January 22, 2018 by Email and Federal Express Stephanie Avakian

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The US Shale Revolution and the Arab Gulf States. the Economic and Political Impact of Changing Energy Markets

SWP Research Paper Stiftung Wissenschaft und Politik German Institute for International and Security Affairs Kirsten Westphal, Marco Overhaus and Guido Steinberg The US Shale Revolution and the Arab Gulf States The Economic and Political Impact of Changing Energy Markets RP 11 November 2014 Berlin All rights reserved. © Stiftung Wissenschaft und Politik, 2014 SWP Research Papers are peer reviewed by senior researchers and the execu- tive board of the Institute. They express exclusively the personal views of the author(s). SWP Stiftung Wissenschaft und Politik German Institute for International and Security Affairs Ludwigkirchplatz 34 10719 Berlin Germany Phone +49 30 880 07-0 Fax +49 30 880 07-100 www.swp-berlin.org [email protected] ISSN 1863-1053 Translation by Meredith Dale (English version of SWP-Studie 15/2014) Table of Contents 5 Problems and Conclusions 7 The US Shale Revolution and the Dynamics of the Global Energy Markets 7 The US Shale Revolution and Its Geo-economic Consequences 12 The New Energy Map 13 US-Exports: Strategic Considerations and Commercial Rationale 14 US Strategic Interests 14 US Engagement in the Persian Gulf 16 The Debate in the United States 18 The Economic Impact of the Shale Revolution on the Gulf States 18 The Position of the Gulf States in the Inter- national Energy Markets 19 The Gulf States and the Changing International Energy Markets 23 Socio-economic Developments in the Gulf 24 Growing Domestic Demand, Home-grown Crises and Political Quandaries 25 Gas Crisis amidst Rich Reserves 27 Political Consequences for Gulf States 27 The Economic Elites and the Shale Revolution 28 Risks to Internal Security 29 Foreign Policy Consequences 31 Conclusions and Recommendations 33 Abbreviations 33 Further Reading Dr. -

Q4 Outlook 2020

Q4 2020 OUTLOOK Banque Havilland is a Private Banking Group established in 2009. The Bank is headquartered in Luxembourg with offices in London, Monaco, Liechtenstein, Dubai and Switzerland. The Group provides private banking, asset and wealth management services and institutional banking services to High Net Worth families and individuals from all over the world. TABLE OF CONTENTS MARKET ENVIRONMENT 4 EQUITIES 9 BONDS 12 COMMODITIES AND CURRENCIES 15 MARKET ENVIRONMENT As we move into the final three months of at home’ theme and certain technological what has been a quite extraordinary year, trends were brought forward by the Covid investors are faced with both imminent outbreak, but even since then the Nasdaq and long-term challenges that on the has rallied a further 30% before the recent surface will require perhaps more intricate pull-back. The performance of growth and and thoughtful planning than has been momentum stocks versus so-called value necessary for some time. stocks has also widened to extreme levels, more so than any point in history, with At global level, the rebound of risk assets earnings per share in the value category since the Covid-inspired nadir of March 23rd having declined by 50% year-on-year by has been so furious that we have reached an aggregate compared with a 15% decline inflection point far earlier than could have for growth. Conversely, many other global been anticipated, as unprecedented central indices are still very much in the red and bank and government stimulus has seen many even then with big gaps between the indices financial assets recover or surpass their pre- of neighbouring economies (eg. -

