Godrej INDUSTRIES Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017-18

Godrej Industries Ltd. www.godrejindustries.com ANNUAL REPORT 2017-18 Contents Board of Directors 02 Corporate Information 04 Chairman’s Statement 06 Financial Highlights 11 Notice & Explanatory Statement 13 Board's Report 27 Report on Corporate Governance 93 Auditor’s Report (Consolidated) 113 Consolidated Accounts 120 Auditor's Report (Standalone) 217 Standalone Accounts 224 Statement Pursuant to Section 129 283 1 BOARD OF DIRECTORS A. B. Godrej Chairman N. B. Godrej Managing Director T. A. Dubash Executive Director & Chief Brand Officer J. N. Godrej V. M. Crishna N. S. Nabar Executive Director & President (Chemicals) K. K. Dastur S. A. Ahmadullah A. B. Choudhury A. D. Cooper K. N. Petigara K. M. Elavia Corporate Information AUDITORS : BSR & Co. LLP, Chartered Accountants BOARD COMMITTEES Audit Committee : K. K. Dastur (Chairman) S. A. Ahmadullah K. N. Petigara A. B. Choudhury Nomination & : S. A. Ahmadullah (Chairman) Compensation Committee A. B. Choudhury K. N. Petigara Stakeholders Relationship/ : A. B. Godrej (Chairman) Shareholders Committee N. B. Godrej T. A. Dubash N. S. Nabar Corporate Social : N. B. Godrej (Chairman) Responsibility Committee: T. A. Dubash K. N. Petigara A. B. Choudhury Risk Management Committee : N. B. Godrej (Chairman) T. A. Dubash N. S. Nabar Management Committee : A. B. Godrej (Chairman) N. B. Godrej A. D. Cooper T. A. Dubash N. S. Nabar CHIEF FINANCIAL OFFICER : Clement Pinto COMPANY SECRETARY : Nilufer Shekhawat REGISTERED OFFICE : Godrej One, Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai 400 079. Phone: 022-2518 8010, 2518 8020, 2518 8030 Fax: 022-2518 8066 website: www.godrejindustries.com CIN No.: L24241MH1988PLC097781 4 REGISTRARS & TRANSFER AGENT : Computech Sharecap Ltd. -

Big Power Trade - Futuros National Stock Exchange of India (NSE)

BiG Power Trade - Futuros National Stock Exchange of India (NSE) País / Região Bolsa Produto Horário Futuros (Moeda, National Stock Exchange of India (NSE) Segunda-feira - Sexta-feira: Acções, Índices de 9:15-15:30 IST* Índia www.nseindia.com acções) IB Simbolo Instrumento Simbolo Moeda ACC ACC LIMITED ACC INR ADANIPOWE ADANI POWER LIMITED ADANIPOWER INR AJANTPHAR AJANTA PHARMA LTD AJANTPHARM INR ALBK ALLAHABAD BANK ALBK INR AMARAJABA AMARA RAJA BATTERIES LTD AMARAJABAT INR AMBUJACEM AMBUJA CEMENTS LIMITED AMBUJACEM INR ANDHRABAN ANDHRA BANK ANDHRABANK INR APOLLOHOS APOLLO HOSPITALS ENTERPRISE APOLLOHOSP INR APOLLOTYR APOLLO TYRES LIMITED APOLLOTYRE INR ARVIND ARVIND LTD ARVIND INR ASHOKLEY ASHOK LEYLAND LIMITED ASHOKLEY INR ASIANPAIN ASIAN PAINTS LTD ASIANPAINT INR AUROPHARM AUROBINDO PHARMA LTD AUROPHARMA INR AXISBANK AXIS BANK LTD AXISBANK INR BAJAJ-AUT BAJAJ AUTO LIMITED BAJAJ-AUTO INR BAJAJFINS BAJAJ FINSERV LTD BAJAJFINSV INR BAJFINANC BAJAJ FINANCE LTD BAJFINANCE INR BALKRISIN BALKRISHNA INDUSTRIES LTD BALKRISIND INR BALRAMCHI BALRAMPUR CHINI MILLS LTD BALRAMCHIN INR BANKBAROD BANK OF BARODA BANKBARODA INR BANKINDIA BANK OF INDIA BANKINDIA INR BANKNIFTY Nifty Bank BANKNIFTY INR BATAINDIA BATA INDIA LTD BATAINDIA INR BEL BHARAT ELECTRONICS LTD BEL INR BEML BEML LIMITED BEML INR BERGEPAIN BERGER PAINTS INDIA LTD BERGEPAINT INR BHARATFIN BHARAT FINANCIAL INCLUSION L BHARATFIN INR BHARATFOR BHARAT FORGE LIMITED BHARATFORG INR BHARTIART BHARTI AIRTEL LIMITED BHARTIARTL INR BHEL BHARAT HEAVY ELECTRICALS BHEL INR BIOCON BIOCON LTD BIOCON -

