Lessons Learned from Christchurch

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Kaiapoi Street Map

Kaiapoi Street Map www.northcanterbury.co.nz www.visitwaimakariri.co.nz 5 19 To Woodend, Kaikoura and Picton North To Rangiora T S S M A I L L I W 2 D R E 62 D I S M A C 29 54 E V A 64 E To Pines, O H and Kairaki 52 U T 39 45 4 57 44 10 7 63 46 47 30 8 32 59 9 38 33 24 65 11 37 66 48 18 16 23 61 26 20 17 27 25 49 13 58 14 12 28 21 51 15 22 31 41 56 50 55 3 1 35 Sponsored by 36 JIM BRYDEN RESERVE LICENSED AGENT REAA 2008 To Christchurch Harcourts Twiss-Keir Realty Ltd. 6 MREINZ Licensed Agent REAA 2008. Phone: 03 327 5379 Email: [email protected] Web: www.twisskeir.co.nz 40 60 © Copyright Enterprise North Canterbury 2016 For information and bookings contact Kaiapoi i-SITE Visitor Centre Kaiapoi Street and Information Index Phone 03 327 3134 Adams Street C5 Cressy Ave F3 Lees Rd A5 Sneyd St F2 Accommodation Attractions Adderley Tce E2 Cridland St E4 Lower Camside Rd B4 Sovereign Bvd C5 1 H3 Blue Skies Holiday & Conference Park 32 F4 Kaiapoi Historic Railway Station Akaroa St G3 Cumberland Pl H2 Magnate Dr C5 Stark Pl D5 2 C4 Grenmora B & B 55 Old North Rd 33 F4 Kaiapoi Museum And Art Gallery Aldersgate St G2 Dale St D4 Magnolia Bvd D5 Sterling Cres C5 3 H3 Kaiapoi on Williams Motel 35 H3 National Scout Museum Alexander Ln F3 Davie St F4 Main Drain Rd D1 Stone St H4 64 F6 Kairaki Beach Cottage 36 H5 Woodford Glen Speedway Allison Cres D5 Dawson Douglas Pl G4 Main North Rd I3 Storer St F1 4 F3 Morichele B & B Alpine Ln F3 Day Pl F5 Mansfield Dr G3 Sutherland Dr C6 5 A5 Pine Acres Holiday Park & Motels Recreation Ansel Pl D5 Doubledays -

REFEREES the Following Are Amongst Those Who Have Acted As Referees During the Production of Volumes 1 to 25 of the New Zealand Journal of Forestry Science

105 REFEREES The following are amongst those who have acted as referees during the production of Volumes 1 to 25 of the New Zealand Journal of Forestry Science. Unfortunately, there are no records listing those who assisted with the first few volumes. Aber, J. (University of Wisconsin, Madison) AboEl-Nil, M. (King Feisal University, Saudi Arabia) Adams, J.A. (Lincoln University, Canterbury) Adams, M. (University of Melbourne, Victoria) Agren, G. (Swedish University of Agricultural Science, Uppsala) Aitken-Christie, J. (NZ FRI, Rotorua) Allbrook, R. (University of Waikato, Hamilton) Allen, J.D. (University of Canterbury, Christchurch) Allen, R. (NZ FRI, Christchurch) Allison, B.J. (Tokoroa) Allison, R.W. (NZ FRI, Rotorua) Alma, P.J. (NZ FRI, Rotorua) Amerson, H.V. (North Carolina State University, Raleigh) Anderson, J.A. (NZ FRI, Rotorua) Andrew, LA. (NZ FRI, Rotorua) Andrew, LA. (Telstra, Brisbane) Armitage, I. (NZ Forest Service) Attiwill, P.M. (University of Melbourne, Victoria) Bachelor, C.L. (NZ FRI, Christchurch) Bacon, G. (Queensland Dept of Forestry, Brisbane) Bagnall, R. (NZ Forest Service, Nelson) Bain, J. (NZ FRI, Rotorua) Baker, T.G. (University of Melbourne, Victoria) Ball, P.R. (Palmerston North) Ballard, R. (NZ FRI, Rotorua) Bannister, M.H. (NZ FRI, Rotorua) Baradat, Ph. (Bordeaux) Barr, C. (Ministry of Forestry, Rotorua) Bartram, D, (Ministry of Forestry, Kaikohe) Bassett, C. (Ngaio, Wellington) Bassett, C. (NZ FRI, Rotorua) Bathgate, J.L. (Ministry of Forestry, Rotorua) Bathgate, J.L. (NZ Forest Service, Wellington) Baxter, R. (Sittingbourne Research Centre, Kent) Beath, T. (ANM Ltd, Tumut) Beauregard, R. (NZ FRI, Rotorua) New Zealand Journal of Forestry Science 28(1): 105-119 (1998) 106 New Zealand Journal of Forestry Science 28(1) Beekhuis, J. -

