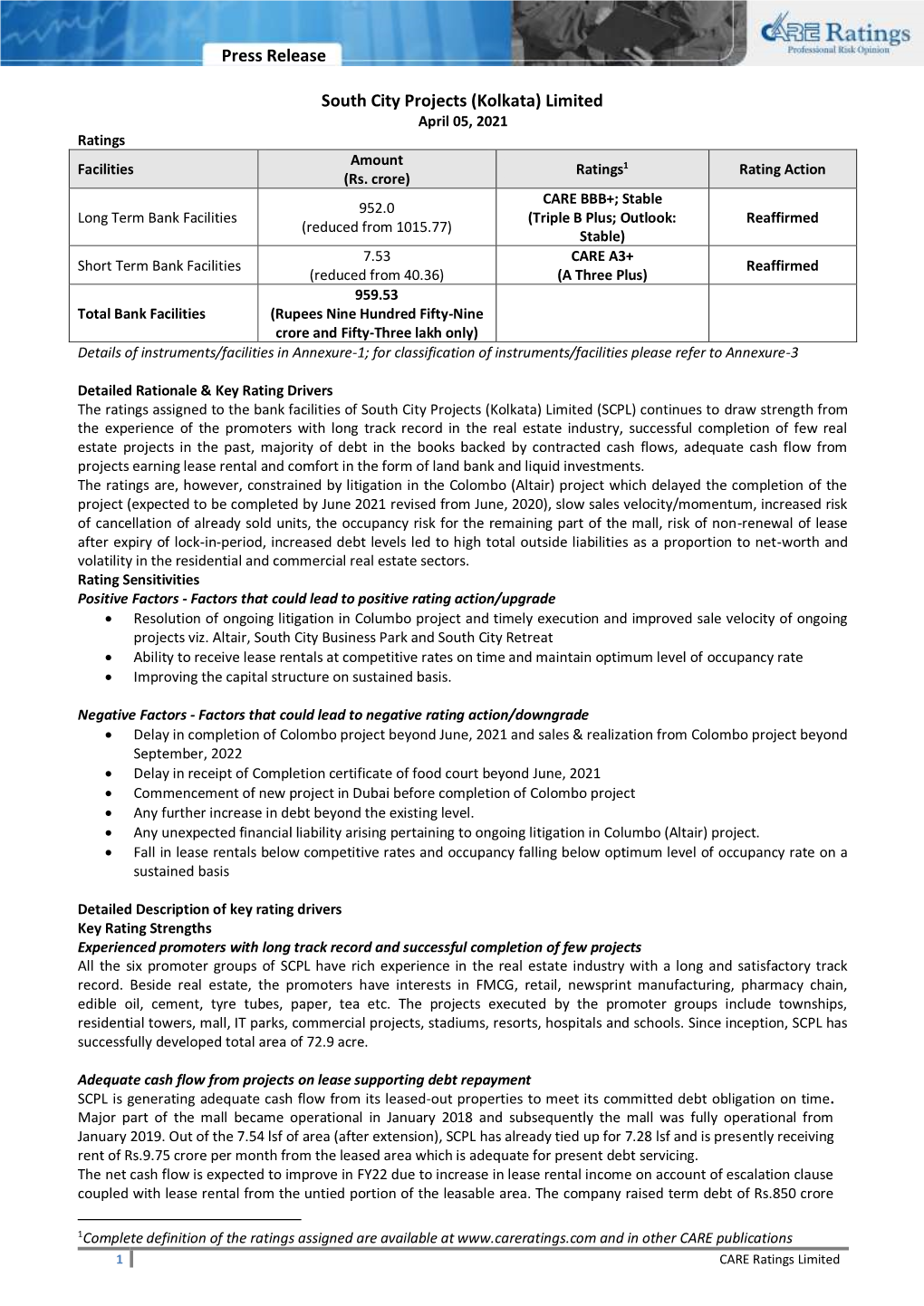

Press Release South City Projects (Kolkata) Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Dreaming of Diasporas: Urban Developments and Transnational Identities in Contemporary Kolkata