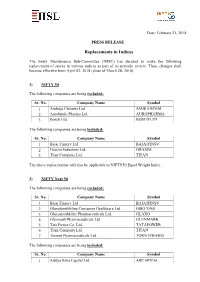

Replacements in Indices

Date: February 21, 2018 PRESS RELEASE Replacements in Indices The Index Maintenance Sub-Committee (IMSC) has decided to make the following replacement of stocks in various indices as part of its periodic review. These changes shall become effective from April 02, 2018 (close of March 28, 2018). 1) NIFTY 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Ambuja Cements Ltd. AMBUJACEM 2 Aurobindo Pharma Ltd. AUROPHARMA 3 Bosch Ltd. BOSCHLTD The following companies are being included: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 Grasim Industries Ltd. GRASIM 3 Titan Company Ltd. TITAN The above replacements will also be applicable to NIFTY50 Equal Weight Index. 2) NIFTY Next 50 The following companies are being excluded: Sr. No. Company Name Symbol 1 Bajaj Finserv Ltd. BAJAJFINSV 2 GlaxoSmithkline Consumer Healthcare Ltd. GSKCONS 3 Glaxosmithkline Pharmaceuticals Ltd. GLAXO 4 Glenmark Pharmaceuticals Ltd. GLENMARK 5 Tata Power Co. Ltd. TATAPOWER 6 Titan Company Ltd. TITAN 7 Torrent Pharmaceuticals Ltd. TORNTPHARM The following companies are being included: Sr. No. Company Name Symbol 1 Aditya Birla Capital Ltd. ABCAPITAL Sr. No. Company Name Symbol 2 Ambuja Cements Ltd. AMBUJACEM 3 Aurobindo Pharma Ltd. AUROPHARMA 4 Bosch Ltd. BOSCHLTD 5 General Insurance Corporation of India GICRE 6 L&T Finance Holdings Ltd. L&TFH 7 SBI Life Insurance Company Ltd. SBILIFE 3) NIFTY 500 The following companies are being excluded: Sr. No. Company Name Symbol 1 Adani Enterprises Ltd. ADANIENT 2 Ahluwalia Contracts (India) Ltd. AHLUCONT 3 Apar Industries Ltd. APARINDS 4 AstraZenca Pharma India Ltd. ASTRAZEN 5 Corporation Bank CORPBANK 6 Dalmia Bharat Ltd. -

