Annual Report 2014 1 Corporate Information

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Notes of the Twenty-Second Meeting Held on 22

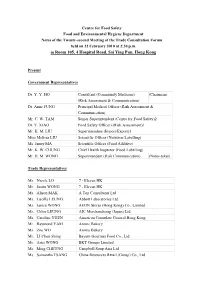

Centre for Food Safety Food and Environmental Hygiene Department Notes of the Twenty-second Meeting of the Trade Consultation Forum held on 22 February 2010 at 2:30 p.m. in Room 105, 4 Hospital Road, Sai Ying Pun, Hong Kong Present Government Representatives Dr. Y. Y. HO Consultant (Community Medicine) (Chairman) (Risk Assessment & Communication) Dr. Anne FUNG Principal Medical Officer (Risk Assessment & Communication) Mr. C. W. TAM Senior Superintendent (Centre for Food Safety)2 Dr. Y. XIAO Food Safety Officer ((Risk Assessment)1 Mr. K. M. LIU Superintendent (Import/Export)3 Miss Melissa LIU Scientific Officer (Nutrition Labelling) Ms. Janny MA Scientific Officer (Food Additive) Mr. K. W. CHUNG Chief Health Inspector (Food Labelling) Mr. H. M. WONG Superintendent (Risk Communication) (Notes-taker) Trade Representatives Ms. Nicole LO 7 - Eleven HK Mr. Justin WONG 7 - Eleven HK Ms. Alison MAK A Top Consultants Ltd Ms. Lucilla LEUNG Abbott Laboratories Ltd Ms. Janice WONG AEON Stores (Hong Kong) Co., Limited Ms. Chloe LEUNG AIC Merchandising (Japan) Ltd. Ms. Caroline YUEN American Consulate General Hong Kong Mr. Raymond YAM Arome Bakery Ms. Zoe WO Arome Bakery Mr. LI Chun Shing Bayern Gourmet Food Co., Ltd Mr. Arist WONG BKT Groups Limited Ms. Ming CHEUNG Campbell Soup Asia Ltd Ms. Samantha TSANG China Resources Retail (Group) Co., Ltd Mr. Dennis CHAN City Super Limited Ms. Grace YEE City Super Limited Ms. May KAN Coca-Cola China Ltd Ms. Caroline HO Coffee Concepts HK Ltd. Ms. NG Wai Kee Fairwood Holdings Limited Mr. Freddy FONG Foodscan Analytics Ltd Ms. Jeannie LOK Four Seas Mercantile Ltd. -

Annual Report 2018

(Incorporated in the Cayman Islands with limited liability) Stock Code: 00831 ANNUAL REPORT 2018 PRINTED ON POST-CONSUMER WASTE RECYCLED PAPER Japanese actress Ms Kiko Mizuhara (centre right) officiated the grand opening for Zoff’s Langham Place store. Contents Corporate Information 2 Highlights 3 Chairman’s Statement 5 CEO’s Statement 8 Management Discussion and Analysis 15 Corporate Governance Report 22 Directors and Senior Management Profile 42 Information for Investors 47 Directors’ Report 48 Independent Auditor’s Report 62 Consolidated Profit and Loss Account 68 Consolidated Statement of Comprehensive Income 69 Consolidated Balance Sheet 70 Consolidated Statement of Changes in Equity 72 Consolidated Cash Flow Statement 73 Notes to the Consolidated Financial Statements 74 Ten-Year Financial Summary 128 Convenience Retail Asia Limited Annual Report 2018 1 Corporate Information Executive Directors Head Office and Principal Place of Business Richard YEUNG Lap Bun (Chief Executive Officer) 15th Floor, LiFung Centre PAK Chi Kin (Chief Operating Officer) 2 On Ping Street Siu Lek Yuen Shatin Non-executive Directors New Territories Victor FUNG Kwok King # (Chairman) Hong Kong William FUNG Kwok Lun + Godfrey Ernest SCOTCHBROOK * Benedict CHANG Yew Teck * Website www.cr-asia.com Independent Non-executive Directors Malcolm AU Man Chung +* Legal Advisers Anthony LO Kai Yiu #* Mayer Brown ZHANG Hongyi #+* (as to Hong Kong Law) Sarah Mary LIAO Sau Tung + Conyers Dill & Pearman, Cayman (as to Cayman Islands Law) Group Chief Compliance and Risk Management Officer Jason YEUNG Chi Wai Auditor PricewaterhouseCoopers Certified Public Accountants Company Secretary Maria LI Sau Ping Principal Banker The Hongkong and Shanghai Registered Office Banking Corporation Limited P.O. -

