New Vancouver Art Gallery at 688 Cambie Street

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vancouver, British Columbia Destination Guide

Vancouver, British Columbia Destination Guide Overview of Vancouver Vancouver is bustling, vibrant and diverse. This gem on Canada's west coast boasts the perfect combination of wild natural beauty and modern conveniences. Its spectacular views and awesome cityscapes are a huge lure not only for visitors but also for big productions, and it's even been nicknamed Hollywood North for its ever-present film crews. Less than a century ago, Vancouver was barely more than a town. Today, it's Canada's third largest city and more than two million people call it home. The shiny futuristic towers of Yaletown and the downtown core contrast dramatically with the snow-capped mountain backdrop, making for postcard-pretty scenes. Approximately the same size as the downtown area, the city's green heart is Canada's largest city park, Stanley Park, covering hundreds of acres filled with lush forest and crystal clear lakes. Visitors can wander the sea wall along its exterior, catch a free trolley bus tour, enjoy a horse-drawn carriage ride or visit the Vancouver Aquarium housed within the park. The city's past is preserved in historic Gastown with its cobblestone streets, famous steam-powered clock and quaint atmosphere. Neighbouring Chinatown, with its weekly market, Dr Sun Yat-Sen classical Chinese gardens and intriguing restaurants add an exotic flair. For some retail therapy or celebrity spotting, there is always the trendy Robson Street. During the winter months, snow sports are the order of the day on nearby Grouse Mountain. It's perfect for skiing and snowboarding, although the city itself gets more rain than snow. -

Hop-On Hop-Off

HOP-ON Save on Save on TOURS & Tour Attractions SIGHTSEEING HOP-OFF Bundles Packages Bundle #1 Explore the North Shore Hop-On in Vancouver + • Capilano Suspension Bridge Tour Whistler • Grouse Mountain General Admission* • 48H Hop-On, Hop-Off Classic Pass This bundle takes Sea-to-Sky literally! Start by taking in the spectacular ocean You Save views in Vancouver before winding along Adult $137 $30 the Sea-to-Sky Highway and ascending into Child $61 $15 the coastal mountains. 1 DAY #1: 48H Hop-On, Hop-Off Classic Pass 2020 WINTER 19 - OCT 1, 2019 APR 30, Your perfect VanDAY #2: Whistler + Shannon Falls Tour* Sea to Bridge Experience You Save • Capilano Suspension Bridge day on Hop-On, Adult $169 $30 • Vancouver Aquarium Child $89 $15 • 48H Hop-On, Hop-Off Classic Pass You Save Hop-Off Operates: Dec 1, 2019 - Apr 30, 2020 Classic Pass Adult $118 $30 The classic pass is valid for 48 hours and * Whistler + Shannon Falls Tour operates: Child $53 $15 Choose from 26 stops at world-class • Dec 1, 2019 - Jan 6, 2020, Daily includes both Park and City Routes • Apr 1 - 30, 2020, Daily attractions and landmarks at your • Jan 8 - Mar 29, 2020, Wed, Fri, Sat & Sun 2 own pace with our Hop-On, Hop-Off Hop-On, Hop-Off + WINTER 19 - OCT 1, 2019 - APR 30, 2020 WINTER 19 - OCT 1, 2019 APR 30, Sightseeing routes. $49 $25 Lookout Tower Special Adult Child (3-12) Bundle #2 Hop-On in Vancouver + • Vancouver Lookout Highlights Tour Victoria • 48H Hop-On, Hop-Off Classic Pass • 26 stops, including 6 stops in Stanley Park CITY Route PARK Route and 1 stop at Granville Island Take an in-depth look at Vancouver at You Save (Blue line) (Green Line) your own pace before journeying to the Adult $53 $15 • Recorded commentary in English, French, Spanish, includes 9 stops includes 17 stops quaint island city of Victoria on a full day of Child $27 $8 German, Japanese, Korean & Mandarin Fully featuring: featuring: exploration. -

