A Brief History of BHP Billiton1

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

For Personal Use Only Use Personal For

.1 S. bhpbi ILl ton Company Secretariat BHP Billiton Limited BHP BullIon Plc 180 Lonscfale Street Neatliouse Place Melbourne Victoda 3000 Austra8a London SW1V 1BH UK GPO Box 86 Melbourne Vicfoda 3001 Australia Tel ^44 20 7802 4000 Tel^61 1300554757Fax+61 396094372 Fax +44 20 7802 4111 bhpbilliton.com bhpbillilon.cotrt 27 June 2008 To: The Company Announcements Office Australian Securities Exchange Messrs James Wallace and Howard Toomey Company Secretaries Haoma Mining NL Haoma Mining NL ("Haoma") Notice of initial substantial holder Please find attached Form 603 (Notice of initial substantial holder), which provides details of BHP Billiton Nickel West Pty Ltd's (formerly WMC Resources Limited) interest in Haoma Mining NL. BHP Billiton Nickel West Pty Ltd acquired these securities pursuant to Alumina Limited's consent dated 5 May 2008, following the incorrect registration of the securities after the demerger of Alumina Limited and WMC Resources Limited in 2003. ' /. / ,'' // F)ona,Smlth V Deity Company Secretary For personal use only BHP BullIon Limded Registered Offica: Level 27, 180 Lonsdale Street, Melbourne VIC 3000, Australia AGN 49004 028 077 Registered in Australia A member of the BHP Billiton Group which is headquartered in Australia BHP Billiton Plc Registered Office: Neathouse Place, London SWIV IBH, UK Registered in London A member of Ihe BHP BullIon Group which is headquartered in Australia 603 page 1/2 153u1y2001 Form 603 Corporations Act 2001 Section 671B Notice of initial substantial holder 1g. Company Name/Scheme Haoma Mining NL ACNIARSN 008 676 177 1. Details of substantial holder (1) Name BlIP Billiton Limited ACN/ARSN (if applicable) 004 028 077 This notice is given by BHP Billiton Limited on behalf of BHP Billiton Limited's controlled bodies corporate (Limited Subsidiaries), on behalf of BlIP Billilon Plc, and on behalf of BF-IP Bifiton Plc's controlled bodies corporate (Plc Subsidiaries) including those named in the list annexed to this Form 603 and marked Annexure A. -

The Great Killings in Indonesia Throug¬H the Australian Mass Media*

The Great Killings in Indonesia through the Australian mass media Richard Tanter1 The killings in the months after October 1965 were the foundation of Suharto's ensuing three decades of power, and in a sense, the foundation of “post-Vietnam” Southeast Asia. They were certainly the pre-condition for subsequent Australian (and US, and Japanese) support for the New Order. The killings can be regarded as the constitutive terror of the New Order state.i Throughout the three decades of Suharto's New Order, these events were literally unspeakable: as if, in Germany, the Nazi crimes could not have been publicly discussed even in 1980. With the passing of Suharto there was some small shift, but essentially the mass trauma remains repressed. Until that trauma is directly and openly addressed, the much in the subjective life of Indonesian politics will remain literally explosive. However, my topic is not the killings themselves, but rather the smaller and less central issue of one aspect of the foreign response and understandings of the killings: contemporary Australian representations of the killings. My starting point is the fact that in Australia - the country next door to Indonesia - there is very little awareness of these killings. This was demonstrated soon after the events. The political sociologist Rod Tiffen carried out a well designed public opinion survey in the early 1970s in Melbourne. Almost 60% of the sample did knew who Suharto was, and most approved of him and Indonesia under his rule. In their account of Suharto's rise to power, most of these knowledgables referred to the coup - as Tiffen remarks, “the best remembered aspect of contemporary Indonesia”. -

