Curiouser and Curiouser …

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Investec W&I – Morning Minutes 16.06.2020

Morning Meeting 16 June 2020 Index +/- % change Currencies +/- 12 month range FTSE 100 6064.7 -40.5 -0.7 £:$ 1.257 0.00 1.15 1.33 FTSE All-Share 3362.1 -17.7 -0.5 Y:$ 107.405 0.07 102.55 112.09 DJ Industrial Average 25763.2 157.6 0.6 E:£ 1.115 0.00 1.07 1.20 S&P 500 3066.6 25.3 0.8 E:$ 1.127 0.00 1.07 1.14 NASDAQ Composite Index 9726.0 137.2 1.4 10 Yr Bond Yld % +/- -3 months -12 months Nikkei Japan 1000 Index 1829.3 -48.5 -2.6 UK 0.19 -0.01 0.38 0.93 Hang Seng Index 23777.0 -524.4 -2.2 US 0.70 0.01 0.95 2.09 EURO STOXX 50 (EUR) 3136.4 -17.3 -0.5 Germany -0.45 -0.02 -0.58 -0.25 Switzerland SMI (PR) 9842.6 46.2 0.5 Price (p) +/- 12 month range France CAC 40 4815.7 -23.5 -0.5 Germany DAX (TR) 11911.4 -37.9 -0.3 Investec plc 165.55 -2.15001 128.8 518.6 Matrix Winners Price +/- % change Sector Winners % change Mkt Wt Bunzl plc 2069.0 185.0 9.8 FTSE All-Share / Support Services - SEC 0.9 5.6 LondonMetric Property Plc 213.2 6.4 3.1 FTSE All-Share / Leisure Goods - SEC 0.85 5.6 Ted Baker PLC 128.3 3.8 3.1 FTSE All-Share / Health Care Equipment & Services - SEC 0.62 1.1 Ashtead Group plc 2417.0 56.0 2.4 FTSE All-Share / Technology Hardware & Equipment - SEC 0.6 0.1 Hikma Pharmaceuticals Plc 2359.0 54.0 2.3 FTSE All-Share / Software & Computer Services - SEC 0.6 1.0 Matrix Losers Price +/- % change Sector Losers % change Mkt Wt Fresnillo PLC 747.6 -46.6 -5.9 FTSE All-Share / Industrial Metals & Mining - SEC -2.1 0.1 Barratt Developments PLC 499.2 -26.6 -5.1 FTSE All-Share / Beverages - SEC -1.8 3.7 Hurricane Energy Plc 6.6 -0.34 -4.9 FTSE All-Share -

Annex 1: Parker Review Survey Results As at 2 November 2020

Annex 1: Parker Review survey results as at 2 November 2020 The data included in this table is a representation of the survey results as at 2 November 2020, which were self-declared by the FTSE 100 companies. As at March 2021, a further seven FTSE 100 companies have appointed directors from a minority ethnic group, effective in the early months of this year. These companies have been identified through an * in the table below. 3 3 4 4 2 2 Company Company 1 1 (source: BoardEx) Met Not Met Did Not Submit Data Respond Not Did Met Not Met Did Not Submit Data Respond Not Did 1 Admiral Group PLC a 27 Hargreaves Lansdown PLC a 2 Anglo American PLC a 28 Hikma Pharmaceuticals PLC a 3 Antofagasta PLC a 29 HSBC Holdings PLC a InterContinental Hotels 30 a 4 AstraZeneca PLC a Group PLC 5 Avast PLC a 31 Intermediate Capital Group PLC a 6 Aveva PLC a 32 Intertek Group PLC a 7 B&M European Value Retail S.A. a 33 J Sainsbury PLC a 8 Barclays PLC a 34 Johnson Matthey PLC a 9 Barratt Developments PLC a 35 Kingfisher PLC a 10 Berkeley Group Holdings PLC a 36 Legal & General Group PLC a 11 BHP Group PLC a 37 Lloyds Banking Group PLC a 12 BP PLC a 38 Melrose Industries PLC a 13 British American Tobacco PLC a 39 Mondi PLC a 14 British Land Company PLC a 40 National Grid PLC a 15 BT Group PLC a 41 NatWest Group PLC a 16 Bunzl PLC a 42 Ocado Group PLC a 17 Burberry Group PLC a 43 Pearson PLC a 18 Coca-Cola HBC AG a 44 Pennon Group PLC a 19 Compass Group PLC a 45 Phoenix Group Holdings PLC a 20 Diageo PLC a 46 Polymetal International PLC a 21 Experian PLC a 47 -

