Deals in Greece 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MER-Greece-2019.Pdf

Anti-money laundering and counter-terrorist financing measures financing counter-terrorist and laundering Anti-money Anti-money laundering and counter-terrorist financing measures Greece Mutual Evaluation Report Greece September 2019 The Financial Action Task Force (FATF) is an independent inter-governmental body that develops and promotes policies to protect the global financial system against money laundering, terrorist financing and the financing of proliferation of weapons of mass destruction. The FATF Recommendations are recognised as the global anti-money laundering (AML) and counter-terrorist financing (CTF) standard. For more information about the FATF, please visit the website: www.fatf-gafi.org. This document and/or any map included herein are without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundaries and to the name of any territory, city or area. This assessment was adopted by the FATF at its June 2019 Plenary meeting. Citing reference: FATF (2019), Anti-money laundering and counter-terrorist financing measures – Greece, Fourth Round Mutual Evaluation Report, FATF, Paris http://www.fatf-gafi.org/publications/mutualevaluations/documents/mer-greece-2019.html © 2019 FATF-. All rights reserved. No reproduction or translation of this publication may be made without prior written permission. Applications for such permission, for all or part of this publication, should be made to the FATF Secretariat, 2 rue André Pascal 75775 Paris Cedex 16, France (fax: +33 1 44 30 61 37 or e-mail: [email protected]). Photo Credit - Cover: © Stratos Kalafatis, Archipelago, Agra Publications, 2017 Table of Contents Key Findings .................................................................................................................................................................... 3 Risks and General Situation ..................................................................................................................................... -

Algeria Upstream OG Report.Pub

ALGERIA UPSTREAM OIL & GAS REPORT Completed by: M. Smith, Sr. Commercial Officer, K. Achab, Sr. Commercial Specialist, and B. Olinger, Research Assistant Introduction Regulatory Environment Current Market Trends Technical Barriers to Trade and More Competitive Landscape Upcoming Events Best Prospects for U.S. Exporters Industry Resources Introduction Oil and gas have long been the backbone of the Algerian economy thanks to its vast oil and gas reserves, favorable geology, and new opportunities for both conventional and unconventional discovery/production. Unfortunately, the collapse in oil prices beginning in 2014 and the transition to spot market pricing for natural gas over the last three years revealed the weaknesses of this economic model. Because Algeria has not meaningfully diversified its economy since 2014, oil and gas production is even more essential than ever before to the government’s revenue base and political stability. Today’s conjoined global health and economic crises, coupled with persistent declining production levels, have therefore placed Algeria’s oil and gas industry, and the country, at a critical juncture where it requires ample foreign investment and effective technology transfer. One path to the future includes undertaking new oil and gas projects in partnership with international companies (large and small) to revitalize production. The other path, marked by inertia and institutional resistance to change, leads to oil and gas production levels in ten years that will be half of today's production levels. After two decades of autocracy, Algeria’s recent passage of a New Hydrocarbons Law seems to indicate that the country may choose the path of partnership by profoundly changing its tax and investment laws in the hydrocarbons sector to re-attract international oil companies. -

