Housing Coop Model

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SAN REMO APARTMENTS, 145- 146 Central Park West, Manhattan

Landmarks Preservation Commission March 31, 1987; Designation List 188 LP-1519 SAN REMO APARTMENTS, 145- 146 Central Park West, Manhattan. Built 1929-30; architect Emery Roth. Landmark Site: Borough of Manhattan Tax Map Block 1127, Lot 29. On September 11, 1984, the Landmarks Preservation Commission held a pub 1 i c hearing on the proposed designation as a Landmark of the San Remo Apartments and the proposed designation of the related Landmark Site (Item No. 13). The hearing had been duly advertised in accordance with the prov1s1ons of law. Eleven witnesses spoke in favor of designation, and one letter was received in support of designation. DESCRIPTION AND ANALYSIS Summary Soaring over Central Park, the profile of the San Remo is among the most important components of the magnificent skyline of Central Park West. The first of the twin-towered buildings which give Central Park West its distinctive silhouette, and one of the New York's last grand apartment houses built in the pre-Depression era, it was designed by Emery Roth, then at the pinnacle of his career as a specialist in apartment house architecture. A residential skyscraper in cl ass i cal garb, the San Remo epitomizes Roth's abi 1 i ty to combine the traditional with the modern, an urbane amalgam of luxury and convenience, decorum and drama. Development of Central Park West Central Park West, the northern continuation of Eighth Avenue bordering on the park, is today one of New York's finest residential streets, but in the mid- nineteenth century it was a rural and inhospitable outpost , notable for its rocky terrain , browsing goats and ramshackle shanties. -

Central Park West

CENTRAL PARK WEST- WEST 73rd - 7 *• t h STREET HISTORIC DISTRICT DESIGNATION REPORT 1977 City of New York Abraham D. Beams, Mayor Landmarks Preservation Commission Beverly Koss Spatt, Chairman Horrls Ketchum, Jr., Vlc©-Chairman Commissioners Margaret Beyer Stephen S. Lash Elisabeth Colt Hawthorne E. Lee George R. Collins Marie V. McGovern William J. Conklin Paul E. Parker, Jr. Barbara lee Dlamonsteln WEST 73*STREET fTMTHlE DAKOTA, iT-WEST TO^T^STREET HISTORIC DISTRICT CENTRAL PAES MANHATTAN DESIGNATED JULY 12, 1977 0E3I0NATC0 tAHOMARR SOUMOARIfS A*£ A* CU«8 UWI Landmarks Preservation Commission July 12, 1977, Number 8 LP-096<» CENTRAL PARK WEST - WEST 73rd - 7*«th STREET HISTORIC DISTRICT BOUNDARIES The property bounded by the western curb line of Central Park West, the northern curb line of West 73rd Street, the eastern curb line of Columbus Avenue and the southern curb line of West 7*»th Street, Manhattan. TESTIMONY AT THE PUBLIC HEARINGS On May 10, 1977, the Landmarks Preservation Commission held a public hearing on this area which is now proposed as an Historic District (Item No. 8). The hearing had been duly advertised In accordance with the provisions of law. Seven persons spoke In favor of the proposed designation. There were no speakers In opposition to designation. -1 HISTORICAL AND ARCHITECTURAL INTRODUCTION The site of the Central Park West - West 73rd-7*»th Street Historic District originally formed part of the farm of Richard Somerlndyck, whose family owned much of the land along the Upper West Side In the late 18th century. Although the farmland had b«en subdivided into lots by 1835, construction did not begin on this block until the l880s, Interest in the Upper West Side as a residential district began to grow In the late 1860s. -

