Beware of Foreclosure Rescue and Loan Modification Scams

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Office of the Attorney General 940 Cmr 25.00

940 CMR: OFFICE OF THE ATTORNEY GENERAL 940 CMR 25.00: FORECLOSURE RESCUE TRANSACTIONS AND FORECLOSURE-RELATED SERVICES Section 25.01: Definitions 25.02: Prohibition on Foreclosure Rescue Transactions and Advance Fees for Foreclosure-related Services 25.03: Marketing of Foreclosure-related Services 25.01: Definitions (1) Foreclosure Rescue Transaction shall mean a transaction: (a) by which residential property is conveyed where the person conveying the property (homeowner) maintains a legal or equitable interest in the property conveyed, including, without limitation, a lease interest, an option to acquire the property, or other interest in the property conveyed; and (b) that is designed or intended by the parties to avoid or delay actual or anticipated foreclosure proceedings against a homeowner’s residential property. (2) Foreclosure-related Services shall mean any goods or services related to, or promising assistance in connection with: (a) avoiding or delaying actual or anticipated foreclosure proceedings concerning residential property; or (b) curing or otherwise addressing a default or failure to timely pay, with respect to a residential mortgage loan obligation. Foreclosure-related Services shall include the offer, arrangement or placement of a residential mortgage loan, or other loan, when those goods or services are advertised, offered or promoted in the context described in 940 CMR 25.01(2)(a) and/or (b). 25.02: Prohibition on Foreclosure Rescue Transactions and Advance Fees for Foreclosure-related Services (1) It is an unfair or deceptive act in violation of M.G.L. c. 93A, § 2(a) to, for compensation or gain or for potential or contingent compensation or gain, whether at the time of the transaction or in the future, engage in, arrange, offer, promote, promise, solicit participation in, or carry out a Foreclosure Rescue Transaction in the Commonwealth or concerning residential property in the Commonwealth. -

Fraud Is Fun Or How a Foreclosure Rescue Scam Changed My Life

Fraud Is Fun or How a Foreclosure Rescue Scam Changed My Life Peter A. Holland We are an association of trial lawyers seeking justice were raised there. Her mother died there. Mary told me that for our clients and for society. As such, we study diligently she earned $50,000 a year, and that the house was mostly paid “how” to try a case. Get the documents. Note the depositions. for – she had over $100,000 in equity in that house. Subpoena the witnesses. Anticipate the objections. Know the Now my stomach is grumbling, but I have to ask: “How judge. Prepare the Opening Statement. did you get into this mess which I cannot get you out of?” But before we can learn “how” to try a client’s case, we Although she was working part time at the time that I met her, should ask the big question: “why?” Specifically, we should previously she was being treated for a very aggressive breast ask at a very deep level: “Why should anyone care about this cancer. Although Mary’s employer was great to her, after her client and this case”? If we cannot articulate the answer this surgery, rehabilitation, chemotherapy and brief relapse, she question, then we can never truly “win” the case. Why we care about a cause can – and should – direct how we try the case. got laid off from work. She fell behind in her mortgage. Getting in touch with the why instead of obsessing on With nowhere to move to, and with the looming the how can restore the creative juices and the passion to your foreclosure sale of the family homestead, Mary turned to a practice. -