ELLAKTOR Presentation March 5Th, 2020 Table of Contents

ELLAKTOR Presentation March 5th, 2020 Table of contents 1 Executive summary 2 Business Overview 3 Capital Structure 4 9M 2019 Financials 1 1 Executive summary 2 Business Overview 3 Capital Structure 4 9M 2019 Financials 2 Executive Summary ELLAKTOR history 1950s-1990s 1990s-2000s 2000-2009 2010-2018 2018 - forward 1950s: Establishment of 1999: Led domestic 2007: Acquisition of TEB, ELLINIKI construction sector Pantechniki, leading to Industry TECHNODOMIKI and consolidation (Merger of controlling stake in Attiki consolidation AKTOR TEB, Elliniki Odos (59%) Technodomiki & AKTOR) 1996: Signed first 2003: Entry into concession projects environment segment Diversification (Attiki Odos and Rio- 2008: Signed 3 out of 5 of activities Antirrio Bridge) major concession projects awarded in Greece 2004: First international 2012: c. €600m of construction contracts in projects in the Balkans Romania and Kuwait Geographic 2014: €3.2bn Doha metro 2005: Internationalisation diversification project in Qatar of HELECTOR through acquisition of Herhof GmbH 2010-2012: Sale of gold 2018: Sale of Athens Resort assets Casino (€13.5 ml) Focus on core 2014: ELTECH ANEMOS 2018: Increased stake in IPO Attiki Odos by 6.5% competencies 2019: Sold Corporate Headquarters (€25.5 ml) and stake in Elpedison (€ 18 ml) 2015: 1st Waste PPP in July 2018: Newly elected Greece Board post 1st proxy fight in Renewed 2016: Moreas completed Greece opportunity / in full operation July 2019: Group 2017-18 :Olympia Odos rationalization / ELTECH & Maliakos completed ANEMOS absorption 4 The ELLAKTOR group led the construction sector consolidation in Greece H’ (Highest) grade construction companies in 1998 (€m) 7th grade(1) construction companies in 2018 (€m)(2) Thessaliki SA Etep SA Parnon SA Themeli SA Odon & Odostromaton SA Ekter SA INTRAKAT SA Gekat SA Europaiki Techniki SA I.G. -

National Competition Report Q2 2017

NATIONAL COMPETITION QUARTERLY REPORT APRIL– JUNE 2017 BELGIUM basis of their “Best and Final Offer.” Third, Infrabel issued individual calls for specific orders within the This section reviews developments under Book IV of the terms and conditions of the framework agreement. The Belgian Code of Economic Law (“CEL”) on the selected companies had to submit their best offer for Protection of Competition, which is enforced by the each call, and the orders were awarded to the lowest Belgian Competition Authority (“the BCA”). Within the bidder. BCA, the Prosecutor General and its staff of prosecutors (collectively, the “Auditorate”) investigate In 2013, the Auditorate started investigating this public alleged restrictive practices and concentrations, while procurement following ABB’s leniency application. the Competition College (the “College”) functions as The investigation revealed that the bidders had agreed the decision-making body. Prior to September 6, 2013, to allocate the orders placed by Infrabel amongst Belgian competition law was codified in the Act on the themselves. For each call, they exchanged price Protection of Economic Competition of September 15, information and instructions to ensure that the 2006 (“APEC”) and enforced by the Belgian pre-designated participant would present the lowest Competition Authority, then composed of the price and win the tender. The Auditorate found that Directorate General for Competition and the these practices had started in 2010–2011 and continued Competition Council. When relevant, entries in this until June 2016. The Auditorate notified its objections report will refer to the former sub-bodies of the BCA. to the companies in August 2016, and settlement talks began a month later. -

Company Profile 2020

COMPANY PROFILE 2020 INFORMATION AS OF 31/12/2019 | 1 ABOUT US • Edison is the oldest energy company in Europe • It is active in the generation and sale of electricity, in the supply, distribution and sale of gas as well as in providing energy and environmental services to end users. • It oversees integrated activities throughout the electricity and mid-stream gas value chains and aims to be a leading player in the country’s energy transition. It has the target of generating 40% of the production mix from renewable sources by 2030, and is working on the construction of two latest-generation combined cycles able to complement renewable production. • It is committed to the diversification of gas procurement sources and routes for the safety and competitiveness of the national system and to promoting alterative responsible uses of gas for the benefit of the decarbonization of the transport sector. • Since 2012, it has been controlled by the EDF (Electricité de France) Group(1), European leader in the electricity sector and a key actor supporting the transition towards a low-carbon energy future. • The brand platform “Building a sustainable energy future together” underpins Edison's goal of being an efficient and responsible power Company with a sustainable development model. 2019 data (1) EDF owns 97.4% of Edison’s share capital (99.5% of the voting rights) Company Profile 2020 | 2 MILESTONES Edison was Italy's first electricity company and is also one of the oldest energy providers in the world: 1883 The first facility in continental Europe for the commercialisation of electricity is built at the Santa Radegonda theatre in Milan. -

