Dec 2013.Xlsx

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Un-Paid Dividend

Descon Oxychem Limited DETAIL OF UNPAID DIVIDEND AMOUNT(S) IN PKR Dated as on: 18-Dec-20 Folio Shareholder Adresses No. of Shares Dividend 301, HAFSA SQUARE, BLOCK-3,, PLOT NO: 9, 208/32439/C ADAM KHALID MCHS., KARACHI-EAST, KARACHI 25,000 21,250 513/20972/C KHALID RAFIQUE MIRZA 5/6 B,PRESS COLONY G7/4 ISLAMABAD 20,000 17,000 B-13, SALMA VILLA, RUBY STREET,GARDEN 307/69264/C SHAN WEST, KARACHI 20,000 17,000 201 MR. AAMIR MALIK 115-BB, DHA, LAHORE. 25,500 15,300 18 MR. ABDUL KHALIQUE KHAN HOUSE NO.558/11, BLOCK W, DHA, LAHORE. 25,500 15,300 282 MR. SAAD ULLAH KHAN HOUSE NO.49/1, DHA, SECTOR 5, LAHORE. 20,000 12,000 269 MR. BILAL AHMAD BAJWA HOUSE NO.C-9/2-1485, KARAK ROAD, LAHORE. 20,000 12,000 HOUSE NO.258, SECTOR A1, TOWNSHIP, 105 MR. ATEEQ UZ ZAMAN KHAN LAHORE. 19,000 11,400 HOUSE NO.53-D, RIZWAN BLOCK, AWAN TOWN, 96 MR. AHMAD FAROOQ LAHORE. 19,000 11,400 HOUSE NO.42, LANE 3, ASKARIA COLONY, 103 MR. MUHAMMAD ANEES PHASE 1, MULTAN CANTT. 18,000 10,800 HOUSE NO.53/1, BLOCK C1, TOWNSHIP, 20 MR. MUHAMMAD SHAHZAD JAMEEL LAHORE. 18,000 10,800 6122/18275/C AHMAD HUSSAIN KAZI HOUSE # 100, HILLSIDE ROAD, E-7. ISLAMABAD 15,000 9,000 59 MR. ZUBAIR UL HASSAN HOUSE NO.10-22, ABID MAJID ROAD, LAHORE. 19,000 8,550 92 MR. ASAD AZHAR HOUSE NO.747-Z, DHA, LAHORE. 19,000 8,550 7161/42148/C MUHAMMAD KASHIF 50-G, BLOCK-2,P.E.C.H.S KARACHI 10,000 8,500 56, A-STREET, PHJASE 5, OFF KHAYABAN-E- 6700/23126/C HIBAH KHAN SHUJAAT D.H.A KARACHI 10,000 8,500 HOUSE # 164, ABUBAKAR BLOCK, GARDEN 12211/597/C JAVED AHMED TOWN, LAHORE 9,000 7,650 HOUSE # P-47 STREET # 4 JAIL ROAD RAFIQ 5801/16681/C MUHAMMAD YOUSAF COLONY FAISALABAD 9,000 7,650 FLAT # B-1, AL YOUSUF GARDEN,, GHULAM HUSSAIN QASIM ROAD, GARDEN WEST, 3277/77663/IIA IMRAN KARACHI 10,000 7,000 67 MR. -

