A Further Dip in Sales/Margins; Cost-Down Pushes out to Late 3Q17

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Android 6.0 Update Overzicht | PHC Tailored Telecom

Android 6.0 update overzicht | PHC tailored telecom Wil je weten wanneer jouw toestel een update krijgt? Kijk dan hieronder naar het overzicht: Inhoud Google ..................................................................................................................................................... 2 Motorola .................................................................................................................................................. 2 Samsung .................................................................................................................................................. 3 LG ............................................................................................................................................................. 4 Sony ......................................................................................................................................................... 5 HTC .......................................................................................................................................................... 6 OnePlus.................................................................................................................................................... 7 Huawei/Honor ......................................................................................................................................... 7 Asus ........................................................................................................................................................ -

Iphone Iphone 4 / 4S Completa –Trasera- Flex- Bateria 50 – 60 – 30 – 25

IPHONE IPHONE 4 / 4S COMPLETA –TRASERA- FLEX- BATERIA 50 – 60 – 30 – 25 IPHONE 5- 5C- 5S- SE COMPLETA –CHASIS- FLEX- BATERIA 60 – 100 – 35 – 35 IPHONE 6 COMPLETA –CHASIS- FLEX- BATERIA 70 – 120 – 35 – 35 IPHONE 6 PLUS / IPHONE 6S COMPLETA –CHASIS- FLEX- BATERIA 80 – 140 – 35 – 35 IPHONE 6S PLUS COMPLETA –CHASIS- FLEX- BATERIA 100 – 150 – 40 – 40 IPHONE 7 COMPLETA –CHASIS- FLEX- BATERIA 110 - 180 - 40 - 40 IPHONE 7 PLUS COMPLETA –CHASIS- FLEX- BATERIA 125 - 200 - 45 - 45 IPHONE 8 COMPLETA –CHASIS- FLEX- BATERIA 135 - 220 - 50 - 50 IPHONE 8 PLUS COMPLETA –CHASIS- FLEX- BATERIA 150 – 250 - 50 - 50 IPHONE X PANTALLA COMPLETA 340 IPAD 2 – 3 - 4, IPAD MINI / MINI 2 TACTIL /COMPLETA/ FLEX/ BATERIA 60/ 100/ 50/ 60 AIPAD AIR TACTIL / COMPLETA/ FLEX/ BATERIA 70 / 150/ 60/ 60 IPAD AIR 2 PANTALLA COMPLETA 280 IPAD MINI 4 PANTALLA COMPLETA 220 IPOD 4G / 5G COMPLETA 50 / 90 S2, S4 MINI, MEGA, J1 2016, J5, J3 (2016), J3 2017, J5 2016, COMPLETA 80 EXPRESS, A3, A5, S3, S3 NEO, S4, J7 2016, ACE 4, J4 PLUS, J6 PLUS, J6, A6 COMPLETA 90 A3 2016, j5 2017, A7 2018 COMPLETA 100 A3 2017, A5 2016, J7, A6 PLUS COMPLETA 110 J7 2017 , ALFA, S5 MINI, A5 2017, S5, S5 NEO, A8 2018 COMPLETA 120 NOTE 3, NOTE 4, S6, S7 COMPLETA 150 S6 EDGE G925, S6 EDGE PLUS G928 COMPLETA 200 S7 EDGE, S8, S8 PLUS COMPLETA 250 NOTE 8, S9, S9 PLUS COMPLETA 275 S9, S9 PLUS, NOTE 9 COMPLETA 295 SERIE CORE, SERIE GRAND, EXPRESS 2, J1, J1 mini y anteriores TACTIL / COMPLETA 40 / 50 GALAXY TAB 10” 2,3,4, A , E, A(2016) T580, T550, T560 TACTIL / COMPLETA 60 / 100 TAB 7” 2,3,4 3 LITE TACTIL / COMPLETA -