Ships at Canada Place = 7240 Disembarking Passengers

Backgrounder Transportation Options from Vancouver Cruise Terminals for Saturday, May 14, 2011 SHIPS AT CANADA PLACE = 7240 DISEMBARKING PASSENGERS Berth Ship Cruise Line Est. Arrival – Est. Departure East Golden Princess Princess 07:00 -16:30 North Zuiderdam Holland America Line 07:00 -17:00 West Sapphire Princess Princess 07:00 - 16:30 If passengers have not made previous transportation arrangements with their cruise line, the following transportation options are available: Shuttles to/from Canada Place (prices for a one-way ticket and in Canadian dollars) • Vancouver International Airport & Richmond hotels: $14 For more info & reservations, please visit: www.vancouvershuttle.ca or call 1.888.941.2121 (Toll free) • Bellingham Airport: $28 For more info & reservations, please visit: www.quickcoach.com or call 1.800.665.2122 (Toll free) • SeaTac Airport: $57 For more info & reservations, please visit: www.quickcoach.com or call 1.800.665.2122 (Toll free) • Victoria: $33.45 (one way) or $64.90 (round trip) For more info & reservations, please visit: www.pacificcoach.com or call 1.800.661.1725 (Toll free) Taxis Canada Place is serviced by the following Vancouver taxi companies: • Black Top & Checker Cabs – Tel: 604.681.2181 • Maclure's Cabs (1984) Ltd - Tel: 604.683.6666 • Vancouver Taxi Ltd - Tel: 604.871-1111 • Yellow Cab Co Ltd – 604.681.1111 ESTIMATED TAXI FARES FROM CANADA PLACE From Canada Place Terminal • To Vancouver International Airport (YVR) - $30-$35 • To Downtown Hotels - $5-$8 • To Stanley Park/Vancouver Aquarium - $13-$15 • To Tsawwassen Ferry Terminal - $65-$70 • To Horseshoe Bay Ferry Terminal - $40-$45 • To Bus Depot - $11-$13 Public Transportation to/from Canada Place • Canada Line to Vancouver International Airport and Richmond: 2 zones $3.75 • Skytrain to Vancouver, New Westminster, Surrey, and Burnaby: from 1 to 3 zones $2.50 - $5.00 • For customer information and schedules, please visit: www.translink.ca or call 1.604.953.3333 Passenger Pick-up • Private vehicles are not allowed to enter the Porte Cochere area during passenger disembark. -

Dead Seal in Fraser River Park

Page 1 From: "Johnston, Sadhu" <[email protected]> To: "Direct to Mayor and Council - DL" <[email protected]> Date: 4/28/2016 2:13:57 PM Subject: Dead seal in Fraser River Park Greetings Mayor and Council- There is a sea lion carcass on the shoreline adjacent to Fraser River Park that has been decaying for quite some time causing an unpleasant odour. Because of the advanced state of decay, it’s been a challenge to determine how best to remove the remains without their disintegrating further and dispersing along the shore. City Engineering and Fire, with advice from Department of Fisheries, Coast Guard and Vancouver Aquarium staff, have decided this morning that burning away the carcass is the best solution. This is a common practice in many coastal communities according to the Aquarium. Park Board staff will assist in trimming back to any surrounding foliage while Engineering/Sanitation will set the fire. VF&RS is providing a water curtain to protect any remaining foliage just above the shoreline. The carcass, according to the Vancouver Aquarium, would supply fuel and should burn in its entirety. VF&RS intends to wash down the rocks afterwards. This approach, while environmentally unpleasant due to combustion, will in fact rid the shoreline of the carcass. As burning within the City boundaries is not allowed under the Fire Bylaw, the Fire Chief is issuing a special permit. This will take place tomorrow. Please call or email if you have questions or comments. Thanks Sadhu Sadhu Aufochs Johnston City Manager [email protected] O. -

Filming Guidelines for the Vancouver Aquarium

Filming Guidelines for the Vancouver Aquarium The Vancouver Aquarium, an Ocean Wise Conservation Association initiative (OWCA), has been the backdrop for countless television, film and commercial productions. Our living backdrop and unique variety of sets makes us one of a kind in the city of Vancouver. As an iconic Vancouver location in the heart of Stanley Park, there are many commercial and film / photo shoot opportunities on-site. This document clarifies the terms and conditions required to proceed with your booking, highlighting our procedures to ensure animal and guest safety. Please note: The film production must be in alignment with the Vancouver Aquarium’s mission and image, and the OWCA reserves the absolute right to grant or deny permission and to determine the terms under which filming may be permitted. Before You Film Permission Ocean Wise is a self-supporting non-profit charitable organization. Our visitors and members are entitled to enjoy the entire Vancouver Aquarium facility, and filming must not detract from our visitors’ overall experience. Filming takes place outside of our hours of operation (see ‘Filming Hours’ on page 5), unless expressed permission is granted. For space closure requests, in whole or part, a minimum of 2 weeks is required for approval, in addition to advance notice. Advance Notice A minimum of two weeks advance notice is required for thorough planning and site visits with all stakeholders. While the Vancouver Aquarium will make every effort to accommodate last minute requests, we will not consider requests with less than 72 hours notice. The Vancouver Aquarium is unable to “hold” location requests for filming without receiving a 50 percent deposit on the total fees. -

