2018 China Insurance Review Thomas P

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Post Event Report

presents 9th Asian Investment Summit Building better portfolios 21-22 May 2014, Ritz-Carlton, Hong Kong Post Event Report 310 delegates representing 190 companies across 18 countries www.AsianInvestmentSummit.com Thank You to our sponsors & partners AIWEEK Marquee Sponsors Co-Sponsors Associate Sponsors Workshop Sponsor Supporting Organisations alternative assets. intelligent data. Tech Handset Provider Education Partner Analytics Partner ® Media Partners Offical Broadcast Partner 1 www.AsianInvestmentSummit.com Delegate Breakdown 310 delegates representing 190 companies across 18 countries Breakdown by Organisation Institutional Investors 46% Haymarket Financial Media delegate attendee data is Asset Managemer 19% independently verified by the BPA Consultant 8% Fund Distributor / Private Wealth Management 5% Media & Publishing 4% Commercial Bank 4% Index / Trading Platform Provider 3% Association 2% Other 9% Breakdown of Institutional Investors Insurance 31% Endowment / Foundation 27% Corporation 13% Pension Fund 13% Family Office 8% Breakdown by Country Sovereign Wealth Fund 6% PE Funds of Funds 1% Mulitlateral Finance Hong Kong 82% Institution 1% ASEAN 10% North Asia 5% Australia 1% Europe 1% North America 1% Breakdown by Job Function Investment 34% Finance / Treasury 20% Marketing and Investor Relations 19% Other 11% CEO / Managing Director 7% Fund Selection / Distribution 7% Strategist / Economist 2% 2 www.AsianInvestmentSummit.com Participating Companies Haymarket Financial Media delegate attendee data is independently verified by the BPA 310 institutonal investors, asset managers, corporates, bankers and advisors attended the Forum. Attending companies included: ACE Life Insurance CFA Institute Board of Governors ACMI China Automation Group Limited Ageas China BOCOM Insurance Co., Ltd. Ageas Hong Kong China Construction Bank Head Office Ageas Insurance Company (Asia) Limited China Life Insurance AIA Chinese YMCA of Hong Kong AIA Group CIC AIA International Limited CIC International (HK) AIA Pension and Trustee Co. -

Allianz Se Allianz Finance Ii B.V. Allianz

2nd Supplement pursuant to Art. 16(1) of Directive 2003/71/EC, as amended (the "Prospectus Directive") and Art. 13 (1) of the Luxembourg Act (the "Luxembourg Act") relating to prospectuses for securities (loi relative aux prospectus pour valeurs mobilières) dated 12 August 2016 (the "Supplement") to the Base Prospectus dated 2 May 2016, as supplemented by the 1st Supplement dated 24 May 2016 (the "Prospectus") with respect to ALLIANZ SE (incorporated as a European Company (Societas Europaea – SE) in Munich, Germany) ALLIANZ FINANCE II B.V. (incorporated with limited liability in Amsterdam, The Netherlands) ALLIANZ FINANCE III B.V. (incorporated with limited liability in Amsterdam, The Netherlands) € 25,000,000,000 Debt Issuance Programme guaranteed by ALLIANZ SE This Supplement has been approved by the Commission de Surveillance du Secteur Financier (the "CSSF") of the Grand Duchy of Luxembourg in its capacity as competent authority (the "Competent Authority") under the Luxembourg Act for the purposes of the Prospectus Directive. The Issuer may request the CSSF in its capacity as competent authority under the Luxemburg Act to provide competent authorities in host Member States within the European Economic Area with a certificate of approval attesting that the Supplement has been drawn up in accordance with the Luxembourg Act which implements the Prospectus Directive into Luxembourg law ("Notification"). Right to withdraw In accordance with Article 13 paragraph 2 of the Luxembourg Act, investors who have already agreed to purchase or subscribe for the securities before the Supplement is published have the right, exercisable within two working days after the publication of this Supplement, to withdraw their acceptances, provided that the new factor arose before the final closing of the offer to the public and the delivery of the securities. -