Htc Desire Turn Off App Download Htc Desire Turn Off App Download

htc desire turn off app download Htc desire turn off app download. #1 Bootloader S-OFF/Unlock Tool. For Your HTC or Motorola Smartphone! HTC 10, One m9, m8, m7, Droid Turbo, Moto x 2013/2014 and more. Verizon HTC 10, HTC 10 TempRoot and NO WIPE S-OFF now in SunShine 3.4! App not compatible? Try our mail in service for almost ALL HTC Phones (Verizon HTC 10 Nougat too!) unlock Your Phone! Turn your phone into a dev phone. SunShine can turn many consumer devices into developer phones with the click of a few buttons. Unlocking and s-off'ing your phone will allow you to easily root the device, install the latest firmware and custom roms. Unlike the other unlock solutions, including the manufacturer solutions, SunShine does not wipe your data. Making it perfect for data recovery, or rooting without the hassle of setting up your device again. Supported Models. (This list is incomplete, run app tests if unsure)) Droid Turbo (SU44/SU49, and now 6.x!) Moto X 2013 (4.4.3 and Lower) Moto X 2014 (All Variants) Droid Mini/Maxx/Uultra (4.4.3 and Lower) Moto G (4.4.3 and Lower) HTC 10 (All Variants) HTC 10 Lifestyle (All Variants) HTC One M9 (All Variants) HTC One A9 (All Variants) HTC One M8 (All Variants) HTC One M7 (All Variants) HTC One E9 (All Variants) HTC One E9+ (All Variants) HTC One M9+ (All Variants) HTC One M9e (All Variants) HTC One Max (All Variants) HTC One Mini (All Variants) HTC One Mini 2 (All Variants) HTC One Remix (All Variants) HTC Butterfly (All Variants) HTC Butterfly 2 (All Variants) HTC Butterfly 3 (All Variants) HTC J (All Variants) HTC DNA (All Variants) HTC Desire 820 (All Variants) HTC Desire 816x (All Variants) HTC Desire 816 (All Variants) HTC Desire 626s (All Variants) HTC Desire 612 (All Variants) HTC Desire 610 (All Variants) HTC Desire 601 (All Variants) HTC Desire 530 (Not Verizon) HTC Desire 510 (32bit Variants Only) HTC Desire Eye (All Variants) and many more (run the app tests!) User Friendly. -

Factory Model Device Model

Factory Model Device Model Acer A1-713 acer_aprilia Acer A1-811 mango Acer A1-830 ducati Acer A3-A10 G1EA3 Acer A3-A10 mtk6589_e_lca Acer A3-A10 zara Acer A3-A20 acer_harley Acer A3-A20FHD acer_harleyfhd Acer Acer E320-orange C6 Acer Aspire A3 V7 Acer AT390 T2 Acer B1-723 oban Acer B1-730 EverFancy D40 Acer B1-730 vespatn Acer CloudMobile S500 a9 Acer DA220HQL lenovo72_we_jb3 Acer DA222HQL N451 Acer DA222HQLA A66 Acer DA222HQLA Flare S3 Power Acer DA226HQ tianyu72_w_hz_kk Acer E330 C7 Acer E330 GT-N7105T Acer E330 STUDIO XL Acer E350 C8n Acer E350 wiko Acer G100W maya Acer G1-715 A510s Acer G1-715 e1808_v75_hjy1_5640_maxwest Acer Icona One 7 vespa Acer Iconia One 7 AT1G* Acer Iconia One 7 G1-725 Acer Iconia One 7 m72_emmc_s6_pcb22_1024_8g1g_fuyin Acer Iconia One 7 vespa2 Acer Iconia One 8 vespa8 Acer Iconia Tab 7 acer_apriliahd Acer Iconia Tab 8 ducati2fhd Acer Iconia Tab 8 ducati2hd Acer Iconia Tab 8 ducati2hd3g Acer Iconia Tab 8 Modelo II - Professor Acer Iconia Tab A100 (VanGogh) vangogh Acer Iconia Tab A200 s7503 Acer Iconia Tab A200 SM-N9006 Acer Iconia Tab A501 ELUGA_Mark Acer Iconia Tab A501 picasso Acer Iconia Tab A510 myPhone Acer Iconia Tab A510 picasso_m Acer Iconia Tab A510 ZUUM_M50 Acer Iconia Tab A701 picasso_mf Acer Iconia Tab A701 Revo_HD2 Acer Iconia TalkTab 7 acer_a1_724 Acer Iconia TalkTab 7 AG CHROME ULTRA Acer Liquid a1 Acer Liquid C1 I1 Acer Liquid C1 l3365 Acer Liquid E1 C10 Acer Liquid E2 C11 Acer Liquid E3 acer_e3 Acer Liquid E3 acer_e3n Acer Liquid E3 LS900 Acer Liquid E3 Quasar Acer Liquid E600 e600 Acer Liquid -