GLOBAL LIST of FGDR MEMBERS Updated on March 24Th, 2021

GLOBAL LIST OF FGDR MEMBERS Updated on March 24th, 2021 Note : to view the guarantee mechanism(s) (deposit, securities, or performance bonds) of which each institution is a member, please use the 'Bank Search engine' on this web site. CIB DENOMINATION 16688 AGENCE FRANCE LOCALE 41829 Al Khaliji France 12240 Allianz banque 19073 ALPHEYS INVEST 19530 Amundi 14758 Amundi ESR 14328 Amundi finance 17273 Amundi Intermédiation 15638 Andbank Monaco S.A.M. 13383 AQUIS EXCHANGE EUROPE 18979 ARAB BANKING CORPORATION SA 17473 Arfinco 16298 Arkéa banking services 18829 Arkéa banque entreprises et institutionnels 15980 Arkéa crédit bail 14518 ARKEA DIRECT BANK 16088 Arkéa Home Loans SFH 16358 Arkéa public sector SCF 23890 Attijariwafa bank europe 45340 Aurel - BGC 16668 Australia and New Zealand banking group limited 13558 Auxifip 16318 AXA BANK EUROPE SCF 12548 Axa banque 25080 Axa banque financement 15573 Axa épargne entreprise 17188 AXA HOME LOAN SFH 17373 Axa Investment Managers IF 11078 BAIL ACTEA IMMOBILIER 14908 Banca popolare di Sondrio (Suisse) 18089 Bank Audi France 14508 Bank Julius Baer (Monaco) S.A.M. 41259 Bank Melli Iran 18769 Bank of China limited 14879 Bank of India 44269 Bank Saderat Iran 17799 Bank Sepah 17579 Bank Tejarat 12579 Banque BCP 12179 Banque BIA 17499 Banque calédonienne d'investissement - B.C.I. 12468 Banque cantonale de Genève (France) S.A. 17519 Banque centrale de compensation 41439 Banque Chaabi du Maroc 24659 Banque Chabrières 10188 Banque Chalus 30087 Banque CIC Est 30027 Banque CIC Nord Ouest 30047 Banque CIC Ouest -

A Field Trip to the Front Lines of the Qatar-Saudi Cold War by Simon Henderson

MENU Policy Analysis / Articles & Op-Eds A Field Trip to the Front Lines of the Qatar-Saudi Cold War by Simon Henderson Sep 28, 2017 Also available in Arabic ABOUT THE AUTHORS Simon Henderson Simon Henderson is the Baker fellow and director of the Bernstein Program on Gulf and Energy Policy at The Washington Institute, specializing in energy matters and the conservative Arab states of the Persian Gulf. Articles & Testimony The ongoing Gulf crisis is seen as an almost childish indulgence in Washington and Europe, but diplomacy and PR campaigns have made little progress in bringing it to an end. he diplomatic row between Qatar and its erstwhile Arab allies -- Saudi Arabia, the United Arab Emirates, T Bahrain, and Egypt (the self-described Anti-Terror Quartet) -- does not seem to be on the road to resolution. At least that is my sense gained during a lightning trip over the past week to London, Bahrain, Abu Dhabi, and Dubai. Instead, positions are hardening with a blithe disregard for the advantage this gives Iran, the common enemy of all the parties, including Qatar, and the possible impact that will have in Washington, where U.S. policy on the Persian Gulf is predicated on the notion that our Gulf allies, despite historic differences, will preserve at least the veneer of unity. Confusing the diplomatic efforts to resolve the crisis have been mixed messages coming out of Washington. U.S. Secretary of State Rex Tillerson has worked hard on mediation efforts, supported by Defense Secretary James Mattis. President Donald Trump, at least until recently, was happy to be seen as backing the position of Saudi Arabia and the UAE but may have been irritated when his bid to organize a peacemaking telephone call between Saudi Crown Prince Mohammad bin Salman and Qatari Emir Tamim bin Hamad al-Thani only resulted in further bad blood. -

Meet the Two Princes Reshaping the Middle East | the Washington Institute

MENU Policy Analysis / Articles & Op-Eds Meet the Two Princes Reshaping the Middle East by Simon Henderson Jun 13, 2017 Also available in Arabic ABOUT THE AUTHORS Simon Henderson Simon Henderson is the Baker fellow and director of the Bernstein Program on Gulf and Energy Policy at The Washington Institute, specializing in energy matters and the conservative Arab states of the Persian Gulf. Articles & Testimony The de facto leaders of Saudi Arabia and the UAE know how to change positions as pressures demand, but getting it wrong in Qatar, Yemen, and other regional hotspots could have dreadful consequences. he dramatic and sudden effort to isolate Qatar, like the fateful intervention before it in Yemen, sprang from the T shared vision of two princes. Depending on your point of view, they may be the harbingers of a new and better Middle East -- or reckless architects of disaster. Indeed, the region's most important relationship may be the dynamic duo of Muhammad bin Salman, the 31-year- old deputy crown prince of Saudi Arabia, and Muhammad bin Zayed, the 56-year-old crown prince of Abu Dhabi, the lead sheikhdom of the United Arab Emirates. They share not only a desire to wage twin battles against Iran and Islamic radicalism, but also a deep appreciation for their conservative Gulf countries' reliance on the United States. Together, they have shrewdly cultivated President Donald Trump, who is eager to show that he has a new strategy for defeating terrorism and confronting Tehran. The reasons for the princes' evident mutual regard can only be guessed at -- Gulf monarchies are maddeningly opaque. -