The Faisalabad Chamber of Commerce & Indusrty

THE FAISALABAD CHAMBER OF COMMERCE & INDUSRTY FINAL ASSOCIATE VOTERS FOR THE YEAR 2016-17 Page 1 of 142 1. 2104577-3610 7. 2106048-4897 13. 2103964-3062 3-A TEXTILES A & H CORPORATION A.A ENTERPRISES P-1 SECOND FLOOR SARA TOWER CENTRE OFFICE # 4, 2ND FLOOR ABUTURAB P-27 GALI NO 7 MOHALLAH QASIM MAIN SUSAN ROAD MADINA BUILDING, AMINPUR BAZAR FAISALABAD ABAD,JHANG ROAD, FAISALABAD TOWN,FAISALABAD NTN : 2681221-5 NTN : 2259549-0 NTN : 1324438-8 STN : STN : STN : 08-90-9999-882-82 TEL : 041-8559844,5506962 TEL : 041-2551678 TEL : 041-8723388 CELL: 0300-9656930 CELL: 0300-9652354,0321-7220920 CELL: 0300-8668801 EMAIL :[email protected], rana_248@hotmai EMAIL :[email protected] EMAIL :[email protected] REP : RANA MUNAWAR HUSSAIN REP : HAMID BASHIR REP : AIJAZ AHMAD NIC : 33100-0147581-1 NIC : 33100-4747059-7 NIC : 33100-5628937-9 2. 2106191-5024 8. 2300939-682 14. 2102967-2222 381 INTERNATIONAL A & H ENTERPRISES A.A ENTERPRISES 1ST FLOOR UNION TRADER OPP. SHELL CHEEMA MARKET RAILWAY ROAD SHOP NO 4 AL HAKEEM CENTRE CHTTREE PUMP NEAR GHOUSHALA DIJKOT ROAD FAISALABAD WALA CHOWK JINNAH COLONY FAISALABAD NTN : 2164711-9 FAISALABAD NTN : 2736536-7 STN : 08-01-5900-008-46 NTN : 2316510-3 STN : TEL : 041-2643933 STN : TEL : 041-2626381 CELL: 0300-8666818 TEL : 041-8739180 CELL: 0344-4444381 EMAIL :[email protected] CELL: 0300-8656607 EMAIL :[email protected] REP : MUHAMMAD ASIM EMAIL :[email protected] REP : JAWAD ALI NIC : 33100-1808192-7 REP : ATIF IDREES NIC : 33100-6169762-5 NIC : 33104-2111449-9 3. 2105589-4504 9. -

Reg. No Name in Full Residential Address Gender Contact No

Reg. No Name in Full Residential Address Gender Contact No. Email id Remarks 20001 MUDKONDWAR SHRUTIKA HOSPITAL, TAHSIL Male 9420020369 [email protected] RENEWAL UP TO 26/04/2018 PRASHANT NAMDEORAO OFFICE ROAD, AT/P/TAL- GEORAI, 431127 BEED Maharashtra 20002 RADHIKA BABURAJ FLAT NO.10-E, ABAD MAINE Female 9886745848 / [email protected] RENEWAL UP TO 26/04/2018 PLAZA OPP.CMFRI, MARINE 8281300696 DRIVE, KOCHI, KERALA 682018 Kerela 20003 KULKARNI VAISHALI HARISH CHANDRA RESEARCH Female 0532 2274022 / [email protected] RENEWAL UP TO 26/04/2018 MADHUKAR INSTITUTE, CHHATNAG ROAD, 8874709114 JHUSI, ALLAHABAD 211019 ALLAHABAD Uttar Pradesh 20004 BICHU VAISHALI 6, KOLABA HOUSE, BPT OFFICENT Female 022 22182011 / NOT RENEW SHRIRANG QUARTERS, DUMYANE RD., 9819791683 COLABA 400005 MUMBAI Maharashtra 20005 DOSHI DOLLY MAHENDRA 7-A, PUTLIBAI BHAVAN, ZAVER Female 9892399719 [email protected] RENEWAL UP TO 26/04/2018 ROAD, MULUND (W) 400080 MUMBAI Maharashtra 20006 PRABHU SAYALI GAJANAN F1,CHINTAMANI PLAZA, KUDAL Female 02362 223223 / [email protected] RENEWAL UP TO 26/04/2018 OPP POLICE STATION,MAIN ROAD 9422434365 KUDAL 416520 SINDHUDURG Maharashtra 20007 RUKADIKAR WAHEEDA 385/B, ALISHAN BUILDING, Female 9890346988 DR.NAUSHAD.INAMDAR@GMA RENEWAL UP TO 26/04/2018 BABASAHEB MHAISAL VES, PANCHIL NAGAR, IL.COM MEHDHE PLOT- 13, MIRAJ 416410 SANGLI Maharashtra 20008 GHORPADE TEJAL A-7 / A-8, SHIVSHAKTI APT., Male 02312650525 / NOT RENEW CHANDRAHAS GIANT HOUSE, SARLAKSHAN 9226377667 PARK KOLHAPUR Maharashtra 20009 JAIN MAMTA -

