Property Ownership and Deed Recording

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

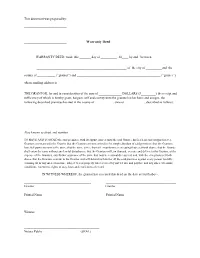

Warranty Deed

This document was prepared by: __________________________ __________________________ __________________________ Warranty Deed WARRANTY DEED, made this _______ day of __________, 20____ by and between _______________________________________________________ of the city of __________and the county of ___________ (“grantor”) and ___________________________________________________ (“grantee”) whose mailing address is ________________________________________________________________ THE GRANTOR, for and in consideration of the sum of ______________ DOLLARS ($_________) the receipt and sufficiency of which is hereby grant, bargain, self and convey unto the grantee his/her heirs and assigns, the following described premises located in the county of ___________, state of ____________, described as follows: Also known as street and number ______________________________________________________ TO HAVE AND TO HOLD the said premises, with its appurtenances unto the said Grantee his/her heirs and assigns forever. Grantors covenant with the Grantee that the Grantors are now seized in fee simple absolute of said premises; that the Grantors have full power to convey the same; that the same is free from all encumbrances excepting those set forth above; that the Grantee shall enjoy the same without any lawful disturbance; that the Grantors will, on demand, execute and deliver to the Grantee, at the expense of the Grantors, any further assurance of the same that may be reasonably required, and, with the exceptions set forth above, that the Grantors warrant to the Grantee and will defend for him/her all the said premises against every person lawfully claiming all or any interest in same, subject to real property taxes accrued by not yet due and payable and any other covenants, conditions, easements, rights of way, laws and restrictions of record. -

The Real Estate Marketplace Glossary: How to Talk the Talk

Federal Trade Commission ftc.gov The Real Estate Marketplace Glossary: How to Talk the Talk Buying a home can be exciting. It also can be somewhat daunting, even if you’ve done it before. You will deal with mortgage options, credit reports, loan applications, contracts, points, appraisals, change orders, inspections, warranties, walk-throughs, settlement sheets, escrow accounts, recording fees, insurance, taxes...the list goes on. No doubt you will hear and see words and terms you’ve never heard before. Just what do they all mean? The Federal Trade Commission, the agency that promotes competition and protects consumers, has prepared this glossary to help you better understand the terms commonly used in the real estate and mortgage marketplace. A Annual Percentage Rate (APR): The cost of Appraisal: A professional analysis used a loan or other financing as an annual rate. to estimate the value of the property. This The APR includes the interest rate, points, includes examples of sales of similar prop- broker fees and certain other credit charges erties. a borrower is required to pay. Appraiser: A professional who conducts an Annuity: An amount paid yearly or at other analysis of the property, including examples regular intervals, often at a guaranteed of sales of similar properties in order to de- minimum amount. Also, a type of insurance velop an estimate of the value of the prop- policy in which the policy holder makes erty. The analysis is called an “appraisal.” payments for a fixed period or until a stated age, and then receives annuity payments Appreciation: An increase in the market from the insurance company. -

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised Or Amended in 2005)

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised or Amended in 2005) drafted by the NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS and by it APPROVED AND RECOMMENDED FOR ENACTMENT IN ALL THE STATES at its ANNUAL CONFERENCE MEETING IN ITS ONE-HUNDRED-AND-THIRTEENTH YEAR PORTLAND, OREGON JULY 30-AUGUST 6, 2004 WITH PREFATORY NOTE AND COMMENTS Copyright ©2004 By NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS April 2005 ABOUT NCCUSL The National Conference of Commissioners on Uniform State Laws (NCCUSL), now in its 114th year, provides states with non-partisan, well-conceived and well-drafted legislation that brings clarity and stability to critical areas of state statutory law. Conference members must be lawyers, qualified to practice law. They are practicing lawyers, judges, legislators and legislative staff and law professors, who have been appointed by state governments as well as the District of Columbia, Puerto Rico and the U.S. Virgin Islands to research, draft and promote enactment of uniform state laws in areas of state law where uniformity is desirable and practical. • NCCUSL strengthens the federal system by providing rules and procedures that are consistent from state to state but that also reflect the diverse experience of the states. • NCCUSL statutes are representative of state experience, because the organization is made up of representatives from each state, appointed by state government. • NCCUSL keeps state law up-to-date by addressing important and timely legal issues. • NCCUSL’s efforts reduce the need for individuals and businesses to deal with different laws as they move and do business in different states. -

