(13) COUNCIL TAX RESOLUTION 2021/22 1. PURPOSE of REPORT the Purpose of This Report Is To

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

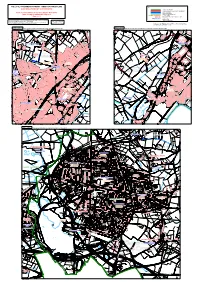

Wigginton & Hopwas Neighbourhood Plan – Historic Environment Map 1

Wigginton & Hopwas Neighbourhood Plan – Historic Environment Map 1: Designated Heritage Assets The map identifies the designated heritage assets within the parish. There are two Conservation Areas: Hopwas and Wigginton. There are also 15 Grade II Listed buildings and structures and a further 14 buildings within Hopwas which have been identified as being of local importance following the Conservation Area Appraisal and Management Plan carried out by Lichfield District Council in May 2012 (http://www.lichfielddc.gov.uk/downloads/file/5037/hopwas_conservation_area_appr aisal_and_management_plan ). This document also provides detailed information on the significance and local character of the village. It should be noted that there are other historic buildings which are not designated which may be deemed to contribute to the local character of the parish and to the individual villages; this may include buildings within Comberford and Wigginton as well as the historic farmsteads (see below). Policy wording which seeks to protect and enhance the character of the settlements in terms of materials used, scale etc. may be appropriate to retain their local distinctiveness. Map 2: Sites of known archaeological interest (excluding buildings and structures) The map shows those sites recorded on the Staffordshire Historic Environment Record (HER), excluding buildings and structures, which are deemed to have an archaeological interest. The Staffordshire HER is a database which records all of the known archaeological sites and monuments as well as the historic buildings. It also incorporates information on archaeological work that has been carried out within the county and further information can be found at www.staffordshire.gov.uk/Historic- Environment-Record . -

Curborough, Elmhurst, Farewell and Chorley Parish Council 12 March 2020

Curborough, Elmhurst, Farewell and Chorley Parish Council 12 March 2020 In attendance: Councillor Brown, Keen, Derry, Tisdale, Jennings, Mejor, Gulliver and Smith. Also in attendance: Members of public: 2 Other Councillors:0 Clerk: Ellen Bird 1. Apologies for Absence Apologies for absence were received from Councillors Packwood, Hammersley, Robinson, Bailey and Councillor Strachan, Lichfield District Council (LDC) and Councillor Tittley, Staffordshire County Council (SCC) Noted 2. Declarations of Interest There were none. 3. Chairman’s Opening Remarks The Chair welcomed everyone to the meeting. The Chair asked that with the likely impact of social isolation for Coronavirus, (which were likely to be announced over the next few days) that Councillors work with their communities to look after vulnerable and older residents. Staffordshire Parish Council Association (SPCA) and the National Association for Local Councils (NALC) would be informing Clerk’s about any legalities that would affect the Parish. Noted 4. Public Forum Potholes A local resident reported large pot holes on Grange Lane and the A515 near Seedy Mill Golf Club. Resolved to ask the Clerk to report these issues to SCC Highways. 1 Date: Signed: 5. To approve the minutes from 9 January 2020 Resolved to a) approve the Parish Meeting minutes held on 9 January 2020. The Minutes were signed by the Chair. b) Approve the adoption of the defibrillator in Chorley by the Parish Council and add it to the Council’s Asset Register c) Ask the Clerk to investigate whether the defibrillator in Chorley could be insured through the Parish Council. Councillors resolved to appoint the following Councillors as signatories on the bank mandate - Jenny Smith - Dorothy Robinson - Sally Keen - Linda Jennings 6. -

