Annual Report 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Native Psyllid Populations and the Distribution of Candidatus Phytoplasma Australiense

Native Psyllid populations and the distribution of Candidatus phytoplasma australiense Dr Calum Wilson Tasmanian Institute of Agriculture Project Number: PT10001 PT10001 This report is published by Horticulture Australia Ltd to pass on information concerning horticultural research and development undertaken for the potato industry. The research contained in this report was funded by Horticulture Australia Ltd with the financial support of: McCain Foods (Aust) Pty Ltd Simplot Australia Pty Ltd - Tasmania Snack Brands Australia Tasmanian Seed Certification Scheme Smiths Snackfood Company All expressions of opinion are not to be regarded as expressing the opinion of Horticulture Australia Ltd or any authority of the Australian Government. The Company and the Australian Government accept no responsibility for any of the opinions or the accuracy of the information contained in this report and readers should rely upon their own enquiries in making decisions concerning their own interests. ISBN 0 7341 3358 8 Published and distributed by: Horticulture Australia Ltd Level 7 179 Elizabeth Street Sydney NSW 2000 Telephone: (02) 8295 2300 Fax: (02) 8295 2399 © Copyright 2014 PT10001 (30 th May 2014) Native psyllid populations and the distribution of Candidatus phytoplasma australiense Final Report Drs Paul Walker & Calum Wilson Tasmanian Institute of Agriculture University of Tasmania HAL Project Number: PT10001 Project Leader’s contact name and contact details and a list of other key personnel: Calum Wilson, Tasmanian Institute of Agriculture (TIA), University of Tasmania, Private Bag 54, Hobart, Tasmania 7001 Tel: (03) 62336841; Email: [email protected] Paul Walker (TIA), Geoff Allen (TIA), Robert Tegg (TIA), Leonie White (TIA), Frank Mulcahy (Simplot Australia Pty Ltd), Brett Pemberton (Smiths Snackfood Company), Allan Smith (Snack Brands Australia) and David Antrobus, (formerly McCains Foods (Aust) Pty Ltd). -

ANNUAL REPORT 2016-17 [email protected] @Foodbankvictoria BEING PART of OURS Foodbankvictoria.Org.Au @Foodbankvictoria

IT TAKES A COMMUNITY HELP US FIGHT HUNGER TO FIGHT HUNGER: Foodbank Victoria, 4/2 Somerville Rd, Yarraville VIC 3013 THANK YOU FOR 03 9362 8300 @FoodbankVic ANNUAL REPORT 2016-17 [email protected] @foodbankvictoria BEING PART OF OURS foodbankvictoria.org.au @foodbankvictoria A&G LAMATTINA & SONS, ALDI, ARNOTT’S, AUSSIE FARMERS DIRECT, CADBURY, CAMPBELL’S, CEREBOS, COCA-COLA AMATIL, COLES , COSTA, DEVONDALE MURRAY GOULBURN, FERRERO, FLETCHER INTERNATIONAL EXPORTS, FONTERRA, GEORGE WESTON FOODS, GOODMAN FIELDER, JACOBS DOUWE EGBERTS, JOHNSON & JOHNSON, KELLOGG’S, KFC, KIMBERLY-CLARK, KRAFT HEINZ, LION, MANILDRA GROUP, MARS, MCCAIN, MCDONALD’S, MDH, METCASH, MONDELEZ, MONTAGUE FRESH, NESTLÉ, ORIENTAL MERCHANT, PARMALAT, PATTIES FOODS, PEPSICO, PERFECTION FRESH, PRIMO SMALLGOODS, PROCTER & GAMBLE, RINOLDI PASTA, SANITARIUM, SCHWEPPES, SIMPLOT, SMITH’S, SNACK BRANDS AUSTRALIA, SPC ARDMONA, SUGAR AUSTRALIA, SUNRICE, THOMAS FOODS, TOLL, UNILEVER, WINC, WOOLWORTHS, 5IVESENSES, A. HARTRODT AUSTRALIA, A2 DAIRY, AB WORLD FOODS, ADMIRAL FOODS, ALFA LOGISTICS, ALFRED E CHAVE, ALI FARM FRESH PRODUCE, ALLIGATOR BRANDS FRESH PASTA, ALLSEPS, ALPHA FLIGHT SERVICES, ALTIMATE FOODS, AMERICOLD, AMV FRESH, AMV FRESH, ANTONELLO PRODUCE, APROMO TRADING, ASALEO CARE, AUSPRO LOGISTICS, AUSTRALIAN DAIRY PARTNERS, AUSTRALIAN INTERNATIONAL FOODS, AUSTRALIAN PHARMACEUTICAL INDUSTRIES, AUXICO CORPORATION, AVELING FRESH, BACO, BAKERS MAISON, BAKERY FRESH, BARKERS MELBOURNE, BAXTERS FOODS AUSTRALIA, BEAK & JOHNSTON, BELLAMY’S ORGANIC, BEMCO AUSTRALIA, BENEDIKT -