Totalmem),Form Factor,System on Chip,Screen Sizes,Screen Densities,Abis,Android SDK Versions,Opengl ES Versions

Manufacturer,Model Name,Model Code,RAM (TotalMem),Form Factor,System on Chip,Screen Sizes,Screen Densities,ABIs,Android SDK Versions,OpenGL ES Versions 10.or,E,E,2846MB,Phone,Qualcomm MSM8937,1080x1920,480,arm64-v8a 10.or,G,G,3603MB,Phone,Qualcomm MSM8953,1080x1920,480,arm64-v8a 10.or,D,10or_D,2874MB,Phone,Qualcomm MSM8917,720x1280,320,arm64-v8a 4good,A103,4GOOD_Light_A103,907MB,Phone,Mediatek MT6737M,540x960,240,armeabi- v7a 4good,4GOOD Light B100,4GOOD_Light_B100,907MB,Phone,Mediatek MT6737M,540x960,240,armeabi-v7a 7Eleven,IN265,IN265,466MB,Phone,Mediatek MT6572,540x960,240,armeabi-v7a 7mobile,DRENA,DRENA,925MB,Phone,Spreadtrum SC7731C,480x800,240,armeabi-v7a 7mobile,KAMBA,KAMBA,1957MB,Phone,Mediatek MT6580,720x1280,320,armeabi-v7a 7mobile,SWEGUE,SWEGUE,1836MB,Phone,Mediatek MT6737T,1080x1920,480,arm64-v8a A.O.I. ELECTRONICS FACTORY,A.O.I.,TR10CS1_11,965MB,Tablet,Intel Z2520,1280x800,160,x86 Aamra WE,E2,E2,964MB,Phone,Mediatek MT6580,480x854,240,armeabi-v7a Accent,Pearl_A4,Pearl_A4,955MB,Phone,Mediatek MT6580,720x1440,320,armeabi-v7a Accent,FAST7 3G,FAST7_3G,954MB,Tablet,Mediatek MT8321,720x1280,160,armeabi-v7a Accent,Pearl A4 PLUS,PEARL_A4_PLUS,1929MB,Phone,Mediatek MT6737,720x1440,320,armeabi-v7a Accent,SPEED S8,SPEED_S8,894MB,Phone,Mediatek MT6580,720x1280,320,armeabi-v7a Acegame S.A. -

Battery Life Test Results HUAWEI TOSHIBA INTEX PLUM

2/12/2015 Battery life tests GSMArena.com Starborn SAMSUNG GALAXY S6 EDGE+ REVIEW PHONE FINDER SAMSUNG LENOVO VODAFONE VERYKOOL APPLE XIAOMI GIGABYTE MAXWEST MICROSOFT ACER PANTECH CELKON NOKIA ASUS XOLO GIONEE SONY OPPO LAVA VIVO LG BLACKBERRY MICROMAX NIU HTC ALCATEL BLU YEZZ MOTOROLA ZTE SPICE PARLA Battery life test results HUAWEI TOSHIBA INTEX PLUM ALL BRANDS RUMOR MILL Welcome to the GSMArena battery life tool. This page puts together the stats for all battery life tests we've done, conveniently listed for a quick and easy comparison between models. You can sort the table by either overall rating or by any of the individual test components that's most important to you call time, video playback or web browsing.TIP US 828K 100K You can find all about our84K 137K RSS LOG IN SIGN UP testing procedures here. SearchOur overall rating gives you an idea of how much battery backup you can get on a single charge. An overall rating of 40h means that you'll need to fully charge the device in question once every 40 hours if you do one hour of 3G calls, one hour of video playback and one hour of web browsing daily. The score factors in the power consumption in these three disciplines along with the reallife standby power consumption, which we also measure separately. Best of all, if the way we compute our overall rating does not correspond to your usage pattern, you are free to adjust the different usage components to get a closer match. Use the sliders below to adjust the approximate usage time for each of the three battery draining components. -

Barometer of Mobile Internet Connections in Indonesia Publication of March 14Th 2018