DC Valuation Table (2018-19)

VALUATION TABLE URBAN WAGHA TOWN Residential 2018-19 Commercial 2018-19 # AREA Constructed Constructed Open Plot Open Plot property per property per Per Marla Per Marla sqft sqft ATTOKI AWAN, Bismillah , Al Raheem 1 Garden , Al Ahmed Garden etc (All 275,000 880 375,000 1,430 Residential) BAGHBANPURA (ALL TOWN / 2 375,000 880 700,000 1,430 SOCITIES) BAGRIAN SYEDAN (ALL TOWN / 3 250,000 880 500,000 1,430 SOCITIES) CHAK RAMPURA (Garision Garden, 4 275,000 880 400,000 1,430 Rehmat Town etc) (All Residential) CHAK DHEERA (ALL TOWN / 5 400,000 880 1,000,000 1,430 SOCIETIES) DAROGHAWALA CHOWK TO RING 6 500,000 880 750,000 1,430 ROAD MEHMOOD BOOTI 7 DAVI PURA (ALL TOWN / SOCITIES) 275,000 880 350,000 1,430 FATEH JANG SINGH WALA (ALL TOWN 8 400,000 880 1,000,000 1,430 / SOCITIES) GOBIND PURA (ALL TOWNS / 9 400,000 880 1,000,000 1,430 SOCIEITIES) HANDU, Al Raheem, Masha Allah, 10 Gulshen Dawood,Al Ahmed Garden (ALL 250,000 880 350,000 1,430 TOWN / SOCITIES) JALLO, Al Hafeez, IBL Homes, Palm 11 250,000 880 500,000 1,430 Villas, Aziz Garden etc KHEERA, Aziz Garden, Canal Forts, Al 12 Hafeez Garden, Palm Villas (ALL TOWN 250,000 880 500,000 1,430 / SOCITIES) KOT DUNI CHAND Al Karim Garden, 13 Malik Nazir G Garden, Ghous Garden 250,000 880 400,000 1,430 (ALL TOWN / SOCITIES) KOTLI GHASI Hanif Park, Garision Garden, Gulshen e Haider, Moeez Town & 14 250,000 880 500,000 1,430 New Bilal Gung H Scheme (ALL TOWN / SOCITIES) LAKHODAIR, Al Wadood Garden (ALL 15 225,000 880 500,000 1,430 TOWN / SOCITIES) LAKHODAIR, Ring Road Par (ALL TOWN 16 75,000 880 200,000 -

Iee Report: 220 Kv Dc T. Line from 500 Kv Faisalabad West to 220 Kv Lalian New Substation

Second Power Transmission Enhancement Investment Program (RRP PAK 48078-002) Initial Environmental Examination May 2016 PAK: Proposed Multitranche Financing Facility Second Power Transmission Enhancement Investment Program Prepared by National Transmission and Despatch Company Limited for the Asian Development Bank. Power Transmission Enhancement Investment Programme II TA 8818 (PAK) Initial Environmental Examination 220 kV Double Circuit Transmission Line from 500 kV Faisalabad West Substation to 220 kV Lalian New Substation May 2016 Prepared by National Transmission & Despatch Company Limited (NTDC) for the Asian Development Bank (ADB) The Initial Environmental Examination Report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB’s Board of Directors, Management, or staff, and may be preliminary in nature. Your attention is directed to the “terms of use” section of the ADB website. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgements as to the legal or other status of any territory or area. 2 | P a g e Table of Contents 1. INTRODUCTION ........................................................................................................... 1 1.1. General ............................................................................................................................ 1 1.2. Project Details -

