE OF EMPIRES: DE SURVIVING MARS STAR WARS: BF II SUBNAUTICA SPIDER-MAN RECENZE | A WAY OUT | PAST CURE | OCTOGEDDON | U k á z k a k n i h y z i n t e r n e t o v é h o k n i h k u p e c t v í w w w . k o s m a s . c z , U I D : K O S 2 9 0 4 1 7 Nakladatelství pro mladé a neobjevené autory Vydáváme, propagujeme a podporujeme www.nakladatelstvi-monument.cz Ukázka knihy z internetového knihkupectví www.kosmas.cz OBSAH ÚVODNÍ SLOVO TÉMA Šéfredaktora S březnem přišlo konečně jaro a s ním i konec dlouhých Ted Price.............................................................................................3 ospalých zimních dnů a chladných nocí. Příliv energie se Far Cry 5..............................................................................................4 ale nekonal jen v rámci psychologického vnímání střídá- ní ročních období, ale konal se i na herní scéně. S áčko- vými tituly jako je Far Cry 5 RECENZE a God of War koneční víme, Pit People...........................................................................................5 že jsme se naplno ocitli v One Hour One Life...........................................................................6 roce 2018 a čekají nás vel- We Were Here Too............................................................................7 ké věci. Octogeddon.....................................................................................8 Fe...........................................................................................................9 -

Playstation 4 Xbox One Nintendo Switch Pc Game 3Ds

Lista aggiornata al 30/06/2020. Potrebbe subire delle variazioni. Maggiori dettagli in negozio. PLAYSTATION 4 XBOX ONE NINTENDO SWITCH PC GAME 3DS PLAYSTATION 4 11-11 Memories Retold - P4 2Dark - Limited Edition - P4 428 Shibuya Scramble - P4 7 Days to Die - P4 8 To Glory - Bull Riding - P4 A Plague Tale: Innocence - P4 A Way Out - P4 A.O.T. 2 - P4 A.O.T. 2 – Final Battle - P4 A.O.T. Wings of Freedom - P4 ABZÛ - P4 Ace Combat 7 - NON PUBBLICARE - P4 Ace Combat 7 - P4 ACE COMBAT® 7: SKIES UNKNOWN Collector's Edition - P4 Aces of the Luftwaffe - Squadron Extended Edition - P4 Adam’s Venture: Origini - P4 Adventure Time: Finn & Jake Detective - P4 Aerea - Collectors Edition - P4 Agatha Christie: The ABC Murders - P4 Age Of Wonders: Planetfall - Day One Edition - P4 Agents of Mayhem - P4 Agents Of Mayhem - Special Edition - P4 Agony - P4 Air Conflicts Vietnam Ultimate Edition - P4 Alien: Isolation Ripley Edition - P4 Among the Sleep - P4 Angry Birds Star Wars - P4 Anima Gate of Memories: The Nameless Chronicles - P4 Anima: Gate Of Memories - P4 Anthem - Legion of Dawn Edition - P4 Anthem - P4 Apex Construct - P4 Aragami - P4 Arcania - The Complete Tale - P4 ARK Park - P4 ARK: Survival Evolved - Collector's Edition - P4 ARK: Survival Evolved - Explorer Edition - P4 ARK: Survival Evolved - P4 Armello - P4 Arslan The Warriors of Legends - P4 Ash of Gods: Redemption - P4 Assassin’s Creed 4 Black Flag - P4 Assassin's Creed - The Ezio Collection - P4 Assassin's Creed Chronicles - P4 Assassin's Creed III Remastered - P4 Assassin's Creed Odyssey -

Metroidvanias

Metroidvanias How is Innovative Movement Important? By Tim Carbone Narrowing It Down Narrowing It Down How is innovative world traversal important to Metroidvania players? ● Previously, I’ve discussed Metroidvania games and how my lens is to focus on their movement and world traversal systems. ● However, to narrow this research down even more, I want to ask a question: ○ How is innovative world traversal important to Metroidvania players? ● Picture: ○ Timespinner Narrowing It Down How is innovative world traversal important to Metroidvania players? ● To go into the word “innovative” specifically, it essentially means that the player has more in their arsenal of getting around than just the standard Mario conventions of platforming that this genre finds itself utilizing so often. ● Those standard conventions are really at the crux of most Metroidvanias, so when talking about movement, it’s important to look at the games that are standing out. ● A game like La-Mulana 2 moves in much more of a standard platformer way than Hollow Knight, and it’s evident when traversing the large world. ● However, we’ll talk about more specific mechanics moving forward. ● Pictures: ○ La-Mulana 2 ○ Hollow Knight Narrowing It Down Metroidvania Movement Traditional Non-traditional Unique ● So before, we were stuck with just the broad term of “Metroidvania movement”, but we’re gonna break it down into three groupings to better analyze the different facets of each. ● First, we have the games that stick to traditional platformer standards with very few changes to the movement or a lack of focus on movement. These are games like Axiom Verge that have you running and jumping, and the only movement change does not fundamentally shift how you move around the areas. -