No 44 Fixed Income Strategies of Insurance Companies and Pension Funds

Committee on the Global Financial System CGFS Papers No 44 Fixed income strategies of insurance companies and pension funds Report submitted by a Working Group established by the Committee on the Global Financial System This Working Group was chaired by Peter Praet, Member of the European Central Bank’s Executive Board July 2011 JEL Classification: G22, G23, G28, M4 Copies of publications are available from: Bank for International Settlements Communications CH-4002 Basel, Switzerland E-mail: [email protected] Fax: +41 61 280 9100 and +41 61 280 8100 This publication is available on the BIS website (www.bis.org). © Bank for International Settlements 2011. All rights reserved. Brief excerpts may be reproduced or translated provided the source is cited. ISBN 92-9131-880-9 (print) ISBN 92-9197-880-9 (online) Preface In November 2010, the Committee on the Global Financial System (CGFS) established a Working Group to examine how insurance companies and pension funds are being affected by forthcoming accounting and regulatory changes in the current low-interest rate environment, and to investigate possible implications of changes in their investment strategies for the financial system. Over the coming years, accounting and regulatory changes could lead to reallocations of funding across financial instruments and sectors and encourage greater use of derivatives. The changes could also make it more difficult for insurance companies and pension funds to play their traditional role as global providers of long-term risk capital and accelerate the shifting of risks to households. The Working Group was chaired by Peter Praet of the National Bank of Belgium, now a Member of the European Central Bank’s Executive Board. -

Ironshore Inc

IRONSHORE INC. Editorial Contact: FOR IMMEDIATE RELEASE L. Gaye Torrance TorranceCo New York, New York (212) 691-5810 cell: (862) 215-7631 [email protected] IRONSHORE APPOINTS DENNIS MAHONEY AND ERIC SIMONSON TO SERVE ON ITS BOARD OF DIRECTORS Hamilton, Bermuda, February 2, 2012 – Ironshore Inc. announced that Dennis L. Mahoney and Eric A. Simonson have been appointed to its Board of Directors. Mr. Mahoney is the former Chairman and Chief Executive Officer of Aon Global in London. Mr. Simonson most recently was Senior Vice President and Chief Investment Officer of Allstate Insurance Company and served as Chairman and President of Allstate Investments, LLC, based in Northbrook, Illinois. “We are pleased to welcome Dennis and Ric as the newest directors to join the Ironshore Board,” said Kevin H. Kelley, Chief Executive Officer of Ironshore Inc. “Both are seasoned insurance industry leaders that will bring a depth of experience and wealth of insight to Ironshore as it builds upon its growing global platform.” Mr. Mahoney is a forty-two year veteran of the broking industry and past President of the Insurance Institute of London. During his years with Aon and its predecessor company, he served in a number of senior leadership roles in retail, wholesale and reinsurance. Prior to his retirement from Aon in 2010, Mr. Mahoney served as Chairman of Aon Global. He also serves as a Director of ACORD the global insurance standards organization. Mr. Simonson’s thirty-five year insurance industry career includes his most recent position as executive and member of the Allstate Corporation’s senior management team at the company’s U.S.- based headquarters. -

International Rating Agency Advisory Newsletter November 2012 Update Welcome to Aon Benfield’S Updated Rating Agency Advisory Newsletter

International Rating Agency Advisory Newsletter November 2012 Update Welcome to Aon Benfield’s updated Rating Agency Advisory Newsletter. In this edition, matters of interest include rating agencies global reinsurance and country risk outlooks, as well as our regular features on : Selected regulatory activities or updates throughout APAC and EMEA. List of rating actions in APAC and EMEA during the 3rd quarter. Links to reports released by Aon Benfield Analytics. We will continuously scan for new content to provide greater value to our clients. We will be glad to hear your feedback so that we can continue to provide the most relevant ratings news and information in future editions. Rating Agency Activity (Data source: Standard & Poor’s, A.M.Best, Fitch, and Moody’s) Standard & Poor’s Numerous market participants provided feedback on S&P’s proposed criteria for rating insurers, “Request for Comment: Insurers Rating Methodology”, published 9 July 2012. S&P has stated in its recent report “S&P Summarizes Submissions On Request For Comments” on 18 October 2012 that it received formal feedback from about 100 market participants, varying from rated insurers, insurance brokers, rating advisors, and industry trade associations. S&P is not yet in a position to comment on the final criteria. However S&P expects to respond to the comments in one of three ways: by changing the proposed criteria, by explaining the original proposals more clearly to remove ambiguity, or by leaving the proposal unchanged. S&P states that it is in the process of analyzing the feedback and testing the impact of various alternatives. -

