Metro Pacific Subsidiary to Sell Development Rights in Global City's

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Informal Learning Choices of Japanese ESL Students in the United States

Portland State University PDXScholar Dissertations and Theses Dissertations and Theses 1-1-2012 Informal Learning Choices of Japanese ESL Students in the United States Brent Harrison Amburgey Portland State University Follow this and additional works at: https://pdxscholar.library.pdx.edu/open_access_etds Let us know how access to this document benefits ou.y Recommended Citation Amburgey, Brent Harrison, "Informal Learning Choices of Japanese ESL Students in the United States" (2012). Dissertations and Theses. Paper 755. https://doi.org/10.15760/etd.755 This Thesis is brought to you for free and open access. It has been accepted for inclusion in Dissertations and Theses by an authorized administrator of PDXScholar. Please contact us if we can make this document more accessible: [email protected]. Informal Learning Choices of Japanese ESL Students in the United States by Brent Harrison Amburgey A thesis submitted in partial fulfillment of the requirements for the degree of Master of Arts in TESOL Thesis Committee: Nike Arnold, Chair Lynn Santelmann Kim Brown Portland State University 2012 INFORMAL LEARNING CHOICES OF JAPANESE ESL STUDENTS i Abstract This study was designed to explore possible relationships between English language learners past formal language learning experiences and beliefs about language learning on the one hand, and their informal learning choices on the other. Six Japanese English as a second language (ESL) students participated in the study. Participants were interviewed and asked to complete an English study log for one week prior to their scheduled interview. The results of the study suggested that there were likely connections between experiences, beliefs, informal learning choices. -

Robinsons Land Corporation RLC

The Exchange does not warrant and holds no responsibility for the veracity of the facts and representations contained in all corporate disclosures, including financial reports. All data contained herein are prepared and submitted by the disclosing party to the Exchange, and are disseminated solely for purposes of information. Any questions on the data contained herein should be addressed directly to the Corporate Information Officer of the disclosing party. Robinsons Land Corporation RLC PSE Disclosure Form 17-11 - List of Stockholders Reference: Section 17.11 of the Revised Disclosure Rules Type of Securities Common Preferred - Others - Record Date of Apr 24, 2019 Stockholders' Meeting Date of Stockholders' May 29, 2019 Meeting Type of Stockholders' Meeting Annual (Annual or Special) Other Relevant Information Please find attached the list of stockholders of Robinsons Land Corporation (RLC) as of April 24, 2019, the record date set by the Board of Directors of RLC to determine the stockholders entitled to notice and to vote at the annual meeting of the stockholders of RLC to be held on May 29, 2019. Filed on behalf by: Name Rosalinda Rivera Designation Corporate Secretary Robinsons Land Corporation April 24, 2019 SH # SH NAME SH ADDRESS NATIONALITY TOTAL NO. OF SHARES PERCENTAGE 0000230766 A & A SECURITIES, INC. 1906 PACIFIC BANK BLDG. AYALA AVENUE, MAKATI CITY FILIPINO 4,000.00 0.00007701 0000230768 A. ANGEL S. TANJANGCO 542 ARQUIZA ST.,ERMITA, MANILA FILIPINO 38,500.00 0.00074126 0000230770 ABOITIZ JEBS EN BULK TRANSPORT CORPORATION CEBU CITY, PHILIPPINES FILIPINO 400.00 0.00000770 0000230771 ABRAHAM T. CO C/O PBU, RCBC 333 SEN GIL PUYAT AVE 1200 MAKATI, METRO MANILA FILIPINO 1,000.00 0.00001925 0000230772 ACRIS CORPORATION 5/F BENPRES BUILDING,MERALCO AVENUE, PASIG CITY FILIPINO 8,900.00 0.00017136 0000230774 ADELINA A. -

