M/S AMPLEXOR INDIA PVT LTD REP

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Day Report 2015 – 2016

KUMARARANI MEENA MUTHIAH COLLEGE OF ARTS AND SCIENCE COLLEGE DAY REPORT 2015-16 12/03/2016 Respected Dr. Mrs. Meena Muthiah, Secretary and Correspondent, Respected Professor, Mr. Kiruba Shankar. , Members of the college governing council, Heads of Sister Institutions, special invitees, faculty members, parents and my dear students- Good evening. Every seed has in it the potential to become a forest Every rock in it has a potential to become a statue Every human being has in him the potential to become great. Get going. Move forward. Aim High. Plan a takeoff. Don't just sit on the runway and hope someone will come along and push the airplane. It simply won't happen. Change your attitude and gain some altitude. Believe me; you'll love it up here. “Be thankful for what you have; you'll end up having more. Cultivate an optimistic mind, use your imagination, always consider alternatives, and dare to believe that you can make possible what others think is impossible.” It gives me immense pleasure to present the report of the college 2015-16 Founded in 1996, Kumararani Meena Muthiah College of Arts and Science is one of the premier educational institutions of Chennai, affiliated to the University of Madras. Dr. Mrs. Meena Muthiah, Secretary and Correspondent, granddaughter of a great visionary late Raja Sir Annamalai Chettiar is a living legend and a pioneer in music, arts, education and health. Under her dynamic leadership the college strives to impart holistic education, with a clear vision of empowering, enhancing and enabling the students to possess the required skills in all facets of managerial, communication and life skills. -

Chennai South Commissionerate Jurisdiction

Chennai South Commissionerate Jurisdiction The jurisdiction of Chennai South Commissionerate \Mill cover the areas covering Chennai Corporation 7-one Nos. X to XV (From Ward Nos. 127 to 2OO in existence as on OL-O4-2OL7) and St.Thomas Mount Cantonment Board in the State of Tamil Nadu. Location I ulru complex, No. 692, Anna salai, Nandanam, chennai 600 o3s Divisions under the jurisdiction of Chennai South Commissionerate. Sl.No. Divisions 1. Vadapalani Division 2. Thyagaraya Nagar Division 3. Valasaravalkam Division 4. Porur Division 5. Alandur Division 6. Guindy Division 7. Advar Division 8. Perungudi Division 9. Pallikaranai Division 10. Thuraipakkam Divrsron 11. Sholinganallur Division -*\**,mrA Page 18 of 83 1. Vadapalani Division of Chennai South Commissionerate Location Newry Towers, No.2054, I Block, II Avenue, I2tn Main Road, Anna Nagar, Chennai 600 040 Jurisdiction Areas covering Ward Nos. I27 to 133 of Zone X of Chennai Corporation The Division has five Ranges with jurisdiction as follows: Name of the Range Location Jurisdiction Areas covering ward Nos. 127 and 128 of Range I Zone X Range II Areas covering ward Nos. 129 and130 of Zone X Newry Towers, No.2054, I Block, II Avenue, 12tr' Range III Areas covering ward No. 131 of Zone X Main Road, Anna Nagar, Chennai 600 040 Range IV Areas covering ward No. 132 of Zone X Range V Areas covering ward No. 133 of Zone X Page 1.9 of 83 2. Thvagaraya Nagar Division of Chennai South Commissionerate Location MHU Complex, No. 692, Anna Salai, Nandanam, Chennai 600 035 Jurisdiction Areas covering Ward Nos. -

GOVERNMENT of INDIA MINISTRY of FINANCE OFFICE of the PRINCIPAL CHIEF COMMISSIONER of CENTRAL TAX and CENTRAL EXCISE 26/1, Mahatma� Gandhi Road, Chennai —600 034