Prevent Deed Theft and Foreclosure Rescue Scams

One West Main Street, Suite 200 Rochester, NY 14614 Phone 585.454.4060 Fax 585.454.2518 www.empirejustice.org Memorandum of Support A.1408/S.6171 Protects New York Homeowners by Preventing Deed Theft Scams and Foreclosure Rescue Scams Empire Justice Center strongly supports A.1408(Weinstein)/S.6171(Hamilton) which would amend the real property law, the civil practice law and rules, and the criminal procedure law, in relation to distressed home loans. By updating multiple provisions of law, the bill comprehensively addresses ever evolving deed theft and foreclosure prevention scams. The Home Equity Theft Prevention Act (RPL sec. 265-a) was passed in 2006 to address an early version of “deed theft” scams, where distressed homeowners were being targeted to sign over their deeds with the promise of assistance to get them out of default or foreclosure and buy back their home in a year’s time. While the law has been effective in keeping out a certain kind of transaction in New York State, in recent years newer versions of the scam have emerged. The bill addresses variations of these scams by broadening the type of transaction that is covered under the law. In addition, the bill extends a right of rescission for homeowners who may unwittingly sign a contract for “assistance,” and the deed of their home, from five days to fourteen days. The extended right of rescission is critical because often homeowners are not even aware that they have signed over their deed. The second law amended under this bill is the “Distressed Property Consultant Law” (RPL sec. -

Foreclosure Rescue Scams

Foreclosure Rescue Scams HOW IT WORKS The pitch Foreclosure rescue firms use a variety of tactics to find homeowners in distress: Some sift through public foreclosure notices in newspapers and on the Internet or through public files at local government offices, and then send personalized letters to homeowners. Others take a broader approach through ads on the Internet, on television or in the newspaper, posters on telephone poles, median strips and at bus stops, or flyers or business cards at your front door. The scam artists use simple messages and broad promises, like: "Stop Foreclosure Now!" or "We can save your home!" A legitimate housing counselor will explain the hurdles in stopping a foreclosure and the risk that it may not be possible. The claims "We guarantee to stop your foreclosure." No one can guarantee to stop a foreclosure except the lender. "We have special relationships within many banks that can speed up case approvals." Scammers offering to contact lenders charge a fee for making a call any homeowner can make for free. In most cases, lenders won't negotiate with a third party other than a homeowner's attorney or a HUD-certified credit counselor acting on behalf of a homeowner. "We stop foreclosures every day. Our team of professionals can stop yours this week!" Preventing a foreclosure, especially once the process has begun, is a lengthy, complex procedure that involves negotiations with a lender over a repayment plan or modification of the original loan terms. Red flags No legitimate housing counselor will: • Guarantee -

Protect Yourself from Mortgage and Foreclosure Rescue Scams

Protect Yourself from Mortgage and Foreclosure Rescue Scams Homeowners who are finding it difficult to make their mortgage or are facing foreclosure are frequently targets of mortgage and foreclosure rescue scams. The scammers are people or companies that promise to help you save your home or lower your mortgage but actually intend to steal your money, home or most of the equity you have accumulated in your home. They’ll take your money and provide no service. It’s a growing crisis and costing homeowners thousands of dollars. Listed below are the more common types of mortgage or foreclosure rescue scams. Phony Counseling or Phantom Help – A scam artist promises a homeowner that they will be able to negotiate a deal with their lender to reduce their mortgage payments and save their home. The scam artist gains credibility by claiming they work for a law firm or credit counselor and promise to handle all of the details for an upfront fee. They often tell homeowners not to contact their lender, lawyer or credit counselor and ask that all mortgage payments be made to them instead of the mortgage provider. Once they have collected their up-front fee or a few mortgage payments, they disappear. Forensic Audit - A scam artist pretends to be a loan auditor and offers to have an attorney or other expert review a homeowner’s loan documents for an up-front fee. The scam artist then claims that they will prepare a report to see if the lender complied with applicable laws. They claim this report will help the homeowner avoid foreclosure, speed-up the loan modification process, reduce monthly mortgage payments and cancel the loan. -

Legislative Solutions for Preventing Loan Modification and Foreclosure Rescue Fraud

