May 29, 2019 VIA ELECTRONIC FILING Public Service Commission

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Rocky Mountain Hss,E

PAC-E 1 r_ i r i fl r\ r.'.-l t t-J ROCKY MOUNTAIN HSS,E#"* 1407 W. North Temple, Suite 330 Salt Lake City, Utah 841'16 May 19,2020 VA OVERNIGHT DELIWRY Idaho Public Utilities Commission I l33l W Chinden Blvd. Building 8 Suite 20lA Boise,ID 83714 Attention: Diane Hanian Commission Secretary Re: Annual Idaho Form 1 Report -2019 Rocky Mountain Power, a division of PacifiCorp, hereby submits for filing an original and seven (7) copies of the Idaho Public Utilities Commission Annual State Form 1 report for 2019. This is being provided with PacifiCorp's annual FERC Form 1. It is respectively requested that all formal correspondence and staffrequests regarding this matter be addressed to: By E-mail (preferred): datarequest@Pac ifi Corp.com By Fax: (503) 813-6060 By regular mail: Data Request Response Center PacifiCorp 825 NE Multnomah, Suite 2000 Portland, OR97232 Any informal inquiries may be directed to Ted Weston, Idaho Regulatory Manager at80l-220- 2963. Vice President, Regulation ANNUAL REPORT IDAHO SUPPLEMENT TO FERC FORM NO. 1 FOR MULTI-STATE ELECTRIC COMPANI ES INDEX Page Title Number 1 Statement of Operating lncome for the Year 2 Electric Operating Revenues 3 -o Electric Operation and Maintenance Expenses 7 Depreciation and Amortization of Electric Plant I Taxes, Other Than lncome Taxes 9 Non-Utility Property 10 Summary of Utility Plant and Accumulated Provisions I 1 -1 2 Electric Plant in Service 13 Materials and Supplies provided in this report is consistent with the unadjusted data reflected in the company's Results of perations in the ldaho general rate case, which will be filed with the ldaho Public Utilities Commission on June 1,2020. -

May 24, 2018 VIA ELECTRONIC FILING Public Service Commission

1407 W. North Temple, Suite 310 Salt Lake City, Utah 84116 May 24, 2018 VIA ELECTRONIC FILING Public Service Commission Heber M. Wells Building, Fourth Floor P. O. Box 45585 Salt Lake City, Utah 84145 Attention: Gary Widerburg Commission Secretary RE: Docket No. 18-999-01 FERC Form No. 1 PacifiCorp (d.b.a. Rocky Mountain Power) submits for electronic filing PacifiCorp’s annual FERC Form No. 1 report for the year ended December 31, 2017. PacifiCorp respectfully requests that all data requests regarding this matter be addressed to: By email (preferred): [email protected] [email protected] By regular mail: Data Request Response Center PacifiCorp 825 NE Multnomah, Suite 2000 Portland, OR 97232 Please direct any informal questions to Jana Saba, Regulatory Manager, at (801) 220-2823. Sincerely, Joelle Steward Vice President, Regulation Enclosure CERTIFICATE OF SERVICE I hereby certify that on May 24, 2018, a true and correct copy of the foregoing was served by electronic mail and overnight delivery to the following: Utah Office of Consumer Services Cheryl Murray Utah Office of Consumer Services 160 East 300 South, 2nd Floor Salt Lake City, UT 84111 [email protected] Division of Public Utilities Erika Tedder Division of Public Utilities 160 East 300 South, 4th Floor Salt Lake City, UT 84111 [email protected] _____________________________ Jennifer Angell Supervisor, Regulatory Operations 1 THIS FILING IS Form 1 Approved OMB No.1902-0021 Item 1:X An Initial (Original) OR Resubmission No. ____ (Expires 12/31/2019) Submission Form 1-F Approved OMB No.1902-0029 (Expires 12/31/2019) Form 3-Q Approved OMB No.1902-0205 (Expires 12/31/2019) FERC FINANCIAL REPORT FERC FORM No. -