High Court Judgment Template

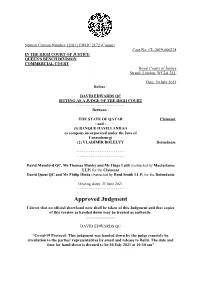

Neutral Citation Number: [2021] EWHC 2172 (Comm) Case No: CL-2019-000238 IN THE HIGH COURT OF JUSTICE QUEEN'S BENCH DIVISION COMMERCIAL COURT Royal Courts of Justice Strand, London, WC2A 2LL Date: 30 July 2021 Before : DAVID EDWARDS QC SITTING AS A JUDGE OF THE HIGH COURT - - - - - - - - - - - - - - - - - - - - - Between : THE STATE OF QATAR Claimant - and - (1) BANQUE HAVILLAND SA (a company incorporated under the laws of Luxembourg) (2) VLADIMIR BOLELYY Defendants - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - David Mumford QC, Mr Thomas Munby and Mr Hugo Leith (instructed by Macfarlanes LLP) for the Claimant David Quest QC and Mr Philip Hinks (instructed by Reed Smith LLP) for the Defendants Hearing dates: 21 June 2021 - - - - - - - - - - - - - - - - - - - - - Approved Judgment I direct that no official shorthand note shall be taken of this Judgment and that copies of this version as handed down may be treated as authentic. ............................. DAVID EDWARDS QC “Covid-19 Protocol: This judgment was handed down by the judge remotely by circulation to the parties’ representatives by email and release to Bailii. The date and time for hand-down is deemed to be 30 July 2021 at 10:30 am” DAVID EDWARDS QC Qatar v Banque Havilland SA & Another SITTING AS A JUDGE OF THE HIGH COURT Approved Judgment David Edwards QC : Introduction 1. On 5 March 2020 a first case management conference (“CMC”) in this action was heard by Cockerill J. Her order gave directions to trial in the usual way. Paragraph 15 provided that there should be a further CMC on the first available date after 9 December 2020 for the determination of any outstanding matters relating to disclosure and expert evidence. -

Women Behind the Scenes How Modernity Is Catching on Before Law in the United Arab Emirates

GLOBAL WOMEN’S GLOBAL WOMEN’S LEADERSHIPLEADERSHIP INITIATIVE INITIATIVE The Women in Public Service Project Women Behind the Scenes How Modernity is Catching on Before Law in the United Arab Emirates institutions has increased to 62 percent.1 There is something fitting that one Although literacy rates of both wom- of the most progressive and rapidly en and men in the UAE are close to 95 modernizing countries in the Middle percent, more women than men complete secondary education and enroll in univer- East was given many of its most sity and post-graduate education.2 significant mandates by a woman. Emirati women, in their federal absolute monarchy, are also outshining their male Long before oil was discovered in this counterparts in secondary school and small but highly influential, elegant coun- university. Ten percent of male students try perched on the Gulf coast of Saudi drop out, but only two percent of female Arabia, between Qatar and Oman, Her students leave school prematurely.3 While Highness Sheikha Fatima bint Mubarak there is room for improvement, the UAE Al Ketbi, wife of the founding President enjoys one of the highest rates of female His Highness Sheikh Zayed bin Sultan Al workforce participation in the Gulf at 47 Nahyan, insisted that women attend the percent, after Qatar (51 percent) and be- two-room school in the village of Al Ain, fore Kuwait (43 percent).4 Two thirds (66 where her husband was governor in 1971. Dr. Kent percent) of the public sector workforce “Sheikha Fatima,” as she is called by Emi- Davis-Packard in the UAE is made up of women (the ratis, went from family to family, giving average global rate is only 48 percent), Adjunct Professor, Middle out food rations to convince them to send with 30 percent of those women in senior East Studies and American their daughters to the school. -