View Annual Report

BED 2 garage driveway dining + lounge BED 1 KITCHEN DuluxGroup Annual Report 2013 Annual Report DuluxGroup Annual Report 2013 Highlights 1 About DuluxGroup 2 Chairman's Report 8 Managing Director's Report 10 Operating and Financial Review 12 Strategy and Growth 12 Material Business Risks 14 Result Summary 16 Financial Performance 17 Segment Detail 23 Corporate Costs 30 Non-recurring Items 31 Future Financial Prospects 32 Sustainability Report 33 Board Members 38 Group Executive 40 Corporate Governance Statement 42 Financial Report 52 Shareholder Statistics 152 Shareholder Information 153 Bed2 dulux wash and wear for bedroom ABN 42 133 404 065 DuluxGroup Limited is an Australian company that owns the Dulux® trade mark in Australia, New Zealand, Papua New Guinea, Samoa and Fiji only and the Cabot’s® trade mark in Australia, New Zealand, Papua New Guinea and Fiji only. DuluxGroup Limited is not associated with, and has no connection to, the owners of the Dulux® and Cabot's® trade marks in any other countries, nor does it sell Dulux® and Cabot's® products in any other countries. DuluxGroup Annual Report 2013 2013 Highlights A strong operating result in Strong cash generation, with net debt generally weak markets was to EBITDA underpinned by profitable market share growth in core segments, 1.95x solid input cost control and good Strong cash generation, with net debt to EBITDA at 1.95x, cash management. post the Alesco acquisition. Strengthened market leadership positions and Final dividend continued investment in key capabilities and longer term growth options have developed solid foundations for the future. 9.5cents NPAT, before non-recurring items Final dividend of 9.5 cents per share fully franked, taking the full year dividend to 17.5 cents, which represents a 70% payout ratio on NPAT, before non-recurring items. -

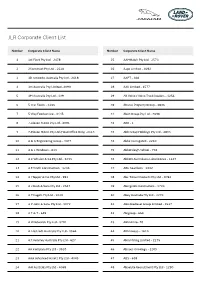

JLR Corporate Client List

JLR Corporate Client List Number Corporate Client Name Number Corporate Client Name 1 1st Fleet Pty Ltd - 2478 25 AAMHatch Pty Ltd - 2573 2 2Construct Pty Ltd - 2620 26 Aapc Limited - 4092 3 3D networks Australia Pty Ltd - 2618 27 AAPT - 468 4 3m Australia Pty Limited -4090 28 AAV Limited - 1577 5 3M Australia Pty Ltd - 139 29 AB Volvo / Volvo Truck Dealers - 1256 6 5 Star Foods - 3166 30 Abacus Property Group - 3036 7 5 Way Foodservice - 3145 31 Abah Group Pty Ltd - 2698 8 7-eleven Stores Pty Ltd - 4091 32 ABB - 1 9 7-Eleven Stores Pty Ltd (Head Office Only) -2113 33 Abb Group Holdings Pty Ltd - 4093 10 A & G Engineering Group - 3473 34 Abbe Corrugated - 2210 11 A & L Windows - 613 35 Abbotsleigh School - 702 12 A C Whalan & Co Pty Ltd - 3233 36 Abbott Australasia Laboratories - 1247 13 A E Smith Construction - 1236 37 ABC Seamless - 1002 14 A I Topper & Co. Pty Ltd - 991 38 Abc Tissue Products Pty Ltd - 4094 15 A J Bush & Sons Pty Ltd - 2647 39 Abergeldie Contractors - 1724 16 A P Eagers Pty Ltd - 3020 40 Abey Australia Pty Ltd - 3270 17 A P John & Sons Pty Ltd - 1072 41 ABG Biodiesel Group Limited - 1537 18 A T & T - 649 42 Abigroup - 650 19 A W Edwards Pty Ltd - 3701 43 ABN Amro -70 20 A. Hartrodt Australia Pty Ltd - 3564 44 ABN Group - 1610 21 A.T. Kearney Australia Pty Ltd - 627 45 Abra Mining Limited - 2275 22 AA Company Pty Ltd - 3510 46 Abraxis Oncology - 2209 23 AAA Advanced Assets Pty Ltd - 4045 47 ABS - 638 24 AAI Australia Pty Ltd - 4068 48 Absolute Recruitment Pty Ltd - 1290 JLR Corporate Client List Number Corporate Client -

