2008 Annual Report to Our Shareholders

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MXD – Evaluering 2018

EVALUERINGSRAPPORT 2018 Evaluering af MXD’s aktiviteter i 2018 Det er MXD’s mission at øge eksporten af dansk professionel populærmusik og herigen- nem at styrke den kunstneriske udvikling og forretningsgrundlaget for danske kunstnere og musikselskaber. MXD’s Strategi 2016-19 definerer tre hovedopgaver, som skal realisere denne mission: 1. Eksportstøtte 2. Internationale projekter 3. Videndeling og kommunikation. I det følgende beskrives aktiviteterne og resultaterne inden for hver af disse. Ad. 1. Eksportstøtte Danske bands/musikselskaber kan søge MXD om støtte til både egne eksportprojekter og til deltagelse i MXD’s eksportprojekter i udlandet, såsom handelsmissioner, Danish Night At Reeperbahn Festival, Ja Ja Ja Club Night etc. Der kan søges om støtte via tre puljer: 1. Eksportstøtte til markedsudvikling 2. Dynamisk eksportstøtte til unikke markedsmuligheder 3. Eksportstøtte til branchefolk I marts 2017 lancerede MXD og DPA (foreningen for sangskrivere, komponister, tekst- forfattere og producere inden for det kommercielle og populære felt) en ny eksportstøt- tepulje, som har til formål at styrke eksporten af dansk-producerede sange: 4. Eksportstøtte til branchefolk - sangskrivning Støttemidlerne kommer fra Kodas Kulturelle Midler, og puljen administreres af MXD. Læs mere om alle fire puljer (herunder formål, vurderingskriterier og MXD’s uddelings- politik) her: mxd.dk/eksportstoette/ Det samlede bogførte resultat for 2018 blev: Pulje Resultat Budget 1. Eksportstøtte til markedsudvikling 1.595.720 2. Dynamisk eksportstøtte til unikke markedsmuligheder 101.497 3. Eksportstøtte til branchefolk 301.952 Ubrugte midler fra tidligere år -123.512 I alt 1.875.657 1.800.000 4. Eksportstøtte til branchefolk – sangskrivning 124.855 0 Ubrugte midler fra tidligere år -15.955 I alt 108.900 180.000 Samlet resultat 1.984.557 1.980.000 I forhold til budgettet blev resultatet for pulje 1.-3. -

2011 Annual Report

232265_BNY_LiveNation_AR_CVR.indd 1 4/13/12 8:12 PM UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2011, OR ! TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-32601 LIVE NATION ENTERTAINMENT, INC. (Exact name of registrant as specified in its charter) Delaware 20-3247759 (State of Incorporation) (I.R.S. Employer Identification No.) 9348 Civic Center Drive Beverly Hills, CA 90210 (Address of principal executive offices, including zip code) (310) 867-7000 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on which Registered Common Stock, $.01 Par Value per Share; New York Stock Exchange Preferred Stock Purchase Rights Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ! No Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ! Yes No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and 2) has been subject to such filing requirements for the past 90 days. -

