Keeping the Dream Alive AMP

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

NOTICE of HEARING -STAGE 2- Chapter 14 – Residential (Part) (Including All Relevant Definitions and Planning Maps)

NOTICE OF HEARING -STAGE 2- Chapter 14 – Residential (Part) (Including all relevant definitions and planning maps) Venue: Christchurch Replacement District Plan Hearings Venue 348 Manchester Street, Christchurch Date: Monday 7 September – Friday 18 September 2015 Time: From 10am daily This notice serves to notify submitters to Chapter 14 Residential (Part) of the Hearing on this matter. In order for the Secretariat to prepare an Indicative Hearing Schedule, submitters who indicated in their submission that they wish to be heard are required to RSVP to the Secretariat ([email protected]) by 1pm, Monday 31 August 2015 with the following information: 1. Submitter number and name (please note that Stage 1 numbers no longer apply). 2. Whether the submitter wishes to speak to their submission at the Hearing. 3. Whether the submitter has legal representation and if so, their lawyer’s name. 4. Whether the submitter is calling any expert evidence, the expert’s name and confirmation that the expert is available to be cross-examined. Note 1: If you do not wish to come to this Hearing and speak, or have anyone speak for you please advise the Secretariat. However your submission will still be considered by the Panel when they deliberate. Note 2: If you supply further evidence or statements the person who has signed the document will be expected to attend the Hearing and be available to answer questions. If you file the document and do not wish to appear, you must file a memorandum to the Hearings Panel seeking leave to be excused from attending. The Secretariat will pre-circulate the Indicative Hearing Schedule by email setting out times for parties to attend. -

Mauri Monitoring Framework. Pilot Study on the Papanui Stream

Te Hā o Te Wai Māreparepa “The Breath of the Rippling Waters” Mauri Monitoring Framework Pilot Study on the Papanui Stream Report Prepared for the Hawke’s Bay Regional Council Research Team Members Brian Gregory Dr Benita Wakefield Garth Harmsworth Marge Hape HBRC Report No. SD 15-03 Joanne Heperi HBRC Plan No. 4729 2 March 2015 (i) Ngā Mihi Toi tü te Marae a Tane, toi tü te Marae a Tangaroa, toi tü te iwi If you preserve the integrity of the land (the realm of Tane), and the sea (the realm of Tangaroa), you will preserve the people as well Ka mihi rā ki ngā marae, ki ngā hapū o Tamatea whānui, e manaaki ana i a Papatūānuku, e tiaki ana i ngā taonga a ō tātau hapu, ō tātau iwi. Ka mihi rā ki ngā mate huhua i roro i te pō. Kei ngā tūpuna, moe mai rā, moe mai rā, moe mai rā. Ki te hunga, nā rātau tēnei rīpoata. Ki ngā kairangahau, ka mihi rā ki a koutou eū mārika nei ki tēnei kaupapa. Tena koutou. Ko te tūmanako, ka ora nei, ka whai kaha ngāwhakatipuranga kei te heke mai, ki te whakatutuki i ngā wawata o kui o koro mā,arā, ka tū rātau hei rangatira mō tēnei whenua. Tena koutou, tena koutou, tena koutou katoa Thanks to the many Marae, hapū, from the district of Tamatea for their involvement and concerns about the environment and taonga that is very precious to their iwi and hapū. Also acknowledge those tūpuna that have gone before us. -

Christchurch Street Names: I - K

Christchurch Street Names: I - K Current name Former Origin of name Suburb Additional information See Source Further information name Ian Place Bishopdale First appears in street directories in 1976. Ibsley Lane Probably named Bexley First appears in street after Ibsley in directories in 1977. Hampshire. Ida Street New Brighton The formation of Ida “New Brighton”, Street was discussed by The Press, 16 the New Brighton March 1915, p 3 Borough Council in 1915. First appears in street directories in 1920. Idaho Place Named after Burwood In a subdivision where Michigan Place, Idaho, a state in all the streets were given Oregon Place, Seneca the Pacific American placenames. Place, Tucson Place, Utah Place, Wichita northwest region First appears in street Place and of the USA. directories in 1981. Yellowstone Crescent. © Christchurch City Libraries February 2016 Page 1 of 122 Christchurch Street Names: I - K Current name Former Origin of name Suburb Additional information See Source Further information name Idris Road Hackett’s Named after Bryndwr, Continues the Welsh Bryndwr, Glandovey Fendall’s legacy: a Road was Cader Idris, a Fendalton, theme of street names in Road, Jeffreys Road history of Fendalton incorporated mountain in Strowan. Bryndwr. and other Welsh and north-west names in the into Idris Wales. Idris Road is first Christchurch, p 77 Road. Fendalton/Bryndwr The section from mentioned in The Press “Riccarton”, The area. Blighs Road to in 1882 when land in the Press, 7 September Wairarapa Road vicinity is advertised for 1871, p 3 (later Wairakei sale. “Advertisements”, Road) was First appears in street The Press, 14 July formerly directories in 1894, 1882, p 4 Hackett’s Road. -