Corporate Presentation May 2015

GODREJ PROPERTIES CORPORATE PRESENTATION MAY 2015 DISCLAIMER This presentation does not constitute or form part of any offer or invitation or appropriate for such purpose. Any opinions expressed in this inducement to sell or issue, or any solicitation of any offer to purchase or presentation are subject to change without notice and past subscribe for, any securities of Godrej Properties Limited (the Company), nor performance is not indicative of future results. None of the Company or shall it or any part of it or the fact of its distribution form the basis of, or be relied its promoters shall have any responsibility or liability whatsoever for any on in connection with, any contract or commitment therefore. loss howsoever arising from this presentation or its contents or otherwise arising in connection therewith. This presentation contains statements that constitute forward-looking statements. These statements include descriptions regarding the intent, This presentation and its contents are confidential and should not be belief or current expectations of the Company or its directors and officers with distributed, published or reproduced, in whole or part, or disclosed by respect to the results of operations and financial condition of the Company. recipients directly or indirectly to any other person. In particular, this Such forward-looking statements are not guarantees of future performance presentation is not for publication or distribution or release in any and involve risks and uncertainties, and actual results may differ from those in country where such distribution may lead to a breach of any law or such forward-looking statements as a result of various factors and regulatory requirement. -

Media Release

| INDUSTRIES Media Release Mumbai, May 30, 2011 Consolidated Total Income for FY 2010-11 at ` 4602 crore up by 24% Consolidated PBDIT for FY 2010-11 at ` 466 crore up by 34% Consolidated PBT for FY 2010-11 at ` 323 crore up by 52% Consolidated Net Profit for FY 2010-11 at ` 293 crore up by 44% Board of Directors recommend 175% final dividend Godrej Industries Limited today reported its financial performance for Q4 & FY 2010-2011. Highlights of the financial results for Q4 & FY 2010-11: ` Cr. Q4 Q4 % FY FY % FY 2011 FY 2010 increase 2011 2010 increase Total Income 1431 1099 30% 4602 3716 24% PBDIT 175 123 42% 466 347 34% PBT 134 96 39% 323 213 52% Net Profit 109 76 43% 293 203 44% EPS (`) (annualised) 13.7 9.6 43% 9.2 6.4 44% Final Dividend proposed for FY 2010-11, subject to shareholders’ approval, is ` 1.75 per equity share of ` 1/- each (previous year ` 1.50 per equity share of ` 1/- each). HIGHLIGHTS OF PERFORMANCE (Q4 FY 2010-11) • Total Income increased by 30% to ` 1431 crore. • PBDIT higher by 42% to ` 175 crore. • Profit Before Tax up by 39% to ` 134 crore. • Net Profit increased by 43% to ` 109 crore. CHAIRMAN’S COMMENTS Commenting on the performance for Q4 & FY 2010-11, Mr. A. B. Godrej, Chairman, Godrej Industries Limited, said: “It gives me great pleasure to announce that it has been an excellent year for all our operating businesses thereby reinforcing the efficacy of our business model, our vision and values, and ‘CREATE’, our strategy for growth. -

