Allergy (CMPA)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2008 Economic and Social Report

Welcome to our factory BRINGING HEALTH THROUGH FOOD TO AS MANY PEOPLE AS POSSIBLE Economic and Social Report DANONE 08 economic and social report Interview with Franck Riboud A BUSINESS FOCUSED 100% ON HEALTH, WITH CLEAR PRIORITIES Special report: Nature NATURE, OUR PATH TO THE FUTURE Strategy DANONE FOR ALL? DANONE 2008 To our readers 2008 Annual reports often focus attention on earnings and num- 23 au 26 bers. But a business is much more Juillet 2009 than that. It’s about people and Evian - France the way they go about things; www.evianmasters.com it’s about values and challenges, a shared culture and a common project. Which is why Danone 08 looks beyond the figures in the hope of sharing with you some of what makes our experience a special adventure. The editorial team Danone 08 is also on www.danone.com Selected texts, insider news, photos and films—meet the people who are the real subject of Danone 08. More information to carry on the adventure. Danone 2008 —— 03 Contents 2008 Introducing a delicious dessert 06 FRANCK RIBOUD 62 DANONE FOR ALL? BRINGING HEALTH THROUGH FOOD TO AS MANY PEOPLE AS POSSIBLE A business 100% focused on Nearly 2 billion people DANONEeconomic and social report with all the goodness of Activia. health, with clear priorities. around the world have 08 access to at least one Danone product. 16 HIGHLIGHTS Achieving organic growth of 8.4%, Danone confirmed 72 INTERVIEW its targets—a roundup of Bernard Hours talks about the initiatives and products the Danone business model that set their mark on and levers for growth. -

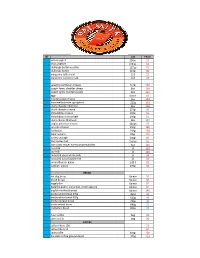

QT . SIZE PRICE Activia Yogurt 250Ml 15 Oikos Yoghurt 150 Gs 16 Challenge Butter Unsalted 113 Gs 72 Challenge Butter 113Gr 85 Ma

QT . SIZE PRICE activia yogurt 250ml 15 oikos yoghurt 150 gs 16 challenge butter unsalted 113 gs 72 challenge butter 113gr 85 margarine table maid 113 15 margarine country crock 113 23 sargento parmesan cheese 141gr 140 joseph farms cheddar cheese 8oz 109 joseph farms monterrey jack 8oz 116 eggs docen 50 monterey jack cheese 6oz 104 mozzarella cheese springfield 227g 103 sharp cheedar tillamook 8oz 150 shard cheedar cheese 227gr 96 philadelphia cheese 190gr 51 philadelphia cheese light 190gr 51 sharp cheese tillamook 8oz 104 singles american cheese 144 gs 97 san rafael bacon 250gr 140 fud bacon 250gr 104 italian salami 85gr 110 turkey sausage 500gr 95 ham turkey fud 250 gs 62 ham oscar mayer honey,smoked,boiled 6oz 116 rice milk 1lt 120 soy milk 1lt 120 caracol & yaqui whole milk 1lt 34 caracol & yaqui lowfat milk 1lt 34 caracol&yaqui galon 1.89 lt 62 yoghurt yoplait 170gr 35 BREAD hot dog bread 6piece 30 bread burger 6piece 30 bagel plain 6piece 92 bagel blueberri, cinnamon, onion,sesame 6piece 92 english muffins thomas 6piece 140 bimbo white bread 395g 395g 42 bimbo white bread 650g 650g 42 bimbo integral bread 720g 46 whole wheat bread 840g 72 multigrain bread 840g 72 flour tortilla bag 30 corn tortilla bag 25 COFFEE coffee filters 100 72 coffee filters 50 42 carey coffe 340gr 150 the cabo coffee ground decaff 375g 203 the cabo coffee medium ground 375g 203 the cabo coffee whole bean dark 375g 203 el marino traditional 369g 131 el marino espreess coffe 200g 102 el marino special roast 200g 110 el marino decaf 369g 159 sweet low sugar -

Danone Opens New Sustainable Nutricia Plant in the Netherlands to Meet Growing, Global Demand for Specialized Infant Formula

