Annual Report 2001-02 Fifty Seventh Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Most Market Roundup.Pmd

MOSt Market Roundup 1st March 2019 EQUITY Market Sensex 36063.81 196.37 Nifty 10863.50 71.00 Cash Volumes (INR in Crores) Dealer's Diary Exchange Today Pev. Day Markets bounced back after falling for 3 trading sessions. Nifty climbed BSE (Cash) - 2,082 0.66% or 71 pts to close at 10863. Rally in the global markets and reduced NSE (Cash) 31,263 42,766 geo-political tensions, boosted the market sentiments. Moreover, Feb NSE(Derivatives) 4,05,084 17,00,963 mfg PMI which came at a 14-month high at 54.3, fall in USDINR and 10- Year G-Sec yield, also helped. China (up 1.5%), Nikkei and Hong Index Advance / Decline gained smartly, European markets advanced half to one percent and Group NIFTY 50 BSE 200 US Futures gained over half a percent. China reported impressive Advance 40 158 economy data and reduced trade war tension between US and China, Decline 10 41 boosted the global markets. India VIX slipped nearly 10%. Small-Cap Unchanged 0 2 Index rose close to 3%, followed by PSU Banks, Media, Auto and Metal stocks. Auto monthly sales for February was a mixed bag. Maruti and Top Nifty - 50 Index Gainers Ashok Leyland reported in-line Feb sales while Bajaj Auto announced lower than expected numbers. Escorts announced better-than- Scrip LTP % Change ZEEL 488 4.5 expected Feb sales. Bajaj Auto declined 1% to close at Rs2863, Maruti HINDPETRO 233 4.4 and Escorts gained 1% and 2% respectively. Tata Motors surged 2% to INDUSINDBK 1,517 2.9 close at Rs180 after the news that the company is likely to sell JLR BPCL 347 2.7 stake. -

BAJAJ Bajaj Holdings & Investment Limited (Formerly Bajaj Auto Limited) CIN:L65993PN1945PLC004656 Regd

BAJAJ Bajaj Holdings & Investment Limited (formerly Bajaj Auto Limited) CIN:L65993PN1945PLC004656 Regd. Office : Bajaj Auto Limited Complex, jJ Mumbai Pune Road, Akurdi, Pune 41 '1035. Tel.: 020-27472851, Fax: 020•27407380 Website: www.bhil.in 28 June 2019 To To Corporate Relations Department. Corporate Listing Department. BSE Limited National Stock Exchange of India Ltd 1st Floor, New Trading Ring Exchange Plaza, 5th Floor Rotunda Building, P J Tower Plot No.C-1, G Block Dalal Street, Bandra-Kurla Complex, Sandra (East), Mumbai 400 001 Mumbai 400 051 BSE Code: 500490 NSE Code: BAJAJHLDNG Dear Sirs/Madam, Sub.: Annual Report for the financial year ended 31 March 2019 This is further to our letter dated 17 May 2019, wherein the Company had informed that the Annual General Meeting of the Company is scheduled to be held on 26 July 2019. In terms of the requirements of Regulation 34(1) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended, please find enclosed the following documents for the financial year 2018-19: • Notice of the 74 th Annual General Meeting • Annual Report • Business Responsibility Report You are requested to kindly take the above information on record. Thanking You, Yours faithfully, For Bajaj Holdings & Investment Limited, ./ Srir m Subbramaniam Company Secretary ,! ii ----:::::::3 BAJAJ HOLDINGS & INVESTMENT LTD. CIN: L65993PN1945PLC004656 Registered office: Mumbai-Pune Road, Akurdi, Pune 411 035. Email: [email protected] website: www.bhil.in Phone: (020) 2747 2851 Fax: (020) 2740 7380 AGM NOTICE Notice is hereby given that the Seventy Fourth Annual General Meeting of the shareholders of Bajaj Holdings & Investment Ltd. -

Financial Performance of Indian Automobile Industry – with Special Reference to Selected Companies