Network Expansion, Incremental Sales and Saint Honore Acquisition Spur Convenience Retail Asia’S Third Quarter Results

For Immediate Release Network expansion, incremental sales and Saint Honore acquisition spur Convenience Retail Asia’s third quarter results Ongoing strategic initiatives and marketing programmes continue to drive future growth Hong Kong, 1 November 2007 – Convenience Retail Asia Limited (“CRA” or “the Group”; SEHK: 8052), operator of the Circle K convenience stores and Saint Honore cake shops in Hong Kong and on the Chinese Mainland, announced healthy increases in turnover and profit for the third quarter of 2007. The results reflect the Group’s successful network expansion and incremental sales from a multi-media branding campaign as well as consolidation of the Saint Honore operations. During the third quarter of 2007, the Group’s turnover increased by 37.5% to HK$810.7 million when compared to the same period last year. The Group recorded a net profit attributable to shareholders of HK$27.8 million during the quarter, representing an increase of 20.3% over the same period last year. Basic earnings per share were 3.82 HK cents. For the nine months ended 30 September 2007, the Group recorded a turnover of HK$2,134.3 million and net profit attributable to shareholders of HK$65.3 million, representing an increase of 28.2% and 17.6% respectively year on year. Mr. Richard Yeung, Chief Executive Officer of CRA, said, “During the period, the strong economic fundamentals underpinned by an overall thriving stock market and further expansion in inbound tourism, provided a favourable market environment for our operations in Hong Kong. In order to maximise positive consumer sentiments and to support the Group's brand building strategic initiative, a multi-media branding campaign was launched in September 2007 and has since successfully generated incremental sales.” "The rise in profits was largely due to the contribution of the Saint Honore operations after consolidation." Mr. -

Convenience Retail Asia Reports Growth in Turnover and Profit for 2007

For Immediate Release Convenience Retail Asia reports growth in turnover and profit for 2007 Successful implementation of management initiatives drives business growth Hong Kong, 12 March 2008 – Convenience Retail Asia Limited (“CRA” or “the Group”; SEHK: 8052), operator of Circle K convenience stores and Saint Honore cake shops in Hong Kong and on the Chinese Mainland, announced that the Group’s sales for the year and the fourth quarter increased to HK$ 2,916.7 million and HK$ 782.4 million respectively, representing a growth of 30.7% and 38.2% when compared to the corresponding periods in 2006. Net profit attributable to shareholders rose by 15.7% and 10.5% to HK$ 86.9 million and HK$ 21.5 million for the year and the fourth quarter when compared to the corresponding periods in 2006. Basic earnings per share increased by 8.8% from 11.10 HK cents to 12.08 HK cents for the year. The Board of Directors has resolved to recommend a final dividend of 5.5 HK cents per share (2006: 5 HK cents). Together with the interim dividend of 1.7 HK cents per share, total dividend for 2007 would be 7.2 HK cents per share (2006: 6.5 HK cents). Mr. Richard Yeung, Chief Executive Officer of CRA, said, “The Group’s retail sales growth in Hong Kong arose from robust consumer confidence, a wealth effect created by the overall upward trend of the stock and property markets, increased inbound tourism and record-breaking tourist expenditure." He observed that both the launch of a brand building television campaign and the successful acquisition and integration of Saint Honore had enhanced CRA’s competitiveness and strengthened its market penetration in the past year. -

Saint Honore Opted for Ge-TS to Complement ERP and Bring Automated Business Logistics