Investment Prospectus Interconnected | Cutting Edge | World Class

DUNEDIN, NEW ZEALAND INVESTMENT PROSPECTUS Interconnected | Cutting Edge | World Class BUSINESS We consider ourselves very fortunate ARCHITECTURE to be able to easily tap into a wealth of design talent and advice from the Otago Polytechnic that’s really boosted our VAN BRANDENBERG global project. Damien van Brandenberg Architecture Van Brandenberg CONTENTS Dunedin, New Zealand, The Business Centre of the South 03 Dunedin Investment Opportunities 05 Vital Statistics 06 Education and Learning 11 Case Study: Lauguage Perfect 12 Human and Animal Health – Health Technologies 15 Case Study: Pacific Edge Ltd 16 Design Technology and Niche Manufacturing 18 Case Study: Escea 20 Access to Markets 22 Resources – People, Support, Research and Land 24 Investor Returns for Property in Dunedin 26 The Regulatory Environment 29 Business Culture and Lifestyle 30 Further Information, Useful Links and Data Sources 36 The authors have made every effort to ensure that the information contained in this publication is reliable but they make no guarantee of its accuracy and completeness and do not accept liability for any errors. Information may change at any time. The information in this prospectus is of a general nature and should be used as a guide only. The companies referred to in this publication are not an exhaustive list and do not comprise all companies located in the city. 01 As a European migrant moving my family of eight to Dunedin from Germany, I am reassured by the friendliness, practical help and optimism that I have found here. Clearly there are business opportunities to create and build on and a thriving business network. -

Treasury Report T2015/1646: EQC Investment Direction

The Treasury Material Provided to the Public Inquiry into EQC Information Release August 2021 This document has been proactively released by the Treasury on the Treasury website at https://treasury.govt.nz/publications/information-release/public-inquiry-eqc Information Withheld Some parts of this information release would not be appropriate to release and, if requested, would be withheld under the Official Information Act 1982 (the Act). Where this is the case, the relevant sections of the Act that would apply have been identified. Where information has been withheld, no public interest has been identified that would outweigh the reasons for withholding it. Key to sections of the Act under which information has been withheld: [23] 9(2)(a) - to protect the privacy of natural persons, including deceased people [25] 9(2)(b)(ii) - to protect the commercial position of the person who supplied the information or who is the subject of the information [26] 9(2)(ba)(i) - to protect information which is subject to an obligation of confidence or which any person has been or could be compelled to provide under the authority of any enactment, where the making available of the information would be likely to prejudice the supply of similar information, or information from the same source, and it is in the public interest that such information should continue to be supplied [31] 9(2)(f)(ii) - to maintain the current constitutional conventions protecting collective and individual ministerial responsibility [33] 9(2)(f)(iv) - to maintain the current constitutional -

Submission on Selwyn District Council Draft Long Term Plan 2018-2028

Submission on Selwyn District Council Draft Long Term Plan 2018-2028 To: Selwyn District Council Submitter: Community & Public Health A division of the Canterbury District Health Board Attn: Kirsty Peel Community and Public Health C/- Canterbury District Health Board PO Box 1475 Christchurch 8140 Proposal: Selwyn District Council is consulting on their long-term plan to ascertain views on how best to manage infrastructure and services in the district over the next 10 years. Page 1 of 9 Template File Pathway: Y:\CFS\CPHGroups\RMC\SDC\LTP\2018\SelwynLTPSubmissionFinal180503.docx SUBMISSION ON SELWYN DISTRICT COUNCIL DRAFT LONG TERM PLAN Details of submitter 1. Canterbury District Health Board (CDHB) 2. The CDHB is responsible for promoting the reduction of adverse environmental effects on the health of people and communities and to improve, promote and protect their health pursuant to the New Zealand Public Health and Disability Act 2000 and the Health Act 1956. 3. These statutory obligations are the responsibility of the Ministry of Health and, in the Canterbury District, are carried out under contract by Community and Public Health under Crown funding agreements on behalf of the Canterbury District Health Board. General comments 4. Health and wellbeing (overall quality of life) is influenced by a wide range of factors beyond the health sector. These influences can be described as the conditions in which people are born, grow, live, work and age, and are impacted by environmental, social and behavioural factors. They are often referred to as the ‘social determinants of health1. Barton and Grant’s Health Map2 shows how various influences on health are complex and interlinked. -

