Diaspora Philanthropy: Private Giving and Public Policy

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Shakira Announces El Dorado World Tour, Presented By

For Immediate Release SHAKIRA ANNOUNCES EL DORADO WORLD TOUR, PRESENTED BY RAKUTEN The World Tour Includes Stops Throughout Europe and North America with Latin American Dates Forthcoming Tickets On-Sale Friday, June 30th; Citi Presale Begins Tuesday, June 27th; Viber Presale Begins Wednesday, June 28th; Live Nation Presale Begins Thursday, June 29th 11th Studio Album “EL DORADO” Certified 5x Platinum Los Angeles, CA (June 27, 2017) – Twelve-time GRAMMY® Award-winner and international superstar Shakira has announced plans to embark on her EL DORADO WORLD TOUR, presented by Rakuten. The tour, produced by Live Nation, will feature many of her catalog hits and kicks off on November 8th in Cologne, Germany. It will feature stops throughout Europe and the US including Paris’ AccorHotels Arena and New York’s Madison Square Garden. A Latin American leg of the tour will be announced at a later date. “Thank you all so much for listening to my music in so many places around the world. I can’t wait to be onstage again singing along with all of you, all of your favorites and mine. It's going to be fun! The road to El Dorado starts now!” Shakira said. The tour announcement comes on the heels of Shakira’s 11th studio album release, EL DORADO, which hit #1 on iTunes in 37 countries and held 5 of the top 10 spots on the iTunes Latino Chart within hours of its release. The 5x platinum album, including her already massive global hits - “La Bicicleta,” “Chantaje,” “Me Enamoré,” and “Déjà vu”- currently holds the top spot on Billboard’s Top Latin Albums, marking her 6th #1 album on this chart. -

Explore-Travel-Guides-R.Pdf

Please review this travel guide on www.amazon.com Submit additional suggestions or comments to [email protected] Businesses in Colombia are constantly evolving, please send us any new information on prices, closures and any other changes to help us update our information in a timely manner. [email protected] Written and researched by Justin Cohen Copyright ©2013 by Explore Travel Guides Colombia ISBN – 978-958-44-8071-2 Map and book design by Blackline Publicidad EU Bogotá, Colombia This travel guide is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 3.0 Unported License. You are free: to share, to copy, distribute and transmit this work. Distributed by Explore Travel Guides Colombia www.gotocolombia.com [email protected] CONTENTS General Information ............................................................................. 17 Colombia Websites for Travelers .............................................................. 48 Activities in Colombia ............................................................................. 59 A Brief History of Colombia ..................................................................... 64 Bogotá .................................................................................................. 89 Outside of Bogotá ................................................................................ 153 Suesca............................................................................................. 153 Guatavita ....................................................................................... -

Jóvenes En(Red)Ados 93 Jóvenes En(Red)Ados

93 ≥ Junio 11 REVISTA DE ESTUDIOS DE REVISTA JUVENTUD DE ≥ Junio 11 | Nº 93 Jóvenes en(red)ados 93 Jóvenes en(red)ados El número monográfico que presentamos es, en cierta medida, deudor de estudios anteriores, también publicados en esta misma colección: Juventud y la Sociedad Red (nº 46), Juventud y teléfonos móviles (nº 57), De las tribus urbanas a las culturas juveniles (nº 64), Jóvenes y medios de comunicación (nº 68), Culturas y lenguajes juveniles (nº 78) y Juventud y nuevos medios de comunicación (nº 88). Así que resulta difícil reflexionar sobre el lenguaje y la cultura juveniles desde Jóvenes en(red)ados enfoques diferentes y evitar la circularidad y la repetición de tópicos apocalípticos, en el peor de los casos, o integrados, pero desde la lejanía nebulosa de la edad que convierte a la juventud en un raro objeto de estudio. Por esta razón, hemos intentado buscar entre los colaboradores el equilibrio de interpretaciones y formas inteligentes (inter legere) de “mirar” (y no solo “ver”) las prácticas discursivas y comunicativas de la juventud, sus formas de expresión cultural, la construcción de su imagen para/frente a los demás, los juegos de lenguaje, el humor y, sobre todo, la creatividad con la que reinventan el mundo. El monográfico está articulado en tres bloques temáticos que atañen a estas cuestiones: Medios y modas, Atrapados en la Red y En la frontera de la lengua, más el bloque teórico introductorio Páramos y ecosistemas juveniles. Portada revista 93.indd 1 04/07/11 15:41 ≥ Junio 11 | Nº REVISTA DE Jóvenes en(red)ados -