Written Follow-Up to Phase 2 Report

Directorate for Financial and Enterprise Affairs GREECE: PHASE 2 FOLLOW - U P R E P O R T O N THE IMPLEMENTATION OF THE PHASE 2 RECOMMENDATIONS APPLICATION OF THE CONVENTION ON COMBATING BRIBERY OF FOREIGN PUBLIC OFFICIALS IN INTERNATIONAL BUSINESS TRANSACTIONS AND THE 1997 REVISED RECOMMENDATION ON COMBATING BRIBERY IN INTERNATIONAL BUSINESS TRANSACTION S This report was approved and adopted by the Working Group on Bribery in International Business Transactions on 12 September 2007. TABLE OF CONTENTS SUMMARY AND CONCLUSIONS BY THE WORKING GROUP ON BRIBERY ............................................. 3 WRITTEN FOLLOW-UP TO PHASE 2 REPORT ................................................................................................ 5 P a g e | 2 SUMMARY AND CONCLUSIONS BY THE WORKING GROUP ON BRIBERY a) Summary of findings 1. Since Phase 2, Greece has introduced an express denial of tax deductibility of bribes. Greece has also taken numerous initiatives to raise the level of awareness of the foreign bribery offences and of the OECD Convention either through public measures or private activities. 2. In particular, the Export Credit Insurance Organisation includes the foreign bribery offence in its presentations as a matter of course. The market authorities, including the Hellenic Capital Markets Commission and the Athens Exchange, have undertaken initiatives on corruption, including foreign bribery. Awareness initiatives have also been undertaken within the Ministries of Finance and Economy, Justice, and the Interior, Public Administration and Decentralisation, and among tax officials. The Hellenic Banks Association in conjunction with all major commercial banks have organised meetings and seminars on the detection of corrupt practices, including money laundering and foreign bribery. However, the Working Group notes that no concrete action has been undertaken by the Hellenic Aid to further raise awareness of the Convention and the foreign bribery offence for its staff. -

Albanian Families' History and Heritage Making at the Crossroads of New

Voicing the stories of the excluded: Albanian families’ history and heritage making at the crossroads of new and old homes Eleni Vomvyla UCL Institute of Archaeology Thesis submitted for the award of Doctor in Philosophy in Cultural Heritage 2013 Declaration of originality I, Eleni Vomvyla confirm that the work presented in this thesis is my own. Where information has been derived from other sources, I confirm that this has been indicated in the thesis. Signature 2 To the five Albanian families for opening their homes and sharing their stories with me. 3 Abstract My research explores the dialectical relationship between identity and the conceptualisation/creation of history and heritage in migration by studying a socially excluded group in Greece, that of Albanian families. Even though the Albanian community has more than twenty years of presence in the country, its stories, often invested with otherness, remain hidden in the Greek ‘mono-cultural’ landscape. In opposition to these stigmatising discourses, my study draws on movements democratising the past and calling for engagements from below by endorsing the socially constructed nature of identity and the denationalisation of memory. A nine-month fieldwork with five Albanian families took place in their domestic and neighbourhood settings in the areas of Athens and Piraeus. Based on critical ethnography, data collection was derived from participant observation, conversational interviews and participatory techniques. From an individual and family group point of view the notion of habitus led to diverse conceptions of ethnic identity, taking transnational dimensions in families’ literal and metaphorical back- and-forth movements between Greece and Albania. -

Annual Report 2007 Design - Production: 2007 2007

NEMESIS S.A. Annual Report 2007 Design - Production: 2007 2007 12A Irodou Attikou str., Annual Report Maroussi 151 24, Athens - GREECE Tel.: (+30) 210 809 4000, Fax: (+30) 210 809 4444 www.moh.gr CMYK CORINTH REFINERIES S.A. Annual Report 2007 TableTable of of contents contents 1 INFORMATION CONCERNING THIS ANNUAL REPORT AND THE COMPANY AUDITORS............................6 2 SHAREHOLDERS’ RIGHTS ..............................................................................................................................8 2.1 General Information ..................................................................................................................................8 2.2 Dividend Taxation......................................................................................................................................9 3 MARKET INFORMATION AND STRUCTURE ................................................................................................10 3.1 Structure of the Oil Refining Market in Greece ..........................................................................................10 3.2 Regulatory Framework ............................................................................................................................11 3.3 Recent Developments in the International Oil Market ................................................................................14 4 COMPANY PROFILE ......................................................................................................................................15 -