Comparison of Liquefaction-Induced Land Damage and Geomorphic Variability in Avonside, New Zealand

6th International Conference on Earthquake Geotechnical Engineering 1-4 November 2015 Christchurch, New Zealand Comparison of Liquefaction-induced Land Damage and Geomorphic Variability in Avonside, New Zealand S.H. Bastin1, M.C. Quigley2, K. Bassett3 Abstract Field mapping, LiDAR, and aerial photography are used to map surface liquefaction-induced lateral spreading fissures and aligned sand blow vents formed during the 22 February 2011 Mw 6.2 Christchurch earthquake. Classification of the study area into 164 polygons enables comparison of liquefaction severity metrics including linear liquefaction feature density, ejecta surface area, and horizontal and vertical ground surface displacements with geomorphic metrics including distance from the downslope free-face, surface elevation, sediment type, and the liquefaction potential index (LPI). Preliminary analyses indicate (i) mean fissure density decreases with increasing distance from the free face at distances of 0-50 m, no relationship is observed at distances >50 m, (ii) mean horizontal ground displacement increases with increasing LPI, and (iii) vertical subsidence is invariant with elevation, implying that other factors (e.g. LPI) may contribute to a complex liquefaction strain field. The basic geology and geomorphology are derived from LiDAR and modern river morphology. Comparison of the liquefaction data with geomorphic mapping indicates geomorphic mapping may be applied to determine the likely distribution of sediments susceptible to liquefaction. Introduction Cyclic shearing of loosely consolidated, fluid saturated sediments during earthquake-induced ground motion results in excess pore-water pressures and reduced shear strength in the affected media. Liquefaction occurs as the grain arrangement collapses causing pore water pressures to exceed the confining pressure (Seed & Idriss, 1982; Idriss & Boulanger, 2008). -

Winter-Hawaii/Australia)

CELEBRITY ECLIPSE® — SEPTEMBER 2022 - APRIL 2023 (WINTER-HAWAII/AUSTRALIA) Date Nights Description Ports British Columbia: Vancouver, At Sea, At Sea, At Sea, At Sea, At Sea, Hawaii: Hilo, Hawaii: Kailua Kona, Hawaii: Lahaina, Maui (overnight), 22-Sept-22 11 Hawaii Kilauea Volcano, Hawaii: Honolulu, Oahu Hawaii: Honolulu, Oahu, At Sea, At Sea, At Sea, At Sea, At Sea, French Polynesia: Papeete, Tahiti, French Polynesia: Bora Bora, French Hawaii, Tahiti, 3-Oct-22 18 Polynesia: Moorea, At Sea, At Sea, International Date Line, At Sea, At Sea, At Sea, At Sea, New Zealand: Auckland, New Zealand: Bay of & Bora Bora Islands, At Sea, At Sea, Australia: Sydney 22-Oct-22 Australia: Sydney, At Sea, At Sea, New Zealand: Milford Sound, New Zealand: Doubtful Sound, New Zealand: Dusky Sound, New Zealand: 27-Nov-22 12 New Zealand Dunedin, New Zealand: Christchurch, New Zealand: Wellington, New Zealand: Napier, New Zealand: Tauranga, New Zealand: Auckland, 16-Feb-23 At Sea, At Sea, Australia: Sydney Australia: Sydney, At Sea, Australia: Brisbane, At Sea, Australia: Wills Island (Cruising), Australia: Port Douglas, Australia: Cairns (Yorkey’s 3-Nov-22 11 Great Barrier Reef Knob), Australia: Airlie Beach, Queensland, At Sea, At Sea, Australia: Sydney (overnight) Australia: Sydney, At Sea, At Sea, New Zealand: Milford Sound, New Zealand: Doubtful Sound, New Zealand: Dusky Sound, New 14-Nov-22 13 New Zealand Zealand: Dunedin, New Zealand: Christchurch, New Zealand: Picton, New Zealand: Napier, New Zealand: Tauranga, New Zealand: Auckland, New Zealand: Bay of -