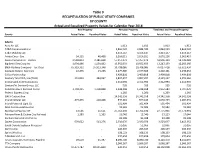

Table 9 RECAPITULATION of PUBLIC UTILITY COMPANIES BY

Table 9 RECAPITULATION OF PUBLIC UTILITY COMPANIES BY COUNTY Actual and Equalized Property Values for Calendar Year 2018 Real Property Personal Property Total Real and Personal Property County Actual Value Equalized Value Actual Value Equalized Value Actual Value Equalized Value Adams Aero Air LLC - - 5,913 5,913 5,913 5,913 AT&T Communications - - 2,844,920 2,844,920 2,844,920 2,844,920 AT&T Mobility LLC - - 3,413,147 3,413,147 3,413,147 3,413,147 Avista Corp - Gas 54,215 46,408 3,016,011 3,016,011 3,070,226 3,062,419 Avista Corporation - Electric 2,548,853 2,181,818 57,357,272 57,357,272 59,906,124 59,539,089 Big Bend Elec Coop Inc 1,694,466 1,450,462 10,552,693 10,552,693 12,247,159 12,003,156 BNSF Railway Company - Tax Dept 65,319,332 55,913,348 10,708,086 10,708,086 76,027,418 66,621,434 Cascade Natural Gas Corp 22,495 19,256 2,379,606 2,379,606 2,402,101 2,398,862 Cellco Partnership - - 3,409,858 3,409,858 3,409,858 3,409,858 Century Tel of WA, Inc (T141) 331,830 284,047 3,807,497 3,807,497 4,139,327 4,091,544 CenturyLink Communications - - 2,312,994 2,312,994 2,312,994 2,312,994 CenturyTel Service Group, LLC - - 935 935 935 935 Columbia Basin Railroad Co Inc 1,704,215 1,458,808 1,248,268 1,248,268 2,952,483 2,707,076 Federal Express Corp - - 1,260 1,260 1,260 1,260 GATX Corporation - - 14,342,358 14,342,358 14,342,358 14,342,358 Inland Cellular LLC 479,495 410,448 599,243 599,243 1,078,739 1,009,691 Inland Power & Light Co - - 501,404 501,404 501,404 501,404 Noel Communications Inc - - 92,582 92,582 92,582 92,582 Northwest Pipeline -

0001193125-17-134664.Pdf

SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 SCHEDULE 13G (Rule 13d-102) INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT TO § 240.13d-1(b), (c) AND (d) AND AMENDMENTS THERETO FILED PURSUANT TO § 240.13d-2 (Amendment No. 1) LIBERTY MEDIA CORPORATION (Name of Issuer) SERIES A SIRIUSXM COMMON STOCK (Title of Class of Securities) 531229409 (CUSIP Number) April 19, 2017 (Date of Event Which Requires Filing of this Statement) Check the appropriate box to designate the rule pursuant to which this Schedule is filed: ☐ Rule 13d-1 (b) ☒ Rule 13d-1 (c) ☐ Rule 13d-1 (d) * The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes.) 1 NAME OF REPORTING PERSON Warren E. Buffett 2 CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☒ (b) ☐ 3 SEC USE ONLY 4 CITIZENSHIP OR PLACE OF ORGANIZATION United States Citizen 5 SOLE VOTING POWER NONE NUMBER OF 6 SHARED VOTING POWER SHARES BENEFICIALLY OWNED BY 10,683,800 EACH 7 SOLE DISPOSITIVE POWER REPORTING PERSON WITH NONE 8 SHARED DISPOSITIVE POWER 10,683,800 9 AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 10,683,800 10 CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES ☐ Not Applicable. -