TOPIA 17 |111 Pablo S. Bose Dreaming of Diasporas: Urban Developments and Transnational Identities in Contemporary Kolkata ABSTRACT This paper examines the contested nature of diasporas and their complex involvement in dynamics of international development by focusing on the recent construction of luxury condominiums on the fringes of the Indian metropolis of Kolkata. These new housing projects are built and marketed with a self-consciously global aesthetic in mind and are actively promoted to both overseas Indian communities and local elites as spaces in which one can take up an explicitly “international” identity. This paper argues that these discourses and developments regarding life-space and lifestyle are part of a broader project intended to help Kolkata regain its past glory as a “world city.” Furthermore, it is suggested that the deployment of the heavily mythologized figure of the global Indian is a crucial element for mobilizing key actors and constituting material transformations in the postcolonial city. RÉSUMÉ Ce texte examine la nature contestée des diasporas et leur implication complexe dans les dynamiques de développement international en se concentrant sur les récentes constructions de condominiums luxueux en bordure de la métropole indienne de Kolkata. Ces constructions nouvelles sont bâties et mises sur le marché en valorisant un esthétisme consciemment global. Elles sont activement promues, à la fois aux communautés Indiennes outre-mer et aux élites locales, comme étant des espaces dans lesquels un individu peut acquérir une identité « internationale » explicite. Ce texte argumente que ces discours et ces développements au sujet de l’espace de vie, et de style de vie, font partie d’un projet plus large visant à soutenir Kolkata pour regagner sa gloire passée comme « ville du monde » . -

Bus Route 1: from Thakurpukur 3A

Route 1 Route 1A ROUTE 2 ROUTE 2A ROUTE 3 2019-20 2019-20 2019-20 2019-20 2019-20 Bus Route 1: From Thakurpukur 3A Bus Route 1A: From Tollygunge Bus Route 2: From Bally Halt To Bus Route 2A: From Kamalgazi Bus Route 3: From Gariahat to Bus Stand to University P.S. to University University to University University Contact No: 9123786980 Contact No: 9123786980 Contact No: 9123786980 Contact No: 9123786980 Contact No: 9123786980 SL SL SL SL SL STOPPAGE STOPPAGE STOPPAGE STOPPAGE STOPPAGE NO NO NO NO NO SOUTHERN AVENUE POSTOFFICE 1 THAKURPUKUR 3A BUS STAND 1 1 RAMCHANDRAPUR 1 KAMALGAZI 1 GARIAHAT MORE SAROBAR CROSSING RASHBIHARI/SOUTHERN AVENUE 2 THAKURPUKUR BAZAR 2 2 BALLY HALT 2 GARIA DHALAI BRIDGE 2 DESHOPRIYO PARK CROSSING (OPP TOLLYGUNGE P.S.) 3 KADAMTALA/PORAASHATTALA 3 RABINDRA SAROBAR 3 BALLY GHAT 3 PATULI CROSSING 3 RASHBIHARI CROSSING 4 SILPARA 4 CHARU MARKET 4 DUNLOP 4 BAGHAJATIN 4 KALIGHAT TRAM DEPOT 5 SAKHERBAZAR 5 BHABANI CINEMA METRO 5 BONHOOGLY 5 HILAND PARK 5 HAZRA CROSSING 6 JANAKALYAN 6 TOLLYGUNGE PHARI 6 GHOSH PARA 6 AJAY NAGAR 6 PURNA CINEMA 7 BEHALA CHOWRASTHA 7 TIPU SULTAN MOSQUE 7 SINTHEE MORE 7 MUKUNDAPUR 7 JADU BAZAR (BHAWANIPUR METRO) 8 BLIND SCHOOL 8 DHAKA KALIBURI 8 CHIRIAMORE 8 METRO CASH AND CARRY 8 ELGIN ROAD 9 MANTON 9 NAVINA CINEMA 9 PAIKPARA BT ROAD 9 KALIKAPUR KHAL BRIDGE 9 EXIDE MORE (RABINDRA SADAN) 10 BEHALA TRAM DEPOT 10 LORDS MORE 10 TALA POST OFFICE 10 RUBY 10 LORDS SINNA ROAD 11 BEHALA PS 11 SOUTH CITY 11 SHYAM BAZAR 11 ULTADANGHA HUDCO 11 CAMAC ST. -

