T HDFC MUTUAL FUND BHAROSA APNO KA

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2012 - 2013

Annual Report 2012 - 2013 Encouraging sustainability Empowering lives Accolades 2012-2013 Asia Money Best Bank Awards Financial Express Best Bank Awards ••Best Domestic Bank in India Best Bank – Private Sector • Best in Strength and Soundness Businessworld Awards for Banking Excellence • Best Banker – Aditya Puri • Most tech-friendly Bank • Deal of the year (Rupee bonds) IBA Banking Technology Awards • Best Online Bank CNBC TV18 India Best Banks and Financial Institutions • Best use of Business Intelligence Awards • Best Customer Relationship Initiative • Best Private Sector Bank • Best Risk Management & Security Initiative • Best use of Mobile Technology in Banking CSO Forum Information Technology Award • Best Information Security Practice IDRBT Banking Technology Excellence Awards • Best Bank in IT for Operational Effectiveness DSCI Information Technology Awards • Security Leader of the year Mint-Aon Hewitt’s India’s Best Managed Boards • Security in Bank • HDFC Bank among India’s six best managed Boards Dun & Bradstreet Banking Awards Nasscom CNBC-TV18 Innovation Award • Overall Best Bank • Best IT driven innovation in Banking (Commercial) • Best Private Sector Bank • Best Asset Quality – Private Sector National Quality Excellence Awards ••Best Retail Banking – Private Sector Best Customer Service Result Dun & Bradstreet Corporate Awards – India’s Top 500 NDTV Profit Business Leadership Awards Companies • Best Bank in India • Best Bank in India Skoch Foundation Financial Inclusion Awards Economic Times Awards for Corporate Excellence -

HDFC Securities AR 2018-19 Cover

Board of Directors Mr. Abhay Aima Dr. (Mrs.) Amla Samanta Mr. Ashish Rathi, Whole Time Director Mr. Bharat Shah, Chairman Mr. Dhiraj Relli, Managing Director Mr. Jagdish Capoor Auditors BSR & Co., LLP Chartered Accountants Bankers HDFC Bank Limited IndusInd Bank Limited IDBI Bank Limited Punjab National Bank Corporation Bank Company Secretary Mr. N. E. Venkitakrishnan Registered Office Office Floor 8, I think Techno Campus, Building B - Alpha, Kanjurmarg (East), Mumbai 400 042 Tel No. : 022-30753400 Fax No.: 022-30753435 Website : www.hdfcsec.com Corporate Identity Number (CIN) - U67120MH2000PLC152193 Registrar & Share Transfer Agents Datamatics Business Solutions Limited, Plot No B-5, Part B Crosslane, MIDC, Marol, Andheri (East), Mumbai - 400 093 Tel. No.: 66712213/2214 Fax No.: 66712011 CONTENTS Page Directors’ Report 1 - 16 Auditors Report 17 - 23 Balance Sheet 24 Profit & Loss Account 25 Statement of Changes in Equity 26 Cash Flow Statement 27 - 28 Notes to the Accounts 29 - 68 DIRECTORS’ REPORT have resulted in a net profit after tax of Rs.329.82 crore as against Rs. 344.73 crore in the previous year. TO THE MEMBERS The Company has emerged as a strong player in the Your Directors are pleased to present the financial services space offering complete financial 19th Annual Report on the business and operations services along with the core broking product. The of the Company together with audited accounts for Company had 278 branches across 165 cities in the the year ended 31 March, 2019. FY19 was the first country as on 31 March 2019 and also has multiple year of applicability of Indian Accounting Standards digital platforms to enable its customers have easy (IND AS) that have been harmonised with access to its products. -

