ARM Holdings Plc by Softbank Group Corp

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Printmgr File

OFFERING MEMORANDUM STRICTLY CONFIDENTIAL NOT FOR DISTRIBUTION IN THE UNITED STATES OF AMERICA OR TO U.S. PERSONS SoftBank Group Corp. $2,750,000,000 6.000% Undated Subordinated NC6 Resettable Notes $1,750,000,000 6.875% Undated Subordinated NC10 Resettable Notes Issue Price: 100.00% The $2,750,000,000 6.000% Undated Subordinated NC6 Resettable Notes (the “NC6 Notes”) and the $1,750,000,000 6.875% Undated Subordinated NC10 Resettable Notes (the “NC10 Notes” and, together with the NC6 Notes, the “Notes” and each, a “Tranche,” the terms and conditions of both Tranches being together, the “Conditions”)) will be issued by SoftBank Group Corp. (the “Company”) on or about July 19, 2017 (the “Issue Date”). The Notes will bear interest on their principal amount from (and including) the Issue Date to (but excluding) July 19, 2023 (in the case of the NC6 Notes) and July 19, 2027 (in the case of the NC10 Notes) at a rate of 6.000 percent and 6.875 percent per annum respectively. Thereafter, the prevailing interest rate on the NC6 Notes and the NC10 Notes shall be 4.226 percent and 4.854 percent per annum, respectively, above the 5 Year Swap Rate for the relevant Reset Period (as defined in the relevant Conditions) and from (and including) July 19, 2038 (in the case of the NC6 Notes) and July 19, 2042 (in the case of the NC10 Notes) (each, a “Second Step-up Date”) the applicable interest rate on the NC6 Notes and the NC10 Notes shall be 4.976 percent and 5.604 percent per annum, respectively, above the 5 Year Swap Rate for the relevant Reset Period. -

Notice of the 38Th Annual General Meeting of Shareholders (April 1, 2017 to March 31, 2018, “FY2017” Or “This Fiscal Year”)

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between the translated document and the Japanese original, the original shall prevail. SoftBank Group Corp. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. Notice of the 38th Annual General Meeting of Shareholders (April 1, 2017 to March 31, 2018, “FY2017” or “this fiscal year”) Information of the Meeting Date and Time: 10:00 AM, Wednesday, June 20, 2018 (Reception will start at 9:00 AM) Venue: Hall A, Tokyo International Forum 5-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo Agenda of the Proposal 1: Appropriation of Surplus Meeting: Proposal 2: Election of Twelve Directors Proposal 3: Revision of Remuneration Paid to Directors Proposal 4: Issuance of Stock Acquisition Rights as Stock Options th Table of Contents Notice of the 38 Annual ■ General Meeting of 2 Shareholders Reference Materials for the ■ Annual General Meeting of 6 Shareholders ■ Business Report 30 Consolidated Financial ■ 61 Statements Non-consolidated Financial ■ 63 Statements ■Audit Reports 65 SoftBank Group Corp. Stock code: 9984 I am pleased to notify you of the 38th Annual SBG expects the combined company to be a General Meeting of Shareholders. force for positive change in mobile In FY2017, SoftBank Group Corp. (“SBG”) communications, video, and broadband set out its global strategy and pressed ahead markets in the U.S., and that it will disrupt the with a full-fledged transformation to a marketplace and lay the foundation for U.S. -