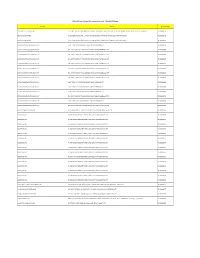

DOLE-NCR for Release AEP Transactions As of 7-16-2020 12.05Pm

DOLE-NCR For Release AEP Transactions as of 7-16-2020 12.05pm Company Address Transaction No. 3M SERVICE CENTER APAC, INC. 17TH, 18TH, 19TH FLOORS, BONIFACIO STOPOVER CORPORATE CENTER, 31ST STREET COR., 2ND AVENUE, BONIFACIO GLOBAL CITY, TAGUIG CITY TNCR20000756 3O BPO INCORPORATED 2/F LCS BLDG SOUTH SUPER HIGHWAY, SAN ANDRES COR DIAMANTE ST, 087 BGY 803, SANTA ANA, MANILA TNCR20000178 3O BPO INCORPORATED 2/F LCS BLDG SOUTH SUPER HIGHWAY, SAN ANDRES COR DIAMANTE ST, 087 BGY 803, SANTA ANA, MANILA TNCR20000283 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000536 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000554 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000569 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000607 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000617 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000632 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000633 8 STONE BUSINESS OUTSOURCING OPC 5TH-10TH/F TOWER 3, PITX #1, KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000638 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY ROAD, TAMBO, PARAÑAQUE CITY TNCR20000680 8 STONE BUSINESS OUTSOURCING OPC 5-10/F TOWER 1, PITX KENNEDY -

The Prospectus Is Being Displayed in the Website to Make the Prospectus Accessible to More Investors. the Pse Assumes No Respons

THE PROSPECTUS IS BEING DISPLAYED IN THE WEBSITE TO MAKE THE PROSPECTUS ACCESSIBLE TO MORE INVESTORS. THE PSE ASSUMES NO RESPONSIBILITY FOR THE CORRECTNESS OF ANY OF THE STATEMENTS MADE OR OPINIONS OR REPORTS EXPRESSED IN THE PROSPECTUS. FURTHERMORE, THE STOCK EXCHANGE MAKES NO REPRESENTATION AS TO THE COMPLETENESS OF THE PROSPECTUS AND DISCLAIMS ANY LIABILITY WHATSOEVER FOR ANY LOSS ARISING FROM OR IN RELIANCE IN WHOLE OR IN PART ON THE CONTENTS OF THE PROSPECTUS. ERRATUM Page 51 After giving effect to the sale of the Offer Shares and PDRs under the Primary PDR Offer (at an Offer price of=8.50 P per Offer Share and per PDR) without giving effect to the Company’s ESOP, after deducting estimated discounts, commissions, estimated fees and expenses of the Combined Offer, the net tangible book value per Share will be=1.31 P per Offer Share. GMA Network, Inc. GMA Holdings, Inc. Primary Share Offer on behalf of the Company of 91,346,000 Common Shares at a Share Offer Price of=8.50 P per share PDR Offer on behalf of the Company of 91,346,000 PDRs relating to 91,346,000 Common Shares and PDR Offer on behalf of the Selling Shareholders of 730,769,000 PDRs relating to 730,769,000 Common Shares at a PDR Offer Price of=8.50 P per PDR to be listed and traded on the First Board of The Philippine Stock Exchange, Inc. Sole Global Coordinator, Bookrunner Joint Lead Manager, Domestic Lead Underwriter and Lead Manager and Issue Manager Participating Underwriters BDO Capital & Investment Corporation First Metro Investment Corporation Unicapital Incorporated Abacus Capital & Investment Corporation Pentacapital Investment Corporation Asian Alliance Investment Corporation RCBC Capital Corporation UnionBank of the Philippines Domestic Selling Agents The Trading Participants of the Philippine Stock Exchange, Inc. -