Volume : 5 | Issue : 12 | December-2016 ISSN - 2250-1991 | IF : 5.215 | IC Value : 79.96 Original Research Paper Commerce Financial Performance of Indian Automobile Industry – with Special Reference to Selected Companies Research Scholar, Department of Commerce, Annamalai P.Manokaran University, Annamalai Nagar Tamilnadu Assistant Professor in Commerce, Department of Commerce, Dr.J.Paramasivam Annamalai University,Annamalai Nagar Tamilnadu The study was made with the objective to analyse financial performance of selected automobile companies in India. For this purpose the researcher selected six companies for the study period of ten years from 2005-06 to 2014-15 using Altman’s Z-score model. The study found that financial performance under Altman’s z-score model was good in case of Maruti Suzuki India Ltd., since calculated value of z-score was more than the standard norm during all the years of the study period. The calculated value of z-score of Mahindra and Mahindra Ltd. was more than the standard norm (2.99) during eight years and it was more than the standard norm during eight years in case of Bajaj Auto Ltd. and TVS Motor Company, since their ABSTRACT financial performance was satisfactory. Financial performance of Tata Motors Ltd. and Ashok Leyland Ltd., was good during four years, since their z-score was more than the standard norm during four years and during five years it was at grey zone and in one year it was poor. KEYWORDS financial performance, z-score, working capital, retained earnings and profit Introduction Methodology India is one of the fastest growing economies in the world. -

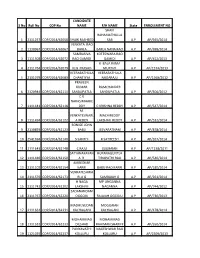

S No Roll No COP No CANDIDATE NAME F/H NAME State

CANDIDATE S No Roll No COP No NAME F/H NAME State ENROLLMENT NO SHAIK RAHAMATHULLA 1 2111257 COP/2014/62058 SHAIK RASHEED SAB A.P AP/945/2014 VENKATA RAO 2 1130967 COP/2014/62067 BARLA BARLA NANA RAO A.P AP/698/2014 SAMBASIVA KOTESWARA RAO 3 1111308 COP/2014/62072 RAO GAMIDI GAMIDI A.P AP/452/2013 K BALA RAMA 4 2111764 COP/2014/62079 KLN PRASAD MURTHY A.P AP/1574/2013 VEERABATHULA VEERABATHULA 5 2131079 COP/2014/62083 CHANTIYYA NAGARAJU A.P AP/1568/2012 PRAVEEN KUMAR RAMCHANDER 6 2120944 COP/2014/62111 SANDUPATLA SANDUPATLA A.P AP/306/2012 C V NARASIMHARE 7 1111441 COP/2014/62118 DDY C KRISHNA REDDY A.P AP/547/2014 M. VENKATESWARL MACHIREDDY 8 1111494 COP/2014/62122 A REDDY LAKSHMI REDDY A.P AP/532/2014 BONIGE JOHN 9 2130893 COP/2014/62123 BABU JEEVARATNAM A.P AP/878/2014 10 2541694 COP/2014/62140 S SANTHI R SATHEESH A.P AP/267/2014 11 2111643 COP/2014/62148 C RAJU SUGRAIAH A.P AP/1238/2011 SATYANARAYAN RUPANAGUNTLA 12 1111480 COP/2014/62150 A R. TIRUPATHI RAO A.P AP/540/2014 AMBEDKAR 13 2131102 COP/2014/62154 KARRI BABU RAO KARRI A.P AP/180/2014 VENKATESHWA 14 2111570 COP/2014/62173 RLU G SAMBAIAH G A.P AP/261/2014 H NAGA MP LINGANNA 15 2111742 COP/2014/62202 LAKSHMI NAGANNA A.P AP/744/2012 SADANANDAM 16 2111767 COP/2014/62220 OGGOJU RAJAIAH OGGOJU A.P AP/736/2013 MADHUSUDAN MOGILAIAH 17 2111661 COP/2014/62231 KACHAGANI KACHAGANI A.P AP/478/2014 MOHAMMAD MOHAMMAD 18 1111532 COP/2014/62233 DILSHAD RAHIMAN SHARIFF A.P AP/550/2014 PUNYAVATHI NAGESHWAR RAO 19 1121035 COP/2014/62237 KOLLURU KOLLURU A.P AP/2309/2013 G SATHAKOTI GEESALA 20 2131021 COP/2014/62257 SRINIVAS NAGABHUSHANAM A.P AP/1734/2011 GANTLA GANTLA SADHU 21 1131067 COP/2014/62258 SANYASI RAO RAO A.P AP/1802/2013 KOLICHALAM NAVEEN KOLICHALAM 22 1111688 COP/2014/62265 KUMAR BRAHMAIAH A.P AP/1908/2010 SRINIVASA RAO SANKARA RAO 23 2131012 COP/2014/62269 KOKKILIGADDA KOKKILIGADDA A.P AP/793/2013 24 2120971 COP/2014/62275 MADHU PILLI MAISAIAH PILLI A.P AP/108/2012 SWARUPARANI 25 2131014 COP/2014/62295 GANJI GANJIABRAHAM A.P AP/137/2014 26 2111507 COP/2014/62298 M RAVI KUMAR M LAXMAIAH A.P AP/177/2012 K. -