IQSI IQ Candriam ESG International Equity ETF Q1 Holdings

Schedule of Investments ─ IQ Candriam ESG International Equity ETF July 31, 2020 (unaudited) Shares Value Shares Value Common Stocks — 99.4% Common Stocks (continued) Australia - 8.0% Belgium (continued) Alumina Ltd. 26,705 $ 29,110 Umicore SA .................... 1,980 $ 93,514 .................... * AMP Ltd. ...................... 34,617 36,370 Total Belgium 597,926 Ampol Ltd. ..................... 2,466 46,476 APA Group..................... 12,077 95,271 Chile - 0.0%(a) ASX Ltd. ...................... 1,960 116,174 Antofagasta PLC ................. 3,609 48,671 AusNet Services ................. 18,374 23,455 Australia & New Zealand Banking Group China - 0.9% Ltd. 27,245 350,916 ...................... Alibaba Health Information Technology Ltd.* 40,385 111,512 BHP Group Ltd. 30,113 793,636 .................. China Gas Holdings Ltd. 19,166 57,620 BHP Group PLC 21,055 457,354 ............ ................. CSPC Pharmaceutical Group Ltd. ...... 49,090 102,991 BlueScope Steel Ltd. 5,121 41,096 .............. Fosun International Ltd. 25,389 28,926 Boral Ltd. 12,274 31,600 ............. ...................... Geely Automobile Holdings Ltd. 52,544 110,509 Brambles Ltd. 15,570 120,370 ........ ................... Haier Electronics Group Co., Ltd.(b) ...... 12,540 43,444 Coca-Cola Amatil Ltd. 5,239 30,734 .............. Prosus NV* ..................... 4,077 395,809 Cochlear Ltd. 652 88,943 ................... Shimao Group Holdings Ltd. 11,833 50,155 Computershare Ltd. 4,730 45,556 .......... ............... Sun Art Retail Group Ltd. ............ 17,990 24,977 CSL Ltd. ...................... 4,635 897,810 Dexus ........................ 11,127 67,908 Total China 925,943 Fortescue Metals Group Ltd. ......... 17,329 216,363 Goodman Group ................. 18,522 224,882 Colombia - 0.0%(a) GPT Group (The) 19,916 55,417 Millicom International Cellular SA ...... -

Workforce-Related Corporate Reporting Where to Next?

Workforce-related corporate reporting Where to next? January 2020 Financial Reporting Council Workforce-related corporate reporting 2 Contents Introduction Examples used Our report highlights examples of current This project sought to test whether the Introduction 2 practice that were identified by the Financial principles of good reporting in our previous Reporting Lab (Lab) team and investors. Quick Read 3 reports on business models, risk and viability Not all of the examples are relevant for reporting and performance metrics could be all companies, and all circumstances, but Regulatory and market context 5 applied in the context of reporting on the each provides an example of a company workforce. Each of these reports has proven that demonstrates an approach to useful Section 1 Investor expectations and company views 6 relevant, as they highlighted the importance disclosures. Highlighting aspects of reporting Governance and management 7 of companies articulating how the workforce contributes to the success of their business by a particular entity should not be considered Business model and strategy 9 model, what the risks and opportunities are, an evaluation of that entity’s annual report as a whole. Investors have contributed to this Risk management 13 and how they measure the success of their strategy through reliable, transparent metrics. project at a conceptual level. Metrics and targets 16 This project therefore builds on the Lab’s The examples used are selected to illustrate The importance of linkage 20 previous messages and provides a view the principles that investors have highlighted from companies and investors about how and, in many cases, have been tested with Section 2 Appendix A – questions and disclosures 21 these areas of reporting can best reflect the investors. -