Before the Christchurch Replacement District Plan Hearings Panel

BEFORE THE CHRISTCHURCH REPLACEMENT DISTRICT PLAN HEARINGS PANEL IN THE MATTER of the Resource Management Act 1991 and the Canterbury Earthquake (Christchurch Replacement District Plan) Order 2014 AND IN THE MATTER of the Subdivision, Development and Earthworks Proposal (Part) Hearing (Stage 2) MEMORANDUM OF COUNSEL ON BEHALF OF CHRISTCHURCH CITY COUNCIL REGARDING INTENDED RESPONSE TO PANEL'S MINUTE DATED 9 JUNE 2016 AND SEEKING AN EXTENSION OF TIME ALSO RELEVANT TO THE RESIDENTIAL NEW NEIGHBOURHOOD PROPOSAL 14 June 2016 Barristers & Solicitors Simpson Grierson M G Conway / C J McCallum Telephone: +64-3-968 4030 Facsimile: +64-3-379 5023 Email: [email protected] PO Box 874 SOLICITORS CHRISTCHURCH 8140 27941139_1.docx 0 MAY IT PLEASE THE PANEL: 1. INTRODUCTION 1.1 This memorandum of counsel is filed on behalf of the Christchurch City Council (Council) in relation to the Stage 2 Chapter 8: Subdivision, Development and Earthworks Proposal (Part) (Proposal). The purpose of this memorandum is to clarify what the Council intends to provide in response to the Minute of the Independent Hearings Panel (Panel), dated 9 June 2016 (Minute). In addition, this memorandum seeks an extension of time to provide that response to the Panel. 2. INTEGRATED CHAPTER 8 2.1 In the Minute, the Panel commented that it would be of assistance if the Council provided a further update of its integrated Residential New Neighbourhood (RNN) provisions in a way that shows how its Subdivision Stage 2 provisions would integrate and accord with the drafting style of those in Decision 13. At paragraph [4] of the Minute, the Panel directed that by 4pm Friday 17 June 2016 the Council is to file an update of its integrated RNN provisions incorporating as a comprehensive set of provisions: (a) the Chapter 13 provisions (greyed out); (b) the integrated RNN provisions, using colour tracking; and (c) the Council's proposed Subdivision Stage 2 provisions, using different colour tracking. -

Copyrighted Material

index 481 COPYRIGHTED MATERIAL > The gannet colony at Cape Kidnappers is the largest and most accessible in the world. 220_9780470894576-bindex.indd0_9780470894576-bindex.indd 481481 111/4/111/4/11 33:26:26 PMPM 482 Index Appellation Central Wine Tours hotels, 78–83 (Queenstown), 29 nightlife & entertainment, 84–87 A Aquariums practical information, 87 Abel Tasman Kayaks, 319 Mapua, 300 restaurants, 70–77 Abel Tasman Mountain Biking, 316 Napier, 198, 220 shopping, 40, 62–69 Abel Tasman National Park, 4, 6, Otago Peninsula, 411, 414 visitor information, 20, 87 24–25, 296, 319 Aramoana Summit, 240 with children, 48–51 Abel Tasman Wilson’s Experiences, Archives New Zealand (Wellington), Auckland Art Gallery, 14, 46–47, 52 24–25, 318 268 Auckland art walk, 14, 54, 55 Absolute Tours (Auckland), 47 Arlidge Adventures Dive Center Auckland Bridge Climb and Bungy, 45 Academy Galleries (Wellington), (Napier), 216 Auckland Central City Library, 54 266–68 Arrowtown, 3, 15, 374 Auckland Domain, 41, 56 AC Baths (Taupo), 179 Architecture Auckland Explorer Bus, 44 Accommodations, 8–9, 474–76. Auckland, 52–59 Auckland i-SITE Visitor Centre, 20 See also Where to Stay sections Christchurch, 341 Auckland Multipass, 50 best, 8 Napier, 29, 196, 200, 201, 208 Auckland Museum, 5, 22, 34, 41, Ackers Point, 434 Wellington, 261 42–44, 48, 56 Agrodome and Agroventures Art, 230, 236–37, 270–71. See also Auckland Town Hall, 54, 87 (Rotorua), 22, 162, 187 art galleries; museums Auckland University District, 58 Ahuriri, 197, 200 Art Deco Trust & Shop (Napier), 201 Auckland Waterfront Sculpture Air Fiordland, 372 Art Deco Walk (Napier), 29, 200, Trail, 271 Airlines, 472. -

