LVB Ar 2016 Page 1 to 72.P65 1 07/05/2016, 1:04 PM ANNUAL REPORT 2015 - 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

VIRUDHUNAGAR DISTRICT Minerals and Mining Irrigation Practices

VIRUDHUNAGAR DISTRICT Virudhunagar district has no access to sea as it is covered by land on all the sides. It is surrounded by Madurai on the north, by Sivaganga on the north-east, by Ramanathapuram on the east and by the districts of Tirunelveli and Tuticorin on the south. Virudhunagar District occupies an area of 4288 km² and has a population of 1,751,548 (as of 2001). The Head-Quarters of the district Virudhunagar is located at the latitude of 9N36 and 77E58 longitude. Contrary to the popular saying that 'Virudhunagar produces nothing, but controls everything', Virudhunagar does produce a variety of things ranging from edible oil to plastic-wares. Sivakasi known as 'Little Japan' for its bustling activities in the cracker industry is located in this district. Virudhunagar was a part of Tirunelveli district before 1910, after which it became a part of Ramanathapuram district. After being grafted out as a separate district during 1985, today it has eight taluks under its wings namely Aruppukkottai, Kariapatti, Rajapalayam, Sattur, Sivakasi, Srivilliputur, Tiruchuli and Virudhunagar. The fertility of the land is low in Virudhunagar district, so crops like cotton, pulses, oilseeds and millets are mainly grown in the district. It is rich in minerals like limestone, sand, clay, gypsum and granite. Tourists from various places come to visit Bhuminathaswamy Temple, Ramana Maharishi Ashram, Kamaraj's House, Andal, Vadabadrasayi koi, Shenbagathope Grizelled Squirrel Sanctuary, Pallimadam, Arul Migu Thirumeni Nadha Swamy Temple, Aruppukkottai Town, Tiruthangal, Vembakottai, Pilavakkal Dam, Ayyanar falls, Mariamman Koil situated in the district of Virudhunagar. Minerals and Mining The District consists of red loam, red clay loam, red sand, black clay and black loam in large areas with extents of black and sand cotton soil found in Sattur and Aruppukottai taluks. -

Tamilnadu Water Supply and Drainage Board

TAMIL NADU WATER SUPPLY AND DRAINAGE BOARD TENDER CALL FOR VARIOUS PACKAGES OF COMBINED WATER SUPPLY SCHEMES FORM OF CONTRACT: ITEM RATE (TWO COVER SYSTEM) INVITATION OF BID NO.01& 02 /HO/2010/DATED 29.12.2010 & 31.12.2010 1. For and on behalf of Tamil Nadu Water Supply and Drainage Board, sealed (wax sealing) bids (in Two cover System) are invited by the Chief Engineers of TWAD Board under Item-war Tender System for Procurement, Construction, Commissioning and Maintenance of 8 Combined Water Supply Scheme in full or in part-Packages (as specified) for as detailed below. 2. This Procurement, Construction, Contract will follow the procedure prescribed under The Tamil Nadu Transparency in Tenders Act, 1998 and Rules 2000 and subsequent amendments there on. 3. Bidding documents in English may be purchased by interested bidders from the concerned Chief Engineers/ Executive Engineers, on submission of written application accompanied with a separate Demand Draft for each Work from any Nationalized/ Scheduled bank drawn in favour of Managing Director,TWAD Board, for the respective packages as detailed below on any working day between 10.00 hours and 17.45 hours as per the dates mentioned below. 4. Cost of tender document per Work is Rs.1000 + 4% VAT. 5. The bid documents can also be downloaded free of cost from www.tenders.tn.gov.in 6. Amount of Earnest Money Deposit will be 1% of the value of work put to tender of the respective Works. 7. Period of contract is as furnished below in respect of the individual Works. -

