Draft Ballot Analysis Final Draft Packet

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Pipefitters PEC Endorsed Candidates 2020 Federal Races CU Regents

Pipefitters PEC Endorsed Candidates 2020 Federal Races John W. Hickenlooper - US Senator Joe Neguse - US House District 02 Jason Crow - US House District 06 Ed Perlmutter - US House District 07 CU Regents Ilana Spiegel - CU Regent District 06 Colorado State Senate Joann Ginal - State Senate District 14 Sonya Jaquez Lewis - State Senate District 17 Steve Finberg - State Senate District 18 Rachel Zenzinger - State Senate District 19 Jeff Bridges - State Senate District 26 Chris Kolker - State Senate District 27 Janet Buckner - State Senate District 28 Rhonda Fields - State Senate District 29 Colorado State House Susan Lontine - State House District 01 Alec Garnett - State House District 02 Meg Froelich - State House District 03 Serena Gonzales-Gutierrez - State House District 04 Alex Valdez - State House District 05 Dan Himelspach - State House District 6 Leslie Herod - State House District 08 Emily Sirota - State House District 09 Edie Hooton - State House District 10 Karen McCormick - State House District 11 Judy Amabile – State House District 13 Colorado State House – Con’t Chris Kennedy – State House District 23 Monica Duran - State House District 24 Lisa A. Cutter - State House District 25 Brianna Titone - State House District 27 Kerry Tipper - State House District 28 Lindsey N. Daugherty - State House District 29 Dafna Michaelson Jenet - State House District 30 Yadira Caraveo - State House District 31 Matt Gray - State House District 33 Kyle Mullica - State House District 34 Shannon Bird - State House District 35 Mike Weissman - State House District 36 Tom Sullivan - State House District 37 David Ortiz - State House District 38 John Ronquillo – State House District 40 Dominique Jackson - State House District 42 Mary Young - State House District 50 Jeni Arndt - State House District 53 District Attorneys Jake Lilly - District Attorney Judicial District 01 Brian Mason - District Attorney Judicial District 17 Amy L. -

The Arc of Colorado 2019 Legislative Scorecard

The Arc of Colorado 2019 Legislative Scorecard A Letter from Our Executive Director: Dear Members of The Arc Community, Once again, I would like to thank each of you for your part in a successful legislative session. We rely on your expertise in the field. We rely on you for our strength in numbers. For all the ways you contributed this session, we are deeply appreciative. I would like to give a special thanks to those that came and testified on our behalf; Stephanie Garcia, Carol Meredith, Linda Skafflen, Shelby Lowery, Vicki Wray, Rowan Frederiksen, and many others who I may not have mentioned here. This session was a historic one. For the first time in 75 years, one party had control of the house, senate, and governor’s office. Additionally, there were 43 new legislators! We enjoyed a productive year in which The Arc of Colorado monitored 100 bills. Of those that we supported, 92% were signed by the governor and 100% of the bills that we opposed died. This high success rate means that individuals with intellectual and developmental disabilities and their families will have more opportunity to better live, work, learn, and play in their Colorado communities, with increased support. We are excited about many of this year’s outcomes. In a very tight budget year, the Joint Budget Committee was able to free up money for 150 additional slots for the Developmental Disabilities waiver waitlist. After three years of involvement, we finally saw the passing of HB19-1194, which places restrictions on suspensions and expulsions of children from preschool, through to second grade. -

