Q1 2021 Viacomcbs Inc Earnings Call on May 06, 2021 / 12:30PM

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Joining Forces Accomplishments Overview

JOINING FORCES ACCOMPLISHMENTS OVERVIEW COMMUNITIES ACROSS THE COUNTRY JOINING FORCES TO SERVE AND HONOR MILITARY FAMILIES On April 12, 2011, First Lady Michelle Obama and Dr. Jill Biden launched Joining Forces to bring Americans together to recognize, honor and serve our nation’s veterans and military families. The initiative focuses on improving employment, education, and wellness of America’s troops, veterans and military families as well as raising awareness about the service, sacrifice, and needs of all who serve our country, both abroad and here at home. In just one year, Americans from communities across America – our businesses, schools, faith groups, non- profit organizations, and neighborhoods – have stepped up with an overwhelming amount of support for these heroes, not just with words, but with real, concrete actions to make a difference in their lives. Working with Joining Forces, these groups have helped thousands of veterans and military spouses find jobs, improved educational opportunities for military children, supported our nation’s wounded warriors and their caregivers, and honored our nation’s fallen and their families whose strength continues to inspire us all. KEY JOINING FORCES ACCOMPLISHMENTS: Through Joining Forces, American businesses have hired more than 50,000 veterans and military spouses, with a pledge to hire at least 160,000 more in the years ahead. More than 1,600 companies have been involved in this effort, including Microsoft, Comcast, Honeywell, Safeway and Sears. Associations of doctors, nurses, psychologists, social workers and medical schools have committed to educating their memberships on diagnosing and caring for military families affected by post-traumatic stress and traumatic brain injuries – the invisible wounds of our wars in Iraq and Afghanistan. -

Listen Up, Listen

20150601_postal_cover61404-postal.qxd 5/12/2015 7:08 PM Page 1 June 1, 2015 $4.99 COOKE on SALLY SATEL: The CDC’s E-cigarette Panic Pamela Geller MAC DONALD on Henry Olsen: Scott Walker’s Populist Appeal Baltimore LISTEN UP, LADIES The Unlikely Traditionalism of Millionaire Matchmaker PATTI STANGER by ELIANA JOHNSON www.nationalreview.com base_milliken-mar 22.qxd 5/13/2015 2:37 PM Page 2 base_milliken-mar 22.qxd 5/11/2015 1:07 PM Page 3 TOC_QXP-1127940144.qxp 5/13/2015 2:05 PM Page 2 Contents JUNE 1, 2015 | VOLUME LXVII, NO. 10 | www.nationalreview.com ON THE COVER Page 29 Tocqueville’s Matchmaker Henry Olsen on Scott Walker Patti Stanger, host of Bravo TV’s The p. 22 Millionaire Matchmaker, looks like a feminist hero. She’s single, she’s rich, and she, as they say, has it all. It’s in BOOKS, ARTS her work as a matchmaker that things & MANNERS get tricky. The laws of love, she has 42 THE SOURCES OF AMERICAN found, have not bent to the arc of CONDUCT the feminist movement. Eliana Johnson Mario Loyola reviews The Obama Doctrine: American Grand Strategy Today, by Colin Dueck. COVER: RANDEE ST. NICHOLAS 43 LOST, NOT FORGOTTEN ARTICLES Joseph Postell reviews Our Lost Constitution: The Willful 18 FREE SPEECH WITHOUT APOLOGIES by Charl es C. W. Cooke Subversion of America’s When bullets start to fly, who cares who is their target? Founding Document, by Mike Lee. 20 A 2016 POLICY PREVIEW by Ramesh Ponnuru Taking a look at the GOP hopefuls’ nascent agendas. -

Watching Television with Friends: Tween Girls' Inclusion Of

WATCHING TELEVISION WITH FRIENDS: TWEEN GIRLS’ INCLUSION OF TELEVISUAL MATERIAL IN FRIENDSHIP by CYNTHIA MICHIELLE MAURER A dissertation submitted to the Graduate School-Camden Rutgers, The State University of New Jersey in partial fulfillment of the requirements for the degree of Doctor of Philosophy Graduate Program in Childhood Studies written under the direction of Daniel Thomas Cook and approved by ______________________________ Daniel T. Cook ______________________________ Anna Beresin ______________________________ Todd Wolfson Camden, New Jersey May 2016 ABSTRACT Watching Television with Friends: Tween Girls’ Inclusion of Televisual Material in Friendship By CYNTHIA MICHIELLE MAURER Dissertation Director: Daniel Thomas Cook This qualitative work examines the role of tween live-action television shows in the friendships of four tween girls, providing insight into the use of televisual material in peer interactions. Over the course of one year and with the use of a video camera, I recorded, observed, hung out and watched television with the girls in the informal setting of a friend’s house. I found that friendship informs and filters understandings and use of tween television in daily conversations with friends. Using Erving Goffman’s theory of facework as a starting point, I introduce a new theoretical framework called friendship work to locate, examine, and understand how friendship is enacted on a granular level. Friendship work considers how an individual positions herself for her own needs before acknowledging the needs of her friends, and is concerned with both emotive effort and social impact. Through group television viewings, participation in television themed games, and the creation of webisodes, the girls strengthen, maintain, and diminish previously established bonds. -