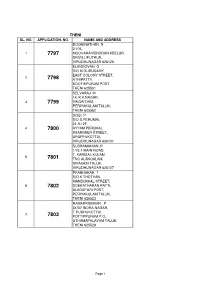

THENI APP.Pdf

THENI SL. NO. APPLICATION. NO. NAME AND ADDRESS BOOMINATHAN. R 2/105, 1 7797 MOOVARAIVENDRAN KEELUR, SRIVILLIPUTHUR, VIRUDHUNAGAR 626125 ELANGOVAN. G S/O M.GURUSAMY EAST COLONY STREET, 2 7798 ATHIPATTY, BOOTHIPURAM POST, THENI 625531 SELVARAJ. M 14, K.K.NAGAR, 3 7799 VAIGAI DAM, PERIYAKULAM TALUK, THENI 625562 GOBI. P S/O S.PERUMAL 21-9-12F, 4 7800 AYYAM PERUMAL ASARIMIER STREET, ARUPPUKOTTAI, VIRUDHUNAGAR 626101 SUBRAMANIAN .P 1/73-1 MAIN ROAD, T. KARISAL KULAM, 5 7801 TNC ALANGALAM, SIVAKASI TALUK, VIRUDHUNAGAR 626127 PRABHAKAR. T S/O K.THOTHAN MANDUKKAL STREET, 6 7802 SOKKATHARAN PATTI, ALAGAPURI POST, PERIYAKULAM TALUK, THENI 626523 RAMAKRISHNAN . P 31/B7 INDRA NAGAR, T.PUDHUKOTTAI, 7 7803 POTTIPPURAM P.O, UTHAMAPALAYAM TALUK, THENI 625528 Page 1 BASKARAN. G 2/1714. OM SANTHI NAGAR, 11TH STREET, 8 7804 ARANMANAI SALI, COLLECTRATE POST, RAMNAD 623503 SURESHKUMAR.S 119, LAKSHMIAPURAM, 9 7805 INAM KARISAL KULAM (POST), SRIVILLIPUTTUR, VIRUTHU NAGAR 626125 VIJAYASANTHI. R D/O P.RAJ 166, NORTH STREET, 10 7806 UPPUKKOTTAI, BODI TK, THENI 625534 RAMJI.A S/O P.AYYAR 5/107, NEHRUNAGAR, 11 7807 E-PUTHUKOTTAI, MURUGAMALAI NAGAR (PO), PERIYAKULAM (TK), THENI 625605 KRISHNASAMY. M 195/31, 12 7808 GANDHIPURAM STREET, VIRUDHUNAGAR 626001 SIVANESAN. M 6/585-3A, MSSM ILLAM, 13 7809 3RD CROSS STREET, LAKSHMI NAGAR, VIRUDHUNAGAR 626001 GIRI. G S/O GOVINDARAJ. I 69, NORTH KARISALKULAM, 14 7810 INAM KARISAL KULAM POST, SRIVILLIPUTTUR TALUK, VIRUDHUNAGAR 626125 PARTHASARATHY. V S/O VELUSAMY 2-3, TNH,BVANNIAMPATTY, 15 7811 VILLAKKUINAM, KARISALKULAM POST, SRIVILLIPUTHUR TALUK, VIRUDHUNAGAR 626125 Page 2 MAHARAJA.S 11, WEST STREET, MANICKPURAM, 16 7812 KAMARAJAPURAM (PO), BODI (TK), THENI 625682 PALANICHAMY. -