A Comparative Study of Fundamental and Technical Analysis on Selected

World Wide Journal of Multidisciplinary Research and Development WWJMRD 2018; 4(6): 102-105 www.wwjmrd.com International Journal Peer Reviewed Journal A Comparative Study of Fundamental and Technical Refereed Journal Indexed Journal Analysis on Selected Automobile Companies In India Impact Factor MJIF: 4.25 E-ISSN: 2454-6615 Dr.S.Kamalasaravanan Dr.S.Kamalasaravanan Associate Professor, Department of Management Abstract Sciences,Hindusthan College of The Automotive industry in India is one of the largest in the world with an annual production of 23.96 Engineering and Technology, million vehicles in FY (fiscal year) 2016–17. The Government of India aims to make automobile Coimbatore, Tamilnadu, India. manufacturing the main driver of "Make in India" initiative, as it expects the passenger vehicles market to triple to 9.4 million units by 2026, as highlighted in the Auto Mission Plan (AMP) 2016-26. So, There is wide opportunities occurs in automobile industry in share market, this study is helpful to investors for safe invest money in selected shares. Keywords: Fundamental analysis, Technical analysis, Automobile industry India, investment decisions, Risk and Return Analysis 1. Introduction Nowadays, Security Analysis and Portfolio Management concern itself with investment in financial assets with specific attention to the returns and risk associated with investing in securities. Traditional investment analysis, when applied to securities, emphasizes the projection of prices and dividends. That is, the potential price of a firm’s common stock and the future dividend stream are forecasted, and then discounted back to the present. This intrinsic value is then compared with the security’s current market price. -

AIMA Life Time Achievement Award for Management Invitation For

Previous Recipients 1999 Mr Prakash Tandon 2000 Mr K T Chandy Chairman (Emeritus) AIMA Life Time Achievement Bhagheeratha Engineering Ltd, Cochin 2001 Mr F C Kohli Award for Management Former Dy Chairman Tata Consultancy Services, Mumbai 2002 Mr Keshub Mahindra Chairman, Mahindra & Mahindra, Mumbai 2003 Mr B M Munjal Chairman, Hero Group AIMA instituted this Award in 1999 to honour some of the 2004 Mr A N Haksar most eminent Professional Managers in the country for their Chairman Emeritus outstanding achievement in Professional Management. ITC Ltd 2005 Dr V Krishnamurthy Criteria for Evaluation Chairman National Manufacturing Competitiveness Innovation and strategic partnerships Council, New Delhi . Sustained strategic leadership and innovation that has 2006 Dr M S Swaminathan altered strategic practice i.e. create an environment for Chairman organisational perfor mance improvement, M S Swaminathan Research Foundation, Chennai accomplishment of mission and strategic objectives, 2007 No Awardee innovation, performance leadership, and organisational 2008 Dr V Kurien agility. Chairman . Institute of the Rural Management Anand & Significant impact on strategy practices in industries Gujrat Cooperative Milk Marketing Federation Ltd beyond the home industry. 2009 Mr R C Bhargava Leadership Chairman . Should be a distinguished and acknowledged leader Maruti Suzuki India Ltd, Gurgaon and an achiever in his / her own organisation / 2010 Mr Ratan N Tata organisation(s). Chairman Tata Group . Awards won / Recognition beyond his/her organisation 2011 Mr Ashok Ganguly for his / her achievements. Member of Parliament and Former Chairman . Should have left footprints in the management Hindustan Unilever Limited profession, management thought and culture. 2012 Mr P R S Oberoi . Chairman Demonstrated efforts to create a workforce that delivers EIH Ltd. -