Q2 2016 Earnings Call Transcript

THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT GME - Q2 2016 GameStop Corp Earnings Call EVENT DATE/TIME: AUGUST 25, 2016 / 9:00PM GMT OVERVIEW: Co. reported 2Q16 operating earnings of $58.3m and EPS of $0.27. Expects 2016 revenues to range from down 2% to up 1.5% and EPS to be $3.90-4.05. Also expects 3Q16 revenues to range between plus 2% and plus 5% and EPS to be $0.53-0.58. THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2016 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. AUGUST 25, 2016 / 9:00PM, GME - Q2 2016 GameStop Corp Earnings Call CORPORATE PARTICIPANTS Paul Raines GameStop Corporation - CEO Rob Lloyd GameStop Corporation - CFO Tony Bartel GameStop Corporation - COO Jason Ellis GameStop Corporation - SVP of Technology Brands Mike Hogan GameStop Corporation - EVP of Strategic Business & Brand Development Mike Mauler GameStop Corporation - EVP and President of International Matt Hodges GameStop Corporation - VP of Public & Investor Relations CONFERENCE CALL PARTICIPANTS Ben Schachter Macquarie Research Equities - Analyst Colin Sebastian Robert W. Baird & Company, Inc. - Analyst Curtis Nagle BofA Merrill Lynch - Analyst Mike Olson Piper Jaffray - Analyst Brian Nagel Oppenheimer - Analyst David Magee SunTrust Robinson Humphrey - Analyst PRESENTATION Operator Good day and welcome to the GameStop Corporation's second-quarter 2016 earnings conference call. A supplemental slide presentation is available at investor.gamestop.com. At the conclusion of the announcement, a question-and-answer session will be conducted electronically. -

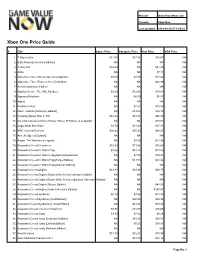

Xbox One Price Guide

Website GameValueNow.com Console Xbox One Last Updated 2018-09-30 07:19:03.0 Xbox One Price Guide # Title Loose Price Complete Price New Price VGA Price 1. 7 Days to Die $14.05 $17.58 $18.67 NA 2. 8 Bit Armies [Collector's Edition] NA NA NA NA 3. A Way Out $16.69 NA $24.03 NA 4. Abzu NA NA $7.11 NA 5. Adventure Time: Finn & Jake Investigations $5.00 $8.55 $11.42 NA 6. Adventure Time: Pirates of the Enchiridion NA NA $42.99 NA 7. AereA [Collector's Edition] NA NA NA NA 8. Agatha Christie: The ABC Murders $9.00 $12.45 $18.87 NA 9. Agents of Mayhem NA $4.59 $8.01 NA 10. Agony NA NA NA NA 11. Alekhine's Gun NA $8.23 $10.88 NA 12. Alien: Isolation [Nostromo Edition] NA $13.09 $16.70 NA 13. Amazing Spider-Man 2, The $16.04 $32.54 $48.05 NA 14. America's Greatest Game Shows: Wheel of Fortune & Jeopardy! NA NA $19.57 NA 15. Angry Birds Star Wars $8.76 $11.23 $17.81 NA 16. ARK: Survival Evolved $26.42 $35.43 $48.47 NA 17. Armello [Special Edition] NA NA NA NA 18. Arslan: The Warriors of Legend NA $8.00 $11.98 NA 19. Assassin's Creed Chronicles $10.99 $13.85 $15.69 NA 20. Assassin's Creed IV: Black Flag $8.66 $10.24 $21.54 NA 21. Assassin's Creed IV: Black Flag [GameStop Edition] NA $7.05 $10.81 NA 22.