2020 ASAC COLORADO Elections Report

Colorado Election 2020 Results This year, Colorado turned even more blue. President Donald Trump lost to Joe Biden by double-digit margins. Senator Cory Gardner lost to former Governor John Hickenlooper, making all statewide elected officials Democrats for the first time in 84 years. In the only competitive congressional race (3rd), newcomer Lauren Boebert (R) beat former state representative Diane Mitsch Bush (D). In the State House: • Representative Bri Buentello (HD 47) lost her seat to Republican Stephanie Luck • Representative Richard Champion (HD 38) lost his seat to Democrat David Ortiz • Republicans were trying to cut the Democrat majority by 3 seats to narrow the committee make up but ¾ targeted Democrats Reps. Cutter, Sullivan, and Titone held their seats • Democrats will control the House with the same 41-24 margin House Democratic Leadership • Speaker – Rep. Alec Garnett (Denver) unopposed (Rep. Becker term limited) • Majority Leader – Rep. Daneya Esgar (Pueblo) • Assistant Majority Leader – Rep. Serena Gonzales-Gutierrez (Denver • Co-caucus chairs – Rep. Meg Froelich (Denver) and Rep. Lisa Cutter (Jefferson County) • Co-whips – Rep. Kyle Mullica (Northglenn) and Rep. Monica Duran (Wheat Ridge) • The Speaker Pro Tempore will be appointed later. Current Speaker Pro Tem Janet Bucker was elected to the Senate. • Democratic JBC members are appointed in the House and Rep. Esgar’s slot will need to be filled. Rep. McCluskie is the other current Democratic member. House Republican Leadership • Minority Leader – Hugh McKean (Loveland) -

Elections Report PROTECTING COLORADO’S ENVIRONMENT

2018 Elections Report PROTECTING COLORADO’S ENVIRONMENT 2018 ELECTIONS REPORT Conservation Colorado 1 A MESSAGE FROM THE Executive Director A PRO-CONSERVATION GOVERNOR For Colorado Dear friend of Polis ran — and won — on a pro-conservation Colorado, vision for Colorado’s future: addressing climate We did it! Conservation change, growing our clean energy economy, Colorado invested and protecting our public lands. more money, time, and effort in this year’s elections than we ever have before, and it paid off. With your support, we helped pro-conservation candidates win their races for governor, attorney general, and majorities in the state House and Senate, meaning we are set up to pass bold policies to protect our air, land, water, and communities. This year’s election marks progress for many reasons. More than 100 women were elected to the U.S. House for the first time in history, including the OUR STAFF WITH JARED POLIS IN GRAND JUNCTION POLIS ADDRESSING VOLUNTEER CANVASSERS first-ever Native American and Muslim women. To help elect Jared Polis, and Senate. We need these pro- Governor-elect Polis and We made some history here in Conservation Colorado and conservation leaders to act with countless state legislators ran Colorado, too. Joe Neguse will be its affiliated Political Action urgency to address the greatest on a commitment to clean our state’s first African American Committees (PACs) spent more threat we’re facing: climate energy. That’s because they representative in Congress, and than $2.6 million and knocked change. know Colorado has always Jared Polis is the first openly gay more than 500,000 doors. -

