Taubman Template

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Free Luggage Strap

AL MA ON RK TI ET A P N L R A E C T E N I EXCLUSIVE OFFERS W IʻI AIK A ĪKĪ , HAW Free Luggage Strap Travel with aloha no matter where you go! Spend $50 or more in one-day of shopping and dining and receive a free gift with purchase at the International Market Place. Tier 1 - Spend $50 or more and receive a luggage strap. Tier 2 - Spend $150 or more and receive a travel kit. Visit Customer Service for redemption and for more details. *Luggage not included. WELCOME. Enjoy Your Visit. Thank you for visiting International Market Place, a Waikīkī icon. Simply present your Passport to Shopping at any of the participating stores or restaurants to redeem your exclusive offer. We appreciate your visit and hope you enjoy your shopping trip. Please visit the Customer Service Desk if we can assist you with anything during your visit. PASSPORT VALID THROUGH: PASSPORT NO. All offers valid through June 30, 2020. Restrictions may apply, and all offers are subject to change at any time without prior notice. Discount cannot be combined with any other offer, discount, promotion, previous purchase or used online. Must present Passport to Shopping at time of purchase to receive offer. Discounts are applied before tax. While supplies last. No cash value. Store participation may change without notice. Only one discount per person, per day. Not redeemable for cash or store credit. Reproductions of these offers will not be accepted. Offers are good at International Market Place store location only. See store for additional restrictions and details. -

Rockaway (Metro New York), New Jersey Rockaway the Heart of New Jersey

BUSINESS CARD DIE AREA 225 West Washington Street Indianapolis, IN 46204 (317) 636-1600 simon.com Information as of 5/1/16 Simon is a global leader in retail real estate ownership, management and development and an S&P 100 company (Simon Property Group, NYSE:SPG). ROCKAWAY (METRO NEW YORK), NEW JERSEY ROCKAWAY THE HEART OF NEW JERSEY Rockaway Townsquare serves local shoppers in Morris County, home to 496,000 people. — Morris County is the 10th most affluent county in the country, with an average annual household income of $133,000. — The center also serves Warren and Sussex Counties in New Jersey and Northeastern Pennsylvania. — The mall is within close proximity to the headquarters of Avis, Honeywell International, and Quest Diagnostics. SOMETHING FOR EVERYONE Morris County’s only super-regional mall, Rockaway Townsquare is the area’s shopping destination of choice with a diverse retail mix. — A multimillion-dollar renovation was recently completed, providing numerous upgrades and amenities as well as a completely remodeled food court. BY THE NUMBERS Anchored by Four Department Stores Lord & Taylor, Macy’s, JCPenney, Sears Square Footage Rockaway Townsquare spans 1,246,000 square feet. Two Levels Boasting more than 180 specialty stores and eateries. IN GOOD COMPANY Distinctive. Classic. Chic. Many fine brands have chosen Rockaway Townsquare as their preferred location in the Rockaway market. — Abercrombie & Fitch — Aéropostale — Build-A-Bear Workshop — Francesca’s — Hollister Co. — Modell’s Sporting Goods — Swarovski — White House I Black Market POSITIONED TO SUCCEED Rockaway Townsquare is in affluent Morris County in New Jersey, 30 miles west of Manhattan. -

Optiplus New York State Provider List 11

Sheet1 ALBANY BRONX KINGS Albany Bronx Brooklyn Sterling Optical Sterling Optical Cohen's Fashion Optical Crossgates Mall 2168 White Plains Road 189 Montague Street 120 Washington Avenue Ext. (718) 931-0500 (718) 855-2333 (518) 456-4151 BERGEN BRONX KINGS Paramus Bronx Brooklyn Lens Lab Express of Paramus Vision Quest Optical Lens Lab Express 193 Route 17 South 880 White Plains Road 482 86th St (201) 368 -1916 (718) 239-9389 (718) 921-5488 BERGEN BRONX KINGS Bergenfield Bronx Brooklyn New Jersey Eye Center Cohen's Fashion Optical Lens Lab Express of Flatbush 1 North Washington Ave. 3416 Jerome Avenue 972 Flatbush Avenue (201) 384-7333 (718) 325-3160 (718) 826-0005 BRONX BRONX KINGS Bronx Bronx Brooklyn General Vision of Lincoln Optic Zone Lens Lab Express of Graham Avenue Hospital 2882 Third Avenue 28 Graham Ave 234 East 149th Street (718) 402-8300 (718) 486-0117 Room 2-A3 (718) 665-0611 BRONX BRONX KINGS Bronx Bronx Brooklyn Bronx Eyecare Bronx Eye Care Family Vision Center 2374 Grand Concourse 5571 Broadway 1023 Church Avenue (718) 365-6300 (718) 543-2020 (718) 826-1234 BRONX KINGS KINGS Bronx Brooklyn Brooklyn Bronx Eyecare General Vision of Flatbush Vogue Optical 2075 Bartow Avenue 2504 Flatbush Ave 3723 Nostrand Ave (718) 671-5666 (718) 253-7700 (718) 646-6200 BRONX KINGS KINGS Bronx Brooklyn Brooklyn Bronx Eyecare General Vision of Court Street Fulton Vision Center 940 Southern Boulevard 66 Court Street 519 Fulton Street (718) 328-7137 (718) 625-0025 (718) 852-7906 KINGS CAMDEN ESSEX Brooklyn Haddon Heights Irvington Mega Vision Center Dr. -