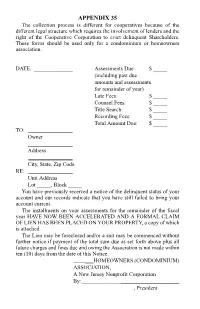

35. Notice of Acceleration of Assessment and Filing of Lien; Claim of Lien

APPENDIX 35 The collection process is different for cooperatives because of the different legal structure which requires the involvement of lenders and the right of the Cooperative Corporation to evict delinquent Shareholders. These forms should be used only for a condominium or homeowners association. DATE: ______________ Assessments Due: $ _____ (including past due amounts and assessments for remainder of year) Late Fees: $ _____ Counsel Fees: $ _____ Title Search: $ _____ Recording Fees: $ _____ Total Amount Due: $ _____ TO: ________________ Owner ________________ Address ________________ City, State, Zip Code RE: ________________ Unit Address Lot _____, Block _____ You have previously received a notice of the delinquent status of your account and our records indicate that you have still failed to bring your account current. The installments on your assessments for the remainder of the fiscal year HAVE NOW BEEN ACCELERATED AND A FORMAL CLAIM OF LIEN HAS BEEN PLACED ON YOUR PROPERTY, a copy of which is attached. The Lien may be foreclosed and/or a suit may be commenced without further notice if payment of the total sum due as set forth above plus all future charges and fines due and owing the Association is not made within ten (10) days from the date of this Notice. ___HOMEOWNERS (CONDOMINIUM) ASSOCIATION, A New Jersey Nonprofit Corporation By: _____________________ , President CLAIM OF LIEN CLAIM OF LIEN _________ Homeowners (Condominium) Association, Inc., a New Jersey nonprofit corporation (“Association”), with an address at , , New Jersey, , in care of (Management Company) , hereby claims a lien for unpaid assessments, charges and expenses in accordance with the terms of that certain Declaration of Covenants and Restrictions (“Declaration”) or Master Deed (“Master Deed”) for _______ recorded on in the County Clerk's Office in Deed Book Page et seq. -

G.S. 45-36.24 Page 1 § 45-36.24. Expiration of Lien of Security

§ 45-36.24. Expiration of lien of security instrument. (a) Maturity Date. – For purposes of this section: (1) If a secured obligation is for the payment of money: a. If all remaining sums owing on the secured obligation are due and payable in full on a date specified in the secured obligation, the maturity date of the secured obligation is the date so specified. If no such date is specified in the secured obligation, the maturity date of the secured obligation is the last date a payment on the secured obligation is due and payable under the terms of the secured obligation. b. If all remaining sums owing on the secured obligation are due and payable in full on demand or on a date specified in the secured obligation, whichever first occurs, the maturity date of the secured obligation is the date so specified. If all sums owing on the secured obligation are due and payable in full on demand and no alternative date is specified in the secured obligation for payment in full, the maturity date of the secured obligation is the date of the secured obligation. c. The maturity date of the secured obligation is "stated" in a security instrument if (i) the maturity date of the secured obligation is specified as a date certain in the security instrument, (ii) the last date a payment on the secured obligation is due and payable under the terms of the secured obligation is specified in the security instrument, or (iii) the maturity date of the secured obligation or the last date a payment on the secured obligation is due and payable under the terms of the secured obligation can be ascertained or determined from information contained in the security instrument, such as, for example, from a payment schedule contained in the security instrument. -

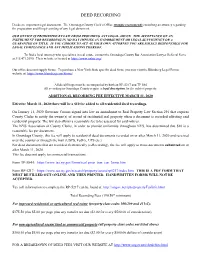

Deed Recording

DEED RECORDING Deeds are important legal documents. The Onondaga County Clerk’s Office strongly recommends consulting an attorney regarding the preparation and filing/recording of any legal document. OUR OFFICE IS PROHIBITED BY LAW FROM PROVIDING ANY LEGAL ADVCE. THE ACCEPTANCE OF AN INSTRUMENT FOR RECORDING IN NO WAY IMPLIES AN ENDORSEMENT OR LEGAL SUFFICIENCY OR A GUARANTEE OF TITLE. IF YOU CHOOSE TO ACT AS YOUR OWN ATTORNEY YOU ARE SOLELY RESPONSIBLE FOR LEGAL COMPLIANCE AND ANY IMPLICATIONS THEREOF. To find a local attorney who specializes in real estate, contact the Onondaga County Bar Association Lawyer Referral Serve at 315.471.2690. Their website is located at https://www.onbar.org/ Our office does not supply forms. To purchase a New York State specific deed form, you may visit the Blumberg Legal Forms website at: https://www.blumberg.com/forms/ All deed filings must be accompanied by both an RP-5217 and TP 584 All recording in Onondaga County require a legal description for the subject property. ADDITIONAL RECORDING FEE EFFECTIVE MARCH 11, 2020 Effective March 11, 2020 there will be a $10 fee added to all residential deed recordings. On January 11, 2020 Governor Cuomo signed into law an amendment to Real Property Law Section 291 that requires County Clerks to notify the owner(s) of record of residential real property when a document is recorded affecting said residential property. The law also allows a reasonable fee to be assessed for said notices. The NYS Association of County Clerks, in order to provide uniformity throughout NYS, has determined that $10 is a reasonable fee per document. -