AXIA Research

Greece Outlook 2019: The year of the elections AXIA Research Table of Contents Start of a new era ......................................................................................................... 3 Early elections or at the end of the government’s term? ....................................................................... 3 Unexciting economic performance, while fiscal space shrinks without pro-growth ........................................... 4 Elections is the key catalyst for the markets .................................................................................... 5 Top picks ......................................................................................................................... 5 2019, the year of the elections ......................................................................................... 6 The day after the Prespa Agreement ......................................................................................................................................... 6 Timing of elections: May vs. September/October ...................................................................................................................... 7 Looking at recent polls ............................................................................................................................................................... 9 Strategies by Syriza and ND ahead and after the elections ...................................................... 13 Syriza to try to close the gap with ND as is already regrouping -

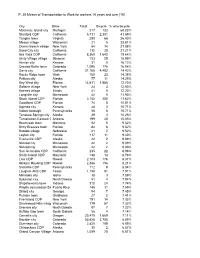

Copy of Censusdata

P. 30 Means of Transportation to Work for workers 16 years and over [16] City State Total: Bicycle % who bicycle Mackinac Island city Michigan 217 132 60.83% Stanford CDP California 5,711 2,381 41.69% Tangier town Virginia 250 66 26.40% Mason village Wisconsin 21 5 23.81% Ocean Beach village New York 64 14 21.88% Sand City city California 132 28 21.21% Isla Vista CDP California 8,360 1,642 19.64% Unity Village village Missouri 153 29 18.95% Hunter city Kansas 31 5 16.13% Crested Butte town Colorado 1,096 176 16.06% Davis city California 31,165 4,493 14.42% Rocky Ridge town Utah 160 23 14.38% Pelican city Alaska 77 11 14.29% Key West city Florida 14,611 1,856 12.70% Saltaire village New York 24 3 12.50% Keenes village Illinois 41 5 12.20% Longville city Minnesota 42 5 11.90% Stock Island CDP Florida 2,152 250 11.62% Goodland CDP Florida 74 8 10.81% Agenda city Kansas 28 3 10.71% Volant borough Pennsylvania 56 6 10.71% Tenakee Springs city Alaska 39 4 10.26% Tumacacori-Carmen C Arizona 199 20 10.05% Bearcreek town Montana 52 5 9.62% Briny Breezes town Florida 84 8 9.52% Barada village Nebraska 21 2 9.52% Layton city Florida 117 11 9.40% Evansville CDP Alaska 22 2 9.09% Nimrod city Minnesota 22 2 9.09% Nimrod city Minnesota 22 2 9.09% San Geronimo CDP California 245 22 8.98% Smith Island CDP Maryland 148 13 8.78% Laie CDP Hawaii 2,103 176 8.37% Hickam Housing CDP Hawaii 2,386 196 8.21% Slickville CDP Pennsylvania 112 9 8.04% Laughlin AFB CDP Texas 1,150 91 7.91% Minidoka city Idaho 38 3 7.89% Sykeston city North Dakota 51 4 7.84% Shipshewana town Indiana 310 24 7.74% Playita comunidad (Sa Puerto Rico 145 11 7.59% Dillard city Georgia 94 7 7.45% Putnam town Oklahoma 27 2 7.41% Fire Island CDP New York 191 14 7.33% Shorewood Hills village Wisconsin 779 57 7.32% Grenora city North Dakota 97 7 7.22% Buffalo Gap town South Dakota 56 4 7.14% Corvallis city Oregon 23,475 1,669 7.11% Boulder city Colorado 53,828 3,708 6.89% Gunnison city Colorado 2,825 189 6.69% Chistochina CDP Alaska 30 2 6.67% Grand Canyon Village Arizona 1,059 70 6.61% P. -