Shop California Insider Tips 2020

SHOP CALIFORNIA INSIDER TIPS 2020 ENJOY THE ULTIMATE SHOPPING AND DINING EXPERIENCES! Exciting Shopping and Dining Tour Packages at ShopAmericaTours.com/shop-California Purchase with code ShopCA for 10% discount. Rodeo Drive 2 THROUGHOUT CALIFORNIA From revitalizing beauty services, to wine, spirits and chocolate tastings, DFS offers unexpected, BLOOMINGDALE’S complimentary and convenient benefits to its See all the stylish sights – starting with a visit to shoppers. Join the DFS worldwide membership Bloomingdale’s. Since 1872, Bloomingdale’s has program, LOYAL T, to begin enjoying members- been at the center of style, carrying the most only benefits while you travel.DFS.com coveted designer fashions, shoes, handbags, cosmetics, fine jewelry and gifts in the world. MACERICH SHOPPING DESTINATIONS When you visit our stores, you’ll enjoy exclusive Explore the U.S.’ best shopping, dining, and personal touches – like multilingual associates entertainment experiences at Macerich’s shopping and special visitor services – that ensure you feel destinations. With centers located in the heart welcome, pampered and at home. These are just of California’s gateway destinations, immerse a few of the things that make Bloomingdale’s like yourself in the latest fashion trends, hottest no other store in the world. Tourism services cuisine, and an unrivaled, engaging environment. include unique group events and programs, Macerich locations provide a variety of benefits special visitor offers and more, available at our to visitors, including customized shopping, 11 stores in California including San Francisco experiential packages, visitor perks and more. Centre, South Coast Plaza, Century City, Beverly To learn more about Macerich and the exclusive Center, Santa Monica Place, Fashion Valley and visitor experiences, visit macerichtourism.com. -

Alumni News & Notes

et al.: Alumni News & Notes and hosted many Homecoming Weekend here are students who maintain strong activities. "The goals of SUSA include pro T ties to Syracuse University after they viding leadership roles for students, pro graduate. Then there are students like viding career and mentoring opportuni Naomi Marcus 'o2. Just beginning her col ties for students, connecting and network lege career, she has already established a ing with Syracuse alumni, and maintain bond with the SU alumni community. ing traditions and a sense of pride in Marcus is an active member of the Syra Syracuse University," says Setek. cuse University Student Alumni Associa Danie Moss '99 says taking an active tion (SUSA}, a student volunteer organiza role in Homecoming Weekend was a mile tion sponsored by the Office of Alumni Re stone for SUSA. She and past SUSA presi lations that serves as a link between students dent Kristin Kuntz '99 saw it as a good way and the University's 22o,ooo alumni. to promote the organization. "Home For Marcus and her fellow student vol coming is a great opportunity for us to unteers, SUSA's appeal lies in its ability to interact with alumni," Moss says. "People bridge generations. "It sounded like a dif don't always realize how much they can ferent kind of organization," Marcus says. learn from other generations, so an organi "Alumni share their experiences with us, zation like this is mutually beneficial." WITH GRATITUDE AND RESPECT and we keep them up-to-date on what's Senior Alison Nathan has been pleas "Thank you"- two simple words that going on here right now. -

Directory of Participating Optical Panelists

DIRECTORY OF PARTICIPATING OPTICAL PANELISTS September 2019 WWW.UFTWF.ORG Table of Contents GENERAL INFORMATION ...................................... 2 PARTICIPATING PANELISTS ................................. 7 NEW YORK .............................................................. 7 Manhattan ......................................................... 7 Staten Island ..................................................... 11 Bronx ................................................................. 12 Queens .............................................................. 15 Brooklyn ............................................................ 21 Nassau .............................................................. 28 Suffolk ............................................................... 32 Westchester, Hudson Valley & Upstate NY ........................................................ 34 NEW JERSEY .......................................................... 38 CONNECTICUT ....................................................... 42 FLORIDA .................................................................. 42 SUPPLEMENTAL LISTINGS ................................... 46 A complete listing of providers throughout the U.S. is available on our website: www.uftwf.org 1 General Information DESCRIPTION OF BENEFITS (A complete description is available in our Red Apple or on our website at: www.uftwf.org) PLAN OVERVIEW PARTICIPATING OPTICAL CENTERS Members can use the optical plan once every two (2) years by bringing a validated certificate to any of -