GOVERNMENT OF INDIA MINISTRY OF FINANCE OFFICE OF THE PRINCIPAL CHIEF COMMISSIONER OF CENTRAL TAX AND CENTRAL EXCISE 26/1, Mahatma Gandhi Road, Chennai —600 034. Phone No.: 044-28331010/5012 Fax No. 044-28331015 Email: [email protected] C.No.IV/16/452/2016-CCO(Tech IV) PF Date: 23.06.2017 MASTER CIRCULAR Sub: Instructions for Transitioning into GST formations With a view to ensure a smooth transition into GST formations the following Instructions are issued. 1. Office locations and Estate Officers: The Office locations have been specified vide Trade Notices No. 002/2017 dated 13.6.2017 and Trade Notice No.003/2017 dated 16.6.2017. The list of Estate officers for office locations in Chennai Zone (Annexure I) and Coimbatore Zone (Annexure II) are enclosed. 2. Successor formations for Infrastructure Purposes: The mapping of erstwhile Central Excise and Service Tax jurisdictions of Chennai Zone and Coimbatore Zone with the jurisdictions of reorganised formations is enclosed as Annexures III, IV and V. The successor field formations may take possession of the existing infrastructure. In case of new formations, Commissioner and his subordinates may ensure adequate infrastructure to all. 3. Handling of Existing Infrastructure: 3.1 It is stressed that infrastructural resources such as furniture, computers and other equipment shall not be removed from their current locations. Further, the consumables such as stationery shall also not be removed. 3.2 The administrative staff of the existing field formations shall continue to be the custodians of the infrastructural resources and shall ensure that all the existing resources, as per the Dead Stock Register, are handed over, under acknowledgment to an officer who would be nominated by the Head of Office of the proposed successor field formations. -

I Commissionerate

OFFICE OF THE CHIEF COMMISSIONER OF CENTRAL EXCISE, CHENNAI 26/1, MAHATHMA GANDHI ROAD, CHENNAI – 600 034 Phone No.28331010 Fax No.28331015/28331050 E Mail [email protected] Chennai – I Commissionerate Name & Address of the Name & Address of the Jurisdiction Office / Location of Appellate Authority CPIO Commissionerate Chennai I Shri.Peri Umasankar, Shri. Raja Asokan 1. All matters under Commissionerate Additional Commissioner Assistant Commissioner the charge of No. 26/1 (121), Mahatma of Central Excise Chennai – I Gandhi Road, (H.Qrs.), Commissionerate Nungambakkam, No.26/1(121), 2. All matters Chennai Mahatma Gandhi Road, pertaining to Tamil nadu Nungambakkam, Personnel & Pincode 600 034. Chennai Vigilance of Cadre Tamil nadu Control Authority, Ph: 044-28331001 Pincode 600 034. Chennai Zone Fax: 044-28331050 3. All matters Ph: 044-28331001 pertaining to the Email: Fax: 044-28331133 offices of the [email protected] Commissioner Email: (Appeals) and the [email protected] Commissioner (Adjudication), Chennai Chennai I Shri.Peri Umasankar, Shri R. David, All matters under his Commissionerate Additional Commissioner Deputy Commissioner, charge pertaining to No. 26/1 (121), Mahatma ‘AB’ Division, the jurisdiction of ‘AB’ Gandhi Road, Ananda Office Center, Division specified in Nungambakkam, 317, Anna Salai, the Trade Notice Chennai Teynampet, 45/2003 dated 03. Tamil nadu Chennai 04.2003 of Chennai I Pincode 600 034. Tamil nadu Commissionerate Pincode : 600 018. Ph: 044-28331001 Fax: 044-28331050 Ph: 044-24364592 Fax::044-24357063 Email: [email protected] Email: [email protected] Chennai I Shri.Peri Umasankar, Shri Washington Vijay All matters under his Commissionerate Additional Commissioner Singh Jacob, charge pertaining to No. -