Press Release – Cuijk, the Netherlands, March 25, 2019 Danone opens new sustainable Nutricia plant in the Netherlands to meet growing, global demand for specialized infant formula • €240 million facility in Cuijk is among Danone’s largest investments in its European production network in the last ten years, building on the Netherland’s agricultural heritage and Nutricia’s scientific capabilities • Plant will produce highly specialized infant formula – including formula for specific health conditions, and will employ close to 500 employees once fully operational • State-of-the-art, sustainable, zero-waste facility powered with 100% renewable electricity Today, Danone proudly announces the official opening of its new Nutricia Cuijk production facility. The opening ceremony, taking place in the presence of a broad range of stakeholders, including the Minister of Agriculture, Nature and Food Quality, Carola Schouten, as well as industry and healthcare representatives, marks the completion of a three-year journey to build a state-of-the-art, energy-efficient, zero- waste plant. The facility will primarily produce specialized infant formula that meets the needs of infants diagnosed with specific medical conditions – such as cow’s milk protein allergy, as well as standard infant formula. The €240 million investment is among Danone’s largest in its European production network in the last ten years. “At Danone, we believe the health of people and the planet are interconnected, as expressed through our company vision ‘One Planet. One Health’. Our new Nutricia Cuijk facility is a significant investment towards achieving that vision. At this facility, we’ll be producing food for vulnerable babies; and we’re also doing everything we can to preserve a healthy and clean environment for future generations,” said Veronique Penchienati -Bosetta, Executive Vice President, Danone Specialized Nutrition. -

Registration Document DANONE Annual Financial Report 13 TABLE of CONTENTS

DANONERegistration Document 13 Annual Financial Report TABLE OF CONTENTS SELECTED FINANCIAL INFORMATION, SOCIAL, SOCIETAL 1 INFORMATION ABOUT THE ISSUER 5 AND ENVIRONMENTAL RESPONSIBILITY 160 AND INFORMATION ON THE 5.1 Danone social, societal and environmental approach 162 REGISTRATION DOCUMENT 4 5.2 Information concerning the Group’s social, societal and environmental performance in compliance with 1.1 Selected fi nancial information 6 the Grenelle II law 165 1.2 Information about the issuer 6 5.3 Funds sponsored by Danone 190 1.3 Information about the Registration Document 8 CORPORATE GOVERNANCE 196 OVERVIEW OF ACTIVITIES, RISK FACTORS 10 6 6.1 Governance bodies 198 2 6.2 Positions and responsibilities of the Directors and nominees to the Board of Directors 222 2.1 History 12 6.3 Compensation and benefi ts for executives 2.2 Presentation of the Group 13 and governance bodies 239 2.3 Strategic growth areas 14 6.4 Internal control and risk management 267 2.4 Description and strategy of the Divisions 16 6.5 Statutory auditors’ special report on related party 2.5 Other elements related to the Group’s activity agreements and commitments 275 and organization 18 2.6 Simplifi ed organizational chart of the Group as of December 31, 2013 23 SHARE CAPITAL AND SHARE OWNERSHIP 284 2.7 Risk factors 25 7 7.1 Company’s share capital 286 7.2 Treasury shares and DANONE call options held DANONE’S BUSINESS HIGHLIGHTS IN by the Company and its subsidiaries 287 2013 AND OUTLOOK FOR 2014 38 7.3 Authorization to issue securities that give access 3 to the share -

Culture Warsw To

Culture Warsw to How the Food Giants Turned Yogurt, a Health Food, into Junk Food Navigating the Dairy Case to Find Quality, Safety and Nutritional Value A Report by The Cornucopia Institute | November 2014 Table of Contents Executive Summary ....................................................... 5 Section I: Yogurt, Probiotics and the Microbiome ................................ 9 Section II: Benefits of Organic Yogurt ......................................... 17 Section III: Greek Yogurt ................................................... 23 Section IV: Ingredients in Yogurt ............................................. 27 Section V: Cost Comparison of Conventional vs. Organic Brands ................... 47 Conclusion ............................................................... 51 Appendix: The Yogurt Market ............................................... 53 References .............................................................. 55 The Cornucopia Institute wishes to sincerely thank the thousands of family farmers and their “urban allies” who fund our work with their generous donations. Special thanks to Olivia Shelton and Maggie Yount for their work on this report. The Cornucopia Institute is dedicated to the fight for economic justice for the family-scale farming community. Through research and education, our goal is to empower farmers and their customers in the good food movement, both politically and through marketplace initiatives. Cornucopia’s Organic Integrity Project acts as a corporate and governmental watchdog assuring that -