Bolderboulder 10K Results

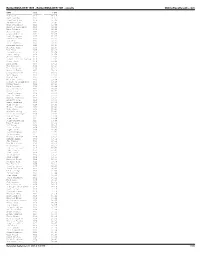

BolderBOULDER 1986 - BolderBOULDER 10K - results OnlineRaceResults.com NAME DIV TIME ---------------------- ------- ----------- Jon Luff M18 31:14 Jeff Sanchez M20 31:23 Jonathan Hume M18 31:58 Ed Ostrovich M27 32:04 Mark Stromberg M21 32:09 Michael Velasquez M16 32:21 Rick Renfrom M32 32:22 James Ysebaert M22 32:24 Louis Anderson M32 32:25 Joel Thompson M27 32:27 Kevin Collins M31 32:34 Rob Welo M22 32:42 Bill Lawrance M31 32:44 Richard Bishop M28 32:45 Chester Carl M33 32:47 Bob Fink M29 32:51 David Couture M18 32:54 Brent Terry M24 32:58 Chris Nelson M16 33:02 Robert III Hillgrove M18 33:05 Steve Smith M16 33:08 Rick Katz M37 33:11 Tom Donohoue M30 33:14 Dale Garland M28 33:17 Michael Tobin M22 33:18 Craig Marshall M28 33:20 Mark Weeks M34 33:21 Sam Wolfe M27 33:23 William Levine M25 33:26 Robert Jr Dominguez M30 33:26 David Teague M32 33:28 Alex Accetta M16 33:29 Dave Dreikosen M32 33:31 Peter Boes M22 33:32 Daniel Bieser M24 33:32 Matt Strand M18 33:33 George Frushour M23 33:34 Everett Bear M16 33:35 Bruce Pulford M31 33:36 Jeff Stein M26 33:40 Thomas Teschner M22 33:42 Mike Chase M28 33:43 Michael Junig M21 33:43 Parrick Carrigan M26 33:44 Jay Kirksey M30 33:46 Todd Moore M22 33:49 Jerry Duckworth M24 33:49 Rick Reimer M37 33:50 RaY Keogh M28 33:50 Dave Dooley M39 33:50 Roger Innes M26 33:50 David Chipman M22 33:51 Brian Boehm M17 33:51 Michael Dunlap M29 33:51 Arthur Mizzi M30 33:52 Jim Tanner M18 33:52 Bob Hillgrove M41 33:52 Ramon Duran M18 33:52 Ken Jr. -

General Assembly State of Colorado Denver

General Assembly State of Colorado Denver August 14, 2020 Colorado Oil & Gas Conservation Commission 1120 Lincoln St #801 Denver, CO 80203 Via email: [email protected] Nearly a decade in the making, the Colorado legislature passed Senate Bill 19-181 last year, charging the Colorado Oil and Gas Conservation Commission (COGCC) “shall regulate oil and gas operations in a manner to protect and minimize adverse impacts to public health, safety, and welfare, the environment, and wildlife resources and shall protect against adverse impacts on any air, water, soil, or biological resources resulting from oil and gas operations.” This historic bill shifted our state focus to better prioritize health and safety as we also regulate this important industry. SB19-181 also made a significant change to the agency itself shifting the COGCC to full time members who can focus on these key issues. In the coming months, we know that your hard work will be key to implementing the legislative vision of this law. Your presence on this commission is intended to ensure fulfillment of the agency’s new mission. Truly, our constituents and local economies are relying on you, in this role, to help improve their overall wellbeing. This is no small task, which is why your expertise and willingness to join this effort makes us proud. We appreciate your support improving protections for public health, safety, and the environment. Due to the previous mission, COGCC commissioners and staff were often drawn between competing interests, often in conflict. This led to permits granted for oil and gas facilities that were not protective of public health, safety, welfare, the environment and wildlife. -

S/L Sign on Letter Re: Rescue Plan State/Local

February 17, 2021 U.S. House of Representatives Washington, D.C. 20515 U.S. Senate Washington, D.C. 20510 Dear Members of Congress: As elected leaders representing communities across our nation, we are writing to urge you to take immediate action on comprehensive coronavirus relief legislation, including desperately needed funding for states, counties, cities, and schools, and an increase in states’ federal medical assistance percentage (FMAP). President Biden’s ambitious $1.9 trillion American Rescue Plan will go a long way towards alleviating the significant financial strain COVID-19 has placed on our states, counties, cities, and schools, and the pocketbooks of working families. Working people have been on the frontlines of this pandemic for nearly a year and have continued to do their jobs during this difficult time. Dedicated public servants are still leaving their homes to ensure Americans continue to receive the essential services they rely upon: teachers and education workers are doing their best to provide quality education and keep their students safe, janitors are still keeping parks and public buildings clean, while healthcare providers are continuing to care for the sick. Meanwhile, it has been ten months since Congress passed the CARES Act Coronavirus Relief Fund to support these frontline workers and the essential services they provide. Without significant economic assistance from the federal government, many of these currently-middle class working families are at risk of falling into poverty through no fault of their own. It is a painful irony that while many have rightly called these essential workers heroes, our country has failed to truly respect them with a promise to protect them and pay them throughout the crisis. -