Saint Honore opted for Ge-TS to complement ERP and bring automated business logistics “If I were to give a rating from 1 to 10, I would highly recommend Ge-TS and give it full marks for its friendly and easy-to-use interface, saving us time to train up our colleagues to become skilful users.” Sylvia Sin Assistant Purchasing Manager, Purchasing Division Saint Honore Cake Shop Ltd Company Profile The successful development of the company and its operations Founded in 1972, Saint Honore Cake Shop Ltd (“Saint has led to an expansion of Saint Honore’s outlets in Hong Kong Honore”) is Hong Kong’s first publicly-listed cake shop retail from 53 to 89 stores in eight years. The company fleet chain operator, and is part of Li & Fung Group. In Hong Kong, frequenting Hong Kong and Shenzhen have increased in both the chain has 89 retail outlets, with over a hundred outlets number and scale, coupled with vehicle hire to meet corporate across Hong Kong, Guangzhou and Macau. needs. Despite a 30-50% rise in trade declaration volumes and fixed manpower, the team achieved their target of cost- The company installed large-scale automated production lines effectiveness with the help of Ge-TS. as early as 1993, and in 1995, they invested significantly in a state-of-the-art food production centre in Shenzhen. Over the “If I were to give a rating from 1 to 10, I would give a full score years, the centre has earned much recognition including the ISO to Ge-TS for its user-friendliness.” Easy to use, it helps our 9001 and HACCP food safety accreditation certificates. -

Convenience Retail Asia Announces 1H 2019 Results

For immediate release Convenience Retail Asia announces 1H 2019 results Group rides successful online-to-offline (O2O) business strategy to achieve revenue, profit growth despite retail market challenges • Good comparable store sales growth at Circle K, higher sales at fast-fashion eyewear business Zoff drove satisfactory year-on-year turnover growth • Combined with higher gross margin of Saint Honore business, net profit for the first half of 2019 increased by 22.4% • The Group will continue its O2O strategy for Circle K and Saint Honore and its store network expansion programme for fast-growing Zoff • The Board of Directors has resolved to declare an interim dividend of 6 HK cents per share, an increase of 20% as compared with 2018 • The Group maintains a healthy financial position with net cash of HK$522 million and no bank borrowings Hong Kong, 15 August 2019 – Convenience Retail Asia Limited (“CRA” or “the Group”; SEHK: 00831), operator of Circle K convenience stores in Hong Kong, Saint Honore Cake Shops in Hong Kong, Macau and Guangzhou, and Zoff eyewear stores in Hong Kong, today announced its financial results for the first half of 2019. Despite dampened consumer sentiment in the local retail market resulting from global macroeconomic and trade dispute concerns, the Group’s turnover increased by 5% to HK$2,704 million compared to the same period last year. This was primarily due to growth in comparable store sales for the convenience store business, which rose 4.4% and contributing total sales to HK$2,185 million, and higher sales at the fast-growing Zoff eyewear chain. -

Convenience Retail Asia Announces 1H 2020 Results

For immediate release Convenience Retail Asia announces 1H 2020 results Effective digital marketing, strong category management, robust health and safety practices help Group achieve satisfactory results during pandemic Group net profit decreased slightly by 0.5% year on year despite COVID-19 outbreak and lower transaction counts across all business units, demonstrating the resilience of the Group’s business model and effectiveness of its online-to-offline (O2O) customer relationship management (CRM) platforms Membership for Circle K’s O2O CRM programme “OK Stamp It” reached 1.55 million while Saint Honore’s “Cake Easy” O2O CRM programme reached 700,000 members Japanese fast-fashion eyewear brand Zoff continued to gain market share via strategic store openings in high-traffic retail areas The Group’s immediate and comprehensive response to the pandemic helped maintain business continuity while ensuring the health and safety of employees and customers The Group expects 2H to remain challenging due to COVID-19 response measures and changing consumer behaviour The Board of Directors has resolved to declare an interim dividend of 6 HK cents per share, the same as in 2019 The Group maintains a healthy financial position with net cash of HK$413 million and no bank borrowings Hong Kong, 13 August 2020 – Convenience Retail Asia Limited (“CRA” or “the Group”; SEHK: 00831), operator of Circle K convenience stores in Hong Kong, Saint Honore Cake Shops in Hong Kong, Macau and Guangzhou, and Zoff eyewear stores in Hong Kong, today announced its financial results for the first half of 2020. The Group’s turnover increased 5.7% to HK$2,859 million year on year, which was largely due to a rise in comparable store sales at its Circle K convenience stores and the expansion of its fast-fashion eyewear business Zoff. -

