Zoetis Inc. Form 10-K Annual Report Filed 2013-03-28

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Zoetis History

ZOETIS HISTORY With more than 65 years of experience and a singular focus on animal health, Zoetis is working every day to better understand and address the real-world challenges faced by those who raise and care for animals. This timeline offers an overview of major milestones over the last six decades, including significant product developments, business acquisitions and corporate recognitions. YEAR PRODUCT INNOVATION AND CORPORATE GROWTH . Researchers at Pfizer, the former parent company of Zoetis, 1950 discovered Terramycin® (oxytetracycline), which is an antibiotic shown to be effective against more than 100 different infectious organisms. It continues to be an effective medicine in protecting the health of livestock today. Pfizer established a dedicated Animal Agriculture division, renamed 1952 Pfizer Animal Health in 1988, which became Zoetis in 2013. Launched Liquamycin® LA 200, a product that can treat 1980 several cattle diseases in one single injection. Launched Dectomax®, an innovative broad-spectrum 1993 parasiticide that continues to be a best-selling product today. Pfizer acquired SmithKline Beecham’s animal health division 1995 (previously Norden Laboratories), and entered the vaccine and small-animal businesses, thereby securing a place in the field of companion animal care. Launched Rimadyl®, the first non-steroidal anti-inflammatory 1997 medicine for dogs, as well as Clavamox®, an anti-infective medicine for dogs and cats. Launched Revolution®, the first FDA-approved topical medicine that protects against heartworm and flea infestations, kill fleas, and treat 1999 and control ear mites. Pfizer acquired Pharmacia Corporation, which allowed the 2003 company to add a variety of animal health assets to its cattle product portfolio. -

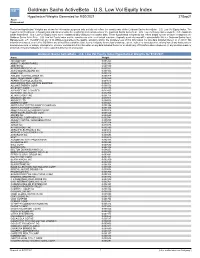

Goldman Sachs Activebeta U.S. Low Vol Equity Index

Goldman Sachs ActiveBeta U.S. Low Vol Equity Index Hypothetical Weights Generated for 9/30/2021 27Sep21 The below Hypothetical Weights are shown for information purposes only and do not reflect the constituents of the Goldman Sachs ActiveBeta U.S. Low Vol Equity Index. The Hypothetical Weights are a hypothetical indication of what the weightings and constituents of the Goldman Sachs ActiveBeta U.S. Low Vol Equity Index would be if the Goldman Sachs ActiveBeta U.S. Low Vol Equity Index were rebalanced daily using current market data. These hypothetical weights do not reflect actual current or future changes to the Goldman Sachs ActiveBeta U.S. Low Vol Equity Index and the constituents at the next actual rebalance (typically quarterly) may differ substantially. Neither Goldman Sachs Asset Management, L.P. ("GSAM") nor any of its affiliates guarantees the quality, accuracy and/or the completeness of this information nor any data included therein or on which this information is based, and neither GSAM nor any of its affiliates shall be liable to any third party for any loss or damage, direct, indirect or consequential, arising from (i) any inaccuracy or incompleteness in, or delays, interruptions, errors or omissions in this information or any data included therein or on which any of this information is based or (ii) any decision made or action taken by any third party in reliance upon this information or any data. Goldman Sachs ActiveBeta U.S. Low Vol Equity Index Hypothetical Weights for 9/30/2021 Name Weight 3M COMPANY 0.005365 ABBOTT -