SENIOR BAILIFF-1.Pdf

SENIOR BAILIFF tpLtp vz;/6481-2018-V Kjd;ik khtl;l ePjpkd;w mYtyfk; ehs; /;? 14/07/2018 ntY}u; khtl;lk;. ntY}u; mwptpf;if tpLtp vz;/855-2018-V- ehs; 24/01/2018 ntY}u; khtl;lk;. Kjd;ik khtl;l ePjpgjp mtu;fsJ mwptpf;ifapd;go ,t;tYtyfj;jpw;F tug;bgw;w tpz;zg;g';fspy;. fPH;fhqk; tpz;zg;g';fs; fyk; vz;/4?y; fz;;l fhuz';fSf;fhf epuhfupf;fg;gl;Ls;sJ vd;W ,jd; K:yk; bjuptpf;fg;gLfpwJ/ khz;g[kpF brd;id cau;ePjpkd;wk; WP No.17676 of 2016 and W.M.P.15371 of 2016 ehs; 03/04/2017 ?y; tH';fpa tHpfhl;Ljy;fspd;go. tpz;zg;g';fs; epuhfupf;fg;gl;l tpz;zg;gjhuu;fSf;F. mtu;fSila tpz;zg;g';fspy; fz;Ls;s FiwghLfs; eptu;j;jp bra;aj;jf;f tifapy; ,Ue;jhy;. mj;jifa FiwghLfis eptu;j;jp bra;a . rk;ge;jg;gl;l tpz;zg;gjhuu;fSf;F xU tha;g;g[ tH';fntz;Lk;/ mjd;go fPH;fhqk; epuhfupf;fg;gl;l tpz;zg;g';fspy; cs;s FiwghLfis. rk;ge;jg;gl;l tpz;zg;gjhuu;fs; eptu;j;jp bra;tjw;fhd fhyk; 16/07/2018 Kjy; 18/07/2018 tiu vd epu;zapf;fg;gl;Ls;sJ/ tHpKiwfs; /;? (Instructions) 1) vd;d fhuz';fSf;fhf - FiwghLfSf;fhf tpz;zg;g';fs; epuhfupf;fg;gl;Ls;snjh. mjid eptu;j;jp bra;tjw;fhf rk;ge;jg;gl;l tpz;zg;gjhuu;fs; j';fs; milahs ml;il (Mjhu; ml;il - Xl;Leu; cupkk; - thf;fhsu; milahs ml;il) ,itfspy; VjhtJ xd;Wld;. -

List of Registered Warehouse for Export of Chilli (As on Date 15.07.2021) Name of Ware House Registration No

List of Registered Warehouse for Export of Chilli (As on date 15.07.2021) Name of ware house Registration no. and Validity date 1. M/s Sri Varu Impex & Logistics 01/2017- Warehouse 24.11.2019 No. 111, Old Alamadi Village, Thiruvallur High 25.11.2017 Road, Chennai-052 2. M/s.Kunvarji Comtrade Retail Pvt. Ltd. 02/2018- Warehouse 12.02.2022 C/o.Kalyx Warehouseing Pvt. Ltd. 13.02.2018 Unit No. 01, Survey No. 321, 338, NR.Choice Laboratory, Brahmanwada, Unjha Dist.Mehsana, Gujarat-384170 3. M/s Vijayakrishna Spice Farms Private Limited 03/2018- Warehouse 14.02.2020 D No. 177/A, Opp. Durga Nagar, Near Mirchi 15.02.2018 Yard, G.T. Road, Guntur, Andhra Pradesh- 522005 4. NIFCO Sea Freight Pvt. Ltd. 04/2018- Warehouse 11.03.2020 Servey No. 354, DIV 7.8.9, Upparapalym Road, 12.03.2018 Alamati, Edapalyam, Red Hills, Chennai- 600067 5. M/s Nandyla Sathyanarayana, 05/2018- Warehouse 19.02.2020 GDL CFS, Krishnapatnam Port Road, 20.02.2018 Nidigutapalem, Nellore- 524232 6. M/s. Samay Agro Products 06/2018-Warehouse 02.04.2021 Plot No. 15, AKVN Food park, Borgaon, 03.04.2018 Chhindwara,(M.P)-480108 7. Value Ingredients 07/2018-Warehouse 08.04.2020 No. 7/2 B, Ambattur, Industrial Estate, M.T.H. 09.04.2018 Road, Ambattur, Chennai-600058 8. S.Jayavel Exim Exports and Imports 08/2018-Warehouse 08.04.2020 152/2, Vichur Main Road, Vellangulam, 09.04.2018 Vichur, Chennai-600103 9. Kanu Krishna Corporation 09/2018-Warehouse 13.04.2020 Plot No. -