Colorado Campaign Contributions Final

Colorado Campaign Contributions Percentage of out-of-state contributions Sources: FEC.gov, sos.state.co.us Race Candidate Party Party Colorado Attorney General George Brauchler Republican 3.6% Democrat Phil Weiser Democrat 12.6% Republican Colorado Governor Jared Polis Democrat 9.5% Unaffiliated Walker Stapleton Republican 24.1% Colorado Secretary of State Jena Griswold Democrat 12.5% Wayne Williams Republican 1.2% Colorado State House District 1 Alysia Padilla Republican 0.0% Susan Lontine Democrat 5.6% Colorado State House District 2 Alec Garnett Democrat 21.2% Colorado State House District 3 Jeff Bridges Democrat 11.2% Toren Mushovic Republican 23.4% Colorado State House District 4 Robert John Republican 0.0% Serena Gonzales-Gutierrez Democrat 2.9% Colorado State House District 5 Alex Valdez Democrat 14.7% Katherine Whitney Republican 25.9% Colorado State House District 6 Chris Hansen Democrat 10.8% Colorado State House District 7 James Coleman Democrat 12.9% Jay Kucera Republican 0.0% Colorado State House District 8 Leslie Herod Democrat 42.2% Colorado State House District 9 Bob Lane Republican Emily Sirota Democrat 67.6% Colorado State House District 10 Edie Hooton Democrat 0.0% Murl Hendrickson Republican 28.6% Colorado State House District 11 Brian Donahue Republican 0.0% Jonathan Singer Democrat 5.5% Colorado State House District 12 David Ross Republican 0.0% Sonya Lewis Democrat 11.3% Colorado State House District 13 KC Becker Democrat 8.6% Kevin Sipple Republican 0.0% Colorado State House District 14 Paul Haddick Democrat 0.0% Shane -

1,011 Candidates and Elected Officials from All 50 States Have Signed the Pledge to Achieve America's Goals. Sign the Pledg

9/14/2020 Pledge — Future Now Start a Giving Circle Policy Work Donate About 1,011 candidates and elected officials from all 50 states have signed the Pledge to Achieve America’s Goals. Sign the pledge ↓ Rep. Kim Abbott MT House Elizabeth Alcorn VA House Rep. Jeramey Anderson MS District 83 District 58 House District 110 Rep. Chris Abernathy ID House Rep. Kelly Alexander NC House Rep. Marti Anderson IA House District 29A District 107 District 36 Rep. Gale Adcock NC House Rep. Terry Alexander SC House Rep. Richard Andrade AZ District 41 District 59 House District 29 Rep. John Ager* NC House Jenn Alford-Teaster NH Senate Anton Andrew PA House District 115 District 8 District 160 Sen. Irene Aguilar* CO Senate Sen. Denise Harper Angel KY Christian Andrews IA House District 32 Senate District 35 District 95 Del. Lashrecse Aird* VA House Rep. Richard Ames* NH House Joey Andrews MI House District District 63 Cheshire 9 79 Sen. Raumesh Akbari TN Rep. Carol Ammons IL House Naomi Andrews NH House Senate District 29 District 103 Rockingham 5 Rep. James Albis* CT House Rep. Mike Amyx KS House Senah Andrews NC House District 99 District 45 District 83 https://givingcircles.futurenow.org/pledge 1/18 9/14/2020 Pledge — Future Now Barb Anness MI House District Rep. Christy Bartlett NH House Rep. Barbara Bessette MT Start 4a5 Giving Circle Policy Work Merrimack 19 House District 24 Donate About Rep. Sarah Anthony MI House Rep. Sydney Batch NC House Sen. Alessandra Biaggi NY District 68 District 37 Senate District 34 Rep. -