A Study on Portfolio Management

Vol 10, Issue 10, Oct / 2019 ISSN NO: 0377-9254 A STUDY ON PORTFOLIO MANAGEMENT 1CHITUKULLA RAVALI REDDY, 2CH. HEMABINDU 1MBA Student, 2Assistant Professor DEPARTMENT OF MBA DRK INSTITUTE OF SCIENCE AND TECHNOLOGY, HYDERABAD Abstract The earliest Portfolio Management techniques optimized projects' profitability or financial returns This paper is entitled to “A Study on using heuristic or mathematical models. However, Portfolio Management on Karvy Stock Broking” this approach paid little attention to balance or Portfolio Management is the responsibility of the aligning the portfolio to the organization's strategy. senior management team of an organization or Scoring techniques weight and score criteria to take business unit. This team, which might be called the into account investment requirements, profitability, Product Committee, meets regularly to manage the risk and strategic alignment. The shortcoming with product pipeline and make decisions about the this approach can be an over emphasis on financial product portfolio. Often, this is the same group that measures and an inability to optimize the mix of conducts the stage-gate reviews in the organization. projects. A logical starting point is to create a product I. INTRODUCTION strategy - markets, customers, products, strategy A portfolio is a collection of money relevant funds, approach, competitive emphasis, etc. The second for example, stocks, securities, wares, financial step is to understand the budget or resources guideline and money companion, just as their available to balance the portfolio against. Third, reserve associate, including shared, trade each project must be assessed for profitability exchanged and shut assets. The central focuses may (rewards), investment requirements (resources), be physical or cash related like offers, Bonds, risks, and other appropriate factors. -

Notice of the Annual General Meeting

Bajaj Electricals Limited (BEL) www.bajajelectricals.com Notice of the Annual General Meeting Notice of the Annual General Meeting Pursuant to Section 101 of the Companies Act, 2013 NOTICE is hereby given that Eighty-second (82nd) Annual General Meeting RESOLVED FURTHER THAT the Board of Directors of the Company (“AGM”) of Bajaj Electricals Limited will be held on Wednesday, August (hereinafter referred to as the “Board”, which term shall be deemed 11, 2021 at 3.00 p.m. (IST) through Video Conferencing/Other Audio Visual to include, unless the context otherwise require, any committee of Means to transact the following business: the Board or any director(s) or officer(s) authorised by the Board to exercise the powers conferred on the Board under this resolution) be Ordinary Business: and is hereby authorised to vary, alter, enhance, or widen the scope of remuneration (including Fixed Salary, Incentives, Commission & 1. To receive, consider and adopt: (a) the audited financial statement of the Increments thereto and retirement benefits) payable to Shri Anuj Poddar Company for the financial year ended March 31, 2021 and the reports during his tenure to the extent permitted under Section 197 read with of the Board of Directors and Auditors thereon; and (b) the audited Schedule V and other applicable provisions, if any, of the Act, without consolidated financial statement of the Company for the financial year being required to seek any further consent or approval of the members ended March 31, 2021 and the report of Auditors thereon. of the Company or otherwise to the end and intent that they shall be 2. -

