Facing up to a Changing Retail Landscape

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Checking out on Plastics, EIA and Greenpeace

Checking out on plastics A survey of UK supermarkets’ plastic habits ACKNOWLEDGEMENTS ABOUT EIA ABOUT GREENPEACE CONTENTS We investigate and campaign against Greenpeace defends the natural We would like to thank The Network ©EIAimage 1. Executive summary 4 environmental crime and abuse. world and promotes peace by for Social Change, Susie Hewson- investigating, exposing and Lowe and Julia Davies. Our undercover investigations 2. Introduction 5 confronting environmental abuse expose transnational wildlife crime, We would would also like like to to thank thank our ABOUT EIA EIAand championingUK responsible with a focus on elephants, pangolins 3. Impacts of plastics on the environment and society 6 numerous other supporters whose 62-63solutions Upper for Street, our fragile Ximporae. Ut aut fugitis resti ut atia andWe investigate tigers, and and forest campaign crimes suchagainst long-term commitment to our Londonenvironment. N1 0NY UK nobit ium alici bla cone consequam asenvironmental illegal logging crime and and deforestation abuse. 4. Methodology 8 organisation’s mission and values T: +44 (0) 20 7354 7960 cus aci oditaquates dolorem volla for cash crops like palm oil. We helped make this work possible. Our undercover investigations E: [email protected] vendam, consequo molor sin net work to safeguard global marine Greenpeace, Canonbury Villas, London N1 5. Results of scorecard ranking 9 expose transnational wildlife crime, eia-international.org fugitatur, qui int que nihic tem ecosystems by addressing the 2PN, UK with a focus on elephants and asped quei oditaquates dolorem threats posed by plastic pollution, T: + 44 (0) 20 7865 8100 6. Summary of survey responses tigers, and forest crimes such as volla vendam, conseqci oditaquates bycatch and commercial EIAE: [email protected] US illegal logging and deforestation for dolorem volla vendam, consequo exploitation of whales, dolphins POgreenpeace.org.uk Box 53343 6.1 Single-use plastic packaging 10 cash crops like palm oil. -

Retail Award Results

Annual Awards 2014 Sponsored by Retail Award Results RETAIL PRODUCT OF THE YEAR ‘Aldi Asia Specialities’ Hoisin Chicken produced by MDC Foods Ltd BEST NEW POULTRY-BASED PRODUCT Gold ‘Aldi Asia Specialities’ Hoisin Chicken MDC Foods Ltd Silver ‘Iceland 18 Piece Party’ Chippy Style Chicken Strips with chip shop style curry dip Iceland Foods Ltd Bronze ‘Iceland Meal in a Bag’ Chicken Teriyaki Stir Fry Iceland Foods Ltd BEST NEW FISH-BASED PRODUCT Gold ‘Aldi Specially Selected’ 4 Coquilles St Jacques Lakeside Food Group Ltd Silver ‘Aldi Specially Selected’ Luxury Topped Side of Salmon Lakeside Food Group Ltd Bronze ‘Aldi Specially Selected’ Smoked Salmon Terrine Lakeside Food Group Ltd BEST NEW VEGETABLE-BASED PRODUCT Gold ‘Asda Chosen by you’ Broccoli & Stilton Risotto Bakes Wessex Foods Silver ‘Morrisons’ Vegetable Lasagne Laila’s Fine Foods Ltd Bronze ‘Eazy Herbs’ Coriander Dujardin Foods Group NV BEST NEW MEAT-BASED PRODUCT Gold ‘Iceland Luxury’ Pork Loin Rack with an Apple Crust Iceland Foods Ltd Silver ‘Iceland Luxury’ Venison Garland Iceland Foods Ltd Bronze ‘Asda Chosen by you’ 2 Pulled Beef Wellingtons Oliver James Foods BEST NEW PIZZA, SAVOURIES AND SAVOURY BREAD PRODUCT Gold ‘Dr. Oetker Stoneoven Tradizionale’ Mozzarella Pizza Dr. Oetker (UK) Ltd Silver ‘Iceland 24 Piece Party’ Sweet & Savoury Croissants Iceland Foods Ltd Bronze ‘Aldi Specially Selected’ 4 Large Beef Dripping Yorkshire Puddings Greencore Grocery Leeds BEST NEW ICE CREAM PRODUCT Gold ‘Gianni’s’ Scrumptious Cherry Ice Cream Aldi Stores Ltd Silver ‘Tesco Finest*’ 3 Cornish Sea Salted Caramel Ice Creams R&R Ice Cream UK Ltd Bronze ‘Supervalu’ Caramel Biscuit Ice Cream Lakeland Dairy Sales Ltd BEST NEW DESSERT/CONFECTIONERY PRODUCT Gold ‘Conditorei Sweet Dreams’ Stracciatella Torte Coppenrath & Wiese (UK) Ltd Silver ‘Aldi Specially Selected’ Dark Chocolate & Orange Mascarpone Cheesecake Aldi Stores Ltd Bronze ‘Iceland Party’ Raspberry Eton Mess Dessert Coppenrath & Wiese (UK) Ltd Details compiled from entry forms. -