CRA Profits in 2017 with Strong Customer Loyalty and Marketing Initiatives

For immediate release CRA profits in 2017 with strong customer loyalty and marketing initiatives Innovative O2O (online-to-offline) business strategy positions Group’s long-term growth in the digital age • Convenience store and bakery businesses achieved satisfactory comparable store sales growth in Hong Kong, despite challenging business environment • Core operating profit and net profit increased by 7.4% and 7.7% respectively, which was mainly attributable to an effective CRM programme and strong marketing campaigns by Circle K together with improved performance from Saint Honore • Growth driven by the Group’s digital initiatives, led by highly successful O2O CRM programmes with membership for “OK Stamp It” and “Cake Easy” exceeding 1,000,000 and 300,000 respectively • The Group obtained the franchise for Japan’s leading fast-fashion eyewear chain Zoff, which holds strong appeal for the internet+ generation, and opened the brand’s first store in Hong Kong • With signs of recovery in the retail market, the Group will continue its marketing and store network expansion programmes while exercising caution towards macroeconomic uncertainties and emphasising operating cost control • The Board of Directors has resolved to declare a final dividend of 14 HK cents per share • The Group maintains a strong financial position with net cash of HK$452 million and no bank borrowings Page 1 of 5 Convenience Retail Asia Limited Press Release – 2017 Annual Results Hong Kong, 7 March 2018 – Convenience Retail Asia Limited, (“CRA” or “the Group”; SEHK: 00831), operator of Circle K convenience stores and Saint Honore Cake Shops in Hong Kong, Macau and Guangdong province, today announced its annual results for the year ended 31 December 2017. -

Saint Honore Holdings Limited 2 ANNUAL REPORT 2004 Chairman’S Statement’S Statement

CONTENTS 2 Corporate Information 3 Chairman’s Statement 5 Management Discussion and Analysis of the Operations 9 Biographical Details of Directors and Senior Management 12 Report of the Directors 23 Report of the Auditors 24 Consolidated Profit and Loss Account 25 Consolidated Balance Sheet 27 Balance Sheet 28 Consolidated Cash Flow Statement 29 Consolidated Statement of Changes in Equity 30 Notes to the Accounts 59 Five-Year Financial Information 61 Notice of Annual General Meeting Corporate Information Information BOARD OF DIRECTORS PRINCIPAL SHARE REGISTRAR AND Executive directors TRANSFER OFFICE Mr. Chan Wai Cheung, Glenn, Chairman Butterfield Fund Services (Bermuda) Limited Mr. Shum Wing Hon, Deputy-chairman Rosebank Centre Mrs. Chan Wong Man Li, Carrina, Managing Director 11 Bermudiana Road Mr. Chan Ka Shun, Raymond Pembroke Mr. Wong Chung Piu, Billy Bermuda Non-executive directors HONG KONG BRANCH SHARE Mr. Chan Ka Lai, Joseph REGISTRAR AND TRANSFER OFFICE Mrs. Chan King Catherine Computershare Hong Kong Investor Services Limited Shops 1712-6 Independent non-executive directors 17/F., Hopewell Centre Dr. Cheung Wai Lam, William 183 Queen’s Road East Dr. Ho Sai Wah, David Wanchai Mr. Bingley Wong Hong Kong AUDIT COMMITTEE PRINCIPAL BANKERS Dr. Cheung Wai Lam, William, Committee Chairman Dah Sing Bank Limited Mr. Chan Ka Lai, Joseph DBS Bank (Hong Kong) Limited Dr. Ho Sai Wah, David Hang Seng Bank Limited Mr. Bingley Wong SOLICITORS COMPANY SECRETARY Sidley Austin Brown & Wood Ms. Wong Tsui Yue, Lucy Conyers Dill & Pearman AUTHORIZED -

Translating Trademarks: Towards the Equal Treatment of Foreign- Language Marks Ung Shen Goh

Osgoode Hall Law School of York University Osgoode Digital Commons PhD Dissertations Theses and Dissertations 3-6-2018 Translating Trademarks: Towards the Equal Treatment of Foreign- Language Marks Ung Shen Goh Follow this and additional works at: https://digitalcommons.osgoode.yorku.ca/phd Part of the International Law Commons, and the International Trade Law Commons Translating Trademarks: Towards the Equal Treatment of Foreign-Language Marks Ung Shen Goh A DISSERTATION SUBMITTED TO THE FACULTY OF GRADUATE STUDIES IN PARTIAL FULFILLMENT OF THE REQUIRMENTS FOR THE DEGREE OF DOCTOR OF PHILOSOPHY Graduate Program in Law York University Toronto, Ontario March 2018 © Ung Shen Goh, 2018 ABSTRACT Part A of this dissertation tells the story of The Coca-Cola Company‟s trademark registrations in Canada in order to illustrate the linguistic issues faced by trademark administrators. A trademark‟s registrability depends on its distinctiveness, which is its ability to can distinguish its trader‟s goods and services from those of another trader. Knowing how well a trademark will function to distinguish means ascertaining first what has already been registered, which is no easy task when the databases cannot administer foreign-language marks that are not Romanized. Part A proposes the solution of transcribing foreign-language marks that are not Romanized, so they can be filed/searched appropriately in databases. Part B of this dissertation tells the story of two competing Chinese bakeries in Canada in order to illustrate the linguistic struggles of -