Printmgr File

OFFERING MEMORANDUM STRICTLY CONFIDENTIAL NOT FOR DISTRIBUTION IN THE UNITED STATES OF AMERICA OR TO U.S. PERSONS SoftBank Group Corp. $1,000,000,000 6% Senior Notes due 2025 $1,000,000,000 5 3⁄8% Senior Notes due 2022 €500,000,000 5 1⁄4% Senior Notes due 2027 €1,250,000,000 4 3⁄4% Senior Notes due 2025 €500,000,000 4% Senior Notes due 2022 SoftBank Group Corp., which changed its name from SoftBank Corp. on July 1, 2015, (the “Company”) is offering $1,000,000,000 aggregate principal amount of its 6% Senior Notes due 2025 denominated in U.S. dollars (the “2025 Dollar Notes”), $1,000,000,000 aggregate principal amount of its 5 3⁄8% Senior Notes due 2022 denominated in U.S. dollars (the “2022 Dollar Notes” and, together with the 2025 Dollar Notes, the “Dollar Notes”), €500,000,000 aggregate principal amount of its 5 1⁄4% Senior Notes due 2027 denominated in euro (the “2027 Euro Notes”), €1,250,000,000 aggregate principal amount of its 4 3⁄4% Senior Notes due 2025 denominated in euro (the “2025 Euro Notes”) and €500,000,000 aggregate principal amount of its 4% Senior Notes due 2022 denominated in euro (the “2022 Euro Notes”, together with the 2027 Euro Notes and the 2025 Euro Notes, the “Euro Notes”, and, together with the Dollar Notes, the “Notes”). The maturity date of the 2027 Euro Notes is July 30, 2027, the maturity date of the 2025 Euro Notes and the 2025 Dollar Notes is July 30, 2025, and the maturity date of the 2022 Euro Notes and the 2022 Dollar Notes is July 30, 2022. -

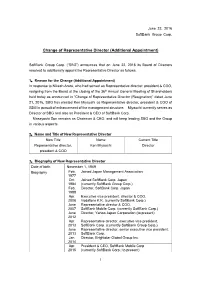

Change of Representative Director (Additional Appointment)

June 22, 2016 SoftBank Group Corp. Change of Representative Director (Additional Appointment) SoftBank Group Corp. (“SBG”) announces that on June 22, 2016 its Board of Directors resolved to additionally appoint the Representative Director as follows. 1.Reason for the Change (Additional Appointment) In response to Nikesh Arora, who had served as Representative director, president & COO, resigning from the Board at the closing of the 36th Annual General Meeting of Shareholders held today as announced in “Change of Representative Director (Resignation)” dated June 21, 2016, SBG has elected Ken Miyauchi as Representative director, president & COO of SBG in pursuit of enhancement of the management structure. Miyauchi currently serves as Director of SBG and also as President & CEO of SoftBank Corp. Masayoshi Son remains as Chairman & CEO, and will keep leading SBG and the Group in various aspects. 2.Name and Title of New Representative Director New Title Name Current Title Representative director, Ken Miyauchi Director president & COO 3.Biography of New Representative Director Date of birth November 1, 1949 Biography Feb. Joined Japan Management Association 1977 Oct. Joined SoftBank Corp. Japan 1984 (currently SoftBank Group Corp.) Feb. Director, SoftBank Corp. Japan 1988 Apr. Executive vice president, director & COO, 2006 Vodafone K.K. (currently SoftBank Corp.) June Representative director & COO, 2007 SoftBank Mobile Corp. (currently SoftBank Corp.) June Director, Yahoo Japan Corporation (to present) 2012 Apr. Representative director, executive vice president, 2013 SoftBank Corp. (currently SoftBank Group Corp.) June Representative director, senior executive vice president, 2013 SoftBank Corp. Jan. Director, Brightstar Global Group Inc. 2014 Apr. President & CEO, SoftBank Mobile Corp. 2015 (currently SoftBank Corp.; to present) 1 June Director, SoftBank Corp. -

ANNUAL REPORT 2017 Softbank Group Corp

ANNUAL REPORT 2017 SoftBank Group Corp. Trajectory of Bringing Essential Management Financial Corporate ANNUAL REPORT 2017 the Information Revolution the Future Forward Information Organization Section Information Disclaimers Definition of Terms • This annual report is made based on information available at the time of • “Fiscal 2016” refers to the fiscal year ended March 31, 2017, and other writing. Plans, forecasts, strategies, and other forward-looking statements fiscal years are referred to in a corresponding manner in this annual in this report are not historical facts, and include elements of risk and report. FYE denotes the fiscal year-end. For example, FYE2016 denotes uncertainty. Actual results may therefore differ materially from these for- March 31, 2017, the last day of fiscal 2016. ward-looking statements due to changes in the business environment and other factors. Company Names • Information in this report regarding companies other than the Company • Unless specifically stated otherwise ”SBG” refers to SoftBank Group Corp. is quoted from public and other sources. We do not guarantee the accu- and “the Company” refers to SoftBank Group Corp. and its subsidiaries. racy of this information. Please refer to page 90 for the abbreviation of subsidiaries’ and associates’ • The Company expressly disclaims any obligation or responsibility to update, company names. revise or supplement any forwardlooking statements in any presentation material or generally to any extent. Use of or reliance on the information Regarding Trademarks in this annual report is at your own risk. • TM and © 2017 Apple Inc. All rights reserved. Apple and iPhone are trademarks of Apple Inc., registered in the U.S. -

