1H 2016 Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Norwegian Cruise Line Holdings Ltd. Stewardship Report

2019 STEWARDSHIP REPORT 2019 NORWEGIAN CRUISE LINE HOLDINGS LTD. STEWARDSHIP REPORT 2 CEO LETTER 19 PUBLIC HEALTH & SAFETY 37 ENVIRONMENTAL MANAGEMENT • Public Health • Environmental Commitment 3 OUR COMPANY • Safety at Sea • Energy & Emissions 5 SAIL & SUSTAIN • Waste 30 SUPPLY CHAIN • Water 6 COMMUNITY INVOLVEMENT • Supplier Diversity • Philanthropy • Eliminating Single-Use Plastics 60 GLOSSARY OF TERMS • Disaster Relief • Sustainable Initiatives • Partnerships • Harvest Caye QUICK REFERENCE DOWNLOADS COMMUNITY PUBLIC HEALTH ENERGY & WASTE MITIGATION WATER CONSERVATION INVOLVEMENT & SAFETY EMISSIONS & RECYCLING & ONBOARD PRODUCTION 1 A LETTER FROM OUR CEO 2019 was another remarkable year for our company, with approximately Team members also played a role in our sustainability efforts and donated over 2.7 million guests visiting more than 490 destinations worldwide. We 1,000 hours giving back to our communities through events such as beach clean welcomed the highly anticipated 27th ship in our fleet, Norwegian Encore, ups, Habitat for Humanity, and dinner services at the Camillus House Campus and prepared for the early 2020 arrival of our 28th ship, Regent’s Seven emergency housing facility. Seas Splendor, all while delivering record financial results. At the same time, we made substantial progress on our Environmental, Social and Governance Since 2017 we have partnered with the Florida Diversity Council, joining like- (ESG) efforts including our global sustainability program, “Sail & Sustain” minded organizations to find ways to promote and expand diversity and equality in the workplace. We continue to reach out to diversity organizations on college and on our environmental goals to reduce CO2 emissions, invest in emerging technologies, minimize waste to landfills and increase sustainable sourcing. -

C NCIERGE COLLECTION 2020 Every Luxuryfree Included UNLIMITED SHORE EXCURSIONS

C NCIERGE COLLECTION 2020 Every LuxuryFREE Included UNLIMITED SHORE EXCURSIONS FREE SPECIALITY RESTAURANTS FREE WIFI THROUGHOUT THE SHIP FREE 24-HOUR ROOM SERVICE FREE UNLIMITED BEVERAGES INCLUDING FINE WINES AND PREMIUM SPIRITS FREE OPEN BARS AND LOUNGES PLUS IN-SUITE MINI-BAR REPLENISHED DAILY FREE PRE-PAID GRATUITIES Terms and Conditions apply WELCOME TO THE REGENT SEVEN SEAS CRUISES CONCIERGE COLLECTION 2020 Dear Luxury Traveller, Travel is a personal experience; luxury travel elevates this to perfectly deliver a personalised and authentic experience from the moment you book. Regent Seven Seas Cruises has travelled the world for more than 25 years, constantly evolving to reflect the desires and interests of guests whilst being absolute in its inclusiveness to deliver the most enriching and luxurious journey on the seven seas. Destination immersion is a top priority, guests are less interested in taking selfies at the Eiffel Tower and more interested in truly immersing themselves within a destination. Hence, we present you with the Concierge Collection – a highly curated selection of bespoke experiences for the discerning traveller. The Concierge Collection expertly matches hand picked Regent Seven Seas voyages with complementary experiences to provide unique and memorable luxury holidays. Take delight in The Royal Edinburgh Military Tattoo performance set against the dramatic backdrop of Edinburgh Castle, later taking stock of memories formed whilst wandering Liverpool’s UNESCO World Heritage waterfront. Work off uncountable scoops of gelato climbing the streets of picturesque Portofino, as you cruise Venice to Monte Carlo with an iconic operatic performance of Aida at Arena di Verona included for a truly Italian experience. -

