Academic Excess, Executive Compensation at Leading Private Colleges and Universities in Massachusetts

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Gallaudet Graduate Catalog 2008-2009

2008 - 2009 Graduate Catalog • Graduate School and Professional Programs • College of Liberal Arts, Sciences, and Technologies Gallaudet University 800 Florida Avenue, NE Washington, D.C. 20002 www.gallaudet.edu Table of Contents About Gallaudet University.............................................. 1 The 2008-2009 Gallaudet University Graduate Catalog was prepared by the Council on Graduate Education, the Provost's Of- Academics.......................................................................... 8 fice, the Graduate School and Professional Programs, and Enroll- Enrollment: Admissions, Leaves, Withdrawals, ment Management. Graduation ................................................................. 15 Every effort was made to print information accurately as of July 1, Academic Standards and Policies ................................... 23 2008. This catalog is not intended to serve as a contract between any student and Gallaudet University. University procedures, programs, Fees, Financial Aid, and Student Employment ............. 37 and courses are under constant review and revision. Gallaudet Uni- versity reserves the right to change any provision, regulation, or re- Campus Life ....................................................................... 47 quirement set forth within this document, and the right to withdraw Graduate School and Professional Programs ............... 52 or amend the content of any course. Please consult the department or appropriate office for possible changes and updated information. A dministration and -

February 26, 2021 President, Search Committee New College of Florida

February 26, 2021 President, Search Committee New College of Florida Via Electronic Mail Dear Members of the Search Committee: As I read your engaging presidential prospectus, I was drawn to New College of Florida’s distinctive liberal arts model. The opportunity to expand on the college’s influence and build on this unique model that is “open-minded, minimally prescriptive, customized, and evolutionary” invigorates me. Each time I read it I feel myself gaining energy and purpose. I enthusiastically submit my “curriculum vitae,” highlighting a cutting edge integration of applied liberal arts, the intersection of career development and education, an inclusive and welcoming community that builds trust, enhanced organizational effectiveness, and successful financial leadership with partnerships and fundraising. My qualifications and experiences prepare me particularly well to help build an increasingly visible role for New College of Florida that draws interest and enrollment from new pools of students throughout the state, region, nation and world. When I first enrolled at Trinity College in Hartford, CT, as an undergraduate, I encountered faculty who were ready and eager to mentor and guide me. One example is Dori Katz, my faculty advisor, who did not tell me that majoring in French would be impossible because I am deaf. She said, "I will help you." But I soon learned that she didn't know how. So I began to teach her about my world, as she taught me about hers. Without the discussion we sustained and the careful attention she gave me over four years, I may never have become the educated, ethical and engaged citizen that I am today. -

Wheaton College NEACAC Fair Anna Maria College Assumption College

Wheaton College NEACAC Fair Anna Maria College Assumption College Bay Path University Bay State College Bridgewater State Univeristy Bridgton Academy Bryant University Castleton University Catholic University Champlain College Coastal Carolina University Colby-Sawyer College Curry College Dean College Eastern Connecticut State University Elmira College Elms College Emmanuel College Endicott College Fisher College Florida Atlantic University Boca Raton, FL Framingham State University Franklin Pierce University Hampshire College Hartwick College HoFstra University Husson University Johnson & Wales University Keene State College Lesley University Maine Maritime Academy Manhattanville College Massachusetts Maritime Academy Massasoit Community College MCPHS University Merrimack College Mount Allison University (Canada) Mount Ida College New England College New England Institute oF Technology New England School oF Photography Newbury College Nichols College Northern Maine Community College Northern Vermont University Norwich University Plymouth State University Purdue University Quinnipiac University Regis Rensselaer Polytechnic Institute Rhode Island College Ringling College oF Art and Design Rivier University Rochester Institute oF Technology Rutgers University-New Brunswick Saint Anselm College Saint Joseph's College Salem State University Salve Regina University Seton Hall University Simmons College Southern New Hampshire University Southern Vermont College Stonehill College SuFFolk University SUNY Cobleskill The College of New Jersey The -

