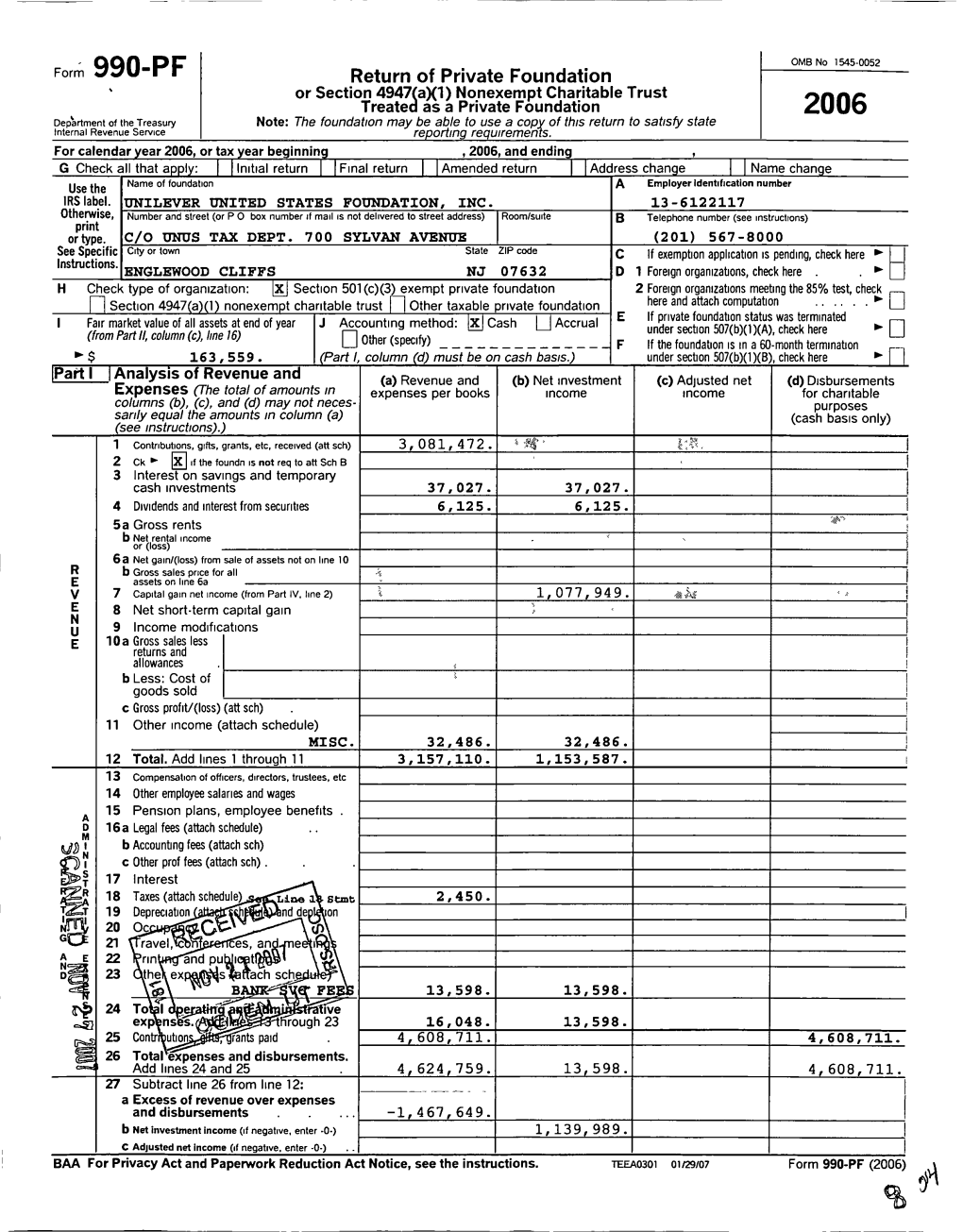

Form 990-PF 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Supreme Court, Appellate Division First Department