TWO WEEKS - SUNDAYS 14Th & 21St March 2021

The Anglican Parishes of Whittington, Weeford and Hints TWO WEEKS - SUNDAYS 14th & 21st March 2021 We are three inclusive Anglican churches where you are always welcome May God’s blessing be upon you We believe in an inclusive Church - church which does not discriminate, on any level, on grounds of economic power, gender, mental health, physical ability, race, age or sexuality. We believe in an hospitable Church which welcomes and serves all people in the name of Jesus Christ; which is inherently Eucharistic and sacramental, scripturally faithful but open to new insights; which seeks to proclaim and apply the Gospel afresh for each generation; and which, in the power of the Holy Spirit, allows all people to grasp how wide and long and high and deep is the love of Jesus Christ. Church Contact: Parish Administrator: Lynne Mills 07721 767963 [email protected] For baptism and wedding bookings and other enquiries Office hours: Thursdays 10.00 am – 3.00 pm Please telephone beforehand to avoid a wasted journey – currently working from home 1 TEMPORARY CANCELLATION OF SERVICES Whittington, Weeford and Hints All services at St Giles’ Church Whittington, St Mary's Church, Weeford, and St Bartholomew's Church, Hints, are cancelled for the foreseeable future. We will continually monitor the situation and we will keep you updated if the situation changes at all. Please be assured of our prayers for you all. Sunday March 14th 2021 – Fourth Sunday of Lent – Mothering Sunday ZOOM MORNING PRAYER AT 9.30 AM Bible Lessons: Exodus 2: 1-10 p58 2 Corinthians 1: 3-7 p1158 Luke 2: 33-35 p1028 COLLECT (BCP) Fourth Sunday of Lent Grant, we beseech thee, Almighty God, that we, who for our evil deeds do worthily deserve to be punished, by the comfort of thy grace may mercifully be relieved; through our Lord and Saviour Jesus Christ. -

Wigginton and Hopwas Parish Council

Wigginton and Hopwas Parish Council DRAFT MINUTES MEETING OF WIGGINTON AND HOPWAS PARISH COUNCIL HELD ON 13th JULY 2017, 7.15 P.M AT THOMAS BARNES SCHOOL, HOPWAS Present: Cllr Stevens (Chair), Cllr Croft, Cllr Moore, Cllr Shirtliff. In attendance: Mrs M Jones (Clerk), 4 members of the public. Open Forum: No contributions were made by residents. 1. To receive and approve apologies. Cllrs Biggs and Gibson had apologised due to holidays. The apologies were accepted. 2. To receive any Declarations of Interest. None received. 3. To approve the Minutes of the meeting of 1st June 2017. RESOLVED to approve the Minutes as a true and accurate record. 4. To receive the Clerk's Report. Hints Road flooding – there had been an update from the drainage team to indicate they would carry out investigations and works over the summer. Bridleway at Hopwas Woods – there had been a complaint from a member of the public regarding the public bridleway running into Hopwas Woods from the top of Hopwas Hill that the MOD were taping it off and informing walkers that they were trespassing. The Clerk had contacted the MOD for their response. Scouts Hopwas Fun day – this would be held on Sunday 16th July at Hopwas Playing Field. 5. To consider any planning matters. (a) Application 17/00783/COU; Keeper’s Cottage, Packington Lane; change of use of land and erection of livery stables. This application was in the neighbouring adjacent parish of Swinfen and Packington. The Clerk had queried whether there would be problems of access for horse boxes at the junction of Packington Lane and Hopwas Hill, but Councillors felt there would not be much additional traffic, ideally the speed limit should be reduced at this point. -

Swinfen and Packington Parish Council Newsletter May 2013

SWINFEN AND PACKINGTON PARISH COUNCIL NEWSLETTER MAY 2013 CHAIRMAN’S REPORT The end of 2013 should bring the introduction of YEAR ENDING MAY 2013 a hybrid bill to provide necessary powers to construct and operate Phase 1 of the railway. The Parish Council met six times during the year and thanks to our continuing good relationship with the It should not be forgotten that Phase 2 the Y Governor and staff at HMYOI Swinfen Hall we have route to Manchester and Leeds was announced continued to use the excellent facility of the thus cutting a swath straight through Conference Centre for our meetings. Staffordshire and creating a whole new set of problems and blight. Construction for Phase 1 is During the year we met Jennifer Cross the new set to start in 2017 to 2026 with view to the line Community Engagement Manager for the Prison and opening to passengers in 2026. the Reverend Jane Newsome, Co-ordinating Chaplain for the Prison who both gave a brief There is a lot that needs to happen before that introduction into their roles at the Prison at Parish but we at the Parish Council will do our best to Council Meetings, also District Councillor Brian achieve the mitigation most suited to our area, Yeates is the Parish Council’s voice at Lichfield this is no easy task. I have to thank Richard Dyott District Council. who along with myself attend many meetings and we shall endeavour to report back anything of We have had through the year numerous discussions relevance to the Council. -