March 29 2016 NEWS RELEASE PALOMA SELECTS ST DAVID's

March 29 2016 NEWS RELEASE PALOMA SELECTS ST DAVID’S FOR ITS WELSH DEBUT The St David’s Partnership, owners of St David’s in Cardiff, one of the UK’s premier retail and leisure destinations, has today announced that Paloma, the independent Italian fashion brand, has opened its first store in Wales at the centre. The 2,000 sq ft Paloma boutique is located on St David’s Grand Arcade, opposite The White Company, and officially launched on March 25. Designed by an in-house team, the store will feature Paloma’s trademark Italian designer womenswear and accessory collections. Currently trading from a store in Brighton, St David’s marks the beginning of an expansion plan for the brand, as it targets key locations in the UK to create a select number of flagship stores. This follows a successful year for the St David’s Partnership, a joint venture between intu and Land Securities, which secured over 90,000 sq ft of lettings and a number of key store openings last year, including the largest H&M store in the UK. Speaking on behalf of the St David’s Partnership, Colin Flinn, regional director at intu, said: “Paloma is a very strong addition to St David’s line-up, adding to the mix of independent retailers that complement the major high street brands. Our strategy of developing St David’s mix in this way ensures the centre remains not only the number one retail and leisure destination in Wales, but one of the most in-demand centres in the country.” Mandhir Shukla, operations director of Paloma added: “St David’s, Cardiff is a fantastic opportunity for Paloma. -

Details of the Implicated Batches Subject to Recall Aldi Lidl Iceland

Details of the implicated batches subject to recall Brand Product Pack Size Use by dates Aldi The Deli Basil Houmous Topped with Pesto and Parmesan 170g All use by dates The Deli Moroccan Houmous Topped with Harissa Chickpeas 170g All use by dates The Deli Reduced Fat Houmous Selection Triple Pack 180g (3x60g) All use by dates (Plain Houmous, Red Pepper Houmous and Caramelised Onion Houmous Flavours) The Deli Reduced Fat Classic Houmous Triple Pack 180g (3x60g) All use by dates The Deli Caramelised Onion Houmous 200g All use by dates The Deli Moroccan Houmous 200g All use by dates The Deli Red Pepper Houmous 200g All use by dates The Deli Sweet Chilli Houmous 200g All use by dates The Deli Reduced Fat Houmous 200g All use by dates The Deli Houmous 200g All use by dates Lidl Meadow Fresh Red Pepper Houmous 170 g 04/11/2019 to 09/11/2019 (inclusive) Meadow Fresh Caramelised Onion Houmous 170 g 03/11/2019 to 09/11/2019 (inclusive) Meadow Fresh Moroccan Style Houmous 170 g 03/11/2019 to 09/11/2019 (inclusive) Meadow Fresh Classic Houmous 200 g 03/11/2019 to 09/11/2019 (inclusive) Meadow Fresh Reduced Fat Houmous 200 g 03/11/2019 to 09/11/2019 (inclusive) Meadow Fresh Classic Houmous 180 g (3 x 60 g) 31/10/2019 to 07/11/2019 (inclusive) Meadow Fresh Reduced Fat Houmous Selection 180 g (3 x 60 g) 04/11/2019 to 05/11/2019 (inclusive) Deluxe Houmous Topped with Pesto and Parmesan 170 g 01/11/2019 to 07/11/2019 (inclusive) Deluxe Red Pepper Houmous Topped with Harissa, Chickpeas & Peppadew, Piquanté Peppers 170 g 01/11/2019 to 06/11/2019 (inclusive) -

The Feasibility of Meeting the Demand for Fresh Food from Horticulture in Iceland