UUCEF's Reported Holdings

Unitarian Universalist Common Endowment Fund, LLC "Top 50" Holdings and Summary Report as of December 31, 2020 Asset Name Shares Market Value SEA LTD ADR 7,505 1,493,870.25 NETFLIX COM INC 2,450 1,324,788.50 SQUARE INC A 5,910 1,286,252.40 VISA INC CLASS A SHARES 5,780 1,264,259.40 SERVICENOW INC 2,045 1,125,629.35 AMAZON COM INC 325 1,058,502.25 MATCH GROUP INC NEW 6,468 977,896.92 UBER TECHNOLOGIES INC 18,435 940,185.00 TWILIO INC A 2,220 751,470.00 ADOBE INC 1,490 745,178.80 FACEBOOK INC CLASS A 2,562 699,835.92 ZOETIS INC 3,828 633,534.00 INTUIT INC 1,665 632,450.25 J P MORGAN CHASE CO 4,953 629,377.71 ALIGN TECHNOLOGY INC 1,165 622,552.70 CHARTER COMMUNICATIONS INC NEW 863 570,917.65 COSTAR GROUP INC 602 556,416.56 BERKSHIRE HATHAWAY INC CL B 2,348 544,430.76 ZILLOW GROUP INC C 3,700 480,260.00 WALT DISNEY CO THE 2,541 460,378.38 WARNER MUSIC GROUP CORP CL A 11,890 451,701.10 BANK OF AMERICA CORP 14,865 450,558.15 TDK CORP 2,800 421,444.14 FLOOR DECOR HOLDINGS INC A 4,485 416,432.25 PFIZER INC 11,239 413,707.59 UNILEVER PLC-SPONSORED ADR 6,655 401,695.80 ROCHE HLDG LTD SPONSORED ADR 9,145 399,599.01 ING GROEP N.V. 42,390 396,310.28 ILLUMINA INC 1,045 386,650.00 ISHARES RUSSELL 1000 VALUE ETF 2,820 385,578.60 SAMPO PLC 8,930 377,722.24 DAIKIN INDUSTRIES 1,700 377,393.58 AXA SA SPONSORED ADR 15,395 367,538.84 INFINEON TECHNOLOG 9,155 351,618.23 AIA GROUP LTD 28,599 350,394.32 VERIZON COMMUNICATIONS INC 5,947 349,386.25 SCHNEIDER ELECTRIC 2,375 343,771.67 ATLASSIAN CORP PLC CLASS A 1,450 339,111.50 VONOVIA SE 4,590 335,617.81 ORSTED -

Zoetis Rings the Bell for Animal Health with One of Biggest Ipos Since Facebook Agency: Ketchum Client: Zoetis

PRSA-NY BIG APPLE AWARDS 2014 Title of Entry: Zoetis Rings the Bell for Animal Health with One of Biggest IPOs since Facebook Agency: Ketchum Client: Zoetis How is it possible that one of the largest U.S. IPOs since Facebook came from an industry that few people even think about? In June 2012, Pfizer announced it was spinning off its Animal Health unit to refocus on its core business. That gave Pfizer Animal Health (PAH) just eight months to engage investors in the world of pet and livestock medicines before a planned initial public offering in early 2013. This was a different breed of IPO, sitting at the intersection of two very different industry sectors, pet and livestock health. There were no direct comparables – the spin-off would make PAH the largest independent public company dedicated solely to animal health. And it wasn’t a startup. How could PAH leverage its $67+ billion dollar parent and 60-year history while drumming up excitement for a nimble “new” business primed to take an industry-leading position? To meet these challenges, it was essential to directly and indirectly reach investors across an integrated paid, earned, owned, and shared (PESO) strategy. RESEARCH / SITUATION ANALYSIS same method used in presidential elections – by Six Ways to Measure Success maslansky + partners. Fifteen sessions in the US, Brazil, China and France let veterinarians, livestock producers 1) Receive a full and fair valuation and employees say “yay” or “neigh” to various messages. 2) Educate and create investor awareness that Zoetis The results showed that audiences valued PAH’s 60-year has greater long-term value as standalone than as history, products and dedicated sales force. -

Wilmington Funds Holdings Template DRAFT

Wilmington Large-Cap Strategy Fund as of 5/31/2021 (Portfolio composition is subject to change) ISSUER NAME % OF ASSETS APPLE INC 4.97% MICROSOFT CORP 4.69% AMAZON.COM INC 3.45% FACEBOOK INC 1.99% ALPHABET INC 1.80% ALPHABET INC 1.77% BERKSHIRE HATHAWAY INC 1.48% JPMORGAN CHASE & CO 1.35% TESLA INC 1.20% JOHNSON & JOHNSON 1.12% UNITEDHEALTH GROUP INC 0.98% VISA INC 0.96% NVIDIA CORP 0.96% BANK OF AMERICA CORP 0.89% HOME DEPOT INC/THE 0.87% WALT DISNEY CO/THE 0.82% MASTERCARD INC 0.80% PAYPAL HOLDINGS INC 0.77% EXXON MOBIL CORP 0.68% PROCTER & GAMBLE CO/THE 0.67% COMCAST CORP 0.66% ADOBE INC 0.62% INTEL CORP 0.59% VERIZON COMMUNICATIONS INC 0.59% CISCO SYSTEMS INC 0.57% CHEVRON CORP 0.55% PFIZER INC 0.54% NETFLIX INC 0.54% AT&T INC 0.53% SALESFORCE.COM INC 0.53% ABBOTT LABORATORIES 0.51% ABBVIE INC 0.50% MERCK & CO INC 0.48% WELLS FARGO & CO 0.48% BROADCOM INC 0.47% THERMO FISHER SCIENTIFIC INC 0.47% ACCENTURE PLC 0.46% CITIGROUP INC 0.45% MCDONALD'S CORP 0.44% TEXAS INSTRUMENTS INC 0.44% COCA-COLA CO/THE 0.44% HONEYWELL INTERNATIONAL INC 0.44% LINDE PLC 0.43% MEDTRONIC PLC 0.43% NIKE INC 0.43% ELI LILLY & CO 0.42% PEPSICO INC 0.42% UNITED PARCEL SERVICE INC 0.41% WALMART INC 0.40% DANAHER CORP 0.40% UNION PACIFIC CORP 0.40% QUALCOMM INC 0.38% BRISTOL-MYERS SQUIBB CO 0.37% ORACLE CORP 0.37% LOWE'S COS INC 0.36% BLACKROCK INC 0.35% CATERPILLAR INC 0.35% AMGEN INC 0.35% BOEING CO/THE 0.35% MORGAN STANLEY 0.35% COSTCO WHOLESALE CORP 0.35% RAYTHEON TECHNOLOGIES CORP 0.34% STARBUCKS CORP 0.34% GOLDMAN SACHS GROUP INC/THE 0.34% GENERAL ELECTRIC -