DRINKDRINK Clean Water • Drinking Water • Strong Communities

CLEAN WATER • DRINKING WATER • STRONG COMMUNITIES WATERKEEPER WATERKEEPER® 100% PCR Paper 5, Number Volume 1 DRINKDRINK DRINK Summer Summer 2008 Summer 2008 $5.95 Cerrella Loaded with trashy features like post-consumer recycled PET canvas upper and recycled rubber outsoles. Look good, feel good, in Curbside. ©2008 TEVA TEVA.COM WATERKEEPER Volume 5 Number 1, Summer 2008 41 44 16 in every issue Cover Feature 6 Letter from the Chairman: 28 Robert F. Kennedy, Jr. Protect the Source Despite treatment to clean water before it reaches your home, what 22 The Movement happens in your waterway impacts what makes it into your glass. Featuring Russian Waterkeepers 30 Contamination in the Coalfields 34 The Long Road to Protecting our Water Supply 64 On the Water 38 Nitrate Contamination in California 66 All Hands on Deck: 39 Threat to Birmingham Water Supply Take Action! 40 Source Water Protection, Not Filtration 41 Upper Neuse Basin Clean Water Initiative 43 Clean Drinking Water from the Hackensack River 44 Silent Spring of the 21st Century? Pharmaceuticals in Our Water 47 Water, Water, Everywhere... 51 Orange County Toasts Domestic over Imports 53 Safe Drinking Water for All 57 The Way Forward: Blue Covenant 58 Water for Life, Water for All 60 Call to Action: Every Drop Counts 66 news and entertainment 12 Splashback 14 Ripples 20 VICTORY: Ecological Marvel Protected 22 62 Ganymede: The Waterkeeper 4 Waterkeeper Magazine Summer 2008 www.waterkeeper.org We all need clean water to survive. Be brave. Join me, my father and all our John Paul Mitchell Systems family to help protect our world, our waterways, our people and every living creature. -

2019 SEC Form 10-K (PDF File)

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-14905 BERKSHIRE HATHAWAY INC. (Exact name of Registrant as specified in its charter) Delaware 47-0813844 State or other jurisdiction of (I.R.S. Employer incorporation or organization Identification No.) 3555 Farnam Street, Omaha, Nebraska 68131 (Address of principal executive office) (Zip Code) Registrant’s telephone number, including area code (402) 346-1400 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbols Name of each exchange on which registered Class A Common Stock BRK.A New York Stock Exchange Class B Common Stock BRK.B New York Stock Exchange 0.750% Senior Notes due 2023 BRK23 New York Stock Exchange 1.125% Senior Notes due 2027 BRK27 New York Stock Exchange 1.625% Senior Notes due 2035 BRK35 New York Stock Exchange 0.500% Senior Notes due 2020 BRK20 New York Stock Exchange 1.300% Senior Notes due 2024 BRK24 New York Stock Exchange 2.150% Senior Notes due 2028 BRK28 New York Stock Exchange 0.250% Senior Notes due 2021 BRK21 New York Stock Exchange 0.625% Senior Notes due 2023 BRK23A New York Stock Exchange 2.375% Senior Notes due 2039 BRK39 New York Stock Exchange 2.625% Senior Notes due 2059 BRK59 New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: NONE Indicate by check mark if the Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

Warren Buffett Faces Insider Trading: a Case Study by Christian Koch, University of South Florida

Volume 4, Number 1 Example Case Study 8 SEPTEMBER 2020 Warren Buffett Faces Insider Trading: A Case Study By Christian Koch, University of South Florida illionaire Warren Buffett has amassed a tially committed insider trading. Sokol resigns large following among those in the invest- from his position unexpectedly. In rank, Sokol Bment world and the numerous sharehold- is behind Charlie Munger, Buffett’s long-time ers of Berkshire Hathaway. Headquartered in business partner. Sokol is Chairman of sever- Omaha, Nebraska, Berkshire Hathaway oper- al Berkshire subsidiaries and has had a long, ates as a conglomerate that owns and operates successful relationship working with Buffett. businesses with famil- In fact, Sokol is consid- iar brand names like ered Buffett’s protégé Fruit of the Loom, GE- and the lead candidate ICO, Dairy Queen and In March 2011, Warren Buffett to replace Buffett upon Duracell. It also oper- stepped into chaos. The Chairman retirement. ates a large marketable of one of Berkshire Hathaway sub- In a March 30, 2011 securities portfolio run sidiaries, David Sokol, had resigned press release, Buffett by Buffett. Some top his position, but there was more to states, “in our first talk equity holdings are Co- the story. about Lubrizol, Dave ca-Cola, Bank of Amer- Sokol mentioned that ica, American Express, he owned stock in the Wells Fargo and Kraft company. It was a pass- Heinz. ing remark and I did not ask him about the date Buffett learns days after the public announce- of his purchase or the extent of his holdings” ment of the all-cash deal to acquire Lubrizol, (Busines Wire, March 30, 2011). -