Date Type Direction Security Name Author Ric 2016-07-11

DATE TYPE DIRECTION SECURITY NAME AUTHOR RIC 2016-07-11 09:47:22 BST CLOSE LONG CREST NICHOLSON HOLDINGS MICK MCNAMARA CRST.L 2016-07-11 09:47:47 BST CLOSE LONG TAYLOR WIMPEY PLC MICK MCNAMARA TW.L 2016-07-12 08:19:26 BST CLOSE LONG DFS FURNITURE PLC STEVE ASFOUR DFSD.L 2016-07-12 08:19:40 BST CLOSE LONG REDROW PLC STEVE ASFOUR RDW.L 2016-07-12 08:19:51 BST CLOSE LONG TRAVIS PERKINS PLC STEVE ASFOUR TPK.L 2016-07-12 08:19:59 BST CLOSE LONG IBSTOCK PLC STEVE ASFOUR IBST.L 2016-07-12 08:20:09 BST CLOSE LONG MONEYSUPERMARKET.COM STEVE ASFOUR MONY.L 2016-07-12 08:20:18 BST CLOSE LONG BELLWAY PLC STEVE ASFOUR BWY.L 2016-07-12 08:20:28 BST CLOSE LONG NORTHGATE PLC STEVE ASFOUR NTG.L 2016-07-12 08:20:41 BST CLOSE LONG HALFORDS GROUP PLC STEVE ASFOUR HFD.L 2016-07-12 08:27:17 BST CLOSE LONG SPORTS DIRECT INTERNATIONAL STEVE ASFOUR SPD.L 2016-07-12 08:36:05 BST OPEN SHORT BERKELEY GROUP HOLDINGS/THE STEVE ASFOUR BKGH.L 2016-07-12 08:36:28 BST OPEN SHORT TAYLOR WIMPEY PLC STEVE ASFOUR TW.L 2016-07-12 08:36:45 BST OPEN SHORT ROYAL BANK OF SCOTLAND GROUP STEVE ASFOUR RBS.L 2016-07-12 08:37:05 BST OPEN SHORT ALDERMORE GROUP PLC STEVE ASFOUR ALD.L 2016-07-12 08:37:43 BST OPEN SHORT REDROW PLC STEVE ASFOUR RDW.L 2016-07-12 08:37:57 BST OPEN SHORT PERSIMMON PLC STEVE ASFOUR PSN.L 2016-07-12 08:38:25 BST OPEN SHORT HASTINGS GROUP HOLDINGS LTD STEVE ASFOUR HSTG.L 2016-07-12 08:42:41 BST OPEN SHORT LLOYDS BANKING GROUP PLC STEVE ASFOUR LLOY.L 2016-07-12 08:50:28 BST OPEN SHORT RIGHTMOVE PLC STEVE ASFOUR RMV.L 2016-07-12 09:49:35 BST OPEN SHORT DIXONS CARPHONE -

Consolidating Our Growth Advancing Our Pipeline

FRESNILLO PLC FRESNILLO ANNUAL REPORT AND ACCOUNTS 2018 AND ACCOUNTS REPORT ANNUAL CONSOLIDATING OUR GROWTH ADVANCING OUR PIPELINE Fresnillo plc Annual Report and Accounts 2018 Fresnillo plc is the world’s largest silver producer and Mexico’s largest gold producer, listed on the London and Mexican stock exchanges. The Company has been a steady and credible member of the FTSE 100 since 2008. Find out more online at www.fresnilloplc.com Fresnillo plc Annual Report and Accounts 2018 01 FRESNILLO TODAY STRATEGIC REPORT CORPORATE GOVERNANCE PERFORMANCE HIGHLIGHTS FINANCIAL STATEMENTS FRESNILLO TODAY This has been another year of production growth across 01 Performance highlights 02 Fresnillo at a glance the portfolio. With our pipeline continuing to advance, 04 Where we operate 06 Consolidating our growth and extensive consolidation activities currently underway, 08 Advancing our pipeline we are well-positioned to seize future opportunities. 10 Chairman’s statement 1 STRATEGIC REPORT Silver production Adjusted revenue 14 Chief Executive’s statement 17 Our markets 20 Business model 22 Relationships with key stakeholders 61.8 moz US$2,243.4m 24 Our strategy and KPIs 28 Managing our risks 42 Viability statement & +5.3% +0.5% going concern statement 44 Review of operations 66 Social and sustainability report Gold production Gross profit 85 Financial review CORPORATE GOVERNANCE 98 Fresnillo’s approach to governance 922.5 koz US$780.7m 99 Chairman’s letter 102 The Board of Directors 106 Executive Committee +1.3% -15.6% 107 Effectiveness 109 The governance -