Zoetis, Inc. (ZTS) Q1 2021 Earnings Call

Corrected Transcript 06-May-2021 Zoetis, Inc. (ZTS) Q1 2021 Earnings Call Total Pages: 22 1-877-FACTSET www.callstreet.com Copyright © 2001-2021 FactSet CallStreet, LLC Zoetis, Inc. (ZTS) Corrected Transcript Q1 2021 Earnings Call 06-May-2021 CORPORATE PARTICIPANTS Steven Frank Glenn C. David Vice President-Investor Relations, Zoetis, Inc. Chief Financial Officer & Executive Vice President, Zoetis, Inc. Kristin C. Peck Chief Executive Officer & Director, Zoetis, Inc. ...................................................................................................................................................................................................................................................... OTHER PARTICIPANTS Erin Wilson Wright Kathleen Miner Analyst, Credit Suisse Securities (USA) LLC Analyst, Cowen and Company Michael Ryskin David R. Risinger Analyst, BofA Securities, Inc. Analyst, Morgan Stanley & Co. LLC Jonathan David Block Nathan Rich Analyst, Stifel, Nicolaus & Co., Inc. Analyst, Goldman Sachs & Co. LLC Louise Chen Chris Schott Analyst, Cantor Fitzgerald Securities Analyst, JPMorgan Securities LLC John Kreger Gregory D. Fraser Analyst, William Blair & Co. LLC Analyst, Truist Securities, Inc. David Westenberg Navaan Ty Analyst, Guggenheim Securities LLC Analyst, Citi Elliot Wilbur David Michael Steinberg Analyst, Raymond James & Associates, Inc. Analyst, Jefferies LLC Balaji Prasad Analyst, Barclays Capital, Inc. 2 1-877-FACTSET www.callstreet.com Copyright © 2001-2021 FactSet CallStreet, LLC Zoetis, Inc. (ZTS) Corrected Transcript Q1 2021 Earnings Call 06-May-2021 MANAGEMENT DISCUSSION SECTION Operator: Welcome to the First Quarter 2021 Financial Results Conference Call and Webcast for Zoetis. Hosting the call today is Steve Frank, Vice President of Investor Relations for Zoetis. The presentation materials and additional financial tables are currently posted on the Investor Relations section of zoetis.com. The presentation slides can be managed by you, the viewer, and will not be forwarded automatically. -