Alcove Flora Fountain

https://www.propertywala.com/alcove-flora-fountain-kolkata Alcove Flora Fountain - Topsia, Kolkata An embodiment of refreshing water bodies and sprawling landscaped greens Alcove Flora Fountain is presented by Alcove Realty at Tangra, Topsia, Kolkata offers residential project that hosts 2, 3 and 4 BHK apartment with good features Project ID: J289645611 Builder: Alcove Realty Location: Flora Fountain, Tangra, Topsia, Kolkata - 700046 (West Bengal) Completion Date: Dec, 2021 Status: Started Description Alcove Flora Fountain by Alcove Realty located at Tangra, Topsia, Kolkata redefines the standard of living with architectural excellence. Project spread over 899 sq. ft.-1882 sq. ft. comprising of 2,3 and 4 bhk apartments. The project is equipped with key amenities including fire safety systems, swimming pool, kids pool etc. & well connected with other parts of city and has all the basic utilities. RERA ID : HIRA/P/KOL/2018/000050 Amenities: swimming pool kids pool locker facilities an AC lounge outdoor yoga deck Alcove Reaqlty, One of the most renowned, trusted and exemplary name in the sphere of real estate - Alcove Realty, spearheaded by the legendary Mr. Amar Nath Shroff, came into existence to set an indelible benchmark with its landmark projects. With forty glorious years of experience, this ‘3 Generation’ company is beheld with distinction and respect among all the renowned builders in Kolkata, at the helm of the industry. Features Security Features Exterior Features Fire Alarm Reserved Parking Recreation Land Features Swimming Pool -

BUS ROUTE-18-19 Updated Time.Xls LIST of DROP ROUTES & STOPPAGES TIMINGS LIST of DROP ROUTES & STOPPAGES TIMINGS

LIST OF DROP ROUTES & STOPPAGES TIMINGS LIST OF DROP ROUTES & STOPPAGES TIMINGS FOR THE SESSION 2018-19 FOR THE SESSION 2018-19 ESTIMATED TIMING MAY CHANGE SUBJECT ESTIMATED TIMING MAY CHANGE SUBJECT TO TO CONDITION OF THE ROAD CONDITION OF THE ROAD ROUTE NO - 1 ROUTE NO - 2 SL NO. LIST OF DROP STOPPAGES TIMINGS SL NO. LIST OF DROP STOPPAGES TIMINGS 1 DUMDUM CENTRAL JAIL 13.00 1 IDEAL RESIDENCY 13.05 2 CLIVE HOUSE, MALL ROAD 13.03 2 KANKURGACHI MORE 13.07 3 KAJI PARA 13.05 3 MANICKTALA RAIL BRIDGE 13.08 4 MOTI JEEL 13.07 4 BAGMARI BAZAR 13.10 5 PRIVATE ROAD 13.09 5 MANICKTALA P.S. 13.12 6 CHATAKAL DUMDUM ROAD 13.11 6 MANICKTALA DINENDRA STREET XING 13.14 7 HANUMAN MANDIR 13.13 7 MANICKTALA BLOOD BANK 13.15 8 DUMDUM PHARI 01:15 8 GIRISH PARK METRO STATION 13.20 9 DUMDUM STATION 01:17 9 SOVABAZAR METRO STATION 13.23 10 7 TANK, DUMDUM RD 01:20 10 B.K.PAUL AVENUE 13.25 11 AHIRITALA SITALA MANDIR 13.27 12 JORABAGAN PARK 13.28 13 MALAPARA 13.30 14 GANESH TALKIES 13.32 15 RAM MANDIR 13.34 16 MAHAJATI SADAN 13.37 17 CENTRAL AVENUE RABINDRA BHARATI 13.38 18 M.G.ROAD - C.R.AVENUE XING 13.40 19 MOHD.ALI PARK 13.42 20 MEDICAL COLLEGE 13.44 21 BOWBAZAR XING 13.46 22 INDIAN AIRLINES 13.48 23 HIND CINEMA XING 13.50 24 LEE MEMORIAL SCHOOL - LENIN SR. 13.51 ROUTE NO - 3 ROUTE NO - 04 SL NO. -