Regent Seven Seas Cruises, Along with Our Sister Brands Oceania

Regent Seven Seas Cruises, along with our sister brands Oceania Cruises and Norwegian Cruise line have agreed to voluntarily suspend operations for cruises embarking March 13th through April 11th. Q) What cruises are included in the suspension? A) Seven Seas Splendor – March 14th and April 1st Seven Seas Explorer – March 24th and April 3rd Seven Seas Navigator – March 28th and April 7th Seven Seas Voyager – none Seven Seas Mariner – none Q) Why are the Voyager and Mariner not affected? A) We had already revised Seven Seas Voyager’s itineraries to reposition her away from Asia, and we recently communicated embarkation suspensions for Mariner’s March 19th and April 8th voyages. Q) What is the compensation? A) Guests will receive 125% FCC or 100% refund. The default compensation will be the FCC. Guests embarking on Splendor’s March 14th voyage will receive a 150% FCC or a 100% Refund for amounts paid to RSSC. That was not included in the broad communication but will be provided due to the immediacy of that voyage. Q) When will they receive the refund? A) Refunds, if chosen, will be processed back in the same form of payment received within 90 days. The future cruise credits will be applied immediately to the clients’ profile if chosen. Q) Have we shut down? A) No, we have temporarily suspended embarkations for the 30 days between March 13th and April 11th.Work in our various global offices continues. Q) What about cruises that are sailing now? A) Those voyages such as Seven Seas Navigator’s current round-trip Auckland voyage that began today, March 13th will end as soon as possible, and guests will be disembarked, and arrangements made to bring them home. -

Cruiseing the Amazon / Rio Negro Expedition Style

PUBLISHED MONTHLY BY THE WORLD OCEAN & CRUISE LINER SOCIETY Vol. 38, Issue 5 - March 15, 2019 “Our 38th Year of Continuous Publication” Single issue price $3 CRUISING THE AMAZON/RIO NEGRO EXPEDITION STYLE by Art Sbarsky After an early-morning, short walk from my unpacking. I did indeed find a place for pre-cruise Manaus hotel through a semi-jungle everything and since I packed everything they path and set of steps, we had our first look at the recommended that I bring, I was pleasantly NatureTours boat, Motor Yacht Tucano I. First surprised to find it all fit rather well, even reaction: attractive/cute but small. Then we had including the bathroom stuff. But it’s not to take an outboard-motor canoe from the dock primitive; they do supply L’Occitane toiletries. to the boat itself. The Monty Python phrase “and With my suitcase stowed away easily under the now for something completely different” came to bed, I made my way to the two primary (and mind immediately. And, for the next six nights, only) public rooms: the outside viewing/sitting that’s exactly what it was. This was an expedition space and the wonderfully air-conditioned salon cruise that for me defined the very nature of this which had multiple purposes, primarily dining type of cruising. and attending a few talks about life on the river and ashore. Yes, references to songs like Old The boat has only eight cabins; thus, it carries Man River and Rolling on the River were made a maximum of 16 guests. -

