January 2020 Banking & Finance

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Announcement

Announcement 100 articles, 2016-02-24 18:01 1 A new poll puts Jeremy Corbyn's leadership in a strong position It’s not self-indulgent to prioritise choice in maternity (9) care A new poll reveals the depth of the disconnection between Labour members and the party's MPs - and an even bigger gulf with the public. 2016-02-24 13:52:05 8KB www.newstatesman.com 2 Detroit News - Home GANNETT Syndication Service 2016-02-24 09:11:44 3KB rssfeeds.detroitnews.com (3) 3 Revisiting Catullus, from political battles to Roman contraception What the Green Man can teach us about our place (3) in the world Daisy Dunn's Catullus's Bedspread: the Life of Rome's Most Erotic Poet, alongside her new translations of his poetry, offer a rollicking good read - as long as they're not taken too much at face value. 2016-02-24 13:52:05 18KB www.newstatesman.com (2) 4 USATODAY - World Top Stories USATODAY - World Top Stories 2016-02-24 11:05:53 3KB rssfeeds.usatoday.com 5 FIFA asks for details of victory speeches ahead of election ZURICH (AP) — FIFA asked presidential candidates to provide details of their intended (2) victory speeches ahead of Friday's election in a bid to keep them on me... 2016-02-24 13:16:00+00:00 1KB www.dailymail.co.uk 6 Donald Trump will never fire Katrina Pierson: Five of the craziest things the controversial spokeswoman has said on the (2) campaign trail Unlike Ted Cruz's shameless sacrifice of his spokesman this week, Trump finds his id echoed by Pierson VIDEO 2016-02-24 17:15:35 3KB www.salon.com 7 Bayer Leverkusen boss Roger Schmidt handed three-match ban (2) Bayer Leverkusen coach Roger Schmidt has been banned for three Bundesliga matches on Wednesday and fined 20,000 euros for refusing to leave when he was sent off in the Bundesliga. -

March 2021 Newsletter

Shree Bhikhubhai N. Patel Managing Trustee & Secretary Sardar Patel Education Trust Volume: II • Issue: II • February - March 2021 B N PATEL INSTITUTE OF PARAMEDICAL AND SCIENCE (PARAMEDICAL DIVISION) B N PATEL COLLEGE OF PHYSIOTHERAPY Managed by Sardar Patel Education Trust, Anand NEWSLETTER Message from the desk In the Issue: Men and women both belong to kitchen; both belong to work space, both have right to freedom Educating girls for the betterment of of choice, freedom to build our beliefs individually. I also talked about how every girl must Indian society BMW Recognizing and Empowering educate herself to build her career, make her money, to build herself esteem, nature her beliefs Women (The unstoppable Force) and be an equal partner in a relationship rather than boxing herself in stereotypical gender roles. MG Motor India inducts young women Everything must be a CHOICE. Working or otherwise! I also support other women's efforts professionals under 'Genesis', a train & hire program to empower young women because I am not her and she is not me. We are all meant to shine differently. Let her READ, Then watch how she -Dr. Arrpita Arorah LEAD Women empowerment in today's era Director Physical Therapists in the times of B. N. Patel Institute of Paramedical and Science (Paramedical Division) COVID-19 B. N. Patel College of Physiotherapy List of women's with padma awards 2K21 B. N. Patel Institute of Nursing Women's Health BMW Recognizing and Empowering MG Motor India inducts young women Women (The unstoppable Force) professionals under 'Genesis', a train & Greetings to all the Wonderful, Outstanding, hire program to empower young women Marvellous, Adorable, Nicest gift from god – Underlining its commitment to enabling more WOMEN !! Wishing you a very Happy International inclusive and diverse workplaces, MG (Morris Women's Day. -