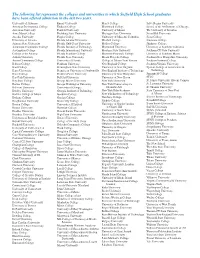

The Following List Represents the Colleges and Universities to Which

The following list represents the colleges and universities to which Suffield High School graduates have been offered admission in the last two years: University of Alabama Emory University Mercy College Salve Regina University American International College Endicott College Merrimack College School of the Art Institute of Chicago American University Fairfield University University of Miami The University of Scranton Anna Maria College Fitchburg State University Michigan State University Seton Hall University Arcadia University Flagler College University of Missouri Columbia Siena College University of Arizona Florida Atlantic University Mitchell College Simmons College Arizona State University Florida Gulf Coast University Molloy College Skidmore College Asnuntuck Community College Florida Institute of Technology Monmouth University University of Southern California Assumption College Florida International University Montana State University Southern CT State University College of the Atlantic Florida Southern College Monterey Peninsula College University of Southern Maine Auburn University Florida State University Mount Holyoke College Southern New Hampshire University Austin Community College University of Florida College of Mount Saint Vincent Southern Vermont College Babson College Fordham University New England College Southern Virginia University Bard College Framingham State University University of New England Spartan College of Aeronautics & Barry University Franciscan University of Steubenville New England Institute of Technology -

Member Colleges & Universities

Bringing Colleges & Students Together SAGESholars® Member Colleges & Universities It Is Our Privilege To Partner With 427 Private Colleges & Universities April 2nd, 2021 Alabama Emmanuel College Huntington University Maryland Institute College of Art Faulkner University Morris Brown Indiana Institute of Technology Mount St. Mary’s University Stillman College Oglethorpe University Indiana Wesleyan University Stevenson University Arizona Point University Manchester University Washington Adventist University Benedictine University at Mesa Reinhardt University Marian University Massachusetts Embry-Riddle Aeronautical Savannah College of Art & Design Oakland City University Anna Maria College University - AZ Shorter University Saint Mary’s College Bentley University Grand Canyon University Toccoa Falls College Saint Mary-of-the-Woods College Clark University Prescott College Wesleyan College Taylor University Dean College Arkansas Young Harris College Trine University Eastern Nazarene College Harding University Hawaii University of Evansville Endicott College Lyon College Chaminade University of Honolulu University of Indianapolis Gordon College Ouachita Baptist University Idaho Valparaiso University Lasell University University of the Ozarks Northwest Nazarene University Wabash College Nichols College California Illinois Iowa Northeast Maritime Institute Alliant International University Benedictine University Briar Cliff University Springfield College Azusa Pacific University Blackburn College Buena Vista University Suffolk University California -

Complete List of Participating Tuition Exchange Institutions

Complete List of Participating Tuition Exchange Institutions United Arab Emirates Massachusetts (continued) Ohio (continued) American University Sharjah - UAE Boston University - MA Mercy College of Northwest Ohio Clark University - MA - OH Greece Curry College - MA Mount St. Joseph University - American College of Greece - GR Dean College - MA OH Elms College - MA Mount Vernon Nazarene Canada Emerson College - MA University - OH King's University College at Western Emmanuel College - MA Muskingum University - OH University - CN Endicott College - MA Notre Dame College - OH Fisher College - MA Ohio Dominican University - OH Alabama Hampshire College - MA Ohio Northern University - OH Birmingham-Southern College - AL Hellenic College Holy Cross - MA Ohio Wesleyan University - OH Huntingdon College - AL Lasell College - MA Otterbein University - OH Judson College - AL Lesley University - MA Tiffin University - OH Samford University - AL Merrimack College - MA University of Dayton - OH Mount Holyoke College - MA University of Findlay - OH Alaska Mount Ida College -MA University of Mount Union - OH Alaska Pacific University - AK National Graduate School of Quality Ursuline College - OH Management - MA Walsh University - OH Arizona Newbury College - MA Wilmington College - OH Arizona Christian University - AZ Nichols College - MA Wittenberg University - OH Grand Canyon University - AZ Pine Manor College - MA Xavier University - OH Prescott College - AZ Regis College - MA Simmons College - MA Oklahoma Arkansas Smith College - MA Oklahoma City -

