Cryptocurrency Price Analysis and Time Series Forecasting

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GJR-GARCH Volatility Modeling Under NIG and ANN for Predicting Top Cryptocurrencies

Journal of Risk and Financial Management Article GJR-GARCH Volatility Modeling under NIG and ANN for Predicting Top Cryptocurrencies Fahad Mostafa 1,* , Pritam Saha 2, Mohammad Rafiqul Islam 3 and Nguyet Nguyen 4,* 1 Department of Mathematics and Statistics, Texas Tech University, Lubbock, TX 79409, USA 2 Rawls College of Business, Texas Tech University, Lubbock, TX 79409, USA; [email protected] 3 Department of Mathematics, Florida State University, Tallahassee, FL 32306, USA; [email protected] 4 Department of Mathematics and Statistics, Youngstown State University, Youngstown, OH 44555, USA * Correspondence: [email protected] (F.M.); [email protected] (N.N.) Abstract: Cryptocurrencies are currently traded worldwide, with hundreds of different currencies in existence and even more on the way. This study implements some statistical and machine learning approaches for cryptocurrency investments. First, we implement GJR-GARCH over the GARCH model to estimate the volatility of ten popular cryptocurrencies based on market capitalization: Bitcoin, Bitcoin Cash, Bitcoin SV, Chainlink, EOS, Ethereum, Litecoin, TETHER, Tezos, and XRP. Then, we use Monte Carlo simulations to generate the conditional variance of the cryptocurrencies using the GJR-GARCH model, and calculate the value at risk (VaR) of the simulations. We also estimate the tail-risk using VaR backtesting. Finally, we use an artificial neural network (ANN) for predicting the prices of the ten cryptocurrencies. The graphical analysis and mean square errors (MSEs) from the ANN models confirmed that the predicted prices are close to the market prices. For some cryptocurrencies, the ANN models perform better than traditional ARIMA models. Citation: Mostafa, Fahad, Pritam Saha, Mohammad Rafiqul Islam, and Keywords: artificial neural network; cryptocurrency; GJR-GARCH; NIG; Monte Carlo simulation; Nguyet Nguyen. -

OCC Interpretive Letter 1174: DLT and Stable Coins

OCC interpretive letter 1174: DLT and stable coins Author: Ousmène Jacques Mandeng, Senior Advisor, Blockchain and Multiparty Systems, Accenture Table of Contents OCC interpretive letter 1174: DLT and stable coins .................................................. 2 OCC’s position on DLT and stable coins ................................................................. 2 DLT-platforms .......................................................................................................... 3 Tokens ..................................................................................................................... 4 Stable coins ............................................................................................................. 4 Token payments ...................................................................................................... 5 Token networks ....................................................................................................... 5 Bank balance sheet tokenization ............................................................................ 6 Next steps ................................................................................................................. 7 Copyright © 2021 Accenture. All rights reserved. 1 United States OCC interpretive letter 1174: DLT and stable coins The United States Office of the Comptroller of the Currency (OCC), a federal supervisor of national banks and cooperative banks, issued new general guidance about stable coins and distributed ledger technology (DLT) -

Defending Against Malicious Reorgs in Tezos Proof-Of-Stake

Defending Against Malicious Reorgs in Tezos Proof-of-Stake Michael Neuder Daniel J. Moroz Harvard University Harvard University [email protected] [email protected] Rithvik Rao David C. Parkes Harvard University Harvard University [email protected] [email protected] ABSTRACT Conference on Advances in Financial Technologies (AFT ’20), October 21– Blockchains are intended to be immutable, so an attacker who is 23, 2020, New York, NY, USA. ACM, New York, NY, USA , 13 pages. https: //doi.org/10.1145/3419614.3423265 able to delete transactions through a chain reorganization (a ma- licious reorg) can perform a profitable double-spend attack. We study the rate at which an attacker can execute reorgs in the Tezos 1 INTRODUCTION Proof-of-Stake protocol. As an example, an attacker with 40% of the Blockchains are designed to be immutable in order to protect against staking power is able to execute a 20-block malicious reorg at an attackers who seek to delete transactions through chain reorga- average rate of once per day, and the attack probability increases nizations (malicious reorgs). Any attacker who causes a reorg of super-linearly as the staking power grows beyond 40%. Moreover, the chain could double-spend transactions, meaning they commit an attacker of the Tezos protocol knows in advance when an at- a transaction to the chain, receive some goods in exchange, and tack opportunity will arise, and can use this knowledge to arrange then delete the transaction, effectively robbing their counterparty. transactions to double-spend. We show that in particular cases, the Nakamoto [15] demonstrated that, in a Proof-of-Work (PoW) setting, Tezos protocol can be adjusted to protect against deep reorgs. -