Main Voter List 08.01.2018.Pdf

Sl.NO ADM.NO NAME SO_DO_WO ADD1_R ADD2_R CITY_R STATE TEL_R MOBILE 61-B, Abul Fazal Apartments 22, Vasundhara 1 1150 ACHARJEE,AMITAVA S/o Shri Sudhamay Acharjee Enclave Delhi-110 096 Delhi 22620723 9312282751 22752142,22794 2 0181 ADHYARU,YASHANK S/o Shri Pravin K. Adhyaru 295, Supreme Enclave, Tower No.3, Mayur Vihar Phase-I Delhi-110 091 Delhi 745 9810813583 3 0155 AELTEMESH REIN S/o Late Shri M. Rein 107, Natraj Apartments 67, I.P. Extension Delhi-110 092 Delhi 9810214464 4 1298 AGARWAL,ALOK KRISHNA S/o Late Shri K.C. Agarwal A-56, Gulmohar Park New Delhi-110 049 Delhi 26851313 AGARWAL,DARSHANA 5 1337 (MRS.) (Faizi) W/o Shri O.P. Faizi Flat No. 258, Kailash Hills New Delhi-110 065 Delhi 51621300 6 0317 AGARWAL,MAM CHANDRA S/o Shri Ram Sharan Das Flat No.1133, Sector-29, Noida-201 301 Uttar Pradesh 0120-2453952 7 1427 AGARWAL,MOHAN BABU S/o Dr. C.B. Agarwal H.No. 78, Sukhdev Vihar New Delhi-110 025 Delhi 26919586 8 1021 AGARWAL,NEETA (MRS.) W/o Shri K.C. Agarwal B-608, Anand Lok Society Mayur Vihar Phase-I Delhi-110 091 Delhi 9312059240 9810139122 9 0687 AGARWAL,RAJEEV S/o Shri R.C. Agarwal 244, Bharat Apartment Sector-13, Rohini Delhi-110 085 Delhi 27554674 9810028877 11 1400 AGARWAL,S.K. S/o Shri Kishan Lal 78, Kirpal Apartments 44, I.P. Extension, Patparganj Delhi-110 092 Delhi 22721132 12 0933 AGARWAL,SUNIL KUMAR S/o Murlidhar Agarwal WB-106, Shakarpur, Delhi 9868036752 13 1199 AGARWAL,SURESH KUMAR S/o Shri Narain Dass B-28, Sector-53 Noida, (UP) Uttar Pradesh0120-2583477 9818791243 15 0242 AGGARWAL,ARUN S/o Shri Uma Shankar Agarwal Flat No.26, Trilok Apartments Plot No.85, Patparganj Delhi-110 092 Delhi 22433988 16 0194 AGGARWAL,MRIDUL (MRS.) W/o Shri Rajesh Aggarwal Flat No.214, Supreme Enclave Mayur Vihar Phase-I, Delhi-110 091 Delhi 22795565 17 0484 AGGARWAL,PRADEEP S/o Late R.P. -

Tata Starbucks Enters Kolkata with Three New Stores

Tata Starbucks Enters Kolkata With Three New Stores KOLKATA, India; March 20, 2018 - Tata Starbucks Private Limited, the 50/50 joint venture between Starbucks Coffee Company (Nasdaq: SBUX) and Tata Global Beverages Limited, will welcome its customers in Kolkata for the first time on March 21. Delivering the iconic ‘Third Place’ experience to customers and stewarding the company’s commitment to the city, Tata Starbucks will open three stores, marking the seventh city for the company in India. Sumitro Ghosh, chief executive officer, Tata Starbucks said, “We are honored to bring Starbucks to Kolkata, a city that has always been known for its cultural heritage and grandeur. Our aspiration is to delight our customers in Kolkata with the unique Starbucks Experience that is built on three core fundamentals – our partners (employees), our stores and our coffee. The institution of the ‘adda’ and the timeless passion it invokes in those who know of the city of Kolkata is inspiring. We hope to pay homage to the city’s inherent tradition by becoming a new ‘adda’ for our customers in Kolkata.” The three stores have been designed to weave Starbucks heritage and coffee passion into the vibrant and colorful culture of Kolkata. The regional craftsmanship, handmade by local artists and designers, brings this narrative to life across the city with different elements emphasized at each store. The Starbucks flagship store, located inside the iconic 108 year old Park Mansions on Park Street, celebrates Starbucks brand heritage with a large depiction of the Starbucks Siren, created with local tapestry, in the many colors found on the streets of Kolkata. -