SUPREME COURT, APPELLATE DIVISION FIRST DEPARTMENT MAY 9, 2013 THE COURT ANNOUNCES THE FOLLOWING DECISIONS: Gonzalez, P.J., Tom, Sweeny, Renwick, Richter, JJ. 10007 Start Elevator, Inc., Index 108412/09 Plaintiff-Appellant, -against- New York City Housing Authority, Defendant-Respondent. _________________________ Agulnick & Gogel, LLC, Great Neck (William A. Gogel of counsel), for appellant. Kelly D. MacNeal, New York (Lauren L. Esposito of counsel), for respondent. _________________________ Order, Supreme Court, New York County (Barbara R. Kapnick, J.), entered June 1, 2010, which granted defendant’s motion to dismiss the complaint, unanimously affirmed, without costs. Plaintiff’s contention that its April 28 and May 4, 2004 letters constituted a notice of claim pursuant to section 23 of the parties’ contract is unavailing (see e.g. Bat-Jac Contr. v New York City Hous. Auth., 1 AD3d 128, 129 [1st Dept 2003]). The April 28 letter merely stated that plaintiff would forward an estimate for the increased cost due to the change from ceramic tiles to glazed structural brick; however, section 23(a) requires that a notice of claim state the “amount of the extra cost.” Although plaintiff’s May 4 letter stated the amount of the extra cost, it was “not designated as a notice of claim” (Bat-Jac, 1 AD3d at 128; see also Everest Gen. Contrs. v New York City Hous. Auth., 99 AD3d 479, 479-480 [1st Dept 2012]), and instead was a change order form requiring defendant to accept and approve the change by signing it. Defendant’s signature does not appear on the May 4 letter. Even assuming that plaintiff’s letters constitute a notice of claim, the release plaintiff signed bars this action (see e.g. -

Press Guests at State Dinners - Lists and Memos (9)” of the Ron Nessen Papers at the Gerald R

The original documents are located in Box 23, folder “Press Guests at State Dinners - Lists and Memos (9)” of the Ron Nessen Papers at the Gerald R. Ford Presidential Library. Copyright Notice The copyright law of the United States (Title 17, United States Code) governs the making of photocopies or other reproductions of copyrighted material. Ron Nessen donated to the United States of America his copyrights in all of his unpublished writings in National Archives collections. Works prepared by U.S. Government employees as part of their official duties are in the public domain. The copyrights to materials written by other individuals or organizations are presumed to remain with them. If you think any of the information displayed in the PDF is subject to a valid copyright claim, please contact the Gerald R. Ford Presidential Library. Digitized from Box-- 23 of The Ron Nessen Papers at the Gerald R. Ford Presidential Library -- GUEST LIST FOR THE DINNER TO BE GIVEN BY THE PRESIDENT AND MRS. FORD IN HONOR OF HIS EXCELLENCY THE PRESIDENT OF THE REPUBLIC OF COLOMBIA AND MRS. LOPEZ ON THURSDAY, SEPT EM- BER 25, 1975 AT EIGHT O'CLOCK, THE WHITE HOUSE . His Excellency The President of the Republic of Colombia and Mrs. Lopez His Excellency The Ambassador of the Republic of Colombia and Mrs. Turbay His Excellency Rodrigo Botero Montoya and Mrs. Botero Minister of Finance His Excellency Rafael Pardo Buelvas and Mrs. Pardo Minister of Agriculture His Excellency Jorge Ramirez Ocampo and Mrs. Ramirez Minister of Economic Development His Excellency Humberto Salcedo Collantes and Mrs. -