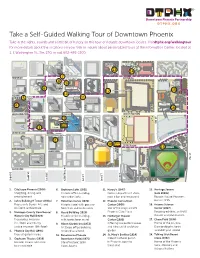

Walking and Tour Map 2020 Final

Take a Self-Guided Walking Tour of Downtown Phoenix Take in the sights, sounds and a little bit of history on this tour of notable downtown locales. Visit dtphx.org/walkingtour for more details about the locations on your trek or inquire about personalized tours at the Information Center, located at 1. E Washington St., Ste. 230, or call 602-495-1500. Herberger St. Mary’s Theater Basilica (1914) Hotel 13 San Carlos 14 (1928) MONROE 7 Hilton Garden MONROE Inn (1932) 8 Heritage Square Heard 9 (Late 1800s) Orpheum Building (1920) Renaissance Lofts Hotel (1931) 6 12 Phoenix Convention Center 15 10 ADAMS Orpheum Hanny’s Theatre (1947) 11 5 (1929) Arizona 4 Science Center City Hall 16 WASHINGTON CityScape WASHINGTON Historic City Hall 1 (1929) Start 5th ST 3 CityScape Here JEFFERSON Luhrs Tower Luhrs Building (1929) (1924) 2 Talking Stick End Resort Arena 18 Here JEFFERSON 17 Chase Field MADISON 7th ST JACKSON VE VE A A 4th ST 3rd 1st AVE CENTRAL AVE 3nd ST 2nd 1st ST 2nd ST 1. CityScape Phoenix (2008) 6. Orpheum Lofts (1931) 11. Hanny’s (1947) 15. Heritage Square Shopping, dining and Historic oce building, Former department store, (Late 1800s) entertainment now urban lofts now a bar and restaurant Rosson House Museum, 2. Luhrs Building & Tower (1920s) 7. Hotel San Carlos (1928) 12. Phoenix Convention built in 1895 Represents Beaux-Arts and Historic hotel with ground- Center (2008) 16. Arizona Science Art Deco architecture floor bars and restaurants Site of the original 1972 Center (1997) 3. Maricopa County Courthouse/ 8. -

1988 Tour of North America

1988 TOUR OF NORTH AMERICA Interstate 88 Tour, part 1: Summer Tour of North America. JUNE 7 Concord, California Concord Pavilion 9 Sacramento, California Cal Expo Amphitheatre 10 Berkeley, California Greek Theatre, University Of California 11 Mountain View, California Shoreline Amphitheatre 13 Salt Lake City, Utah Park West, Park City 15 Denver, Colorado Fiddler's Green Amphitheatre 17 St Louis, Missouri The Muny, Forest Park 18 East Troy, Wisconsin Alpine Valley Music Theatre 21 Cuyahoga Falls, Ohio Blossom Music Center 22 Cincinnati, Ohio Riverbend Music Center 24 Holmdel, New Jersey Garden State Performing Arts Center 25 Holmdel, New Jersey Garden State Performing Arts Center 26 Saratoga Springs, New York Saratoga Performing Arts Center 28 Canandaigua, New York Finger Lakes Performing Arts Center 30 Wantagh, New York Jones Beach Theater, Jones Beach State Park JULY 1 Wantagh, New York Jones Beach Theater, Jones Beach State Park 2 Mansfield, Massachussetts Great Woods Performing Arts Center 3 Old Orchard Beach, Maine Old Orchard Beach Ballpark 6 Philadelphia, Pennsylvania Frederick Mann Music Center 8 Montreal, Quebec, Canada Forum de Montréal 9 Ottawa, Ontario, Canada Ottawa Civic Centre Arena 11 Hamilton, Ontario, Canada Copps Coliseum 13 Charlevoix, Michigan Castle Fares Music Theatre 14 Chicago, Illinois Poplar Creek Music Theatre, Hoffman Estates 15 Indianapolis, Indiana Indiana State Fairground Grandstand 17 Rochester, Michigan Meadowbrook Music Theatre, Oakland University 18 Rochester, Michigan Meadowbrook Music Theatre, Oakland -

Live Entertainment

Live Entertainment This pack has been designed to provide information on setting up a business in the Live Entertainment industry in Scotland, as well as helping to inform the market research section of your business plan. You can find more information on how to write a business plan from the Business Gateway website (www.bgateway.com/businessplan), including an interactive template and tips to get you started. This market report was updated by Business Gateway in June 2018. If you find the information contained in this document useful, tell us about it! Send us feedback here; we will use your comments to help improve our service. What do I need to know about the Live Entertainment market? The following summary statistics have been taken from market research reports and reliable resources that the Information Service uses to compile industry information. They should give you an indication of how your industry is faring at present and whether there is demand for your type of business: ♦ The live music industry is performing extremely well with more than 32 million people attending a music festival or concert in 2016, a 12% rise on 2015. There has been an increase in the number of live events and overseas visitors. Nearly 1 million music tourists from overseas attended a live event in the UK in 2016, up by 20% on 2015 figures. These factors are set to push the music concert and festivals market to an estimated value of £2.202 million in 2017. UK consumers are attending more music festivals than in 2016. Some 24% attended this type of event in 2017 compared to 21% in the previous year. -