Store Locations

Store Locations City Store Name Locality Ahemdabad Law Garden Cross Words Ahemdabad Prahalad nagar Toy Zapp/Toy Cra Ahemdabad CG Road Kavita Toys Ahmedabad Hamleys ALPHA ONE AHMEDABAD Ahmedabad Landmark Abhijeet V AHM Law Garden Ahmedabad Shoppers Stop ALPHA AHMEDABAD Ahmedabad Shoppers Stop CG ROAD AHMEDABAD Amritsar Hamleys MALL OF AMRITSAR Amritsar Shoppers Stop AMRITSAR Aurangabad Shoppers Stop AURANGABAD Bangalore ToysRus Toys R us, Phoenix Marketcity, Bangalore Bangalore ToysRus Toys R us, Vegacity, Bangalore Bangalore Hamleys PHOENIX MARKET CITY BANGALORE Bangalore Hamleys LIDO 1MG ROAD MALL BANGALORE Bangalore Landmark Brigade Orion Mall Bangalore Bangalore ToysRus Phoenix Marketcity Bangalore Landmark Forum Mall BNG Koramangala Bangalore Hamleys MANTRI-MALL-BANGALORE Bangalore ToysRus Vegacity Bangalore Hamleys VR MALL BANGALORE Bangalore Shoppers Stop BENRGATTA Bangalore Shoppers Stop WHITEFIELD INORBIT BNG Bangalore Shoppers Stop SOUL SPACE BANGALORE Bangalore Shoppers Stop GARUDA Bangalore Landmark CMJ BLDG BNG Kamraj Road Bangalore Shoppers Stop MANTRI MALLESWARAM Bangalore Shoppers Stop OLD MADRAS BNG Bangalore Shoppers Stop KORAMANGALA Bangalore Shoppers Stop WHITEFIELD Bangalore Banshri Evergreen Toys Bangalore Bllundre Peekaboo / Baby Desire Bangalore HSR layout Kids Giggle / Baby Desire / Baby Outlet Bangalore Commercial Street Toy World Bangalore Frazer Town Dream World Bangalore HBR Layout Toy Junction Bhopal Hamleys DB CITY MALL BHOPAL Bhopal Shoppers Stop BHOPAL Bhubaneshwar Hamleys ESPLANADEONE-OD-BBR Chandigarh -

16‐06‐20 13 5 Seals Garden Lane Cossipore 700002 1 1

Affected Zone DAYS SINCE Date of reporting of REPORTING Sl No. Address Ward Borough Local area the case 13 5 SEALS GARDEN LANE The premises itself 1 1 1 Cossipore 16‐06‐20 COSSIPORE 700002 14 The affected flat/the 59 Kalicharan Ghosh Rd standalone house 2 kolkata ‐ 700050 West 2 1 Sinthi Bengal India 16‐06‐20 14 The premises itself 21/123 RAJA MANINDRA 3 31 Paikpara ROAD BELGACHIA 700037 16‐06‐20 14 14A BIRPARA LANE The premises itself 4 kolkata ‐ 700030 West 31 Belgachia 16‐06 ‐20 BBlIdiengal India 14 The flat itself A4 6 R D B RD Kolkata ‐ 5 41 Paikpara 700002 West Bengal India 16‐06‐20 14 110/1A COSSIPORE Road The premises itself 6 Kolkata ‐ 700002 West 6 1 Chitpur 16‐06‐20 Bengal India 14 Adjacent common passage of affected hut 14 3 GALIFF STREET 7 7 1 Bagbazar including toilet and BAGHBAZAR 700003 water source of the 16‐06‐20 slum 14 Adjacent common passage of affected hut 14 3 GALIFF STREET 8 7 1 Bagbazar including toilet and BAGHBAZAR 700003 water source of the 16‐06‐20 slum 14 Affected Zone DAYS SINCE Date of reporting of REPORTING Sl No. Address Ward Borough Local area the case 1 RAMKRISHNA LANE The premises itself 9 Kolkata ‐ 700003 West 7 1 Girish Mancha 16‐06‐20 Bengal India 14 The premises itself 4/2/1B KRISHNA RAM BOSE 10 STREET SHYAMPUKUR 10 2 Shyampukur KOLKATA 700004 16‐06‐20 14 T/1D Guru Charan Lane The premises itself 11 Kolkata ‐ 700004 West 10 2 Hatibagan 16‐06‐20 Bengal India 14 Adjacent common 47 1 SHYAMBAZAR STREET passage of affected hut 12 Kolk at a ‐ 700004 W est 10 2 Shyampu kur iilditiltdncluding toilet and -