First Horizon Advisors, Inc. Form 13F-HR Filed 2021

SECURITIES AND EXCHANGE COMMISSION FORM 13F-HR Initial quarterly Form 13F holdings report filed by institutional managers Filing Date: 2021-08-09 | Period of Report: 2021-06-30 SEC Accession No. 0001588539-21-000004 (HTML Version on secdatabase.com) FILER First Horizon Advisors, Inc. Mailing Address Business Address 165 MADISON AVE., 14TH 165 MADISON AVE., 14TH CIK:1588539| IRS No.: 621254528 | State of Incorp.:TN | Fiscal Year End: 1231 FL. FL. Type: 13F-HR | Act: 34 | File No.: 028-15658 | Film No.: 211155059 MEMPHIS TN 38103 MEMPHIS TN 38103 (901)818-6132 Copyright © 2021 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE OMB Number: 3235-0006 COMMISSION Expires: July 31, 2015 Washington, D.C. 20549 Estimated average burden hours per response: 23.8 FORM 13F FORM 13F COVER PAGE Report for the Calendar Year or Quarter Ended: 06-30-2021 Check here if Amendment: ☐ Amendment Number: This Amendment (Check only one.): ☐ is a restatement. ☐ adds new holdings entries. Institutional Investment Manager Filing this Report: Name: First Horizon Advisors, Inc. Address: 165 MADISON AVE., 14TH FL. MEMPHIS, TN 38103 Form 13F File Number: 028-15658 The institutional investment manager filing this report and the person by whom it is signed hereby represent that the person signing the report is authorized to submit it, that all information contained herein is true, correct and complete, and that it is understood that all required items, statements, schedules, lists, and tables, are considered integral parts of this form. Person Signing this Report on Behalf of Reporting Manager: Name: Ed Dellinger Title: VP Phone: 9018186222 Signature, Place, and Date of Signing: Ed Dellinger MEMPHIG, TENNESSEE 08-09-2021 [Signature] [City, State] [Date] Report Type (Check only one.): ☒ 13F HOLDINGS REPORT. -

Ultra Short SOI 12.31.2014

Baird Ultra Short Bond Fund Schedule of Investments December 31, 2014 Principal % of Amount Value Net Assets LONG-TERM INVESTMENTS U.S. Treasury Securities U.S. Treasury Bonds, 2.000%, 01/31/2016 $ 10,000,000 $ 10,178,120 2.375%, 03/31/2016 2,500,000 2,561,720 12,739,840 14.9% Corporate Bonds Finance ABN AMRO Bank N.V., 1.033%, 10/28/2016 (Acquired 01/03/2014 through 10/03/2014, Cost $326,099) * f 325,000 327,320 Ally Financial Inc., 3.125%, 01/15/2016 500,000 501,250 American Express Company, 0.823%, 05/22/2018 500,000 499,984 Ameriprise Financial, Inc., 5.650%, 11/15/2015 325,000 338,110 AmSouth Bank, Class AI, 5.200%, 04/01/2015 400,000 404,000 Banco Santander-Chile, 1.131%, 04/11/2017 (Acquired 04/08/2014, Cost $200,000) * f 200,000 199,107 Barclays Bank PLC, 2.500%, 01/30/2015 f 500,000 500,207 BB&T Corporation: 5.200%, 12/23/2015 41,000 42,635 0.892%, 02/01/2019 880,000 881,220 BNP Paribas SA, 0.692%, 05/07/2017 f 1,000,000 998,574 BPCE, 1.082%, 02/10/2017 f 500,000 503,311 Capital One Financial Corporation, 3.150%, 07/15/2016 1,015,000 1,043,874 Citigroup Inc., 0.506%, 06/09/2016 950,000 940,912 Commonwealth Bank of Australia, 0.833%, 10/08/2015 (Acquired 01/03/2014, Cost $199,800) * f 200,000 199,956 Countrywide Financial Corporation, 6.250%, 05/15/2016 400,000 424,537 Credit Agricole SA, 1.106%, 10/03/2016 (Acquired 01/03/2014, Cost $250,404) * f 250,000 251,559 Credit Suisse, 0.724%, 05/26/2017 f 500,000 499,389 Deutsche Bank Aktiengesellschaft, 0.843%, 02/13/2017 f 150,000 150,215 Dresdner Bank AG, 7.250%, 09/15/2015 f 357,000 369,164 Fifth Third Bancorp, 0.667%, 12/20/2016 1,000,000 992,012 First Horizon National Corporation, 5.375%, 12/15/2015 550,000 569,416 First Tennessee Bank National Association, 5.050%, 01/15/2015 250,000 250,321 General Electric Capital Corporation, 0.740%, 01/14/2019 1,000,000 1,000,392 HSBC Finance Corporation, 5.500%, 01/19/2016 300,000 313,652 HSBC USA Inc., 0.843%, 11/13/2019 250,000 249,993 ING Bank N.V., 4.000%, 03/15/2016 (Acquired 03/08/2011, Cost $517,981) * f 500,000 517,167 J.P. -

Zoetis Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K (Mark One) ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2013 or TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to __________ Commission File Number: 001-35797 Zoetis Inc. (Exact name of registrant as specified in its charter) Delaware 46-0696167 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporation or organization) 100 Campus Drive, Florham Park, New Jersey 07932 (Address of principal executive offices) (Zip Code) (973) 822-7000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $0.01 par value per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of Securities Act. Yes No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

“An Industry Perspective on Putting Global Animal Welfare Principles Into Action”