PROCESSED FOOD Disclaimer

PROCESSED FOOD DISCLAIMER Austrade does not endorse or guarantee the performance or suitability of any introduced party or accept liability for the accuracy or usefulness of any information contained in this Report. Please use commercial discretion to assess the suitability of any business introduction or goods and services offered when assessing your business needs. Austrade does not accept liability for any loss associated with the use of any information and any reliance is entirely at the user's discretion. ©Commonwealth of Australia 2013 This work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced by any process without prior written permission from the Commonwealth, available through the Australian Trade Commission. Requests and inquiries concerning reproduction and rights should be addressed to the Marketing Manager, Austrade, GPO Box 5301, Sydney NSW 2001 or by email to [email protected] Publication date: October 2013 2 PROCESSEDPROCESSED FOOD LEADERS IN QUALITY, SAFE AND SUSTAINABLE FOOD PROCESSED FOOD 3 INTRODUCTION Australia is a world-leading source of high-quality, safe and INDUSTRY OVERVIEW innovative processed food, with demonstrable expertise in the supply of quality products to domestic and export markets. INDUSTRY STRENGTHS As a major global producer of key Australia is well positioned to meet These categories represent many › BAKERY, CEREALS commodities such as wheat, barley, Asia’s rapidly growing demand of Australia’s elaborately and AND CONFECTIONERY sugar, dairy products, beef and sheep for protein-based processed substantially transformed products › DAIRY meat, Australia provides its food and food products and the capacity within Australia’s food and beverage beverage processors with exceptional to increase production to meet manufacturing industry. -

Processing Potato Strategic Investment Plan

Potato – processing STRATEGIC INVESTMENT PLAN 2017-2021 Content Introduction 3 The processing potato SIP 3 Processing potato SIP at a glance 4 Section one: Context 6 The Australian processing potato industry 6 Operating environment 19 Section two: Processing potato industry outcomes 21 Section three: Processing potato industry priorities 24 Industry investment priorities 24 Aligning to Hort Innovation investment priorities 27 Section four: Processing potato industry monitoring and evaluation 29 Processing potato SIP monitoring, evaluation and reporting 29 Processing potato SIP M&E plan 31 Section five: Impact assessment 35 Section six: Risk management 37 DISCLAIMER Any views contained in this Strategic Investment Plan (SIP) do not necessarily represent the views of Horticulture Innovation Australia Limited (Hort Innovation) or its commitment to a particular course of action or a guarantee of specific outcomes. Hort Innovation will make research and development (R&D) and marketing investments to meet its obligations as outlined in the Deed of Agreement between Hort Innovation and the Australian Government (2014-18) and the Hort Innovation Constitution (2016). Hort Innovation reserves the right to amend or vary the SIP without notice. Hort Innovation makes no representations and expressly disclaims all warranties (to the extent permitted by law) as to the accuracy, completeness, or currency of information provided in Section 1 of this SIP. Recipients or users of the information contained therein (and any links) should take independent action before relying on its accuracy in any way. Hort Innovation is not responsible for, and will not be liable for, any loss, damage, claim, expense, cost (including legal costs) or other direct or indirect liability arising in any way (including from Hort Innovation or any other person’s negligence or otherwise) from the use, non-use or reliance on the information contained in Section 1 of this SIP. -

GAIN Report Global Agriculture Information Network

Foreign Agricultural Service GAIN Report Global Agriculture Information Network Voluntary Report - public distribution Date: 1/6/2003 GAIN Report #AS3002 Australia Product Brief Snack Food 2003 Approved by: Andrew C. Burst U.S. Embassy Prepared by: Hassall & Associates Report Highlights: The major snack food brands in Australia are dominated by large food processing companies, the majority of which are owned by U.S. multinationals. Opportunities for large scale exports of packaged snack food products to the Australian retail sector are limited. The ingredients market for snack foods may offer greater opportunities for U.S. exporters than the retail market, particularly for those products targeted towards nutritional snacks. The best prospects in the snack food sector appear to be seasonings, flavors, cooking oils, thickeners, processed fruit and nuts, and possibly yogurt probiotics. Includes PSD changes: No Includes Trade Matrix: No Unscheduled Report Canberra [AS1], AS This report was drafted by consultants: Hassall & Associates Pty Ltd GPO Box 4625 Sydney, NSW 1044 Tel: +61-2-9241-5655 Fax: +61-2-9241-5684 E-mail: [email protected] Disclaimer: As a number of different sources were used to collate market information for this report, there are areas in which figures are slightly different. The magnitude of the differences is, in most cases, small and the provision of the data, even though slightly different, is to provide the U.S. exporter with the best possible picture of the Australian Retail Food Sector where omission may have -