Tamil Nadu Government Gazette

© GOVERNMENT OF TAMIL NADU [Regd. No. TN/CCN/467/2009-11. 2009 [Price : Rs. 170. 40 Paise. TAMIL NADU GOVERNMENT GAZETTE PUBLISHED BY AUTHORITY No. 28B] CHENNAI, WEDNESDAY, JULY 22, 2009 Aadi 6, Thiruvalluvar Aandu–2040 Part VI–Section 1 (Supplement) NOTIFICATIONS BY HEADS OF DEPARTMENTS, ETC. TAMIL NADU DENTAL COUNCIL NOTICE OF ELECTION TO THE DENTAL COUNCIL OF INDIA, NEW DELHI AND TO THE TAMIL NADU DENTAL COUNCIL, CHENNAI (Ref. No. TNDC/GCP/PER/09-2.) No. VI(1)/218/2009. Notice under Dental Council of India Election Regulations, 1952—Section 3(3) AND Notice under Tamil Nadu Dental Council Rules—G.O. No. 2638/Health and Family Welfare Department/Government of Tamil Nadu, dated 24-07-1950 — Election Rules — Section 2(3) Election of one member to the Dental Council of India under Section 3(a) AND Election of four members to the Tamil Nadu Dental Council under Section 21(a) AND Election of four members to the Tamil Nadu Dental Council under Section 21(b) of The Dentists Act, 1948. The Preliminary Electoral Roll as on 30th June 2009, showing the particulars of names of the registered Dentists to vote in the elections mentioned above, is published in the Tamil Nadu Government Gazette, Issue No. 28B, dated 22nd July 2009. Claims and Objections relating to the entries or omissions in the Preliminary Electoral Roll, with proof, shall be sent by registered post only to the undersigned on or before 31st August 2009 at 5 p.m. Claims and Objections received after the said date will not be accepted. -

To Download the Judgment

WWW.LIVELAW.IN Judgment dt. 16.10.2020 in WA No.53 of 2020 [Asst. Commissioner of CGST & Central Excise v. Sutherland Global Services Private Limited] 1 / 135 IN THE HIGH COURT OF JUDICATURE AT MADRAS RESERVED ON : 01.10.2020 PRONOUNCED ON : 16.10.2020 CORAM THE HON'BLE DR.JUSTICE VINEET KOTHARI AND THE HON'BLE MR.JUSTICE KRISHNAN RAMASAMY Writ Appeal No.53 of 2020 1. Assistant Commissioner of CGST and Central Excise Guindy Division, 3rd Floor EVR Periyar Maligai 690, Anna Salai, Nandanam Chennai 600 035. 2. Commissioner CGST and Central Excise MHU Complex, V Floor Anna Salai, Nandanam Chennai 600 035. 3. Union of India rep. by its Secretary Ministry of Finance Department of Revenue North Block New Delhi 110 001. 4. Central Board of Excise and Customs 815, Nehru Place, Market Road New Delhi 100 019. .. Appellants Vs. 1. Sutherland Global Services Private Limited 45-A, Velacherry Main Road http://www.judis.nic.in WWW.LIVELAW.IN Judgment dt. 16.10.2020 in WA No.53 of 2020 [Asst. Commissioner of CGST & Central Excise v. Sutherland Global Services Private Limited] 2 / 135 Vijayanagaram Chennai 600 042. 2. Government of Tamil Nadu rep. by its Secretary State Tax Department Fort St. George Chennai 600 009. 3. The Chairman GSTN, East Wing, World Mark-1 4th Floor, Tower B, Aerocity Indira Gandhi International Airport New Delhi 110 037. .. Respondents ----- Appeal under Clause 15 of the Letters Patent filed against the order dated 05.09.2019 made in W.P.No.4773 of 2018 on the file of this Court. -

New Year Calendar -.:: Universal Service

TELEPHONE NUMBERS OF PUBLIC UTILITY SERVICES Useful to the Residents of Kottur Gardens ADYAR CANCER HOSPITAL 22350340 AMBULANCE Ambulance Emergency 108/102* Apollo Ambulance 1068 Child Trust Hospital (For Children) 28259601/28277487 Flying Squad Ambulance Service 26474100/26441217 Madras Medical Mission 26561801/26565961 MIOT Accident Rescue 22492288/22493636 Sri Ramachandra Emergency Medical Service 24768402/8027 Sundaram Medical Foundation 26268844 Trauma Care Consortium 28150700/28150311 Voluntary Health Services St. John Ambulance 28194630 Sankara Nethralaya 28271036 BLOOD BANKS Apollo Hospitals 28294870 Child Trust Hospital 28259601 Govt. General Hospital 25363131 Govt. Royapettah Hospital 28533051 Institute of Child Health Hospital 28251135 Madras Medical Mission 26565961 Southern Railway Head Qtrs. Hospital Blood Bank 26461008 Sri Ramachandra Hospital Blood Bank 24768017 Voluntary Health Services 22541972/2829 Jeevan Blood Bank 65850850 Lions Club 28414949/28415959 The Tamil Nadu Dr. MGR Medical University 22301871 HOSPITAL - GOVERNMENT Govt.General Hospital 25363131/25363139 Govt. Royapettah Hospital 28483051/52/53 Govt. Stanley Hospital 25214941 Govt. Dental Hospital 25340441 Institute of Rehabilitation Medicine, K.K.Nagar 24891687/1668 2678 Railway Hospital 26461256 61 Govt. Hospital, Saidapet 24358753 HOSPITALS - PRIVATE Andhra Mahila Sabha Hospital 24938311 Apollo Hospital 28293333/0200 Billroth Hospital (Chennai Kaliappa) 24936390/6184/6157 Child Trust Hospital 28277487 Madras Medical Mission 26565961 MIOT Hospital 22492288/3636 -