Notice of the 35 Annual General Meeting of Shareholders

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. SoftBank Corp. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. Notice of the 35th Annual General Meeting of Shareholders (April 1, 2014 to March 31, 2015, “FY2014”) Information of the Meeting Date and Time: 10:00 AM, Friday, June 19, 2015 (Reception will start at 9:00 AM) Venue: Hall A, Tokyo International Forum 5-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo Agenda of the Proposal 1: Appropriation of Surplus Meeting: Proposal 2: Partial Change in the Articles of Incorporation Proposal 3: Election of nine Directors Proposal 4: Election of two Audit & Supervisory Board Members th Table of Contents Notice of the 35 Annual ■ General Meeting of 2 Shareholders Reference Materials for the ■ Annual General Meeting of 6 Shareholders ■Business Report 21 Consolidated Financial ■ 46 Statements ■Financial Statements 48 ■Audit Reports 50 We will no longer distribute gifts on the day of the Annual General Meeting of Shareholders. We ask for your understanding on this matter. SoftBank Corp. Stock code: 9984 To Our Shareholders It is my great pleasure to notify you of the Corp., Supercell Oy) for the full year, whereas 35th Annual General Meeting of Shareholders. in the previous fiscal year results were In FY2014, SoftBank Corp. recorded net recorded from when they were consolidated. sales of ¥8,700 billion, operating income of In addition, gains recorded in connection ¥982.7 billion, and net income attributable to with the listing of Alibaba Group Holding owners of the parent of ¥668.4 billion, with Limited also contributed significantly to the net sales and net income attributable to increase in net income attributable to owners owners of the parent both reaching record of the parent. -

Printmgr File

IMPORTANT NOTICE NOT FOR DISTRIBUTION IN OR INTO THE UNITED STATES OR TO U.S. PERSONS OR OTHERWISE THAN TO PERSONS TO WHOM IT CAN LAWFULLY BE DISTRIBUTED IMPORTANT: You must read the following disclaimer before continuing. The following disclaimer applies to the attached offering memorandum. You are advised to read this disclaimer carefully before accessing, reading or making any other use of the attached offering memorandum. In accessing the attached offering memorandum, you agree to be bound by the following terms and conditions, including any modifications to them from time to time, each time you receive any information from us as a result of such access. CONFIRMATION OF YOUR REPRESENTATION: You have accessed the attached document on the basis that you have confirmed your representation to the issuer and to Deutsche Bank AG, London Branch, Citigroup Global Markets Limited, Goldman Sachs International, Morgan Stanley & Co. International plc, Mizuho International plc, Mizuho Securities Asia Limited, Crédit Agricole Corporate and Investment Bank, Merrill Lynch International, J.P. Morgan Securities plc, UBS AG Hong Kong Branch, Barclays Bank PLC, BNP Paribas, Credit Suisse (Hong Kong) Limited, Daiwa Capital Markets Europe Limited, ING Bank N.V., Singapore Branch, Nomura International plc and SMBC Nikko Capital Markets Limited (together, the “Initial Purchasers”) that (1) you are not a U.S. Person, as defined in Regulation S under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or a dealer or professional fiduciary acting -

Notice of the 37Th Annual General Meeting of Shareholders (April 1, 2016 to March 31, 2017, “FY2016” Or “This Fiscal Year”)