Aon Executive Remuneration Survey

Aon Reward Solutions Proprietary and Confidential Aon Executive Remuneration Survey Participating organisations | May 2021 Aon Rewards Solutions Proprietary and Confidential Participating Organisations Organisation Name Disclosed Contributed .au Domain Administration Limited N Y [24]7.ai N Y 4 Pines Brewing Company N Y 8X8 N Y Abacus DX N Y Abacus Property Group Y N AbbVie Pty Ltd N Y AC3 N Y ACCELA N Y Accent Resources NL Y N Accenture Australia Ltd N Y AccorHotels N Y Achmea Australia N Y ACI Worldwide N Y Acquia N Y Activision Blizzard N Y Adaman Resources N Y A-dec Australia N Y Adelaide Brighton Y N Adherium Limited N Y ADInstruments NZ Limited N Y Administrative Services N Y Adobe Systems Inc N Y Adtran N Y AEMO N Y Aeris Resources Limited N Y Afterpay Touch Group Limited Y N Agilent Technologies Australia Pty Ltd N Y AGL Energy Limited Y N AIA Australia N Y AIG Australia Limited N Y Akamai Technologies N Y Alcoa of Australia Limited N Y Alibaba Group Inc N Y Align Technology Inc. N Y Aon Executive Remuneration Service (Australia) | Participating organisations | May 2021 1 Aon Rewards Solutions Proprietary and Confidential Organisation Name Disclosed Contributed Alkane Resources Limited N Y Allianz Australia Ltd N Y Allscripts N Y Alphapharm Pty Ltd N Y ALS Limited Y N Altium Ltd Y Y Alumina Y N AMA Group Ltd Y N amaysim Australia Ltd Y Y Amazon.com N Y Amcor Limited Y N AMEC Foster Wheeler Australia Pty Ltd N Y American Express Australia Ltd N Y AMP Services Limited Y Y Ampol Limited Y N Analog Devices N Y Ancestry.com N Y Anglo -

![Companies Attended Iot Impact 2019 [Ui!] Group Celestino Property](https://docslib.b-cdn.net/cover/4918/companies-attended-iot-impact-2019-ui-group-celestino-property-9224918.webp)

Companies Attended Iot Impact 2019 [Ui!] Group Celestino Property

Companies attended IoT Impact 2019 [ui!] Group Celestino Property Group Huawei Technologies (Australia) NetFoundry Snack Brands Australia [ui!] The Urban Institute Celestino Pty Limited Hunter Water Corporation NetReturn Consulting SoftCrafts Solutions 2it Central Coast Council Hut34 Newcastle City Council Software AG 7 Oaks Capital Chief Data Scientist, NSW HybridX LLC NewieVentures Softwear AG A2EP Chris Alfred Hydrix Engineering Nexon Asia Pacific South East Water ACCAN Chujing Cai IAG Nextgen Technologies Spanish Trade Commission ACCC Cisco IAN JAMES FINLAY Nitto Denko Spectrum Automation Accenture Cisco Jasper IBM NNNCo Sphere Accenture Strategy City of Gold Coast council IBM Internet of Things Offerings Nokia Split Spaces Access RnD City of Mandurah IBM Watson Nokia Software ST Consulting PL AccessTel Pty Ltd Cochlear IBM, Watson IoT for Buildings NRMA ST CONSULTING PTY LTD Acer Computer Cognate Gnosis IBMS Pty Ltd NSW Ambulance Steadworks ACMA Cohda Wireless ICM Consulting NSW Data Analytics Centre STMicroelectronics ACSC Commonwealth Bank of Australia Icom NSW Department of Industry Stockland ActewAGL Distribution Communications Alliance ICT International NSW Smart Sensing Network Strategic Sourcing Australia Actility Communications Day IDC Solutions Nube iO StratosQuo Ad News Communicatons Day IDEAMED Pty Ltd NZ Tech Successful Endeavours Adam Game Conclave Health Management Group IDG Media Old Ways, New Successful Endeavours Pty Ltd ADTEC Communications Connected IoT IDS Australasia Pty Limited Omniflex Swinburne University -

Eroding Corporate Water Reporting?