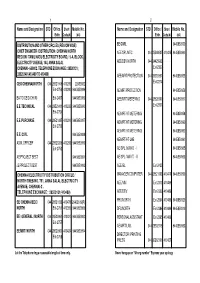

Name and Designation STD Office / Short Mobile No. Name and Designation STD Office / Short Mobile No

1 2 Name and Designation STD Office / Short Mobile No. Name and Designation STD Office / Short Mobile No. Extn. Code(#) (#4) Extn. Code(#) (#4) DISTRIBUTION AND OTHER CIRCLES (REGION WISE): EE/CIVIL 9445850939 CHIEF ENGINEER / DISTRIBUTION / CHENNAI NORTH AEE/SPL/MTC 044 25548507 410425 9445850964 REGION / TAMIL NADU ELECTRICITY BOARD, / 5-A, BLOCK, ELECTRICITY AVENUE, 144, ANNA SALAI, AEE/DEV/NORTH 044 24425603 CHENNAI - 600002. TELEPHONE EXCHANGE: 28520131; Ext-2309 28520140 (410489 TO 410498) AEE/MRT/PROTECTION 044 28520961 9445850955 CE/D/CHENNAI/NORTH 044 28521949 410295 22455582 Ext-2274 Ext-2756 410290 9445850999 AE/MRT/PROTECTION 9445850956 EA TO CE/D/CH (N) Ext-2457 9445850989 AEE/MRT/METERING 044 28520961 9445850957 E.E./TECHNICAL 044 28520411 410292 9445850990 Ext-2501 Ext-2754 AE/MRT/HT/METERING 9445850958 E.E./PURCHASE 044 28521087 410291 9445850987 AE/MRT/HT METERING 9445850960 Ext-2753 AE/MRT/HT/METERING 9445850962 E.E./CIVIL 9445850988 AE/MRT/HT-LAB 9445850961 ADM. OFFICER 044 28523269 410293 9445850986 Ext-2752 AE/SPL. MAINT. - I 9445850965 AE/PROJECT BEST 9445850991 AE/SPL. MAINT. - II 9445850966 JE/PROJECT BEST 9445850992 AEE/GL Ext-2420 CHENNAI ELECTRICITY DISTRIBUTION CIRCLE / MANAGER/COMPUTER 044 28521963 410476 9445850899 NORTH/TNEB/NO. 791, ANNA SALAI, ELECTRICITY AEE/MM Ext-2313 410489 AVENUE, CHENNAI-2 . TELEPHONE EXCHANGE : 28520131(410489) AEE/DEV Ext-2309 410489 SE/ CHENNAI EDC / 044 28521833 410478 26402619(R) PRO/NORTH Ext-2504 410489 9445850929 NORTH Ext-2751 410355 9445850909 DFC/NORTH Ext-2386 410489 9445850919 EE / GENERAL / NORTH 044 28520961 410424 9445850900 PERSONAL ASSISTANT Ext-2365 410489 Ext-2757 AE/MRT/LAB. -