Cool Tech Startups in NYC - Modified Based on Mapped in NY Companies

Cool Tech Startups in NYC - Modified Based on Mapped In NY Companies Company Name Address URL Hiring "Document Prep- ' - ' Program"' "More than just ' - ' Figleaves' #Fit4ME' ' - ' 'brellaBox' ' - ' 'wichcraft' ' - ' (GFree)dom' ' - ' 0s&1s Novels' ' - ' 1 Knickerbocker' ' - ' 1 Main Street Capital' ' - ' 10 Speed Labs' '1239 Broadway' 1000|MUSEUMS, Inc' ' - ' 107 Models' ' - ' 10Lines' ' - ' 10gen' ' - ' 11 Picas' ' - ' 144 Investments' ' - ' 1754 & Company, LLC' ' - ' 1800Postcards.com' '121 Varick Street' 1800TAXISTA.COM ' - ' Page 1 of 514 10/02/2021 Cool Tech Startups in NYC - Modified Based on Mapped In NY Companies Jobs URL Page 2 of 514 10/02/2021 Cool Tech Startups in NYC - Modified Based on Mapped In NY Companies INC' 18faubourg by Scharly ' - ' Designer Studio' 1938 News' '1 Astor Pl' 1DocWay' '483 Broadway, Floor 2, New York, NY 10013' 1NEEDS1 LLC' ' - ' 1Stop Energies' ' - ' 1World New York' ' - ' 1er Nivel S.A.' ' - ' 1stTheBest Inc' ' - ' 1stdibs.com' '51 Astor Place' 20x200' '6 Spring Street' 24eight, LLC' ' - ' 24symbols' '42 West 24th Street ' 27 Perry' ' - ' 29th Street Publishing' ' - ' 2Cred' ' - ' 2J2L' ' - ' 2U (aka 2tor)' '60 Chelsea Piers, Suite 6020' 2findLocal' '2637 E 27th St' 2nd Nature Toys' ' - ' Page 3 of 514 10/02/2021 Cool Tech Startups in NYC - Modified Based on Mapped In NY Companies Page 4 of 514 10/02/2021 Cool Tech Startups in NYC - Modified Based on Mapped In NY Companies 303 Network, Inc.' ' - ' 33across' '229 West 28th Street, 12th Fl' 345 Design' '49 Greenwich Ave, Suite 2' A.R.T.S.Y Magazine' -

Mapped in NY Companies

Mapped In NY Companies Company Name Address Address2 "Document Prep-Program"' ' - ' ' - ' "More than just Figleaves' ' - ' ' - ' #Fit4ME' ' - ' ' - ' 'brellaBox' ' - ' ' - ' 'wichcraft' ' - ' ' - ' (GFree)dom' ' - ' ' - ' 0s&1s Novels' ' - ' ' - ' 1 Knickerbocker' ' - ' ' - ' 1 Main Street Capital' ' - ' ' - ' 10 Speed Labs' '1239 Broadway' 'Penthouse' 1000|MUSEUMS, Inc' ' - ' ' - ' 107 Models' ' - ' ' - ' 10Lines' ' - ' ' - ' 10gen' ' - ' ' - ' 11 Picas' ' - ' ' - ' 144 Investments' ' - ' ' - ' 1754 & Company, LLC' ' - ' ' - ' 1800Postcards.com' '121 Varick Street' '4th Floor' Page 1 of 1390 09/25/2021 Mapped In NY Companies City Category Name URL ' - ' ' - ' ' - ' ' - ' ' - ' ' - ' ' - ' ' - ' ' - ' 'New York' ' - ' ' - ' ' - ' ' - ' ' - ' ' - ' ' - ' 'New York' Page 2 of 1390 09/25/2021 Mapped In NY Companies Hiring Jobs URL Why NYC Page 3 of 1390 09/25/2021 Mapped In NY Companies Community Postcode Borough Latitude Longitude Council District Board 10001 MANHATTAN 40.747135 -73.988397 5 3 10013 MANHATTAN 40.724861 -74.005946 2 3 Page 4 of 1390 09/25/2021 Mapped In NY Companies Census Tract BIN BBL NTA 76 1082273 1008320001 Midtown-Midtown South 37 1009728 1005780067 SoHo-TriBeCa- Civic Center-Little Page 5 of 1390 09/25/2021 Mapped In NY Companies 1800TAXISTA.COM INC' ' - ' ' - ' 18faubourg by Scharly Designer Studio' ' - ' ' - ' 1938 News' '1 Astor Pl' ' - ' 1DocWay' '483 Broadway, Floor 2, New York, NY '483 Broadway, Floor 2' 10013' 1NEEDS1 LLC' ' - ' ' - ' 1Stop Energies' ' - ' ' - ' 1World New York' ' - ' ' - ' 1er Nivel S.A.' ' -