2.2.3. Danone

1 2.2.3. Danone without any clear sustainability criteria. The company currently reports having reached 6.4% recycled material in its total volume of Danone is a French multinational; its product ranges cover infant nutrition, water, and dairy- and plant-based products, and its well- plastic packaging; this has increased from 5.3% in 2017, which they attribute to the increase of rPET.15 known brands include Activia, Alpro, Aptamil, Nutricia, Evian and Volvic.1 The company has declared its plastic footprint as 820,000 metric tonnes, and has published a breakdown of its packaging portfolio by material and packaging type.2 It said that, in 2017, 86% of The company reports plans to eliminate single-use plastic straws and cutlery by 2025,16 and highlights a pilot scheme assessing alterna- its total packaging (and 77% of plastic packaging) was already reusable, recyclable or compostable.3 The company was identified as the tives to plastic straws with its Indonesian brand, Aqua.17 However, there is very little detail about how the single-use-plastic items will fourth-biggest global plastic polluter in the 2018 Break Free From Plastic Audit, but did not feature in the top ten in the 2019 audit.4 be eliminated, or whether they will be replaced with another single-use material. Danone has also committed to phasing out all PVC and Nevertheless, as a multinational, fast-moving consumer-goods (FMCG) company with a significant plastic footprint, we have chosen to PVDC from packaging by 2021. include Danone in this analysis. Danone appears to be one of very few companies that explicitly reference the need for effective collection systems and express support for DRS, which is commendable.5 Danone also says it will help to meet – or go beyond – mandatory-col- lection targets, as set by regulators worldwide. -

ANNUAL REPORT 2019 Danone

ANNUAL REPORT 2019 Danone Accelerating the FOOD revolution TOGETHER Celebrating ‘ONE PERSON, BUSiNESS-LED 100 YEARS ONE VOiCE, ONE SHARE’ COALITiONS of pioneering healthy 100,000 employees for inclusive growth innovation co-owning our future & biodiversity Contents #1 Danone in 2019 4 11 Danone Empowering employees at a gIance to co-own our vision 12 2019 Celebrating 100 years of pioneering Key milestones healthy innovation together 8 13 Interview with our Chairman and CEO, Collective action Emmanuel Faber, for greater impact by Danone employees & transformational change 10 Progressing towards our 2030 Goals #2 Performance Creating sustainable & profitable value for all 15 22 3 questions to Essential Dairy Cécile Cabanis, CFO & Plant-Based 1 24 #3 Health & Nutrition Waters performance 2 18 Specialized Nutrition Collaborative Environmental performance innovation 20 Building a healthier Social performance & sustainable food system together 29 34 Boosting Co-creating innovation the future of food 30 3 Growing with purpose A people-powered company 32 Biodiversity: from farm to fork For more information: danone.com/integrated- annual-report-2019 3 Danone at a glance OUR MISSION: ‘BRINGING HEALTH THROUGH FOOD A GLOBAL LEADER WITH A UNIQUE HEALTH-FOCUSED TO AS MANY PEOPLE AS POSSIBLE’ PORTFOLIO IN FOOD AND BEVERAGES LEADING POSITIONS (1) STRONG PROGRESS ON PROFITABLE GROWTH IN 2019 #1 #1 #2 €25.3 bn 15.21% €3.85 €2.10 Sales Recurring operating Recurring earnings Dividend per share WORLDWiDE EUROPE WORLDWiDE margin per share (EPS) payable in -