1) Network Hospital

1) Network Hospital Sr.No. Name of Hospital Address City State Pin Apollo Hospitals - New No.1, Old No.28, Platform 1 Sheshadripuram (U/o AHEL) Road, Near Mantri Mall, Bangalore Karnataka Sheshadripuram 560020 Aster CMI Hospital No. 43/2, NH-7, Hebbal, 2 Sahakara Nagar,, Bangalore Bangalore Karnataka Kodigehalli Gate, 560092 3 Bangalore Baptist Hospital Bellary Road,Hebbal., Bangalore Karnataka 560024 BGS Global Hospital BGS Health & Education City, 4 No # 67,Uttarahalli road, Bangalore Karnataka Kengeri, 560060 Columbia Asia - Sarjapura Survey No.46/2, Ward No.150,, 5 Bangalore Karnataka Road Ambalipura 560102 Columbia Asia Hospital - Sy No 10P & 12P 6 Whitefield Ramagondanhalli Village, Bangalore Karnataka Varthur Hobli Whitefield 560066 Columbia Asia Medical Kirloskar Buisiness Park Bellary 7 Bangalore Karnataka Centre Road, 560024 COLUMBIA ASIA REFERRAL 26/1,80 feet,Dr. Rajkumar 8 Bangalore Karnataka HOSPITAL- YESHWA Road, Malleshwaram(west) 560055 Fortis Hospitals Ltd - 9 154/9, Bannergatta, Bangalore Karnataka Bannerghatta Road 560076 Fortis Hospitals Ltd - 10 14, Cunningham Road, Bangalore Karnataka Cunningham Road 560052 Fortis Hospitals Ltd - 23 ,80feet Rd,Gurukripalaya 11 Nagarbhavi layout, opp to fab mall,2nd Bangalore Karnataka stage,Nagarbhavi 560072 12 Manipal Hospital 98, Rustom Bagh, Airport Road Bangalore Karnataka 560017 Manipal Hospitals #143, 212-215, EPIP Industrial 13 Whitefield Pvt. Ltd. (MHEPL) Area, Hoodi Village, KR Puram Bangalore Karnataka Hobli 560066 Narayana Hrudayalaya No. 258 / A, Bommasandra 14 Industrial Area, Hosur main Bangalore Karnataka road, Anekal Taluk 560099 People Tree Hospital(Unit of #2, Service Road, Tumkur Road, 15 TMI Health Care Pvt.) (NH-4), Opp.Hotel Vivanta, Bangalore Karnataka Yeshwantpur 560022 Sagar Hospital - Bangalore Shavige Malleshwara Hills, Behind DSI Campus, 16 Bangalore Karnataka Kumaraswamy Layout,Banashankari 560078 Sakra World Hospital No. -

TRADE NOTICE No. 002/2017 Dated 20-06-2017

Phone No. 28331010/28335012 Fax No. 044-28331050/1015 E Mail : ccu-cexchnaxiic.in GOVERNMENT OF INDIA MINISTRY OF FINANCE DEPARTMENT OF REVENUE OFFICE OF THE PRINCIPAL CHIEF COMMISSIONER OF CENTRAL EXCISE CHENNAI CENTRAL EXCISE ZONE 26/1, MAHATHMA GANDHI ROAD, CHENNAI - 600 034 GST Trade Notice No.002/2017 Date: 20-06-2017 Sub: CGST - Jurisdiction of Principal Chief Commissioner of Central Tax and Principal Commissioner / Commissioner / Additional Commissioner of Central Tax under the Central Goods & Services Act, 2017 and the jurisdiction & location of the Commissionerates in the State of Tamilnadu and Union Territory of Puducherry with effect from 22.06.2017 - Notification No.2/ 2017-Central Tax dated 19.06.2017 - Reg. Vide Notification No.2/2017-Central Tax dated 19.06.2017 issued by the Central Board of Excise & Customs under Section 5 of the Central Goods and Services Tax Act, 2017 and Section 3 of the Integrated Goods and Services Tax Act, 2017, the jurisdiction of Principal Chief Commissioner of Central Tax / Principal Commissioner / Commissioner / Additional Commissioner of Central Tax under the Central Goods & Services Tax Act, 2017 and the jurisdiction of the Commissionerates which will function under the Administrative control of the Principal Chief Commissioner, Chennai Zone, covering the State of Tamilnadu and Union Territory of Puducherry with effect from 22.06.2017 has been notified. Accordingly, the Commissionerates under the jurisdiction of the Principal Chief Commissioner of Central Tax, their geographical jurisdiction and that of Sub Commissionerate, Divisions / Ranges along with their location is furnished in the Annexures to this Trade Notice: 2. The Trade & Industry Associations/Chambers of Commerce are requested t bring the contents of the Trade Notice to the notice of all their members. -