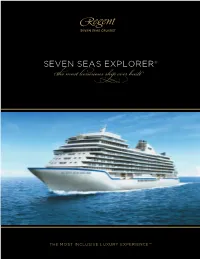

SEVEN SEAS EXPLORER® the Most Luxurious Ship Ever Built™

sEVEN sEAs EXpLorEr® the most luxurious ship ever built™ THE mOsT INClUsIvE luxury EXPERIENCE™ you really can havE it All Every wish... Every whim... Every want... main lObby Seven Seas Explorer® is spaciously intimate, breathlessly elegant and perfectly staffed to offer Regent seven seas Cruises’ special brand of all-inclusive luxury. The summer of 2016 will herald not only the launch of the most luxurious ship to sail the seven seas, but also the moment when you can experience the new standard in elegance and sophistication. Journey to the world’s most beautiful places in spacious designer suites, indulge in a decadent treatment at the world renowned Canyon Ranch spaClub®, enjoy a musical performance in a plush lounge, and delight in extensive gourmet dining throughout the day and night. Everything for your pleasure and enjoyment is included. THE inc usive REGENTall- EXPERIENCE 2-FOr-1 all-inClUsive Fares Free ROUNDTRIP AIR* Free roundtrip BUsINEss ClAss AIR** ON EUROPEAN vOyages Free UNlImITED sHORE ExcursIONs Free Luxury Hotel Package† Free sPECIAlTy REstaurants Free UNlImITED BEverages INClUDING fINE wINEs AND PREmIUm spiritS Free OPEN BARs AND lOUNGEs PlUs IN-sUITE mINI-BAR REPlENIsHED daily Free PRE-paid GRATUITIEs Free wIfI THROUGHOUT THE sHIP† Free TRANsfERs BETwEEN AIRPORT AND sHIP * Visit www.RSSC.com for Terms & Conditions **Applies to Penthouse suites & higher † Applies to Concierge suites & higher. for fREE wifi, minute limitations apply. la veranda/sette mari our AWArD-WINNING FLEET 2015 wORlD’s BEsT CRUIsE lINE BEsT lUXURy CRUIsE lINE • TOP-RATED mEDIUm-sIZE sHIP • BEsT lUXURy sTATEROOms Elegant mid-sized ships with All Ocean-view suites and Private Balconies, visiting Nearly 350 Destinations worldwide Seven Seas Voyager® | Seven Seas Mariner® | Seven Seas Navigator® | Seven Seas Explorer® summer 2016 regent sUite — in-sUite spa ® suITEs Seven Seas Explorer regent sUite CATEGORy Rs — tHe WOrld’s mOST eXClUsive ADDRESS 3,875 sq. -

Regent Seven Seas Cruises®, Along with Our Sister Brands Oceania

Regent Seven Seas Cruises®, along with our sister brands Oceania Cruises® and Norwegian Cruise Line®, has agreed to voluntarily suspend operations for cruises embarking through July 31, 2020. Q) Which cruises are included in the suspension? A) Active reservations on these canceled sailings as of March 13, 2020: Seven Seas Splendor™ — March 14, April 1 Seven Seas Explorer® — March 12, March 24, April 3 Seven Seas Mariner® — March 19, April 8, April 29 Seven Seas Navigator® — March 13, March 28, April 7 A) Active reservations on these canceled sailings as of March 30, 2020: Seven Seas Splendor™ — April 16, April 30 Seven Seas Explorer® — April 17, April 27, May 4 Seven Seas Voyager® — April 16 Seven Seas Navigator® — April 25 A) Active reservations on these canceled sailings as of April 10, 2020: Seven Seas Splendor™ — May 12 Seven Seas Voyager® — May 11 Seven Seas Navigator® — May 11 A) Active reservations on these canceled sailings as of April 24, 2020: Seven Seas Splendor™ — May 21, May 28, June 4, June 16, June 26 Seven Seas Explorer® — May 18, May 30, June 11, June 23, June 30 Seven Seas Voyager® — May 23, June 4, June 14, June 24 Seven Seas Mariner® — May 17, June 4, June 17, June 24 Seven Seas Navigator® — May 22, June 5, June 15, June 30 A) Active reservations on these canceled sailings as of May 20, 2020: Seven Seas Splendor™ — July 6, July 13, July 23 Seven Seas Explorer® — July 10, July 17 Seven Seas Voyager® — July 6, July 16, July 28 Seven Seas Mariner® — July 1, July 8, July 15, July 22, July 29 Seven Seas Navigator® — July 14, July 28 Q) What is the compensation? A) Guests will receive 100% Future Cruise Credit plus a Bonus 25% Future Cruise Credit, or 100% refund. -