The Wrybill Newsletter of the Canterbury Region, Ornithological Society of New Zealand

The Wrybill Newsletter of the Canterbury Region, Ornithological Society of New Zealand Regional representative: Jan Walker 305 Kennedys Bush Road, Christchurch 8025 Ph 03 322 7187. Email: [email protected] January 2010 Droppings from the Regional Rep him anyway. It was richly deserved. The Ashley/Rakahuri Group also won the Wondering where to start, why not the partiest Canterbury/Aoraki Conservation Award for 2009. party of the bird calendar for OSNZ Canterbury? This is of course the Xmas BBQ at Colin and There are some good outings planned for this Cherry’s Fenland House farm. Around 15 folk year, so do come along even if you haven’t done rose to the occasion. Five teams went out so in the past. We are a friendly lot and not at all around the lake before lunch and two later on, competitive, well perhaps a little…… much later on, to mop up the left-overs. Nothing exceptional was seen except 3 Bitterns and a Some excellent evening meetings took place at small colony of nesting Caspian Terns, neither of the end of last year. Sara Kross, studying which are waders, unfortunately. The event Falcons in a Marlborough vineyard, had a continues to be one of Canterbury’s finest, fascinating video record of the birds to show rivaling the Show, Cup Week and an All-Black their lives in detail. She asked for small-bird Test, put together. If that didn’t get you reading experts to help her identify the prey items shown this, I give up. in the film, not that there was much left to see. -

1 BEFORE the INDEPENDENT HEARINGS PANEL UNDER The

BEFORE THE INDEPENDENT HEARINGS PANEL UNDER the Resource Management Act 1991 sand the Canterbury Earthquake (Christchurch Replacement District Plan) Order 2014 AND IN THE MATTER of the Proposed Christchurch Replacement District Plan SUBMITTER Keith Woodford (Submitter #2314) STATEMENT OF EVIDENCE OF Keith Bernard Woodford 16 DECEMBER 2015 Email: [email protected] Mobile 021 2688 343 1 Evidence in relation to the proposed South Halswell Development Submitter: Keith Woodford (#2314) Date: 16 December 2015 1. Basis of Evidence This evidence is presented by me as a person who belongs to the community of interest. My evidence comes primarily from my own historical documentation of seismic and hydrological factors specific to the South Halswell Zone, supported by other published documentary evidence. I am a retired professor and I am now an independent consultant in agri-food systems. I do not claim expert status in relation to either hydrology or geo-technic design. However, I consider myself to be generally informed on scientific matters relating to natural hazards, based on a science-based training, combined with 40 years professional experience across land-based systems in many countries. I have previously written extensively on earthquake related matters, including South Halswell and its special conditions, at my own website (https://keithwoodford.wordpress.com/ and from there click on the ‘Canterbury earthquake’ category). Three of my own website articles that specifically refer to the effects of the September 2010 earthquake and draw -

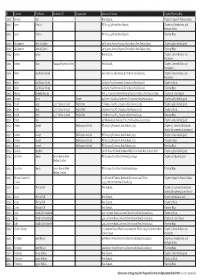

STAGE TWO Submissions List(9Nov)