E H R I C H S G R a H N Rengifo

s t e v e n j o h a n n e s e h r i c h s G r a h n e r i k r e n G i fo t h o m a s b e k a s s t e p h a n b a r e a a . j . l a z a 2010 Hofstra University Men’s Soccer Quick Facts Location: Hempstead, New York 11549 Director of Special Events: table of contents Founded: 1935 Chrissy Arnone Enrollment: 12,100 Athletic Department Phone: 1 Quick Facts/ Nickname: Pride (516) 463-6750 Table of Contents Colors: Gold, White and Blue 2 This is Hofstra University Affiliation: NCAA Division I Senior Assistant Director of Athletic Conference: Colonial Athletic Association Communications/ 4 Head Coach Richard Nuttall Home Field: Hofstra Soccer Stadium Soccer Contact: Jeremy Kniffin 6 Assistant Coaches (1,600) Office Phone: (516) 463-6759 7 2010 Roster Surface: Field Turf Office Fax: (516) 463-5033 8 2010 Outlook Press Table Phone: (516) 523-6185 Cell Phone: (516) 523-6185 10 Player Bios E-mail Address: 23 Hofstra University President President: Stuart Rabinowitz [email protected] Faculty Athletics Representative: Associate Director of Athletics for 24 University Senior Dr. Michael Barnes Communications: Administration/Trustees Director of Athletics: Jack Hayes Stephen Gorchov 25 Hofstra University Director Executive Associate Director of Athletics: Office Phone: (516) 463-4933 of Athletics Danny McCabe Senior Sports Information Director: 26 Hofstra Athletic Administration Senior Associate Director of Athletics: Jim Sheehan and Head Coaches Cindy Lewis Office Phone: (516) 463-6764 28 Hofstra Heritage Associate Director of Athletics for -

Central Park Conservancy

Central Park Conservancy ANNUAL REPORT 2016 Table of Contents 2 Partnership 4 Letter from the Chairman of the Board of Trustees and the Conservancy President 5 Letter from the Mayor and the Parks Commissioner 6 Forever Green 10 Craftsmanship 12 Historic Boat Landings Reconstructed at the Lake 16 Perimeter Reconstruction Enhances the East 64th Street Entrance 17 Northern Gateway Restored at the 110th Street Landscape 18 Putting the Adventure Back Into Adventure Playground 20 The Conservation of King Jagiello 22 Southwest Corner Update: Pedestrian-Friendly Upgrades at West 63rd Street 24 Infrastructure Improves the Experience at Rumsey Playfield Landscape 26 Woodlands Initiative Update 30 Stewardship 32 Volunteer Department 34 Operations by the Numbers 40 Central Park Conservancy Institute for Urban Parks 44 Community Programs 46 Friendship 54 Women’s Committee 55 The Greensward Circle 56 Financials 82 Supporters 118 Staff & Volunteers 128 Central Park Conservancy Mission, Guiding Principle, Core Values, and Credits Cover: Hernshead Landing Left: Raymond Davy 3 CENTRAL PARK CONSERVANCY Table of Contents 1 Partnership Central Park Conservancy The City of New York This was an exciting year for the Our parks are not only the green spaces where we go to exercise, experience nature, relax, and spend Conservancy. In spring, we launched our time with family and friends. For many New Yorkers, they are also a lifeline and places to connect with their most ambitious campaign to date, Forever community and the activities that improve quality of life. They are critical to our physical and mental Green: Ensuring the Future of Central well-being and to the livability and natural beauty of our City. -

ED 119 399 Publishers and Producers in the U.S. Canada

DOCUMENT RESUME ED 119 399 95 EC 081 389 TITLE Publisher Source Directory: A List of Where to Buy or Rent Instructional Materials and Other Educational ' Aids, Devices, and Media Including More Than 1,600 Publishers and Producers in the U.S. Canada, and Europe. Revised Edition. INSTITUTION National Center on Educational Media and Materials for the Handicapped, Columbus, Ohio. SPONS AGENCY Bureau of Education for the Handicapped (DHEW/OE), Washington, D.C. REPORT NO NC-75 303 PUB DATE Oct 75 CONTRACT OEC-300-72-4478 NOTE 86p. EDRS PRICE MF-$0.83 HC-$4.67 Plus Postage DESCRIPTORS Audiovisual Aids; Books; Electromechanical Aids; Exceptional Child Education; Films; *Handicapped Children; *Instructional Materials; *Instructional Media; *Resource Guides; Tape Recordings; Toys ABSTRACT Listed are more than 1,600 publishers, producers, and distributors of educational materials for use with the handicapped. Entries are presented in alphabetical order according to name. Beneath each source's name and address are code numbers which correspond to the type of materials each publisher's catalog lists. Provided is a list of the codes and definitions for 74 types of instructional aids, devices, and/or media which include books, audiovisual aids, films, tapes, electromechanical aids, and toys. (SB) *********************************************************************** Documents acquired by ERIC include many informal unpublished * materials not available from other sources. ERIC makes every effort * * to obtain the best copy available. Nevertheless, items of marginal * * reproducibility are often encountered and this affects the quality * * of the microfiche and hardcopy reproductions ERIC makes available * * via the ERIC Document Reproduction Service (EDRS). EDRS is not * responsible for the quality of the original document. -