Pies Descalzos” and Costa Cruises Together for the Construction of a School in Colombia

Shakira’s Fundación “Pies Descalzos” and Costa Cruises together for the construction of a school in Colombia October 18, 2017 In Barcelona Shakira and Neil Palomba, President of Costa Cruises, announced the official start of the project with a symbolic "First brick" delivery ceremony. The school will be built in Cartagena (Colombia), with scheduled delivery in June 2019, providing education and support to 1,300 local students and the entire close communities involved. Genoa, 18 October 2017 – International superstar Shakira and Costa Cruises top management celebrated in Barcelona the official start of the donation project to the Fundación Pies Descalzos for the construction of a school in Colombia. The project is aimed at helping local children and their families and providing a quality education for disadvantaged children as well as a community center for their families. During the presentation event, Neil Palomba, President of Costa Cruises, delivered the first stone of the school, a brick that represent the "Brick of Happiness", to Shakira to symbolize the beginning of the project. The construction will start in Cartagena in 2018 when the brick will arrive on board a Costa cruise ship after a journey from Barcelona to Cartagena. During the sailing both Costa ship's crew and guests will have the chance to leave a dedication and a special message. The new school will be built in Cartagena between the districts "Ciudad del Bicentenario" and "Villa de Aranjuez", and is scheduled for delivery in June 2019, providing education and support to 1,300 local students from 6 to 18 years. It will follow the "public quality education" model provided by the Fundación Pies Descalzos, including also nutrition and health programs and special training activities for parents and the community at large. -

Traces of the Past

UNIT 1 Traces of the past Learning objectives talk about past events and their impacts on the present listen for specific information keep a conversation going conduct an interview B1U1.indd 1 15-5-21 下午3:50 Opening up 1 Think of the activities you sometimes do at weekends and add as many activities as possible to each word web below. 3) TV 1) watch shopping a basketball game go to the gym 4) tennis play a computer 2) game a walk go for 2 Work in pairs and compare your answers. Then ask your partner whether he / she likes a meal doing any of the activities mentioned in the word webs and whether he / she did any of them last weekend. 2 New Horizon College English | Third Edition B1U1.indd 2 15-5-21 下午3:50 Opening up 1 Reference answers 1) go swimming / to the cinema 2) go for a trip / a cup of coffee 3) watch a soap opera / a DVD movie 4) play golf / the piano 2 Reference answers A: Do you like going shopping? B: Yes, I do. A: Did you go shopping last weekend? B: No, I didn’t. I went to see a movie last weekend. UNIT 1 Traces of the past T 2 U1右页加水印.indd 2 15-5-27 下午4:33 Listening to the world Sharing 1 Watch a podcast from the beginning to the end for its general idea. New words Part 2 2 Read the paragraph. Then watch Part 1 The Hangover /D5 'h{Œ5Uv5/ 《宿醉》(电影名) of the podcast and fill in the blanks with the socialize /'s5US58laIz/ v. -