VFA 2019 SIP-Introduction

July 2 –Aug. 9 Mon. to Fri. 9am to 3pm Ages: 12-18 Register Now VFA HIGH SCHOOL 5621 Killarney Street Vancouver, BC, Canada VFA V5R 3W4 High School Tel: 604-436-2332 E-mail: [email protected] Website: www.vfa.bc.ca Vancouver Formosa Academy offers a special full-time summer ESL program for international students who would like to improve their English skills and enjoy activities in Vancouver. Week Schedule Week 1: July 2-5 Week 4: July 22-26 Week 2: July 8-12 Week 5: July 29-Aug. 2 Week 3: July 15-19 Week 6: Aug. 6-9 Notes: 2 weeks minimum registration No class on July 1st (Canada Day) and August 5th (B.C. Day) Homestay available for students age 13 and over Program dates may be dependent on enrollment @ English Language Classes Reading, Grammar, Writing, Listening, Speaking, Pronunciation @ Academic Preparation Classes Canadian Cultural Studies, Computer Skills @ Special Activities and Fieldtrips *- May include Stanley Park Gastown Vancouver Aquarium Science World Granville Island Burnaby Village Museum Fraser River Discovery Centre Canada Place BC Sports Hall of Fame Whistler Day Trip Activity fees and public transit fare for fieldtrips are included in tuition Program Fees and Registration Application Fee $100 Tuition Fee 2 Weeks $900 3 Weeks $1,300 4 Weeks $1,650 5 Weeks $2,000 6 Weeks $2,350 Notes: 2 weeks minimum registration 2nd , 3rd family member – 5% discount on tuition A special fee schedule for immigrants is available upon request. Homestay Arrangement $300 Room & Board $300 per week Registration and Payment Deadlines Register in person, by email, fax or via internet. -

1 Map from Vancouver Convention Centre to SFU Downtown 515 West

PLANS OF WHERE THINGS ARE IN THE CONVENTION CENTRE AND MAPS TO OUR OFF-SITE EVENTS 18 August COMMITTEE AND COUNCIL MEETINGS - Simon Fraser University downtown Harbour Centre Map from Vancouver Convention Centre to SFU downtown 515 West Hastings Floor Plan of Committee Meetings and Icebreaker Social at Simon Fraser University downtown Icebreaker Mixer 1700-2200 Rooms 1400-1410 Council Meeting Room #1550 Enter from Hastings Street 1 WBS MEETING AT VANCOUVER CONVENTION CENTRE 19 & 20 August Where to go over power points etc. – Room 107 LEVEL 1 (Ground Floor up escalators ½ storey) Sunday 19 August LEVEL 1 : Rob Butler’s Plenary : Room #109 2 19-20 August Sunday & Monday; LEVEL 2 : WBS Meeting Rooms: # 212 – 214 Meeting #s 212-214 20 August Monday --- IOC Opening Ceremonies and Talks and Mixer Ballrooms A and D IOC Mixer No-Host Bar Ballroom D Opening talks and ceremonies Ballroom A PLUS Canada Night Tuesday 21 August Ballroom A 3 21 August Tuesday – Friday. BASEMENT LEVEL Poster setup and our WBS Exhibit Booth, VCC Posters near the back wall; WBS Booth #235 in Exhibit Hall Poster area in the very back. See below. Our Booth is #235 Posters WBS Booth #235 4 Wednesday 22 August WATERBIRD SOCIETY BANQUET Steamworks Pub UBER ROOM Convention Centre SFU Downtown Steamworks Pub for Banque During the IOC there are bird films (at Science World, a short bike or Sky Train ride away), a paired poet- scientist reading of prose and poems afternoon 23rd and 25th, talks by Margaret Atwood and “The Birds of Nunavut” by Tony Gaston unveiling (Tues 21st, Canada Evening), 3 scientists from the Middle East- Palestine, Israel, and Jordan, talk about Birds as Peacemakers (Thurs 23rd evening); Purnima Barman, Whitley Award Stork Conservation (Friday 24th evening); Jennifer Ackerman, “The Genius of Birds“ (Saturday 25th evening). -