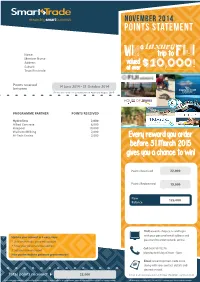

Points Statement

STstatement.pdf 7 10/11/14 2:27 pm NOVEMBER 2014 POINTS STATEMENT a luxury Name win trip to Fiji Member Name Address valued $10 000 Suburb at over , ! Town/Postcode Points received 14 June 2014 - 31 October 2014 between (Points allocated for spend between April and August 2014) FIJI’S CRUISE LINE PROGRAMME PARTNER POINTS RECEIVED Hydroflow 2,000 Allied Concrete 6,000 Hirepool 10,000 Waikato Milking 2,000 Hi-Tech Enviro 2,000 Every reward you order before 31 March 2015 gives you a chance to win! Points Received 22,000 Points Redeemed 15,000 New 125,000 Balance Visit rewards-shop.co.nz and login with your personal email address and Update your account in 3 easy steps: password to order rewards online. 1. Visit smart-trade .co.nz/my-account 2. Enter your personal email address Call 0800 99 76278 3. Set your new password Monday to Friday 8:30am - 5pm. Now you’re ready to get more great rewards! Email [email protected] along with your contact details and desired reward. * Total points received 22,000 Smart Trade International Ltd, PO Box 370, WMC, Hamilton 3240 *If your total points received does not add up, it may be a result of a reward cash top up, points transfer or manual points issue. Please call us if you have any queries. All information is correct as at 31 October 2014. Conditions apply. Go online for more details. GIVE YOUR POINTS A BOOST! Over 300 businesses offering Smart-Trade reward points. To earn points from any of the companies listed below, contact the business, express your desire to earn points and discuss opening an account. -

Christchurch Central Recovery Plan Te Mahere ‘Maraka Ōtautahi’

Christchurch Central Recovery Plan Te Mahere ‘Maraka Ōtautahi’ Sumner beach and Shag rock at dawn, prior to 22 February 2011, from Whitewash Head (Christchurch city and Southern Alps behind) Section Title Here i Christchurch Central Recovery Plan Mihi/Greeting Ka huri nei te moko ki te hau tere Explanation: i heki takamori ai i a Maukatere This mihi is given by the Ngāi Tahu Kia pākia Kā Pākihi o te Rūnanga – Te Ngāi Tūāhuriri – to mawhera mata whenua acknowledge and respect the people who have been lost and those whose I te kūkumetaka mai a Rūaumoko hearts are grieving them, and the I ōna here ki tēnei ao sorrow of this. It also acknowledges the He mate kai tākata, he mate kai losses and pain of all people in greater whenua Christchurch and Canterbury who have suffered as a result of the earthquakes. He mate kai hoki i te kākau momotu kino nei Ngāi Tahu recognise their atua/god Rūaumoko as having pulled his Auē te mamae e! umbilical cord and caused so Nei rā te reo mihi a Tūāhuriri much to break, including land from Tēnei te karaka o te iwi hou the mountains to the sea. While acknowledging the pain, Ngāi Tahu see Kāti Morehu, Kāti Waitaha, Kāti us uniting as one people – the survivors Ōtautahi (mōrehu) of greater Christchurch and Ōtautahi, maraka, maraka Canterbury. The mihi is a call to greater Christchurch to rise up, and together to Kia ara ake anō ai te kāika nei rebuild their city brighter and better. Hei nohoaka mō te katoa Tūturu kia tika, tūturu kia kotahi Tūturu kia whakamaua ake ai kia tina, tina! Haumi e, Hui e, Taiki e! - Te Ngāi Tūāhuriri Rūnanga Christchurch Central Recovery Plan ii Ministerial Foreword He Kōrero Whakataki Rebuilding central Christchurch What could a 21st century city look like if infrastructure and cultural touchstones of is one of the most ambitious its people were given the chance to ‘build a truly international city, one that serves projects in New Zealand’s again’, keeping the good and improving as ‘the gateway to the South Island’. -