SYMPHONIC SONDHEIM Tuesday, January 29, 2013, 7

01-29 Sondheim:Layout 1 1/23/13 10:55 AM Page 19 SYMPHONIC SONDHEIM Tuesday , January 29, 2013, 7:30 p.m. 15,492nd Concert This concert is made possible with generous support from Perry and Martin Granoff, Ted and Mary Jo Shen, and Thomas and Alice Tisch. Paul Gemignani, Conductor Nathan Lane , Host (New York Philharmonic debut) Global Sponsor Guest artist appearances are made possible through the This concert will last approximately two and one-quarter Hedwig van Ameringen Guest hours, which includes one intermission. Artists Endow ment Fund . Avery Fisher Hall at Lincoln Center Home of the New York Philharmonic Exclusive Timepiece of the New York Philharmonic January 2013 19 01-29 Sondheim:Layout 1 1/23/13 10:55 AM Page 20 New York Philharmonic SYMPHONIC SONDHEIM Paul Gemignani, Conductor Nathan Lane, Host (New York Philharmonic debut) STEPHEN SONDHEIM ( b. 1930) Suite from Sunday in the Park with George (1983–84), arr. Michael Starobin Selections from The Enclave (1973) ERIC HUEBNER, STEVEN BECK , piano CHRISTOPHER S. LAMB, DANIEL DRUCKMAN , percussion Dances from Pacific Overture s Prologue “The Advantages of Floating in the Middle of the Sea ” “There is No Other Way” (Tamate’s Dance) “March to the Treaty House” “Someone in a Tree” “Pretty Lady” “Next” Intermission Suite from Into the Woods (1985–87) Suite from Stavisky (1974) Suite from Sweeney Todd: The Demon Barber of Fleet Street (1978–79) Host remarks co-written by Nathan Lane and Mark Horowitz. The New York Philharmonic thanks the Musicians of the Orchestra for donating their services to benefit the pension fund of the New York Philharmonic. -

Bank of America and Shoppes

Bank of America and Shoppes OFFERING MEMORANDUM UPPER WEST SIDE (MANHATTAN), NEW YORK 2260 BROADWAY, UPPER WEST SIDE (MANHATTAN), NY 10024 Bank of America and Shoppes PRESENTED BY: Matt Brooks Joseph Chichester Managing Director Managing Director [email protected] [email protected] (949) 221-1832 (949) 221-1813 R.E. License No. 01976931 R.E. License No. 01915138 Nicholas Coo BROKER OF RECORD: Senior Managing Director Richard Berlinghof [email protected] Target Rock Partners (949) 221-1811 711 Third Ave, 20th Floor R.E. License No 01226006 New York, NY 10017 R.E. License No 10311203686 4 14 21 TABLE OF CONTENTS PROPERTY OVERVIEW AREA OVERVIEW FINANCIAL ANALYSIS STATEMENT OF CONFIDENTIALITY & DISCLAIMER Faris Lee Investments (“FLI”) has been engaged as the exclusive financial by FLI from sources it deems reasonably reliable. Summaries of any or in connection with the sale of the Property shall be limited to advisor to the Seller in connection with Seller’s solicitation of offers for documents are not intended to be comprehensive or all-inclusive, those expressly provided in an executed Purchase Agreement and the purchase of the property known as 2260 Broadway, City of New but rather only outline some of the provisions contained therein and shall be subject to the terms thereof. In no event shall a prospective York, County of New York, State of New York. Prospective purchasers are qualified in their entirety by the actual document to which they relate. purchaser have any other claims against Seller or FLI or any of their advised that as part of the solicitation process, Seller will be evaluating affiliates or any of their respective officers, directors, shareholders, a number of factors including the current financial qualifications of the No representation or warranty, expressed or implied, is made by owners, employees, or agents for any damages, liability, or causes prospective purchaser. -

West Side Story

The Cultural Perspectives of West Side Story By Sandra Flavin A thesis presented to the Honors College of Middle Tennessee State University in partial Fulfillment of the requirements for graduation from the University Honors College. March 2019 The Cultural Perspectives of West Side Story By Sandra Flavin APPROVED: ______________________________ Kate Goodwin Department of Theatre and Dance ______________________________ Dr. Philip E. Phillips, Associate Dean University Honors College Dedication For my mother, who loved the arts, especially musical theatre. Thank you for introducing me to this wonderful musical at the tender age of seven. You are remembered. iii Acknowledgments Doing a project like this takes time. It also takes patience and diligence while working toward a common goal. I have collaborated with many people in my day, and I have never met someone so dedicated to a project like Kate Goodwin. Her love for the performing arts is immeasurable. With her unwavering support and dedication, I have been able to create a piece of theatre history that will hopefully find its way to those who love the arts, and those who want to learn about West Side Story. I could not have done it without her. To Kristi Shamburger, thank you for reading this thesis with love and an open mind. Your passion for musical theatre inspires me. I would also like to thank Dr. Martha Hixon for her encouragement and support. She was more than willing to me when I needed her expertise. iv Abstract The Cultural Perspectives of West Side Story By Sandra Flavin Advisor: Kate Goodwin This thesis explores the cultural perspectives of West Side Story and whether the musical should be shelved as a piece of history. -