Hdfc-Asset-Management-Company

HDFC Asset Management Company Limited Board of Directors Ms. Roshni Nadar Malhotra Independent Director Deepak S. Parekh (DIN: 02346621) Non-Executive Director and Chairman (DIN: 00009078) Mr. Shashi Kant Sharma Additional Independent Director Keki Mistry (DIN: 03281847) Non-Executive Director (DIN: 00008886) Mr. Milind Barve Managing Director Renu S. Karnad (DIN: 00087839) Non-Executive Director (DIN: 00008064) Auditors M/s. BSR & Co. LLP N. Keith Skeoch Chartered Accountants Non-Executive Director (DIN: 00165850) Key Managerial Personnel Mr. Piyush Surana James Aird Chief Financial Officer Non-Executive Director (ICAI Membership No.: 72979) (DIN: 01057384) Ms. Sylvia Furtado Mr. Dhruv Kaji Company Secretary Independent Director (Membership No.: A17976) (DIN: 00192559) Bankers Mr. Jairaj Purandare HDFC Bank Ltd. Independent Director (DIN: 00159886) Registered Office HDFC House, 2nd Floor, Mr. Sanjay Bhandarkar H. T. Parekh Marg, Independent Director 165-166, Backbay Reclamation, (DIN: 01260274) Churchgate, Mumbai 400 020. Tel. No. : 022-6631 6333 Mr. Parag Shah Fax No. : 022-6658 0203 Independent Director CIN : L65991MH1999PLC123027 (DIN: 00374944) Website: www.hdfcfund.com For complete Annual Report of HDFC Asset Management Company Limited (HDFC AMC), please refer their website at https://www.hdfcfund.com/about-us/financial/annual-reports Page referred at certain sections appearing in this Report is as per HDFC AMC’s Annual Report. 319 Twenty First Annual Report 2019-20 Directors’ Report To the Members Your Directors have pleasure in -

View Annual Report

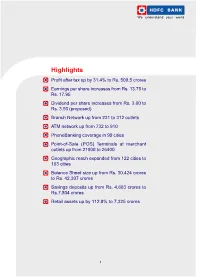

HDC BANK We understand your world Highlights Profit after tax up by 31.4% to Rs. 509.5 crores Earnings per share increases from Rs. 13.75 to Rs. 17.95 Dividend per share increases from Rs. 3.00 to Rs. 3.50 (proposed) Branch Network up from 231 to 312 outlets ATM network up from 732 to 910 PhoneBanking coverage in 99 cities Point-of-Sale (POS) Terminals at merchant outlets up from 21800 to 26400 Geographic reach expanded from 122 cities to 163 cities Balance Sheet size up from Rs. 30,424 crores to Rs. 42,307 crores Savings deposits up from Rs. 4,663 crores to Rs.7,804 crores Retail assets up by 112.9% to 7,325 crores 1 1 financial highlights Rs. in lacs _______________________________________________________________________________________________________________________________1999-2000 2000-2001 2001-2002 2002-2003______________________2003-2004 Interest Income 679,87 1,259,46 1,702,99 2,013,61 2,548,93 _____________________________________________________________________________________________________________________________________________________ Interest Expense 374,28 753,75 1,073,74 1,191,96 1,211,05 _____________________________________________________________________________________________________________________________________________________ Net Interest Income 305,59 505,71 629,25 821,65 1,337,88 _____________________________________________________________________________________________________________________________________________________ _______________________________________________________________________________________________________________________________Other -

Acknowledgement

STUDENT DECLARATION This is to certify that I have completed the Project titled “A STUDY ON HOME LOANS” under the guidance of “Mr. Amit Kumar Gupta” in the partial fulfillment of the requirement for the award of the degree of “Masters in Business Administration” from “Rukmini Devi Institute Of Advanced Studies, New Delhi.” This is an original work and I have not submitted it earlier elsewhere. RAJNI CERTIFICATE This is to certify that the project titled “A STUDY ON HOME LOANS” is an academic work done by “RAJNI” submitted in the partial fulfillment of the requirement for the award of the degree of “Masters in Business Administration” from “Rukmini Devi Institute Of Advanced Studies, New Delhi.” under my guidance and direction. To the best of my knowledge and belief the data and information presented by him in the project has not been submitted earlier elsewhere. Mr. Amit Kumar Gupta (Project Guide) RDIAS ACKNOWLEDGEMENT "Gratitude is not a thing of expression; it is more matter of feeling." There is always a sense of gratitude which one express towards others for their help and supervision in achieving the goals. This formal piece of acknowledgement is an attempt to express the feeling of gratitude towards people who helpful me in successfully completing of my training. I would like to express my deep gratitude to Mr.Amit Khanna my training coordinator for their constant co-operation. He was always there with his competent guidance and valuable suggestion through out the pursuance of this research project. Special thanks to Mr.Amit Kumar Gupta who guided me to work honestly and to give valuable suggestion for improving my work Last but not least I would also like to place of appreciation to all the respondents whose responses were of utmost importance for the project. -