LEGISLATIVE SOLUTIONS FOR PREVENTING LOAN MODIFICATION AND FORECLOSURE RESCUE FRAUD HEARING BEFORE THE SUBCOMMITTEE ON HOUSING AND COMMUNITY OPPORTUNITY OF THE COMMITTEE ON FINANCIAL SERVICES U.S. HOUSE OF REPRESENTATIVES ONE HUNDRED ELEVENTH CONGRESS FIRST SESSION MAY 6, 2009 Printed for the use of the Committee on Financial Services Serial No. 111–28 ( U.S. GOVERNMENT PRINTING OFFICE 51–587 PDF WASHINGTON : 2009 For sale by the Superintendent of Documents, U.S. Government Printing Office Internet: bookstore.gpo.gov Phone: toll free (866) 512–1800; DC area (202) 512–1800 Fax: (202) 512–2104 Mail: Stop IDCC, Washington, DC 20402–0001 VerDate Nov 24 2008 11:15 Sep 03, 2009 Jkt 051587 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 K:\DOCS\51587.TXT TERRIE HOUSE COMMITTEE ON FINANCIAL SERVICES BARNEY FRANK, Massachusetts, Chairman PAUL E. KANJORSKI, Pennsylvania SPENCER BACHUS, Alabama MAXINE WATERS, California MICHAEL N. CASTLE, Delaware CAROLYN B. MALONEY, New York PETER T. KING, New York LUIS V. GUTIERREZ, Illinois EDWARD R. ROYCE, California NYDIA M. VELA´ ZQUEZ, New York FRANK D. LUCAS, Oklahoma MELVIN L. WATT, North Carolina RON PAUL, Texas GARY L. ACKERMAN, New York DONALD A. MANZULLO, Illinois BRAD SHERMAN, California WALTER B. JONES, JR., North Carolina GREGORY W. MEEKS, New York JUDY BIGGERT, Illinois DENNIS MOORE, Kansas GARY G. MILLER, California MICHAEL E. CAPUANO, Massachusetts SHELLEY MOORE CAPITO, West Virginia RUBE´ N HINOJOSA, Texas JEB HENSARLING, Texas WM. LACY CLAY, Missouri SCOTT GARRETT, New Jersey CAROLYN MCCARTHY, New York J. GRESHAM BARRETT, South Carolina JOE BACA, California JIM GERLACH, Pennsylvania STEPHEN F. LYNCH, Massachusetts RANDY NEUGEBAUER, Texas BRAD MILLER, North Carolina TOM PRICE, Georgia DAVID SCOTT, Georgia PATRICK T. -

Defaulting on the Dream

Defaulting on the Dream States Respond to America’s Foreclosure Crisis The Pew Charitable Trusts applies the power of knowledge to solve today’s most challenging problems. This report is a joint effort between Pew’s Center on the States (PCS) and Pew’s Health and Human Services (HHS) program. PCS identifies and encourages effective policy approaches to critical issues facing states. HHS’ Family Financial Security portfolio seeks to advance common-sense solutions to help Americans save for tomorrow and manage debt today. Center on the States Health and Human Services Susan Urahn, managing director Shelley Hearne, managing director Project Team Kil Huh Ann Cloke Lori Grange Tobi Walker Michele Mariani Vaughn David Draine Carla Uriona Jessica Riordan Jeremy Ratner ACKNOWLEDGMENTS This report is partially based on analysis by the Center for Responsible Lending (CRL), a nonprofit, nonpartisan research and policy organization dedicated to protecting homeownership and family wealth by working to eliminate abusive financial practices. CRL is a partner in Pew’s Family Financial Security portfolio, and we thank Debbie Goldstein, Ellen Schloemer, Evan Fuguet and Mary Moore for their research and guidance. It also is partially based on the research of Michael Collins and Rochelle Nawrocki Gorey of PolicyLab Consulting, which does not necessarily endorse its findings or conclusions. We would like to thank Kathy Litzenberg and David L. Martin for their editorial assistance, and Mike Heffner, Lucy Pope and Denise Kooper of 202design for their design assistance. Additional staff from PCS reviewed drafts of the report and offered excellent comments and insights that were instrumental to its completion. -