Event Results

Brent International School Manila HY-TEK's MEET MANAGER 7.0 - 3:41 PM 9/14/2019 Page 1 42nd Brent Invitational Swim Meet - 9/14/2019 Results Event 1 Girls 8 & Under 25 SC Meter Freestyle Name Age Team Seed Time Finals Time Points 1 Leighton, Ella 8 Brent International School 18.31 18.44 7 2 Rivadelo, Bella 8 NordAngliaIntlSchoolMnl 22.98 18.59 5 3 Flegler, Lilika 8 Manila Japanese School 19.37 19.46 4 *4 Hoddinott, Senna 7 International School Manila 20.36 19.81 2 . 50 *4 Prashasnth, Draya 8 NordAngliaIntlSchoolMnl NT 19.81 2 . 50 6 Bate, Chiara Marie 8 International School Manila 19.83 20.17 1 7 Ratkai, Szoia 6 International School Manila 21.04 20.53 8 Akimoto, Wakana 7 Manila Japanese School 22.21 21.02 9 Georgiou, Angelica 7 International School Manila 21.41 21.13 10 Georgiou, Joanita 7 International School Manila 22.04 21.39 11 Nguyen, Quyen 7 International School Manila 21.63 21.45 *12 Ando, Shiori 7 Manila Japanese School 33.00 22.12 *12 Green, Emma 8 International School Manila 32.74 22.12 14 Martel, Anika 7 British School Manila 23.45 22.28 15 Endo, Hanna 7 International School Manila 21.44 22.49 16 Long, Caylin 7 British School Manila 27.70 22.70 17 Elliot Lopez, Tara 8 British School Manila 26.08 23.47 18 Wee, Mariana 6 British School Manila 32.58 24.36 19 Barber, Sienna 8 International School Manila 23.64 24.49 20 Quiñonero Lozano, Lucia 7 International School Manila 25.39 24.53 21 Power, Zara 7 British School Manila 24.99 24.72 22 Gane, Raynaya 7 British School Manila 26.57 24.79 23 Hayashi, Fumiko 7 International School Manila -

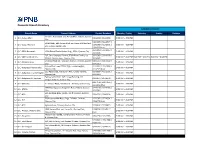

Domestic Branch Directory BANKING SCHEDULE

Domestic Branch Directory BANKING SCHEDULE Branch Name Present Address Contact Numbers Monday - Friday Saturday Sunday Holidays cor Gen. Araneta St. and Aurora Blvd., Cubao, Quezon 1 Q.C.-Cubao Main 911-2916 / 912-1938 9:00 AM – 4:00 PM City 912-3070 / 912-2577 / SRMC Bldg., 901 Aurora Blvd. cor Harvard & Stanford 2 Q.C.-Cubao-Harvard 913-1068 / 912-2571 / 9:00 AM – 4:00 PM Sts., Cubao, Quezon City 913-4503 (fax) 332-3014 / 332-3067 / 3 Q.C.-EDSA Roosevelt 1024 Global Trade Center Bldg., EDSA, Quezon City 9:00 AM – 4:00 PM 332-4446 G/F, One Cyberpod Centris, EDSA Eton Centris, cor. 332-5368 / 332-6258 / 4 Q.C.-EDSA-Eton Centris 9:00 AM – 4:00 PM 9:00 AM – 4:00 PM 9:00 AM – 4:00 PM EDSA & Quezon Ave., Quezon City 332-6665 Elliptical Road cor. Kalayaan Avenue, Diliman, Quezon 920-3353 / 924-2660 / 5 Q.C.-Elliptical Road 9:00 AM – 4:00 PM City 924-2663 Aurora Blvd., near PSBA, Brgy. Loyola Heights, 421-2331 / 421-2330 / 6 Q.C.-Katipunan-Aurora Blvd. 9:00 AM – 4:00 PM Quezon City 421-2329 (fax) 335 Agcor Bldg., Katipunan Ave., Loyola Heights, 929-8814 / 433-2021 / 7 Q.C.-Katipunan-Loyola Heights 9:00 AM – 4:00 PM Quezon City 433-2022 February 07, 2014 : G/F, Linear Building, 142 8 Q.C.-Katipunan-St. Ignatius 912-8077 / 912-8078 9:00 AM – 4:00 PM Katipunan Road, Quezon City 920-7158 / 920-7165 / 9 Q.C.-Matalino 21 Tempus Bldg., Matalino St., Diliman, Quezon City 9:00 AM – 4:00 PM 924-8919 (fax) MWSS Compound, Katipunan Road, Balara, Quezon 927-5443 / 922-3765 / 10 Q.C.-MWSS 9:00 AM – 4:00 PM City 922-3764 SRA Building, Brgy. -