“An industry perspective on putting global animal welfare principles into action” Sherry Vaughn DVM Global Animal Welfare Compliance Zoetis Research and Development Kalamazoo, Michigan USA 1 Agenda for today’s presentation 1. My background and One Health 2. About Zoetis and its mission in the animal health industry 3. Creating a corporate culture of global animal welfare 4. Animal welfare standards in a global environment 5. Expectations of today’s animal scientists 6. Q & A 7. Resources 2 My Background BS; New Mexico State University DVM; Colorado State University Veterinary Practice and Research • Many species including NHPs • Simian Hemorrhagic fever/Ebola Currently Zoetis VMRD, Kalamazoo, Michigan Interests: Public Health, Infectious disease research, research ethics and welfare for animals and people 3 One Health “Approximately 60% of all human pathogens are zoonotic and 75% of recent and emerging diseases affecting humans are diseases of animal origin” (CDC) One Health: Global optimal health for people, animals and the Environment environment: It’s all connected! Animal Human Health Health 4 Agenda for today’s presentation 1. My background and One Health 2. About Zoetis and its mission in the animal health industry 3. Creating a corporate culture of global animal welfare 4. Animal welfare standards in a global environment 5. Expectations of today’s animal scientists 6. Q & A 7. Resources 5 Our History and Heritage Pfizer sold minority stake in Zoetis. Zoetis Launched Draxxin, became a standalone Pfizer researchers Convenia, Cerenia, -

Best in Show Zoetis Earns a Wide Moat

Best in Show Zoetis Earns a Wide Moat Pfizer's animal health unit has a wide moat in an attractive industry, but the proposed offering range looks to fully price in the firm's advantages. January 29, 2013 Contributing Analysts Zoetis' IPO will be the first opportunity for a pure-play investment in one of the major animal health manufacturers. The underfollowed industry has historically been buried within big pharma firms and largely ignored, but we believe David Krempa Associate Equity Analyst it has very attractive characteristics. As the market leader, Zoetis is the best-positioned firm in the industry, and Specialty Pharmaceuticals we believe it warrants a wide economic moat. Its scale, fragmented customer base, cash-pay market, and minimal [email protected] generic competition all contribute to the firm's ability to earn returns well in excess of its cost of capital. +1 312-696-6633 Damien Conover, CFA TRANSACTION SNAPSHOT Director Pharmaceuticals [email protected] Zoetis is scheduled to begin trading on the NYSE on Feb. 1 under the ticker symbol ZTS. Pfizer will offer 86.1 million +1 312-696-6052 Class A Zoetis shares of the 504.5 million (17.1%) total diluted shares to be outstanding at the time of the offering assuming a $23.50 pricing, the midpoint of the $22-$25 proposed offering range. The $2 billion offering would value Zoetis at $11.1 billion-$12.6 billion. Pfizer will hold all Class B shares, which carry 10 times the voting power of Company Stats Class A shares, and has said it may subsequently make a tax-free distribution to its shareholders of all or part of its Zoetis (ZTS) Fair Value: $22 Trend: Stable remaining Zoetis stake. -

The Portfolio of Pershing Square Holdings, Ltd

November 25, 2014 Dear Pershing Square Holdings, Ltd. Shareholder: The portfolio of Pershing Square Holdings, Ltd. (“PSH”) outperformed the major market indexes for the third quarter of 2014, year-to-date and since inception as set forth below1: 3rd Quarter October Year to Date 2014 2014 2014 Jan 1 - Oct 31 Since Inception Pershing Square Holdings, Ltd. 12/31/12 - 10/31/14 Gross Return 6.4% 1.8% 43.4% 62.1% Net of All Fees 5.3% 1.4% 35.0% 47.9% Indexes (including dividend reinvestment) 12/31/12 - 10/31/14 S&P 500 Index 1.1% 2.4% 11.0% 46.9% Russell 1000 Index 0.7% 2.4% 10.6% 47.2% Dow Jones Industrial Average 1.9% 2.2% 6.8% 38.5% The PSH IPO was completed on October 1, 2014 on the Euronext Amsterdam exchange with a capital raise of $2.73 billion from new investors. An additional $212.5 million was raised from existing investors in Pershing Square International, Ltd. who elected to roll over their investments to PSH, and from Pershing Square employees who invested $129 million of additional capital. When combined with existing assets, this capital raise translated into an initial public capital base of more than $6.2 billion. As this is our first letter to the public shareholders of PSH, we thought it would be useful to share how we think about PSH and our long-term goals for the company. Our long-term goal is to compound our capital at a high rate of return while minimizing the risk of permanent loss of capital.