# Surname First Name On Behalf Of Organisation Address for Service Chapter/Planning Map 2000 Bennett Earl New Zealand, Chapter 21 Specifi c Purpose Zones 2001 Lyons Patricia PO Box 33,Lyttelton,New Zealand, Chapter 10 Designations and Heritage Orders 2001 Lyons Patricia PO Box 33,Lyttelton,New Zealand, Planning Maps 2002 McGammon John & Colleen 49 St James Avenue,Papanui,Christchurch,New Zealand,8053 Chapter 14 Residential (part) 2002 McGammon John & Colleen 49 St James Avenue,Papanui,Christchurch,New Zealand,8053 Planning Maps 2004 Burton James New Zealand, Chapter 6 General Rules and Procedures 2005 Arneric Erion Raropua Property Limited New Zealand, Chapter 6 General Rules and Procedures 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Chapter 6 General Rules and Procedures 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Chapter 17 Rural 2006 Keller Gail Nicola (Nicky) 607 Johns Road,Harewood,Christchurch,New Zealand, Planning Maps 2007 Mundy Reginald George Unit 4, 6 Lonsdale Street,New Brighton,Christchurch,New Zealand,8083 Chapter 18 - Open Space 2008 George Brent Private 64A Dyers Pass Road,Cashmere,Christchurch,New Zealand,8022 Chapter 14 Residential (part) 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New Zealand,2585 Chapter 14 Residential (part) 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New Zealand,2585 Chapter 17 Rural 2009 Smith Greg 477C Yaldhurst Road Poplar West 2 Holdens Road,RD 5,Papakura,New -

Christchurch Place Names: N - Z

Christchurch Place Names: N - Z Current name Former Origin of name Where Additional information See Source Related sources name Naughty Boys’ In 1961 two boys, In the Avon Created in the 1950s Our Environment “Two boys die after Island Frank Raymond River between when a new river Issue 14 Autumn 1998 cave in soft soil Murray, 12 and Evans Avenue channel was dredged in collapses”, The Peter Edward and Kibblewhite the Avon River near Press, 28 April Leary, 13, Street, New Tovey Street at South 1961, p 12 suffocated after a Brighton. New Brighton to ease tunnel they were flooding problems. It is a digging caved in 400m long island, on them. Local accessible only through residents say the ankle deep mud and has name of the island always been a magnet appears to be for adventurous boys. linked to that Boarded up tunnels can tragedy. still be seen on the island. New Brighton The often-quoted story Rainestown "New Brighton", "Brighton's pioneers of the naming of New Lyttelton Times, 13 are recalled", Brighton has five men April 1868, p 2 Christchurch Star- bringing their bullock “O-rua-paeroa”, Star, Sun, 3 October through modern day 8 May 1896, p 2 1949, p 2 Wainoni in 1860, "Imagine... buying crossing the Avon, “New Brighton New Brighton for settling and buying land memories”, Star, 12 February 1895, p 2 ₤300", Pegasus in the area of the park Post, 20 April 1977, adjacent to the Bower “Early New p 12 Hotel site. A plaque in Brighton”, Star, 20 the park commemorates The Borough of © Christchurch City Libraries February 2016 Page 1 of 156 Christchurch Place Names: N - Z Current name Former Origin of name Where Additional information See Source Related sources name their arrival. -

Residential Auction Results for Harcourts Christchurch

RESIDENTIAL AUCTION RESULTS FOR HARCOURTS CHRISTCHURCH AUCTIONS TO 9TH JULY Listing office Suburb Address Type Listing number Auctioneer Auction date Result Amount sold City Cashmere 46 Bengal Drive - CR43577 Phil McGoldrick 3/08/2020 S $800,000 Belfast Belfast 3 Cassidy Place H BF35349 Mark McGoldrick 5/08/2020 S $440,000 Fendalton Fendalton 88c Hinau Street A FE7512 Phil McGoldrick 5/08/2020 PI - Rolleston Ilam 6 Camrose Place H RL2338 Mark McGoldrick 5/08/2020 S 670,000 Hornby Lincoln 2 Lindum Place H HR5469 Mark McGoldrick 5/08/2020 S $475,000 Hornby Prebbleton 252 Trents Road L HR5487 Mark McGoldrick 5/08/2020 PI - Lincoln St Albans 41 Eversleigh Street T LN2726 Mark McGoldrick 5/08/2020 S $740,000 Belfast St Albans 72 Innes Road As Is BF35328 Mark McGoldrick 5/08/2020 S ND Where Is Belfast St Albans 7 Jed Lane As Is BF35357 Mark McGoldrick 5/08/2020 S $495,000 Where Is City Woolston 118 Mackworth Street - CR43534 Roger Dawson 5/08/2020 S $308,000 Papanui Aidanfield 92 McMahon Drive H PI64688 Mark Morrison 6/08/2020 S $690,500 Avonhead Avonhead 15 Wardour Mews - AH5430 Roger Dawson 6/08/2020 S $840,000 Avonhead Avonhead 31 Colina Street - AH5395 Lisa Yardely- 6/08/2020 S $625,000 Vaiese Papanui Bryndwr 14 Brookside Terrace H PI62978 Chris Kennedy 6/08/2020 PI - Papanui Burnside 1 Kingsgate Place H PI64682 Chris Kennedy 6/08/2020 S $445,000 Halswell Burwood 12 Kingsbridge West - FH4964 Ned Allison 6/08/2020 S $575,000 Ferrymead Cashmere 19A Cracroft Terrace - FM5621 Roger Dawson 6/08/2020 S $1,312,500 Commercial Halswell 8/29 Ensign -