Governance in Decentralized Networks

Governance in decentralized networks Risto Karjalainen* May 21, 2020 Abstract. Effective, legitimate and transparent governance is paramount for the long-term viability of decentralized networks. If the aim is to design such a governance model, it is useful to be aware of the history of decision making paradigms and the relevant previous research. Towards such ends, this paper is a survey of different governance models, the thinking behind such models, and new tools and structures which are made possible by decentralized blockchain technology. Governance mechanisms in the wider civil society are reviewed, including structures and processes in private and non-profit governance, open-source development, and self-managed organisations. The alternative ways to aggregate preferences, resolve conflicts, and manage resources in the decentralized space are explored, including the possibility of encoding governance rules as automatically executed computer programs where humans or other entities interact via a protocol. Keywords: Blockchain technology, decentralization, decentralized autonomous organizations, distributed ledger technology, governance, peer-to-peer networks, smart contracts. 1. Introduction This paper is a survey of governance models in decentralized networks, and specifically in networks which make use of blockchain technology. There are good reasons why governance in decentralized networks is a topic of considerable interest at present. Some of these reasons are ideological. We live in an era where detailed information about private individuals is being collected and traded, in many cases without the knowledge or consent of the individuals involved. Decentralized technology is seen as a tool which can help protect people against invasions of privacy. Decentralization can also be viewed as a reaction against the overreach by state and industry. -

![Can Ethereum Classic Reach 1000 Dollars Update [06-07-2021] 42 Loss in the Last 24 Hours](https://docslib.b-cdn.net/cover/0683/can-ethereum-classic-reach-1000-dollars-update-06-07-2021-42-loss-in-the-last-24-hours-490683.webp)

Can Ethereum Classic Reach 1000 Dollars Update [06-07-2021] 42 Loss in the Last 24 Hours

1 Can Ethereum Classic Reach 1000 Dollars Update [06-07-2021] 42 loss in the last 24 hours. At that time Bitcoin reached its all-time high of 20,000 and so did Ethereum ETH which surpassed 1,000. 000 to reach 1; Tezos XTZ is priced at 2. In the unlikely event of a significant change for the worst, we expect the Bitcoin price to continue appreciating. ERC-721 started as a EIP draft written by dete and first came to life in the CryptoKitties project by Axiom Zen. ERC-721 A CLASS OF UNIQUE TOKENS. It does not mandate a standard for token metadata or restrict adding supplemental functions. Think of them like rare, one-of-a-kind collectables. The Standard. Institutions are mandating that they invest in clean green technologies and that s what ethereum is becoming, she said. Unlike bitcoin s so-called proof of work, which rewards miners who are competing against each other to use computers and energy to record and confirm transactions on its blockchain, ethereum plans to adopt the more efficient proof of stake model, which chooses a block validator at random based on how much ether it controls. Kaspar explained her thesis Friday on Yahoo Finance Live, citing new updates coming to the cryptocurrency s network later this year. 42 loss in the last 24 hours. At that time Bitcoin reached its all-time high of 20,000 and so did Ethereum ETH which surpassed 1,000. 000 to reach 1; Tezos XTZ is priced at 2. In the unlikely event of a significant change for the worst, we expect the Bitcoin price to continue appreciating. -