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. SoftBank Group Corp. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. Notice of the 37th Annual General Meeting of Shareholders (April 1, 2016 to March 31, 2017, “FY2016” or “this fiscal year”) Information of the Meeting Date and Time: 10:00 AM, Wednesday, June 21, 2017 (Reception will start at 9:00 AM) Venue: Hall A, Tokyo International Forum 5-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo Agenda of the Proposal 1: Appropriation of Surplus Meeting: Proposal 2: Election of Eleven Directors Proposal 3: Election of Three Audit & Supervisory Board Members Proposal 4: Issuance of Stock Acquisition Rights as Stock Options th Table of Contents Notice of the 37 Annual ■ General Meeting of 2 Shareholders Reference Materials for the ■ Annual General Meeting of 6 Shareholders ■ Business Report 28 Consolidated Financial ■ 57 Statements Non-consolidated Financial ■ 59 Statements ■ Audit Reports 61 SoftBank Group Corp. Stock code: 9984 To Our Shareholders th I am pleased to notify you of the 37 Annual segment and the acquisition of the ARM General Meeting of Shareholders. business. In FY2016, SoftBank Group Corp. (“SBG”) Net income attributable to owners of the actively expanded its operations in parent increased, primarily due to the preparation for the IoT* era. These efforts, recording of net income from discontinued included the acquisition of UK-based ARM operations through the sale of Supercell Holdings plc, a major semiconductor design shares. -

Page 1 Issuer Name Meeting Date Cusip Proposal Number Proposal Description Proponent Vote Decision Aeon Financial Service Co Ltd

Issuer Name Meeting Date Cusip Proposal Number Proposal Description Proponent Vote Decision ABC-Mart Inc. 5/24/2018 J00056101 1 Allocation of Profits/Dividends Management For ABC-Mart Inc. 5/24/2018 J00056101 2.1 Elect Minoru Noguchi Management For ABC-Mart Inc. 5/24/2018 J00056101 2.2 Elect Yukie Yoshida Management For ABC-Mart Inc. 5/24/2018 J00056101 2.3 Elect Kiyoshi Katsunuma Management For ABC-Mart Inc. 5/24/2018 J00056101 2.4 Elect Joh Kojima Management For ABC-Mart Inc. 5/24/2018 J00056101 2.5 Elect Takashi Kikuchi Management For ABC-Mart Inc. 5/24/2018 J00056101 2.6 Elect Kiichiroh Hattori Management For Acom Co Ltd 6/22/2018 J00105106 1 Allocation of Profits/Dividends Management For Acom Co Ltd 6/22/2018 J00105106 2.1 Elect Shigeyoshi Kinoshita Management Against Acom Co Ltd 6/22/2018 J00105106 2.2 Elect Kaoru Wachi Management For Acom Co Ltd 6/22/2018 J00105106 2.3 Elect Masataka Kinoshita Management For Acom Co Ltd 6/22/2018 J00105106 2.4 Elect Teruyuki Sagehashi Management For Acom Co Ltd 6/22/2018 J00105106 2.5 Elect Noriyoshi Watanabe Management For Acom Co Ltd 6/22/2018 J00105106 2.6 Elect Naoki Hori Management For Adastria Co.Ltd. 5/24/2018 J0011S105 1 Amendments to Articles Management For Adastria Co.Ltd. 5/24/2018 J0011S105 2.1 Elect Michio Fukuda Management For Adastria Co.Ltd. 5/24/2018 J0011S105 2.2 Elect Osamu Kimura Management For Adastria Co.Ltd. 5/24/2018 J0011S105 2.3 Elect Taiki Fukuda Management For Adastria Co.Ltd. -