Attachment A

Attachment A Below is a list of the new transfer types in part 4 of the RTC form. A definition is given along with what instrument needs to be recorded for that specific transfer type. • Sheriff’s Sale ‐ mortgage ‐ A mortgage involves two parties—the property owner who borrowed the money and the bank or lender—and is a written agreement executed by the property owner to secure the payment of a loan that is evidenced by a promissory note. If the property owner misses scheduled payment(s) and the lender sends a notice of default, the foreclosure process is initiated. The lender “accelerates” the time for all payment under the loan so that the full amount is due. The borrower cannot stop the foreclosure proceedings by paying only the late payments; the entire loan must be paid off. For one year after the foreclosure sale, the borrower has the right to redeem the property back by paying the amount of the loan, any taxes or repair cost the buyer paid, and interest. Also, during this one year period of “redemption”, the borrower is entitled to retain possession if they and their family occupied the property as a home. Publicly advertising mortgage sales in the foreclosure process is required. The notice of sale must be physically posted on the property and legal notification to all parties claiming an interest in the property is required. The instrument that will be recorded is the sheriff’s certificate of sale. • Sheriff’s Sale ‐ trust indenture ‐ A trust indenture involves three parties—the borrower (also known as the grantor) , the trustee (often an attorney), and the name of the bank or other lender set out as a beneficiary—and is a written agreement executed by a borrower to give bare legal title to a trustee to secure payment of a loan. -

Bundle of S Cks—Real Property Rights and Title Insurance Coverage

Bundle of Scks—Real Property Rights and Title Insurance Coverage Marc Israel, Esq. What Does Title Insurance “Insure”? • Title is Vested in Named Insured • Title is Free of Liens and Encumbrances • Title is Marketable • Full Legal Use and Access to Property Real Property Defined All land, structures, fixtures, anything growing on the land, and all interests in the property, which may include the right to future ownership (remainder), right to occupy for a period of +me (tenancy or life estate), the right to build up (airspace) and drill down (minerals), the right to get the property back (reversion), or an easement across another's property.” Bundle of Scks—Start with Fee Simple Absolute • Fee Simple Absolute • The Greatest Possible Rights Insured by ALTA 2006 Policy • “The greatest possible estate in land, wherein the owner has the right to use it, exclusively possess it, improve it, dispose of it by deed or will, and take its fruits.” Fee Simple—Lots of Rights • Includes Right to: • Occupy (ALTA 2006) • Use (ALTA 2006) • Lease (Schedule B-Rights of Tenants) • Mortgage (Schedule B-Mortgage) • Subdivide (Subject to Zoning—Insurable in Certain States) • Create a Covenant Running with the Land (Schedule B) • Dispose Life Estate S+ck • Life Estate to Person to Occupy for His Life+me • Life Estate can be Conveyed but Only for the Original Grantee’s Lifeme • Remainderman—Defined in Deed • Right of Reversion—Defined in Deed S+cks Above, On and Below the Ground • Subsurface Rights • Drilling, Removing Minerals • Grazing Rights • Air Rights (Not Development Rights—TDRs) • Canlever Over a Property • Subject to FAA Rules NYC Air Rights –Actually Development Rights • Development Rights are not Real Property • Purely Statutory Rights • Transferrable Development Rights (TDRs) Under the NYC Zoning Resoluon and Department of Buildings Rules • Not Insurable as They are Not Real Property Title Insurance on NYC “Air Rights” • Easement is an Insurable Real Property Interest • Easement for Light and Air Gives the Owner of the Merged Lots Ability to Insure. -

Get a Glossary of Terms Used in the Title Industry

GLOSSARY A Abstract Plant – A geographically arranged abstract plant, currently kept to date, that is adequate for use in insuring titles, so as to provide for the safety and protection of the policyholders. An abstract plant as further defined in Rule P-12 and as further provided for in the Insurance Code, Chapter 2501.003 and Chapter 2502, must include an abstract plant for each county in which a title insurance agent or direct operation maintains an office. Abstract of Title - A compilation of all the recorded documents relating to a parcel of land. Usually kept by the land owner and used as the basis for an attorney as to the condition of title. Still in use in some states, and in some areas of Texas, but mostly replaced by issuance of title insurance. Abstract of Judgment – A lien created by a statutory filing of a court judgment in the real property records. This lien, commonly referred to as an AJ (in Texas), attaches to all non- exempt real property of the person or entity that the judgment was against. Acceleration Clause (in a mortgage) – Specifies conditions under which the lender may advance the time when the entire debt which is secured by the mortgage becomes due. For example, most mortgages contain provisions that the note shall become due immediately upon the sale of the securing land without the lender's consent or upon failure of the landowner to pay an installment when due. Access – The right to enter and leave a tract of land from a public way. Can include the right to enter and leave over the lands of another. -