Corporate and Foreign Interests Behind White House Push to Transfer U.S

Corporate and Foreign Interests Behind White House Push to Transfer U.S. Nuclear Technology to Saudi Arabia Prepared for Chairman Elijah E. Cummings Second Interim Staff Report Committee on Oversight and Reform U.S. House of Representatives July 2019 oversight.house.gov EXECUTIVE SUMMARY On February 19, 2019, the Committee on Oversight and Reform issued an interim staff report prepared for Chairman Elijah E. Cummings after multiple whistleblowers came forward to warn about efforts inside the White House to rush the transfer of U.S. nuclear technology to Saudi Arabia. As explained in the first interim staff report, under Section 123 of the Atomic Energy Act, the United States may not transfer nuclear technology to a foreign country without the approval of Congress in order to ensure that the agreement meets nine nonproliferation requirements to prevent the spread of nuclear weapons. These agreements, commonly known as “123 Agreements,” are typically negotiated with career experts at the National Security Council (NSC) and the Departments of State, Defense, and Energy. The “Gold Standard” for 123 Agreements is a commitment by the foreign country not to enrich or re-process nuclear fuel and not to engage in activities linked to the risk of nuclear proliferation. During the Obama Administration, Saudi Arabia refused to agree to the Gold Standard. During the Trump Administration, Saudi Crown Prince Mohammed bin Salman (MBS) went further, proclaiming: “Without a doubt, if Iran developed a nuclear bomb, we will follow suit as soon as possible.” There is strong bipartisan opposition to abandoning the “Gold Standard” for Saudi Arabia in any future 123 Agreement. -

List of PRA-Regulated Banks

LIST OF BANKS AS COMPILED BY THE BANK OF ENGLAND AS AT 2nd December 2019 (Amendments to the List of Banks since 31st October 2019 can be found below) Banks incorporated in the United Kingdom ABC International Bank Plc DB UK Bank Limited Access Bank UK Limited, The ADIB (UK) Ltd EFG Private Bank Limited Ahli United Bank (UK) PLC Europe Arab Bank plc AIB Group (UK) Plc Al Rayan Bank PLC FBN Bank (UK) Ltd Aldermore Bank Plc FCE Bank Plc Alliance Trust Savings Limited FCMB Bank (UK) Limited Allica Bank Ltd Alpha Bank London Limited Gatehouse Bank Plc Arbuthnot Latham & Co Limited Ghana International Bank Plc Atom Bank PLC Goldman Sachs International Bank Axis Bank UK Limited Guaranty Trust Bank (UK) Limited Gulf International Bank (UK) Limited Bank and Clients PLC Bank Leumi (UK) plc Habib Bank Zurich Plc Bank Mandiri (Europe) Limited Hampden & Co Plc Bank Of Baroda (UK) Limited Hampshire Trust Bank Plc Bank of Beirut (UK) Ltd Handelsbanken PLC Bank of Ceylon (UK) Ltd Havin Bank Ltd Bank of China (UK) Ltd HBL Bank UK Limited Bank of Ireland (UK) Plc HSBC Bank Plc Bank of London and The Middle East plc HSBC Private Bank (UK) Limited Bank of New York Mellon (International) Limited, The HSBC Trust Company (UK) Ltd Bank of Scotland plc HSBC UK Bank Plc Bank of the Philippine Islands (Europe) PLC Bank Saderat Plc ICBC (London) plc Bank Sepah International Plc ICBC Standard Bank Plc Barclays Bank Plc ICICI Bank UK Plc Barclays Bank UK PLC Investec Bank PLC BFC Bank Limited Itau BBA International PLC Bira Bank Limited BMCE Bank International plc J.P. -