Regent Seven Seas Cruises® Announces New 2022-2023 Voyage Collection

October 21, 2020 Regent Seven Seas Cruises® Announces New 2022-2023 Voyage Collection Close to 150 Sailings, 17 Maiden Ports of Call, 105 Overnight Calls and Over 350 UNESCO World Heritage Sites MIAMI, Oct. 21, 2020 /PRNewswire/ -- Regent Seven Seas Cruises has revealed its brand new 2022-2023 Voyage Collection featuring exotic and iconic destinations, allowing guests to explore the world while enjoying an unrivaled experience with every luxury included. The thoughtfully curated Voyage Collection consists of 148 sailings from April 2022 to the end of April 2023 across Africa and Arabia, Alaska, Asia, Australia and New Zealand, Canada and New England, the Caribbean and Panama Canal, the Mediterranean, Northern Europe and South America, as well as transoceanic crossings and five Grand Voyages. Sailings range from 7 nights up to the recently announced 143-night 2023 World Cruise. The Voyage Collection boasts 17 maiden ports of call for the line and 105 overnight visits. Highlights include Seven Seas Splendor's™ summer season in Scandinavia and the Baltics; Seven Seas Explorer® in the Mediterranean discovering Turkey and Black Sea ports;S even Seas Voyager's® tour of Africa and her winter season in South America which includes a sailing to Antarctica; Seven Seas Mariner's® Alaskan summer and 2023 World Cruise; and Seven Seas Navigator's® Grand Arctic Adventure and Caribbean cruises which feature two voyages from Bridgetown, Barbados. More detailed information about the ships' individual deployments can be found below. Opportunities for truly immersive and unforgettable luxury travel vacations abound with access to over 350 UNESCO World Heritage Sites across thousands of FREE unlimited shore excursions in the Voyage Collection. -

Unrivalled Space at Sea™

UNRIVALLED SPACE AT SEA™ We have always believed that lavish, personal space is core to experiencing the ultimate in luxury travel, and that when cruising the seven seas, your accommodations should be unrivalled in every way. REGENT SUITE LIVING ROOM — SEVEN SEAS SPLENDOR™ 2 RSSC.COM 3 UNRIVALLED SPACE AT SEA™ The luxury of personal space is central to the promise of An Unrivalled Experience® with Regent Seven Seas Cruises®. It provides the extravagant freedom guests need to explore and relax to the fullest. As the preeminent luxury cruise line on the ocean, we pride ourselves in offering some of the largest balconies and most spacious suites at sea. Our wide range of speciality restaurants, al fresco and in-suite dining options, exquisite lounges, bars and expansive spaces are perfect to rest and celebrate in, knowing there is never a queue or a crowd and that every detail is taken care of and every amenity is included. Join us and discover how — with our unrivalled space at sea — we will exceed your loftiest expectations of comfort and personalised service for a truly unforgettable experience aboard The World’s Most Luxurious Fleet™. REGENT SUITE BALCONY — SEVEN SEAS EXPLORER® 4 RSSC.COM 5 A SPACE FOR EVERY EXPERIENCE PERSONAL SPACE ON BOARD You always have an abundance of space aboard each of our perfectly sized, luxury ships. Sprawling suites, multiple dining options and large social areas means there are no crowds and no waiting. WITH A MAXIMUM OF 490 TO 750 GUESTS, from the beloved Seven Seas Navigator ® to the new Seven Seas SplendorTM, -

