Devolved Taxes Legislation Working Group

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tax Dictionary T

Leach’s Tax Dictionary. Version 9 as at 5 June 2016. Page 1 T T Tax code Suffix for a tax code. This suffix does not indicate the allowances to which a person is entitled, as do other suffixes. A T code may only be changed by direct instruction from HMRC. National insurance National insurance contribution letter for ocean-going mariners who pay the reduced rate. Other meanings (1) Old Roman numeral for 160. (2) In relation to tapered reduction in annual allowance for pension contributions, the individual’s adjusted income for a tax year (Finance Act 2004 s228ZA(1) as amended by Finance (No 2) Act 2015 Sch 4 para 10). (3) Tesla, the unit of measure. (4) Sum of transferred amounts, used to calculate cluster area allowance in Corporation Tax Act 2010 s356JHB. (5) For the taxation of trading income provided through third parties, a person carrying on a trade (Income Tax (Trading and Other Income) Act 2005 s23A(2) as inserted by Finance (No 2) Act 2017 s25(2)). (6) For apprenticeship levy, the total amount of levy allowance for a company unit (Finance Act 2016 s101(7)). T+ Abbreviation sometimes used to indicate the number of days taken to settle a transaction. T$ (1) Abbreviation: pa’anga, currency of Tonga. (2) Abbreviation: Trinidad and Tobago dollar. T1 status HMRC term for goods not in free circulation. TA (1) Territorial Army. (2) Training Agency. (3) Temporary admission, of goods for Customs purposes. (4) Telegraphic Address. (5) In relation to residence nil rate band for inheritance tax, means the amount on which tax is chargeable under Inheritance Tax Act 1984 s32 or s32A. -

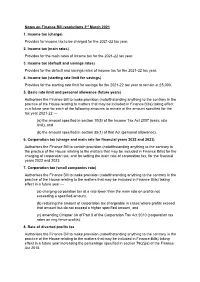

Notes on Finance Bill Resolutions 3Rd March 2021 1

Notes on Finance Bill resolutions 3rd March 2021 1. Income tax (charge) Provides for income tax to be charged for the 2021-22 tax year. 2. Income tax (main rates) Provides for the main rates of income tax for the 2021-22 tax year. 3. Income tax (default and savings rates) Provides for the default and savings rates of income tax for the 2021-22 tax year. 4. Income tax (starting rate limit for savings) Provides for the starting rate limit for savings for the 2021-22 tax year to remain at £5,000. 5. Basic rate limit and personal allowance (future years) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to matters that may be included in Finance Bills) taking effect in a future year for each of the following amounts to remain at the amount specified for the tax year 2021-22 — (a) the amount specified in section 10(5) of the Income Tax Act 2007 (basic rate limit), and (b) the amount specified in section 35(1) of that Act (personal allowance). 6. Corporation tax (charge and main rate for financial years 2022 and 2023) Authorises the Finance Bill to contain provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) for the charging of corporation tax, and for setting the main rate of corporation tax, for the financial years 2022 and 2023. 7. Corporation tax (small companies rate) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) taking effect in a future year — (a) charging corporation tax at a rate lower than the main rate on profits not exceeding a specified amount, (b) reducing the amount of corporation tax chargeable in cases where profits exceed that amount but do not exceed a higher specified amount, and (c) amending Chapter 3A of Part 8 of the Corporation Tax Act 2010 (corporation tax rates on ring fence profits). -