Madurai Bench

MADURAI BENCH S.No. ROLL No. NAME OF ADVOCATE ADDRESS 2/26, NORTH STREET, KEELAMATHUR POST, 1 132/2013 ABDUL KABUR A. MADURAI - 625 234 ABDUL KALAM BAGADUR NO - 680/2, 7TH STREET, G.R. NAGAR, 2 336/2000 SHA S.I. K.PUDUR, MADURAI - 625007. NO 9, PIONEER AVENUE, NARAYANAPURAM, 3 1775/2003 ABDUL MUTHALIF M.A. NEW NATHAM ROAD, MADURAI - 625014. 11/2, SHEKKADI 2ND STREET,AVVAIYAR LANE, 4 3660/2015 ABDUL NAVAS S. NARIMEDU, MADURAI DT-625002. NO.3, SRI GURU RAGAVENDRA BHAVAN, 5 2238/2015 ABIRAM VIKASH S.J. PARENTS TEACHERS ROAD, S. KODIKULAM, MADURAI DIST -625007. PEACE TOWERS, PLOT NO.8, 120 FEET, K. 6 1882/2015 ABISHA ISAAC I. PUDUR ROAD, MATTUTHAVANI, MADURAI DIST -625007. 100, VATHIYAR COMPOUND, FATHIMA NAGAR, 7 2115/2007 ABIYA K. BETHANIYAPURAM, MADURAI - 16. NO.8, MUNIYANDI KOIL STREET, MELUR - 8 308/2010 ABUL KALAM AZAD C. 625106, MELUR,MADURAI DT. 5/8/14, MUSLIM MELATHERU, NATHAM, 9 2879/2013 ABUTHAHEER S. DINDIGUL DIST -624401 DOOR NO:3/320, D.PUDUKOTTAI, 10 2432/2010 ADITHYAVIJAYALAYAN N. CHATRAPATTI PO. ODDANCHATRAM TK. DINDIGUL DT.624614 PLOT NO 12, CLASSIC AVENUE, NEAR VALAR 11 893/1993 AGAYARKANNI K. NAGAR, ELANTHAIKULAM VILLAGE, OTHAKADAI POST, MADURAI - 625107. S.No. ROLL No. NAME OF ADVOCATE ADDRESS 12 1825/2013 AJAY PARTHIBAN R.M. NO:336, K.K.NAGAR MADURAI NO.1624, THERKUKATOOR, VALANTHARAVAI 13 1943/2008 AJAYKOSE C. PO, RAMANATHAPURAM. 1/36E MUTHUKRISHNAN NAGAR,TNAU NAGAR 14 2612/2011 AJITH GEETHAN A. 3RD STREET,Y.OTHAKADAI,MADURAI-625107 NO.70, MATHA NAICKEN PATTI ROAD, 15 3410/2013 AJITHA P. -

Secretarial Department CIN L65110TN1926PLC001377 Ref

Secretarial Department CIN L65110TN1926PLC001377 Ref/Sec/93rdAGM/79/2020-2021 September 01, 2020 The General Manager The General Manager Department of Corporate Services Department of Corporate Services National Stock Exchange of India BSE Limited Exchange Plaza, C-1-Block G Listing Department Bandra Kurla Complex, Bandra-E PhirozeJeejeeboy Tower Mumbai - 400 051 Dalal Street, Fort Mumbai - 400 001 Company symbol: LAKSHVILAS Security code no: 534690 Dear Sir / Madam, Sub: Notice of the 93rd AGM & Annual Report for the year 2019-20 of The Lakshmi Vilas Bank Limited (“Bank”). In compliance with the applicable regulations of SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended, we herewith enclose the Notice of the 93rd Annual General Meeting (AGM) and Annual Report for the year 2019-20 of the Bank. The same is also made available on the website of the Bank at the following link: Notice of https://www.lvbank.com/UserFiles/LVB%2093rd%20AGM%20Notice%202020.pdf the 93rd Annual General Meeting Annual https://www.lvbank.com/UserFiles/LVB%2093rd%20Annual%20Report%202019- Report of 20.pdf the Bank for the year 2019-2020 Dispatch of the Notice of 93rdAGM and the Annual Report for FY 2019-20 (by e-mail only) to the shareholders will be carried out by National Securities Depository Limited (NSDL) on September 02, 2020. This is for your kind information. Thanking you, Yours faithfully, N Ramanathan Company Secretary ___________________________________________________________________________ The Lakshmi Vilas Bank Ltd., Corporate Office, “LVB HOUSE”, No.4, Sardar Patel Road, Guindy, Chennai – 600 032 | Phone: 044-22205306 | Email: [email protected] THE LAKSHMI VILAS BANK LIMITED CIN L65110TN1926PLC001377 Registered Offi ce: Salem Road, Kathaparai, Karur - 639 006. -