Barometer of mobile Internet connections in Indonesia Publication of March 14th 2018 Year 2017 nPerf is a trademark owned by nPerf SAS, 87 rue de Sèze 69006 LYON – France. Contents 1 Methodology ................................................................................................................................. 2 1.1 The panel ............................................................................................................................... 2 1.2 Speed and latency tests ....................................................................................................... 2 1.2.1 Objectives and operation of the speed and latency tests ............................................ 2 1.2.2 nPerf servers .................................................................................................................. 2 1.3 Tests Quality of Service (QoS) .............................................................................................. 2 1.3.1 The browsing test .......................................................................................................... 2 1.3.2 YouTube streaming test ................................................................................................ 3 1.4 Filtering of test results .......................................................................................................... 3 1.4.1 Filtering of devices ........................................................................................................ 3 2 Overall results 2G/3G/4G ............................................................................................................ -

217834 Telefono Libre Meizu M3 Note 5,5" Grey M681h2/16 Meizu

217834 TELEFONO LIBRE MEIZU M3 NOTE 5,5" GREY M681H2/16 MEIZU CARACTERÍSTICAS Resolución de la pantalla : 1920 x 1080 Pixeles Capacidad de almacenamiento interno : 16 GB RAM interna : 2 GB Resolución de la cámara trasera (numérica) : 13 MP Capacidad de la tarjeta SIM : SIM doble 3G : Sí GPS : Sí Diagonal de la pantalla : 5.5" Número de núcleos de procesador : 4 Frecuencia del procesador : 1,8 GHz núcleos coprocesador : 4 Frecuencia del coprocesador : 1 GHz 4G : Sí Capacidad de batería : 4100 mAh Color del producto : Negro, Gris Los productos pueden variar sin previo aviso y estar sujetos a stocks o variaciones en el diseño o errores tipográficos. LA IMAGEN PUEDE NO CORRESPONDER CON EL PRODUCTO. Procesador Familia de procesador : MediaTek Arquitectura del procesador : ARM Cortex-A53 64-bit : Sí Coprocesador : Sí arquitectura Coprocesador : ARM Cortex-A53 Modelo del procesador : Helio P10 Número de núcleos de procesador : 4 Frecuencia del procesador : 1,8 GHz núcleos coprocesador : 4 Frecuencia del coprocesador : 1 GHz Exhibición Resolución de la pantalla : 1920 x 1080 Pixeles Pantalla táctil : Sí Sensor de orientacíon : Sí Forma de la pantalla : Plana Razón de contraste (típica) : 1000:1 Relación de aspecto : 16:9 Tecnología táctil : Multi-touch Brillo de pantalla : 450 cd / m² Tipo de pantalla táctil : Capacitiva Densidad del pixel : 403 ppp Diagonal de la pantalla : 5.5" Puertos e Interfaces Puerto USB : Sí Conector USB : Micro-USB Auriculares : 3,5 mm Peso y dimensiones Peso : 163 g Ancho : 75,5 mm Profundidad : 8,2 mm Altura : 153,6 -