ROBINSONS LAND CORPORATION 43Rd FLOOR ROBINSONS EQUITABLE TOWER ADB AVE

ROBINSONS LAND CORPORATION 43rd FLOOR ROBINSONS EQUITABLE TOWER ADB AVE. COR. POVEDA RD. ORTIGAS CENTER, PASIG CITY TEL. NO.: 633-7631, 637-1670, 240-8801 FAX NO.: 633-9387 OR 633-9207 July 10, 2012 PHILIPPINE STOCK EXCHANGE, INC. 3rd Floor, Philippine Stock Exchange Ayala Triangle, Ayala Avenue Makati City Attention: Ms. Janet A. Encarnacion Head – Disclosure Department PHILIPPINE DEALING AND EXCHANGE CORP. 37/F, Tower 1, The Enterprise Center 6766 Ayala Avenue corner Paseo de Roxas, Makati City Attention: Mr. Cesar B. Crisol President and Chief Operating Officer Re: Robinsons Land Corporation (RLC) List of Top 100 Stockholders and PCD Participants Gentlemen: In compliance with PSE Memo for Brokers No. 225-2003, please find attached the following. 1. List of Top 100 Stockholders of RLC as of June 30, 2012. 2. List of Top 100 PCD Participants of RLC as of June 30, 2012. Thank you. Very truly yours, ROSALINDA F. RIVERA Corporate Secretary /lbo BPI STOCK TRANSFER OFFICE ROBINSONS LAND CORPORATION TOP 100 STOCKHOLDERS AS OF JUNE 30, 2012 RANK STOCKHOLDER NUMBER STOCKHOLDER NAME NATIONALITY CERTIFICATE CLASS OUTSTANDING SHARES PERCENTAGE TOTAL 1 10003137 J. G. SUMMIT HOLDINGS, INC. FIL U 2,496,114,787 60.9725% 2,496,114,787 29/F GALLERIA CORPORATE CTR. EDSA COR. ORTIGAS AVE. MANDALUYONG CITY 2 16012118 PCD NOMINEE CORPORATION (NON-FILIPINO) NOF U 1,023,189,383 24.9934% 1,023,189,383 37/F THE ENTERPRISE CENTER TOWER 1, COR. PASEO DE ROXAS, AYALA AVENUE, MAKATI CITY 3 16012119 PCD NOMINEE CORPORATION (FILIPINO) FIL U 539,962,142 13.1896% 539,962,142 37/F THE ENTERPRISE CENTER TOWER 1, COR. -

INFORMATION SHEET for INTERNAL TRAINING PURPOSES ONLY Come to Where Contemporary Lifestyles M Eet

INFORMATION SHEET FOR INTERNAL TRAINING PURPOSES ONLY COMe To WHERE CONTEMPORARY LIFESTYLEs M EET FOR INTERNAL TRAINING PURPOSES ONLY VERSION 1.0 AS OF MARCH 2015 A MASTER PLAN OF CONVERGENCE The core of Bonifacio Global City’s new center of gravity, Park Triangle, presents Alveo Land’s Park Triangle Residences. This sole condominium development in this dynamic destination, located at the corner of 32nd Street and 11th Avenue, offers unmatched proximity to premier schools, offices, and leisure scenes. A landmark tower among the few communities to rise above the area’s corporate row, it is also the only property in BGC with direct access to an Ayala mall. PARK TRIANGLE RESIDENCES ARTIST’S PERSPECTIVE FOR INTERNAL TRAINING PURPOSES ONLY FOR INTERNAL TRAINING PURPOSES ONLY VERSION 1.0 AS OF MARCH 2015 VERSION 1.0 AS OF MARCH 2015 BONIFACIO GLOBAL CITY An Ayala Land growth center with unmatched accessibility— perfect for a city where life comes together. Breakthrough ideas connecting, practices rooted in sustainability, a city that works. Infrastructure, city management, and green processes collaborating for an unparalleled living and working experience. At BGC’s new center of gravity, Park Triangle pulls you closer to a galaxy of urban conveniences orbiting your pivotal destination. BGC SkYLINE FOR INTERNAL TRAINING PURPOSES ONLY FOR INTERNAL TRAINING PURPOSES ONLY VERSION 1.0 AS OF MARCH 2015 VERSION 1.0 AS OF MARCH 2015 KALAYAAN AVENUE TO MAKATI/ORTIGAS MANILA JAPANESE SCHOOL 8TH AVE THE BRITISH SCHOOL MANILA ST. LUKE’S 34TH ST MEDICAL 38TH ST CENTER S&R MC HOME DEPOT TURF BGC ENERGY CENTER INTERNATIONAL CROSSROADS SCHOOL MANILA RIZAL DRIVE 5TH AVE 32ND ST SHANGRI-LA UP PROFESSIONAL AT THE FORT 7TH AVE SCHOOLS TRACK 30TH THE MINDMUSEUM EVERY ONE BONIFACIO NATION 9TH AVE TRESTON HIGH STREET BONIFACIO INTERNATIONAL HIGH STREET COLLEGE 30TH ST CARLOS P. -