Annual Report 2009 ERGO Insurance Group

ERGO 48 (50022335) GROUP ANNUAL REPORT 2009 REPORT GROUP ANNUAL Overview of ERGO Insurance Group 2009 2008 Change previous year (%) Total premiums € million 19,050 17,711 7.6 Gross premiums written € million 17,470 16,578 5.4 Expenses for claims and benefits € million 16,114 13,893 16,0 Investment result € million 4,401 2,871 53.3 Result before impairment losses of goodwill € million 734 929 – 21.0 Consolidated result € million 173 73 135.6 Investments € million 113,277 108,191 4.7 Technical provisions (net) € million 109,197 101,809 7.3 Equity € million 3,857 3,568 8.1 Full-time representatives 21,963 21,709 1.2 Salaried employees 33,152 31,508 5.2 Group earnings per share in accordance with IFRS € 2.14 0.76 183.0 Dividend per share € 0.60 –– With premium income of € 19bn, ERGO is one of the ERGO has the right sales channel for every client: major insurance groups in Europe. Worldwide, ERGO almost 22,000 self-employed full-time insurance agents, is represented in more than 30 countries and concen- staff working in direct sales, as well as insurance bro- trates on Europe and Asia. In Europe, ERGO is no. 1 in kers and strong cooperation partners – both in Ger- the health and legal expenses insurance segments, many and abroad – look after clients. In addition, and is among the market leaders in its home market of ERGO maintains a far-reaching sales partnership with Germany. More than 50,000 people work for the Group, the major European bank UniCredit Group, both in either as salaried employees or as full time self- Germany as well as in Central and Eastern Europe. -

2. MS&AD Insurance Group Strategies

Japan’s Insurance Market 2013 The Toa Reinsurance Company, Limited The Toa Reinsurance Company, Limited Japan’s Insurance Market 2013 Contents Page To Our Clients Tomoatsu Noguchi President and Chief Executive, The Toa Reinsurance Company, Limited 1 1. The Japanese Non-Life Insurance Market Yasuyoshi Karasawa President, Chief Executive Officer, Mitsui Sumitomo Insurance Company, Limited 2 2. Practical Risk Appetite David Simmons Managing Director, Analytics, Willis Re Head of Strategic Capital and Result Management 12 3. Japanese Insurance Company Management and the Introduction of Enterprise Risk Management Systems Nobuyasu Uemura Managing Director, Capitas Consulting Corporation 23 4. Enhancement of Enterprise Risk Management and Emerging Risk for Insurers Koichi Dezuka Executive Director, Ernst & Young ShinNihon LLC 27 5. Trends in Japan’s Non-Life Insurance Industry Underwriting & Planning Department The Toa Reinsurance Company, Limited 32 6. Trends in Japan’s Life Insurance Industry Life Underwriting & Planning Department The Toa Reinsurance Company, Limited 37 Supplemental Data: Results of Japanese major non-life insurance groups (company) for fiscal 2012, ended March 31, 2013 (Non-Consolidated Basis) 44 ©2013 The Toa Reinsurance Company, Limited. All rights reserved. The contents may be reproduced only with the written permission of The Toa Reinsurance Company, Limited. To Our Clients It gives me great pleasure to have the opportunity to welcome you to our brochure, Japan’s Insurance Market 2013. It is encouraging to know that over the years our brochures have been well received even beyond our own industry’s boundaries as a source of useful, up-to-date information about Japan’s insurance market, as well as contributing to a wider interest in and understanding of our domestic market. -

Corporate Responsibility Report 2010/2011

MUNICH RE CORPORATE RESPONSIBILITY Contents Page Strategy and challenges 2 Statement by the CEO 4 Guiding concept and mission 5 Fields of action and objectives 6 Milestones 8 Stakeholder dialogue 12 Challenges 14 Management 20 Responsible corporate governance 21 Sustainable investments 29 Responsibility towards staff 36 Our environmental awareness 50 Solutions 58 Strategic approach 59 Reinsurance 60 Primary insurance 67 Munich Health 72 Asset management 75 Commitments 77 New corporate citizenship concept 78 Focal areas – Investing in the future 79 Foundations – Making a difference 85 Facts and figures 89 About the corporate responsibility portal 90 Key performance indicators 91 GRI and Global Compact Communication on Progress 99 SRI-Indices and awards 134 Partnerships, initiatives and foundations 136 MUNICH RE Corporate Responsibility Contact Privacy Statement Legal Notice Imprint CORPORATE RESPONSIBILITY MUNICH RE STRATEGY AND CHALLENGES MANAGEMENT SOLUTIONS COMMITMENT FACTS AND FIGURES Corporate Responsibility in Figures STRATEGY AND CHALLENGES Munich Re is committed to its corporate responsibility. To ensure that we meet 28,000 this commitment, responsible action is a mainstay of our strategy, firmly ingrained in our organisation, and thus addresses the major challenges of our More than 28,000 entries are time. » more tracked within NatCatSERVICE, our collection of natural catastrophe database. » more STATEMENT BY THE CEO CURRENT NEWS Quick Links » Statement by the CEO EARNING TRUST 08.08.2011 » Guiding concept and mission Project cooperation on corporate responsibility » A forward-looking and responsible approach has Sustainable investments between Munich University of Applied » been focused by Munich Re for many years. Responsibility towards staff Sciences and Munich Re » Corporate Responsibility is and has always been Foundations » an integral part of Munich Re’s Group strategy. -