Current AFFAIRS

CONTENTS VOL-16 ISSUE -2 Editor Citizenship Amendment Act Impeachment of Donald (CAA) 2019 Trump N.K. Jain Advisors Neeraj Chabra K.C.Gupta Registered Office Mahendra Publication Pvt. Ltd. 103, Pragatideep Building, International Financial Services COP25 Climate Summit Plot No. 08, Laxminagar, Centres Authority Bill, 2019 District Centre, New Delhi - 110092 TIN-09350038898 w.e.f. 12-06-2014 Branch Office Mahendra Publication Pvt. Ltd. E-42,43,44, Sector-7, Noida (U.P.) Interview 5 For queries regarding Current Affairs - One Liner 6-9 promotion, distribution & advertisement, contact:- Spotlight 10 [email protected] The People 11-17 Ph.: 09208037962 News Bites 18-48 Citizenship Amendment Act (CAA) 2019 49-50 Owned, printed & published by N.K. Jain Impeachment of Donald Trump 51-52 103, Pragatideep Building, International Financial Services Centres Authority Bill, Plot No. 08, Laxminagar, 2019 53-54 District Centre, New Delhi - 110092 COP25 Climate Summit 55-56 Please send your suggestions and grievances to:- Word of English - Etymology 57 Mahendra Publication Pvt. Ltd. Designation : Who's Who 61 CP-9, Vijayant Khand, Quiz Time - General Awareness 62-71 Gomti Nagar Lucknow - 226010 SSC CHSL PRE - Previous Paper 2019 72-82 E-mail:[email protected] CRP Clerk Mains - Model Paper 2019 83-113 © Copyright Reserved # No part of this issue can be printed in Subscription form is on Pg 60 whole or in part without the written permission of the publishers. # All the disputes are subject to Delhi jurisdiction only. Mahendra Publication Pvt. Ltd. Editorial "Victory is not always winning the battle...but rising every time you fall." - Napoleon Bonaparte Dear Aspirants, We feel delighted to present to you the "February 2020" edition of "Master In Current Affairs". -

Batting Star Friends Kohli, De Villiers Face

BBASKETBALLASKETBALL | Page 5 GGOLFOLF | Page 6 Curry is India’s Shiv red-hot in Kapoor wins return for 3rd Asian title Warriors of the year Monday, January 1, 2018 CRICKET Rabia II 14, 1439 AH Friends Kohli and GULF TIMES De Villiers face off in India-SA series SPORT Page 3 TENNIS/ QATAR EXXONMOBIL OPEN New hope in the new season That has been pretty much the case The shadows of Rafael Nadal, time and of the sport.” Czech Republic’s over the past few years, and as the new Roger Federer, Novak Djokovic Berdych, who made the Wimbledon Berdych says 2018 Tournament Director Karim tennis season gets underway, things are and Andy Murray loom larger fi nal in 2010 where he lost to Nadal, how- Alami (C) poses with top seed Dominic not too diff erent. than ever for the ‘young guns’ ever is still hopeful of winning a Grand will be a “very Thiem of Austria (L) and third seeded The shadows of Rafael Nadal, Roger and some of the underachieving Slam. Tomas Berdych of the Czech Republic Federer, Novak Djokovic and Andy Mur- older players hoping to make a “I think that’s the beauty of our sport interesting year” as ahead of the Qatar ExxonMobil Open. ray loom larger than ever for the ‘young splash on the world scene that no matter where you are, you still guns’ and some of the underachieving have a big chance. It’s about that particu- Djokovic and Nadal older players hoping to make a splash on year” as Czech veteran Tomas Berdych lar day, and from that one day you can battle injuries the world scene. -

June 2019 Current Affairs MCQ

Facebook Page Facebook Group Telegram Group Telegram Channel AMBITIOUSBABA.COM |[email protected] 1 Facebook Page Facebook Group Telegram Group Telegram Channel ISRO Space Technology Cell (STC) at the 1st & 2nd June 2019 institute where Assam Governor Jagdish Mukhi inaugurated a new academic Q1. Narendra Modi took oath as the PM for complex and research and development a second consecutive term. How many building. other members of the Council of Ministers, (a) Bhabha Atomic Research Centre including Rajnath Singh, Amit Shah, Nitin (b) Vikram Sarabhai Space Centre Gadkari, and Sadananda Gowda, also took (c) ISRO the oath? (d) DRDO (a) 58 (e) NASA (b) 56 Ans.3.(c) (c) 54 Exp.Indian Institute of Technology (IIT), (d) 55 Guwahati has signed an MoU with The Indian (e) 57 Space Research Organisation (ISRO) to set up Ans.1.(e) an IITG-ISRO Space Technology Cell (STC) at Exp. Narendra Modi took oath as the PM for a the institute where Assam Governor Jagdish second consecutive term. 57 other members Mukhi inaugurated a new academic complex of the Council of Ministers, including Rajnath and research and development building. Singh, Amit Shah, Nitin Gadkari, and Q4. DV Sadananda Gowda is the new Sadananda Gowda, also took the oath. A total cabinet minister for chemicals and of 24 Cabinet Ministers took oath at the fertilizers in Prime Minister Narendra forecourt of the Rashtrapati Bhavan, followed Modi’s government. Where is the by nine Ministers of State (Independent constituency of DV Sadananda Gowda? Charge) and 24 Ministers of State. (a) Bengaluru South Q2. As the World Environment Day is (b) Bengaluru North approaching, Ministry of Environment, (c) Bangalore Rural Forest and Climate Change launched a (d) Bangalore Central theme song ‘_________________________’ on air (e) Bagalkot pollution. -