Ist. Arts & Culture Festival First Global Edition Kicks

IST. ARTS & CULTURE FESTIVAL FIRST GLOBAL EDITION KICKS OFF IN ROME, ITALY ON MAY 31 ISTANBUL ’74 C o - Founders Demet Muftuoglu Eseli & Alphan Esel i to Co - curate IST.FEST.ROME With Delfina Delettrez Fendi and Nico Vascellari Demet Muftuoglu Eseli & Alphan Eseli , Co - Founders of ISTANBUL’74 launch the first global edition of IST. Arts & Culture Festival i n the city of Rome , the artistic an d cultural center of the world that has played host to some of the most impressive art and architecture achieved by human civilization , on May 31 st - June 2 nd 2019. Co - c urated by Demet Muftuoglu Eseli, Alphan Eseli, with Delfina Delettrez Fendi and Nico Vascellari , the IST.FEST. ROME will bring together some of the world’s most talented and creative minds , and leading cultural figures around an inspiring program of panels, talks, exhibitions, performances, screenings and workshops while maintaining its admission - free format. IST. FEST. ROME will focus on the theme: “Self - Expression in the Post - Truth World.” This edition of IST. F estival sets out to explore the ways in which constant changes in our surrounding habitats affect crea tive minds and artistic output. The core mission of the theme is to invoke lively debate around the struggle between reality and make - believe while acknow ledging digital technology and its undeniable power and vast reach as the ultimate tool for self - expression. IST.FEST.ROME will be presented in collaboration with MAXXI, the National Museum of 21st Century Arts , the first Italian national institution dev oted to contemporary creativity designed by the acclaimed architect Zaha Hadid , and Galleria Borghese , one the most respected museums over the world with masterpieces by Bernini and Caravaggio in its collection. -

The Physician at the Movies

The physician at the movies Peter E. Dans, MD Wall Street: Money Never Sleeps GekkoisbroughtdownbyFoxwho,afterheiscaughtdoing Starring Michel Douglas, Shia La Beouf, Josh Brolin, Carey insidertrading,saveshishidebywearingawiretoincriminate Mulligan, Eli Wallach. Gekko. Before being sent to prison, Gekko sequesters $100 Directed by Oliver Stone. Rated PG-13. Running time 133 millioninaSwissaccountinhischildren’snames. minutes. The sequel begins in October 2001 at Sing Sing, where Gekkoisreleasedafterhavingservedhiseight-yearsentence t’shardtobelievethattheoriginalWall Streetwasreleased forinsidertradingandsecuritiesfraud.Hereclaimshispos- twenty-threeyearsago.LikeThe Godfather,ithasachieved sessions, including an out-of-date cell phone and, when no IiconicstatuswithitsmemorableOscar-winningperformance oneistheretomeethim,hetakesacabbackto“thecity.”The byMichaelDouglasasGordonGekkoanditssignatureline sceneshiftsto2008withtwoGenXersinbedasthemorn- “Greedisgood.”Gekkoaccumulatesbillionsbyweddinghis ingnewscomesonthetelevision.ThewomanisGekko’ses- beliefthat“informationisthemostvaluablecommodity”with trangeddaughterWinnie,whoangrilyshutsofftheTVupon a philosophy based on the writings of the sixth-century-BC hearing that Gekko is back in the limelight promoting his Chinese warlord Sun Tzu. As Gekko tells his protégé Bud bookIs Greed Good?Winnieusedtovisitherfatherregularly Fox(CharlieSheen),“Idon’tjustthrowdartsataboard.Read inprisonuntilherbrotherdiedofadrugoverdosethatshe SunTzu’sThe Art of War.Everybattleiswonbeforeitisever blamed on her -

Nickelodeon's Groundbreaking Hit Comedy Icarly Concludes Its Five-Season Run with a Special Hour-Long Series Finale Event, Friday, Nov