Harvard College Student Group Performances Held in Her Honor

The HARVARD FOUNDATION Journal SPRING 2011 HARVARD UNIVERSITY VOL. XXX, NO. 2 In Memoriam: Singer and Humanitarian Shakira Honored as The Reverend Professor Peter J. Gomes Harvard Foundation’s 2011 Artist of the Year at Cultural Rhythms Festival Dr. Arthur Kleinman Named 2011 Distinguished Faculty Member Harvard Artist in Residence: Dr. Maggie Werner-Washburne Presented the Archie Panjabi 2011 Scientist of the Year Award In this issue: Mental Health Awareness The Color of Baseball Annual Student/Faculty Awards Dinner Harvard Foundation Provides Japan Relief 2 HARVARD FOUNDATION JOURNAL, SPRING 2011 Table of Contents Harvard Foundation Journal Contents and Featured Programs p. 3 Letter from the Director p. 4-7 Cultural Rhythms Festival and 2011 Artist of the Year, Shakira, honored for her humanitarian work p. 8 Harvard Artist in Residence: The Good Wife’s Archie Panjabi p. 9 The Reverend Professor Peter J. Gomes Remembered p. 10 Dr. Maggie Werner-Washburne presented with the 2011 Scientist of the Year award p. 11 The annual Albert Einstein Science Conference brings over 100 inner-city students to Harvard University p. 12 The Color of Baseball p. 13 The Harvard Foundation Writer’s Series presents Wayetu Moore p. 13 The Harvard Foundation Film Series presents Desigirls p. 14 Former Harvard Foundation intern Winona LaDuke honored p. 14 The Harvard Foundation Race, Gender, & Sexuality Series works with students groups to promote mental health p. 14 How to End Gang Violence in America p. 15 Martin Luther King Jr.’s legacy celebrated at Memorial Church with Father Gregory Boyle p. 16-17 Student/Faculty Awards Dinner Student Initiated Programs p. -

Shakira Gets Animated for Brand-New Dora the Explorer Book in Celebration of Preschool Icon's 10Th Anniversary

Shakira Gets Animated for Brand-new Dora the Explorer Book in Celebration of Preschool Icon's 10th Anniversary Nickelodeon Consumer Products and Simon & Schuster Release Dora the Explorer in World School Day Adventure Written by Shakira NEW YORK, Nov. 2, 2010 /PRNewswire via COMTEX/ -- Nickelodeon Consumer Products (NCP) and Simon & Schuster are releasing Dorathe Explorer in World School Day Adventure, the first-ever jacketed hardcover Dora the Explorer storybook, in celebration of Dora's 10th Anniversary. Penned by Grammy Award-winning singer, songwriter, and humanitarian Shakira, this brand-new global adventure features an animated character of the songstress herself. World School Day Adventure follows Dora, Boots and Shakira as they celebrate 'World School Day' with students from all corners of the earth. When some schools are missing supplies, it's up to Dora and Boots to make some very special deliveries. (Photo: http://photos.prnewswire.com/prnh/20101102/NY93318 ) (Photo: http://www.newscom.com/cgi-bin/prnh/20101102/NY93318 ) "I'm a big fan of Dora because she inspires kids all over the world," said Shakira. "It was such an honor working with Nickelodeon to write this story with its message of helping others and education, which is very close to my heart." With distinct art styles and lustrous watercolor illustrations, Dorathe Explorer in World School Day Adventure is the first of its kind in the Dora the Explorer publishing portfolio. Available in English and Spanish versions, Dorathe Explorer in World School Day Adventure is on sale at all major retailers today and is priced at $16.99. Additionally, a portion of the book's proceeds will benefit The Barefoot Foundation, Shakira's non-profit organization dedicated to childhood education. -