Underwriting Issues and Innovations Seminar

Underwriting Issues and Innovations Seminar Attendee List by Last Name As of July 12, 2017 Stephen Abrokwah Merly Agellon Geoff Andrews Swiss Re Life & Health America Inc Sun Life Financial Carpe Data Fort Wayne, IN Toronto, ON Santa Barbara, CA David Aronson Thomas Ashley Denise Bates MIB Gen Re Penn Mutual Life Insurance Co Braintree, MA Stamford, CT Horsham, PA Natalie Bergstrom JP Bewley Phillip Beyer AIG Big Cloud Analytics USAA Life Insurance Company Milwaukee, WI Atlanta, GA San Antonio, TX Donnamarie Blake Paul Boudreau Laura Boylan Lexisnexis Risk Solution Munich Re Haven Life Alpharetta, GA Atlanta, GA New York, NY Greg Brandner Colin Bruesewitz Jessica Bublitz Munich Re American Family Insurance Milliman Intelliscript Nashwauk, MN Sun Prairie, WI Brookfield, WI Peggy Buck Marc Cagen Minyu Cao Milliman Intelliscript Fidelity Life Association RGA Brookfield, WI Chicago, IL Chesterfield, MO Eric Carlson Paul Carmody Audrey Chervansky Milliman Inc Pacific Guardian Life Insurance Swiss Re Life & Health America Brookfield, WI Honolulu, HI Armonk, NY Amanda Christensen Juliet Christenson Jennifer Ciollaro Riversource Insurance Royal Neighbors of America Swiss Re Minneapolis, MN Rock Island, IL Fort Wayne, IN Derek Coburn Brian Coens Joanne Collins Unum Clinical Reference Laboratory Stoneriver Worcester, MA Lenexa, KS Waxhaw, NC Chris Connor Sean Conrad Steve Cox Illinois Mutual Life Insurance Hannover Re Oneamerica Financial Partners Company Charlotte, NC Indianapolis, IN Peoria, IL Kathryn Cox Kim Curley Mike Curran RGA Great-West Financial Force Diagnostics, Inc. Chesterfield, MO Greenwood Village, CO Bannockburn, IL Bruce Dahlquist Donna Daniells Ben Davidson Clinical Reference Laboratory AXA US Sagicor Life Insurance Lenexa, KS Charlotte, NC Scottsdale, AZ Jim Davis Dee Davis Paul Dennee Synodex Swiss Re Trustmark Insurance Co Canton, CT Fort Wayne, IN Lake Forest, IL Tedd Determan Ammon Dixon Cris Downey Force Diagnostics, Inc. -

Annual Report 2018 1 Corporate Profile

Annual Report Meiji Yasuda Life Insurance Company, 20Year ended March18 31, 2018 Contents Corporate Profi le 2 Individual Administrative Services (Individual Administrative Service Reforms) 36 Meiji Yasuda Philosophy 4 Group Insurance Administrative Services (Group Insurance Administrative Service Reforms) 37 A Message from the President 6 Asset Management (Asset Management Reforms) 38 History of Our Challenges 8 Asset Management Administrative Services (Asset Management Administrative Service Reforms) 39 Value Creation Process at Meiji Yasuda Life 12 Overseas Insurance Business Contributing to the SDGs through Business (Overseas Insurance Business Reforms) 40 Activities 14 Domestic Affi liate Business (Domestic Group Company Management Reforms) 41 Topics Operating Base Reinforcement Strategy Stepping up After-Sales Service Tailored for the Elderly 16 Adopting a More Sophisticated Management Enhancing Our Product Lineup 18 Approach (Governance Reforms) 42 Pursuing Customer-Focused Business Operations 19 Human Resource Management (HR Reforms) 43 Our Support of Meiji Yasuda J. League and General Affairs, Infrastructure Management Other Initiatives to Vitalize Local Communities 20 and Working Environment Development (General Affairs Reforms) 44 Promoting Sustainable Investment and Financing 22 System Development Structure Community Vitalization Initiatives via (System Development Structure Reforms) 45 Partnerships with Local Governments 23 Brand Strategy Initiatives to Realize Improved Work Engagement 24 Solidifying Brand Recognition by Disseminating -