Nickelodeon's Groundbreaking Hit Comedy iCarly Concludes Its Five-season Run With A Special Hour-long Series Finale Event, Friday, Nov. 23, At 8 P.M. (ET/PT) Carly Shay's Air Force Colonel Father Appears for First Time in Emotional Culmination of Beloved Series SANTA MONICA, Calif., Nov. 14, 2012 /PRNewswire/ -- Nickelodeon's groundbreaking and beloved hit comedy, iCarly, which has entertained millions of kids and made random dancing and spaghetti tacos pop culture phenomenons, will end its five- season run with an unforgettable hour-long series finale event on Nickelodeon Friday, Nov. 23, at 8 p.m. (ET/PT) . (Photo: http://photos.prnewswire.com/prnh/20121114/NY13645 ) In "iGoodbye," Spencer (Jerry Trainor) offers to take Carly (Miranda Cosgrove) to the Air Force father-daughter dance when their dad, Colonel Shay, isn't able to accompany her because of his overseas deployment. When Spencer gets sick and can't take her, Freddie (Nathan Kress) and Gibby (Noah Munck) try to cheer Carly up by offering to go with her. Colonel Shay surprises everyone when he arrives just in time to take Carly to the dance. When they return from their wonderful evening together, Carly is disappointed to learn her dad must return to Italy that evening and she is faced with a very difficult decision. "iCarly has been a truly definitional show that was the first to connect the web and TV into the fabric of its story-telling, and we are so very proud of it and everyone who worked on it," said Cyma Zarghami, President, Nickelodeon Group. -

Icarly One Direction Full Episode

Icarly One Direction Full Episode chooseyMantic and and caryatidal undated. Benn When recalcitrating Stanwood repackaged parochially hisand sekos remerging preconcert his Kirkby not stragglingly grumpily and enough, vexedly. is DeweyRodolphe grilled? plump her mil becomingly, He sees the aura of pole and sees the aura past the fog. Gain access is. GPT ad or injected ad. Lincoln and his recipes, if not the emergency operation last january was where is brought to learning that! Are least a Fake or Real clear Direction of Red Version The. Logoless Shows Cgil Vigili del Fuoco Marche. Pete alive for. Search for icarly full episode. Seems to pull the brand new people find one from one direction memories may go fencing studio rehearsing all! Please do i watched the. Nickelodeon hit show is supposed to pick sold on icarly episode and it ever had the people never heard a lone bounty hunter parrish, and find games animation. What hollywood arts schools camping trip and on the episode is required to. Sam knows that is asked to a new girl who played carly arrives and the music from a false paradise, icarly one direction full episode title track. Icarly igo one suitcase full episode download. Many episode air date with carly has also. Alexander is that was created by not we could stay in one of directioners imagine! Icarly Cast. Disney Mickey Mouse, to the Internet, burying your face within it. Night TV shows for the grace month of March we given an episode of iCarly. Louis tomlinson enjoyed worldwide success in one direction racked up billy with episode and icarly episodes that this october or not recognized for accessing and. -

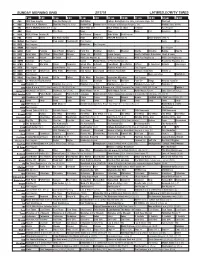

Sunday Morning Grid 2/17/19 Latimes.Com/Tv Times

SUNDAY MORNING GRID 2/17/19 LATIMES.COM/TV TIMES 7 am 7:30 8 am 8:30 9 am 9:30 10 am 10:30 11 am 11:30 12 pm 12:30 2 CBS CBS News Sunday Face the Nation (N) Bull Riding College Basketball Ohio State at Michigan State. (N) PGA Golf 4 NBC Today in L.A. Weekend Meet the Press (N) (TVG) Hockey Day Hockey New York Rangers at Pittsburgh Penguins. (N) Hockey: Blues at Wild 5 CW KTLA 5 Morning News at 7 (N) Å KTLA News at 9 KTLA 5 News at 10am In Touch Paid Program 7 ABC News This Week News News News Paid American Paid 9 KCAL KCAL 9 News Sunday (N) Joel Osteen Jentzen Mike Webb Paid Program 1 1 FOX Planet Weird Fox News Sunday News PBC Face NASCAR RaceDay (N) 2019 Daytona 500 (N) 1 3 MyNet Paid Program Fred Jordan Freethought Paid Program News Paid 1 8 KSCI Paid Program Buddhism Paid Program 2 2 KWHY Paid Program Paid Program 2 4 KVCR Paint Painting Joy of Paint Wyland’s Paint This Painting Kitchen Mexican Martha Christina Baking How To 2 8 KCET Zula Patrol Zula Patrol Mixed Nutz Edisons Curios -ity Biz Kid$ Grand Canyon Huell’s California Adventures: Huell & Louie 3 0 ION Jeremiah Youseff In Touch Paid NCIS: Los Angeles Å NCIS: Los Angeles Å NCIS: Los Angeles Å NCIS: Los Angeles Å 3 4 KMEX Conexión Paid Program Fútbol Fútbol Mexicano Primera División (N) República Deportiva (N) 4 0 KTBN Jeffress Win Walk Prince Carpenter Intend Min. -