University of Canberra Patrick Mullins Quick Books, Quick Manoeuvres

Mullins Quick books, quick manoeuvres University of Canberra Patrick Mullins Quick books, quick manoeuvres: Disentangling the dangers and opportunities of the quickie political biography Abstract: The publication of the biography of the political leader is de rigueur in the Australian electoral cycle. Characterised by their haste of production, by their regurgitation of already-published articles, and by a liberal use of quotes attributed and not, such books are often ephemeral confections, destined for the dustbin whether their subject is successful or not (Blewett, 2007). But the political quickie is, on closer inspection, a mix of competing opportunities and dangers that belie its negative description. When considered, the quickie is revealing of the uses of biographical writing to perform, connect, and manoeuvre within a political context. Biographical note: Patrick Mullins is a PhD candidate at the University of Canberra. Keywords: Biography – Life Writing – Political Subject – Journalism 1 Mullins Quick books, quick manoeuvres Two biographies of Kevin Rudd were commissioned within days of his becoming leader of the Australian Labor Party in December 2006. Upon their near-simultaneous publication in June 2007, Neal Blewett characterised the texts as the latest examples in a long line of ‘quickies’: They have roughly the shelf life of homogenised cheese and are almost certainly destined for that knacker’s yard for books – the remainder store – regardless of whether their subject is successful or not […] These books are hastily compiled confections: a regurgitation of published articles on the subject’s career […] plus a dollop of his speeches and writings, mixed together with a heady collection of quotes from colleagues and associates, frequently unattributed. -

THE MAKING of the NEWCASTLE INDUSTRIAL HUB 1915 to 1950

THE MAKING OF THE NEWCASTLE INDUSTRIAL HUB 1915 to 1950 Robert Martin Kear M.Bus. (University of Southern Queensland) A thesis submitted in fulfilment of the requirements for the degree of a Master of Philosophy in History January 2018 This research was supported by an Australian Government Research Training Program (RTP) Scholarship STATEMENT OF ORIGINALITY I hereby certify that the work embodied in the thesis is my own work, conducted under normal supervision. The thesis contains no material which has been accepted, or is being examined, for the award of any other degree or diploma in any other university or other tertiary institution and, to the best of my knowledge and belief, contains no material previously published or written by another person, except where due reference has been made in the text. I give consent to the final version of my thesis being made available worldwide when deposited in the University’s Digital Repository, subject to the provisions of the Copyright Act 1968 and any approved embargo. Robert Kear ii ABSTRACT Aim of this Thesis The aim of this thesis is to chart the formation of the Newcastle Industrial Hub and to identify the men who controlled it, in its journey from Australian regional obscurity before 1915, to be the core of Australian steel manufacturing and technological development by 1950. This will be achieved through an examination of the progressive and consistent application of strategic direction and the adoption of manufacturing technologies that progressively lowered the manufacturing cost of steel. This thesis will also argue that, coupled with tariff and purchasing preferences assistance, received from all levels of government, the provision of integrated logistic support services from Newcastle’s public utilities and education services underpinned its successful commercial development. -

How Mining MADE Australia

PUBLICITY MATERIALS DIRTY BUSINESS HOW MINING MADE AUSTRALIA SERIES PRODUCER & DIRECTOR JACOB HICKEY PRODUCER ALEX WEST EXECUTIVE PRODUCERS JOE CONNOR, KEN CONNOR & ALEX WEST © ATOM 2013 PAGE 1 OF 10 A STUDY GUIDE BY MARGUERITE O’HARA http://www.metromagazine.com.au ISBN: 978-1-74295-286-4 http://www.theeducationshop.com.au OUTLINE OF THIS GUIDE A. Introductory material, including curriculum guide- lines, the language of mining, pre-viewing questions for discussion and brief biographies of the experts appearing in the series INTRODUCTION B. Three sets of questions and quotes relating to each of the three episodes – Money, Power and Land Dirty Business is the story of mining. Beneath our feet is a treasure trove of unimaginable riches. But this story is C. Conclusions – looking at the production values of about much more than precious minerals and dusty mine the series, post-viewing questions about the topic shafts. For 150 years mining has changed the lives of us all and the series as a whole and References and in unexpected and extraordinary ways. It sparked waves Resources of mass immigration and ignited political revolt. But min- ing has also toppled Prime Ministers and it has wrenched Aboriginal people’s land away. It has saved Australia from financial ruin and made people rich in the most unpredict- THE FILMMAKERS able ways. Mining’s rich history is a battleground that has divided, and yet forged, the nation. Land, money and power Key Crew – this is the epic history of mining. SERIES PRODUCER & DIRECTOR Jacob Hickey This series explores that history over three one-hour WRITERS Jacob Hickey and Alex West episodes from the Victorian goldfields to the Western NARRATOR Colin Friels Australian Pilbara. -