ANNUAL REPORT 2019 PRINTED on POST-CONSUMER WASTE RECYCLED PAPER Zoff Continued Its Fast Expansion, Including a New Location at the Prestigious Lee Theatre Plaza

(Incorporated in the Cayman Islands with limited liability) Stock Code: 00831 ANNUAL REPORT 2019 PRINTED ON POST-CONSUMER WASTE RECYCLED PAPER Zoff continued its fast expansion, including a new location at the prestigious Lee Theatre Plaza. Contents Corporate Information 2 Highlights 3 Chairman’s Statement 5 CEO’s Statement 8 Management Discussion and Analysis 14 Corporate Governance Report 20 Directors and Senior Management Profile 40 Information for Investors 45 Directors’ Report 46 Independent Auditor’s Report 59 Consolidated Profit and Loss Account 65 Consolidated Statement of Comprehensive Income 66 Consolidated Balance Sheet 67 Consolidated Statement of Changes in Equity 69 Consolidated Cash Flow Statement 70 Notes to the Consolidated Financial Statements 71 Ten-Year Financial Summary 128 Convenience Retail Asia Limited Annual Report 2019 1 Corporate Information Executive Directors Head Office and Principal Place of Business Richard YEUNG Lap Bun (Chief Executive Officer) 15th Floor, LiFung Centre PAK Chi Kin (Chief Operating Officer) 2 On Ping Street Siu Lek Yuen Shatin Non-executive Directors New Territories Victor FUNG Kwok King # (Chairman) Hong Kong William FUNG Kwok Lun + Godfrey Ernest SCOTCHBROOK * Benedict CHANG Yew Teck * Website www.cr-asia.com Independent Non-executive Directors Malcolm AU Man Chung +* Legal Advisers Anthony LO Kai Yiu #* Mayer Brown ZHANG Hongyi #+* (as to Hong Kong Law) Sarah Mary LIAO Sau Tung + Conyers Dill & Pearman, Cayman (as to Cayman Islands Law) Group Chief Compliance and Risk Management Officer Jason YEUNG Chi Wai Auditor PricewaterhouseCoopers Certified Public Accountants Company Secretary Maria LI Sau Ping Principal Banker The Hongkong and Shanghai Registered Office Banking Corporation Limited P.O. -

Convenience Retail Asia Limited 利亞零售有限公司

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CONVENIENCE RETAIL ASIA LIMITED 利亞零售有限公司 (Incorporated in the Cayman Islands with limited liability) (Stock Code: 00831) RESULTS ANNOUNCEMENT FOR THE YEAR ENDED 31 DECEMBER 2020 Financial Highlights 2020 2019 Change HK$’000 HK$’000 (Restated) • Revenue -0.5% 1,191,701 1,197,453 • Core operating profit +50.6% 67,456 44,785 • Core operating profit (included interest expenses on lease liabilities) +59.3% 61,859 38,824 • Profit attributable to shareholders of the Company Continuing Operations +84.1% 61,150 33,213 Included Discontinued Operations +1,412.9% 3,140,446 207,574 • Basic earnings per share (HK cents) Continuing Operations +81.8% 8.0 4.4 Included Discontinued Operations +1,409.9% 410.7 27.2 • Dividend paid per share (HK cents) Basic -76.0% 6 25 Special +1,733.3% 385 21 Total +750.0% 391 46 1 Operation Highlights • Full-year profit increased 1,412.9%, primarily due to the one-off gain of HK$2,879 million from the sale of Circle K Hong Kong business to the brand owner • Net profit from Continuing Operations increased 84.1%, mainly due to an increase in festive sales and improvement in gross profit by the Saint Honore business as well as receiving certain government subsidies