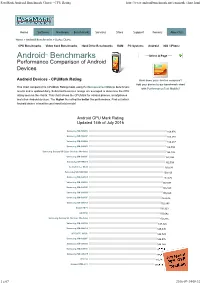

Passmark Android Benchmark Charts - CPU Rating

PassMark Android Benchmark Charts - CPU Rating http://www.androidbenchmark.net/cpumark_chart.html Home Software Hardware Benchmarks Services Store Support Forums About Us Home » Android Benchmarks » Device Charts CPU Benchmarks Video Card Benchmarks Hard Drive Benchmarks RAM PC Systems Android iOS / iPhone Android TM Benchmarks ----Select A Page ---- Performance Comparison of Android Devices Android Devices - CPUMark Rating How does your device compare? Add your device to our benchmark chart This chart compares the CPUMark Rating made using PerformanceTest Mobile benchmark with PerformanceTest Mobile ! results and is updated daily. Submitted baselines ratings are averaged to determine the CPU rating seen on the charts. This chart shows the CPUMark for various phones, smartphones and other Android devices. The higher the rating the better the performance. Find out which Android device is best for your hand held needs! Android CPU Mark Rating Updated 14th of July 2016 Samsung SM-N920V 166,976 Samsung SM-N920P 166,588 Samsung SM-G890A 166,237 Samsung SM-G928V 164,894 Samsung Galaxy S6 Edge (Various Models) 164,146 Samsung SM-G930F 162,994 Samsung SM-N920T 162,504 Lemobile Le X620 159,530 Samsung SM-N920W8 159,160 Samsung SM-G930T 157,472 Samsung SM-G930V 157,097 Samsung SM-G935P 156,823 Samsung SM-G930A 155,820 Samsung SM-G935F 153,636 Samsung SM-G935T 152,845 Xiaomi MI 5 150,923 LG H850 150,642 Samsung Galaxy S6 (Various Models) 150,316 Samsung SM-G935A 147,826 Samsung SM-G891A 145,095 HTC HTC_M10h 144,729 Samsung SM-G928F 144,576 Samsung -

Electronic 3D Models Catalogue (On July 26, 2019)

Electronic 3D models Catalogue (on July 26, 2019) Acer 001 Acer Iconia Tab A510 002 Acer Liquid Z5 003 Acer Liquid S2 Red 004 Acer Liquid S2 Black 005 Acer Iconia Tab A3 White 006 Acer Iconia Tab A1-810 White 007 Acer Iconia W4 008 Acer Liquid E3 Black 009 Acer Liquid E3 Silver 010 Acer Iconia B1-720 Iron Gray 011 Acer Iconia B1-720 Red 012 Acer Iconia B1-720 White 013 Acer Liquid Z3 Rock Black 014 Acer Liquid Z3 Classic White 015 Acer Iconia One 7 B1-730 Black 016 Acer Iconia One 7 B1-730 Red 017 Acer Iconia One 7 B1-730 Yellow 018 Acer Iconia One 7 B1-730 Green 019 Acer Iconia One 7 B1-730 Pink 020 Acer Iconia One 7 B1-730 Orange 021 Acer Iconia One 7 B1-730 Purple 022 Acer Iconia One 7 B1-730 White 023 Acer Iconia One 7 B1-730 Blue 024 Acer Iconia One 7 B1-730 Cyan 025 Acer Aspire Switch 10 026 Acer Iconia Tab A1-810 Red 027 Acer Iconia Tab A1-810 Black 028 Acer Iconia A1-830 White 029 Acer Liquid Z4 White 030 Acer Liquid Z4 Black 031 Acer Liquid Z200 Essential White 032 Acer Liquid Z200 Titanium Black 033 Acer Liquid Z200 Fragrant Pink 034 Acer Liquid Z200 Sky Blue 035 Acer Liquid Z200 Sunshine Yellow 036 Acer Liquid Jade Black 037 Acer Liquid Jade Green 038 Acer Liquid Jade White 039 Acer Liquid Z500 Sandy Silver 040 Acer Liquid Z500 Aquamarine Green 041 Acer Liquid Z500 Titanium Black 042 Acer Iconia Tab 7 (A1-713) 043 Acer Iconia Tab 7 (A1-713HD) 044 Acer Liquid E700 Burgundy Red 045 Acer Liquid E700 Titan Black 046 Acer Iconia Tab 8 047 Acer Liquid X1 Graphite Black 048 Acer Liquid X1 Wine Red 049 Acer Iconia Tab 8 W 050 Acer -