Number 18 of 2016 Finance Act 2016

Number 18 of 2016 Finance Act 2016 Number 18 of 2016 FINANCE ACT 2016 CONTENTS PART 1 UNIVERSAL SOCIAL CHARGE, INCOME TAX, CORPORATION TAX AND CAPITAL GAINS TAX CHAPTER 1 Interpretation Section 1. Interpretation (Part 1) CHAPTER 2 Universal Social Charge 2. Amendment of section 531AN of Principal Act (rate of charge) CHAPTER 3 Income Tax 3. Exemption in respect of certain expense payments for resident relevant directors 4. Amendment of section 472AB of Principal Act (earned income tax credit) 5. Amendment of section 466A of Principal Act (home carer tax credit) 6. Fisher tax credit 7. Amendment of section 480A of Principal Act (relief on retirement for certain income of certain sportspersons) 8. Amendment of section 477B of Principal Act (home renovation incentive) 9. Help to Buy 10. Amendment of section 825C of Principal Act (special assignee relief programme) 11. Amendment of section 823A of Principal Act (deduction for income earned in certain foreign states) 12. Amendment of section 472AA of Principal Act (relief for long-term unemployed starting a business) 13. Amendment of section 216A of Principal Act (rent-a-room relief) 14. Retirement benefits 1 [No. 18.] Finance Act 2016. [2016.] CHAPTER 4 Income Tax, Corporation Tax and Capital Gains Tax 15. Living City Initiative 16. Amendment of section 97 of Principal Act (computational rules and allowable deductions) 17. Amendment of section 285A of Principal Act (acceleration of wear and tear allowances for certain energy-efficient equipment) 18. Amendment of section 657 of Principal Act (averaging of farm profits) 19. Amendment of section 288 of Principal Act (balancing allowances and balancing charges) 20. -

Finance Act 2009 (C.10) Which Received Royal Assent on 21 July 2009

These notes refer to the Finance Act 2009 (c.10) which received Royal Assent on 21 July 2009 FINANCE ACT 2009 —————————— EXPLANATORY NOTES INTRODUCTION 1. These notes relate to the Finance Act 2009 that received Royal Assent on 21st July 2009. They have been prepared by HM Revenue and Customs in partnership with HM Treasury in order to assist the reader in understanding the Act. They do not form part of the Act and have not been endorsed by Parliament. 2. The notes need to be read in conjunction with the Act. They are not, and are not meant to be, a comprehensive description of the Act. So, where a section or part of a section does not seem to require any explanation or comment, none is given. 3. The Act is divided into nine parts: (1) Charges, rates, allowances, etc (2) Income tax, corporation tax and capital gains tax (3) Pensions (4) Value Added Tax (5) Stamp taxes (6) Oil (7) Administration (8) Miscellaneous (9) Final Provisions The Schedules follow the sections on the Act. 4. Terms used in the Act are explained in these notes where they first appear. Hansard references are provided at the end of the notes. 1 These notes refer to the Finance Act 2009 (c.10) which received Royal Assent on 21 July 2009 SECTION 1: INCOME TAX: CHARGE AND MAIN RATES FOR 2009-10 SUMMARY 1. Section 1 imposes the income tax charge for 2009-10 and sets the basic rate of income tax at 20 per cent and the higher rate at 40 per cent. -

Customs and Excise Acts (Application) (Amendment) Order 2019 Index

Customs and Excise Acts (Application) (Amendment) Order 2019 Index c CUSTOMS AND EXCISE ACTS (APPLICATION) (AMENDMENT) ORDER 2019 Index Article Page 1 Title ................................................................................................................................... 3 2 Commencement .............................................................................................................. 3 3 Interpretation ................................................................................................................... 3 4 Application ...................................................................................................................... 3 5 Amendment of the principal Order ............................................................................. 4 6 Amendment of Customs and Excise Acts (Application) Order 2011 .................... 13 SCHEDULE 15 EXCEPTIONS, ADAPTATIONS AND MODIFICATIONS SUBJECT TO WHICH PART 3 OF SCHEDULE 7, PART 2 OF SCHEDULE 8 AND PARAGRAPH 9 OF SCHEDULE 9 TO THE TAXATION (CROSS-BORDER TRADE) ACT 2018 (C.22 OF PARLIAMENT) SHALL HAVE EFFECT IN THE ISLAND 15 GENERAL MODIFICATION 15 SCHEDULE 7 – IMPORT DUTY: CONSEQUENTIAL AMENDMENTS 15 PART 3 – AMENDMENTS OF OTHER ENACTMENTS 15 SCHEDULE 8 – VAT AMENDMENTS CONNECTED WITH WITHDRAWAL FROM THE EU 17 PART 2 – AMENDMENTS TO OTHER ENACTMENTS 17 SCHEDLE 9 – EXCISE DUTY AMENDMENTS CONNECTED WITH WITHDRAWAL FROM EU 18 PARAGRAPH 9 18 ANNEX 19 ENDNOTES 24 TABLE OF ENDNOTE REFERENCES 24 c SD No.2019/0083 Page 1 Customs and Excise Acts (Application) -