Voyage Collection

THE MOST INCLUSIVE LUXURY EXPERIENCE™ 2019-2020 VOYAGE COLLECTION Table of Contents Fleet Calendar | 2 The Regent Experience | 6 Seven Seas Explorer® | 10 Seven Seas Voyager® | 24 Seven Seas Mariner® | 38 Seven Seas Navigator® | 50 World Cruise | 62 Grand Voyages | 68 FREE Land Programs | 74 Overland Programs | 80 Seven Seas Society® | 82 Air-Inclusive Program | 84 Terms & Conditions | 86 1 MARCH 2019 THROUGH NOVEMBER 2019 fleet calendar MAR 2019 APR 2019 MAY 2019 JUN 2019 TRANSATLANTIC CROSSINGS MEDITERRANEAN NORTHERN EUROPE ® Seven Seas Explorer MAR 25 | 14 NIGHTS APR 8 | 10 NIGHTS MAYDEC 108 || 1210 NIGHTS NIGHTS JUN 1 | 12 NIGHTS Miami to Lisbon Lisbon to Barcelona RomeRoundtrip to Barcelona Miami Roundtrip London 375 SUITES, Page 23 Page 12 PagePage 138 13 Page 16 ALL WITH PRIVATE APR 18 | 12 NIGHTS MAYDEC 20 | 1412 NIGHTS JUN 13 | 12 NIGHTS BALCONIES Barcelona to Venice BarcelonaRoundtrip to MiamiLondon London to Stockholm Page 12 PagePage 139 13 Page 16 APR 30 | 10 NIGHTS JUN 25 | 7 NIGHTS Venice to Rome Stockholm to Copenhagen Page 13 Page 16 TRANSATLANTIC CROSSINGS MEDITERRANEAN ® Seven Seas Voyager MAR 22 | 14 NIGHTS APR 5 | 11 NIGHTS MAY 4 | 10 NIGHTS JUN 3 | 12 NIGHTS Miami to Barcelona Barcelona to Rome Athens to Monte Carlo Barcelona to Venice Page 37 Page 26 Page 27 350 SUITES, Page 28 ALL WITH PRIVATE APR 16 | 10 NIGHTS MAY 14 | 10 NIGHTS JUN 15 | 10 NIGHTS BALCONIES Rome to Jerusalem Monte Carlo to Barcelona Venice to Monte Carlo Page 26 Page 27 Page 28 APR 26 | 8 NIGHTS MAY 24 | 10 NIGHTS JUN 25 | 7 NIGHTS Jerusalem -

2019 River Cruises

NEWPORT NEWS OFFICE WILLIAMSBURG OFFICE 10858 Warwick Blvd. 240 McLaws Circle (Kingsmill) Newport News, VA 23601 Williamsburg, VA 23185 757-599-3011 • 1-800-462-3204 757-229-7854 F 2 A 0 L 1 L 8 Personalwww.warwicktravel.com Service at its Best! [email protected] 19 75 The Most Inclusive Luxury Experience Welcome to the world of Regent Seven Serenity becomes you at their Canyon to be – a sumptuous and very personal Seas Cruises, the world’s most inclusive Ranch Spa Club. Peace of mind is the experience where your every wish, your luxury experience with a four-ship fleet key to looking and feeling your best. every whim and your every want are that visits more than 450 destinations Onboard spas, fitness and wellness met with gratifying luxuries, satisfying around the world. The cruise line’s facilities and beauty salons share this comfort and complete fulfillment fares include all-suite accommodations, philosophy. of your wanderlust. Anticipate an round-trip business-class air on unforgettable journey to the world’s intercontinental flights from U.S. and You may dine whenever, wherever greatest destinations where everything is Canada, the largest collection of free, and with whomever you choose in included, without exception and without unlimited shore excursions, unlimited any of their open-seating restaurants. compromise. You really can have it all internet access, highly personalized Compass Rose is their flagship aboard Regent Seven Seas Cruises. service, exquisite cuisine, fine wines restaurant featuring European-inspired and spirits, prepaid gratuities, ground Continental specialties, as well as Upon completing your first voyage, you transfers and one-night, pre-cruise hotel vegetarian, Kosher and Canyon Ranch are automatically welcomed into the package for guests staying in Concierge- SpaClub cuisine. -