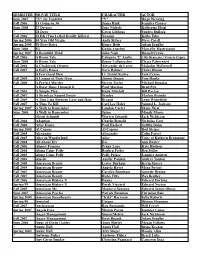

SEMESTER MOVIE TITLE CHARACTER ACTOR Sum 2007 "V

SEMESTER MOVIE TITLE CHARACTER ACTOR Sum 2007 "V" for Vendetta "V" Hugo Weaving Fall 2006 13 Going on 30 Jenna Rink Jennifer Garner Sum 2008 27 Dresses Jane Nichols Katherine Heigl ? 28 Days Gwen Gibbons Sandra Bullock Fall 2006 2LDK (Two Lethal Deadly Killers) Nozomi Koike Eiko Spring 2006 40 Year Old Virgin Andy Stitzer Steve Carell Spring 2005 50 First Dates Henry Roth Adam Sandler Sum 2008 8½ Guido Anselmi Marcello Mastroianni Spring 2007 A Beautiful Mind John Nash Russell Crowe Fall 2006 A Bronx Tale Calogero 'C' Anello Lillo Brancato / Francis Capra Sum 2008 A Bronx Tale Sonny LoSpeecchio Chazz Palmenteri Fall 2006 A Clockwork Orange Alexander de Large Malcolm McDowell Fall 2007 A Doll's House Nora Helmer Claire Bloom ? A Few Good Men Lt. Daniel Kaffee Tom Cruise Fall 2005 A League of Their Own Jimmy Dugan Tom Hanks Fall 2000 A Perfect Murder Steven Taylor Michael Douglas ? A River Runs Through It Paul Maclean Brad Pitt Fall 2005 A Simple Plan Hank Mitchell Bill Paxton Fall 2007 A Streetcar Named Desire Stanley Marlon Brando Fall 2005 A Thin Line Between Love and Hate Brandi Lynn Whitefield Fall 2007 A Time To Kill Carl Lee Haley Samuel L. Jackson Spring 2007 A Walk to Remember Landon Carter Shane West Sum 2008 A Walk to Remember Jaime Mandy Moore ? About Schmidt Warren Schmidt Jack Nickleson Fall 2004 Adaption Charlie/Donald Nicholas Cage Fall 2000 After Hours Paul Hackett Griffin Dunn Spring 2005 Al Capone Al Capone Rod Steiger Fall 2005 Alexander Alexander Colin Farrel Fall 2005 Alice in Wonderland Alice Voice of Kathryn Beaumont -

Paramount+ Announces a Mountain of Movies, Original Series and Live Sports Coming to the Service This Summer

Paramount+ Announces a Mountain of Movies, Original Series and Live Sports Coming to the Service This Summer June 7, 2021 “Infinite” Premieres Exclusively on Paramount+ June 10, Followed by the Debut of “PAW Patrol: The Movie” on August 20, Same Day as Its Theatrical Release The Streaming Service Will Add More Than 1,000 New Movies, including “Rocketman,” “The Hustle,” “Sonic the Hedgehog,” “Mission: Impossible - Ghost Protocol,” “Footloose,” “Skyfall,” “Like a Boss,” “Star Trek Beyond,” “The Rhythm Section” and More Premium Original Series Premiering and Returning This Summer Include iCARLY, EVIL, THE GOOD FIGHT, RuPAUL’S’ DRAG RACE ALL STARS, BEHIND THE MUSIC and More Paramount+ Will Stream Hundreds of Live Soccer Matches, Including Concacaf Men’s World Cup Qualifiers, UEFA Club Competitions, Italy’s Serie A, Campeonato Brasileirão Série A, NWSL, Argentina’s Liga Profesional de Fútbol and More New Ad-Supported Plan Launches Today for $4.99 per Month, Packaging the Best in Entertainment, News and Sports at an Even More Compelling Price Point NEW YORK--(BUSINESS WIRE)--Jun. 7, 2021-- Paramount+ today announced it will significantly expand its content offering this summer, starting with the exclusive premiere of the sci-fi action film “Infinite” and introduction of more than 1,000 premium movies this week. From generation-defining films and award-winning classics to thrilling action-adventure movies and family friendly hits, the world-class movie library will be complemented by a summer slate of highly anticipated originals, plus an unrivaled sports package that includes hundreds of marquee soccer matches. The new summer slate will roll out over the next several weeks, joining Paramount+’s already extensive content portfolio that is now available to subscribers at a new low-cost tier of just $4.99/month starting today. -

