Ifci Tower, 61 Nehru Place, New Delhi-110019 Website

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

District : South

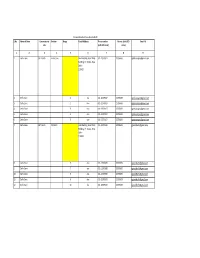

S.No Health Facility Name Address Assembly Name Type Agency DISTRICT : SOUTH 1 Kalkaji Colony Hospital Kalkaji , Delhi 110019 Kalkaji(51) Hospital South Delhi Municipal Corporation 2 National Insitute of Mehrauli, Delhi 110030 Malviya Nagar(43) Hospital MoHFW, GOI Tuberculosis and Chest Diseases 3 Bhatti Mines IPP-VIII MCD Health Centre, Sanjay Colony, Chhattarpur(46) Maternity South Delhi Bhatti Mines, Delhi 110074 Hospital/Home Municipal Corporation 4 Hauzkhas IPP-VIII MCD Health Centre,Sarvpriya Vihar, Malviya Nagar(43) Maternity South Delhi Hauz Khas, Delhi 110016 Hospital/Home Municipal Corporation 5 Nehru Place-IPP-VIII IPP- VIII, Giri Nagar, Nehru Place, Kalkaji(51) Maternity South Delhi Delhi 110019 Hospital/Home Municipal Corporation 6 Okhla Phase-I IPP-VIII Okhla Phase-I,Near MCD Primary Tughlakabad(52) Maternity South Delhi SchoolOpp., DDA Flats Kalkaji , Delhi Hospital/Home Municipal 110019 Corporation 7 Fatehpur Beri MCD PHC Village Fatehpur Beri, Delhi 110074 Chhattarpur(46) Primary Health South Delhi Centre Municipal 8 Mehrauli MCD PHC Village Mehrauli , Delhi 110030 Mehrauli(45) Primary Health South Delhi Centre Municipal 9 DGD Begumpur Near Malviya Nagar, Kalu Sarai, Malviya Nagar(43) Allopathic DHS Begumpur, Delhi 110017 Dispensary 10 DGD Ber Sarai Opp. Main Gate, JNU Campus, Delhi Mehrauli(45) Allopathic DHS 110018 Dispensary 11 DGD Chattarpur Chattarpur Chhattarpur(46) Allopathic DHS Village, Delhi 110030 Dispensary 12 DGD Chirag Delhi H. No. 828, Chirag Delhi, Delhi Greater Kailash(50) Allopathic DHS 13 DGD Dakshinpuri opp. Kali Ambedkar Nagar(48) Allopathic DHS Building Main Road , Dakshinpuri, Dispensary 14 DGD Jonapur Jonapur Village, Delhi 110047 Chhattarpur(46) Allopathic DHS Dispensary 15 DGD Khanpur JJ Colony, Khanpur, Delhi 110062 Ambedkar Nagar(48) Allopathic DHS 16 DGD Madangir Block No. -