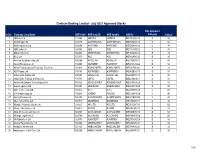

Working July 2021.Xlsx

Centrum Broking Limited - July 2021 Approved Stocks CBL Approved Sr.No Company Long Name BSE Code BSE Scrip ID NSE Symbol ISIN No Category Haircut 1 3M India Ltd 523395 3MINDIA 3MINDIA INE470A01017 D 50 2 Aarti Drugs Ltd 524348 AARTIDRUGS AARTIDRUGS INE767A01016 D 50 3 Aarti Industries Ltd 524208 AARTIIND AARTIIND INE769A01020 C 40 4 ABB India Ltd 500002 ABB ABB INE117A01022 C 40 5 Abbott India Ltd 500488 ABBOTINDIA ABBOTINDIA INE358A01014 B 25 6 ACC Ltd 500410 ACC ACC INE012A01025 B 25 7 Accelya Solutions India Ltd 532268 ACCELYA ACCELYA INE793A01012 E 60 8 Adani Enterprises Ltd 512599 ADANIENT ADANIENT INE423A01024 D 50 9 Adani Ports & Special Economic Zone Ltd 532921 ADANIPORTS ADANIPORTS INE742F01042 A 20 10 ADF Foods Ltd 519183 ADFFOODS ADFFOODS INE982B01019 D 50 11 Aditya Birla Capital Ltd 540691 ABCAPITAL ABCAPITAL INE674K01013 D 50 12 Aditya Birla Fashion & Retail Ltd 535755 ABFRL ABFRL INE647O01011 D 50 13 Advanced Enzyme Technologies Ltd 540025 ADVENZYMES ADVENZYMES INE837H01020 D 50 14 Aegis Logistics Ltd 500003 AEGISLOG AEGISCHEM INE208C01025 D 50 15 Agro Tech Foods Ltd 500215 ATFL ATFL INE209A01019 E 60 16 AIA Engineering Ltd 532683 AIAENG AIAENG INE212H01026 C 40 17 Ajanta Pharma Ltd 532331 AJANTPHARM AJANTPHARM INE031B01049 C 40 18 Akzo Nobel India Ltd 500710 AKZOINDIA AKZOINDIA INE133A01011 C 40 19 Alembic Pharmaceuticals Ltd 533573 APLLTD APLLTD INE901L01018 E 60 20 Alkem Laboratories Ltd 539523 ALKEM ALKEM INE540L01014 B 25 21 Alkyl Amines Chemicals Ltd 506767 ALKYLAMINE ALKYLAMINE INE150B01039 D 50 22 Allcargo Logistics -

Code of Conduct

Code of Conduct This Code of Conduct is applicable to all employees, associates in business and members of the Board of Directors of Godrej Industries Limited and Associate Companies (GILAC), across geographies. You as an employee or associate of GILAC are expected to read the Code of Conduct (the ‘Code’), be aware of its principles to follow during the conduct of your business work for GILAC and sign a periodic declaration of acknowledgement that you have read, understood and agree to abide by the principles laid down in this Code and all the other policies of the respective GILAC company and submit such declaration to the HR Team. There will be zero-tolerance policy as to any violation of this Code. Godrej Consumer Products 2 Code of conduct A MESSAGE FROM OUR CHAIRMAN Dear colleague, We at Godrej, are fortunate to draw from a strong legacy that has held us in good stead for over a hundred years now. We believe, our values strengthened with re-emphasis through the codified ‘Godrej Way’ principles distinguish our successes, even as we grow and adapt, in sync with the changing times. So, it is imperative that we continue to earn and value the trust and respect of our colleagues, customers, suppliers, shareholders and other members of the communities of which we are a part. The Godrej Code of Conduct is the essence of our business principles and provides you a charter as to how they apply to each of us. I encourage you to adhere to these principles in both spirit and practice, as you lead Godrej into the future. -

NTDOP Strategy December 2018 Update

NTDOP Strategy December 2018 Update Investment Objective Top 10 Holding & Top 5 Sectors The Strategy aims to deliver superior returns by investing in stocks Scrip Names % Holdings from sectors that can benefit from the Next Trillion Dollar GDP growth by focusing on different Multicap stocks Kotak Mahindra Bank Ltd. 11.10 Page Industries Ltd. 10.17 Performance Voltas Ltd. 8.87 Bajaj Finance Ltd. 5.33 5.63X Eicher Motors Ltd. 5.26 65 NTDOP Strategy Nifty 500 City Union Bank Ltd. 4.99 55 L&T Technology Services Ltd. 4.38 45 Bosch Ltd. 4.27 35 Max Financial Services Ltd. 3.97 25 Godrej Industries Ltd. 3.89 15 1.79X Sectors % Allocation 5 Banking & Finance 30.21 -5 FMCG 17.98 Jul-12 Jul-17 Jan-10 Jan-15 Jun-10 Jun-15 Oct-08 Oct-13 Oct-18 Apr-11 Apr-16 Sep-11 Feb-12 Sep-16 Feb-17 Dec-07 Dec-12 Dec-17 Aug-09 Aug-14 Nov-10 Nov-15 Mar-09 Mar-14 May-13 May-18 May-08 Auto & Auto Ancillaries 13.11 Diversified 12.76 29.54 Infotech 8.05 NTDOP Strategy Nifty 500 26.72 26.64 Cash 0.14 17.02 15.53 16.42 15.84 13.01 13.43 13.81 13.26 10.86 Market Capitalization 7.12 5.45 Market Capitalization % Equity 1 year 2 Year 3 Years 4 Years 5 Years 7 Years 10 years Since Large cap 43 -3.00 -0.50 Inception Midcap 51 Smallcap 6 Weighted Average Market Cap (Rs. -