Mystical Passages

FREE BUSINESS CLASS AIR* IN ALL SUITE CATEGORIES MYSTICAL PASSAGES SOUTH AMERICA • PANAMA CANAL APRIL 2017 APRIL 2018 through ◆ AWARDS AND ACCOLADES ◆ 2016 ◆ BEST FOR SUITES, CLASSIC LUXURY Town & Country Cruise Awards 2016 ◆ BEST CABINS Cruise Critic U.S. Editors’ Picks Awards 2017 ◆ U.S. NEWS & WORLD REPORT’S BEST CRUISE LINES Best Luxury Line (Silver) Best Cruise Line for Couples (Silver) COVER IMAGE: MACHU PICCHU — FROM LIMA, PERU 2 IT’S ALL INCLUDED enjoy ... • 2-For-1 All-Inclusive Fares The Most Inclusive Luxury • FREE Business Class Air* on Intercontinental Flights Experience™. This is cruising as it • FREE Roundtrip Air* was meant to be — a sumptuous on Domestic Flights and very personal experience • FREE Unlimited Shore Excursions where your every wish, your every • FREE 1-Night Pre-Cruise whim and your every want are met Hotel Package† with gratifying luxuries, satisfying • FREE Unlimited Beverages Including comfort and complete fulfillment Fine Wines and Premium Spirits of your wanderlust. Anticipate • FREE Open Bars and Lounges PLUS an unforgettable journey through In-Suite Mini-Bar Replenished Daily vibrant South America or the • FREE Pre-Paid Gratuities fascinating Panama Canal where • FREE Specialty Restaurants everything is included, without • FREE Transfers Between exception and without compromise. Airport and Ship* You really can have it all aboard • FREE Unlimited WiFi Regent Seven Seas Cruises®. *See page 35 for Terms & Conditions. † Applies to Concierge Suites & higher. 25 YEARS OF UNFORGETTABLE THE MOST INCLUSIVE LUXURY EXPERIENCE TM ANNIVERSARY VOYAGES INCLUDE: Exclusive Behind-the-Scenes Galley Lunch Special Tasting Events • Commemorative Pin Visit Regent25.com Seven Seas Society Members enjoy an Enhanced Ambassador Offer. -

2014 Clia Annual State of the Industry Press Conference & Media Marketplace

2014 CLIA ANNUAL STATE OF THE INDUSTRY PRESS CONFERENCE & MEDIA MARKETPLACE Welcome to 2014 Media Marketplace - Azamara Club Cruises - Seabourn - American Cruise Line - Tauck River Cruises - AMA Waterways - Windstar Cruises - Carnival Cruise Lines Port Representation - Costa Cruises - Port Everglades - Crystal Cruises - South Carolina Port - Cunard Line Authority - Hurtigruten - MSC Cruises - Paul Gauguin - Royal Caribbean CLIA United Under One Banner NORTH AMERICA • EUROPE • BELGIUM & LUXEMBOURG • FRANCE • GERMANY • NETHERLANDS • SPAIN • UK & IRELAND • BRAZIL • ASIA • AUSTRALASIA December 17, 2012 Cruise Industry Forms Global Trade Association New Association Model to Promote “One Industry, One Voice” Global CLIA Alaska UK & Ireland Germany Netherlands NW & Canada France Belgium Europe North America Italy US Spain Asia Hawaii Brazil Australasia CLIA Members 63 cruise line members, representing over 95% of global cruise capacity 13,500 global travel agency members who reach over 50,000 agents 250 Executive Partners (port authorities, destinations, and maritime and industry suppliers) Specialty Cruise Collection CLIA Specialty Cruise Collection Specialty Cruise Collection Top consumer interest in specialty cruising: Attractive destination Scenic, cultural shore options activities and sightseeing Thematic itineraries Smaller ship size and slower pace Personalized service Inclusive pricing and offerings Ability to meet and make new friends Robust Investment for an Expanding Global Cruise Industry 2014 2013 – 2014 16 new ships 29 new ships with 20,000 with 34,000+ beds beds 2014 Global 2015 - 2018 Fleet another 20 Ships 410 Ships 467,629 beds 52,000+ beds CLIA Member Lines New Ships (2014-2018) 1. Royal Caribbean Quantum of the Seas 18. Norwegian Escape (4,200) (4,100) 19.American Cruise Lines (TBD) 2.