Final Thesis for MS-Degree in Environment and Natural Resources The Feasibility of Meeting the Demand for Fresh Food from Horticulture in Iceland Azusa Yamada Supervisor: Sveinn Agnarsson Ragnheidur Inga Thorarinsdottir The Feasibility of Meeting the Demand for Fresh Food from Horticulture in Iceland Azusa Yamada Final Thesis for MS Degree in Environment and Natural Resources Supervisors: Sveinn Agnarsson Ragnheidur Inga Thorarinsdottir Faculty of Business Administration School of Social Sciences, University of Iceland Graduating February 2020 1 The feasibility of meeting the demand for fresh food from horticulture in Iceland. This is a 30-credit thesis submitted in fulfilment of the requirements for an MS degree in Environment and Natural Resources linked with the Faculty of Business Administration, School of Social Sciences, University of Iceland. © 2020 Azusa Yamada This thesis can be copied only with the author’s permission. Printed by: Háskólaprent Reykjavík 2020 2 Acknowledgements First and foremost, I would like to express my deepest gratitude to my supervisors, Ragnheidur Inga Thorarinsdottir and Sveinn Agnarsson. Thank you, Ragnheidur, for seeing the potential in this topic at an early stage and encouraging me with constructive advice. Sveinn, thank you for your profound belief in my work and unparalleled support. I couldn’t have come this far without your support and guidance. I would also like to acknowledge and thank all of the interviewees and experts, whose names cannot be disclosed, who were involved in this project. Their passionate participation and input were indispensable to this work. I am also grateful to the Watanabe Trust Fund of the University of Iceland scholarship programme for allowing me to explore my passions and cultivate my intellectual curiosity in this beautiful country. -

Spar (Costcutter) and Sandpiper

Case M1290J Proposed Acquisition - Spar (Costcutter) and Sandpiper ______________ _____________ Decision Document No: CICRA 17/10 Date: 26 April 2017 Jersey Competition Regulatory Authority 2nd Floor Salisbury House, 1-9 Union Street, St Helier, Jersey, JE2 3RF Tel 01534 514990, Fax 01534 514991 Web: www.cicra.je 1 Summary 1. SandpiperCI Retail Limited (Sandpiper), part of the Sandpiper Group, proposes to acquire a number of the Jersey stores of Spar (Channel Islands) Limited together with its subsidiaries (Spar). The transaction has been notified to the Jersey Competition Regulatory Authority (JCRA) for approval pursuant to Article 21 of the Competition (Jersey) Law 2005 (the Law). 2. The JCRA has determined that, subject to meeting the commitment offered by Sandpiper in relation to the Sandpiper store at First Tower, the proposed acquisition will not lead to a substantial lessening of competition in any relevant market and hereby approves the acquisition by Sandpiper. The Notified Transaction 3. On 28 March 2017, the JCRA received an application for approval from Sandpiper (the Purchaser) for its proposed acquisition of several stores operated by Spar (the Target). The transaction relates to the purchase of 13 of the 16 convenience stores currently operated by the Target being: i) Costcutter at La Route de St Aubin, St Helier (Millbrook) ii) Costcutter at Main Road, Gorey Village, Grouville (Gorey) iii) Costcutter at Augres Garage, La Route de la Trinite, Trinity (Augres) iv) Costcutter at Links Hault, St Brelade (La Moye) v) Costcutter -

Iceland Foods' Use of Bond Proceeds to Fund Restaurant Expansion While Withholding Relief Money Sparks ESG Concerns

Iceland Foods' use of bond proceeds to fund restaurant expansion while withholding relief money sparks ESG concerns 24 February 2021 | 19:22 GMT Iceland Foods’ managing director Richard Walker in a recent press report noted the company cannot afford to pay back business rates relief, due to the costs of making shops COVID-safe and buying out its previous shareholder, Brait. But the UK-headquartered frozen food retailer was able to use recent bond issuance proceeds to fund the acquisition of a group of restaurants that will enter the bondholder restricted group in FY21/22, while not returning government rates relief, unlike supermarket peers, sparking corporate governance concerns, according to three buysiders. The company priced a B2/B/B+ rated GBP 250m senior secured 2028 note with a 4.375% yield on 12 February with HSBC as sole global coordinator and physical bookrunner. Use of proceeds included GBP 170.2m to refinance existing 2024 notes, GBP 20m to refinance a term facility, GBP 52.8m to boost cash on balance sheet and GBP 7m fees and expenses. It was the GBP 52.8m earmarked for cash on balance sheet that marked a shift in company strategy. In its bond prospectus the frozen food company noted that during FY21/22 period- end March, it intended to consolidate its interest in a group of restaurants it now owns, into the bondholder restricted group. After this consolidation, it plans to use cash on balance sheet to repay the restaurant business debt when prudent to do so, which consists of loans largely owed to shareholders over the next 18 to 24 months subject to reaching deleveraging targets. -