List of BDO Branches Authorized to Exchange Foreign Currencies As of (March 8, 2021)

List of BDO Branches Authorized to Exchange Foreign Currencies as of (March 8, 2021) I. US Dollar (USD) – All BDO Branches II. Other Currencies • Australian Dollar (AUD) • Japanese Yen (JPY) • Bahrain Dinar (BHY) • Korean Won (KRW) • British Pound (GBP) • Saudi Rial (SAR) • Brunei Dollar (BND) • Singapore Dollar (SGD) Chinese Yuan (CNY) • Canadian Dollar (CAD) • Swiss Frank (CHF) • Euro (EUR) • Taiwan Dollar (TWD) • Hongkong Dollar (HKD) • Thailand Baht (THB) • Indonesian Rupiah (IDR) • UAE Dirham (AED) 1 A Place - Coral Way 1 A. Arnaiz – Paseo 2 A. Bonifacio Ave. - Balintawak 2 A. Arnaiz-San Lorenzo Village 3 A. Santos - St. James 3 A. Santos - St. James 4 Acropolis - E. Rodriguez Jr. 4 ADB Avenue Ortigas 5 ADB Avenue Ortigas 5 Alabang Hills 6 Alabang - Madrigal Ave 6 Alabang - Madrigal Ave 7 Angeles City – Miranda 7 Araneta Center Ali Mall II 8 Angono – M.L. Quezon Avenue 8 Arranque 9 Arranque 9 Asia Tower - Paseo 10 Arranque - T. Alonzo 10 Aurora Blvd. - Broadway Centrum 11 Asia Tower - Paseo 11 Aurora Blvd - Notre Dame 12 Aurora Blvd - Broadway Centrum 12 Aurora Blvd. - Yale 13 Aurora Blvd - Notre Dame 13 Ayala Alabang - Richville Center 14 Aurora Blvd. - Yale 14 Ayala Avenue - People Support 15 Ayala Alabang - Richville Center 15 Ayala Avenue - SGV1 Bldg 16 Ayala Avenue - People Support 16 Ayala Triangle 1 17 Ayala Avenue - SGV1 Bldg 17 Baclaran 18 Ayala – Rufino 18 Bacolod – Araneta 19 Baclaran 19 Bacolod - Capitol Shopping 20 Bacolod – Araneta 20 Baguio - Session Road 21 Bacolod - Capitol Shopping 21 Baguio - Marcos Highway Centerpoint 22 Bacolod – Gonzaga 22 Banawe - Agno 23 Bacoor - Aguinaldo Highway 23 Banawe - Amoranto 24 Bagtikan – Chino Roces Avenue 24 Batangas - Sto. -

School Membership Pack

SCHOOL MEMBERSHIP PACK 1. Introduction Letter p. 2 2. Membership Application Form p. 4 3. Pre-Membership Visit Survey Form p. 8 4. Candidate School Staff List Form p. 11 5. Pre-Membership Visit Report p. 12 6. Application Procedure Flowchart p. 29 7. FOBISIA Constitution p. 30 8. FOBISIA By-Laws p. 41 9. Pre-Membership Visit Document Checklist p. 60 10. Schedule of School Membership Fees p. 61 11. School Membership FAQs p. 62 FOBISIA Chair | Mr. Anthony Rowlands | [email protected] FOBISIA CEO | Mr. John Gwyn Jones | [email protected] Dear Applicant, RE INVITATION TO APPLY FOR FOBISIA MEMBERSHIP FOR YOUR SCHOOL Thank you for your interest in becoming a FOBISIA Member School. Membership is open to schools located in Asia that provide a British-type curriculum for a significant majority of students. To qualify as members, schools must satisfy the membership criteria as set out in FOBISIA’s Constitution and By-laws, and successfully complete the application process as set out in Regulation 6 of the Constitution. The governing body of a school must approve the application. To apply for membership of FOBISIA, please prepare a Letter of Intent, which is an official letter from the Head of School (max. one A4-page) providing some context for the application, e.g. history of the school, current status, reasons for wanting to join FOBISIA. Please also complete the following forms and email them, along with your Letter of Intent, to FOBISIA (To: [email protected] ): • Initial Application Form (F1) • Pre-Membership Visit Survey Form (F2) • Staff List Form (F3) Please ensure you retain a copy of these documents as they may be required for reference in a subsequent stage of the application process, should a Pre-Membership Visit be recommended by FOBISIA’s Membership Committee. -