Reports of Cases

Report s of C ases OPINION OF ADVOCATE GENERAL WATHELET 1 delivered on 5 September 2013 Case C-362/12 Test Claimants in the Franked Investment Income Group Litigation v Commissioners of Inland Revenue, Commissioners for Her Majesty’s Revenue and Customs (Request for a preliminary ruling from the Supreme Court of the United Kingdom (United Kingdom)) (Recovery of national taxes which are contrary to European Union law — Limitation period for instituting proceedings — National legislation curtailing the limitation period with retroactive effect and without advance notice) I – Introduction 1. This request for a preliminary ruling is the third such request made to the Court in the context of a group action brought before the United Kingdom courts by the Test Claimants in the Franked Investment Income Group Litigation (‘the Test Claimants’) – companies belonging to the British American Tobacco group and the Aegis group – concerning the tax treatment of dividends paid to parent companies established in the United Kingdom by subsidiaries established abroad. 2. The first of the two earlier requests was made to the Court on 30 October 2004 by the High Court of Justice (England & Wales), Chancery Division (United Kingdom), and concerned the compatibility of 2 the tax treatment of those dividends with the fundamental freedoms entrenched in the FEU Treaty. Following the first ruling made by the Court in the context of this litigation, on 12 December 2006, the national court decided, by judgment of 27 November 2008, to refer questions seeking clarification 3 as to the proper interpretation of that ruling. 3. The Test Claimants lodged an appeal against the judgment of 27 November 2008 before the Court 4 of Appeal (England & Wales), which, by judgment of 23 February 2010, confirmed the decision of the High Court of Justice (England & Wales), Chancery Division, to make a second request to the Court for a preliminary ruling. -

Finance Act 2004

Finance Act 2004 CHAPTER 12 CONTENTS PART 1 EXCISE DUTIES Tobacco products duty 1 Rates of tobacco products duty Alcoholic liquor duties 2 Rate of duty on beer 3 Rates of duty on wine and made-wine 4 Duty stamps for spirits etc Hydrocarbon oil etc duties 5Rates 6 Road fuel gas 7 Sulphur-free fuel 8 Definition of “fuel oil” 9 Mixing of rebated oil 10 Bioethanol 11 Biodiesel 12 Fuel substitutes 13 Warehousing 14 Treatment of certain energy products Betting and gaming duties 15 General betting duty: pool betting 16 Rates of gaming duty ii Finance Act 2004 (c. 12) Amusement machine licence duty 17 Amusement machine licence duty: rates Vehicle excise duty 18 Fee for payment of duty by credit card PART 2 VALUE ADDED TAX 19 Disclosure of VAT avoidance schemes 20 Groups 21 Reverse charge on gas and electricity supplied by persons outside UK 22 Use of stock in trade cars for consideration less than market value PART 3 INCOME TAX, CORPORATION TAX AND CAPITAL GAINS TAX CHAPTER 1 INCOME TAX AND CORPORATION TAX CHARGE AND RATE BANDS Income tax 23 Charge and rates for 2004-05 24 Personal allowances for those aged 65 or more Corporation tax 25 Charge and main rate for financial year 2005 26 Small companies’ rate and fraction for financial year 2004 27 Corporation tax starting rate and fraction for financial year 2004 28 The non-corporate distribution rate Trusts 29 Special rates of tax applicable to trusts CHAPTER 2 CORPORATION TAX: GENERAL Transfer pricing 30 Provision not at arm’s length: transactions between UK taxpayers etc 31 Exemptions for dormant companies and small and medium-sized enterprises 32 Special applications of paragraph 6 of Schedule 28AA to the Taxes Act 1988 Penalties: temporary relaxation 33 Provision not at arm’s length: temporary relaxation of liability to penalty Finance Act 2004 (c. -