Prospectus Dated 5 July 2016

This document comprises a prospectus (the ‘‘Prospectus’’) for the purposes of Article 3 of EU Directive 2003/71/EC, as amended (the ‘‘Prospectus Directive’’) relating to the New Sainsbury’s Shares and has been prepared in accordance with the Prospectus Rules of the Financial Conduct Authority (the ‘‘FCA’’) made under section 73A of the Financial Services and Markets Act 2000 (the ‘‘FSMA’’). The Prospectus will be made available to the public in accordance with the Prospectus Rules. The directors of J Sainsbury plc (‘‘Sainsbury’s’’ or the ‘‘Company’’), whose names appear on page 44 of this Prospectus, and the Company accept responsibility for the information contained in this Prospectus. To the best of the knowledge of the Company and the Sainsbury’s Directors (each of whom has taken all reasonable care to ensure that such is the case), the information contained in this Prospectus is in accordance with the facts and contains no omission likely to affect the import of such information. Investors are advised to examine all the risks that might be relevant in connection with the value of an investment in the New Sainsbury’s Shares. Investors should read the entire Prospectus (including the documents, or parts thereof, incorporated by reference) and, in particular, the section headed ‘‘Risk Factors’’ for a discussion of certain factors that should be considered in connection with an investment in the Company, the Combined Group, the existing Sainsbury’s Shares and the New Sainsbury’s Shares. J SAINSBURY PLC (incorporated under the Companies -

Checking out on Plastics III

Checking Out on Plastics III January 2021 ACKNOWLEDGEMENTS ABOUT EIA ABOUT GREENPEACE EIA UK CONTENTS 62-63 Upper Street, With support from John Ellerman We investigate and campaign against Greenpeace defends the natural Executive Summary 4 London N1 0NY UK Foundation. environmental crime and abuse. world and promotes peace by Introduction 6 T: +44 (0) 20 7354 7960 investigating, exposing and Background 7 “We aim to advance the wellbeing Our undercover investigations E: [email protected] confronting environmental abuse Methodology 8 of people, society and the natural expose transnational wildlife crime, eia-international.org and championing responsible Summary of results 10 world by focusing on the arts, with a focus on elephants and solutions for our fragile Targets 12 environment and social action. tigers, and forest crimes such as Environmental Investigation Agency UK environment. The plastic packaging footprint 13 We believe these areas can make illegal logging and deforestation for UK Charity Number: 1182208 Own-brand versus branded reductions 14 an important contribution to cash crops like palm oil. We work to Company Number: 07752350 Overall trends in this year’s survey 16 wellbeing.” safeguard global marine ecosystems Registered in England and Wales Retailer snapshot: highlights and lowlights 18 by addressing the threats posed Plastic bags 20 by plastic pollution, bycatch Single-use items 24 and commercial exploitation of Fruit and vegetables 28 whales, dolphins and porpoises. Reuse and refill 30 Finally, we reduce the impact of Recycling and recycled content 32 climate change by campaigning Online 33 to eliminate powerful refrigerant Convenience retailers 34 greenhouse gases, exposing related Conclusions 35 illicit trade and improving energy Recommendations 36 efficiency in the cooling sector. -

Leeds BID Feasibility Study

Leeds BID Feasibility Study Detailed Report February 2014 Leeds Business Improvement District Feasibility Study 11 1.0 Introduction and Executive 2.0 Business Improvement Districts Summary Detailed report 2.0 Business Improvement Districts “The growth rate of BIDs continues to rise and the ballot success rate remains high at 84% overall, and 3.0 Leeds City Centre 91% for renewal ballots demonstrating that this is a tool that the business community is seeing real value 4.0 Consultation from. The scale and reach of BIDs is now significant with close to 70,000 businesses paying levies across 5.0 BID Boundary and Levy options the country and a total investment in BID areas 6.0 Recommendations and of almost £100 million annually”. – British BIDs 2013 Nationwide Survey next steps 7.0 Risks and issues Appendices History of BIDs 22 *BIDs around the world BIDs in the UK and Ireland . BIDs were first established in North America in the mid-1960s . In 2004 legislation for the creation of BIDs was . Since then more than 1,500 BIDs have been introduced in England, and later in Scotland, adopted in many countries around the world Wales and Ireland including: . Since then more than 170 BIDs have been created including those in London, Birmingham, – 450 United States Manchester and Edinburgh – 350 Canada – 185 Australia . Each BID proposal is different depending on – 140 New Zealand local needs and priorities, but usually focus on: – 260 Japan – 40 South Africa – Safety and security – 225 European countries – Cleaning and maintenance – Events and marketing – Retail and evening economy – Access and signage *source www.britishbids.info How BIDs work 33 A BID is defined by a geographical area where partners pull together to create a better place to live and work. -