43Rd Annual General Meeting of Housing Development Finance Corporation Limited 30Th July 2020, Thursday, 2:30 (IST) to 5:00 (IST)

43rd Annual General Meeting of Housing Development Finance Corporation Limited 30th July 2020, Thursday, 2:30 (IST) to 5:00 (IST) Chairman’s speech - Mr. Deepak S. Parekh Dear Shareholders, Good afternoon, I hope you and your family are safe and in good health. On behalf of the Board of Directors, I welcome you to the 43rd Annual General Meeting of your Corporation conducted through a video conference facility. It is indeed my regret that I am unable to meet you in person but we are in unprecedented times. It is now nearly 130 days since the national lockdown was first announced in India in March 2020. While restrictions on lockdown have gradually being lifted, the sense of unease has not abated. At HDFC, we are giving it our best to continue running the business despite the odds and even here, at our AGM, though we are meeting virtually we still have a chance to interact with each other. We have to be adaptable to the new normal. It is 2.30 pm and I have been informed that the requisite quorum is present and accordingly call this meeting to order. With me present here in the boardroom of HDFC’s office are Mr. Jalaj Dani, an Independent Director, Mr. Keki Mistry, our Vice Chairman and CEO, Mr. Srinivasa Rangan, who is our ED and Chief Financial Officer, Mr. Ajay Agarwal, the Company Secretary. I welcome all the Directors of the Corporation who are attending through video conference Dr. J. J. Irani, Mr. Nasser Munjee, Mr. U. K. Sinha, Dr. -

Full Page -2002-03.P65

Highlights Profit after tax up by 30.5% to Rs. 387.6 crores Earnings per share increases from Rs. 11.01 per share to Rs. 13.75 per share Dividend per share increases from Rs. 2.50 per share to Rs. 3.00 per share (proposed) Branch Network up from 171 to 231 outlets ATM network up from 479 to 732 PhoneBanking coverage in 80 cities Point-of-Sale (POS) Terminals at merchant outlets up from 6480 to 21804 Geographic reach expanded from 77 cities to 123 cities Balance Sheet size up from Rs. 23,787 crores to Rs. 30,424 crores Assigned highest rating CRISIL GVC Level 1 on corporate governance and value creation by The Credit Rating Information Services Of India Limited (CRISIL) 1 financial highlights Rs. in lacs 1998-1999 1999-2000 2000-2001 2001-2002 2002-2003 Interest Income 37,608 67,987 125,946 170,299 202,297 Interest Expense 22,918 37,428 75,375 107,374 119,196 Net Interest Income 14,690 30,559 50,571 62,925 83,101 Other Income 6,807 12,535 18,553 33,325 47,310 Net Revenues 21,497 43,094 69,124 96,250 130,411 Operating costs 8,879 17,139 30,959 41,795 59,183 Operating Result 12,618 25,955 38,165 54,455 71,228 Loan Loss Provisions 758 5,360 5,296 8,577 8,839 Depreciation and amortisation on investments 94 581 1,338 1,916 5,257 Others 81 529 25 1,424 47 Profit before tax 11,685 19,485 31,506 42,538 57,085 Provision for taxation 3,445 7,481 10,494 12,834 18,325 Profit after tax 8,240 12,004 21,012 29,704 38,760 Funds : Deposits 291,511 842,772 1,165,811 1,765,381 2,237,607 Subordinated debt 13,500 15,000 20,000 20,000 20,000 Stockholders Equity -

HDFC Bank Limited Annual Report 2014-15 10 (` Crore)