List of Foreign Exchange Authorised Branches in India

LIST OF FOREIGN EXCHANGE AUTHORISED BRANCHES IN INDIA SWIFT CODE ADDRESS BARBINBBTSY SPECIALISED INTEGRATED TREASURY BRANCH .Baroda Sun Towers 4th & th floor C 34 Gblock Bandra Kurla Complex Bandra East Mumbai 400051 Tel no 022 66363600 general 022 66363636 & 67592705 Fax 022 67592830 67592670 Tel : 022-67592759 /60 mob 9833832772 E mail [email protected] BARBINBBBMO MUMBAI MAIN OFFICE 10/12, Mumbai Samachar Marg, Fort, Mumbai-400 001. Tel :(DGM) 022-22048649 (Forex) 22825201 (General) 22048641 Fax : 22040494 E-mail : [email protected] BARBINBBPAT PATNA MAIN BRANCH Frazer Road, Patna 800 001. Tel : 0612 2225284/2222105/2225837) Fax :0612 2225284 E-mail : [email protected] BARBINBBJAM JAMSHEDPUR MAIN BRANCHBank of Baroda Building,.Main Road, Bistrupur Jamshedpur 831 001 Tel : 0657 424723/423770) Fax :0657 422319 E-mail : [email protected] BARBINBBBHU BHUBANESHWAR BRANCH 91/92, 1st Floor, Bapuji Nagar, Bhubaneshwar – 751 509 Khurda District Tel :0674-2532214 | 2530018 Fax : 530018 E-mail : [email protected] BARBINBBCMS CAMAC STREET BRANCH 3-B, Camac Street, Kolkata-700 016. Tel : 033 22467190 (Mgr) 22293414 (Forex) 033 22291720, 5181 (General) Fax : 033 22264576 E-mail : [email protected] BARBINBBIBB INTERNATIONAL BUSINESS BRANCH 4, India Exchange Place 1st Floor, Kolkata-700 001. Tel : 033 22422694, 22426703 (AGM) / 22434777 (CM) 033 22106721, 22422697 (Forex) Fax No.22424387 E-Mail [email protected] BARBINBBMAT CHANDAVARKAR ROAD BRANCH 309, Matunga (Central Railway) Chandavarkar Road, Mumbai-400 019. Tel : 022-24142374 (Mgr), 24100456 (Forex) 24141699, 24142399 (General) E mail [email protected] BARBINBBGHE GHATKOPAR (EAST) BRANCH A – Chetan Bldg., Rajawadi Road, Ghatkopar (East), Mumbai – 400 077 Tel : 022-25106379, 25107731,25025653(Mgr) Fax : 25135232 E-mail : [email protected] BARBINBBTHW THANE (WEST) BRANCH Annapurna Bhavan, Gokhale Road, Naupada, Thane (West) - 400 602. -

Downlod Bus Routes

Number of Buses in S. No. Cluster No Route No. From To operation (varies Via Depot Buses Booking Status Availability Status from time to time) Azadpur,Wazir Pur Depot, Punjabi Bagh, Zakhira, Moti Nagar, Shadi 1 3 78 Azadpur Inderpuri (Krishi Kunj) 19 BBM Depot AL 1 18 Pur Depot, Lohi Mandi,Inderpuri (Krishi Kunj) Nehru Vihar,Balak Ram Hospital,Khalsa College,Shakti Nagar Nagia Park,Gulabi Bagh,Shastri Nagar E Block,Zakhira,Moti Nagar,P/S Kirti 2 4 108 Nehru Vihar Hari Nagar Clock Tower 17 BBM Depot AL 1 16 Nagar,Maya Puri Xing / Maya Puri Depot,Beri Wala Bagh,Hari Nagar Clock Tower Nathu Pura,Kaushik Enclave,Jharoda Xing Transport Authority (Burari),Nirankari Colony (Radio Colony),GTB Nagar,Old Sectt,ISBT 3 3 185 Nathupura Kendriya Terminal 7 (Kashmiri Gate),Red Fort,Delhi Gate,Vivekanand Marg,Palika BBM Depot AL 1 6 Kendra,Kendriya Terminal Church Road. Kalyan Vihar,Rana Pratap Bagh,P/S Roop Nagar/Roshnara Road,Delhi University,Balak Ram Hospital,Gur Nanak Sar,Bhajan Pura,C 4 4 3 262 Kalyan Vihar Harsh Vihar 4 Yamuna Vihar,Nand Nagari Depot,Harsh Vihar. BBM Depot AL 4 ISBT (Kashmere Gate),Old Sectt,Khalsa College,Shakti Nagar Nagia Park,Gulabi Bagh Xing,Shastri Nagar E Block,Zakhira,Moti Nagar,Raja Garden,Mukharji Park(Subhash Nagar Crossing),Tilak Nagar,Distret 5 3 813 ISBT Kashmere Gate Mangla Puri Terminal 11 Centre ,Uttam Nagar /A1 Janak Puri,C-1 Janakpuri, New Dabri BBM Depot AL 2 9 Road,Mangla Puri (T) Old Delhi Railway Station,Tis Hazari Animal Hospital/ Mori Gate,Ice Factory,Guru Govind Singh Marg,Sarai Rohila,Zakhira,Punjabi Bagh Old Delhi Railway 6 3 937A Sultanpuri Terminal 21 Terminal,Madipur JJ Colony,Peera Garhi Chowk,Mangolpuri B- BBM Depot AL 1 20 Station(Fatehpuri) Block,Mangolpuri S Block,Sultanpuri Terminal. -