Danone Sells Earthbound Farm to Taylor Farms

Press Release – Paris, April 11, 2019 Danone sells Earthbound Farm to Taylor Farms Danone announces it has signed a definitive agreement for the sale of Earthbound Farm, the US organic salads business, to California-based Taylor Farms, a family-owned salads and fresh foods company. The transaction closed today. The sale of Earthbound Farm, which had annual sales of about USD400m in 2018, is part of Danone’s portfolio management and capital allocation optimization strategy. Earthbound Farm, founded in 1984 in California, is the largest producer of organic salads in the US. The company had been owned by WhiteWave Foods since 2013. Danone acquired WhiteWave in 2017, significantly expanding its global presence in plant-based and organic food products and creating a global leader uniquely positioned to capitalize on consumer trends towards healthier and more sustainable eating and drinking choices. About Danone (www.danone.com) Dedicated to bringing health through food to as many people as possible, Danone is a leading global food & beverage company building on health-focused and fast-growing categories in three businesses: Essential Dairy & Plant-based products, Waters and Specialized Nutrition. Danone aims to inspire healthier and more sustainable eating and drinking practices, in line with its ‘One Planet. One Health’ vision which reflects a strong belief that the health of people and that of the planet are interconnected. To bring this vision to life and create superior, sustainable, profitable value for all its stakeholders, Danone has defined its 2030 Goals: a set of nine integrated goals aligned with the Sustainable Development Goals (SDGs) of the United Nations. -

Danone's Subsidiaries and Equity Holdings As of December 31, 2018

Danone's subsidiaries and equity holdings as of December 31, 2018 The following list includes all Danone consolidated or equity companies as of December 31, 2018, being specified that it does not include subsidiaries of companies under equity method. Table of content Companies listed by country ................................................................................................................................ 1 Companies listed by legal name ......................................................................................................................... 12 Companies listed by country Country Legal name Ownership Algeria DANONE DJURDJURA 100% Argentina ADVANCED MEDICAL NUTRITION SA 100% Argentina AGUAS DANONE DE ARGENTINA SA 100% Argentina BEST CARE NUTRITION DOMICILIRIA SA 100% Argentina DANONE ARGENTINA SA 99.81% Argentina DAN-TRADE SA 100% Argentina KASDORF SA 100% Argentina LAS MAJADAS SA 100% Argentina LOGISTICA LA SERENISIMA 94.82% Argentina NUTRICIA-BAGO SA 51% Australia DANONE MURRAY GOULBURN PTY LTD (1) 50% Australia NUMICO RESEARCH AUSTRALIA PTY LTD 100% Australia NUTRICIA AUSTRALIA HOLDINGS PTY LTD 100% Australia NUTRICIA AUSTRALIA PTY LTD 100% Austria DANONE GESMBH 100% Austria MILUPA GMBH 100% Austria NUTRICIA GMBH 100% Azerbaijan DANONE LLC 97.64% Bangladesh GRAMEEN DANONE FOODS LIMITED (1) 39.91% Belarus DANONEBEL 97.64% 1 Ownership Country Legal name Belarus DANONE PRUZHANY JLLC 57.02% Belarus JLLC DANONE SHKLOV 49.80% Belgium ALPRO COMM.VA 100% Belgium ALPRO HOLDINGS BVBA 100% Belgium BIALIM BELGIQUE -

Meeting Minutes of the Working Group on Claims

NUTRITION UNIT SCIENTIFIC PANEL ON NUTRITION, NOVEL FOODS AND FOOD ALLERGENS th MINUTES OF THE 100 MEETING OF THE WORKING GROUP ON CLAIMS Held on tele-conference on 6 September 2021 (Agreed on 17 September 2021) Participants ◼ Working Group Members: Jean-Louis Bresson, Stefaan De Henauw, Alfonso Siani (Chair), and Frank Thies. ◼ European Commission representatives: SANTE Unit E1: Stephanie Bodenbach, Heidi Moens. ◼ EFSA: Nutrition Unit: Janusz Ciok, Leng Heng, Leonard Matijevic, Silvia Valtueña Martinez, and Ariane Titz. ◼ Others: Not Applicable. 1. Welcome and apologies for absence The Chair welcomed the participants. 2. Adoption of agenda The agenda was adopted without changes. 3. Declarations of Interest of Working Groups members In accordance with EFSA’s Policy on Independence1 and the Decision of the Executive Director on Competing Interest Management2, EFSA screened the Annual Declarations of Interest filled out by the 1 http://www.efsa.europa.eu/sites/default/files/corporate_publications/files/policy_independence.pdf 2 http://www.efsa.europa.eu/sites/default/files/corporate_publications/files/competing_interest_management_17.pdf European Food Safety Authority Via Carlo Magno 1A – 43126 Parma, Italy Tel. +39 0521 036 111 [email protected] │ www.efsa.europa.eu Working Group members invited to the present meeting. For further details on the outcome of the screening of the Annual Declarations of Interest, please refer to Annex. Oral Declaration(s) of Interest were asked at the beginning of the meeting and no additional interest was declared. 4. Agreement of the minutes of the 99th Working Group meeting held on 16 July 2021 via web conference. The minutes of the 99th Working Group meeting were agreed by written procedure on 25 July 2021. -