Exakm Sa Reference List of Major Project & Supplies 2000 – 2015

EXAKM SA REFERENCE LIST OF MAJOR PROJECT & SUPPLIES 2000 – 2015 Industrial Commercial & Technical Co. CLIENT EQUIPMENT BRAND PROJECT YEAR NEW INTERNATIONAL AIRPORT OF ERGOKAT ATE HYDRANTS ERHARD GmbH ATHENS 2000 “EL. VENIZELOS” NEW INTERNATIONAL AIRPORT OF SAFETY VALVES FOR WATER SUPPLY ERGOKAT ATE BAILEY BIRKETT ATHENS 2000 NETWORK “EL. VENIZELOS” NEW INTERNATIONAL AIRPORT OF J/V ERGOKAT-ELTER-PYRAMIS Co- PENSTOCKS ERHARD GmbH ATHENS 2000 OPERATION “EL. VENIZELOS” BALL VALVES, BUTTERFLY VALVES, EVINOS & MORNOS RIVERS JUNCTION, TERNA SA ERHARD GmbH 2000 CONTROL VALVES TUNEL & DIVERTION GREEK SUGAR INDUSTRY PNEUMATIC CONTROL VALVES SAMSON AG EZA S.A 2000 FISCHER & UNILEVER S.A - ELAIS VARIABLE ARE FLOWMETERS PEIRAOS FACTORY 2000 PORTER – ABB EYATH - SEWAGE CENTRAL J/V ATHENA S.A – X. KONSTANTINIDIS PENSTOCKS ERHARD GmbH TRANSMISSION NETWORK OF 2000 S.A THESSALONIKI FISCHER & ATHENIAN BREWERY S.A ELECTROMAGNETIC FLOWMETERS “IOLI” NATURAL WATER PLANT 2000 PORTER – ABB MUNICIPAL ENTERPRISE OF WATER 122 DISTRICT HEATING CONSUMER SUPPLY AND SEWAGE OF KOZANI EXAKM SA KOZANI DISTRICT HEATING 2000 THERMAL SUBSTATIONS HYDROELECTRIC POWER PLANT OF HYDROENERGIAKI S.A PENSTOCKS ERHARD GmbH 2000 “ANTHOCHORI” EXAKM SA Page 1 of 21 Ave. Kallirrois 39 Tel.: +30 210 9215332, +30 210 9218441, +30 210 9216887 GR-11743 Athens Fax: +30 210 9218761 http://www.exakm.gr Factory & North Greece Branch: Ο.Τ 039Β – Insustrial Area of Sindos, GR-57022 Thessaloniki, Τel. +30 2310 799954, +30 2310 570387 EXAKM SA REFERENCE LIST OF MAJOR PROJECT & SUPPLIES 2000 – 2015 -

Elteb Annual Report 2003

22000033 A N N U A L R E P O R T TABLE OF CONTENTS IMPORTANT NOTICE………………………………………………………..5 1. COMPANY SUMMARY FINANCIAL FIGURES…………………………..5 2. CONSOLIDATED SUMMARY FINANCIAL DATA………………………..9 3. INFROMATION ON THE PERSONS RESBONSIBLE FOR THE ANNUAL REPORT AND THE COMPANY AUDITORS…………………………… 12 4. SHAREHOLDERS’ RIGHTS……………………………………………… 19 4.1 General………………………………………………………………………… 19 4.2 Taxation of dividends……………………………………………………………… 21 4.3 Shareholders’ obligations……………………………………………………… 21 5. STOCK EXCHANGE INFORMATION ON COMPANY SHARES…… 22 6. INFORMATION ON THE SHARES…………………………………… 24 7. INFORMATION ABOUT THE COMPANY………………………… 24 7.1 General Information …………………………………………………………… 24 7.2 Brief History………………………………………………………………… 26 7.3 Outline of Operations ………………………………………………………. 27 7.4 Co-financed projects…………………………………………………………….... 30 7.5 Fixed Assets …………………………………………………………………… 36 7.6 General Information on the Company’s Share Capital………………………… 38 7.7 Shareholders………………………………………………………………….........41 7.8 Management – Administration …………………………………………………....42 7.9 Participation of Elliniki Technodomiki Teb’s main Shareholders and members of the Board of Directors in the capital or management of other companies………………48 7.10 Organizational Chart……………………………………………………………… 52 7.11 Personnel……………………………………………………………………… 53 7.12 Investments ………………………………………………………………… 53 7.13 Use of capital raised through the last share capital increase…………………… 56 8. FINANCIAL HIGHLIGHTS……………………………………………… 59 8.1 Activity………………………………………………………………………… 59 8.2 Profit/Loss for 2001-2003……………………………………………………