Joe Duley in Groups, Discuss the Wall Questions

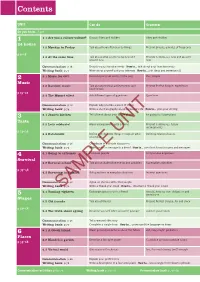

PRE-INTERMEDIATE StluUents' Boo� :witlr �ctiveBoo� an MYiEn is Ba [P.lus �ocaoular:vi �ainer. �rami ta: C ace ALWAYS LEARNING PEARSON .. � - --·-- - - Class & Armatina Crace Workbook MP3 CD with Richard Acklam PEARSON Longman Contents UNIT Can do Grammar Do you know... ? p 8 1.1 Are you a culture vulture? 1.2 Monday to Friday Talk about how often you oo things Present _Simple; adverbs of frequency 1.3 At the 88.IJle tiine Talk about what you're doing now and Present Continuous: now and around around now now Co=unication p 16 Describe your learning neecls How to ... talk about your learning needs Writing bank p 135 Write about yourself and your interests How to ... join ideas and sentences (1) 2.1 Music for 007 Describe personal events i the past Past Simple 2.2 Barefoot music Talk about personal achievements and Present Perfect Simple: experience experiences 2.3 The Mozart effect Ask different types of questions Questions Coilllllunication p 26 Explain why you like a piece of music Writing bank p 136 Write a short biography ab )ut someone's life How to... plan your writing 3.1 Jamie's kitchen Tell a friend about your future plans be going to: future plans 3;2 Let's celebrate! Make arrangements with a friend Present Continuous: future arrangements 3.3 Ratatouille Define and describe things to explain what Defining relative clauses you mean Contribute to a simple discussion Write a note or message to a friend How to... use short forms in notes and messages 4.1 Going to extremes Compare people 4.2 Survival school Talk about challenging eve 4.3 Surviving in English Ask questions in everyday 1;ituations Indirect questions Coilllllunioation p 46 Agree on choices with other people Writing bank p 138 Write a 'thank you' email I-low to.. -

International Superstar Shakira Announces 2010 European Tour Presented by Seat

INTERNATIONAL SUPERSTAR SHAKIRA ANNOUNCES 2010 EUROPEAN TOUR PRESENTED BY SEAT 214 Global Award Nominations 50 Million Albums Worldwide 1 Stage nd Tickets Go On Sale Beginning July 2 (June 28, 2010) – Hot on the heels of her captivating World Cup performance, Shakira, one of the most exciting and successful global artists in recent history, with more than 214 global award nominations and more than 50 million albums sold worldwide, has announced her 2010 global tour and her highly anticipated return to Europe. The European Tour, produced by Live Nation, will begin on November 16th in Lyon, France at La Halle Tony Garnier. Shakira has already performed at Rock in Rio in Lisbon and she headlined the festival in Madrid where there were more than 85,000 fans. She will also perform at this weekend’s Glastonbury Festival in the UK on Saturday, June 26th and will be performing at the 2010 FIFA World Cup closing ceremony on July 11. In keeping with Shakira’s inspired originality, as well as her sensual rhythms and deliciously unpredictable spirit, the tour promises to push the limits of the live concert experience, bringing fans a pulsating spectacle crossing all musical boundaries. Shakira’s latest hit and the official anthem of the 2010 World Cup, Waka Waka (This Time For Africa) has caught on around the globe, immediately following Shakira’s headline performance at the kick-off concert of the FIFA World Cup in South Africa. The song has exploded onto the scene with the music video quickly becoming the most viewed video on YouTube for the month of June and the song anchoring the #1 spot on charts in over 15 countries. -

Children, Sites of Opportunity, and Building Everyday Peace

“It’s about finding a way”1: Children, sites of opportunity, and building everyday peace in Colombia Abstract The multiple forms of violence associated with protracted conflict disproportionately affect young people. Literature on conflict-affected children often focuses on the need to provide stability and security through institutions such as schools but rarely considers how young people themselves see these sites as part of their everyday lives. The enduring, pervasive, and complex nature of Colombia’s conflict means many young Colombians face the challenges of poverty, persistent social exclusion, and violence. Such conditions are exacerbated in ‘informal’ barrio communities such as los Altos de Cazucá, just south of the capital Bogotá. Drawing on field research in this community, particularly through interviews conducted with young people aged 11 to 17 in the this community, this article explores how young people themselves understand the roles of the local school and NGO in their personal conceptualisations of the violence in their everyday lives. The evidence indicates that children use spaces available to them opportunistically and that these actions can and should be read as contributing to local, everyday forms of peacebuilding. The ways in which institutional spaces are understood and used by young people as ‘sites of opportunity’ challenges the assumed illegitimacy of young people’s voices and experiences in these environments. Keywords: Colombia, children, violence, peacebuilding, education, everyday peace. 1 Christian (not his real name), a 16 year old young man from the community of los Altos de Cazucá, in interview, November 2010. 1 Introduction Colombia’s protracted conflict between the national government and leftist guerrillas the FARC (Fuerzas Armadas Revolucionarias de Colombia) has had significant consequences for many Colombians who have lived with violence and insecurity for decades. -