Upper West Side Central Park

Neighborhood Map ¯ 325 661 675 667 668 666 660 2487 2488 301 299 237 235 201 199 101 99 1 W 92 Street W 92 Street Central Sol Bloom Playground Baptist Church e v i r D Safari 320 646 645 t 2468 2465 Playground s a Goddard Riverside E Trinity School Community Center Avenue 5 301 299 237 235 201 199 1 W 91 Street W 91 Street Annunciation Greek Orthodox Church Wise Towers Houses 619 The Eldorado 625 626 2446 301 299 237 235 201 199 101 W 90 Street W 90 Street St. Gregory’s Central Park Playground Loop West Side Jacqueline Kennedy Community Garden M7 M104 M10 M7 M11 608 607 M104 M10 M11 Onassis Reservoir Broadway 301 299 231 229 201 199 101 99 1 Central Park West Park Central West End Avenue End West W 89 Street W 89 Street Avenue Amsterdam Playground Avenue Columbus Eighty Nine LXXXIX 595 588 587 588 2406 5 Avenue 5 301 299 235 233 201 199 101 99 W 88 Street W 88 Street W e st D r iv 574 e 561 575 574 572 577 2393 2394 W 87 Street Garden 86 St 301 299 M86 249 247 201 199 101 99 1 M1 LTD M86SBS SBS W 87 Street W 87 Street St. Ignatius Downtown M4 LTD of Antioch Only M86 SBS Episcopal Church Bridge No. 27 555 555 556 540 2379 2372 Church of West Park St. Paul & M86SBS Broadway Presbyterian M86 M86SBS SBS 301 St. Andrew 239 237 201 Church M86 101 99 1 Amsterdam Avenue Amsterdam SBS Columbus Avenue West End Avenue End West M86SBS M86SBS M86SBS M86SBS 86 Street Transverse W 86 St W 86 Street M86 M86SBS M86SBS M86SBS M86SBS SBS South Gate M86 M86 Spector House Central Park LTD M2 SBS 86 St SBS Bard Graduate Playground Loop e Bridge No. -

Gotham Magazine

ELECTRONICALLY REPRINTED FROM NOVEMBER 2007 A custom-made, hand-carved alabaster and brass chandelier hangs from the 20-foot ceiling of the foyer. It lights up the limestone-coated steel staircase, which was the most challenging renovation feat. “I made it more sweeping than the original, to go with the drama of the apartment,” says Carol E. Levy. “They had to bring it in pieces and weld it here, and the railing was handmade in Brooklyn. We saw the whole staircase being made…. We have the staircase of our dreams. It makes a statement and really separates the private and public rooms.” Solid as aRock Carol E. Levy finds home sweet home in the legendary Beresford. by Jennifer Gould Keil • photographs by Marco Ricca The 50-foot hallway on the upper level is daughters Chloe and Camryn’s racetrack for their plasma cars—aerodynamic mini cars that speed up and down the corridor. Levy designed the custom limestone moldings and corbels on all the archways—three in the upper hallway and two in the foyer—to accentuate the architectural design. The living room walls are custom-painted honey beige to look like limestone. Levy even designed the hardwood floors, which display a subtle herringbone pattern in oak, with mahogany and maple trim on the edges. She joined the living room with a sunroom to create a larger, more welcoming space with “a wall of seven windows out to the terrace, with extraordinary light.” OPPOSITE PAGE, TOP: The eat-in kitchen includes European-made stainless steel and glass cabinetry, including a large pantry with pull- out stainless steel drawers and a pop-up stainless steel step-stool. -

THE REGULATIONS for REPAIR WORK on LANDMARKED BUILDINGS - in the CASES of 1930S’ Title HIGH-RISE HOUSING in NEW YORK CITY