IN the HIGH COURT of JUDICATURE at MADRAS DATED: 05.09.2019 CORAM: the HONOURABLE Dr. JUSTICE ANITA SUMANTH Writ Petition No.477

W.P.No.4773 of 2018 IN THE HIGH COURT OF JUDICATURE AT MADRAS DATED: 05.09.2019 CORAM: THE HONOURABLE Dr. JUSTICE ANITA SUMANTH Writ Petition No.4773 of 2018 & WMP Nos.5916 & 13148 of 2018 Sutherland Global Services Private Limited, 45-A Velachery Main Road, Vijayanagaram, Chennai 600 042 ..................................... Petitioner vs. 1. Assistant Commissioner CGST and Central Excise, Guindy Division, 3rd floor, EVR Periyar Maligai, 690, Anna Salai, Nandanam, Chennai-600 035. 2. Commissioner of CGST and Central Excise, MHU Complex, V Floor, Anna Salai, Nandanam, Chennai-600 035. 3. Government of Tamil Nadu, Represented by its Secretary, State Tax Department, Fort St. George, Chennai – 600 009. 4. Union of India, Represented by its Secretary, Ministry of Finance, Department of Revenue, North Block, New Delhi – 110 001. 5. Central Board of Excise and Customs, 815, Nehru Place, Market Road, New Delhi -110 019. 6. The Chairman, GSTN, East Wing, World Mark-1, 4th Floor, Tower B, Aerocity, Indira Gandhi International Airport, New Delhi-110 037 ..................... Respondents Prayer: Petition filed under Article 226 of the Constitution of India praying for issuance of a Writ of Certiorari to quash the letter in C.No.IV/1602.2018-GST Tech http://www.judis.dnica.itned 14.02.2018 issued by the Assistant Commissioner of GST and Central Excise, Guindy Division and direct the respondents to enable the petitioner to avail and 1/27 W.P.No.4773 of 2018 utilize the Credit pertaining to Education Cess, Secondary and Higher Education Cess and Krishi Kalyan Cess. For Petitioner : Mr. Raghavan Ramabadran For Respondents : Ms.Aparna Nandakumar – R1, 2, 4 and 5 Mr.M.Hariharan, AGP – R3 Mr.V.Sundareswaran, Standing Counsel – R6 O R D E R The petitioner prays for a writ of Certiorari quashing letter dated 14.02.2018 issued by the 1st respondent Assessing Officer. -

Metropolitan Transport Corporation (Chennai) Limited Chennai – 600 002

METROPOLITAN TRANSPORT CORPORATION (CHENNAI) LIMITED CHENNAI – 600 002. (A GOVERNMENT OF TAMILNADU UNDERTAKING) MANUAL UNDER RIGHT TO INFORMATION ACT – 2005 INDEX Sl. No. Details of Information Page Number 1. Introduction 1 2. Designation of Public Information Officer/ 2 Assistant Public Information Officer/ Appellate Authority. 3. Procedure and fee structure. 3 4. Organisation details and departments. 4 5. Officers /Branches with Phone number 7 Details 6. General information on area of operation, 11 different types of routes. 7. Student concession tickets, Monthly season 12 tickets, Travel as you please ticket. 8. Chartered trip, hiring of buses and luggage 13 fare. 9. Classification of routes. 15 10. Details of Night services. 56 11. Issue of Free passes to Physically 57 Handicapped, Mentally Retarded, Blind, Freedom Fighters. 12. Public Complaints, Lost property details. 59 13 Buses to private parties on hire basis. 60 14 Free passes to students up to 12th Standard. 61 15 Accident Branch details 62 INTRODUCTION In order to promote transparency and accountability in the working of every Public Authority and to empower the citizens to secure access to information under the control of each public authority, the Government of India have enacted “The Right to Information Act 2005”, (RTI ACT) which came into force on 15.06.2005. In accordance with the provisions of section 4(1) (b) of this Act, the Metropolitan Transport Corporation (Chennai) Limited has brought out this Manual for information and guidance of the general public. The purpose of this manual is to inform the general public about this department’s organizational set up, functions and duties of its officers, records and documents available with the department.