Rising to the Challenges, Moving Forward with Confidence

FRESNILLO PLC ANNUAL REPORT AND ACCOUNTS RISING TO THE CHALLENGES, Fresnillo plc Fresnillo MOVING FORWARD WITH Annual Report and Accounts 2019 CONFIDENCE A CHALLENGING YEAR Fresnillo plc is the world’s largest silver producer and Mexico’s largest gold producer, listed on the London and Mexican stock exchanges. OUR PURPOSE Our Purpose is to contribute to the wellbeing of people, through the sustainable mining of silver and gold. STRATEGIC REPORT CORPORATE GOVERNANCE FINANCIAL STATEMENTS ADDITIONAL INFORMATION 01 Performance highlights 108 Chairman’s letter 156 Independent auditor’s report 238 Consolidated audited mineral 02 Where we operate on Governance 2019 169 Consolidated income statement resource statement 06 Chairman’s statement 109 Our approach to governance 170 Consolidated statement of 239 Consolidated audited 10 Chief Executive’s statement 112 The Board of Directors comprehensive income mineral resource statement 14 Markets review 116 Executive Committee 171 Consolidated balance sheet of exploration projects 16 Business model 117 Board leadership and purpose 172 Consolidated statement and prospects 18 Relationships with key 120 Division of responsibilities of cash flows 240 Audited ore reserve statement stakeholders 122 Composition, succession 173 Consolidated statement 241 Audited ore reserve statement 22 Our strategy and evaluation of changes in equity for Minera Juanicipio 24 Progress against our strategy 123 Nominations Committee report 174 Notes to the consolidated 242 Operating statistics 30 Review of operations 126 Audit -

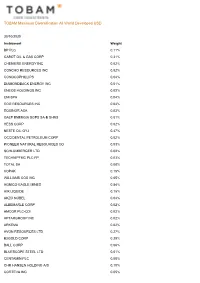

TOBAM Maximum Diversification All World Developed USD

TOBAM Maximum Diversification All World Developed USD 30/10/2020 Instrument Weight BP PLC 0.11% CABOT OIL & GAS CORP 0.31% CHENIERE ENERGY INC 0.02% CONCHO RESOURCES INC 0.02% CONOCOPHILLIPS 0.04% DIAMONDBACK ENERGY INC 0.01% ENEOS HOLDINGS INC 0.02% ENI SPA 0.04% EOG RESOURCES INC 0.04% EQUINOR ASA 0.03% GALP ENERGIA SGPS SA-B SHRS 0.01% HESS CORP 0.02% NESTE OIL OYJ 0.47% OCCIDENTAL PETROLEUM CORP 0.02% PIONEER NATURAL RESOURCES CO 0.03% SCHLUMBERGER LTD 0.02% TECHNIPFMC PLC FP 0.03% TOTAL SA 0.08% VOPAK 0.15% WILLIAMS COS INC 0.05% AGNICO-EAGLE MINES 0.84% AIR LIQUIDE 0.15% AKZO NOBEL 0.04% ALBEMARLE CORP 0.02% AMCOR PLC-CDI 0.02% APTARGROUP INC 0.02% ARKEMA 0.02% AVON RESOURCES LTD 0.27% B2GOLD CORP 0.29% BALL CORP 0.06% BLUESCOPE STEEL LTD 0.01% CENTAMIN PLC 0.08% CHR HANSEN HOLDING A/S 0.10% CORTEVA INC 0.05% TOBAM Maximum Diversification All World Developed USD 30/10/2020 Instrument Weight COVESTRO AG 0.02% CRODA INTERNATIONAL PLC 0.02% DS SMITH PLC 0.01% EMS-CHEMIE HOLDING AG-REG 0.01% EVONIK INDUSTRIES AG 0.01% FORTESCUE METALS GROUP LTD 0.05% FRANCO-NEVADA CORP 1.14% FRESNILLO PLC 0.03% GIVAUDAN-REG 0.08% HEIDELBERGCEMENT AG 0.02% ICL GROUP LTD 0.11% INTERNATIONAL PAPER CO 0.04% INTL FLAVORS & FRAGRANCES 0.02% JAMES HARDIE INDUSTRIES-CDI 0.02% JOHNSON MATTHEY PLC 0.01% KANSAI PAINT CO LTD 0.01% KINROSS GOLD CORP 0.44% KIRKLAND LAKE GOLD LTD 0.54% KONINKLIJKE DSM NV 0.06% MARTIN MARIETTA MATERIALS 0.04% MITSUBISHI CHEMICAL HOLDINGS 0.02% NEWCREST MINING LTD 0.48% NEWMONT CORP 1.47% NIPPON PAINT CO LTD 0.22% NIPPON STEEL CORP -