JA-Recruitment-E-Book.Pdf

WWW.GKSERIES.COM Index Chapters Page No. English 2 Mathematics 170 Reasoning 381 Current Affairs Quiz 576 General Knowledge 952 Assam History 992 Computer Awareness 1032 Page | 1 https://www.gkseries.com/ WWW.GKSERIES.COM English 1. PERDILECTION (1) predicament (2) afterthought (3) aversion (4) postponement Explanation: aversion (Noun) : reluctance; dislike; a strong feeling of not liking somebody/something. predilection (Noun) : liking, preference. 2. POMPOUS (1) uppish (2) humble (3) meek (4) grandiose Explanation: humble (Adjective) :modest; no showing. pompous (Adjective) : pretentious; showing; grandiose. 3. SERENE (1) calm (2)angry (3) ruffled (4) bitter Page | 2 https://www.gkseries.com/ WWW.GKSERIES.COM Explanation: ruffled (Adjective) : disturbed; flustered. serene (Adjective) : calm and peaceful. 4. RELEASE (1) hide (2) bury (3) close (4) confine Explanation: confine (Verb) : to keep inside the limits; restrict; to keep a person/animal in a small space. release (Verb) : set free; stop holding ; let go. 5. CLEAR (1) implicit (2) effulgent (3) nebulous/opaque (4) lucid Explanation: nebulous (Adjective) : not clear; vague. clear (Adjective) : easy to understand; direct; obvious. implicit (Adjective) : not clear; indirect. 6. DISCRIMINATION (1) bias Page | 3 https://www.gkseries.com/ WWW.GKSERIES.COM (2) equality (3) motivation (4) replenishment Explanation: equality ( Noun) : the fact of being equal in rights, status etc. discrimination (Noun) :the practice of treating somebody or a particular group less fairly than others; partiality; bias. 7. ENDANGERED (1) protected (2) livening up (3) abundant (4) blissful Explanation: protected (Adjective) : make sure that something is not harmed, injured, damaged etc. endangered (Adjective) : putting somebody/something in a situation in which they could be harmed or damaged. -

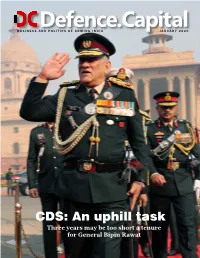

Read the Full Interview in the Jan. 2020 Edition Of

Defence.Capital BUSINESS AND POLITICS OF ARMING INDIA JANUARY 2020 CDS: An uphill task Three years may be too short a tenure for General Bipin Rawat Sample Market Reports For Commissioning Reports and for Pricing, Contact Us: IndoStrat Enterprises Phone: +91 9871050869 * * * Email: [email protected] 2 Defence.Capital JANUARY 2020 EDITORIAL Dear Reader, t truly gives me immense happiness to greet as you step into New Year 2020. I am doubly happy Ibecause it has been our singular privilege to present to you Defence.Capital, a uniquely placed news portal and monthly magazine focusing on the defence, aerospace, homeland security and shipping sectors. Am sure the discerning reader and observer in you will lap up this product from the IndoStrat En- terprises stable. While the online portal will be a platform to provide you breaking news, the monthly magazine in a print form and in the electronic, soft copy format will be explainers of issues that are gripping the focus sectors. The January 2020 edition of Defence.Capital with special focus on the Army Day is the first ever of the printed magazine and the ezine editions, though the online product is already six months old. The editorial team looks forward to your valuable suggestions and feedback on the product and ways to improve it further, so that the website and the magazine become the first stop of all the stake-holders in the sectors from which we will be bringing news that you can use. Defence Budget 2020-21 It is but customary that the Indian government presents the general budget for the 2020-21 fiscal within a month or so of entering a new year. -

6TOIDC COL 17R1.QXD (Page 1)