The Asian Banker Transaction Banking Awards Best Cash Management Bank in India The Asset Triple A Awards India - Best in Treasury and Working Capital - SMEs Financial Highlights 2005-2006 2006-2007 2007-2008 Interest income 4,547.26 7,055.35 10,530.43 Interest expense 1,929.50 3,179.45 4,887.12 Net interest income 2,617.76 3,875.90 5,643.31 Other income 1,237.08 1,679.21 2,495.94 Net revenues 3,854.84 5,555.11 8,139.25 Operating costs 2,116.82 2,975.08 4,311.03 Operating result 1,738.02 2,580.03 3,828.22 Provisions and contingencies 484.51 941.28 1,547.59 Loan loss provisions 484.21 877.13 1,278.84 Others 0.30 64.15 268.75 Profit before tax 1,253.51 1,638.75 2,280.63 Provision for taxation 382.73 497.30 690.45 Profit after tax 870.78 1,141.45 1,590.18 Funds : Deposits 55,796.82 68,297.94 100,768.60 Subordinated debt 1,702.00 3,282.60 3,249.10 Stockholders’ equity 5,299.53 6,433.15 11,497.23 Working funds 73,506.39 91,235.61 133,176.60 Loans 35,061.26 46,944.78 63,426.90 Investments 28,393.96 30,564.80 49,393.54 Key Ratios : Earnings per share (`) * 5.58 7.26 9.24 Return on average networth 17.47% 19.40% 16.05% Tier 1 capital ratio 8.55% 8.58% 10.30% Total capital ratio 11.41% 13.08% 13.60% Dividend per share (`) * 1.10 1.40 1.70 Dividend payout ratio 22.55% 22.92% 22.17% Book value per share as at March 31 (`) * 33.85 40.28 64.88 Market price per share as at March 31 (`) ** 154.85 190.83 266.25 Price to earnings ratio 27.74 26.29 28.80 ` 1 Crore = ` 10 Million * Figures for the years prior to 2011-2012 have been adjusted to reflect the effect of split of equity shares from nominal value of ` 10 each into five equity shares of nominal value of ` 2 each. -

44Th Annual General Meeting of Housing Development Finance Corporation Limited 20Th July 2021, Tuesday, 11:00 (IST) to 14:48 (IST)

44th Annual General Meeting of Housing Development Finance Corporation Limited 20th July 2021, Tuesday, 11:00 (IST) to 14:48 (IST) Moderator: Dear Shareholders, good morning and a very warm welcome to the 44th Annual General Meeting of Housing Development Finance Corporation Limited through video conferencing. As a reminder, for the smooth conduct of the Meeting, the Members will be in the mute mode, and audio and video will be opened when they speak at the AGM as per the pre-registration. Please note that, as per the requirements, the proceedings of the Annual General Meeting will be recorded and the recording will be available on the website of the Company. I now hand over the proceedings to Mr. Deepak S. Parekh, Chairman of Housing Development Finance Corporation Limited” Chairman’ speech - Mr. Deepak S. Parekh Dear Shareholders, Good morning to all of you. I hope you and your family are safe and in good health. On behalf of the Board of Directors and on my behalf, I welcome you all to the 44th Annual General Meeting of your Corporation conducted through video conferencing. It is 11:00 am and I have been informed that the necessary quorum is present. I accordingly call this meeting to order. I am happy to announce that we have a full attendance of the Board at this AGM and I would like to thank all the Directors for making yourself available despite this being a busy period for AGMs and Board meetings, at the outset I would like to mention that as per applicable law the tenure of Mr. -

Sylvia Gregory Furtado

Ref/No/HDFCAMC/SE/2020-21/21 Date – June 5, 2020 National Stock Exchange of India Limited BSE Limited Exchange Plaza, Plot C/1, Block G, Sir PJ Towers, Bandra Kurla Complex, Bandra (East) Dalal Street, Mumbai – 400051 Mumbai – 400001 Kind Attn: Head – Listing Department Kind Attn: Sr. General Manager – DCS Listing Department Sub: Disclosure under Regulation 23(9) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“Regulations”) Dear Sir/Madam, Pursuant to the aforesaid Regulations, please find enclosed disclosure of related party transactions as per the format specified in the applicable accounting standards, for the year ended March 31, 2020. The said disclosure is also available on the website of the Company, www.hdfcfund.com. This is for your information and records. Thank you, Yours faithfully, For HDFC Asset Management Company Limited Sylvia Furtado Company Secretary Encl: a/a HDFC Asset Management Company Limited A Joint Venture with Standard Life Investments CIN: L65991MH1999PLC123027 Registered Office :"HDFC House", 2ndFloor, H.T. Parekh Marg, 165-166, Backbay Reclamation, Churchgate, Mumbai-400 020 Tel.: 022 - 6631 6333 Fax: 022 - 6658 0203 Website: www.hdfcfund.com email: [email protected] HDFC ASSET MANAGEMENT COMPANY LIMITED Related Party Transactions (As per the format of Indian Accounting Standard on ‘Related Party Disclosures’, Ind AS 24) List of related parties of the Company (as per policy on related party transactions) with whom there have been transactions during the year -