List of Sanchar Haat

List of Sanchar Haat 1 Laxmi Nagar 22512400,22411343, All Days 9 AM to Tele.Exch.Bldg,De 22508717, except 7 PM Trans lhi 22044530, 22508716 Holidays (on Yamun Sunday a 9 AM to 2 PM) 56A , PKT-A 22721188, , 22721500, 18001111All Days 9 AM to Cli Mayur Vihar PH-II 22771188 69 except 7 PM ck Sundays/Holid her ays e DDA Shopping 22240005, 22240006, All Days 9 AM to Clic Centre,Madhu 22240025 except 7 PM k Vihar,IP extn Sundays/Holid her ays e DDA Shopping 22379600, 22372730, 18001122All Days 9 AM to Centre,AGCR 22372211, 00 except 7 PM Enclave,Delhi 22375173 Sundays/Holid ays Pocket-4, Mayur 22712530, 22718582, 18001111All Days 9 AM to Clic Vihar-I, Delhi 22718581, 68 except 7 PM k 22710980, 22711700, Sundays/Holid her 22713200 ays e H-Pocket,DDA 22580039, 22139800, NIL All Days 9 AM to Clic Shoping 22595509 except 7 PM k Centre,Dilshad Sundays/Holid her garden ays e DDA Shopping 22827373,22827702, 2 18001114All Days 9 AM to Clic Centre,RSU 2827701 14 except 7 PM k Blg,New Zafrabad Sundays/Holid her Extn. ays e Sec-18,Opp. Atta (0120-2516993,0120- All Days 9 AM to Mkt,Noida D- 2516994) except 7 PM 1/112 J S Arcade Sundays/Holid Sec-18 Noida ays DDA Mkt,MIG 22814042, 22816042, All Days 9 AM to Flats , Loni 22811001 except 7 PM Road,Delhi Sundays/Holid ays C-10 Yamuna 22915110,22917110, All Days 9 AM to Vihar Main 22916110, except 7 PM Exchange Bldg. -

447 Bus Time Schedule & Line Route

447 bus time schedule & line map 447 Bhalswa JJ Colony - Nehru Place Terminal View In Website Mode The 447 bus line (Bhalswa JJ Colony - Nehru Place Terminal) has 2 routes. For regular weekdays, their operation hours are: (1) Bhalswa Jj Colony: 5:00 AM - 7:00 PM (2) Nehru Place Terminal: 6:25 AM - 8:40 PM Use the Moovit App to ƒnd the closest 447 bus station near you and ƒnd out when is the next 447 bus arriving. Direction: Bhalswa Jj Colony 447 bus Time Schedule 53 stops Bhalswa Jj Colony Route Timetable: VIEW LINE SCHEDULE Sunday 5:00 AM - 7:00 PM Monday 5:00 AM - 7:00 PM Nehru Place Terminal Tuesday 5:00 AM - 7:00 PM Nehru Place Lala Lajpat Rai Path, New Delhi Wednesday 5:00 AM - 7:00 PM Sant Nagar Thursday 5:00 AM - 7:00 PM Friday 5:00 AM - 7:00 PM Kailash Colony Saturday 5:00 AM - 7:00 PM Lady Shri Ram College Kendriya Vidhyalaya Central School 447 bus Info Direction: Bhalswa Jj Colony Moolchand Hospital Stops: 53 Trip Duration: 78 min Mahatma Gandhi Marg, New Delhi Line Summary: Nehru Place Terminal, Nehru Place, Gupta Market Sant Nagar, Kailash Colony, Lady Shri Ram College, Kendriya Vidhyalaya, Central School, Moolchand Mahatma Gandhi Marg, New Delhi Hospital, Gupta Market, Ring Road (Near Gupta Ring Road (Near Gupta Mkt.) Mkt.), Lajpat Nagar 2 Ring Road, PG DAV College / Sri Niwaspuri, Nehru Nagar, Ashram, Bhogal, Bhogal, Nizamuddin Extension, Police Station Nizamuddin Lajpat Nagar 2 Ring Road (Dargah), Amir Khusro Park / Oberoi Hotel, Delhi Public School, Sunder Nagar, Zoo, National Stadium, PG DAV College / Sri Niwaspuri I.T.P.O. -