THE REGULATIONS FOR REPAIR WORK ON LANDMARKED BUILDINGS - IN THE CASES OF 1930S’ Title HIGH-RISE HOUSING IN NEW YORK CITY Author(s) CHUTSEN LIAO; YUJOU JUAN; WENHSIUNG LAI; KAUNHUNG LIN Proceedings of the Thirteenth East Asia-Pacific Conference on Structural Engineering and Construction (EASEC-13), Citation September 11-13, 2013, Sapporo, Japan, C-3-6., C-3-6 Issue Date 2013-09-11 Doc URL http://hdl.handle.net/2115/54280 Type proceedings The Thirteenth East Asia-Pacific Conference on Structural Engineering and Construction (EASEC-13), September 11- Note 13, 2013, Sapporo, Japan. File Information easec13-C-3-6.pdf Instructions for use Hokkaido University Collection of Scholarly and Academic Papers : HUSCAP THE REGULATIONS FOR REPAIR WORK ON LANDMARKED BUILDINGS - IN THE CASES OF 1930S’ HIGH-RISE HOUSING IN NEW YORK CITY CHUTSEN LIAO1*†, YUJOU JUAN2, WENHSIUNG LAI3, and KAUNHUNG LIN4 1Department of Creative Design and Architecture, National University of Kaohsiung, Taiwan 234Department of Civil and Environmental Engineering, National University of Kaohsiung, Taiwan ABSTRACT New York City Landmarks Preservation Commission was established in 1965, and the Landmarks Law was enacted at the same time. Many guidelines and regulations were established for both the staff of Landmarks Preservation Commission and a person in charge of the repair works. Public and private organizations should comply with these regulations when conducting their work. According to Landmarks Law, people who take responsibility for landmark building’ s repair works related to the façade have to notify Landmarks Preservation Commission. High-rise housing was legal to build in New York City since the legislation of Multiple Dwellings Law of 1929. -

National Register of Historic Places Registration Form

NPS Form 10-900 OMB No. 10024-0018 (Oct. 1990) United States Department of the Interior National Park Service National Register of Historic Places Registration Form This form is for use in nominating or requesting determinations for individual properties and districts. See instructions in How to Complete the National Register of Historic Places Registration Form (National Register Bulletin 16A). Complete each item by marking “x” in the appropriate box or by entering the information requested. If an item does not apply to the property being documented, enter “N/A” for “not applicable.” For functions, architectural classification, materials, and areas of significance, enter only categories and subcategories from the instructions. Place additional entries and narrative items on continuation sheets (NPS Form 10-900a). Use a typewriter, word processor, or computer to complete all items. 1. Name of Property historic name South Village Historic District other names/site number N/A 2. Location street & number Bedford St., Bleecker St., Broome St., Carmine St., Clarkson St., Cornelia St., Downing St., Grand St., Jones St., LaGuardia Pl., Leroy St., MacDougal St., Minetta Ln., Morton St., Prince St., St. Luke’s Pl., Seventh Ave, Sixth Ave., Spring St., Sullivan St., Thompson St., Varick St., Washington Sq. So., Watts St., West 3rd St, West 4th St., W. Houston St. [ ] not for publication city or town Manhattan [ ] vicinity state New York code NY county New York code 061 zip code 10012 3. State/Federal Agency Certification As the designated authority under the National Historic Preservation Act, as amended, I hereby certify that this [X] nomination [ ] request for determination of eligibility meets the documentation standards for registering properties in the National Register of Historic Places and meets the procedural and professional requirements as set forth in 36 CFR Part 60. -

BACKGROUND INFORMATION INTERVIEWS & Commentary

PlayNotes SEASON: 45 IssUE: 07 BACKGROUND INFORMATION INTERVIEWS & COMMENTARY Discussion Series Page to Stage discussions are presented in partnership with the Portland Public Library. These discussions, led by Portland Stage artistic staff, actors, directors, and designers answer questions, share stories and explore the challenges of bringing a particular play to the stage. Page to Stage occurs at noon on the Tuesday two weeks before a show opens at the Portland Public Library’s Main Branch. The Artistic Perspective, hosted by Artistic Director Anita Stewart, is an opportunity for audience members to delve deeper into the themes of the show through conversation with special guests. A different scholar, visiting artist, playwright, or other expert will join the discussion each time. The Artistic Perspective discussions are held after the first Sunday matinee performance. Curtain Call discussions offer a rare opportunity for audience members to talk about the production with the performers. Through this forum, the audience and cast explore topics that range from the process of rehearsing and producing the text to character development to issues raised by the work Curtain Call discussions are held after the second Sunday matinee performance. All discussions are free and open to the public. Show attendance is not required. To subscribe to a discussion series performance, please call the Box Office at 207.774.0465. CENTRAL PARK BOAT PROPOSAL, PHOTO BY SHANNEN NORMAN. Portland Stage Company Educational Programs are generously supported through the annual donations of hundreds of individuals and businesses, as well as special funding from: George & Cheryl Higgins The Onion Foundation The Davis Family Foundation Our Education Media partner is THOUGHTS FROM THE EDITORS Thoughts from the Editors: What’s your Favorite Musical and Why? While not considered a traditional musical, my favorite story with music is Hedwig and the Angry Inch. -