Open'er Festival

SHORTLISTED NOMINEES FOR THE EUROPEAN FESTIVAL AWARDS 2019 UNVEILED GET YOUR TICKET NOW With the 11th edition of the European Festival Awards set to take place on January 15th in Groningen, The Netherlands, we’re announcing the shortlists for 14 of the ceremony’s categories. Over 350’000 votes have been cast for the 2019 European Festival Awards in the main public categories. We’d like to extend a huge thank you to all of those who applied, voted, and otherwise participated in the Awards this year. Tickets for the Award Ceremony at De Oosterpoort in Groningen, The Netherlands are already going fast. There are two different ticket options: Premium tickets are priced at €100, and include: • Access to the cocktail hour with drinks from 06.00pm – 06.45pm • Three-course sit down Dinner with drinks at 07.00pm – 09.00pm • A seat at a table at the EFA awards show at 09.30pm – 11.15pm • Access to the after-show party at 00.00am – 02.00am – Venue TBD Tribune tickets are priced at €30 and include access to the EFA awards show at 09.30pm – 11.15pm (no meal or extras included). Buy Tickets Now without further ado, here are the shortlists: The Brand Activation Award Presented by: EMAC Lowlands (The Netherlands) & Rabobank (Brasserie 2050) Open’er Festival (Poland) & Netflix (Stranger Things) Øya Festivalen (Norway) & Fortum (The Green Rider) Sziget Festival (Hungary) & IBIS (IBIS Music) Untold (Romania) & KFC (Haunted Camping) We Love Green (France) & Back Market (Back Market x We Love Green Circular) European Festival Awards, c/o YOUROPE, Heiligkreuzstr. -

View Annual Report

Full Year 2013 Results - Record Performance • Concert Attendance Up 19% - Total Ticketmaster 400 Million Fans Delivering Over $17 Billion GTV • 900 Million Fans Visit Ticketmaster, Creating User Database of 250 Million Fan Preferences • Revenue Up 11% to $6.5 Billion • AOI Increased 10% to $505 Million • Moved to Profitability in Operating Income off $140 Million • Reported Net Income Improved by $120 Million TO OUR STOCKHOLDERS: 2013 Results We had a record year in 2013 and are well positioned for continued growth in 2014 and beyond. During 2013, we further grew our unmatched concerts global fan base by 10 million fans, attracting almost 60 million fans to our concerts. This tremendous growth fueled our sponsorship and ticketing businesses with Ticketmaster managing nearly 4400 million total tickets in 2013. Combined, we delivered a record year for revenue, AOI and free cash flow. Our results demonstrate the effectiveness of our business model, establishing Live Nation as what we believe to be the number one player in each of our businesses, with concerts driving our flywheel, which is then monetized across our high margin on-site, sponsorship and ticketing businesses. Strong Fan Demand for Live Events We continue to see the tremendous power of live events, with strong global consumer demand. Research shows that live events are a high priority for discretionary spending, and over 80% of our fans surveyed indicate that they plan on attending the same or more events in 2014 as in 2013. Another sign of the strength of our business is that 85% of Live Nation’s fan growth came organically, from our promoting more shows in amphitheaters, arenas and stadiums; from launching new festivals; and from establishing operatioons in new markets. -