Kolkata- Retail Q4 2019

M A R K E T B E AT KOLKATA Retail Q4 2019 Main Streets remain the primary traction nodes With the city’s mall inventory stable at 4.71 msf for over a year now and the superior grade mall inventory operating at near 100% occupancy levels, there has been a sustained retailer drift towards the prominent main streets like Park Street & Gariahat with a similar trend visible in the last quarter 5.94% MALL VACANCY RATE (2019) of the year as well. Retailers have also shown an increased interest for peripheral locations like Narendrapur, Sodepur among others for their footprint expansion. Around 82% of the annual leasing volumes recorded in 2019 was on account of main street activity, compared to around 74% share in 2018. This growing share of main streets in the city’s gross leasing activity over the last couple of years, clearly indicates that main streets LEASING SHARE OF MAIN STREETS have stepped in the gap for fulfilling retailer demand which has been restricted by the low availability of quality and organised retail space in the 82% (2019) city. With superior grade malls operating at full capacity and with no new mall supply getting added, moderate transaction activity has been observed in next-in-line malls during the year, which has resulted in a 64 bps y-o-y drop in overall mall vacancy rates by end 2019. Vacancy levels in average malls are in the 11-12% range, with retailer traction remaining sluggish in these projects as retailers prefer main streets over such SHARE OF HYPERMARKETS IN developments. -

Store Name Address State City West-VS Shop No. G

Store Name Address State City West-VS Shop No. G- 21, Ground Floor, Centre Maharashtra Mumbai One Mall, Sector-30, Vashi Frc30020 1-Jain Nagar Road, Abohar Punjab Punjab Abhohar Cell World 5-9-215/ Bg-5, Shop No.01, Saphari Andhra Pradesh Abids Communications Private Plaza, Chirag Alo Lane , Abids Adrash Kumar & Sons Bhagat Singh Chowk,Near Weear Well, Punjab Abohar Abore,Punjab Pund0040 PUND2114 MOBILE Allen Solly Show room , Circular Road, Punjab Abohar RAJD16048 Purnima NAKODA TOWER,OPP.SHANTI KUNJ, Rajasthan Abu Road Stores Abu MOUNT ROAD, ABUROAD Big C Mobiles Pvt Ltd Ambedkar Chowkopp Ganesh Talkies Andhra Pradesh Adilabad Univercell D No 4 3 6 6 And 43 6 7 Hameedpura Andhra Pradesh Adilabad Telecommunications India Pvt Ltd Univercell Ground Floor D No 744 & 45 Andhra Pradesh Adilabad Telecommunications India Garimillaboundaries Main Road Pvt Ltd Mahchiryala Apex Electronics # 4-2-173/10, Cinema Road, Adilabad. Andhra Pradesh Adilabad Communication(Ses) 504001 Andd12633 Cell World 6-5-84/A And 6-7-77/14/10, Netaji Andhra Pradesh Adilabad Communications Private Chwk, Bhotapur , Adilabad Andd13850 ANDD5080 DIGITAL ZONE 4-3-8/4/5 Cinema Road Andhra Pradesh Adilabad Adilabad,Andhra Pradesh-504001 Sky Mobiles Near Ks Rtc Bus Stand Mc Road Kerala Adoor Adoor,Pathanamthitta Kerd5628 Satisfaction 142, Motorstand Road, Agartala Tripura Agartala G S Electronics (Ses) 160 H.G.B Rd.,Melar Math, Near Tripura Agartala Womens Commission Office Trid0595 Sadar Bazar 4, Taj Road, Sadar Bazar, Agra - Uttar Pradesh Agra Frc30056 Shop No.3, Block 5C, -