Newspaper Guild of New York • the New York Times •

Newspaper Guild of New York • The New York Times • Guild-Times Benefits Fund Summary Plan Description for Retired Employees Age 65 or Over Effective July 1, 2006 SUMMARY PLAN DESCRIPTION FOR RETIRED EMPLOYEES AGE 65 OR OVER TABLE OF CONTENTS Newspaper Guild of New York/The New York Times Benefits Fund ..............1 Highlights of Your Benefits Fund Program for Retired Employees Age 65 or Over .......................................................3 Eligibility for Benefits ..........................................................................................5 Who is Eligible? .....................................................................................5 For Yourself ..............................................................................5 For Your Dependents ..............................................................5 Is Coverage Automatic or Must I Enroll? .............................6 What Should I Do If My Family Status Changes? ..............6 Contributions to the Cost of Coverage .............................................................7 Medical Benefits ..................................................................................................8 Before Age 65 ........................................................................................8 Age 65 or Older .....................................................................................8 Prescription Drug Program ..................................................................8 Medicare Part D .....................................................................................9 -

Manhattan Office Market

Manhattan Offi ce Market 2 ND QUARTER 2015 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 1001 Avenue of the Americas Looking Ahead Partnership for New York City: New York’s Future as the World Financial Capital The report released in June concluded that while New York City remains the preferred location of global fi nancial companies to establish their headquarters, there is a growing trend to relocate jobs and business operations to lower cost, more business-friendly locations that are beyond the city’s border. A comprehensive survey was conducted in collaboration with Gerson Lehrman Group (GRG), intending to better understand how the fi nancial industry is evolving; and what measures are required to solidify New York’s competitive advantage as a global fi nancial center. Collected data represents an overview of the responses from 50-fi rm respondents that included large banks, insurance companies and asset managers, private equity fi rms, hedge funds, and fi nancial technology (FinTech) startups; and represent about 1/3rd of the total industry employment in the city. Additionally, observations were included from 8-real estate fi rms that were surveyed; along with interviews from other related experts in the fi eld. Financial Industry – an economic snapshot • Contributes 20% of the city’s economic output, representing twice that of the next top-grossing industry. • Accounts for nearly 1/3rd of the city’s private sector payroll, despite accounting for only 8%, or about 310,000 of the city’s private sector jobs in 2013; of which 23,000 jobs are high-technology in the areas of software, data processing and network management. -

Special Libraries, September 1962

San Jose State University SJSU ScholarWorks Special Libraries, 1962 Special Libraries, 1960s 9-1-1962 Special Libraries, September 1962 Special Libraries Association Follow this and additional works at: https://scholarworks.sjsu.edu/sla_sl_1962 Part of the Cataloging and Metadata Commons, Collection Development and Management Commons, Information Literacy Commons, and the Scholarly Communication Commons Recommended Citation Special Libraries Association, "Special Libraries, September 1962" (1962). Special Libraries, 1962. 7. https://scholarworks.sjsu.edu/sla_sl_1962/7 This Magazine is brought to you for free and open access by the Special Libraries, 1960s at SJSU ScholarWorks. It has been accepted for inclusion in Special Libraries, 1962 by an authorized administrator of SJSU ScholarWorks. For more information, please contact [email protected]. SPECIAL LIBRARIES ASSOCIATION Putting Knowledge to Work OFFICERS DIRECTORS President SARAAULL ETHELS. KLAHRE University of Houston Federal Reserve Bank of Clezeland, Clez'eland, Ohio Houston 4, Texas First Vice-president and President-Elect JOANM. HUTCHINSON MRS.MILDRED H. BRODE Research Center, Diamond Alkali David Taylor Model Bash, IVash~ngtoiz,D. C. Company, Painesville, Ohio Second Vice-president ROBERTW. GIBSON,JR. PAULW. RILEY College of Business Adminirtfatiun Thomas J. Watson Research Center, Yorktouw Heights, New Yorh Boston College Chestnut Hill, Massachusetts Secretary MRS.JEANNE B. NORTH MRS.ELIZABETH B. ROTH Lochheed Missiles & Space Diz,ision. Pdo Alto, Standard Oil Company of Califor- California nia, San Francisco, California Treasurer EDWARDG. STRABLE RALPHH. PHELPS J. Walter Thompson Company Engineering Societies Library, New Yorh, New Yorh Chicago, Illinois Immediate Past-President hins. ELIZABETHR. USHER EUGENEB. JACKSON Metropolitan Museum of A!t Research Laboratories, General Moio~sCorporation New York, New Yorh Warren, Michigaiz EXECUTIVE SECRETARY: BILL M. -