FTSE 100 & the UK Modern Slavery

FTSE 100 & the UK Modern Slavery Act: From Disclosure to Action 02 FTSE 100 & the UK Modern Slavery Act: Table of Contents 03 Executive summary ▌ Key findings ▌ Key recommendations 06 FTSE 100 Ranking 09 Introduction ▌ Policy developments 11 UK Modern Slavery Act 12 Methodology ▌ Review and revision ▌ Assessment ▌ Minimum requirements 14 Structure, Business & Supply Chains 15 Policies in Relation to Slavery & Trafficking 16 Due Diligence Process 18 Risk Assessment & Management 20 Effectiveness 21 Training 22 Wider trends ▌ Compliance with Section 54 of the MSA ▌ Gaps in reporting ▌ Business model 24 From mandatory transparency to mandatory due diligence 25 Conclusion 26 Recommendations ▌ UK Government ▌ Companies ▌ Investors From Disclosure to Action 03 Executive summary Modern slavery and human trafficking are now the second largest criminal industry in the world. The Global Slavery Index estimates there are 16 million victims of forced labour in the private sector. It is an uncomfortable truth that many of the goods and services sold by companies every day are produced by workers who suffer the most severe exploitation. In 2015, the UK Government introduced the Modern Slavery Act (MSA), which requires certain companies publish an annual statement detailing what steps they have taken to tackle modern slavery, both in their operations and in their supply chains. Business & Human Rights Resource Centre has tracked companies’ reporting every year since, and our findings show that the MSA has failed to deliver the transformational change many hoped for. Three years on, most companies still publish generic statements committing to fight modern slavery, without explaining how. Sadly, only a handful of leading companies have demonstrated a genuine effort in their reporting to identify and mitigate risks. -

Pegasus UCITS Fund UK Equity L/S January 2015

Pegasus UCITS Fund UK Equity L/S January 2015 FACTSHEET THE MANAGER Performance Returns The Pegasus UCITS Fund returned +1.3% in January (GBP Institutional share class). Monthly Review The best headline monthly total return for European equities in over three years hides elevated cross asset volatility over the period. There were three >3% Eurostoxx moves in the first week of trade alone, compared to only four in 2014, with five-day realised volatility David Yarrow is a Partner and at three year highs. Macro news flow dominated with a focus on weakness in industrial commodities, surprise SNB action, confirmation of ECB QE and the Greek election that followed were destabilising for risk assets. Unhelpfully, it was also another month of net Fund Manager at Clareville downgrades in the UK. Capital. Prior to Clareville, David spent 8 years working Against this backdrop, we were pleased the fund delivered absolute returns on both sides of the balance sheet. as an institutional stockbroker Oil and currency tailwinds continue to underpin earnings momentum in IAG, although there were two other developments in the period in UK equities, both in London and New York. In that, at the margin, helped the equity to outperform. Firstly, there were renewed hopes of an Aer Lingus deal. Despite having had to upsize the offer twice, we feel the latest disclosed terms still allow for good returns. However, despite support from both Boards, there 1993 he was appointed a Director of Equities at remains political risk around labour agreements and slot use which we await further clarity on. -

Beyond the Balance Sheet IFC Toolkit for Disclosure and Transparency

Beyond the Balance Sheet IFC Toolkit for Disclosure and Transparency Beyond the Balance Sheet IFC Toolkit for Disclosure and Transparency Beyond the Balance Sheet | IFC Toolkit for Disclosure and Transparency i © 2018 International Finance Corporation. All rights reserved. 2121 Pennsylvania Avenue, NW Washington, DC 20433 USA Internet: www.ifc.org The material in this work is copyrighted. Copying and/or transmitting portions or all of this work without permission may be a violation of applicable law. IFC encourages dissemination of its work and will normally grant permission to reproduce portions of the work promptly, and when the reproduction is for educational and non-commercial purposes, without a fee, subject to such attributions and notices as we may reasonably require. IFC does not guarantee the accuracy, reliability, or completeness of the content included in this work, or for the con- clusions or judgments described herein, and accepts no responsibility or liability for any omissions or errors (including, without limitation, typographical errors and technical errors) in the content whatsoever or for reliance thereon. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of the World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. The findings, interpretations, and conclusions expressed in this volume do not necessarily reflect the views of the Executive Directors of the World Bank or the governments they represent. The contents of this work are intended for general informational purposes only and are not intended to constitute legal, securities, or investment advice, an opinion regarding the appropriateness of any investment, or a solicitation of any type.