2836 Kennedys Bush Rd – Residential

BEFORE THE CHRISTCHURCH REPLACEMENT DISTRICT PLAN HEARINGS PANEL IN THE MATTER of the Resource Management Act 1991 and the Canterbury Earthquake (Christchurch Replacement District Plan) Order 2014 AND IN THE MATTER of the Residential (part) Stage 2 Proposal SUBMITTER Kennedys Bush Road Neighbourhood Association in opposition to Submission 2170 SUBMISSION FS 2836 STATEMENT OF EVIDENCE OF JONATHAN DOUGLAS GILLARD ON BEHALF OF KENNEDYS BUSH ROAD NEIGHBOURHOOD ASSOCIATION 27 August 2015 Jonathan Gillard, c/- Wynn Williams Level 5, Wynn Williams House, 47 Hereford Street, Christchurch Phone 379 7622 Introduction 1 My full name is Jonathan Douglas Gillard. I am a Committee Member of the Kennedys Bush Road Neighbourhood Association. 2 I am a Barrister and Solicitor of the High Court of New Zealand and have been practising law for 28 years. 3 I am giving evidence on behalf of the Kennedys Bush Road Neighbourhood Association in support of its further submission FS 2836 in opposition to Submission 2170 by Rock Hill Limited. Scope of Evidence 4 To demonstrate: (a)that the proposal by Rock Hill Limited contained in submission 2170 to extend the Redmond Spur Residential Hill zone and existing Rock Hill subdivision at the top of Kennedys Bush Road into a rural zone and extend the roading network into the rural zone will result in diminishing both the rural landscape and the outstanding natural landscape features; and (b)That the proposal would encroach on "significant landscape" areas as shown on the Stage 3 maps of the proposed Replacement District Plan. Executive Summary 5 The evidence will show that the proposal would diminish the outstanding natural features and landscapes that have already been identified by the Environment Court and High Court and the operative City Plan as worthy of protection from residential development including any further roading beyond the present contour level of residential development at the top of Kennedys Bush Road. -

Agenda of Council

Christchurch City Council AGENDA Notice of Meeting: An ordinary meeting of the Christchurch City Council will be held on: Date: Thursday 8 April 2021 Time: 9.30am Venue: Council Chambers, Civic Offices, 53 Hereford Street, Christchurch Membership Chairperson Mayor Lianne Dalziel Deputy Chairperson Deputy Mayor Andrew Turner Members Councillor Jimmy Chen Councillor Catherine Chu Councillor Melanie Coker Councillor Pauline Cotter Councillor James Daniels Councillor Mike Davidson Councillor Anne Galloway Councillor James Gough Councillor Yani Johanson Councillor Aaron Keown Councillor Sam MacDonald Councillor Phil Mauger Councillor Jake McLellan Councillor Tim Scandrett Councillor Sara Templeton 1 April 2021 Principal Advisor Dawn Baxendale Chief Executive Tel: 941 6996 Jo Daly Council Secretary 941 8581 [email protected] www.ccc.govt.nz Note: The reports contained within this agenda are for consideration and should not be construed as Council policy unless and until adopted. If you require further information relating to any reports, please contact the person named on the report. Watch Council meetings live on the web: http://councillive.ccc.govt.nz/live-stream Council 08 April 2021 Page 2 Council 08 April 2021 TABLE OF CONTENTS Karakia Timatanga ....................................................................................................... 5 1. Apologies / Ngā Whakapāha .................................................................................. 5 2. Declarations of Interest / Ngā Whakapuaki Aronga .................................................