State Election Results, 2005

Official Publication of the Abstract of Votes Cast for the 2005 Coordinated 2006 Primary 2006 General To the Citizens of Colorado: The information in this abstract is compiled from material filed by each of Colorado’s sixty- four County Clerk and Recorders. This publication is a valuable tool in the study of voting patterns of Colorado voters during the 2005 Coordinated, 2006 Primary, and 2006 General Election. As the State’s chief election officer, I encourage the Citizens of Colorado to take an active role in our democratic process by exercising their right to vote. Mike Coffman Colorado Secretary of State Table of Contents GLOSSARY OF ABSTRACT TERMS .............................................................................................. 4 DISCLAIMER ......................................................................................................................... 6 DIRECTORY .......................................................................................................................... 7 United States Senators .........................................................................................................................7 Congressional Members .......................................................................................................................7 Governor ..........................................................................................................................................7 Lieutenant Governor ...........................................................................................................................7 -

2021 Legislative Session in Review Rocky Mountain Partnership

2021 Legislative Session In Review Rocky Mountain Partnership The 2021 Colorado Legislative Session ended on Tuesday, June 15 with over 670 bills introduced. It will certainly go down as one of the most consequential sessions in recent memory, as Democrats — who are in their third year in the state house majority — changed everything from the tax code to the criminal justice system and the state’s transportation funding mechanism. Looking to next year, January 12, 2022, has been set as the convening date for the Second Regular Session of the 73rd Colorado General Assembly. In 2021, Rocky Mountain Partnership actively participated in the 2021 legislative session for the first time. Below, you’ll find a few quick takeaways on the work of the Policy & Legislative Advisory Network and the Rocky Mountain Partnership over the last six months. Want more information about the Policy & Legislative Advisory Network and who is involved? Click HERE to learn more. Questions? Reach out to Senior Director of Policy & Advocacy Kayah Swanson HERE. All 9 Bills Supported by RMP Passed During the 2021 Colorado Legislative Session, the Policy & Legislative Advisory Network identified nine bills in line with the Partnership's policy priorities for formal endorsement by the Partnership. All nine of the bills supported by the Partnership passed! RMPartnership.org Page 1 of 4 Presented Priorities to 8 Regional Lawmakers One of the goals for this year was to build out relationships with the legislative delegation in the geographic footprint of the Partnership. The Backbone Team held introductory calls with eight different state legislators, where they were onboarded to the work of the Partnership and the policy priorities established for 2021. -

LEGISLATIVE WRAP-UP Colorado’S 2012 Legislative Session: the Colorado Coalition Against Domestic Violence Achieves Its Policy Priorities

LEGISLATIVE WRAP-UP Colorado’s 2012 Legislative Session: The Colorado Coalition Against Domestic Violence Achieves Its Policy Priorities Colorado’s 69th General Assembly wrapped up the 2012 legislative session May 9th; then, they found themselves ordered into a special session by Governor Hickenlooper to finish their busi- ness in a more democratic manner because House leadership had allowed the clock run out on the Civil Unions Bill and some 30 other bills caught up in line behind it. One of the bills which the Colorado Coalition Against Domestic Violence invested a significant amount of time and energy on, the School Discipline Bill (Senate Bill 46), nearly failed along with the Civil Unions legislation, but was rescued during the special session by being added onto another related bill. The School Discipline Bill is one of many successful policy efforts, which CCADV accom- plished on behalf of our members and survivors this year. Other 2012 legislative priorities for the Colorado Coalition Against Domestic Violence include Senate Bill 56, which we contributed several provisions to and provided input on other provisions which Senator Morgan Carroll brought forward. Senate Bill 56 addresses aspects of various court appointed roles in domestic relations cases and requires persons in those roles to make disclosures if they have any per- sonal, financial, or familial relationships that would create a conflict of interest with regard to the parties in the case to which they were appointed or with the court. Both of these senate bills passed and have been signed into law by the Governor! CCADV also worked diligently to support, oppose, and amend dozens of other pieces of legisla- tion this past session.