Re 68, Oar Compliance, 5/31/2012

August 30, 2012 VIA OVERNIGHT DELIVERY Oregon Public Utility Commission 550 Capital Street, N.E., Suite 215 Salem, Oregon 97301-2551 Attn: Judy Johnson RE: PacifiCorp FERC Form No. 1 - Resubmission Please find enclosed two copies of the Resubmission of PacifiCorp’s annual FERC Form No. 1 report for the year ended December 31, 2011. FERC recently issued an order requiring certain restatements and revisions in PacifiCorp’s accounting practices for its wholly owned coal mining and management subsidiaries. Historically, these entities were consolidated and intercompany profits were eliminated. Under the requirements of the order, PacifiCorp is now required to account for these subsidiaries under the equity method and not eliminate profit on intercompany transactions. This resubmission reflects these changes. Please direct any informal questions to Bryce Dalley, Director of Regulatory Affairs & Revenue Requirement, at (503) 813-6389. Sincerely, William R. Griffith Vice President, Regulation Enclosure THIS FILING IS Form 1 Approved OMB No.1902-0021 Item 1: An Initial (Original) ORX Resubmission No. ____ (Expires 12/31/2014) Submission Form 1-F Approved OMB No.1902-0029 (Expires 12/31/2014) Form 3-Q Approved OMB No.1902-0205 (Expires 05/31/2014) FERC FINANCIAL REPORT FERC FORM No. 1: Annual Report of Major Electric Utilities, Licensees and Others and Supplemental Form 3-Q: Quarterly Financial Report These reports are mandatory under the Federal Power Act, Sections 3, 4(a), 304 and 309, and 18 CFR 141.1 and 141.400. Failure to report may result in criminal fines, civil penalties and other sanctions as provided by law. The Federal Energy Regulatory Commission does not consider these reports to be of confidential nature Exact Legal Name of Respondent (Company) Year/Period of Report PacifiCorp End of 2011/Q4 FERC FORM No.1/3-Q (REV. -

Warren Buffett Trip

Warren Buffett Trip Omaha, Nebraska January 2018 Letter from Smart Woman Securities National Meeting with Warren Buffett on January 12th was an honor and a privilege that SWS members will treasure for a lifetime! During the 2 ½ hour Q&A session, we intently listened to Mr. Buffett as he educated us on business, provided advice on rela- tionships and shared meaningful and humorous insights on life and success. He is often referred to as the “Sage of Omaha”, a title earned for being the world’s greatest investor. The definition of a sage is someone characterized by wisdom, prudence and good judgement and Mr. Buffett truly embodies each of these qualities. But the depth of his tremendousness goes far beyond his financial acumen. And because of his generosity with his time, we were able to see and hear for ourselves just how wonderful a person he is. His brilliance, humility, kindness and optimism were evident and inspiring. Our rigorous preparation requirements included readings from The Intelligent Investor, The Making of an American Capital- ist, watching video interviews, dissecting the Annual Shareholder newsletter, and participating in weekly discussion groups. By thoroughly researching companies and studying biographies of the executives that we were meeting, it allowed the students to take full advantage of the opportunity of asking thoughtful questions beyond what anyone could easily access on the internet. All agreed that the preparation allowed them to derive the maximum benefit from the trip. That afternoon was followed by an exclusive dinner at Mr. Buffett’s favorite steakhouse, Gorat’s with our members and SWS Co- founders, Tracy Britt Cool and Teresa Hsiao. -