05-06 Catalog.Indb

The University Community The University Community Patron George W. Bush President Board of Trustees Glenn B. Anderson, Chair, Arkansas Ken H. Levinson, California Cynthia W. Ashby, Georgia The Honorable John McCain, Arizona Celia May L. Baldwin, Vice Chair, California Nanette Fabray MacDougall,** California Philip W. Bravin,* South Dakota Carol A. Padden,* California Brenda Jo Brueggemann, Ohio Alexander E. Patterson,* Connecticut Susan J. Dickinson, Colorado Frank Ross, Maryland Richard A. Dysart,* California Robert G. Sanderson,* Utah Harvey Goodstein, Arizona Benjamin J. Soukup, Jr., South Dakota Mervin D. Garretson,* Delaware Christopher D. Sullivan, New Jersey Bill Graham, Secretary,Washington Charles V. Williams, Ohio Pamela Holmes, Wisconsin The Honorable Lynn Woolsey, California Tom Humphries, California Frank H. Wu, Michigan The Honorable Thomas Penfi eld Jackson,* DC John T.C. Yeh,* Maryland L. Richard Kinney, Wisconsin * Emeritus The Honorable Ray LaHood, Illinois ** Honorary 144 The University Community University Administration I. King Jordan, President; B.A., Gallaudet University; M.A., Gary B. Aller, Executive Director, Business and Support Ph.D., University of Tennessee Services; B.A., University of Washington Jane K. Fernandes, Provost; B.A., Trinity College; M.A., David F. Armstrong, Director, Budget; B.A., Ph.D., Ph.D., University of Iowa University of Pennsylvania Paul Kelly, Vice President, Administration and Finance; Deborah E. DeStefano, Executive Director, Enrollment B.S., University of Massachusetts; M.B.A., Babson College; Services; B.A., M.A., Gallaudet University J.D., George Washington University Katherine A. Jankowski, Dean, Laurent Clerc National Lindsay Dunn, Special Assistant to the President, Advocacy; Deaf Education Center; B.A., Gallaudet University; M.Ed., B.A., Gallaudet University; M.A., New York University University of Arizona; Ph.D., University of Maryland Patricia M. -

Undergraduate and Graduate Programs

UNIVERSITY of NEW ENGLAND 2001-2002 Catalog Undergraduate and Graduate Programs of the College of Arts and Sciences and the College of Health Professions Notice Print date on this document is June 21, 2001. Subject to change - see page 6, Accreditation, Memberships, and Other Notices. To be made avail- able in hard copy format to all first-time matriculated students entering in the academic year 2001-2002; -or- available electronically through the University of New England's Web Page* University Campus Westbrook College Campus 11 Hills Beach Road 716 Stevens Avenue Biddeford, Maine 04005-9599 Portland, Maine 04103-7225 207-283-0171 207-797-7261 This catalog is available at the UNE Web Site *Visit our Internet Web Site: http://www.une.edu/ This page left intentionally blank... TABLE OF CONTENTS Information Directory 4 About the University Of New England 5 Undergraduate Programs -- 15 Administrative Services and Policies 15 Undergraduate Program Descriptions 47 Core Curriculum 48 Department of Biological Sciences 50 Department of Chemistry and Physics 59 Department of Creative and Fine Arts 61 Department of Dental Hygiene 62 Department of Education 65 Department of English 73 Department of Environmental Science & Studies 74 Health Services Management Program 78 Department of History and Politics 80 Interdisciplinary Majors 82 Learning Assistance Center 84 Department of Mathematical and Computer Sciences 87 Department of Nursing 88 Department of Occupational Therapy 96 Department of Performance Management 101 Department of Philosophy and -

Dean College Academic Catalog 2017–2018 Table of Contents

ACADEMIC CATALOG 2017–2018 Academic Catalog 2017–2018 Published by Dean College, 99 Main Street, Franklin, Massachusetts 02038-1994 The College reserves the right to make changes in tuition, program costs, curriculum, regulations and program dates and to make additional charges for special features and services whenever such actions are deemed advisable. Main Phone Number: 508-541-1900 www.dean.edu Admissions Information: 877-TRY-DEAN (877-879-3326) or 508-541-1508 Admissions Fax: 508-541-8726 Admissions Email: [email protected] TIPS FOR USING THE INTERACTIVE VERSION OF THE DEAN COLLEGE ACADEMIC CATALOG This PDF is designed for easy navigation using clickable links. All text colored red is a link, just as on the Dean College website. There are links from each Table of Contents entry to the corresponding page, from each Index entry to the corresponding page, between pages (when the text refers to “see page...”), as well as to websites and email addresses. • To use these links, hover the mouse pointer over the red text. When the open hand symbol changes to a hand with a pointing finger, click. The view will change to the linked page. • To jump back to the page you started from, choose Previous View in the Page Navigation flyout under the View menu. Press Alt+Left Arrow (Command+Left Arrow on Mac) to retrace links to previously viewed pages. (Exact location of commands varies with different versions of Acrobat and/or Reader.) • To add the Preview View button to the toolbar, right-click (Windows) or Ctrl- click (Mac) the Page Navigation toolbar, and then select Previous View or Show All Tools. -