Colonizing, Decolonizing, and Globalizing Kolkata

ASIAN CITIES Sen Colonizing, Decolonizing, and Globalizing Kolkata and Globalizing Decolonizing, Colonizing, Siddhartha Sen Colonizing, Decolonizing, and Globalizing Kolkata From a Colonial to a Post-Marxist City Colonizing, Decolonizing, and Globalizing Kolkata Publications The International Institute for Asian Studies (IIAS) is a research and exchange platform based in Leiden, the Netherlands. Its objective is to encourage the interdisciplinary and comparative study of Asia and to promote (inter)national cooperation. IIAS focuses on the humanities and social sciences and on their interaction with other sciences. It stimulates scholarship on Asia and is instrumental in forging research networks among Asia Scholars. Its main research interests are reflected in the three book series published with Amsterdam University Press: Global Asia, Asian Heritages and Asian Cities. IIAS acts as an international mediator, bringing together various parties in Asia and other parts of the world. The Institute works as a clearinghouse of knowledge and information. This entails activities such as providing information services, the construction and support of international networks and cooperative projects, and the organization of seminars and conferences. In this way, IIAS functions as a window on Europe for non-European scholars and contributes to the cultural rapprochement between Europe and Asia. IIAS Publications Officer: Paul van der Velde IIAS Assistant Publications Officer: Mary Lynn van Dijk Asian Cities The Asian Cities Series explores urban cultures, societies and developments from the ancient to the contemporary city, from West Asia and the Near East to East Asia and the Pacific. The series focuses on three avenues of inquiry: evolving and competing ideas of the city across time and space; urban residents and their interactions in the production, shaping and contestation of the city; and urban challenges of the future as they relate to human well-being, the environment, heritage and public life. -

COVID-19 and Urban Vulnerability in India

COVID-19 and Urban Vulnerability in India Swasti Vardhan Mishra Amiya Gayen Sk. Mafizul Haque [email protected] [email protected] [email protected] Doctoral Candidate Doctoral Candidate Assistant Professor Department of Geography, Department of Geography, Department of Geography, University of Calcutta University of Calcutta University of Calcutta The University of Calcutta. 35, B. C. The University of Calcutta. 35, B. C. The University of Calcutta. 35, B. C. Road, Kolkata 700 019 Road, Kolkata 700 019 Road, Kolkata 700 019 & & Guest faculty, Assistant Professor under RUSA, Department of Geography, Department of Geography, West Bengal State University, Kolkata Midnapore College (Autonomous) & Vidyasagar University, Midnapore Guest faculty, Department of Geography, Rabindra Bharati University, Kolkata The article is published in Habitat International Doi: 10.1016/j.habitatint.2020.102230 Article number: 102230 #Uncorrected Proof# 1 COVID-19 and Urban Vulnerability in India Swasti Vardhan Mishra Amiya Gayen Sk. Mafizul Haque [email protected] [email protected] [email protected] Doctoral Candidate Doctoral Candidate Assistant Professor Department of Geography, Department of Geography, Department of Geography, University of Calcutta University of Calcutta University of Calcutta The University of Calcutta. 35, B. C. The University of Calcutta. 35, B. C. The University of Calcutta. 35, B. C. Road, Kolkata 700 019 Road, Kolkata 700 019 Road, Kolkata 700 019 & & Guest faculty, Assistant Professor under RUSA, Department of Geography, Department of Geography, West Bengal State University, Kolkata Midnapore College (Autonomous) & Vidyasagar University, Midnapore Guest faculty, Department of Geography, Rabindra Bharati University, Kolkata Abstract The global pandemic has an inherently urban character. The UN-Habitat’s publication of a Response Plan for mollification of the SARS-CoV-2 based externalities in the cities of the world testifies to that.