Office of the Chief Commissioner of CGST & CX, Delhi Zone C.R

Quarterly updation relating to CPIOs and Appellate Authority (upto March 2021) Office of the Chief Commissioner of CGST & CX, Delhi Zone C.R. Building, I.P. Estate, New Delhi-110109 A. Chief Commissioner S.No Office/Location CPIO (Sh. /Smt) Appellate Jurisdiction Notified . of Authority office for Commissionerate (Sh./Smt.) payment of fees 1 Office of the Chief Ms. Rhea Joshi, Smt. Samrita Kaur Matters relating -- Commissioner of Deputy Commissioner, C.R. Gill, Joint to the Office of CGST & CX, Delhi Building, I.P. Estate, New Commissioner,C.R. the Chief Zone, C.R. Building, Delhi-110109 Building, I.P. Estate, Commissioner, I.P. Estate, New Email : [email protected] New Delhi-110109 CGST & CX, Delhi Delhi-110109 Email : zone. [email protected] B. Commissionerate S.No Commissionerate CPIO Appellate Jurisdictio Notified office . Authority n for payment of (Sh./Smt.) fees 1 CGST Delhi North Shri Subodh Kumar Gupta, Shri Rajender Jindal, Matters CAO Pay Cell, Assistant Commissioner, Additional relating to CGST Delhi North CGST Delhi North, Room Commissioner, Hqrs. No-264(A), C.R. Building, CGST Delhi North, Commission I.P. Estate, New Delhi- Room No. 131, First erate, North 110002 Foor, C.R. Building. Email : [email protected] I.P. Estate, New Delhi-110002 Email : rajender.jindal@gov .in 2 CGST Delhi East Shri Hriday Singh, Assistant Ms. Vijayarani. S., Matters Administrative Commissioner,2nd Floor, Additional relating to Office, Pay Cell, C.R. Building, I.P. Estate, Commissioner, Hqrs. 2nd Floor, C.R. New Delhi-1100109 Room No. 128, 1st Commission Building, I.P. Contact No. -

Delhi Software Companies

Delhi Software Companies S/W Company Names Contact Address Contact Number ABO Software Pvt Ltd B-102 Gulmohar Park +91-11 2-6512822, 2- New Delhi -110049 6968976 Website: www.edisphere.com/index.htm AbsolutData Technologies Pvt 254, Okhla Industrial Estate, Phase III, Ltd New Delhi - 110020 +91-11-4655-5400 Website: www.absolutdata.com AbsolutData Technologies Pvt 264, Okhla Industrial Estate, Phase III, +91-11-4655-5300 Ltd New Delhi - 110020 Accent Consulting (A division 1601, Chiranjiv Tower, 43, Nehru Place of Accent Overseas Pvt Ltd) New Delhi-110019 (011) 26288265/66/67 Website: www.accentinfoways.com Accenture Services Pvt Ltd 6th Floor, DLF Centre, Sansad Marg New Delhi 110 001 +91 11 23355000 Website: www.accenture.com Agilent Technologies Chandiwala Estate, (International) Pvt Ltd Maa Anandmai Marg, Kalkaji, +91 (11) 2682-6415 New Delhi-110019 Website: www.home.agilent.com Allied Telesyn International 192 Manu Apartments, 6 Mayur Vihar Asia Pte Ltd New Delhi 110 091 2256691 Website: www.alliedtelesyn.com Amadeus India Pvt Ltd E-9, Connought House Connought Place +91 11 30613300 New Delhi - 110 001 Website: www.amadeus.in AREVA T&D Systems India Chandiwala Estate Maa Anand Mai Ashram Ltd Marg - Kalkaji +91 11 4181 1201 Website: www.alstom.com/home/ Ashtech Infotech Pvt. Ltd. B-50/A, 2nd Floor, Kalkaji, New Delhi - 110019 011 - 26238781 / 82 Website: www.ashinfo.com Atari Informatics Ltd. F-7, 3rd Floor, East of Kailash, New Delhi-110065 26448055 - 58 Website: www.atariinfo.com/index.htm Aver Software Technologies E - 1/3, Malaviya -