UCITS IV Plenum CAT Bond Fund

UCITS IV Trust Agreement Including the fund-specific Appendix and Prospectus July 1st 2016 Plenum CAT Bond Fund UCITS according to Liechtenstein law in the legal form of a trusteeship (hereinafter referred to as “UCITS”) (Single fund) Management Company CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern, www.caiac.li Plenum CAT Bond Fund Trust Agreement & Prospectus Organization of the UCITS at a glance Management Company: CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern Board of Directors: Dr. Roland Müller Dr. Dietmar Loretz Gerhard Lehner Executive Board: Thomas Jahn Raimond Schuster Asset manager: Plenum Investments AG Brandschenkestrasse 41, CH-8002 Zürich Custodian: Banque Havilland (Liechtenstein) AG Austrasse 61, FL-9490 Vaduz Share register: Banque Havilland (Liechtenstein) AG Austrasse 61, FL-9490 Vaduz Sales Office: CAIAC Fund Management AG Haus Atzig, Industriestrasse 2, FL-9487 Bendern Auditor UCITS: Deloitte (Liechtenstein) AG Landstrasse 123, FL-9495 Triesen Auditor Management Company: ReviTrust Grant Thornton AG Bahnhofstrasse 15, FL-9494 Schaan Representatives and Distributors ACOLIN Fund Services AG in Switzerland: Affolternstrasse 56, CH-8050 Zürich Paying agent in Switzerland: Frankfurter Bankgesellschaft (Switzerland) AG Börsenstrasse 16, P.O. Box, CH-8022 Zurich Paying and information agent DZ BANK AG in Germany: Platz der Republik 60, D-60265 Frankfurt Paying agent in Austria: Erste Bank der österreichischen Sparkassen AG Graben 21, A-1010 Vienna Tax representative in -

Dollars and Decadence Making Sense of the US-UAE Relationship

Dollars and Decadence Making Sense of the US-UAE Relationship Colin Powers April 2021 Noria Research Noria Research is an independent and non-profit research organization with roots in academia. Our primary mandates are to translate data gathered on the ground into original analyses, and to leverage our research for the purpose of informing policy debates and engaging wider audiences. It is our institutional belief that political crises cannot be understood without a deep grasp for the dynamics on the ground. This is why we are doctrinally committed to field-based research. Cognizant that knowledge ought to benefit society, we also pledge to positively impact civil society organizations, policymakers, and the general public. Created in Paris in 2011, Noria’s research operations now cover the Americas, Europe, North Africa, the Middle East and South Asia. Licence Noria Research encourages the use and dissemination of this publication. Under the cc-by-nc-nd licence, you are free to share copy and redistribute the material in any medium or format. Under the following terms, you must give appropriate credit, provide a link to the license, and indicate if changes were made. You may do so in any reasonable manner, but not in any way that suggests the licensor endorses you or your use. You may not use the material for commercial purposes. If you remix, transform, or build upon the material, you may not distribute the modified material. Disclaimer The opinions expressed in this publication are those of the author alone and do not necessarily reflect the position of Noria Research. Author: Colin Powers Program Director: Robin Beaumont Program Editor: Xavier Guignard Graphic Design: Romain Lamy & Valentin Bigel Dollars and Decadence Making Sense of the US-UAE Relationship Colin Powers April 2021 About Middle East and North Africa Program Our research efforts are oriented by the counter-revolution that swept the Middle East and North Africa in the aftermath of 2011. -

The Abraham Accords: Paradigm Shift Or Realpolitik? by Tova Norlen and Tamir Sinai

The Abraham Accords: Paradigm Shift or Realpolitik? By Tova Norlen and Tamir Sinai Executive Summary This paper analyzes the motives and calculations of Israel, the United States, and the United Arab Emirates— the signatories of the Abraham Accords—which were signed on the White House Lawn on September 15, 2020. The Accords normalize relations between Israel and the United Arab Emirates (UAE) and Israel and Bahrain. The agreements signed by Israel with two Gulf States symbolizes a major shift in Middle Eastern geopolitics, which have long been characterized by the refusal of Arab Gulf states to engage in talks with Israel. However, the possible larger consequences of the agreement cannot be fully understood without considering the complex set of domestic and foreign policy causes that prompted the parties to come to the negotiating table. By signing the agreement, Israeli Prime Minister Benyamin Netanyahu was able to avoid the controversial West Bank annexation plan, which, if executed, could prove disastrous for him both at home and abroad. On the other hand, the UAE, while officially claiming credit for preventing the annexation, is now able to establish full diplomatic relations with Israel, with great advantages both to its economy and military security. For the Trump administration, the Abraham Accord represents the President’s first real foreign policy achievement, a victory especially welcome so close to the U.S. elections. This will be popular with the president’s conservative, pro-Israel base, and an achievement that Democrats, Biden in particular, will have difficulties critiquing. Geopolitically, the deal strengthens the informal anti-Iran alliance in the region, increasing pressure on Tehran and strengthening U.S.