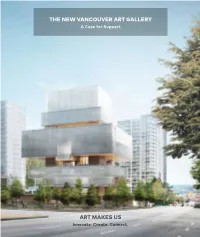

THE NEW VANCOUVER ART GALLERY a Case for Support

THE NEW VANCOUVER ART GALLERY A Case for Support A GATHERING PLACE for Transformative Experiences with Art Art is one of the most meaningful ways in which a community expresses itself to the world. Now in its ninth decade as a significant contributor The Gallery’s art presentations, multifaceted public to the vibrant creative life of British Columbia and programs and publication projects will reflect the Canada, the Vancouver Art Gallery has embarked on diversity and vitality of our community, connecting local a transformative campaign to build an innovative and ideas and stories within the global realm and fostering inspiring new art museum that will greatly enhance the exchanges between cultures. many ways in which citizens and visitors to the city can experience the amazing power of art. Its programs will touch the lives of hundreds of thousands of visitors annually, through remarkable, The new building will be a creative and cultural mind-opening experiences with art, and play a gathering place in the heart of Vancouver, unifying substantial role in heightening Vancouver’s reputation the crossroads of many different neighbourhoods— as a vibrant place in which to live, work and visit. Downtown, Yaletown, Gastown, Chinatown, East Vancouver—and fuelling a lively hub of activity. For many British Columbians, this will be the most important project of their Open to everyone, this will be an urban space where museum-goers and others will crisscross and encounter generation—a model of civic leadership each other daily, and stop to take pleasure in its many when individuals come together to build offerings, including exhibitions celebrating compelling a major new cultural facility for its people art from the past through to artists working today— and for generations of children to come. -

Provincial Public Library Grant Report (Plgr) 2019 North Vancouver City Library

PROVINCIAL PUBLIC LIBRARY GRANT REPORT (PLGR) 2019 NORTH VANCOUVER CITY LIBRARY INTRODUCTION The City of North Vancouver (the “City”) is a small community located at the base of the mountains on the North Shore. It is bounded to the south by the Burrard Inlet, and the District of North Vancouver to the east and west. With a land area of approximately 12 square kilometres, the City supports a population of 57,325 people. Due to its central location on the North Shore, relatively high density, transit accessibility with a SeaBus connection, and proximity to Vancouver’s central business district, the City is recognized as a Regional Town Centre within the Metro Vancouver region. The City of North Vancouver’s population continues to flourish, and grew by 353 residents (0.6%) between 2018 and 2019. Recent census documents tell us that 67% of the population speaks English or French, with 32% identifying English as a second language. The most predominant languages after English are Farsi, Tagalog, Chinese (Mandarin and Cantonese), Korean and Spanish. We have a large contingent of newcomers in the community due its relative affordability. Settlement support and services are in high demand. Other trends show that the population is aging, over 16% of the population is over the age of 65 and it is predicted that this percentage will increase. At the same time, there are more young people than ever and this population is growing at one of the fastest rates in Metro Vancouver. The City’s Official Community Plan (OCP), adopted in 2014, provides direction while balancing the diverse needs of the community. -

VANCOUVER AQUARIUM VETERINARY FELLOWSHIP Job Title

VANCOUVER AQUARIUM VETERINARY FELLOWSHIP Job Title: Veterinary Fellow Department: 105 Job Family: Veterinary Care Pay Band: Employment Temporary Full-Time Hours Per Week: Approx. 37.5 Status: Close Date: December 1, 2016 Wage Type: Salary Direct Reports: None Reports to: Staff Veterinarian ROLE OVERVIEW Reporting to the Staff Veterinarian, the Veterinary Fellow will assist the veterinary staff in providing medical management for a large captive display collection that includes marine mammals, terrestrial mammals, birds, reptiles, amphibians and a large variety of native and tropical fish as well as approximately 150 live-stranded marine mammals (mostly harbour seals) which are cared for by the Vancouver Aquarium. This is a one-year position beginning in summer 2017 for a veterinarian interested in pursuing specialized training in aquatic animal medicine. As part of the application process, please email: cover letter, CV, three letters of reference, and veterinary transcripts to Demash Kristanto, HR Coordinator, at [email protected]. Application deadline: December 1st, 2016. Decisions will be made by Jan 20th , 2017 KEY ACCOUNTABILITIES Responsible for providing medical management for the captive display collection and live stranded marine mammals by: Conducting veterinary duties such as examinations, blood sampling, parasite screening, diagnostic imaging, anesthesia, vaccinations and surgeries; Assisting in the development of the health management program, treatment regimens and emergency medical procedures; Taking responsibility for treatment of hospital cases; Keeping up to date records. Assist the veterinary staff in providing a comprehensive animal health program to the Vancouver Aquarium by: Completing regular veterinary rounds; Conducting regular physical examinations; Managing and encouraging routine communication between the veterinary and staff/researchers. -