Message from the AD Overview Table of Contents

Overview The 2019 fall season for New England College Athletics has come to a close. Each fall team saw tremendous success, which included: • 17 all-conference honors • 3 Rookie of the Years -Kayla Paquin (Women’s Soccer) -Wiskens Flavil (Men’s Soccer) -Haleigh Bilodeau (Cross Country) • One Coach of the Year -Kirsten Morrison (Volleyball) Dave DeCew was appointed as the Director of Athletics of New England College on July 10th, 2019, after spending 17 years as the men’s soccer coach Message From The AD “As the new Director of Athletics, I am humbled to have the pleasure to share our first Community Update with you and all that is happening in Athletics. I am excited to inte- grate this newsletter as at least a semi-annual production to communicate with everyone the success of all our teams and also focus on department initiatives. Our goals are to collectively enhance all that is happening here in the competitive arena, the Table of Contents academic realm, and within our entire com- Cross Country ........................................................................................(2) munity. It has been inspiring to see first-hand Field Hockey ..........................................................................................(3) the dedication, commitment, and ability of all Men’s Soccer ...........................................................................................(4) our coaches, athletic trainers, administrators, Women’s Rugby ......................................................................................(5) -

English Language Programs & Pathways 2021

explore. learn. excel. English Language Programs & Pathways 2021 Table of Contents The FLS Advantage 2 Boston Commons 19-20 FLS by the Numbers 3 Chestnut Hill College 21-22 Locations Preview 4 Accommodation 23 In-Person Programs 5-6 Volunteering Opportunities 24 Test Preparation Courses 7 Your First Day 25 Online Programs 8 Keeping Students Safe During Covid 26 Study 30+ at Boston Commons 9 Exclusive Features 27 Overview of FLS Levels 10 Pathways at FLS 28 Concurrent Enrollment 11 Universal Placement Program (UPP) 29-30 High School Completion 12 UPP School List & Map 31-32 Citrus College 13-14 Testimonials 33 Saddleback College 15-16 Calendar & Locations Key 34 Marymount Manhattan College 17-18 The FLS Advantage Here are just a few reasons why FLS International offers international students an unbeatable learning and cultural experience: • Small class sizes ensuring individual student attention • College and university placement assistance at no additional charge • Programs using the immersion method of language instruction emphasizing spoken English • Structured Pathway programs to effectively prepare students for college entrance • Eighteen levels of English study • Unique English Everywhere program highlighting key curriculum points each week • Experienced academic counselors • Accreditation by CEA (Commission on English Language Program Accreditation) • Centers located in safe and secure environments • Monthly Language Extension Day, letting students use their English in new settings • Highly qualified teaching staff with all faculty holding Master’s Degrees or TESOL credentials WELCOME TO FLS With globalization increasing, it’s more important than ever to learn about other cultures. There’s no better way to understand a new culture than by learning its language. -

The Academic Workplace Education (NERCHE)

University of Massachusetts Boston ScholarWorks at UMass Boston New England Resource Center for Higher The Academic Workplace Education (NERCHE) Spring 1992 The Academic Workplace (Spring/Summer 1995): Today's College Students: Myths and Realities New England Resource Center for Higher Education at the University of Massachusetts Boston Zelda F. Gamson University of Massachusetts Boston Arthur Levine Teachers College at Columbia University Follow this and additional works at: https://scholarworks.umb.edu/nerche_academicworkplace Part of the Higher Education Commons, and the Higher Education and Teaching Commons Recommended Citation New England Resource Center for Higher Education at the University of Massachusetts Boston; Gamson, Zelda F.; and Levine, Arthur, "The Academic Workplace (Spring/Summer 1995): Today's College Students: Myths and Realities" (1992). The Academic Workplace. 9. https://scholarworks.umb.edu/nerche_academicworkplace/9 This Occasional Paper is brought to you for free and open access by the New England Resource Center for Higher Education (NERCHE) at ScholarWorks at UMass Boston. It has been accepted for inclusion in The Academic Workplace by an authorized administrator of ScholarWorks at UMass Boston. For more information, please contact [email protected]. The Academic Workplace New England Resource Center for Higher Education Spring/Summer 1995 Volume 6, Number 2 Sharon Singleton, Editor Letter from the Director Published by the New England Resource Center for Higher Education Graduate College of Education University of Massachusetts at Boston Boston, Massachusetts 02125-3393 t is easy to forget about students nowadays. Harried, burdened by Telephone (617) 287-7740 jobs and families and worried about economic uncertainty, students Fax (617) 287-7747 eMail [email protected].