Property Ownership for Women Enriches, Empowers and Protects

ICRW Millennium Development Goals Series PROPERTY OWNERSHIP FOR WOMEN ENRICHES, EMPOWERS AND PROTECTS Toward Achieving the Third Millennium Development Goal to Promote Gender Equality and Empower Women It is widely recognized that if women are to improve their lives and escape poverty, they need the appropriate skills and tools to do so. Yet women in many countries are far less likely than men to own property and otherwise control assets—key tools to gaining eco- nomic security and earning higher incomes. Women’s lack of property ownership is important because it contributes to women’s low social status and their vulnerability to poverty. It also increasingly is linked to development-related problems, including HIV and AIDS, hunger, urbanization, migration, and domestic violence. Women who do not own property are far less likely to take economic risks and realize their full economic potential. The international community and policymakers increasingly are aware that guaranteeing women’s property and inheritance rights must be part of any development agenda. But no single global blueprint can address the complex landscape of property and inheritance practices—practices that are country- and culture-specific. For international development efforts to succeed—be they focused on reducing poverty broadly or empowering women purposely—women need effective land and housing rights as well as equal access to credit, technical information and other inputs. ENRICH, EMPOWER, PROTECT Women who own property or otherwise con- and tools—assets taken trol assets are better positioned to improve away when these women their lives and cope should they experience and their children need them most. -

How to Buy Title Insurance In

How to Buy Title Insurance in [Insert State] This guide: • Covers the basics of title insurance. • Explains the need for title insurance. • Offers tips to shop for title insurance and closing services. • Gives you questions you should ask before you buy title insurance. [Name] [DOI Logo] [Superintendent of Insurance] [DOI Website Address] Drafting Note: This template has been developed for state departments of insurance who are interested in providing a consumer education publication regarding title insurance. The template was developed as a comprehensive guide that can be edited/personalized to meet the individual needs of a state. DRAFT: 3-23-215-25-21 1 Table of Contents Introduction Page 3 Buying or Refinancing a Property Page 3 What is Title Insurance, and What Does it Cover? Page 4 Two Types of Title Insurance—Owner’s and Lender’s Policies Page 4 What Doesn’t Title Insurance Cover? Page 4 Who Sells Title Insurance? Page 5 The Right to Choose Your Own Title Agent/Company Page 5 Who Pays for Title Insurance? Page 5 What Does Title Insurance Cost? Page 6 Ask if You’re Eligible for Discounts Page 6 The Difference Between Title and Homeowners Insurance Page 6 Questions to Ask Before You Buy Title Insurance Page 6 The Real Estate Closing Page 7 Closing Agents Page 8 Questions to Ask When You Choose a Closing Agent Page 8 Closing Protection Page 8 Shop Around for Title Insurance and Closing Services Page 8 Cost Comparison Chart Page 9 Final Tips to Remember Page 10 How to File a Title Insurance Claim Page 10 The [INSERT DOI NAME] is Here to Help Page 10 Other Resources Available Page 11 Disclaimer: The information included in this publication is meant to serve as a guide and is not a substitute for legal or professional advice. -

Chain of Title – Information Sheet

Chain of Title – information sheet Important note about this Chain of Title guidance This information sheet provides you with guidance about the New Zealand Film Commission (NZFC) requirements in relation to Chain of Title. It will help you provide the Chain of Title information we require for any form of NZFC funding. It is not intended to be legal advice nor is it intended to be comprehensive. You are welcome to call us to discuss any Chain of Title queries you may have. Before acting on this information, we recommend you seek other professional and legal advice. What is Chain of Title? Chain of Title is a timeline of transfers of title (ownership) in the rights to a project. The ‘chain’ analogy is used to illustrate the line of ownership running from the current owner back to the original owner of the property. Chain of Title means, collectively, all of the agreements that give you permission to use other people’s material in, and contributions to, your film. Why is Chain of Title important? In the film and television industry, it is very important to be able to have written agreements showing that the producer owns or controls the rights in the film. Before they will invest or lend to a production, funders and investors will want to see evidence that the production company has the right to make and distribute the film. And before they’ll represent or show a film, exhibitors, film festivals, sales agents and distributors will usually require documentation to verify the producer’s rights in the film.