Founding of a Steel Industry Australia's Steel Industry Has Its

Founding of a Steel Industry Australia's steel industry has its origins in an unusual reversal of the ancient art of alchemy. Its founders made their fortunes not in the pursuit of gold and silver, as they all in some way hoped they might, but in the making of iron and steel. The industry has its genesis in the 19th century, in the days when gold mining and great landholdings were the main hope for wealth in Australia. Just where the story begins is a matter of personal perspective. For some, it begins with John Lysaght in England, for others with Charles Rasp at Broken Hill, and for yet others with the Hoskins family in Port Kembla or even Lithgow. All of these sought wealth from gold or silver along the way to founding the Australian steel industry, and their ultimate success is now embodied in the company that has become BlueScope Steel Limited. Over the years the three main threads of this story - Lysaght, BHP and Hoskins - have been interwoven in countless ways. The result is a fascinating and complex tale of endeavour in the best Australian traditions. Founding fathers A little chronology helps set the scene. Lysaght is the oldest part of the story, dating back to 1857, when a young John Lysaght set up a small galvanising business in Bristol, England. His company would ultimately form a very large part of the BlueScope Steel business, although it did not begin local production until 1921 when it set up a rolling and galvanising plant in Newcastle. For John Lysaght, the impetus to seek lucrative markets in Australia came from the gold rushes which began in the 1850s. -

Australian Iron & Steel

lllawarra H rstorical Society August 61 THE BACKGROUND BEHIND THE FORMATION OF AUSTRALIAN IRON AND STEEL LTD. AND ITS EARLY HISTORY Don Reynolds presented a paper at the June Meet1ng on this topic. He began by outlining the efforts of James Rutherford in establishing an Ironworks at Lith gow in 1876, then detailing how William Sandford produced the first steel in Australia in May, 1900. Dan's paper then explored the manouvers involved in the Hoskins Family gaining control of the Lithgow works and the reasons for the family's decision to remove operations at Lithgow to another site. We reprint Dan's paper in full from the point where BHP establishes a Steelworks at Newcastle in competition with the Hoskins Lithgow Works. BHP entered the iron and steel industry in competition with Hoskins when they opened their new steelworks at Newcastle. The BHP plant was new, it was well laid out, it was on a good coal field for producing matallurgical coke, itwas on a tidewater location and it had ample reserves of good quality iron ore, even though the ore was in South Australia. Hoskins had a relatively old plant (much of it very old), the plant was poorly laid out and split between two sites at Lith gow, it had to rail it's raw materials and products long distances, it's reserves of iron ore were small and of low grade and the local coal made inferior metall urgical coke. The Hoskins' Family were finding the position anything but promising. In 1916 they purchased the leases of an undeveloped coal mine at Wongawilli and built a mine, coal washery and coke ovens at Wongawilli to supply coke to their Lithgow works. -

2013 Annual Report

SURFACEBELOW THE Some statements in this report are forward-looking statements within the meaning of the US Private Securities Litigation Reform Act of 1995. Forward-looking statements also include those containing such words as ‘anticipate’, ‘estimates’, ‘should’, ‘will’, ‘expects’, ‘plans’ or similar expressions. Forward-looking statements involve risks and uncertainties that may cause actual outcomes to be different from the forward-looking statements. Important factors that could cause actual results to differ from the forward looking statements include: (a) material adverse changes in global economic, alumina or aluminium industry conditions and the markets served by AWAC; (b) changes in production and development costs and production levels or to sales agreements; (c) changes in laws or regulations or policies; (d) changes in alumina and aluminium prices and currency exchange rates; and (e) the other risk factors summarised in Alumina’s Form 20-F for the year ended 31 December 2012. Unless otherwise indicated, the values in this report are presented in US dollars. CONTENTS 1 2 AT A GLANCE 4 CHAIRMAN AND CHIEF EXECUTIVE OFFICER’S REPORT 8 SUSTAINABILITY AND THE AWAC BUSINESS 10 CORPORATE GOVERNANCE STATEMENT 23 DIRECTORS’ REPORT 28 OPERATING AND FINANCIAL REVIEW 37 REMUNERATION REPORT 71 FINANCIAL REPORT 112 SHAREHOLDER INFORMATION 113 FINANCIAL HISTORY Challenging market conditions continued in 2013, stemming from a well-supplied alumina market, a sustained low international alumina pricing environment and an unfavourable foreign exchange position. Against this backdrop, Alumina Limited improved its results by recording a net profit of US$0.5 million, an increase of US$56.1 million from the previous year. -