Current Bicycle Friendly Businesses Through Fall 2016

Current Bicycle Friendly Businesses through Fall 2016 Current Award BFB Number of Business Name Level Since Type of Business Employees City State PLATINUM Platinum 1 California - Platinum Platinum CA University of California, Davis Platinum 2013 Education 20,041 Davis CA Facebook Platinum 2012 Professional Services 5,289 Menlo Park CA Ground Control Systems (previously listed as Park a Bike) Platinum 2014 Manufacturing/Research 14 Sacramento CA Bici Centro/Santa Barbara Bicycle Coalition Platinum 2014 Non-Profit 6 Santa Barbara CA SONOS INC Platinum 2015 Telecommunications & Media 389 Santa Barbara CA Santa Monica Bike Center Platinum 2012 Bicycle Shop 11 Santa Monica CA Colorado - Platinum Platinum CO City of Fort Collins Platinum 2011 Government Agency 551 Fort Collins CO New Belgium Brewing Company Platinum 2009 Hospitality/Food/Retail 410 Fort Collins CO District of Columbia - Platinum Platinum Washington Area Bicyclist Association Platinum 2014 Non-Profit 18 Washington DC Idaho - Platinum Platinum ID Boise Bicycle Project Platinum 2011 Bicycle Shop 12 Boise ID Illinois - Platinum Platinum IL The Burke Group Platinum 2010 Professional Services 168 Rosemont IL Indiana - Platinum Platinum IN Bicycle Garage Indy Downtown Platinum 2016 Bicycle Shop 5 Indianapolis IN Massachusetts - Platinum Platinum MA Urban Adventours Platinum 2008 Hospitality/Food/Retail 25 Boston MA Landry's Bicycles Platinum 2008 Bicycle Shop 24 Natick MA Minnesota - Platinum Platinum MN Quality Bicycle Products Platinum 2008 Bicycle Industry 450 Bloomington MN Target -

Culturalupdate

CONCIERGE UNLIMITED INTERNATIONAL March 2014 culturalupdate Volume XXIV—Issue III Arts/Museums March is the Month to Celebrate! opens Are you hosting a Mardi Gras party, want something exciting in your 1 Dayanita Singh Art Institute office for St. Patrick’s Day, having a March Madness pool and need a 14 Carlos Barberena Prospectus Art Gallery spectacular prize? Let CUI assist with your celebration requests! through ♦ Authentic King’s Cakes ♦Special Event Catering ♦Sports Tickets 2 The Surrealists Philadelphia, PA ♦Delicious Desserts ♦Destination Accomodations ♦And More! 9 Ed Clark Art Institute 9 The Way of the Shovel MCA 20 Hiroshige’s Winter Scenes Art Institute New/News 23 Outside the Lines Houston, TX Chef’s Burger Bistro (164 East Grand Avenue), from 30 The Long Road to Mazatlan Art Institute 30 John Ronan’s Poetry Foundation Art Institute Master Chef, Edward Leonard and Benny Siddu, the owner 4/27 London’s Lost Jewels Museum of London of Chicago staples such as Volare and Benny’s Chophouse, 4/15 Harris Bank Chicago: Lilli Carré MCA comes “a common thing done in an uncommon way!” 5/18 Christopher Williams: The Art Institute Previously where Boston Blackie’s resided, you will now find hand-crafted Production Line of Happiness burgers along with home-made buns. It’s not just about the burger 5/4 Treasures of the Walt Disney Archives MSI though, selections such as lamb tacos and deviled eggs are on the menu ongoing too. This type of innovative menu makes Chef’s Burger Bistro not just Chicago: Crossroads of America Chicago History Museum another burger joint. -

Qurrat Ann Kadwani: Still Calling Her Q!

1 More Next Blog» Create Blog Sign In InfiniteBody art and creative consciousness by Eva Yaa Asantewaa Tuesday, May 6, 2014 Your Host Qurrat Ann Kadwani: Still calling her Q! Eva Yaa Asantewaa Follow View my complete profile My Pages Home About Eva Yaa Asantewaa Getting to know Eva (interview) Qurrat Ann Kadwani Eva's Tarot site (photo Bolti Studios) Interview on Tarot Talk Contact Eva Name Email * Message * Send Contribute to InfiniteBody Subscribe to IB's feed Click to subscribe to InfiniteBody RSS Get InfiniteBody by Email Talented and personable Qurrat Ann Kadwani (whose solo show, They Call Me Q!, I wrote about Email address... Submit here) is back and, I hope, every bit as "wicked smart and genuinely funny" as I observed back in September. Now she's bringing the show to the Off Broadway St. Luke's Theatre , May 19-June 4, Mondays at 7pm and Wednesdays at 8pm. THEY CALL ME Q is the story of an Indian girl growing up in the Boogie Down Bronx who gracefully seeks balance between the cultural pressures brought forth by her traditional InfiniteBody Archive parents and wanting acceptance into her new culture. Along the journey, Qurrat Ann Kadwani transforms into 13 characters that have shaped her life including her parents, ► 2015 (222) Caucasian teachers, Puerto Rican classmates, and African-American friends. Laden with ▼ 2014 (648) heart and abundant humor, THEY CALL ME Q speaks to the universal search for identity ► December (55) experienced by immigrants of all nationalities. ► November (55) Program, schedule and ticket information ► October (56) ► September (42) St. -