One Year of Miss-Hits Reducing the Cost of Doing Business

INDEPENDENT . INCISIVE . ANALYTICAL weeklycuttingedge.com August 16-31 2019 Vol# 15 Issue # 1 Rs. 100 Politics The Senate surprise The Senate no-confidence vote results took everyone by surprise. In the 104-strong House, 53 votes were needed for the first- ever no-trust motion against a Senate chair - man to succeed. But the motion got only 50 yes votes from the 100 present in the House. Nasim Ahmed Pg 05 Conflict Kashmir in turmoil The Indian government’s outrageous move to revoke the special status of occupied Jammu and Kashmir has renewed tension between India and Pakistan. It has not only jeopardized peace in the region but also in the world. The decision has come weeks after US President Donald Trump offered Cover Story mediation on the issue. The offensive proves the struggle of Kashmiris for their right to self-determination has become difficult to handle for India. Shahid Hussain One year of Pg 10 miss-hits Shahid Hussain Page 4 Roundup Our guide to keeping you updated on the latest news and reviews from around the world. Art and Culture. Film. Books. Health. Science Pg 23 Editor: Dr. Niloufer Mahdi Index CUTTING EDGE Reconstruction Page 4 Economics Page 15 One year of miss-hits Reducing the cost of doing business P Education Page 5 olitics Page 16 The Senate surprise Back to square one — but with a change Page 6 Exploration Conspiracy Reko Diq case: Where did we falter? Page 18 Dismantled Kashmir Graft Viewpoint Page 7 NAB’s widening radar Page 19 Rich banks and poor people Trafficking Society Page 8 Page 20 Best guardians Sham marriages in Pakistan Debacle Opinion Page 21 Page 9 The Senate upset The abrogation of Kashmir's special status: Why now? Your View Conflict Page 22 Page 10 Letters to the editor from Kashmir in turmoil our readers Round Up Assessment Page 23 Books & movies, Health, Science Page 11 PML-N’s indictment Page 12 Crisis Robbing Kashmir of special status Cutting Edge Editor Page 13 Peace Dr. -

LAHORE-Ren98c.Pdf

Renewal List S/NO REN# / NAME FATHER'S NAME PRESENT ADDRESS DATE OF ACADEMIC REN DATE BIRTH QUALIFICATION 1 21233 MUHAMMAD M.YOUSAF H#56, ST#2, SIDIQUE COLONY RAVIROAD, 3/1/1960 MATRIC 10/07/2014 RAMZAN LAHORE, PUNJAB 2 26781 MUHAMMAD MUHAMMAD H/NO. 30, ST.NO. 6 MADNI ROAD MUSTAFA 10-1-1983 MATRIC 11/07/2014 ASHFAQ HAMZA IQBAL ABAD LAHORE , LAHORE, PUNJAB 3 29583 MUHAMMAD SHEIKH KHALID AL-SHEIKH GENERAL STORE GUNJ BUKHSH 26-7-1974 MATRIC 12/07/2014 NADEEM SHEIKH AHMAD PARK NEAR FUJI GAREYA STOP , LAHORE, PUNJAB 4 25380 ZULFIQAR ALI MUHAMMAD H/NO. 5-B ST, NO. 2 MADINA STREET MOH, 10-2-1957 FA 13/07/2014 HUSSAIN MUSLIM GUNJ KACHOO PURA CHAH MIRAN , LAHORE, PUNJAB 5 21277 GHULAM SARWAR MUHAMMAD YASIN H/NO.27,GALI NO.4,SINGH PURA 18/10/1954 F.A 13/07/2014 BAGHBANPURA., LAHORE, PUNJAB 6 36054 AISHA ABDUL ABDUL QUYYAM H/NO. 37 ST NO. 31 KOT KHAWAJA SAEED 19-12- BA 13/7/2014 QUYYAM FAZAL PURA LAHORE , LAHORE, PUNJAB 1979 7 21327 MUNAWAR MUHAMMAD LATIF HOWAL SHAFI LADIES CLINICNISHTER TOWN 11/8/1952 MATRIC 13/07/2014 SULTANA DROGH WALA, LAHORE, PUNJAB 8 29370 MUHAMMAD AMIN MUHAMMAD BILAL TAION BHADIA ROAD, LAHORE, PUNJAB 25-3-1966 MATRIC 13/07/2014 SADIQ 9 29077 MUHAMMAD MUHAMMAD ST. NO. 3 NAJAM PARK SHADI PURA BUND 9-8-1983 MATRIC 13/07/2014 ABBAS ATAREE TUFAIL QAREE ROAD LAHORE , LAHORE, PUNJAB 10 26461 MIRZA IJAZ BAIG MIRZA MEHMOOD PST COLONY Q 75-H MULTAN ROAD LHR , 22-2-1961 MA 13/07/2014 BAIG LAHORE, PUNJAB 11 32790 AMATUL JAMEEL ABDUL LATIF H/NO. -