Redalyc.Tracking Transnational Shakira on Her Way to Conquer The

Zona Próxima ISSN: 1657-2416 [email protected] Universidad del Norte Colombia Gontovnik, Gónica Tracking transnational Shakira on her way to conquer the world Zona Próxima, núm. 13, julio-diciembre, 2010, pp. 142-155 Universidad del Norte Barranquilla, Colombia Available in: http://www.redalyc.org/articulo.oa?id=85317326010 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative ARTÍCULOS DE REFLEXIÓN DISCUSSION ARTICLES Tracking transnational Shakira on her way to conquer the world zona Rastreando a la Shakira transnacional en su camino a la globalizacion Mónica Gontovnik Cristo Hoyos. Hamaca. Pastel, tinta y acrílico sobre papel (detalle). próxima MÓNICA GONTOVNIK PROFESORA TIEMPO COMPLETO DE LA UNIVERSIDAD DEL NORTE ADSCRITA AL DEPARTAMENTO DE HUMANIDADES Y FILOSOFÍA. MIEMBRO DEL GRUPO DE INVESTIGACIÓN DE LITERATURA DEL zona próxima CARIBE. CANDIDATA A DOCTOR EN ESTUDIOS INTERDISCIPLINARIOS EN ARTES Y PROFESORA DE LA UNIVERSIDAD DE OHIO. MASTER EN Revista del Instituto ESTUDIOS INTERDISCIPLINARIOS EN ARTE Y PSICOLOGÍA DE NAROPA de Estudios en Educación UNIVERSITY, COLORADO. BACHELOR OF SCIENCE EN DANZA DE Universidad del Norte SKIDMORE UNIVERSITY WITHOUT WALLS, NEW YORK. EGRESADA DE LA FACULTAD DE FILOSOFÍA Y LETRAS DE LA UNIVERSIDAD nº13 julio - diciembre, 2010 METROPOLITANA, BARRANQUILLA. POETA Y PERFORMER. 35 WOLFE STREET # 41. ATHENS, OHIO, 45701. ISSN 1657-2416 [email protected] The Colombian singer and composer Shakira, has become a transnational ACT musical product. Her presence on the world STR stage is by now a commodity that screams AB the ideology of a unified globe. -

NTE-Students-Preintermediate.Pdf

Contents UNIT Can do Grammar Vocabulary Speaking and Pronunciation Listening and Reading Do you know…? p 8 1 1.1 Are you a culture vulture? Discuss likes and dislikes Likes and dislikes Going out Sentence stress R What do you like doing at the weekend? 24 hours 1.2 Monday to Friday Talk about how often you do things Present Simple; adverbs of frequency Describing your day and lifestyle do/does L Valentino Rossi – motorcycle champion How to… respond to information p 9–18 1.3 At the same time Talk about what you’re doing now and Present Continuous: now and around Time phrases R Online chatting around now now Communication p 16 Describe your learning needs How to… talk about your learning needs Reference p 17, Review and Practice p 18 Writing bank p 73 Write about yourself and your interests How to… join ideas and sentences (1) 2 2.1 Music for 007 Describe personal events in the past Past Simple Music How to… refer to past times L Music in James Bond films Music 2.2 Barefoot music Talk about personal achievements and Present Perfect Simple: experience Achievements have/has R Shakira – pop star and business woman experiences p 19–28 2.3 The Mozart effect Ask different types of questions Questions Intonation in questions R The Mozart effect L Music Communication p 26 Explain why you like a piece of music Reference p 27, Review and Practice p 28 Writing bank p 74 Write a short biography about someone’s life How to… plan your writing 3.1 Jamie’s kitchen Tell a friend about your future plans be going to: future plans How to… talk about future