Sponsorship Packages

SPONSORSHIP PACKAGES 6 DECEMBER - TROXY, LONDON WWW.FESTIVALAWARDS.COM Annual Celebration of the UK Festival Industry THE EVENT An awards ceremony that will leave UK festival organisers feeling celebrated, indulged and inspired. A highlight of the UK Festivals Calendar, the UKFA was founded in 2002 and is now celebrating its 15th year. With over 650 festival organisers, music agents and trade suppliers in attendance, the evening brings together the UK Festival scene’s key players for a night of entertainment, networking, street food, innovative cocktails and an exclusive after party – all held at the historic Troxy in London. Recognising the festival industries’ brightest and best, previous award winners include Michael Eavis (Glastonbury Festival), Peter Gabriel (WOMAD), Download Festival, Latitude and TRNSMT. We look forward to celebrating 2018’s triumphs with this year proving to be bigger and better than ever. THE BENEFITS The Awards offer sponsors the opportunity to network with the UK’s leading festival influencers and gain extensive exposure: EXCLUSIVE NETWORKING OPPORTUNITIES With the UK festival industry’s key players in attendance, the Awards offers unparalleled opportunity to network and engage one-on-one with decision makers. POSITION YOUR BRAND IN FRONT OF THE UK’S TOP FESTIVAL ORGANISERS Last year’s shortlisted festivals are the most influential, established and recognisable in the country. The UK’s greatest influencers will be attending the event and sponsors will have the opportunity to showcase products and services to a broad prospect base. UK FESTIVAL AWARDS 2017 SPONSORS & SUPPORTERS SPONSORSHIP OPPORTUNITIES HEADLINE PARTNER SPONSORSHIP Bespoke Sponsor Packages £20,000 If you are looking for a more unique package, contact us for The Headline Partner package is designed to offer your brand details about bespoke sponsorship packages. -

Waste Watch: Nearly $100M of Waste in Illinois State and Local Government

ILLINOIS POLICY INSTITUTE FALL 2018 SPECIAL REPORT GOOD GOVERNMENT Waste Watch: Nearly $100M of waste in Illinois state and local government Additional resources: illinoispolicy.org 190 S. LaSalle St., Suite 1500, Chicago, IL 60603 | 312.346.5700 | 802 S. 2nd St., Springfield, IL 62704 | 217.528.8800 Table of contents PAGE 03 EXECUTIVE SUMMARY PAGE 04 INTRODUCTION PAGE 07 STATE BUDGET: $54 MILLION IN WASTE, $27 MILLION IN PORK PAGE 10 LOCAL GOVERNMENT: $16 MILLION (FISCAL YEARS 2015-2018) PAGE 20 CICERO AND COUNTY GOVERNMENT: DISHONORABLE MENTIONS AND TAXPAYER TRANSPARENCY LAWS PAGE 22 CONCLUSION PAGE 22 APPENDIX A PAGE 23 APPENDIX B Executive summary Illinois taxpayers are fed up and overtaxed. Residents have little faith that their governments are spending their tax dollars well – and for good reason. The state’s most recent spending plan is out of balance by as much as $1.5 billion, and includes $54.2 million in wasteful spending and $27 million in pork-barrel spending. The line between pork and waste is admittedly blurry, but generally speaking, pork-barrel spending refers to special projects lawmakers sneak into the state budget that satisfy interests in their district. These projects may be appropriate to fund under different circum- stances or by different means. Waste, on the other hand, refers to spending that does not serve a legitimate purpose of government. Given that lawmakers made the 1,245-page budget public just hours before voting on it, the amount of both waste and pork may come as a surprise to them as well as to their constituents.