Bajaj Auto Companyname

RESULT UPDATE BAJAJ AUTO Strong show in a tough environment India Equity Research| Automobiles COMPANYNAME Bajaj Auto’s (BJAUT) Q2FY20 EBITDA of INR12.7bn (down 6.6% YoY) EDELWEISS 4D RATINGS surpassed our estimate 15% driven by significant improvement in Absolute Rating HOLD realisation. Post a bleak Q2FY20, near-term demand outlook has Rating Relative to Sector Underperform improved, triggered by the festive season as well as clarity on GST rate Risk Rating Relative to Sector Low cut. With current inventory at 60 plus days and the BS VI transition Sector Relative to Market Overweight around the corner, sustained bounce-back in demand remains key. Near- term export growth is likely to find some support from new product launches (Pulsar NS) as well as resumption of 3W exports to a few key MARKET DATA (R: BAJA.BO, B: BJAUT IN) markets (Egypt). However, we expect margin to remain range bound as CMP : INR 3,163 Target Price : INR 3,177 sustained improvement in mix is likely to be offset by rising share of 52-week range (INR) : 3,237 / 2,400 exports and BS VI transition costs. Maintain ‘HOLD’ with revised TP of Share in issue (mn) : 289.4 INR3,163 (earlier INR2,988) as we roll over to 12x March 2021E EPS. M cap (INR bn/USD mn) : 915 / 12,905 Avg. Daily Vol.BSE/NSE(‘000) : 533.6 Q2FY20: Strong show Net revenue at INR77bn (down 4% YoY) was 5% ahead of estimate due to sharp 5% SHARE HOLDING PATTERN (%) QoQ improvement in ASP. Strong ASP growth was driven by higher share of 110/125cc Current Q1FY20 Q4FY19 motorcycles and domestic 3W sales. -

Bajaj Auto Limited 6Th Annual Report 2012-13

Bajaj Auto Limited Bajaj Auto 6th Annual Report 2012-13 Since 1945 Bajaj Auto Limited 6th Annual Report 2012-13 Akurdi Pune 411 035 India www.bajajauto.com Bajaj Auto Limited indidesign.in pragati.com Contents Board of Directors .........................................................................02 Management Team .........................................................................04 Chairman’s Letter ...........................................................................06 Management Discussion and Analysis ...................................09 Corporate Governance ................................................................. 29 General Shareholder Information ............................................41 Directors’ Report ............................................................................50 Report on Corporate Social Responsibility .......................... 62 Standalone Financial Statements .............................................71 Consolidated Financial Statements .......................................131 Board of Directors Management Auditors Rahul Bajaj Rahul Bajaj Dalal & Shah Chairman Chairman Chartered Accountants Madhur Bajaj Madhur Bajaj Vice Chairman Vice Chairman Rajiv Bajaj Rajiv Bajaj Cost Auditor Managing Director Managing Director A P Raman Sanjiv Bajaj Pradeep Shrivastava Cost Accountant Chief Operating Officer Kantikumar R Podar Abraham Joseph Shekhar Bajaj Chief Technology Officer Bankers D J Balaji Rao R C Maheshwari President Central Bank of India State Bank of India D S Mehta (Commercial -