OID‰†KOID‰†OID‰†MOID‰†C The Times of India, New Delhi, Thursday,November 6, 2003 Leonard set for World cap record Joe may step up in weight Lazio coach apologises Jason Leonard will equal international rugby's world cap record Joe Calzaghe says he is considering moving up Lazio coach Roberto Mancini apologised when he lines up for England against Wales on Sunday. The to fight in the light-heavyweight division. The for Sinisa Mihajlovic's behaviour after the Harlequins prop has forced himself into Clive Woodward's unbeaten Welshman said: "The older you get, the defender spat at Chelsea striker Adrian World Cup quarter-finals starting XV, above Gloucester loose- bigger you get and the harder it is to make the Mutu. The incident happened in the head Trevor Woodman. It will be Leonard's 111th cap, putting super-middleweight division. Joe has reigned first half of Chelsea's Champions him alongside Frenchman Philippe Sella supreme at 168lb since October 1997 League 4-0 win at the Stadio Olimpico Chelsea, Man United post big victories in Champions League It is not for me to pass judge- ment on my own performance. Wanted: Brilliance at Barabati We play our best in - Rahul Dravid on captaincy Kiwis face depleted Indian attack in crucial tie; Nehra, Karthik likely to play desperate situations SPORTS DIGEST AFP a position to complain about Cuttack: Comprehensively out- LEADING EDGE seaming wickets. However, Ajit Ninan played by world champions Aus- RAHUL DRAVID: THE Stephen Fleming back home the wickets seam tralia in Mumbai, India need to fire CAPTAIN’S TAKE consistently for 100 overs. -

T.N.E.B.Engineers' Sangam Salutes the Cricketing Genious Sachin Tendulkar for His Fabulous Contribution to the Game of Cricket

T.N.E.B.ENGINEERS’ SANGAM SALUTES THE CRICKETING GENIOUS SACHIN TENDULKAR FOR HIS FABULOUS CONTRIBUTION TO THE GAME OF CRICKET. WE PRAY FOR THE GOOD HEALTH AND HAPPINESS TO THE GENIOUS AND HIS FAMILY. CONGRATULATIONS FOR MANY MORE SUCCESS AND RECORDS. A life in brief Born: 24 April 1973, Mumbai, India. Family: Married Anjali in 1995, paediatrician and daughter of a Gujarati industrialist. They have two children, Sara and Arjun. Education: Attended Sharadashram Vidyamandir High School in Mumbai. Has been a professional cricketer from the age of 15. Career: Scored a century on his first-class debut for Bombay – at 15 the youngest Indian ever to do so. At 16, in 1989, he made his Test debut against Pakistan, the third- youngest player to play Test cricket. More than 20 years on the statistics abound. Tendulkar's 166 Test matches put him second on the all-time list, two behind Australia's Steve Waugh. Last month he became the first batsman to pass 13,000 Test runs. His 47 Test centuries are a record. (Australia's Ricky Ponting his next on the list with 39.) In one-day internationals he has scored more runs than anybody – 17,598. At 37, there is no talk of retirement and he plans to play in next year's World Cup. Sachin Tendulkar Records, Sachin Tendulkar World Records, Sachins ODI And Test Records. Test Cricket Game Appearances: On his Test debut, Sachin Tendulkar was the third youngest debutant (16y 205d). Mushtaq Mohammad (15y 124d) and Aaqib Javed (16y 189d) debuted in Test matches younger than Tendulkar. -

Sainik Cover Copy

2018 16-30 April Vol 65 No 8 ` 5 SAINIK Samachar Prime Minister inaugurates India’s mega exhibition – DEFEXPO 2018 The Prime Minister, Shri Narendra Modi visiting the pavilions, at the inauguration ceremony of the DefExpo India 2018, at Mahabalipuram, Tamil Nadu on April 12, 2018. The Prime Minister, Shri Narendra Modi witnessing the demonstration of equipment of the three Armed forces, at the inauguration ceremony of the DefExpo India 2018, at Mahabalipuram, Tamil Nadu on April 12, 2018. In This Issue Since 1909 BIRTH ANNIVERSARY CELEBRATIONS PM’s Address at DEFEXPO 2018 4 (Initially published as FAUJI AKHBAR) Vol. 65 q No 8 26 Chaitra - 10 Vaisakha, 1940 (Saka) 16-30 April 2018 The journal of India’s Armed Forces published every fortnight in thirteen languages including Hindi & English on behalf of Ministry of Defence. It is not necessarily an organ for the expression of the Government’s defence policy. The published items represent the views of respective writers and correspondents. Editor-in-Chief Hasibur Rahman Senior Editor Ms Ruby T Sharma RM Appreciates National 7 DRDO Celebrates 8 Editor Ehsan Khusro Level Open Challenge… ‘Make in India’ Spirit… Sub Editor Sub Maj KC Sahu Coordination Kunal Kumar Business Manager Rajpal Our Correspondents DELHI: Col Aman Anand; Capt DK Sharma VSM; Wg Cdr Anupam Banerjee; Manoj Tuli; Nampibou Marinmai; Ved Pal; Divyanshu Kumar; Photo Editor: K Ramesh; ALLAHABAD: Gp Capt BB Pande; BENGALURU: Guruprasad HL; CHANDIGARH: Anil Gaur; CHENNAI: T Shanmugam; GANDHINAGAR: Wg Cdr Abhishek Matiman; GUWAHATI: -