LAHORE HI Ill £1

Government of Pakistan Revenue Division Federal Board of Revenue ***** Islamabad, the 23rd July, 2019. NOTIFICATION (Income Tax) S.R.O. 9^ (I)/2019.- In exercise of the powers conferred by sub-section (4) of section 68 of the Income Tax Ordinance, 2001 (XLIX of 2001) and in supersession of its Notification No. S.R.O. 121(I)/2019 dated the Is' February, 2019, the Federal Board of Revenue is pleased to notify the value of immoveable properties in columns (3) and (4) of the Table below in respect of areas or categories of Lahore specified in column (2) thereof. (2) The value for residential and commercial superstructure shall be — (a) Rs.1500 per square foot if the superstructure is upto five years old; and (b) Rs.1000 per square foot if the superstructure is more than five years old. (3) In order to determine the value of constructed property, the value of open plot shall be added to the value worked out at sub-paragraph (2) above. (4) This notification shall come into force with effect from 24th July, 2019. LAHORE .-r* ALLAMA IQBAL TOWN S. Area Value of Residential Value of No property per maria Commercial (in Rs.) property per maria (in Rs.) HI ill £1 (41 1 ABDALIAN COOP SOCIETY 852,720 1,309,000 2 ABADI MUSALA MOUZA MUSALA 244,200 447,120 3 ABID GARDEN ABADI MUSALA 332,970 804,540 4 ADJOINING CANAL BANK ALL 564,960 1,331,000 SOCIETY MOUZA KANJARAN 5 ADJOINING CANAL BANK ALL 746,900 1,326,380 SOCIETY MOUZA IN SHAHPUR KHANPUR 6 AGRICHES COOP SOCIETY 570,900 1,039,500 7 AHBAB COLONY 392,610262,680 8 AHMAD SCHEME NIAZ BAIG 390,443 800,228 -

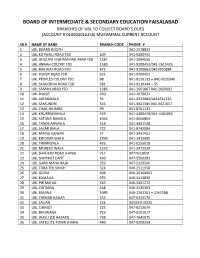

Branches of Ubl to Collect Board's Dues

BOARD OF INTERMEDIATE & SECONDARY EDUCATION FAISALABAD BRANCHES OF UBL TO COLLECT BOARD’S DUES (ACCOUNT # 010901016256) MUKAMMAL CURRENT ACCOUNT SR.# NAME OF BANK BRANCH CODE PHONE. # 1 UBL BOARD BOOTH - 041-2578833 2 UBL KOTWALI ROAD FSD 109 041-9200453 3 UBL GHULAM MUHAMMAD ABAD FSD 1287 041-2694655 4 UBL JINNAH COLONY FSD 1580 041-9200452/041-2615425 5 UBL RAILWAY ROAD FSD 472 041-9200662/0419200884 6 UBL DIJKOT ROAD FSD 531 041-9200451 7 UBL PEOPLES COLONY FSD 98 041-9220133 – 041-9220346 8 UBL SARGODHA ROAD FSD 581 041-9210344 – 35 9 UBL SAMAN ABAD FSD 1286 041-2661867 041-2660092 10 UBL DIJKOT 260 041-2670031 11 UBL JARANWALA 36 041-4312983/0414311126 12 UBL SAMUNDRI 326 041-3421585 041-3421657 13 UBL CHAK JHUMRA 99 041-8761131 14 UBL KHURRIANWALA 429 041-4360429/041-4364050 15 UBL SATANA BANGLA 1066 041-4600804 16 UBL TANDLIANWALA 518 041-3441548 17 UBL SALAR WALA 722 041-8742084 18 UBL MAMU KANJAN 37 041-3431452 19 UBL KHIDDAR WALA 1590 041-3413005 20 UBL THIKRIWALA 433 041-0255018 21 UBL MUREED WALA 1332 041-3472529 22 UBL SHAHEED ROAD JHANG 217 0477613829 23 UBL SHORKOT CANT 430 047-5500281 24 UBL GARH MAHA RAJA 359 047-5320506 25 UBL TOBA TEK SINGH 324 046-2511958 26 UBL GOJRA 404 046-35160062 27 UBL KAMALIA 970 046-3413830 28 UBL PIR MAHAL 545 046-3361272 29 UBL CHITIANA 668 046-2545363 30 UBL RAJANA 1093 046-2262201 – 2261588 31 UBL CHENAB NAGAR 153 047-6334576 32 UBL LALIAN 154 04533-610225 33 UBL CHINIOT 225 047-6213676 34 UBL BHOWANA 726 047-6201017 35 UBL WASU (18 HAZARI) 738 047-7645075 36 UBL SATELLITE TOWN JHANG 440 047-9200254 BOARD OF INTERMEDIATE & SECONDARY EDUCATION FAISALABAD BRANCHES OF MCB TO COLLECT BOARD’S DUES (ACCOUNT # (0485923691000100) PK 365 GOLD SR.# NAME OF BANK BRANCH CODE PHONE. -