Historic Context Statement for LGBT History in New York City

Historic Context Statement for LGBT History in New York City PREPARED FOR MAY 2018 Historic Context Statement for LGBT History in New York City PREPARED BY The NYC LGBT Historic Sites Project: Jay Shockley, Amanda Davis, Ken Lustbader, and Andrew Dolkart EDITED BY Kathleen Howe and Kathleen LaFrank of the New York State Office of Parks, Recreation, and Historic Preservation PREPARED FOR The National Park Service and the New York State Office of Parks, Recreation, and Historic Preservation Cover Image: Participants gather at the starting point of the first NYC Pride March (originally known as Christopher Street Gay Liberation Day) on Washington Place between Sheridan Square and Sixth Avenue, June 28, 1970. Photo by Leonard Fink. Courtesy of the LGBT Community Center National History Archive. Table of Contents 05 Chapter 1: Introduction 06 LGBT Context Statement 09 Diversity of the LGBT Community 09 Methodology 13 Period of Study 16 Chapter 2: LGBT History 17 Theme 1: New Amsterdam and New York City in the 17th and 18th Centuries 20 Theme 2: Emergence of an LGBT Subculture in New York City (1840s to World War I) 26 Theme 3: Development of Lesbian and Gay Greenwich Village and Harlem Between the Wars (1918 to 1945) 35 Theme 4: Policing, Harassment, and Social Control (1840s to 1974) 39 Theme 5: Privacy in Public: Cruising Spots, Bathhouses, and Other Sexual Meeting Places (1840s to 2000) 43 Theme 6: The Early Fight for LGBT Equality (1930s to 1974) 57 Theme 7: LGBT Communities: Action, Support, Education, and Awareness (1974 to 2000) 65 Theme -

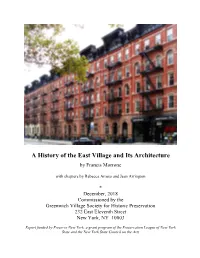

A History of the East Village and Its Architecture

A History of the East Village and Its Architecture by Francis Morrone with chapters by Rebecca Amato and Jean Arrington * December, 2018 Commissioned by the Greenwich Village Society for Historic Preservation 232 East Eleventh Street New York, NY 10003 Report funded by Preserve New York, a grant program of the Preservation League of New York State and the New York State Council on the Arts Greenwich Village Society for Historic Preservation 232 East Eleventh Street, New York, NY 10003 212-475-9585 Phone 212-475-9582 Fax www.gvshp.org [email protected] Board of Trustees: Arthur Levin, President Trevor Stewart, Vice President Kyung Choi Bordes, Vice President Allan Sperling, Secretary/Treasurer Mary Ann Arisman Tom Birchard Dick Blodgett Jessica Davis Cassie Glover David Hottenroth Anita Isola John Lamb Justine Leguizamo Leslie Mason Ruth McCoy Andrew Paul Robert Rogers Katherine Schoonover Marilyn Sobel Judith Stonehill Naomi Usher Linda Yowell F. Anthony Zunino, III Staff: Andrew Berman, Executive Director Sarah Bean Apmann, Director of Research and Preservation Harry Bubbins, East Village and Special Projects Director Ariel Kates, Manager of Programming and Communications Matthew Morowitz, Program and Administrative Associate Sam Moskowitz, Director of Operations Lannyl Stephens, Director of Development and Special Events The Greenwich Village Society for Historic Preservation was founded in 1980 to preserve the architectural heritage and cultural history of Greenwich Village, the East Village, and NoHo. /gvshp /gvshp_nyc www.gvshp.org/donate Acknowledgements This report was edited by Sarah Bean Apmann, GVSHP Director of Research and Preservation, Karen Loew, and Amanda Davis. This project is funded by Preserve New York, a grant program of the Preservation League of New York State and the New York State Council on the Arts.