June 2018 • £8.00 Tipping Point for Landfill

SHOPPINGCENTREThe business of retail destinations www.shopping-centre.co.uk June 2018 • £8.00 Tipping point for landfill Technology diverts food waste from landfill 10 Development 12 Sustainability 17 Parking Intu Watford Centres face food Global tech alliance nears completion waste challenge to streamline parking The Highcross Beacons, @HXBeacons Creative LED solutions to make spaces and places memorable. ADI design content-driven experiences and exceptional digital installations that deliver the unexpected. We combine giant LED platforms with larger-than-life creative to drive large scale IRKEKIQIRXERHMRXIVEGXMSR8SƼRHSYX more visit www.adi.tv/shoppingcentre For more information visit www.adi.tv/shoppingcentre 0800 592 346 | [email protected] | www.adi.tv CONTENTS Editor’s letter Editor Graham Parker 07956 231 078 Fraser is widely forecast to be Wolfson has complained that [email protected] next, with as many as 30 stores a two-tier market is emerging Editorial Assistant earmarked for closure. with retailers paying widely dif- Iain Hoey However the CVA is a form ferent rents for adjacent stores 07757 946 414 of insolvency and the question depending on whether or not [email protected] has to be asked whether these they have been through a CVA. Sales Manager businesses are in fact insolvent. He’s now inserting CVA clauses Trudy Whiston In the end that’s a decision for into leases allowing Next to 01293 416 090 [email protected] lawyers and accountants and claim a rent cut if a neighbour- not magazine editors, but the ing brand wins one through a Database Manager At last there are signs that land- suspicion is that companies CVA. -

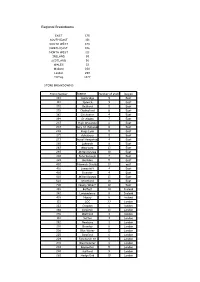

Regional Breakdowns Name

Regional Breakdowns EAST 175 SOUTH EAST 131 SOUTH WEST 174 NORTH EAST 106 NORTH WEST 113 IRELAND 30 SCOTLAND 96 WALES 32 Midland 230 London 290 TOTAL 1377 STORE BREAKDOWNS Store Number Name Number of staff Region 123 Cambridge 9 East 141 Ipswich 9 East 172 Bedford 5 East 175 Chelmsford 8 East 182 Colchester 4 East 194 St Albans 7 East 237 High Wycombe 6 East 247 Bury St. Edmunds 8 East 248 Kings Lynn 5 East 271 Aylesbury 5 East 273 Hemel Hempstead 4 East 285 Lakeside 8 East 287 Moorgate 13 East 297 Milton Keynes 10 East 302 Peterborough 7 East 322 Basildon 5 East 402 Norwich Cfields 13 east 416 Lowestoft 4 East 460 Bicester 4 East 510 Milton Keynes 13 East 522 Stratford 18 East 700 Canary Wharf 10 East 188 Belfast 14 Ireland 342 Londonderry 8 Ireland 418 Newry 8 ireland 121 LOC 33 London 132 Croydon 6 london 148 Kingston 13 London 178 Watford 4 london 181 Sutton 3 London 192 Newbury 3 London 201 Bromley 8 London 206 Blue Water 12 London 225 Romford 6 London 229 Fenchurch St 5 London 231 Westminster 6 London 232 Bayswater 5 London 240 Guilford 9 London 282 Hedge End 10 London 289 Putney 6 London 290 Greenford 5 London 292 Kensington 9 London 293 Strand 15 London 308 Staines 3 London 329 Uxbridge 4 London 330 Richmond 7 London 359 Camberley 4 London 366 Islington 8 London 377 Woking 5 London 378 Redhill 5 London 398 Harrow 5 London 405 Clapham 5 London 431 Crawley 4 London 432 Holborn 6 London 438 Wimbledon 6 London 464 Enfield 5 London 470 Wood Green 5 London 472 Epsom 6 London 479 White City 13 london 511 Oxford St 25 London 518 Hounslow