THREE WEEKS - SUNDAYS 15Th, 22Nd & 29Th August 2021

The Anglican Parishes of Whittington, Weeford and Hints THREE WEEKS - SUNDAYS 15th, 22nd & 29th August 2021 We are three inclusive Anglican churches where you are always welcome May God’s blessing be upon you We believe in an inclusive Church - church which does not discriminate, on any level, on grounds of economic power, gender, mental health, physical ability, race, age or sexuality. We believe in an hospitable Church which welcomes and serves all people in the name of Jesus Christ; which is inherently Eucharistic and sacramental, scripturally faithful but open to new insights; which seeks to proclaim and apply the Gospel afresh for each generation; and which, in the power of the Holy Spirit, allows all people to grasp how wide and long and high and deep is the love of Jesus Christ. Church Contact: Parish Administrator: Lynne Mills 07721 767963 [email protected] For baptism and wedding bookings and other enquiries Office hours: Thursdays 10.00 am – 3.00 pm Please telephone beforehand to avoid a wasted journey PLEASE NOTE LYNNE IS ON ANNUAL LEAVE 22-28 AUGUST 2021 1 Sunday 15th August 2021 – Trinity 11 – The Blessed Virgin Mary St Giles’ 09:30 Said Eucharist (CW) The Revd Mal Hawksworth St Mary’s 11:30 Said Eucharist for Patronal Festival The Revd Val Hicks St Bart’s 18:30 Evening Worship Dr Trevor James Bible Lessons: Isaiah 61: 10-end p748 Galatians 4: 4-7 p1170 Luke 1: 46-55 p1026 COLLECT (BCP) Trinity 11 O God, who declares thy almighty power most chiefly in shewing mercy and pity: mercifully grant unto us such a measure of thy grace, that we, running the way of thy commandments, may obtain thy gracious promises and be made partakers of thy heavenly treasure; through Jesus Christ our Lord. -

Whittington to Handsacre HS2 London-West Midlands May 2013

PHASE ONE DRAFT ENVIRONMENTAL STATEMENT Community Forum Area Report 22 | Whittington to Handsacre HS2 London-West Midlands May 2013 ENGINE FOR GROWTH DRAFT ENVIRONMENTAL STATEMENT Community Forum Area Report ENGINE FOR GROWTH 22 I Whittington to Handsacre High Speed Two (HS2) Limited, 2nd Floor, Eland House, Bressenden Place, London SW1E 5DU Telephone 020 7944 4908 General email enquiries: [email protected] Website: www.hs2.org.uk © Crown copyright, 2013, except where otherwise stated Copyright in the typographical arrangement rests with the Crown. You may re-use this information (not including logos or third-party material) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit www.nationalarchives.gov.uk/doc/open-government-licence/ or write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or e-mail: [email protected]. Where we have identified any third-party copyright information you will need to obtain permission from the copyright holders concerned. To order further copies contact: DfT Publications Tel: 0300 123 1102 Web: www.dft.gov.uk/orderingpublications Product code: ES/30 Printed in Great Britain on paper containing at least 75% recycled fibre. CFA Report – Whittington to Handsacre/No 22 I Contents Contents Draft Volume 2: Community Forum Area Report – Whittington to Handsacre/No 22 5 Part A: Introduction 6 1 Introduction 7 1.1 Introduction to HS2 7 1.2 Purpose of this report 7 1.3 Structure of this report 9 Part B: Whittington -

Elford Neighbourhood Plan Is Being Submitted by a Qualifying Body

• • • • • Basic Condition Statement Evidence/Reference The plan is related to the use and development of land and does not include excluded development The Elford Neighbourhood Plan is being submitted by a qualifying body The Elford Neighbourhood Plan covers a stated plan period The Elford Neighbourhood Plan covers a designated Neighbourhood Area The Elford Neighbourhood Plan is in conformity with the NPPF The Elford Neighbourhood Plan contributes to sustainable development as set out by the NPPF • • • The Elford Neighbourhood Plan is in conformity with the Lichfield District Local Plan Strategy (2015) The Elford Neighbourhood Plan is in conformity with the appropriate EU regulations Appendices: Appendix 1 – Designated Neighbourhood Area Appendix 2 – Assessment of Compliance Tables: - Table 1: National Planning Policy Framework - Table 2: Lichfield District Council Local Plan Strategy Elford Parish Edingale CP Fradley and Streethay CP Elford CP Whittington CP Harlaston CP Fisherwick CP Wigginton and Hopwas CP Reproduced from The Ordnance Survey Mapping with the permission of the Controller of Her Majesty's Stationery Offices (C) Crown Copyright : License No 100017765¯ Dated 2012 Key Map supplied by Lichfield District Council Elford Parish Appendix 2 - Assessment of Compliance Table Table 1 - Assessment of Compliance Table - NPPF √ Compliment ~ Not applicable x A conflict may occur National Planning Policy Framework 1 - Building a 2 - Ensuring the 3 - Supporting a 4 - Promoting 5 - Supporting high 6 - Delivering a 7 - Requiring good 8 -