Sr # CITY OUTLET NAME OUTLET ADDRESS 1 Karachi STANDARD SERVICE STN 17-A BLOCK 6 P.E.C.H.S KARACHI 2 Karachi STADIUM SERVICE STATION OPP

Sr # CITY OUTLET NAME OUTLET ADDRESS 1 Karachi STANDARD SERVICE STN 17-A BLOCK 6 P.E.C.H.S KARACHI 2 Karachi STADIUM SERVICE STATION OPP. HOME ECONOMICS COLLEGE STADIUM 3 Karachi SITARA HILAL TRC STN KM31/32 SUPER.H.WAYDEH TORE TAPPO KONKARKARACHI 4 Karachi QURBAN SERVICE STATION ST-21 GIZRI ROAD KDA SCHEME NO 5 KAR 5 Karachi PSO S/S IDEAL NEAR KDA WORKSHOP SHAHRAH-E-FAISAL 6 Karachi PSO S/S 7 (A.B GHAZI) AT ABDULLAH SHAH GHAZICLIFTONKARACHI 7 Karachi PSO S/S 3 (MG MOTORS) STREET 32/1 SHEET # FT-3 KARACHI 8 Karachi PSO S/S 28 BHITTAI 28 A-9,MAIN KORANGIROAD, KARACHI" 9 Karachi PSO S/S 25 (ITTEHAD) P-I MAIN KHYABANE-EITTEHAD, KARACH 10 Karachi PSO S/S 23 (DEFENCE) M.S.11, KORANGI,KARACHI" 11 Karachi NOOR PET. SERVICE PSO PETROL PUMP188/A SMCHS SHAHRAHE-FAISAL 12 Karachi NEW AERO SER STATION NEAR AIRPORT CLUB KARACHI AIRPORT KARACHI 13 Karachi METRO SERVICE STATION OPP JINAH COLLEGEN-NAZIMABADDISTT K 14 Karachi MEHRAN FILLING STATION SURVEY NO:77 (PART) LARKANA LINER, MALIR CANTT 15 Karachi FANCY SERVICE STATION ST-1A BLOCK 10FEDERAL B AREADISTT KARACHI WEST 16 Karachi BURRAQUE PET SERVICE 3-B BURRAQUE HOUSINGSCHEMS NO-33KARACHI 17 Karachi AL-ASKAR SERVICE STATION 26th STREET, DHA PHASE VIII 18 Karachi SAM PETROLEUM SERVICE PLOT NO. A & B SUB BLOCK-E BLOCK 1, NAZIMABAD DIST-KARACHI 19 Karachi Q. STAR SERVICE STATION MAIN KORANGI ROAD OPP. CSD KARACHI 20 Karachi TRICO SERVICE STN PLOT NO SB-14 JAIL DRIG ROAD KDA SC-1 21 Karachi SADIQ GASOLINE PLOT NO 1A F.B.AREAKARACHI. -