150+ Important Current Affairs Questions for CDS I 2020

www.gradeup.co 150+ Important Current Affairs Questions for CDS I 2020 1.11-day long ‘Dhanu Jatra’ is celebrated in which state of India? A. West Bengal B. Orissa C. Andhra Pradesh D. Tamil Nadu E. Karnataka Answer: B Solution: • On 31st December 2019 the famous 11-day long ‘Dhanu Jatra’, has begun in Odisha. 2.Which state government has planned to deliver sand at doorsteps? A. Tamil Nadu B. Utter Pradesh C. New Delhi D. Andhra Pradesh E. Bihar Answer: D Solution: • The Andhra Pradesh government is planning to introduce door-delivery of sand from January 2, 2020. • Under this initiative, the AP government will deliver sand at doorsteps and collect transportation charges from the customers. 3.China has started a joint naval drill with which among the following countries in the Gulf of Oman? A. Iran and India B. Iran and Russia C. Iran and Oman D. Oman and India E. India and Russia Answer: B Solution: 1 www.gradeup.co • China, Russia, and Iran will hold trilateral naval exercises in the Gulf of Oman from 27th December to 30th December 2019. • This will be the first such move by the three countries in the volatile Middle East. 4.Consider the following: 1) GHG Emissions 2) Renewable Energy 3) Energy Use 4) Climate Policy Which of the following is not an indicator for monitoring countries in Climate change performance index? A. 1, 2 and 3 B. 2, 3 and 4 C. 1, 3 and 4 D. All the above-mentioned indicators are correct Answer: D Solution: CCPI is an independent monitoring tool of countries’ climate protection performance. -

Slowdown Hits Ts Budget, Outlay Slashed By

Follow us on: RNI No. TELENG/2018/76469 @TheDailyPioneer facebook.com/dailypioneer Established 1864 Published From ANALYSIS 9 HYDERABAD 11 SPORTS 16 HYDERABAD DELHI LUCKNOWBHOPAL LOOK BEYOND BALANCING BETWEEN NADAL CHAMPION RAIPUR CHANDIGARH BHUBANESWAR THE SURFACE NATURE AND HUMANS ONCE AGAIN RANCHI DEHRADUN VIJAYAWADA *LATE CITY VOL. 1 ISSUE 337 HYDERABAD, TUESDAY SEPTEMBER 10, 2019; PAGES 16 `3 *Air Surcharge Extra if Applicable TAMANNAAH TO SHAKE A LEG WITH MAHESH? { Page 13 } www.dailypioneer.com NEW GUV HEAPS PRAISE ON TS GOVT SLOWDOWN HITS TS BUDGET, Telangana a model State in the country OUTLAY SLASHED BY 20% PNS n HYDERABAD Governor Tamilisai Soundararajan lavished prais- Total expenditure Scheme expenditure es on Chief Minister K Chandrasekhar Rao and the Jagan decision Telangana government for on PPAs Rs 1,46,492 cr Rs 75,263.24 cr implementing various novel initiatives and schemes for the overall development of affected foreign Establishment expenditure the state and all sections of investments people. The governor released a PNS n HYDERABAD Rs 71,229 cr message addressing the people of Telangana on Monday. In Union Minister for Power her message, Dr I am happy to share and Renewable Energy Total Revenue receipts Soundararajan said, "I am the joy of my role as a Minister, RK Singh, said that Rs 1,13,099.92 cr happy to share the joy of my partner in the task of it was not within Andhra role as a partner in the task of Pradesh Chief Minister YS n State share in central promoting all-round promoting all-round devel- development of Telangana Jaganmohan Reddy's discre- taxes Rs 19,718.57 cr opment of Telangana State tion to review the Power State with the able FLAGSHIP n with the able guidance and Purchase Agreements State's own tax leadership of Chief Minister guidance and leadership of (PPAs) in irrigations PROGRAMMES revenue Rs Sri Kalvakuntla Chief Minister Sri schemes and it was unfortu- 69,328.57 cr Chandrasekhar Rao." Kalvakuntla Chandrasekhar nate that he had decided to Aasara pensions She added, "Today, do so.