Australian Participation in the G20

Australian Participation in the G20 Xu Yi-Chong Australia is committed to active participation and policy leadership within the G20. Indeed, Prime Minister of Australia in 2007-09, Kevin Rudd, is often credited with bringing the leaders of the G20 together for their first summit in September 2008. Four years later, the public, media and the international community have taken the G20 as a given and they expect that the old powers under the umbrella of the G8 would sit down at the table to discuss urgent international issues with the emerging economies as equals. In retrospect, this may be the case. History, however, could have gone in a different direction. In 2008, many multilateral and regional venues had existed for countries to manage their common problems: on macroeconomic issues, there were the remnants of the Bretton Woods system, the International Monetary Fund (IMF) and the World Bank; the old power club, the Financial Stability Forum of G7, G8; the World Economic Forum (WEF); the Bank of International Settlement (BIS) of central banks, and the list goes on. With many multilateral institutions available, there were still concerns about the relevance of these institutions. The Economist commented on the G8 summit in July 2008 as all the signs showed a coming recession in many developed countries: What is the point of their discussing the oil price without Saudi Arabia, the world’s biggest producer? Or waffling about the dollar without China, which holds so many American Treasury bills? Or slapping sanctions on Robert Mugabe, with no African present? Or talking about global warming, AIDS or inflation without anybody from the emerging world? Cigar smoke and ignorance are in the air.1 It became clear that, even though emerging economies, especially BRICs, drew increasing worldwide attention, many still held that the “decoupling the- ory” was more of a dream than a reality, as evidenced in 2008 when emerging economies were affected by the economic down-turns in developed countries as they started reducing their imports. -

Alumina Limited 2020 Annual Review

ASX ANNOUNCEMENT 31 MARCH 2021 Alumina Limited 2020 Annual Review Attached, in accordance with Listing Rule 3.17 is a copy of Alumina Limited’s Annual Review 2020 that will be issued to shareholders. This ASX announcement was approved and authorised for release by Stephen Foster, Company Secretary. Stephen Foster Company Secretary For investor enquiries: For media enquiries: Charles Smitheram Tim Duncan Manager – Treasury & Investor Relations Hinton and Associates Phone: +61 3 8699 2613 Phone: +61 3 9600 1979 Mobile: +61 412 340 047 Mobile: +61 408 441 122 Email: [email protected] ROCK SOLID Annual Review 2020 2 About Alumina Limited 4 At a Glance 6 AWAC – A Global Business 8 Map of Operations 10 Chairman and CEO Report 16 Sustainability 19 Board of Directors 22 Executive Management 24 Letter by Chair of Compensation Committee 28 Remuneration Summary 42 Condensed Consolidated Statement of Financial Position 43 Financial History About Chairman and Sustainability Our People Remuneration and Back to contents Alumina Limited CEO Report Financial Reports 1 RESILIENT ROBUST RESPONSIBLE Qualities that have evolved from decades of partnership, planning and perseverance – through the good times, and those as challenging as 2020. Alumina Limited Annual Review 2020 2 The Annual Review is presented in US dollars, unless otherwise specified. ABOUT ALUMINA LIMITED Alumina Limited is a leading Australian company listed on the Australian Securities Exchange (ASX). Alumina Limited is the 40 per cent partner in the AWAC joint venture whose assets comprise globally leading bauxite mines and alumina refineries in Australia, Brazil, Spain, Saudi Arabia and Guinea. AWAC also has a 55 per cent interest in the Portland aluminium smelter in Victoria, Australia. -