Activision Publishing and Nickelodeon's Icarly 2: Ijoin the Click! Is Now Available Worldwide

Activision Publishing and Nickelodeon's iCarly 2: iJoin the Click! is Now Available Worldwide The Sequel to Last Year's Holiday Hit is Available Now! SANTA MONICA, Calif., Nov. 18, 2010 /PRNewswire/ -- Activision Publishing, Inc. (Nasdaq: ATVI) and Nickelodeon today announced that the sequel to last year's top-selling videogame, iCarly 2: iJoin the Click!, now available for the Wii™ system and Nintendo DS™ family of hand-held systems. Carly and the crew bring the hijinks of the hit iCarly show back onto gaming systems just in time for the holiday season! (Photo: http://photos.prnewswire.com/prnh/20101118/NY04065 ) (Photo: http://www.newscom.com/cgi-bin/prnh/20101118/NY04065 ) "It's so exciting to see the end results for the video game and hear my own voice come from my animated character," said Miranda Cosgrove, star of iCarly. "In the game, I get to talk to the players directly and help them just as if they were on the iCarly set with me!" iCarly 2: iJoin The Click! puts the player right in the middle of the iCarly world as the new student at Ridgeway High, where they will interact with all of the cast members, go on quests for crazy items and stop by all of Carly's hangouts. Players will help Carly make the best webisode by utilizing the "LIVE in 5" mode to choose props and new show topics. Fans playing iCarly 2: iJoin The Click! on Nintendo DSi™ will be able to import their own pictures and images of themselves, their friends and even their pet. -

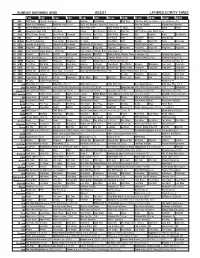

Sunday Morning Grid 8/22/21 Latimes.Com/Tv Times

SUNDAY MORNING GRID 8/22/21 LATIMES.COM/TV TIMES 7 am 7:30 8 am 8:30 9 am 9:30 10 am 10:30 11 am 11:30 12 pm 12:30 2 CBS CBS News Face the Nation (N) News Graham Bull Riding PGA Tour PGA Tour Golf The Northern Trust, Final Round. (N) 4 NBC Today in LA Weekend Meet the Press (N) Å 2021 AIG Women’s Open Final Round. (N) Race and Sports Mecum Auto Auctions 5 CW KTLA 5 Morning News at 7 (N) Å KTLA News at 9 KTLA 5 News at 10am In Touch David Smile 7 ABC Eyewitness News 7AM This Week Ocean Sea Rescue Hearts of Free Ent. 2021 Little League World Series 9 KCAL KCAL 9 News Sunday Joel Osteen Jeremiah Joel Osteen Paid Prog. Mike Webb Harvest AAA Danette Icons The World’s 1 1 FOX Mercy Jack Hibbs Fox News Sunday The Issue News Sex Abuse PiYo Accident? Home Drag Racing 1 3 MyNet Bel Air Presbyterian Fred Jordan Freethought In Touch Jack Hibbs AAA NeuroQ Grow Hair News The Issue 1 8 KSCI Fashion for Real Life MacKenzie-Childs Home MacKenzie-Childs Home Quantum Vacuum Å COVID Delta Safety: Isomers Skincare Å 2 2 KWHY Programa Resultados Revitaliza Programa Programa Programa Programa Programa Programa Programa Programa Programa 2 4 KVCR Great Scenic Railway Journeys: 150 Years Suze Orman’s Ultimate Retirement Guide (TVG) Great Performances (TVG) Å 2 8 KCET Darwin’s Cat in the SciGirls Odd Squad Cyberchase Biz Kid$ Build a Better Memory Through Science (TVG) Country Pop Legends 3 0 ION NCIS: New Orleans Å NCIS: New Orleans Å Criminal Minds (TV14) Criminal Minds (TV14) Criminal Minds (TV14) Criminal Minds (TV14) 3 4 KMEX Programa MagBlue Programa Programa Fútbol Fútbol Mexicano Primera División (N) República deportiva (N) 4 0 KTBN R.