S.No Name of Zone Commissioner Ate Division Range Postal Address

Contact Details of Seva Kendra Delhi S.No Name of Zone Commissioner Division Range Postal Address Phone number Fax no. (with STD Email Id ate (with STD code) code) 1 2 3 4 5 6 7 8 9 1 Delhi-Zone GST-North Darya Ganj IAEA Building, Near WHO 011-23379027 23705659 [email protected] Building, I.P. Estate, New Delhi- 110002 2 Delhi-Zone 1 -do- 011-23379027 23705659 [email protected] 3 Delhi-Zone 2 -do- 011-23379027 23705659 [email protected] 4 Delhi-Zone 3 -do- 011-23379027 23705659 [email protected] 5 Delhi-Zone 4 -do- 011-23379027 23705659 [email protected] 6 Delhi-Zone 5 -do- 011-23379027 23705659 [email protected] 7 Delhi-Zone GST-North Old Delhi IAEA Building, Near WHO 011-23379655 23705659 [email protected] Building, I.P. Estate, New Delhi- 110002 8 Delhi-Zone 6 -do- 011-23379655 23705659 [email protected] 9 Delhi-Zone 7 -do- 011-23379655 23705659 [email protected] 10 Delhi-Zone 8 -do- 011-23379655 23705659 [email protected] 11 Delhi-Zone 9 -do- 011-23379655 23705659 [email protected] 12 Delhi-Zone 10 -do- 011-23379655 23705659 [email protected] 13 Delhi-Zone GST-North Karol Bagh Building No. 4, 5 011-25414414 25168125 [email protected] Shopping Centre, Milan Cinema Complex, Karampura, New Delhi- 110015 14 Delhi-Zone 11 -do- 011-25414414 25168125 [email protected] 15 Delhi-Zone 12 -do- 011-25414414 25168125 [email protected] 16 Delhi-Zone 13 -do- 011-25414414 25168125 [email protected] 17 Delhi-Zone 14 -do- 011-25414414 25168125 [email protected] 18 Delhi-Zone 15 -do- 011-25414414 25168125 [email protected] 19 Delhi-Zone GST-North Kamla Nagar Building No. -

NATIONAL SMALL INDUSTRIES CORPORATION (A Government of India Enterprise) NSIC Exhibition Complex Opp: Kalkaji Mandir, Okhla Industrial Estate, New Delhi-110020

NATIONAL SMALL INDUSTRIES CORPORATION (A Government of India Enterprise) NSIC Exhibition Complex Opp: Kalkaji Mandir, Okhla Industrial Estate, New Delhi-110020 NSIC EXHIBITION COMPLEX, NEW DELHI (INDIA) A PERFECT VENUE FOR ORGANIZING EXHIBITIONS/TRADE FAIRS As you are aware, National Small Industries Corporation Limited, an ISO 9001:2015 certified company is committed to enhance the competitiveness of small enterprises through a judicious blend of promotional and commercial activities. Globalization and liberalization of economy has not only thrust many challenges but has also thrown up many opportunities. NSIC has quickly altered its focus to the need of its stakeholders and assumed a role of facilitator rather than a direct player. OPPORTUNITY To showcase the competencies of small scale industries and to capture market opportunities NSIC has constructed its own state of Art Exhibition Complex adjacent to its corporate office and successfully organized several exhibitions / events in recent past. The Exhibition Complex is strategically located and has lush green surroundings in the posh South Delhi area which enjoys very good connectivity from International Airport, New Delhi Railways Station and commercial place like Connaught Place and Nehru Place. Some of the best hotels also happen to be in the close vicinity. SALIENT FEATURES * Situated in the Heart of South Delhi opposite Kalkaji Mandir. * Fully Air Conditioned Hall of 1500 sq.mtrs. * 15000 sq.mtrs. Open space with hard standing base. * Separate Entry and Exit Gates – Gate No.3 & 4. * Govind Puri Metro Station in front of Gate No.4. * Okhla NSIC Metro Station near Gate No.3. * Ample parking space to accommodate about 700 cars/bikes approx. -