Leading WISP Links Branches to Leading Bank Pakistan

CASE STUDY: PRIME BANK Leading WISP Links Branches to Leading Bank Pakistan Customer to deploy wireless services commercially in Prime Bank was the vision of a group of Pakistani Pakistan. With the biggest pool of dedicated professionals with extensive domestic and and highly qualified technical specialists in the international banking and finance experience. country, Data4 Networks offers a comprehensive In 1992, this group teamed up with successful, range of services: System Program Planning and like-minded business houses in Pakistan and Management, Engineering Design, Application overseas, including a highly regarded and well- Engineering, Frequency Band Planning, Path diversified business group in Saudi Arabia, and Survey, Design, Network Engineering, Operations Prime Bank evolved from vision to reality. and Maintenance. The company has offices in three major Pakistani cities, including Islamabad, Now, more than a decade later, the Bank’s Lahore and Karachi. prudent and profitable operations have positioned it on the leading edge of financial services. Prime Bank combines highly efficient delivery systems The Situation and Challenge with continual product innovation. Its emphasis Prime Bank needed to link all of its branch on superior customer service and commitment to offices in Lahore and Karachi to the data centers the latest information technology platform are the in each city, providing e-mail services, Internet cornerstones of Prime Bank’s overall strategy to access and, most important, access to the keep it among the top global banks. bank’s centralized server. It was imperative that the link be extremely secure and deliver carrier- class reliability to enable the bank to share all Solution Provider the banking services in their centralized server A leader in wireless data communication since environment. -

List of Category -I Members Registered in Membership Drive-Ii

LIST OF CATEGORY -I MEMBERS REGISTERED IN MEMBERSHIP DRIVE-II MEMBERSHIP CGN QUOTA CATEGORY NAME DOB BPS CNIC DESIGNATION PARENT OFFICE DATE MR. DAUD AHMAD OIL AND GAS DEVELOPMENT COMPANY 36772 AUTONOMOUS I 25-May-15 BUTT 01-Apr-56 20 3520279770503 MANAGER LIMITD MR. MUHAMMAD 38295 AUTONOMOUS I 26-Feb-16 SAGHIR 01-Apr-56 20 6110156993503 MANAGER SOP OIL AND GAS DEVELOPMENT CO LTD MR. MALIK 30647 AUTONOMOUS I 22-Jan-16 MUHAMMAD RAEES 01-Apr-57 20 3740518930267 DEPUTY CHIEF MANAGER DESTO DY CHEIF ENGINEER CO- PAKISTAN ATOMIC ENERGY 7543 AUTONOMOUS I 17-Apr-15 MR. SHAUKAT ALI 01-Apr-57 20 6110119081647 ORDINATOR COMMISSION 37349 AUTONOMOUS I 29-Jan-16 MR. ZAFAR IQBAL 01-Apr-58 20 3520222355873 ADD DIREC GENERAL WAPDA MR. MUHAMMA JAVED PAKISTAN BORDCASTING CORPORATION 88713 AUTONOMOUS I 14-Apr-17 KHAN JADOON 01-Apr-59 20 611011917875 CONTRALLER NCAC ISLAMABAD MR. SAIF UR REHMAN 3032 AUTONOMOUS I 07-Jul-15 KHAN 01-Apr-59 20 6110170172167 DIRECTOR GENRAL OVERS PAKISTAN FOUNDATION MR. MUHAMMAD 83637 AUTONOMOUS I 13-May-16 MASOOD UL HASAN 01-Apr-59 20 6110163877113 CHIEF SCIENTIST PROFESSOR PAKISTAN ATOMIC ENERGY COMMISION 60681 AUTONOMOUS I 08-Jun-15 MR. LIAQAT ALI DOLLA 01-Apr-59 20 3520225951143 ADDITIONAL REGISTRAR SECURITY EXCHENGE COMMISSION MR. MUHAMMAD CHIEF ENGINEER / PAKISTAN ATOMIC ENERGY 41706 AUTONOMOUS I 01-Feb-16 LATIF 01-Apr-59 21 6110120193443 DERECTOR TRAINING COMMISSION MR. MUHAMMAD 43584 AUTONOMOUS I 16-Jun-15 JAVED 01-Apr-59 20 3820112585605 DEPUTY CHIEF ENGINEER PAEC WASO MR. SAGHIR UL 36453 AUTONOMOUS I 23-May-15 HASSAN KHAN 01-Apr-59 21 3520227479165 SENOR GENERAL MANAGER M/O PETROLEUM ISLAMABAD MR.