The Local Government Boundary Commission For

THE LOCAL GOVERNMENT BOUNDARY COMMISSION FOR ENGLAND KEY ELECTORAL REVIEW OF STAFFORDSHIRE DISTRICT BOUNDARY PROPOSED ELECTORAL DIVISION BOUNDARY Draft recommendations for electoral division boundaries WARD BOUNDARY PARISH BOUNDARY in the County of Staffordshire May 2011 PARISH WARD BOUNDARY Sheet 5 of 7 LICHFIELD DISTRICT DISTRICT NAME DOVE ED PROPOSED ELECTORAL DIVISION NAME SHOBNALL WARD WARD NAME BRANSTON CP PARISH NAME This map is based upon Ordnance Survey material with the permission of Ordnance Survey on behalf of HENHURST PARISH WARD PARISH WARD NAME the Controller of Her Majesty's Stationery Office © Crown copyright. Scale : 1cm = 0.07500 km Unauthorised reproduction infringes Crown copyright and may lead to prosecution or civil proceedings. Grid Interval 1km The Local Government Boundary Commission for England GD100049926 2011. COINCIDENT BOUNDARIES ARE SHOWN AS THIN COLOURED LINES SUPERIMPOSED OVER WIDER ONES. SHEET 5, MAP 5a SHEET 5, MAP 5b Proposed electoral division boundaries in the east of East Staffordshire borough Proposed electoral division boundaries in the south east of East Staffordshire borough 8 Sandyford Dingle 3 Sports Field A Postern House Sports Farm Ground Rolleston on Dove B D CA E Rolleston Sinai Park i M L s L A IS m Equine Centre il T C l E R a S O W n t A N r t e Y l e R a d m O R A a D i l w C a R y A Y D T O H V O E Rolleston on Dove R C BURTON TOWN ED N L E IF R F O R Golf Course A O (8) D A Beacon Hill D Stretton SHOBNALL WARD ROLLESTON ON DOVE WARD SHOBNALL CP ROLLESTON ON DOVE CP The Rough al an -

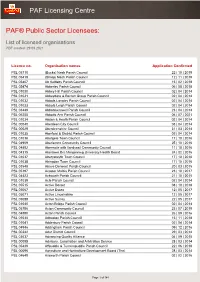

List of Licensed Organisations PDF Created: 29 09 2021

PAF Licensing Centre PAF® Public Sector Licensees: List of licensed organisations PDF created: 29 09 2021 Licence no. Organisation names Application Confirmed PSL 05710 (Bucks) Nash Parish Council 22 | 10 | 2019 PSL 05419 (Shrop) Nash Parish Council 12 | 11 | 2019 PSL 05407 Ab Kettleby Parish Council 15 | 02 | 2018 PSL 05474 Abberley Parish Council 06 | 08 | 2018 PSL 01030 Abbey Hill Parish Council 02 | 04 | 2014 PSL 01031 Abbeydore & Bacton Group Parish Council 02 | 04 | 2014 PSL 01032 Abbots Langley Parish Council 02 | 04 | 2014 PSL 01033 Abbots Leigh Parish Council 02 | 04 | 2014 PSL 03449 Abbotskerswell Parish Council 23 | 04 | 2014 PSL 06255 Abbotts Ann Parish Council 06 | 07 | 2021 PSL 01034 Abdon & Heath Parish Council 02 | 04 | 2014 PSL 00040 Aberdeen City Council 03 | 04 | 2014 PSL 00029 Aberdeenshire Council 31 | 03 | 2014 PSL 01035 Aberford & District Parish Council 02 | 04 | 2014 PSL 01036 Abergele Town Council 17 | 10 | 2016 PSL 04909 Aberlemno Community Council 25 | 10 | 2016 PSL 04892 Abermule with llandyssil Community Council 11 | 10 | 2016 PSL 04315 Abertawe Bro Morgannwg University Health Board 24 | 02 | 2016 PSL 01037 Aberystwyth Town Council 17 | 10 | 2016 PSL 01038 Abingdon Town Council 17 | 10 | 2016 PSL 03548 Above Derwent Parish Council 20 | 03 | 2015 PSL 05197 Acaster Malbis Parish Council 23 | 10 | 2017 PSL 04423 Ackworth Parish Council 21 | 10 | 2015 PSL 01039 Acle Parish Council 02 | 04 | 2014 PSL 05515 Active Dorset 08 | 10 | 2018 PSL 05067 Active Essex 12 | 05 | 2017 PSL 05071 Active Lincolnshire 12 | 05 -