Organisation Nominated/ Standing Counsel Address

ORGANISATION NOMINATED/ ADDRESS CONTACT Nos. STANDING COUNSEL ARABIC SENIOR SECONDARY MR. M.ATYAB SIDDIQUI 316, LAWYERS CHAMBERS, CELL-9871321935 SCHOOL ANGLO ARABIC MODEL DELHI HIGH COURT, NEW DELHI- TEL.NO.23386708 SCHOOL SHAFIQ MEMORIAL 110003 SENIOR SECONDARY SCHOOL TEL.NO.95-120-4357203 J-122, AFTAB HOUSE, 95-120-4357204 SECTOR-41, NOIDA TEL.NO.26981472 [CHAMBER OF THE LEGAL ADVISER, TELEFAX;26981472 REGISTRAR'S OFFICE, JAMIA MILLIA ISLAMIA, JAMIA NAGAR, NEW DELHI-110025] ALL INDIA COUNCIL FOR 1. MR. AMITESH KUMAR 199, SIMANT VIHAR, KAUSHAMBI PH.95120- TECHNICAL EDUCATION(AICTE) GHAZIABAD, U.P. 3204673,2816166 PH. 23386914,23385275 OFFICE/CHAMBER's ADDRESS: MOB: 9811034115 20-A, LAWYERS CHAMBER FAX NO. 23385245 SUPREME COURT,NEW DELHI-110001 ALL INDIA INSTITUTE OF 1. MR. MUKUL GUPTA OFFICE ADDRESS: TEL. 23382840 & MEDICAL SCIENCES 236, 2ND FLOOR, 23382163 LAWYERS CHAMBERS, (LETTER DTD 21.02.2008) HIGH COURT OF DELHI, NEW DELHI RESIDENTIAL ADDRESS:- 27436362,27436838 C-118, ASHOK VIHAR, NEW DELHI – 110052 ALL INDIA INSTITUTE OF MR. MEHMOOD PRACHA CHAMBER NO. 134, MEDICAL SCIENCES ―STANDING LEGAL COUNSEL‖ PATIALA HOUSE COURTS COMPLEX, (LETTER DTD 27.01.2011) NEW DELHI-01 APPAREL EXPORTS PROMOTION MR. G.L.RAWAL 249, LAWYERS CHAMBERS BUILDING 23686241, 23747585 COUNCIL (A.E.P.C) MR. KULJEET RAWAL DELHI HIGH COURT, NEW DELHI 23747161 MR. RAJESH RAWAL AIRPORTS AUTHORITY OF INDIA MR. DIGVIJAY RAI 477, LAWYERS CHAMBERS, MOB.: 9873103599 BLOCK-II, HIGH COURT OF ‗STANDING COUNSEL‘ DELHI, SHER SHAH ROAD, NEW DELHI-110003. [AUTHORISED TO ACCEPT OFFICE AT : PH.(OFFICE): ADVANCE NOTICES, ETC.] 011-41040522 A-190, DEFENCE COLONY, e-mail: NEW DELHI-110024 digvijayrai@rediffmail. -