![Guntur Branch [0150], #4-3-34, Behind Hindu College G.T.Road, Guntur – 522003](https://docslib.b-cdn.net/cover/1427/guntur-branch-0150-4-3-34-behind-hindu-college-g-t-road-guntur-522003-1701427.webp)

Guntur Branch [0150], #4-3-34, Behind Hindu College G.T.Road, Guntur – 522003

GUNTUR BRANCH [0150], #4-3-34, BEHIND HINDU COLLEGE G.T.ROAD, GUNTUR – 522003 E-AUCTION SALE NOTICE E-Auction Sale Notice for Sale of Immovable Assets under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 read with proviso to Rule 8 (6) of the Security Interest (Enforcement) Rules, 2002. Notice is hereby given to the public in general and in particular to the Borrower (s) and Guarantor (s) that the below described immovable property/ies mortgaged/charged to Union Bank of India (e-Corporation Bank), Guntur Branch, Guntur the physical possessions of which has been taken by the Authorised Officer of Union Bank of India (e-Corporation Bank), Guntur Branch, Guntur will be sold on "As is where is","As is what is" and "Whatever there is" on 18-11-2020, for recovery of outstanding dues and other expenses due to Union Bank of India (e-Corporation Bank), Guntur Branch, Guntur from the following Borrowers and Guarantors. Last Date for submission of Bids:17-11-2020. The Reserve Price and Earnest Money Deposit will be as under. Borrower/s: 1 M/s Sri Eswara Cotton Ginning Mill Represented by: Prop: Modepalli Hymavathi W/o Narasimha Rao, 8/215/4/a,c/o anjani cotton pvt ltd. ananthavarappadu road, etukuru,guntur -522017 2. Modepalli Hymavathi W/o Narasimha Rao, D.no: 9-96, pedaparimi, thullur mandal, guntur district. Guarantor/s: 1.Mr. Kondaveeti Srinivasa Rao S/o China Raja Rao Flat No: 401, Svr Mysonet,4/2 Chandramouli Nagar,Guntur.2.Smt. Kondaveeti Siva Kumari W/o Srinivasa Rao, Flat No: 401, Svr Mysonet, 4/2 Chandramouli Nagar, Guntur. -

Mint Building S.O Chennai TAMIL NADU

pincode officename districtname statename 600001 Flower Bazaar S.O Chennai TAMIL NADU 600001 Chennai G.P.O. Chennai TAMIL NADU 600001 Govt Stanley Hospital S.O Chennai TAMIL NADU 600001 Mannady S.O (Chennai) Chennai TAMIL NADU 600001 Mint Building S.O Chennai TAMIL NADU 600001 Sowcarpet S.O Chennai TAMIL NADU 600002 Anna Road H.O Chennai TAMIL NADU 600002 Chintadripet S.O Chennai TAMIL NADU 600002 Madras Electricity System S.O Chennai TAMIL NADU 600003 Park Town H.O Chennai TAMIL NADU 600003 Edapalayam S.O Chennai TAMIL NADU 600003 Madras Medical College S.O Chennai TAMIL NADU 600003 Ripon Buildings S.O Chennai TAMIL NADU 600004 Mandaveli S.O Chennai TAMIL NADU 600004 Vivekananda College Madras S.O Chennai TAMIL NADU 600004 Mylapore H.O Chennai TAMIL NADU 600005 Tiruvallikkeni S.O Chennai TAMIL NADU 600005 Chepauk S.O Chennai TAMIL NADU 600005 Madras University S.O Chennai TAMIL NADU 600005 Parthasarathy Koil S.O Chennai TAMIL NADU 600006 Greams Road S.O Chennai TAMIL NADU 600006 DPI S.O Chennai TAMIL NADU 600006 Shastri Bhavan S.O Chennai TAMIL NADU 600006 Teynampet West S.O Chennai TAMIL NADU 600007 Vepery S.O Chennai TAMIL NADU 600008 Ethiraj Salai S.O Chennai TAMIL NADU 600008 Egmore S.O Chennai TAMIL NADU 600008 Egmore ND S.O Chennai TAMIL NADU 600009 Fort St George S.O Chennai TAMIL NADU 600010 Kilpauk S.O Chennai TAMIL NADU 600010 Kilpauk Medical College S.O Chennai TAMIL NADU 600011 Perambur S.O Chennai TAMIL NADU 600011 Perambur North S.O Chennai TAMIL NADU 600011 Sembiam S.O Chennai TAMIL NADU 600012 Perambur Barracks S.O Chennai -