Changes in Share Capital and Shareholdings of Shareholders

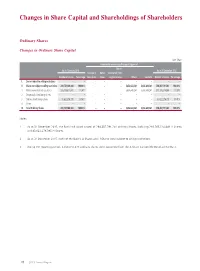

Changes in Share Capital and Shareholdings of Shareholders Ordinary Shares Changes in Ordinary Share Capital Unit: Share Increase/decrease during the reporting period Shares As at 1 January 2015 As at 31 December 2015 Issuance of Bonus transferred from Number of shares Percentage new shares shares surplus reserve Others Sub-total Number of shares Percentage I. Shares subject to selling restrictions – – – – – – – – – II. Shares not subject to selling restrictions 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% 1. RMB-denominated ordinary shares 205,108,871,605 71.04% – – – 5,656,643,241 5,656,643,241 210,765,514,846 71.59% 2. Domestically listed foreign shares – – – – – – – – – 3. Overseas listed foreign shares 83,622,276,395 28.96% – – – – – 83,622,276,395 28.41% 4. Others – – – – – – – – – III. Total Ordinary Shares 288,731,148,000 100.00% – – – 5,656,643,241 5,656,643,241 294,387,791,241 100.00% Notes: 1 As at 31 December 2015, the Bank had issued a total of 294,387,791,241 ordinary shares, including 210,765,514,846 A Shares and 83,622,276,395 H Shares. 2 As at 31 December 2015, none of the Bank’s A Shares and H Shares were subject to selling restrictions. 3 During the reporting period, 5,656,643,241 ordinary shares were converted from the A-Share Convertible Bonds of the Bank. 79 2015 Annual Report Changes in Share Capital and Shareholdings of Shareholders Number of Ordinary Shareholders and Shareholdings Number of ordinary shareholders as at 31 December 2015: 963,786 (including 761,073 A-Share Holders and 202,713 H-Share Holders) Number of ordinary shareholders as at the end of the last month before the disclosure of this report: 992,136 (including 789,535 A-Share Holders and 202,601 H-Share Holders) Top ten ordinary shareholders as at 31 December 2015: Unit: Share Number of Changes shares held as Percentage Number of Number of during at the end of of total shares subject shares Type of the reporting the reporting ordinary to selling pledged ordinary No. -

China Landscape: Selections from the Taikang Collection 2019

China Landscape: Selections from the Taikang Collection 2019 March 21 – May 5, 2019 Opening Reception: March 21, Thursday, 4:00pm Producer: Taikang Insurance Group General Organizer: Chen Dongsheng General Coordinator: Ying Weiwei Curator: Tang Xin Artists: Ai Xuan, Ai Zhongxin, Cai Guo-Qiang, Chen Ren, Chen Shaoxiong, Chen Yifei, Chen Zhen, Ding Fang, Ding Yi, Fang Lijun, Gao Weigang, Hu Xiangqian, Jiang Zhaohe, Jiang Zhuyun, Jin Shangyi, Li Yo u son g , Liu Chuang, Liu Kaiqu, Liu Wei, Liu Wei, Liu Xiaodong, Liu Xinyi, Liu Ye, Luo Zhongli, Ma Qiusha, Mao Xuhui, Nabuqi, Qiu Xiaofei, Shang Yang, Shen Yaoyi, Shi Chong, Su Tianci, Sui Jianguo, Wang Guangle, Wang Guangyi, Wang Sishun, Wang Yuyang, Wu Dayu, Wu Guanzhong, Wu Zuoren, Xie Molin, Xu Bing, Xu Wenkai (aaajiao), Yang Jiechang, Yao Qingmei, Yuan Qingyi, Yu Yo uha n , Zeng Fanzhi, Zhang Peili, Zhang Wenyuan, Zhang Xiaogang, Zhao Bandi, Zhao Zhao, PSFO, Zhou Chunya Address: No.A07, 798 Art Zone No.2 Jiuxianqiao Rd, Chaoyang District, Beijing, CHINA Open Hours: 11:00 - 17:00 Monday to Sunday About the Exhibition Taikang Insurance Group will present “China Landscape: Selections from the Taikang Collection 2019” from 21st March to 5th May 2019 at No.A07, 798 Art Zone. The exhibition is the third time we show Taikang Collection publicly, following its inaugural presentation at the National Art Museum of China in 2011 and the Wanlin Art Museum of Wuhan University in 2015. Warming up the inauguration of Taikang Art Museum, Chen Dongsheng, Chairman of the Board and Chief executive Officer of Taikang Insurance Group, plays the leading role of the general organizer of the exhibition, while Ying Weiwei, Secretary of The Board, Assistant President of Taikang Insurance Group plays the role of the general coordinator.