764S Bus Time Schedule & Line Route

764S bus time schedule & line map 764S Dichau Kalan Depot View In Website Mode The 764S bus line (Dichau Kalan Depot) has 2 routes. For regular weekdays, their operation hours are: (1) Dichau Kalan Depot: 5:00 AM - 8:40 AM (2) Nehru Place Terminal: 5:00 AM - 8:40 AM Use the Moovit App to ƒnd the closest 764S bus station near you and ƒnd out when is the next 764S bus arriving. Direction: Dichau Kalan Depot 764S bus Time Schedule 54 stops Dichau Kalan Depot Route Timetable: VIEW LINE SCHEDULE Sunday 5:00 AM - 8:40 AM Monday 5:00 AM - 8:40 AM Nehru Place Terminal Tuesday 5:00 AM - 8:40 AM Pumposh Enclave Wednesday 5:00 AM - 8:40 AM Os Communication / Masjid Moth Thursday 5:00 AM - 8:40 AM Chirag Dilli Friday 5:00 AM - 8:40 AM Swami Nagar Saturday 5:00 AM - 8:40 AM North Paint Nursing Home Sadhna Enclave 764S bus Info Panchsheel Club (Sarv Priya Vihar) Direction: Dichau Kalan Depot Stops: 54 Trip Duration: 102 min IIT Gate Line Summary: Nehru Place Terminal, Pumposh Enclave, Os Communication / Masjid Moth, Chirag Jia Sarai Dilli, Swami Nagar, North Paint Nursing Home, Sadhna Enclave, Panchsheel Club (Sarv Priya Vihar), IIT Hostel IIT Gate, Jia Sarai, IIT Hostel, Istm, Munirka Family Planning, Munirka Dda Flats, Vasant Vihar Depot, Istm Vasant Vihar, Swami Malai Mandir, Vasant Village / Shani Mandir, Arjun Path / Subroto Park, Arjun Path, Munirka Family Planning APS Colony, Palam Airport Bypass, I O L, Indian Oil Station, Prehlad Pur, Palam Colony Flyover, Dwarka Munirka Dda Flats Flyover / Palam Village, Dwarka More, J M International School, -

S.No. Station Name Station Landline No. Station Mobile No. Line 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 2

Updated List of Station Landline Telephone Numbers and Mobile Numbers S.No. Station Name Station Landline No. Station Mobile No. Line 1 New Bus Adda 7290018822 7303498348 2 Hindon River 07290018832 7303498347 3 Arthala 7290019646 7303498346 4 Mohan Nagar 7290018560 7303498345 5 Shyam Park 7290018557 7303498344 6 Rajender Nagar 7290018413 7303498343 7 Raj Bagh 7290018457 7303498342 8 Shahid Nagar 07290019023 7303498341 9 Dilshad Garden 7290049191 8800793100 10 Jhilmil 7290049044 8800793101 11 Mansarovar Park 7290048677 8800793102 12 Shahadra 7290048466 8800793103 13 Welcome 7290048366 8800793104 14 Seelampur 7290048299 8800793105 Line-1 15 Shastri Park 7290048282 8800793106 16 Kashmere Gate (Rail Corridor) 01123860837 8800793107 17 Tis Hazari 7290048155 8800793108 18 Pul Bangash 7290048122 8800793109 19 Pratap Nagar 7290048118 8800793110 20 Shastri Nagar 7290048055 8800793111 21 Inderlok 7290048022 8800793112 22 Kanahiya Nagar 7290048011 8800793113 23 Keshav Puram 7290047997 8800793114 24 Netaji Subhash Place 7290047966 8800793115 25 Kohat Enclave 7290047899 8800793116 26 Pitam Pura 7290047647 8800793117 27 Rohini East 7290047399 8800793118 28 Rohini West 7290047355 8800793119 29 Rithala 7290046922 8800793120 30 Samaypur Badli 7290020884 7042744337 31 Rohini Sector-18, 19 7290020885 7042744336 32 Haiderpur-Badli Mor 7290013837 7042744335 33 Jahangirpuri 7290052042 8800793121 34 Adarsh Nagar 7290052062 8800793122 35 Azadpur 7290052072 8800793123 36 Model Town 7290052082 8800793124 37 G.T.B Nagar 7290052092 8800793125 38 Vishwavidhyalaya