Keki Mistry.Cdr

WITH YOU, RIGHT THROUGH A Chartered Accountant from the Institute of Chartered Accountants of India (ICAI). Mr. Keki Mistry brings with him over three decades of varied work experience in the Banking & Financial Services domain. Mr. Keki Mistry Vice Chairman & In 1981, Mr. Mistry joined HDFC Ltd. India's premier housing finance Chief Executive Officer, HDFC Ltd. company. Over the years he held several responsibilities, prior to being inducted onto its Board as Executive Director in 1993. He was appointed as the Managing Director in 2000, as the Vice Chairman & Managing Director in October 2007 and the Vice-Chairman & Chief Executive Officer of the Corporation with effect from January 1, 2010. Mistry is responsible for the overall functioning of the Corporation. As a part of the management team, Mr. Mistry has played a critical role in the successful transformation of HDFC into India's leading Financial Services Conglomerate by facilitating the formation of companies including HDFC Bank Ltd., HDFC Asset Management Company Ltd., HDFC Life Insurance Company Ltd. (earlier known as HDFC Standard Life Insurance Company Ltd) and HDFC ERGO General Insurance Company Ltd In 1975, Mr. Mistry began his career with AF Ferguson & Co, a renowned Chartered Accountancy Firm, followed by short stints with Hindustan Unilever Ltd. and Indian Hotels Company Ltd. Besides being on the board of several HDFC Group companies, Mr. Mistry is also on the Boards of Tata Consultancy Services, Torrent Power Ltd, CDC Group (London), Griha Investments – Mauritius, Griha pte ltd – Singapore and Flipkart Pvt. Ltd, Singapore. He is also on the Advisory Boards of a few Indian Corporates. -

Hdfc Bank Parivartan

Experiential Leadership Enabling Personalized Customer Journeys Through Technology Annual Report 2017-18 WorldReginfo - 03d46869-2995-4009-9da7-406403ee432e HIGHLIGHTS Net Profit 17,487 crore An increase of 20.2% compared to the previous year. Balance Sheet Size 1,063,934 crore An increase of 23.2% compared to the previous year. Total Deposits 788,771 crore An increase of 22.5% compared to the previous year. Total Advances 658,333 crore An increase of 18.7% compared to the previous year. Capital Adequacy Ratio 14.8% Tier I Capital Ratio 13.2% Gross Non-performing Assets 1.30% of Gross Advances Network Banking outlets: 4,787 ATMs: 12,635 Cities/Towns: 2,691 WorldReginfo - 03d46869-2995-4009-9da7-406403ee432e TABLE OF CONTENTS Board and Management 2 AGM and Record Date Details 5 Evolving into an Experience Business, Digitally 6 Parivartan – A Step towards Progress 10 Working with the Government 12 Graphical Highlights 14 Financial Highlights 18 Directors’ Report 20 Independent Auditors’ Report 77 Financial Statements 80 Basel III- Pillar 3 Disclosures 155 Independent Auditors’ Report for 156 Consolidated Financial Statements Consolidated Financial Statements 160 Secretarial Auditor’s Certificate 209 on Corporate Governance Corporate Governance 210 Shareholder Information 234 WorldReginfo - 03d46869-2995-4009-9da7-406403ee432e BOARD AND MANAGEMENT BOARD OF DIRECTORS Shyamala Gopinath Bobby Parikh Partho Datta Malay Patel Chairperson Umesh Chandra Srikanth Nadhamuni Keki Mistry Sarangi Aditya Puri Paresh Sukthankar Kaizad Bharucha Managing Director