Company Reliance Industries Limited Tata Consultancy Services

Top 1000 Private Sector Companies (Rank-wise List) Company Reliance Industries Limited Tata Consultancy Services (TCS) Infosys Technologies Ltd Wipro Limited Bharti Tele-Ventures Limited ITC Limited Hindustan Lever Limited ICICI Bank Limited Housing Development Finance Corp. Ltd. TATA Steel Limited Ranbaxy Laboratories Limited HDFC Bank Ltd Tata Motors Limited Larsen & Toubro Limited (L&T) Satyam Computer Services Ltd. Maruti Udyog Limited Bajaj Auto Ltd. HCL Technologies Ltd. Hero Honda Motors Limited Hindalco Industries Ltd Reliance Energy Limited Grasim Industries Limited Jet Airways (India) Ltd. Sun Pharmaceuticals Industries Ltd Cipla Ltd. Gujarat Ambuja Cements Ltd. Videsh Sanchar Nigam Limited The Tata Power Company Limited Sterlite Industries (India) Ltd. Associated Cement Companies Ltd. Nestlé India Ltd. Hindustan Zinc Limited GlaxoSmithKline Pharmaceuticals Limited Siemens India Ltd. Motor Industries Company Limited Mahindra & Mahindra Limited UTI Bank Ltd. Zee Telefilms Limited Bharat Forge Limited ABB Limited i-Flex Solutions Ltd. Dr. Reddy's Laboratories Ltd. Nicholas Piramal India Limited Kotak Mahindra Bank Limited Reliance Capital Ltd. Ultra Tech Cement Ltd. Patni Computer Systems Ltd. Wockhardt Limited Indian Petrochemicals Corporation Limited Biocon India Limited Essar Oil Limited. Asian Paints Ltd. Dabur India Limited Jaiprakash Associates Limited JSW Steel Limited Tata Chemicals Limited Tata Tea Limited Tata Teleservices (Maharashtra) Limited The Indian Hotels Co. Ltd. Glenmark Pharmaceuticals Limited NIRMA Limited Jindal Steel & Power Ltd HCL Infosystems Ltd. Cadila Healthcare Limited Colgate-Palmolive (India) Limited The Great Eastern Shipping Company Limited Aventis Pharma India Ltd Ashok Leyland Limited Pantaloon Retail (India) Limited Indian Rayon And Industries Limited Financial Technologies (India) Ltd United Phosphorus Limited Matrix Laboratories Limited Sesa Goa Limited Lupin Ltd Cummins India Limited Crompton Greaves Limited. -