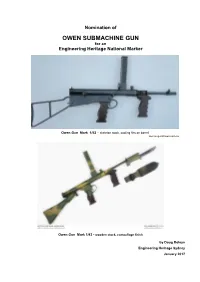

Owen Submachine Gun.Nomination

Nomination of OWEN SUBMACHINE GUN for an Engineering Heritage National Marker Owen Gun Mark 1/42 - skeleton stock, cooling fins on barrel source gunshows.com.nz Owen Gun Mark 1/43 - wooden stock, camouflage finish by Doug Boleyn Engineering Heritage Sydney January 2017 Table of Contents Page 1. Introduction 2 2. Nomination Letter 4 3. Nomination Support Information Basic Data 5 4. Basic History 8 5. Engineering Heritage Assessment 11 6. Interpretation Plan 14 7. References & Acknowledgements 15 Appendices 1. Statement of Support for Engineering Heritage Recognition 16 2. History Time Line of the Owen Submachine Gun 17 3. Photos of the Owen Submachine Gun and other submachine guns used 28 in World War 2 4. Drawings of the Owen Submachine Gun 34 5. Statistics of the various models of the Owen Gun and Comparison Table 35 6. Biographies of Companies and People Associated with the Owen Gun 39 7. Glossary Terminology and Imperial Unit Conversions 44 8. Author's Assessment of Engineering Heritage Significance Check List 45 Rev 05 01 17 Page 1 1. Introduction. The Owen submachine gun [SMG] (1) that bears its designer's name was the only weapon of World War 2 used by Australian troops that was wholly designed and manufactured in Australia. Conceptually designed by Evelyn Owen, a committed young inventor, the concept was further developed to production stage by Gerard Wardell Chief Engineer Lysaght's Newcastle Works Pty Limited - Port Kembla Branch (2) [Lysaghts] with the assistance of Evelyn Owen ( and Fred Kunzler a Lysaght employee who had been a gunsmith in his native Switzerland. -

Financial Services Guide and Independent Expert’S Report in Relation to the Proposed Demerger of Coles Group Limited by Wesfarmers Limited

FINANCIAL SERVICES GUIDE AND INDEPENDENT EXPERT’S REPORT IN RELATION TO THE PROPOSED DEMERGER OF COLES GROUP LIMITED BY WESFARMERS LIMITED GRANT SAMUEL & ASSOCIATES PTY LIMITED ABN 28 050 036 372 5 OCTOBER 2018 FINANCIAL SERVICES GUIDE Grant Samuel & Associates Pty Limited (“Grant Samuel”) holds Australian Financial Services Licence No. 240985 authorising it to provide financial product advice on securities and interests in managed investments schemes to wholesale and retail clients. The Corporations Act, 2001 requires Grant Samuel to provide this Financial Services Guide (“FSG”) in connection with its provision of an independent expert’s report (“Report”) which is included in a document (“Disclosure Document”) provided to members by the company or other entity (“Entity”) for which Grant Samuel prepares the Report. Grant Samuel does not accept instructions from retail clients. Grant Samuel provides no financial services directly to retail clients and receives no remuneration from retail clients for financial services. Grant Samuel does not provide any personal retail financial product advice to retail investors nor does it provide market-related advice to retail investors. When providing Reports, Grant Samuel’s client is the Entity to which it provides the Report. Grant Samuel receives its remuneration from the Entity. In respect of the Report for Wesfarmers Limited in relation to proposed demerger of Coles Group Limited (“the Wesfarmers Report”), Grant Samuel will receive a fixed fee of $1.5 million plus reimbursement of out-of-pocket expenses for the preparation of the Report (as stated in Section 8.3 of the Wesfarmers Report). No related body corporate of Grant Samuel, or any of the directors or employees of Grant Samuel or of any of those related bodies or any associate receives any remuneration or other benefit attributable to the preparation and provision of the Wesfarmers Report.