High Court of Delhi Advance Cause List

HIGH COURT OF DELHI ADVANCE CAUSE LIST LIST OF BUSINESS FOR WEDNESDAY,THE 14TH SEPTEMBER,2011 INDEX PAGES 1. APPELLATE JURISDICTION 1 TO 43 2. COMPANY JURISDICTION 44 TO 44 3. ORIGINAL JURISDICTION 45 TO 53 4. REGISTRAR GENERAL/ 54 TO 66 REGISTRAR(ORGL.)/REGISTRAR (ADMN.)/ JOINT REGISTRARS(ORGL.) 14.09.2011 1 (APPELLATE JURISDICTION) 14.09.2011 [Note : Unless otherwise specified, before all appellate side courts, fresh matters shown in the supplementary lists will be taken up first.] COURT NO. 1 (DIVISION BENCH-1) HON'BLE THE CHIEF JUSTICE HON'BLE MR. JUSTICE SANJIV KHANNA FRESH MATTERS & APPLICATIONS 1. LPA 670/2011 SURENDER TOMAR VINAY K SHAILENDRA,SHOBHNA CM APPL. 15370/2011 Vs. DELHI DEVELOPMENT TAKIAR,SANJAY PATHAK CM APPL. 15372/2011 AUTHORITY AND ANR 2. W.P.(C) 6547/2011 OM PRAKASH TIWARI AND ORS PETITIONER IN PERSON CM APPL. 13191-13192/2011 Vs. TRANSPORT DEPARTMENT OF DELHI FOR ADMISSION 3. CM APPL. 7596/2011 VINOD KUMAR GOEL PET.IN-PERSON,ROHIT In W.P.(C) 3590/2008 Vs. D.D.A GOEL,RAJIV BANSAL (Disposed off case 4. W.P.(C) 8765/2009 RAHUL GUPTA MAYANK MISHRA,NANDA CM APPL. 3312/2011 Vs. DDA AND ANR. KINRA,RAJIV BANSAL,SAQIB CM APPL. 13162/2011 5. W.P.(C) 11352/2009 SURENDER KUMAR SHARMA PET. IN PERSON,SUMEET Vs. THE CHIEF EXECUTIVE PUSHKARNA,JITENDRA KUMAR,AJAY OFFICER (WATER), NCT OF DELHI VERMA,SHYEL TREHAN AND ORS 6. W.P.(C) 2306/2011 NARMADA SUBODH K PATHAK,SAPNA CM APPL. 4932/2011 Vs. UNION OF INDIA AND ORS. CHAUHAN,SUMEET PUSHKARNA 7. -

Exhibit to the Board's Report Pertaining to Particulars Of

Infosys Annual Report Annual Infosys 2020-21 Exhibit to the Board’s report pertaining to particulars of employees Information as per Rule 5 of Chapter XIII, the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 Employees drawing a remuneration of ` 1.02 crore or above per annum and posted in India Employee name Designation Educational Age Experience Date of joining Gross remuneration Previous employment qualification (in years) paid(1) and designation Abhishek Goyal VP & Delivery Head, ENG B.Tech, PGD 47 24 Sep 11, 2000 1,09,49,284 Asian Paints (I) Limited, Area Manager Alok Uniyal VP & Industry Principal, Quality B.Tech, MBA 52 27 Aug 2, 2004 1,27,19,734 Mphasis Limited, Senior consultant Ammayappan Marimuthu AVP & Senior Delivery Manager, BE 47 24 Jan 22, 2001 1,10,28,061 Sony India Limited, System ADM Engineer Amrita Srikanth AVP & Principal – Technical B.Com, DBM, 46 18 Nov 22, 2012 1,04,48,436 Deloitte Haskins & Sells, Accounting Group CA Manager – Audit & Assurance Anil Kumar P.N. AVP & Delivery Head, ADM B.Tech, ME 49 26 Aug 5, 1996 1,10,88,187 Bajaj Auto Limited, Engineer Anoop Kumar VP & Business Excellence – Head, BE, PGD 50 29 May 3, 2000 1,17,84,641 Tata Steel Private Limited, Quality Deputy Manager Arun Kumar H.R. SVP & Head – Business Strategy, BE 48 26 Nov 7, 1994 1,76,41,771 – Planning and Operations Ashok Bhaskar Hegde VP & Delivery Head, ADM BA, MA, MBA, 53 26 Jan 2, 2012 1,04,92,096 Wipro Technologies Limited, PHD Head-FS Business Analyst & Investment Banking Practice Balaji Sampath VP & Segment Head – Marketing BE, MBA 50 27 Dec 23, 2004 1,32,95,683 Microsoft Corporation Private Limited, Business Manager Balakrishna D.R.