Wigginton and Hopwas Parish Council

Wigginton and Hopwas Parish Council. Chairman of the Parish Council Councillor Keith Stevens Mrs. M. Jones, Clerk, Wigginton and Hopwas Parish Council, 50, Cornwall Avenue Tamworth, Staffordshire. B78 3YB 01827 50230 [email protected] 14/02/13 Mrs Clare Egginton Principal Development Plans Officer Lichfield District Council District Council House Frog Lane Lichfield WS13 6YU Dear Clare Re: Application for Designation of a Neighbourhood Area At the Parish Council meeting held on 7th February 2013 it was resolved that the Parish Council should apply to Lichfield District Council to request that the Parish of Wigginton and Hopwas be designated a Neighbourhood Area. Accordingly as a Parish Council and relevant body for the purposes of section 61G of the 1990 Act we enclose a map identifying the Parish of Wigginton and Hopwas which we believe is an area appropriate to be designated a Neighbourhood Area. The Parish of Wigginton and Hopwas is predominately rural, comprising the villages of Hopwas and Wigginton, the hamlet of Comberford, and several farms and outlying properties. It is bordered on the south by the town of Tamworth, which is used for services by many residents. The Parish Council believes that the development of a Neighbourhood Plan through consultation with residents is appropriate for providing for the needs of the communities which it serves. Yours sincerely Mrs M Jones Mrs M Jones Clerk to Wigginton and Hopwas Parish Council Wigginton & Hopwas Parish Harrllastton CP Ellfforrd CP Whiittttiingtton CP Fiisherrwiick CP Thorrpe Consttanttiine CP Wiiggiintton and Hopwas CP Swiinffen and Packiingtton CP Hiintts CP Fazelley CP Reproduced from The Ordnance Survey Mapping with the permission of the Controller of Her Majesty's Stationery Offices (C) Crown Copyright : License No 10001776¯5 Dated 2013 Key Map supplied by Lichfield District Council Lichfield District Boundary Wigginton & Hopwas Parish. -

Wigginton Hopwas and Comberford Neighbourhood Plan Appendix G

Wigginton Hopwas and Comberford Neighbourhood Plan Appendix G Publicising the Plan Parish Council Newsletter March 2013 Leaflet promoting meeting June 2013 Poster promoting meeting July 2013 Parish Council Newsletter October 2013 Flyer promoting public meeting January 2014 Flyer delivered to all properties and businesses March 201-5 Covering letter accompanying copy of Plan delivered to all properties August 2015 For mcrs informaticn about LViggi*tcn and Hopwas Farish Ccuncil and regular updates see wwar.wi ggi nto n a n d hopwas,ec"ufu Ft.ilASE CONTACT U5 T{-} HSLP DEVET-OP OUR, NIIGI-I*{iIJRi-ICCD P!-AN! Wiggintan & Hepwas l{eighbosfhe$d *rea prcp*sa! PLAY AREAS Wiggir:t*r': *nd h'fopwas Parish Tlhe Localism Act efii:*les c*rx'lrer*nities tc prcrd**e lheir srvn f*rm*l Cou nci I r;':anages eomberford lVlillenniun'r Gr*en and Hopwas pians ior a defined a:e {the }.ieigtlbourhoad Areal. ?hey *re PlayinE Field. This includes discreticnary, buf a e*r*rarxrtii3' hes the right t* d*eide t* prepare arranging fon the grass to be s*ch a plan if it wisires e*" Neigtrb+urhood Flans ar* prapar*d by ihe cut, bushes to he trimmed, bark to **mmscity and sei E:*t lq:calpianning polici*s isl r*ia**n tc that be replenished and pfay equipment area. They have t* be i* ii*e with naiional ar:d i*cai planni*g to he insp*ct*d anet n"laintained. pciicy, liave ta b* independently examined and tir*.si v*f.ed *pac in a Residents of ihe whole parish are i*sai referendum.