3040 Tamil Nadu Public Service Commission Bulletin [August 16, 2016

3040 TAMIL NADU PUBLIC SERVICE COMMISSION BULLETIN [AUGUST 16, 2016 DEPARTMENTAL EXAMINATIONS MAY 2016 DEPARTMENTAL TEST IN THE TAMIL NADU MEDICAL CODE (WITH BOOKS) LIST OF REGISTER NUMBER OF PASSED CANDIDATES - CONTD. CHENNAI - Contd. CHENNAI - Contd. 000959 EZHUMALAI V S/O VELLAIYAN, NO.218, MEL ST 001258 INDUMATHI G. MADRAS MEDICAL COLLEGE CHENNAI KOTTAPUTHUR PO, CHINNASALEM TK VILLUPURAM DT PINCODE:600003 PINCODE:606209 001260 INDUMATHI P B4 SHYAMS ROYAL ENCLAVE 25 SATHYA 000963 FARZANA . Y 228/3, MOSQUE STREET BALUCHETTY NAGAR 2ND STREET MOGAPPAIR ROAD PADI CHATRAM KANCHIPURAM PINCODE:631551 PINCODE:600050 000967 FELCY EMALDA M NO.53, MUTHURAMALINGAM ST, 001266 ISAKKIAMMAL .M ROYAL WOMENS HOSTEL 2, SENTHIL NAGAR, THIRUMULLAIVOYAL, CHENNAI VEERASAMY STREET EGMORE CHENNAI. PINCODE:600062 PINCODE:600008 000969 FRANCIS RAJESH A O/O THE GOVERNMENT ANALYST 001300 JANAGHI.M NURSES QUARTERS GOVT STANLEY FOOD ANALYSIS LAB, KI CAMPUS GUINDY CHENNAI - 32 HOSPITAL CHENNAI PINCODE:600001 PINCODE:600032 001314 JASMINE BEAULA D 2/917, NELLI NAGAR NEAR RS WATET 000977 GANAPATHY V 3/340 CHOKKAMMAN KOIL STREET TANK DHARMAPURI PINCODE:636701 DESUMUGIPET POST, THIRUKKALUKUNDRAM PINCODE:603109 001395 JEEVA B 1/56 VINAYAGAR KOIL STREET PUDUMAVILANGAI TIRUVALLUR PINCODE:631203 001012 GAYATHRI C R 49,SUNDARAM STREET STUARTPET ARAKKONAM PINCODE:631001 001396 JEEVA E 42C, MANDAPAM STREET PILLAIYARPALAYAM KANCHIPURAM PINCODE:631501 001033 GEETHA T S7A,EAST MAIN ROAD, LAKSHMI NAGAR 4THSTAGE NANGANALLUR CHENNAI PINCODE:600061 001400 JEEVANAKUMARI A PLOT 20 MIG2 TAMIL NADU HOUSINGBOARD COLONY TONDIARPET PINCODE:600081 001039 GEETHAMAI T. G. N. OLD14/NEW18 DR,RATHAKRISHNAN NAGAR 1ST ST CHOOLAIMEDU,CHENNAI PIN:600094 001418 JEYAKANNAN M. 6-1-69, KATCHAKARIAMMAN KOVIL T.KALLUPATTI PERAIYUR TK, MADURAI DT 001056 GIRIJA P. -