Comment Submitted by Massachusetts Attorney General

THE COMMONWEALTH OF MASSACHUSETTS OFFICE OF THE ATTORNEY GENERAL ONE ASHBURTON PLACE BOSTON, MASSACHUSETTS 02108 MARTHA COAKLEY ATTORNEY GENERAL July 13, 2009 Federal Trade Commission Office of the Secretary Room H-135 (Annex W) 600 Pennsylvania Avenue, NW Washington, DC 2058~ < Re: Comment of Massachusetts Attorney General Martha Coakley concerning Mortgage Assistance Relief Services Rulemaking,·Rule No. R911003 Dear Commissioners of the Federal Trade Commission: Thank you for the opportunity to comment on the Mortgage Assistance Relief Services Rulemaking, Rule No. R911 003. I. General Overview of Comment Predatory lending practices that have led to the foreclosure crisis continue to besiege the nation and our economy. As the proliferation ofrisky, unfair and deceptive lending practices led to skyrocketing foreclosure rates, my Office has seen an increasing number ofdistressed homeowners preyed upon by unscrupulous parties trying to capitalize upon the foreclosure crisis. These unfair and deceptive activities include scam artists attempting to convince desperate homeowners to transfer ownership of their homes ("foreclosure-rescue schemes") or advertising and charging upfront fees with an illusory promise to help homeowners obtain loan modifications or other foreclosure-related services ("advance-fee schemes"). In response, my Office has sought to address the foreclosure-rescue and advance fee schemes through regulation, litigation and other advocacy. In mid-2006, my Office began prosecuting individuals and companies engaged in foreclosure-rescue schemes. In June of 2007 we issued emergency regulations under the Massachusetts Consumer Protection Act, which became final in August of2007. These regulations prohibit both foreclosure-rescue and advance-fee schemes. I In December 2008 we began prosecuting individuals and companies engaged in advance-fee schemes in violation of our regulations. -

Public Safety Strategies for Addressing Mortgage Fraud and the Foreclosure Crisis Author About This Report Acknowledgements

Best Practices Public Safety Strategies for Addressing Mortgage Fraud and the Foreclosure Crisis author about this report acknowledgements Robert V. Wolf This report was supported by the Bureau of A number of people provided essential assistance. Director of Communications Justice Assistance under grant number Foremost among them are the participants in the two Center for Court Innovation 2009-DC-BX-K018 awarded to the Center days of conversations on foreclosure, vacant proper- for Court Innovation. The Bureau of Justice ties, and mortgage fraud organized by the Bureau of May 2010 Assistance is a component of the U.S. Justice Assistance. The participants not only shared Department of Justice’s Office of Justice their good ideas but provided feedback on early drafts. Programs, which also includes the Bureau Also crucial to the development of this report are of Justice Statistics, the National Institute of James H. Burch II, Pamela Cammarata, Ben Gorban, Justice, the Office of Juvenile Justice and Preeti Puri Menon, Kim Norris, Cornelia Sorensen Delinquency Prevention, and the Office for Sigworth, and Paul Steiner of the Bureau of Justice Victims of Crime. Points of view or opinions Assistance; Greg Berman, Julius Lang, and in this document do not represent the offi- Christopher Watler of the Center for Court cial positions or policies of the U.S. Innovation; and Caroline Cooper and Tenzing Lahdon Department of Justice. of American University. A FULL RESPONSE TO AN EMPTY HOUSE| 1 A FULL RESPONSE TO AN EMPTY HOUSE: PUBLIC SAFETY STRATEGIES -