A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets

Journal of Risk and Financial Management Review A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets Nikolaos A. Kyriazis Department of Economics, University of Thessaly, 38333 Volos, Greece; [email protected] Abstract: This study is an integrated survey of GARCH methodologies applications on 67 empirical papers that focus on cryptocurrencies. More sophisticated GARCH models are found to better explain the fluctuations in the volatility of cryptocurrencies. The main characteristics and the optimal approaches for modeling returns and volatility of cryptocurrencies are under scrutiny. Moreover, emphasis is placed on interconnectedness and hedging and/or diversifying abilities, measurement of profit-making and risk, efficiency and herding behavior. This leads to fruitful results and sheds light on a broad spectrum of aspects. In-depth analysis is provided of the speculative character of digital currencies and the possibility of improvement of the risk–return trade-off in investors’ portfolios. Overall, it is found that the inclusion of Bitcoin in portfolios with conventional assets could significantly improve the risk–return trade-off of investors’ decisions. Results on whether Bitcoin resembles gold are split. The same is true about whether Bitcoins volatility presents larger reactions to positive or negative shocks. Cryptocurrency markets are found not to be efficient. This study provides a roadmap for researchers and investors as well as authorities. Keywords: decentralized cryptocurrency; Bitcoin; survey; volatility modelling Citation: Kyriazis, Nikolaos A. 2021. A Survey on Volatility Fluctuations in the Decentralized Cryptocurrency Financial Assets. Journal of Risk and 1. Introduction Financial Management 14: 293. The continuing evolution of cryptocurrency markets and exchanges during the last few https://doi.org/10.3390/jrfm years has aroused sparkling interest amid academic researchers, monetary policymakers, 14070293 regulators, investors and the financial press. -

Distributed Self-Government in Protocol Communities an Introduction and Index of Examples

SUBSCRIBE NOW AND RECEIVE CRISIS AND LEVIATHAN* FREE! “The Independent Review is a sparkling effervescence of views and insights on economics, history, and politics for people who don’t mind having their minds bent and blistered with high entropy ideas.” —GEORGE GILDER, bestselling author, Wealth and Poverty, Knowledge and Power, and Microcosm Subscribe to The Independent Review and receive a free book of your choice* such as the 25th Anniversary Edition of Crisis and Leviathan: Critical Episodes in the Growth of American Government, by Founding Editor Robert Higgs. This quarterly journal, guided by co-editors Christopher J. Coyne, and Michael C. Munger, and Robert M. Whaples offers leading-edge insights on today’s most critical issues in economics, healthcare, education, law, history, political science, philosophy, and sociology. Thought-provoking and educational, The Independent Review is blazing the way toward informed debate! Student? Educator? Journalist? Business or civic leader? Engaged citizen? This journal is for YOU! *Order today for more FREE book options Perfect for students or anyone on the go! The Independent Review is available on mobile devices or tablets: iOS devices, Amazon Kindle Fire, or Android through Magzter. INDEPENDENT INSTITUTE, 100 SWAN WAY, OAKLAND, CA 94621 • 800-927-8733 • [email protected] PROMO CODE IRA1703 Distributed Self-Government in Protocol Communities An Introduction and Index of Examples F TOM W. BELL e live in exciting times for governance. Large and powerful institutions used to come in only a few standardized types, such as nation-states and W commercial corporations. But the advent of distributed organizations, built on computer code and fueled by digital cash, has supercharged the evolution of social coordination systems. -

Impossibility of Full Decentralization in Permissionless Blockchains

Impossibility of Full Decentralization in Permissionless Blockchains Yujin Kwon*, Jian Liuy, Minjeong Kim*, Dawn Songy, Yongdae Kim* *KAIST {dbwls8724,mjkim9394,yongdaek}@kaist.ac.kr yUC Berkeley [email protected],[email protected] ABSTRACT between achieving good decentralization in the consensus protocol Bitcoin uses the proof-of-work (PoW) mechanism where nodes earn and not relying on a TTP exists. rewards in return for the use of their computing resources. Although this incentive system has attracted many participants, power has, CCS CONCEPTS at the same time, been significantly biased towards a few nodes, • Security and privacy → Economics of security and privacy; called mining pools. In addition, poor decentralization appears not Distributed systems security; only in PoW-based coins but also in coins that adopt proof-of-stake (PoS) and delegated proof-of-stake (DPoS) mechanisms. KEYWORDS In this paper, we address the issue of centralization in the consen- Blockchain; Consensus Protocol; Decentralization sus protocol. To this end, we first define ¹m; ε; δº-decentralization as a state satisfying that 1) there are at least m participants running 1 INTRODUCTION a node, and 2) the ratio between the total resource power of nodes Traditional currencies have a centralized structure, and thus there run by the richest and the δ-th percentile participants is less than exist several problems such as a single point of failure and corrup- or equal to 1 + ε. Therefore, when m is sufficiently large, and ε and tion. For example, the global financial crisis in 2008 was aggravated δ are 0, ¹m; ε; δº-decentralization represents full decentralization, by the flawed policies of banks that eventually led to many bank which is an ideal state. -