———————— an BILLE AIRGEADAIS 2007 FINANCE BILL 2007 ———————— Mar a Tionscnaıodh As Initiated E

———————— AN BILLE AIRGEADAIS 2007 FINANCE BILL 2007 ———————— Mar a tionscnaı´odh As initiated ———————— EXPLANATORY MEMORANDUM ———————— PART 1 Income Tax, Corporation Tax and Capital Gains Tax Chapter 1 Interpretation Section 1 contains a definition of ‘‘Principal Act’’ i.e. the Taxes Consolidation Act 1997, for the purposes of Part 1 of the Bill relating to income tax, corporation tax and capital gains tax. Chapter 2 Income Tax Section 2 sets out the standard rate bands which are to apply for the year 2007 and subsequent years. The section provides for increases in the bands as follows: Tax Year 2006 Tax year 2007 and subsequent years \\ Single person 32,000 34,000 Widowed/single parent 36,000 38,000 Married couple one earner 41,000 43,000 two earners 64,000 68,000 In the case of married couples with two incomes, the standard rate band is transferable between them up to the extent of the band applicable to a one income married couple i.e. \43,000. The second spouse may avail of the balance of the \68,000 band, that is, \25,000. Section 3 and Schedule 1 provide for increases in personal reliefs announced in the Budget for the year 2007 and subsequent years as follows:— 1 Relief Tax credit Tax credit for for the year the year 2007 2006 and subsequent years \\ Basic personal tax credit married person 3,260 3,520 widowed person bereaved in year of assessment 3,260 3,520 single person 1,630 1,760 Additional tax credit for certain widowed persons 500 550 One parent family tax credit 1,630 1,760 Widowed parent tax credit 1st year 3,100 3,750 2nd year 2,600 3,250 3rd year 2,100 2,750 4th year 1,600 2,250 5th year 1,100 1,750 Age tax credit married person 500 550 single person 250 275 Incapacitated child tax credit 1,500 3,000 Blind person’s tax credit blind person 1,500 1,760 both spouses blind 3,000 3,520 Employee tax credit 1,490 1,760 The schedule includes specific legislation necessary to give effect to the changes in each of the relevant sections of the Taxes Consoli- dation Act 1997. -

Finance Bill Explanatory Notes

Finance Bill Explanatory Notes 19 March 2020 Introduction ............................................................................................................................................ 5 Part 1: Income Tax, Corporation Tax and Capital Gains Tax .......................................................... 6 Clause 1: Income tax charge for tax year 2020 - 21 ............................................................................ 7 Clause 2: Main rates of income tax for tax year 2020- 21 ................................................................. 8 Clause 3: Default and savings rates of income tax for tax year 2020- 21 ........................................ 9 Clause 4: Starting rate limit for savings for tax year 2020-21 ........................................................ 10 Clause 5: Main rate of corporation tax for financial year 2020 ...................................................... 11 Clause 6: Corporation tax: charge and main rate for financial year 2021 .................................... 12 Clause 7: Determining the appropriate percentage for a car: tax year 2020-21 onwards .......... 13 Clause 8: Determining the appropriate percentage for a car: tax year 2020-21 only .................. 15 Clause 9: Determining the appropriate percentage for a car: tax year 2021-22 only .................. 17 Clause 10: Apprenticeship bursaries paid to persons leaving local authority care .................... 19 Clause 11: Tax treatment of certain Scottish social security benefits ........................................... -

FINANCE ACT 2003 ———————— ARRANGEMENT of SECTIONS PART 1 Income Tax, Corporation Tax and Capital Gains Tax Chapter 1 Interpretation Section 1