Process for Triage and Assessment to Avoid Foreclosure

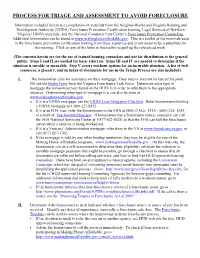

PROCESS FOR TRIAGE AND ASSESSMENT TO AVOID FORECLOSURE Information included herein is a compilation of materials from the NeighborWorks and Virginia Housing and Development Authority (VHDA) Foreclosure Prevention Certification training, Legal Services of Northern Virginia (LSNV) materials, and the National Consumer Law Center’s Foreclosure Prevention Counseling. Additional information can be found at www.makinghomeaffordable.gov. This is a toolkit of the materials used in the foreclosure prevention certification training from these resources and is not meant to be a substitute for the training. Click on any of the links in this toolkit to pull up the referenced work. (The contents herein are for the use of trained housing counselors and not for distribution to the general public. Steps I and II are needed for basic referrals. Steps III and IV are needed to determine if the situation is curable or incurable. Step V covers workout options for an incurable situation. A list of web resources, a glossary, and an index of documents for use in the Triage Process are also included) I. The homeowner calls for assistance on their mortgage. They may or may not be late at this point. Fill out the Intake Form from the Virginia Foreclosure Task Force. Determine what type of mortgage the homeowner has (found on the HUD-1) in order to refer them to the appropriate resource. Determining what type of mortgage it is can also be done at www.makinghomeaffordable.gov. a. If it is a VHDA mortgage, see the VHDA Loss Mitigation Checklist. Refer homeowners holding a VHDA mortgage to 1-800-227-8432. -

Foreclosure Rescue Fraud Prevention Act of 2008, Florida Statute Section 501.1377, Took Effect October 1, 2008

. ASK THE ADVOCATE By: Leonard Elias, Esq. SAVING YOUR HOME Are you facing the threat of losing your home? Experts say that millions of people are at risk of losing their homes because of predatory loans, job loss, divorce, medical reasons, and death. Be wary of individuals and companies offering to rescue you out of your difficult financial situation. These companies advertise over the Internet and in local publications, plaster posters on telephone poles, and stick flyers in your front door. These foreclosure rescue consultants get your attention by promising that they can “Stop Foreclosure Now.” Just how does the scheme work? In some cases, the person tells you that he can make a deal with your lender to save your house if you pay a fee first. You may be told not to speak to your lender, lawyer or credit counselor, and to let the “consultant” negotiate the details. Once you pay the fee, the swindler takes off with your money. In another case, the scam artist offers to "buy" your property by satisfying the amount that is overdue on your loan. He convinces you to move out and deed the property over to a third party. You are given the option of renting the property with the option to buy it back later. The rent payment on the home is often higher than you can afford. When you cannot make the rent payment you face eviction from your home. Or, if you express a desire to buy back the property, the scam artist fixes the price of the home higher than you can afford. -

A Foreclosure Rescue As the Solution to the Trapped Homeowner Equity Problem Cori Harvey Florida A&M University College of Law, [email protected]

Florida A&M University College of Law Scholarly Commons @ FAMU Law Journal Publications Faculty Works Spring 2014 "We Buy Houses": A Foreclosure Rescue as the Solution to the Trapped Homeowner Equity Problem Cori Harvey Florida A&M University College of Law, [email protected] Follow this and additional works at: http://commons.law.famu.edu/faculty-research Part of the Banking and Finance Law Commons, Bankruptcy Law Commons, Consumer Protection Law Commons, and the Property Law and Real Estate Commons Recommended Citation Cori Harvey, "We Buy Houses": A Foreclosure Rescue as the Solution to the Trapped Homeowner Equity Problem, 79 Mo. L. Rev. 371 (2014). This Article is brought to you for free and open access by the Faculty Works at Scholarly Commons @ FAMU Law. It has been accepted for inclusion in Journal Publications by an authorized administrator of Scholarly Commons @ FAMU Law. For more information, please contact [email protected]. "We Buy Houses": A Foreclosure Rescue as the Solution to the Trapped Homeowner Equity Problem Cori Harvey* 1. INTRODUCTION Foreclosure rescue transactions are viewed widely as scams designed, among other things, to dupe poor, minority, and elderly homeowners out of the equity in their homes. 1 The transactions are frequently called "foreclosure rescue scams.t" "equity skimming schemes.t" or other derogatory terms. However, foreclosure rescue transactions come in many forms and, as an alternative to foreclosure, often maintain valuable options for homeowners that the homeowners otherwise would lose in the traditional foreclosure pro cess.4 For this reason, many of these transactions, though imperfect, should be preserved and supported.