Case Study: New Zealand

Case Study: New Zealand Background Because of its geographic location, its dependence on tourism, and the absence of a comprehensive rail network, New Zealand has developed a large international and national airports network over the years. Until 1966, almost all New Zealand important airports were developed by the State and remained under the central Government ownership and management. There are three main international airports. First, Auckland Airport is the busiest and the main international airport. It is the only airport serving the Auckland metropolitan area, which gathers a third of the country’s total population. Second, Wellington International Airport is also a major domestic hub serving mainly business and government. International flights at Wellington Airport are principally from/to Australia. Third, Christchurch International Airport is the major international airport in the South Island, where it acts as the main hub and attracts a significant share of New Zealand’s international tourist traffic. There are other international airports in New Zealand, such as Dunedin, Hamilton, Queenstown, and Palmerston North, which also get flights from other countries (mainly Australia). Other commercial airports serve domestic and regional traffic. Commercialization/privatization: Airports The commercialization of New Zealand’s airports started early. First, the 1961 Joint Airport Scheme established the principles that resulted in both central and local governments jointly owning and operating airport facilities. The objective of this policy was both to benefit from the expertise of local governments on regional economic needs and opportunities, and to make local government directly invest in airport infrastructure. In 1974, 24 airports throughout New Zealand were under a joint venture ownership. -

Changes to Disaster Insurance in New Zealand

437 CHANGES TO DISASTER INSURANCE IN NEW ZEALAND SUMMARY This article is based on material supplied by EQC in its information kit detailing the background to and consequences of the Earthquake Act 1993. After discussing the need for a change in insuring for disasters, the new natural disaster insurance for residential properties - EQCover - is outlined. This is followed by an outline of the phase-out of EQC cover for disaster insurance for commercial and "Special Purpose" properties. The new structure for and role of the Earthquake Commission is also outlined. INTRODUCTION there hadn't even been cleared away, let alone rebuilt. Recently, Parliament passed the Earthquake Commission Act Since its establishment, the EQC has been called on to pay 1993 which will take effect from 1 January 1994. The main out on claims relating to several moderately severe events, points of this legislation are that disaster insurance cover - such as the 1968 Inangahua earthquake, the 1987 Bay of now called EQCover - will cover only residential property Plenty earthquake, and the Abbotsford landslip, and on many and this will insure dweelings for replacement value rather claims arising from milder earthquakes. than the indemnity value. This paper explains why the Earthquake and War Damage Commission (EQC) was set up Why chani:e the old system? back in 1945, what has happened since that time, and why changes are now being made to New Zealand's natural EQC maintains a large fund and has considerable disaster insurance system. reinsurance in place to cover, as much as possible, the insurance costs associated with earthquakes and certain other The rini: of fire disasters in New Zealand. -

THE NEW ZEALAND GAZETTE No. 81

2066 THE NEW ZEALAND GAZETTE No. 81 FIRST SCHEDULE-continued SECOND SCHEDULE-continued LICENCES GRANTED--Continued LICENCES SURRENDERED OR REvoKED--Continuea Licence Place at Which Licence Place at Which Name of Licensee Operative Business is Name of Licensee Cancelled Business was From Carried On From Carried On Mangorei Motor and Trans- Morgan and Hall Ltd. 31/10/63 Christchurch port Engineers Ltd. 1/10/63 New Plymouth Murphy, Thomas George 1/11/63 Wellington Metal Maintenance Ltd. 18/11/63 Auckland Morrall, O. R., and Co. Ltd... 1/5/63 Lower Hutt Paramount Imports Ltd. 2/10/63 Auckland Motor Specialties (Merchants) Prestige Tray Co. (Brian James Ltd. 1/11/63 Newmarket, Mount Dally, trading as) 31/5/63 Auckland Roskill, Otahuhu, Prince Manufacturing (Gordon Takapuna, New Leslie Prince, trading as) .. 31/8/63 Wellington Lynn, Wanganui, Napier, Papakura Salon Sales Ltd. 1/6/63 Auckland Murphy, W. J., and Co. (W. J. Saunders, P. H. and Co. Ltd... 30/9/63 Wellington Murphy, trading as) 4/10/63 Auckland Small, N. W., (Engineers) Ltd. 30/6/63 Auckland Speciality Motor Equipment New Lynn Furniture Co. Ltd. 29/10/63 Auckland (Jack Maxwell Shaw, trading N.Z. Motor Distributors Ltd. 1/12/63 Wellington as) 30/6/63 Christchurch Nicholas Products Ltd. 1/7/63 Auckland S.S.A. Co. Ltd. 31/5/63 Linden Stocks, A. J., and Co. (Arthur Ocean Trading Ltd. 1/10/63 Wellington James Stocks, trading as) .. 31/8/63 Petone Paramount Enterprises Ltd. 3/10/63 Auckland Tatham, D. G., Precision Pay, David, Ltd.