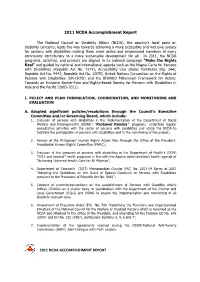

2011 NCDA Accomplishment Report

2011 NCDA Accomplishment Report The National Council on Disability Affairs (NCDA), the country’s focal point on disability concerns, leads the way towards achieving a more accessible and inclusive society for persons with disabilities making them more active and empowered members of every community contributory to a more sustainable development for all. In 2011, the NCDA programs, activities, and projects are aligned to its national campaign “Make the Rights Real” and guided by national and international agenda such as the Magna Carta for Persons with Disabilities (Republic Act No. 7277), Accessibility Law (Batas Pambansa Blg. 344), Republic Act No. 9442, Republic Act No. 10070, United Nations Convention on the Rights of Persons with Disabilities (UN-CRPD) and the BIWAKO Millennium Framework for Action: Towards an Inclusive Barrier-Free and Rights-Based Society for Persons with Disabilities in Asia and the Pacific (2003-2012). I. POLICY AND PLAN FORMULATION, COORDINATION, AND MONITORING AND EVALUATION A. Adopted significant policies/resolutions through the Council’s Executive Committee and/or Governing Board, which include: 1. Inclusion of persons with disabilities in the implementation of the Department of Social Welfare and Development’s (DSWD) “Pantawid Pamilya” program; undertake regular consultative activities with the sector of persons with disabilities and utilize the NCDA to facilitate the participation of persons with disabilities and in the monitoring of the project; 2. Review of the Philippines’ Human Rights Action Plan through the Office of the President- Presidential Human Rights Committee (PHRC); 3. Inclusion of the concerns of persons with disabilities in the Department of Health’s (DOH) “2011 and beyond” health programs in line with the Aquino administration’s health agenda of “Achieving Universal Health Care for All Filipinos”; 4. -

Working at the Asian Development Bank Presentation Outline About

Working at Presentation Outline the Asian Development Bank • About ADB • ADB’s Long Term Strategic Framework (Strategy 2020) Masayuki Tamagawa • Human Recourse Issues Director General Budget, Personnel, Management Systems Department • Working at ADB & Living in Manila 2008 ADB Members About ADB • Multilateral Development Bank founded in 1966 • One of the International Financial Institutions (IFIs), such as World Bank, IMF, etc. • 67 members (48 in the region, 41 borrowing members) • Japan and the United States, coequally ADB’s largest shareholders(15.571%) • Regional voting power 65.040% Regional Member Countries (Borrowing) Regional Member Countries (Non-Borrowing) Nonregional Member Countries ADB’s Vision ADB’s Mission An Asia and Pacific region free of poverty To help our developing member countries reduce poverty, and improve living conditions and quality of life Asia & Pacific – Growth and Poverty 12.0 More than Staff 10.0 65% of the population 8.0 living on • 2,443 employees, 6.0 less than from 55 of its 67 members GDP Growh Rate (%) 2$/day is • 852 Professional Staff (101 in field Office) 4.0 from Asia • 1,591 Local Staff (479 in field Office) 2.0 and Pacific, 0.0 totaling 1.7 2000 2001 2002 2003 2004 2005 2006 2007 Billion. China India Viet Nam United States Japan Organization Board of Governors Operational Structure •Evaluation Board of Directors •Compliance Review Knowledge Management •Regional & Sustainable Development President Operations 1 •Economics and Research •South Asia •Regional Economic Integration Managing Vice President