Pro Lacrosse in British Columbia 1909-1924

Old School Lacrosse PROFESSIONAL LACROSSE IN BRITISH COLUMBIA ®®® 1909-1924 compiled & Edited by David Stewart-Candy Vancouver 2017 Old School Lacrosse – Professional Lacrosse in British Columbia 1909-1924 Stewart-Candy, David J. First Printing – February 14, 2012 Second Printing – October 21, 2014 This version as of February 14, 2017 Vancouver, British Columbia 2012-2017 Primary research for this book was compiled from game boxscores printed in the Vancouver Daily Province and New Westminster British Columbian newspapers. Additional newspapers used to locate and verify conflicting, damaged, or missing data were the Victoria Daily Colonist , Vancouver World & Vancouver Daily World , Vancouver Daily Sun & Vancouver Sun , and Vancouver Daily News Advertiser . Research was done by the author at the Vancouver Public Library (Robson Street branch) and New Westminster Public Library between 2002 and 2012. The Who’s Who biographies were written between September 2013 and June 2016 and originally posted at oldschoollacrosse.wordpress.com. All photographs unless otherwise noted are in public domain copyright and sourced from the City of Vancouver Archives, New Westminster City Archives, or the Canadian Lacrosse Hall of Fame collections. The photograph of Byron ‘Boss’ Johnson is taken from the book Portraits of the Premiers (1969) written by SW Jackman. Author contact information: Dave Stewart-Candy [email protected] oldschoollacrosse.wordpress.com This work is dedicated to Larry ‘Wamper’ Power and Stan Shillington... Wamper for the years of encouragement and diligently keeping on my back to ensure this project finally reached completion... Stan for his lament that statistics for field lacrosse were never set aside for future generations... until now… both these men inspired me to sit down and do for field lacrosse statistics what they did for box lacrosse.. -

Vancouver Art Gallery Unveils Herzog & De

VANCOUVER ART GALLERY UNVEILS HERZOG & DE MEURON'S CONCEPTUAL DESIGN GALLERY PRESENTS MUSEUM DESIGN THAT DOUBLES ITS CURRENT SIZE WITH NEW BUILDING TO FULFILL ITS LONGSTANDING COMMITMENT TO BETTER SERVE THE ARTISTS AND AUDIENCES OF VANCOUVER, BRITISH COLUMBIA AND BEYOND Board of Trustees Commits $23 Million to Gallery in First Phase of Capital Campaign VANCOUVER, BRITISH COLUMBIA (September 29, 2015) – The Vancouver Art Gallery today unveiled Herzog & de Meuron’s conceptual design for a new museum building in downtown Vancouver. The 310,000-square-foot building is designed to serve the Gallery’s expanding collection and to support the work of artists from Vancouver, throughout British Columbia and across the world, to engage its growing audiences and enrich educational opportunities for lifelong learning, and to advance Vancouver’s reputation as an international centre for contemporary art. The new building features over 85,000 square feet of exhibition space—more than doubling its current size—with 40,000 square feet of galleries dedicated to the museum’s vast collection. It also features a new education centre that includes a 350-seat auditorium, workshops and a resource centre for research, library services and artist archives. A public presentation of the conceptual design by the Gallery’s leadership and the architects, featuring the Honourable Judith Guichon, Lieutenant Governor of British Columbia, the Honourable Peter Fassbender, Minister of Community, Sport and Cultural Development, and His Worship Gregor Robertson, Mayor of Vancouver, will be held on Tuesday, September 29, at 6:30 pm at the Queen Elizabeth Theatre. Starting September 30, a presentation on the new museum will be on view free of charge at the Gallery, and details of the design will be available online at www.vanartgallery.bc.ca/future.