Blockchain Security

CO 445H BLOCKCHAIN SECURITY Dr. Benjamin Livshits Apps Stealing Your Data 2 What are they doing with this data? We don’t know what is happening with this data once it is collected. It’s conceivable that this information could be analysed alongside other collections of data to provide insights into a person’s identity, online activity, or even political beliefs. Cambridge Analytica and other dodgy behavioural modification companies taught us this. The fact is we don’t know what is happening to the data that is being exfiltrated in this way. And in most cases we are not even aware this is taking place. The only reason we know about this collection of data-stealing apps is because security researcher, Patrick Wardle told us. Sudo Security Group’s GuardianApp claims another set of dodgy privacy eroding iOS apps, while Malwarebytes has yet another list of bad actors. http://www.applemust.com/how-to-stop-mac-and-ios-apps-stealing-your-data/ From Malwarebytes 3 https://objective-see.com/blog/blog_0x37.html Did You Just Steal My Browser History!? 4 Adware Doctor Stealing Browsing History 5 https://vimeo.com/288626963 Blockchain without the Hype 6 Distributed ledgers and blockchain specifically are about establishing distributed trust How can a community of individuals agree on the state of the world – or just the state of a database – without the risk of outside control or censorship Doing this with open-source code and cryptography turns out to be a difficult problem Distributed Trust 7 A blockchain is a decentralized, distributed and public -

BITBOND RESEARCH REPORT Digital Assets2021 Institutional Adoptionof Bitbond July 2021 Research Report

Institutional Adoption of Digital Assets 2021 Bitbond Research Report July 2021 RESEARCH REPORT RESEARCH BITBOND 1 Foreword Capital markets and financial services are currently going through an unprecedented level of change. While fintech companies have been reshaping consumer finance for several years, more recently, this force for change has also arrived in the institutional finance world. Foreword Corporate and investment banks, asset managers, institutional We hope you enjoy reading it and that you will be as excited investors, family offices, and other market participants are as we are when discovering that the institutional adoption becoming increasingly driven by technology. Either to gain a of digital assets is not a future promise but a reality that is competitive advantage, fight decreasing margins, or adapt to already here today. regulatory changes. We thank the entire Bitbond team for putting the hard work As part of this development, financial institutions are increas- into this research piece that it takes to create a full picture of ingly turning to digital assets to take advantage of the vast the status quo. Special thanks go to Bitbond crew members opportunities behind distributed ledger technology (DLT), Felix Stremmer and Henri Falque-Pierrotin, as well as senior blockchain, and decentralized finance (DeFi). At the time of banking analyst Sam Theodore for writing the introduction. publication, the total market capitalization of digital assets is We would equally like to thank all contributors at the around USD 1.4 trillion—a fivefold increase over one year. numerous financial institutions who were so open to sharing their insights with us. Without your input, this report would not While the absolute value may seem insignificant compared have been possible. -