A Guide to Art + Architecture + Design in Times Square

A GUIDE TO ART + ARCHITECTURE + DESIGN IN TIMES SQUARE Chaos by Design Like any crossroads, the Crossroads of the World evolved through trading and talking and selling and hawking. But its shape and sweep evolved by design. This guide takes you to the district’s edges and helps you absorb the architectural gambits and visionary plans that made Times Square its colorful, dizzying self. Times Square’s future, as designed by renowned Norwegian architectural firm Snøhetta. Completion expected 2015. West 43 9 11 10 12 6 8 7 13 West 42 2 3 4 5 West 40th to 43rd West 41 1 Broadway Eighth Avenue Seventh Avenue Sixth Avenue West 40 SITE LOCATION PAGE 5 1 The (new) New York Times Building 620 Eighth Avenue 10 2 McDonald’s 220 West 42nd Street 10 3 New Amsterdam Theatre 214 West 42nd Street 11 4 NYC Subway Entrance Broadway at West 42nd Street 11 5 The Return of Spring Times Square Subway Station 12 5 Times Square Mural Times Square Subway Station 12 5 New York in Transit Times Square Subway Station 13 6 1 Times Square 1 Times Square 13 7 New Victory Theater 209 West 42nd Street 14 8 New 42nd Street Studios 229 West 42nd Street 14 9 The Westin New York at Times Square 270 West 43rd Street 15 10 NYPD Mosaic Broadway at West 42nd Street 15 11 Reuters 3 Times Square 16 12 Condé Nast Building 4 Times Square 16 13 Bank of America One Bryant Park 17 Architecture Interiors Public Art Signage West 46 24 West 43th to 46th 25 West 45 23 21 22 West 44 Eighth Avenue 19 20 14 16 15 18 17 Broadway Seventh Avenue Sixth Avenue West 43 SITE LOCATION PAGE 7 14 ABC News Ticker 1500 Broadway 17 15 US Armed Forces Recruiting Station Broadway at West 43rd Street 18 16 Paramount Building 1501 Broadway 18 17 The Former New York Times Building 229 West 43rd Street 19 18 Second Stage Theatre 305 West 43rd Street 19 19 John’s Pizzeria 260 West 44th Street 20 20 St. -

The Top Brokers | the Real Deal | New York Real Estate News Page 1 of 7

The top brokers | The Real Deal | New York Real Estate News Page 1 of 7 www TheGrandAtDiamondBeach com AdsbyGoogle THE TOP BROKERS A look at Manhattan's 75 residential agents with the most exclusives June 02, 2010 07:00AM By Candace Taylor Top agents, in order from left: Carrie Chiang, Dolly Lenz, Serena Boardman, Hervé Senequier, Leonard Steinberg Manhattan's top real estate agents are as diverse as the city itself, proving once again that there's more than one way to make a buck in this town. This year, The Real Deal's annual ranking of the city's top brokers showcases a range of different business models, from agents who sell hundreds of newly built condos a year to those who specialize in historic townhouses, and everything in between. Generally speaking, however, Manhattan's top brokers fall into two camps: those who work alone or with a single partner, and those with teams. "There's two ways to do it," explained Corcoran's Leighton Candler, who ranked No. 11 on this year's list. Some big-name brokers become "a company within a company," she said, selling a high volume of listings with help from a number of junior agents. Others, like herself, choose only a few very high-priced listings, and handle them with only an assistant or two. Whatever their business model, agents said properties priced north of $20 million are more likely to change hands this year than they were in 2009. Deals, however, are still taking much longer than they did in the past.