———————— Number 3 of 2003 ———————— FINANCE ACT 2003 ———————— ARRANGEMENT OF SECTIONS PART 1 Income Tax, Corporation Tax and Capital Gains Tax Chapter 1 Interpretation Section 1. Interpretation (Part 1). Chapter 2 Income Tax 2. Age exemption. 3. Employee tax credit. 4. Amendment of section 122 (preferential loan arrangements) of Principal Act. 5. Amendment of section 126 (tax treatment of certain benefits payable under Social Welfare Acts) of Principal Act. 6. Application of PAYE to perquisites, benefits-in-kind, etc. 7. Payment of tax in respect of share options in certain cir- cumstances. 8. Payment of tax under section 128 (tax treatment of directors of companies and employees granted rights to acquire shares or other assets) of Principal Act. 9. Amendment of section 244 (relief for interest paid on certain home loans) of Principal Act. 10. Amendment of Chapter 1 (payments in respect of pro- fessional services by certain persons) of Part 18 of, and Schedule 13 to, Principal Act. 11. Amendment of section 65 (Cases I and II: basis of assessment) of Principal Act. [No. 3.] Finance Act 2003. [2003.] Section 12. Restriction of reliefs where individual is not actively partici- pating in certain trades. 13. Income tax: ring-fence on use of certain capital allowances on certain industrial buildings and other premises. 14. Pension arrangements. Chapter 3 Income Tax, Corporation Tax and Capital Gains Tax 15. Amendment of Part 16 (income tax relief for investment in corporate trades — business expansion scheme and seed capital scheme) of Principal Act. 16. Rental income: restriction of relief for certain interest. 17. Claims for repayment, interest on repayments and time limits for assessment. -

Explanatory Notes to Finance Bill 2020

Finance Bill Explanatory Notes 19 March 2020 Introduction ............................................................................................................................................ 5 Part 1: Income Tax, Corporation Tax and Capital Gains Tax .......................................................... 6 Clause 1: Income tax charge for tax year 2020 - 21 ............................................................................ 7 Clause 2: Main rates of income tax for tax year 2020- 21 ................................................................. 8 Clause 3: Default and savings rates of income tax for tax year 2020- 21 ........................................ 9 Clause 4: Starting rate limit for savings for tax year 2020-21 ........................................................ 10 Clause 5: Main rate of corporation tax for financial year 2020 ...................................................... 11 Clause 6: Corporation tax: charge and main rate for financial year 2021 .................................... 12 Clause 7: Determining the appropriate percentage for a car: tax year 2020-21 onwards .......... 13 Clause 8: Determining the appropriate percentage for a car: tax year 2020-21 only .................. 15 Clause 9: Determining the appropriate percentage for a car: tax year 2021-22 only .................. 17 Clause 10: Apprenticeship bursaries paid to persons leaving local authority care .................... 19 Clause 11: Tax treatment of certain Scottish social security benefits ........................................... -

Finance (No. 3) Bill Explanatory Notes

Finance (No. 3) Bill Explanatory Notes 7 November 2018 Introduction ............................................................................................................................. 5 Part 1: Direct taxes .................................................................................................................. 6 Clause 1: Income tax charge for tax year 2019-20 .............................................................. 7 Clause 2: Corporation tax charge for financial year 2020 ................................................. 8 Clause 3: Main rates of income tax for tax year 2019-20 ................................................... 9 Clause 4: Default and savings rates of income tax for tax year 2019-20 ....................... 10 Clause 5: Basic rate limit and personal allowance ........................................................... 11 Clause 6: Starting rate limit for savings for tax year 2019-20 ......................................... 13 Clause 7: Optional remuneration arrangements: arrangements for cars and vans .... 14 Clause 8: Exemption for benefit in form of vehicle-battery charging at workplace ... 17 Clause 9: Exemptions relating to emergency vehicles .................................................... 19 Clause 10: Exemption for expenses related to travel ....................................................... 22 Clause 11: Beneficiaries of tax-exempt employer-provided pension benefits ............. 24 Clause 12: Tax treatment of social security income ........................................................