Meizu MX6 Teardown Guide ID: 65393 - Draft: 2021-04-28

Meizu MX6 Teardown Guide ID: 65393 - Draft: 2021-04-28 Meizu MX6 Teardown Teardown of the Meizu MX6 on Monday July 25th 2016. Written By: Kelsea Weber This document was generated on 2021-05-10 01:21:29 AM (MST). © iFixit — CC BY-NC-SA www.iFixit.com Page 1 of 18 Meizu MX6 Teardown Guide ID: 65393 - Draft: 2021-04-28 INTRODUCTION Hot on the heels of the Huawei P9, the Meizu MX6 is the next Chinese-designed smartphone to land on our teardown table. At first glance, this iPhone look-alike is making us see double! The MX6 couldn’t be the long lost twin to the iPhone, could it? Let’s get this teardown started and find out. Stay up to date on the latest repair news, and get a behind-the-scenes look at where the teardown magic happens by following us on Facebook, Instagram, or Twitter. [video: https://www.youtube.com/watch?v=u6TsjbeiGAc] TOOLS: P2 Pentalobe Screwdriver iPhone (1) iSclack (1) Spudger (1) Phillips #00 Screwdriver (1) Tweezers (1) SIM Card Eject Tool (1) iFixit Opening Tool (1) This document was generated on 2021-05-10 01:21:29 AM (MST). © iFixit — CC BY-NC-SA www.iFixit.com Page 2 of 18 Meizu MX6 Teardown Guide ID: 65393 - Draft: 2021-04-28 Step 1 — Meizu MX6 Teardown On the outside, the MX6 walks the iPhone walk, but does it talk the talk? Here's what we know so far: MediaTek Helio X20 deca-core (a.k.a. 10 cores!) CPU w/ ARM Mali-T880 GPU 4 GB LPDDR3 RAM and 32 GB of storage 5.5-inch, 1080p high-precision display (~401 ppi) 12 MP ƒ/2.0 main camera w/ 1.25 μm pixels and 5 MP front-facing camera Flyme OS 5.2 over Android 6.0 Marshmallow 3,060 mAh battery with 24 W fast charging USB-C port, Dual SIM support, and Meizu mTouch fingerprint sensor This document was generated on 2021-05-10 01:21:29 AM (MST). -

Presentación De Powerpoint

Modelos compatibles de Imóvil No. Marca Modelo Teléfono Versión del sistema operativo 1 360 1501_M02 1501_M02 Android 5.1 2 100+ 100B 100B Android 4.1.2 3 Acer Iconia Tab A500 Android 4.0.3 4 ALPS (Golden Master) MR6012H1C2W1 MR6012H1C2W1 Android 4.2.2 5 ALPS (Golden Master) PMID705GTV PMID705GTV Android 4.2.2 6 Amazon Fire HD 6 Fire HD 6 Fire OS 4.5.2 / Android 4.4.3 7 Amazon Fire Phone 32GB Fire Phone 32GB Fire OS 3.6.8 / Android 4.2.2 8 Amoi A862W A862W Android 4.1.2 9 amzn KFFOWI KFFOWI Android 5.1.1 10 Apple iPad 2 (2nd generation) MC979ZP iOS 7.1 11 Apple iPad 4 MD513ZP/A iOS 7.1 12 Apple iPad 4 MD513ZP/A iOS 8.0 13 Apple iPad Air MD785ZP/A iOS 7.1 14 Apple iPad Air 2 MGLW2J/A iOS 8.1 15 Apple iPad Mini MD531ZP iOS 7.1 16 Apple iPad Mini 2 FE276ZP/A iOS 8.1 17 Apple iPad Mini 3 MGNV2J/A iOS 8.1 18 Apple iPhone 3Gs MC132ZP iOS 6.1.3 19 Apple iPhone 4 MC676LL iOS 7.1.2 20 Apple iPhone 4 MC603ZP iOS 7.1.2 21 Apple iPhone 4 MC604ZP iOS 5.1.1 22 Apple iPhone 4s MD245ZP iOS 8.1 23 Apple iPhone 4s MD245ZP iOS 8.4.1 24 Apple iPhone 4s MD245ZP iOS 6.1.2 25 Apple iPhone 5 MD297ZP iOS 6.0 26 Apple iPhone 5 MD298ZP/A iOS 8.1 27 Apple iPhone 5 MD298ZP/A iOS 7.1.1 28 Apple iPhone 5c MF321ZP/A iOS 7.1.2 29 Apple iPhone 5c MF321ZP/A iOS 8.1 30 Apple iPhone 5s MF353ZP/A iOS 8.0 31 Apple iPhone 5s MF353ZP/A iOS 8.4.1 32 Apple iPhone 5s MF352ZP/A iOS 7.1.1 33 Apple iPhone 6 MG492ZP/A iOS 8.1 34 Apple iPhone 6 MG492ZP/A iOS 9.1 35 Apple iPhone 6 Plus MGA92ZP/A iOS 9.0 36 Apple iPhone 6 Plus MGAK2ZP/A iOS 8.0.2 37 Apple iPhone 6 Plus MGAK2ZP/A iOS 8.1