A Response Letter

Via Electronic Mail and U.S. Mail July 30, 2020 The Honorable Gavin Newsom Governor of the State of California 1303 Tenth Street, Suite 1173 Sacramento, CA 95814 Dear Governor Newsom: Thank you for your July 29, 2020, letter regarding PacifiCorp’s hydroelectric developments on the Klamath River in southern Oregon and northern California. We share your concerns about social and environmental progress and remain committed to solving these deeply rooted cultural and community impacts. For over a decade, PacifiCorp has been working in close partnership with Tribal Nations, the states of California and Oregon, irrigators, local governments, and other Klamath River Basin stakeholders to solve long-standing and complex challenges. PacifiCorp remains committed to continued collaboration with California, indigenous peoples and other Basin stakeholders to chart a path forward. As initially envisioned in 2008, dam removal was one component of a larger effort to address endangered fish, water quality concerns, contested claims to water by various stakeholders and comprehensive Basin restoration. The original Klamath Hydroelectric Settlement Agreement (KHSA) established a landmark co-funding mechanism, $250 million in California bond funding for dam removal, and an additional $200 million commitment from PacifiCorp’s Oregon and California customers. In addition, PacifiCorp would transfer its interest in its hydroelectric license and all associated property. The settlement balanced California and Oregon’s desire for dam removal as a public policy outcome with ensuring protections for PacifiCorp’s customers. That balance has underpinned the settlement for over a decade. These core principles were carried forward in the amended KHSA that PacifiCorp, along with former California Governor Brown signed in 2016. -

~ ~\T~10UNTAIN Vice President and General Counsel 1407 W

R. Jeff Richards ~ ~\t~10UNTAIN Vice President and General Counsel 1407 W. North Temple, Suite 320 Salt Lake City, UT 84116 801-220-4734 Office jeff. [email protected] September 28, 2016 VIA OVERNIGHT DELIVERY =I"-.) Idaho Public Utilities Commission O"' 1..-- 472 West Washington (/) ;:;o --: --, -0 rn Boise, ID 83702-5983 ' ,w.,."-...• N (') c:,,..... ,;~... .. co m Attention: Jean D. Jewell - :.--;- ):,,. < --- ·-· - Commission Secretary ::.-1 3: m (f)0 \.0 0 Cl) Re: PacifiCorp Notice of Affiliate Transaction ...:- 0 0:, Case No. PAC-E-05-8 z Dear Ms. Jewell: This letter will serve as notice pursuant to Commitment I 17(2), incorporated in the Idaho Public Utilities Commission Order No. 29973 issued February 13, 2006, as supplemented by Order No. 29998 March 14, 2006, in the above-referenced proceeding, approving the acquisition of PacifiCorp by MidAmerican Energy Holdings Company (now "Berkshire Hathaway Energy Company" or "BHE"), of ongoing ordinary course affiliated interest transactions from time to time with Environment One Corp., a wholly-owned indirect subsidiary of Precision Castparts Company (Environment One). PacifiCorp is a wholly-owned indirect subsidiary of Berkshire Hathaway Energy Company. BHE is a subsidiary of Berkshire Hathaway Inc. On January 29, 2016, Berkshire Hathaway Inc. completed its acquisition of Precision Castparts Company, causing it, and its subsidiaries including Environment One, to become new affiliates of PacifiCorp. Therefore, Berkshire Hathaway, lnc.'s ownership interest in BHE and Environment One may create an affiliated interest relationship between PacifiCorp and Environment One in some PacifiCorp jurisdictions. Environment One provides PacifiCorp with certain mechanical parts, supplies and services used by PacifiCorp's large thermal generation plants, including vacuum pumps, cloud chamber assemblies and collector analysis, cleaning and repair. -

Inspiring Sustainability Improving Lives

inspiring sustainability improving lives 2017 SUSTAINABILITY REPORT Table of Contents 1. INTRODUCTION About this Report ......................................................................................................................3 Message from Our CEO and CSO ............................................................................................4 Executive Summary ..................................................................................................................6 2. ENVIRONMENTAL Environmental Sustainability.....................................................................................................................10 Environmental Data Summary .................................................................................................12 Energy, Emissions and Climate Change ..................................................................................14 Product Footprint and Lifecycle Thinking ................................................................................17 Waste and Recycling ...............................................................................................................20 Water Consumption and Safety ..........................................................................................................23 3. SOCIAL Workplace Health, Safety and Security ...................................................................................25 Product Health and Safety ......................................................................................................30