L'empire Danone

Succession Par CORINNE BOUCHOUCHI Danone entre deux eaux 46 L’OBS/N°2764-26/10/2017 STEPHAN GLADIEU/BLOSSOM 2764MET_046.indd 46 24/10/2017 17:08 GRANDS FORMATS Côté pile : une ’antre de Danone est un bel de l’action ? Peut-il vraiment mettre en immeuble haussmannien, au œuvre les valeurs qu’il fait miroiter aux ambition sociale, cœur de Paris, près des Gale- jeunes qu’il recrute ? ries Lafayette. Au mur, des pho- Le changement que prépare le nouveau des produits sains tographies accueillent le visi- PDG de Danone est, lui, d’abord centré sur Lteur : enfants souriants aux pieds nus dans le produit. Le « Manifesto » est son œuvre : et la caution d’un la terre, agriculteurs aux champs, mais « C’est une sorte de guide pour répondre à aussi les figures incontournables de la la révolution de l’alimentation à travers nos Nobel de la paix. maison : Antoine Riboud, le fondateur ; marques. Il est écrit en de nombreuses lan- Franck, son fils et successeur, aux côtés de gues et nous avons veillé à ce qu’il n’ait Côté face : un son grand ami le Prix Nobel de la paix aucune traduction officielle. C’est impor- Muhammad Yunus ; et enfin Emmanuel tant car en arabe, en chinois, en hindi ou en marché boursier Faber, le nouveau PDG du groupe, nommé français, les notions d’aliment, d’alimenta- le 18 octobre dernier. C’est le troisième tion, d’ingrédient et de nourriture ne sont à satisfaire, un dirigeant seulement en cinquante ans. pas les mêmes », explique-t-il à « l’Obs » au Danone a le sens de la durée. -

Danone / the Whitewave Foods Company Regulation (Ec)

EUROPEAN COMMISSION DG Competition Case M.8150 - DANONE / THE WHITEWAVE FOODS COMPANY Only the English text is available and authentic. REGULATION (EC) No 139/2004 MERGER PROCEDURE Article 6(1)(b) in conjunction with Art 6(2) Date: 16/12/2016 In electronic form on the EUR-Lex website under document number 32016M8150 EUROPEAN COMMISSION Brussels, 16.12.2016 C(2016) 8870 final In the published version of this decision, some information has been omitted pursuant to Article PUBLIC VERSION 17(2) of Council Regulation (EC) No 139/2004 concerning non-disclosure of business secrets and other confidential information. The omissions are shown thus […]. Where possible the information omitted has been replaced by ranges of figures or a general description. To the notifying party: Subject: Case M.8150 - DANONE / THE WHITEWAVE FOODS COMPANY Commission decision pursuant to Article 6(1)(b) in conjunction with Article 6(2) of Council Regulation No 139/20041 and Article 57 of the Agreement on the European Economic Area2 Dear Sir or Madam, (1) On 26 October 2016, the European Commission received a notification of a proposed concentration pursuant to Article 4 of Council Regulation (EC) No 139/2004 by which Danone S.A. ("Danone", France) acquires within the meaning of Article 3(1)(b) of the Merger Regulation sole control over The WhiteWave Foods Company ("WhiteWave", USA) (the "Transaction"). Danone is referred to as the Notifying Party, while Danone and WhiteWave are collectively referred to as the "Parties". 1 OJ L 24, 29.1.2004, p. 1 (the 'Merger Regulation'). With effect from 1 December 2009, the Treaty on the Functioning of the European Union ('TFEU') has introduced certain changes, such as the replacement of 'Community' by 'Union' and 'common market' by 'internal market'.