ERODING CORPORATE WATER REPORTING? A STUDY OF THE AUSTRALIAN FOOD, BEVERAGE AND TOBACCO SECTOR 1 | P a g e Legal notice Copyright © CPA Australia Ltd (“CPA Australia”) (ABN 64 008 392 452), 2015. All rights reserved. All trademarks and trade names are proprietary to CPA Australia and must not be downloaded, reproduced or otherwise used without the express consent of CPA Australia. You may access and display these materials on your computer, monitor or other video display device and make one printed copy of any whole page or pages for your personal use only. Other than for the purposes of and subject to the conditions prescribed under the Copyright Act 1968 (Cth) (or any other applicable legislation throughout the world), or as otherwise provided for herein, you may not use these materials in any manner without the prior written permission of the copyright owner. CPA Australia and the authors have used reasonable care and skill in compiling the content of these materials. However, CPA Australia makes no warranty as to the accuracy or completeness of any information contained therein nor does CPA Australia accept responsibility for any acts or omissions in reliance upon these materials. These materials are intended to be a guide only and no part is intended to be advice, whether legal or professional. All persons are advised to seek professional advice to keep abreast of any legal or other reforms and developments. To the extent permitted by applicable law, CPA Australia, its employees, agents and consultants exclude all liability for any loss or damage claims and expenses including but not limited to legal costs, indirect special or consequential loss or damage (including but not limited to, negligence) arising out of the information in the materials. -

HR Benefits Report Australia

Aon Talent, Rewards & Performance Proprietary and Confidential HR Benefits Report Australia HR Benefits Report (Australia) November 2018 Aon Talent, Rewards & Performance Proprietary and Confidential Table of Contents Introduction 3 Superannuation 4 Insurance 5 Leave 6 Parental Leave 8 Health and Wellbeing 11 Food and Beverages 13 Office/Work Environment 15 Employee Perquisites 17 Other Benefits 18 Communication Channels 19 Participant information 20 Appendix: Definitions of terms used in this report 24 Contact information 25 2 HR Benefits Report (Australia) November 2018 Aon Talent, Rewards & Performance Proprietary and Confidential Participant information The 2018 Benefits Report (Australia) is based on responses from 293 organisations: 1. Accolade Wines 36. Baptcare 2. ACH Group 37. BaptistCare - NSW & ACT 3. Act for Peace 38. Barnardos Australia 4. A-dec Australia 39. Barwon Child, Youth & Family 5. ADInstruments 40. Batchfire Resources 6. Adshel 41. BDO Administration (QLD) Pty Ltd 7. Aeris Resources 42. Beca Group 8. AIA Australia 43. Betfair Pty 9. AIG Australia 44. BGIS Pty Ltd 10. Allianz Worldwide Partners 45. BHP Billiton 11. AMP 46. Billabong Gold 12. Anglicare SA 47. BOC Limited 13. Aon Corporation 48. Boeing Australia Group 14. APN Outdoor (Trading) 49. BPAY Group 15. APRA AMCOS 50. Bridge Housing 16. Arcadis Australia Pacific 51. Broadspectrum 17. Aristocrat Leisure 52. Brother International (Aust) 18. Arq Group 53. Bundaberg Brewed Drinks 19. Aurecon Australia 54. Canon Information Systems Research 20. AusNet Services Australia 21. Aussie 55. CanTeen Australia 22. ANZ 56. Capricorn Copper 23. Australia for UNHCR 57. Cardno 24. Australia Pacific Airports Corporation 58. Carey Mining 25. Australia Post 59. -

Marketer of the YEAR Wines with a Winning Edge

Marketer of the YEAR Wines with a winning edge By Helen Ward SOUTH Australia’s BRL Hardy Wine Company topped a field of 13 finalists to win the Australian Marketing Institute’s prestigious 2001 National Marketer of the Year Award, which was announced during a gala dinner at AMI’s national conference at Sydney’s Star City Casino on 11 October. BRL Hardy won the consumer goods section and the ultimate prize for its ‘Wicked Wines!’ campaign, a promotion designed to introduce young adults to a type of alcoholic beverage they tend to associate with their parents rather than themselves. BRL Hardy’s brand manager, Denys Hornabrook, who accepted the award, said it was tremendously gratifying to be recognised by his peers as being the best in a field of such high- quality candidates. “In this tough and extremely competitive business we always thought we were doing things Kevin Luscombe presents Denys Hornabrook, brand manager with BRL Hardy Wine right, but this award has confirmed it,” Company, with the trophy for his company’s Marketer of the Year win. he said. The company’s awards submission 24-32 years — only one other Lust, Greed, Envy and Flirt — the clearly demonstrated to the judging Australian winemaker had made a four wines making up the Wicked panel the disciplined and thorough deliberate and successful attempt at Wines! collection — are just what that process employed by Hornabrook and capturing the overall 21-40 age group, 20-something woman is looking for. his team in bringing the Wicked Wines! which represents 30% of the The combination of unique bottle concept to market.