Tamil Nadu Public Service Commission Bulletin

© [Regd. No. TN/CCN-466/2012-14. GOVERNMENT OF TAMIL NADU [R. Dis. No. 196/2009 2015 [Price: Rs. 280.80 Paise. TAMIL NADU PUBLIC SERVICE COMMISSION BULLETIN No. 18] CHENNAI, SUNDAY, AUGUST 16, 2015 Aadi 31, Manmadha, Thiruvalluvar Aandu-2046 CONTENTS DEPARTMENTAL TESTS—RESULTS, MAY 2015 Name of the Tests and Code Numbers Pages. Pages. Second Class Language Test (Full Test) Part ‘A’ The Tamil Nadu Wakf Board Department Test First Written Examination and Viva Voce Parts ‘B’ ‘C’ Paper Detailed Application (With Books) (Test 2425-2434 and ‘D’ (Test Code No. 001) .. .. .. Code No. 113) .. .. .. .. 2661 Second Class Language Test Part ‘D’ only Viva Departmental Test in the Manual of the Firemanship Voce (Test Code No. 209) .. .. .. 2434-2435 for Officers of the Tamil Nadu Fire Service First Paper & Second Paper (Without Books) Third Class Language Test - Hindi (Viva Voce) (Test Code No. 008 & 021) .. .. .. (Test Code 210), Kannada (Viva Voce) 2661 (Test Code 211), Malayalam (Viva Voce) (Test The Agricultural Department Test for Members of Code 212), Tamil (Viva Voce) (Test Code 213), the Tamil Nadu Ministerial Service in the Telegu (Viva Voce) (Test Code 214), Urdu (Viva Agriculture Department (With Books) Test Voce) (Test Code 215) .. .. .. 2435-2436 Code No. 197) .. .. .. .. 2662-2664 The Account Test for Subordinate Officers - Panchayat Development Account Test (With Part-I (With Books) (Test Code No. 176) .. 2437-2592 Books) (Test Code No. 202).. .. .. 2664-2673 The Account Test for Subordinate Officers The Agricultural Department Test for the Technical Part II (With Books) (Test Code No. 190) .. 2593-2626 Officers of the Agriculture Department Departmental Test for Rural Welfare Officer (With Books) (Test Code No. -

July - September, 2015

Government of India Ministry of Agriculture and Farmers Welfare (Department of Agriculture, Cooperation and Farmers Welfare) Southern Region Farm Machinery Training and Testing Institute Garladinne, Dist.Anantapur, A.P. -515731. Volume: 3 No.10 JULY - SEPTEMBER, 2015 Er.P.K.PANDEY, DIRECTOR From the Director’s Desk Agricultural Mechanization plays an important role in bringing self sufficiency in Agriculture sector in India. Farm Mechanization also enables conservation of inputs, reduces unit cost of production, increases productivity and removes drudgery and hazards to humans and animals. This is possible with selection and use of appropriate machines/implements and human resources development of mechanization aspects by means of imparting training to net the benefits of agricultural mechanization. This is the objective underlying setting up of a Farm Machinery Training and Testing Institute for the Southern Region of the country. The Government of India established this prestigious Institute at Garladinne in Anantapur Dist (A.P.) in the year 1983 for the promotion and strengthening of Agricultural mechanization through Training and Testing programs especially in the Southern Region. With the set objectives, the Institute has sailed through successfully for about three decades and has spread its tentacles at the grass root level. Today, the Institute with its state of art training & testing facilities, stands a pioneer in the field of agricultural mechanization. It is hoped that the e-newsletter brought out for the quarter July-September, 2015 will be useful. IN THIS ISSUE PARTICULARS PAGE No. Training Activities 2 Demonstration 3 Testing Activities 5 Administration 7 SRFMT&TI NEWSLETTER 1 TRAINING ACTIVITIES The Institute is equipped with a very wide range of different makes, models and types of Tractors, Land-Shaping-Equipments, Tillage-Equipments, Harvesting & Processing Equipments, Irrigation Pumps and various Irrigation Equipments and Plant Protection Equipments etc., used in mechanized farming.