Corporate Governance Report

This document has been translated from the Japanese original (as submitted to the Tokyo Stock Ex- change) for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. SoftBank Group Corp. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. Corporate Governance Report Last Update: October 2, 2017 SoftBank Group Corp. Representative: Masayoshi Son, Chairman & CEO Contact: Investor Relations TEL: +81 3 6889 2290 TSE Securities Code: 9984 www.softbank.jp/en I. Basic views on corporate governance, capital structure, corporate profile and other basic information 1. Basic views SoftBank Group Corp. (“SBG”) and its subsidiaries (collectively, the “Company”) is guided by a fundamental concept of “free, fair, innovative,” and a corporate philosophy of “Information Revolution – Happiness for everyone.” The Company aims to be a provider of essential technologies and services to people around the world through its endeavors in various businesses in the information and technology industries. SBG, the SoftBank Group (the “Group”)’s holding company, recognizes that it is vital to maintain effective corporate governance in order to realize this vision. SBG continues to strengthen governance within the Group by taking measures such as formulating the SoftBank Group Charter to share the Group’s fundamental concept and philosophy, and Group Company Management Regulations of the SoftBank Group to set out the management policy and management framework for group companies, among other matters. SBG also sets out various rules which group companies and their officers and employees are to comply with. -

Notice of the 36Th Annual General Meeting of Shareholders (April 1, 2015 to March 31, 2016, “FY2015” Or “This Fiscal Year”)

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. SoftBank Group Corp. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. Notice of the 36th Annual General Meeting of Shareholders (April 1, 2015 to March 31, 2016, “FY2015” or “this fiscal year”) Information of the Meeting Date and Time: 10:00 AM, Wednesday, June 22, 2016 (Reception will start at 9:00 AM) Venue: Hall A, Tokyo International Forum 5-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo Agenda of the Proposal 1: Appropriation of Surplus Meeting: Proposal 2: Election of eight Directors Proposal 3: Amounts and Features of Stock Options issued to Directors as Remuneration Proposal 4: Issuance of the Stock Acquisition Rights as Stock Options Proposal 5: Transfer of Shares of Subsidiaries in Accordance with the Reorganization of Group Companies th Table of Contents Notice of the 36 Annual ■ General Meeting of 2 Shareholders Reference Materials for the ■ Annual General Meeting of 6 Shareholders ■ Business Report 28 Consolidated Financial ■ 53 Statements ■ Financial Statements 55 ■Audit Reports 57 SoftBank Group Corp. Stock code: 9984 To Our Shareholders I am pleased to notify you of the 36th Annual Alibaba Group Holdings Limited, despite an General Meeting of Shareholders. increase in operating income attributable I would like to offer my heartfelt mainly to a remeasurement gain following the condolences to all those affected by the 2016 consolidation of ASKUL Corporation by Kumamoto Earthquake and my sincere hopes Yahoo Japan Corporation. -

Notice of the 34 Annual General Meeting of Shareholders

This document has been translated from the Japanese original for reference purposes only. In the event of any discrepancy between this translated document and the Japanese original, the original shall prevail. SoftBank Corp. assumes no responsibility for this translation or for direct, indirect or any other forms of damages arising from the translation. Notice of the 34th Annual General Meeting of Shareholders (April 1, 2013 to March 31, 2014, “FY2013”) Information of the Meeting Date and Time: 10:00 AM, Friday, June 20, 2014 (Reception will start at 9:00 AM) Venue: Hall A, Tokyo International Forum 5-1, Marunouchi 3-chome, Chiyoda-ku, Tokyo Agenda of the Proposal 1: Appropriation of Surplus Meeting: Proposal 2: Election of three Directors Table of Contents Notice of the 34th Annual General Meeting of ■ 2 Shareholders Reference Materials for the Annual General Meeting ■ 7 of Shareholders ■ Business Report 12 ■ Consolidated Financial Statements 39 ■ Financial Statements 42 ■ Audit Reports 45 SoftBank Corp. Stock code: 9984 To Our Shareholders It is my great pleasure to present you the Japan, which achieved its 17th consecutive Notice of our 34th Annual General Meeting of year of increased revenue and profit, also Shareholders. contributed to growth, despite the elimination In FY2013, the SoftBank Group recorded net of store tenant fees, etc. under a new strategy sales of ¥6 trillion, and operating income of in its e-commerce business. ¥1 trillion. We were able to achieve such Guided by the corporate philosophy of substantial growth as a result of actively “Information Revolution – Happiness for engaging in acquisitions of companies everyone,” the SoftBank Group will continue including Sprint in the U.S., in addition to to work as one to make even greater strides achieving increases in revenue and profit at forward.