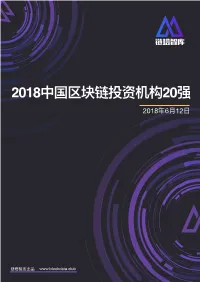

2018中国区块链投资机构20强 2018年6⽉12⽇

2018中国区块链投资机构20强 2018年6⽉12⽇ 链塔智库出品 www.blockdata.club 前⾔ 近年来,中国区块链⾏业的快速发展逐渐获得投资机构关注,中国区块链⾏业投资年增速已连续多年超 过100%。专注于区块链⾏业的投资机构正在⻜速成⻓,在区块链产业积极布局,构建⾃⼰的版图,⽽ 持开放态度的传统投资机构也在跑步⼊局。 链塔智库对活跃于区块链领域的120家投资机构及其所投项⽬进⾏分析,从区块链⾏业投资影响⼒、投 资标的数量、投资⾦额总量等⽅⾯选取了⼆⼗家表现最好的投资机构重点研究,形成结论如下: 从投资项⽬分类来看,这些投资机构普遍看好区块链平台类的公司。 从投资标的地域来看,这些投资机构更多的投资于海外项⽬。 从国内项⽬⻆度来看,北京地区项⽬占⽐最⾼。 从投资轮次来看,⼤部分投资发⽣在天使轮及A轮,反映⾏业仍处于早期阶段。 www.blockdata.club ⽬录 PART.1 2018中国区块链投资机构20强 榜单 PART.2 2018中国区块链投资机构20强 榜单分析 PART.3 影响⼒、投资数⽬、投资⾦额 细分榜单 PART.4 2018中国区块链投资机构版图 www.blockdata.club PART.1 2018中国区块链投资机构20强榜单 链塔智库基于链塔数据库数据,辅以整理超过120余家活跃于区块链领域的投资机构及所投项⽬,从 各家机构在投资影响⼒、投资项⽬数量、投资总额、回报情况、退出情况等维度进⾏评分(单项评价 最⾼10分),评选出2018中国区块链投资机构20强。 区块链投资机构评分维度模型 投资⾦额 重点项⽬影响⼒ 投资影响⼒ 背书能⼒ 媒体影响⼒ 退出情况 总投资数⽬ 投资数⽬ 所投项⽬已发Token数 回报情况 链塔智库研究绘制 www.blockdata.club www.blockdata.club 1 38.1% 21.1%95% 2018中国区块链 79.5% 投资机构 TOP 20 70.2% 名次 47.5% 机构名称 创始⼈ 总评价 影响⼒评分 数量评分 ⾦额评分 1 分布式资本 沈波 9.1 9 10 9 2 硬币资本 李笑来 9.0 10 9 8 3 连接资本 林嘉鹏 8.7 7 10 7 4 15.8% Dfund 赵东 8.1 7 6 9 5 54.1% IDG资本 熊晓鸽 7.7 9 4 9 6 泛城资本 陈伟星 7.5 9 5 6 7 真格基⾦ 徐⼩平 7.4 7 5 7 8 节点资本 杜均 7.1 6 10 7 9 丹华资本 张⾸晟 6.8 8 6 5 10 维京资本 张宇⽂ 6.5 8 5 5 11 了得资本 易理华 6.4 8 6 4 12 FBG Capital 周硕基 6.3 6 6 8 13 千⽅基⾦ 张银海 6.2 8 6 5 14 红杉资本中国 沈南鹏 6.1 10 4 5 15 创世资本 朱怀阳、孙泽宇 6.0 6 6 6 16 Pre Angel 王利杰 5.9 6 8 5 17 蛮⼦基⾦ 薛蛮⼦ 5.8 8 5 3 18 隆领资本 蔡⽂胜 5.5 7 5 3 19 ⼋维资本 傅哲⻜、阮宇博 5.2 6 5 5 20 BlockVC 徐英凯 5.1 6 5 4 数据来源:链塔数据库及公开信息整理 www.blockdata.club www.blockdata.club 2 PART.2 2018中国区块链投资机构20强榜单分析 2.1 区块链平台项目最受欢迎,占比44% 链塔智库根据收录的投资机构20强所投项⽬以及公开信息,对投资项⽬所属⾏业进⾏分类。 20强投资机构投资项⽬⾏业分布 其他 2% 社交 6% ⽣活 8% ⾦融 29% ⽂娱 11% 区块链平台 44% -

Altcoins, Ethereum Projects, and More – Bonus Content

Altcoins, Ethereum projects, and More – Bonus Content Welcome to the bonus online content for Mastering Blockchain – Third Edition! This content complements the main text, with the intention to enhance the reader learning experience. The material covered here has not been included in the core book for reasons of brevity and scope, but it contains valuable information, and has thus been included here for reference and further learning. We'll list and briefly describe the topics covered in these pages here, as an idea of what will be covered in this package. The topics are best read in conjunction with the chapters specified here, but can also be accessed as a reference guide for various topics at any point! • Bitcoin forks: It is recommended that this topic is read after Chapter 7, Bitcoin Network and Payments. It covers alternative Bitcoin projects such as Bitcoin Cash and Bitcoin Unlimited. • Alternative coins: This is intended to be read in conjunction with Chapter 9, Alternative Coins. This topic covers some important cryptocurrency projects such as Zcash and Primecoin. We cover in detail, among other things, how various clients can be installed, and how mining can be performed. • Ethereum networks, trading and investment: It's recommended to read this material with Chapter 11, Ethereum 101. This topic briefly introduces the different types of Ethereum networks and some technical details. Also, we introduce some basics regarding the trading and investment of ether, the Ethereum cryptocurrency. • Ethereum EVM opcodes: This topic should be read in conjunction with Chapter 12, Further Ethereum. Here, we list all EVM opcodes, with descriptions and some technical details, such as their opcode representation and gas consumption.