Report on Corporate Governance

REPORT ON CORPORATE GOVERNANCE COMPANY’S PHILOSOPHY ON denotes the highest rating. The CGR2+ has a lead Independent Director, CORPORATE GOVERNANCE rating implies that according to ICRA’s in line with the accepted best Corporate governance refers to the current opinion, the rated company has practices, to strengthen the framework of rules and practices adopted and follows such practices, focus and quality of discussion through which the board of directors conventions, and codes that would at the Board level. ensures accountability, fairness, provide its financial stakeholders a high and transparency in a company’s level of assurance on the quality of The Board meets at least relationship with all its stakeholders. corporate governance. once in a quarter to review the Company’s quarterly The Company is a part of the 122-year- The SVG1 rating is on a rating scale of performance and financial old Godrej Group, which has established SVG1 to SVG6, where SVG1 denotes results. Board meetings are a reputation for honesty, integrity, and the highest rating. The SVG1 rating governed with a structured sound governance. The Company’s implies that in ICRA’s current opinion, agenda. The Board periodically philosophy on corporate governance the Company belongs to the highest reviews compliance reports with envisages attainment of the highest category on the composite parameters respect to laws and regulations levels of transparency, accountability, of stakeholder value creation and applicable to the Company. and equity in all facets of its operations management as well as corporate Before the commencement of and interactions with its stakeholders, governance practices. the Audit Committee meeting, including shareholders, employees, the members of the Audit lenders, and the government. -

RESULTS PRESENTATION First Quarter, Financial Year 2016 DISCLAIMER

RESULTS PRESENTATION First Quarter, Financial Year 2016 DISCLAIMER Some of the statements in this communication may be 'forward looking statements' within the meaning of applicable laws and regulations. Actual results might differ substantially or materially from those expressed or implied. Important developments that could affect the Company's operations include changes in industry structure, significant changes in political and economic environment in India and overseas, tax laws, import duties, litigation and labor relations 02 I GODREJ PROPERTIES I RESULTS PRESENTATION Q1 FY16 AGENDA Overview 01 Q1 FY16 Operational Highlights 02 Q1 FY16 Financial Highlights 03 Annexure 04 GODREJ GROUP Established in 1897 Value Creation for Investors $4.5 bn in annual revenue1 2 14 Year CAGR 600 million people use a Godrej product every day Godrej ranked as 2nd most trusted Indian brand3 BSE SENSEX 16 $2.8 billion brand valuation by Interbrand4 Amongst India’s most diversified and trusted Godrej Consumer Products 37 conglomerates Real estate identified as one of the key growth Godrej Industries Limited 41 businesses for the Group (%) 1. Group Revenues in FY15 Note: CAGR calculated for closing prices as of 18th June, 2001 and 30th June, 2015 2. Godrej Group internal study 3. The Brand Trust Report 2013 4. Interbrand study done in 2011 Godrej & Boyce Godrej Industries Godrej Properties Godrej Consumer Godrej Agrovet 04 I GODREJ PROPERTIES I RESULTS PRESENTATION Q1 FY16 GODREJ PROPERTIES Established in 1990 Presence in 12 cities across India Real estate worth over US $1.3 bn sold in the past three years Chandigarh 0.7, 1 NCR 8.0, 5 100 million sq.ft. -

Godrej Industries Limited Corporate Presentation

Godrej Industries Limited Corporate Presentation November 2007 Disclaimer This presentation does not constitute or form part of any offer or invitation or inducement to sell or issue, or any solicitation of any offer to purchase or subscribe for, any securities of Godrej Industries Limited (“GIL”) (the “Company”), nor shall it or any part of it or the fact of its distribution form the basis of, or be relied on in connection with, any contract or commitment therefor. This presentation contains statements that constitute forward-looking statements. These statements include descriptions regarding the intent, belief or current expectations of the Company or its directors and officers with respect to the results of operations and financial condition of the Company. These statements can be recognized by the use of words such as “expects,” “plans,” “will,” “estimates,” “projects,” or other words of similar meaning. Such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, and actual results may differ from those in such forward-looking statements as a result of various factors and assumptions which the Company believes to be reasonable in light of its operating experience in recent years. The Company does not undertake to revise any forward-looking statement that may be made from time to time by or on behalf of the Company. No representation, warranty, guarantee or undertaking, express or implied, is or will be made as to, and no reliance should be placed on, the accuracy, completeness or fairness of the information, estimates, projections and opinions contained in this presentation. Readers must make their own assessment of the relevance, accuracy and adequacy of the information contained in this presentation.