Metro Public Hearing Pamphlet

Proposed Service Changes Metro will hold a series of six virtual on proposed major service changes to public hearings beginning Wednesday, Metro’s bus service. Approved changes August 19 through Thursday, August 27, will become effective December 2020 2020 to receive community input or later. How to Participate By Phone: Other Ways to Comment: Members of the public can call Comments sent via U.S Mail should be addressed to: 877.422.8614 Metro Service Planning & Development and enter the corresponding extension to listen Attn: NextGen Bus Plan Proposed to the proceedings or to submit comments by phone in their preferred language (from the time Service Changes each hearing starts until it concludes). Audio and 1 Gateway Plaza, 99-7-1 comment lines with live translations in Mandarin, Los Angeles, CA 90012-2932 Spanish, and Russian will be available as listed. Callers to the comment line will be able to listen Comments must be postmarked by midnight, to the proceedings while they wait for their turn Thursday, August 27, 2020. Only comments to submit comments via phone. Audio lines received via the comment links in the agendas are available to listen to the hearings without will be read during each hearing. being called on to provide live public comment Comments via e-mail should be addressed to: via phone. [email protected] Online: Attn: “NextGen Bus Plan Submit your comments online via the Public Proposed Service Changes” Hearing Agendas. Agendas will be posted at metro.net/about/board/agenda Facsimiles should be addressed as above and sent to: at least 72 hours in advance of each hearing. -

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 Gamestop Dimond Center 80

Store # Phone Number Store Shopping Center/Mall Address City ST Zip District Number 318 (907) 522-1254 GameStop Dimond Center 800 East Dimond Boulevard #3-118 Anchorage AK 99515 665 1703 (907) 272-7341 GameStop Anchorage 5th Ave. Mall 320 W. 5th Ave, Suite 172 Anchorage AK 99501 665 6139 (907) 332-0000 GameStop Tikahtnu Commons 11118 N. Muldoon Rd. ste. 165 Anchorage AK 99504 665 6803 (907) 868-1688 GameStop Elmendorf AFB 5800 Westover Dr. Elmendorf AK 99506 75 1833 (907) 474-4550 GameStop Bentley Mall 32 College Rd. Fairbanks AK 99701 665 3219 (907) 456-5700 GameStop & Movies, Too Fairbanks Center 419 Merhar Avenue Suite A Fairbanks AK 99701 665 6140 (907) 357-5775 GameStop Cottonwood Creek Place 1867 E. George Parks Hwy Wasilla AK 99654 665 5601 (205) 621-3131 GameStop Colonial Promenade Alabaster 300 Colonial Prom Pkwy, #3100 Alabaster AL 35007 701 3915 (256) 233-3167 GameStop French Farm Pavillions 229 French Farm Blvd. Unit M Athens AL 35611 705 2989 (256) 538-2397 GameStop Attalia Plaza 977 Gilbert Ferry Rd. SE Attalla AL 35954 705 4115 (334) 887-0333 GameStop Colonial University Village 1627-28a Opelika Rd Auburn AL 36830 707 3917 (205) 425-4985 GameStop Colonial Promenade Tannehill 4933 Promenade Parkway, Suite 147 Bessemer AL 35022 701 1595 (205) 661-6010 GameStop Trussville S/C 5964 Chalkville Mountain Rd Birmingham AL 35235 700 3431 (205) 836-4717 GameStop Roebuck Center 9256 Parkway East, Suite C Birmingham AL 35206 700 3534 (205) 788-4035 GameStop & Movies, Too Five Pointes West S/C 2239 Bessemer Rd., Suite 14 Birmingham AL 35208 700 3693 (205) 957-2600 GameStop The Shops at Eastwood 1632 Montclair Blvd. -

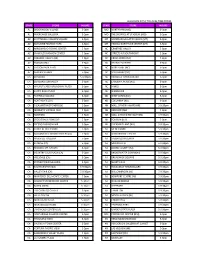

Living in the Elm City a Guide to Getting Around New Haven

Living in the Elm City A Guide to Getting Around New Haven 1 Welcome to ! Welcome to your new home! There’s so much to do in New Haven that some guidance will go a long way toward making sure you get the most out of the Elm City. The Yale Housing Office has prepared this guide for your own use. Included is a comprehensive list of restaurants, pharmacies, bars, entertainment venues, and even barber shops. This is by no means everything that the Elm City has to offer but rather a selection carefully crafted in order to ensure that you know where to find things as different as Cuban food, coffee and toiletries and local parks. If you want to do your own exploring, this guide provides suggestions of places to start. If you want to explore later, but want to start with something a little more structured, consider taking a campus tour. The Yale Visitor Information Center is located at 149 Elm St., and their number is (203) 432-2300. Their office is open from 9:00 a.m. – 4:30 p.m. on weekdays and from 11:00 a.m. – 4:00 p.m. on weekends. Free Campus tours (approximately 1 hour in length) are given Monday through Friday at 10:30 a.m. and 2:00 p.m., and on Saturdays and Sundays at 1:30 p.m. Table of Contents Restaurants . 3-6 Coffee, Sweets & Bakeries . 6-7 Groceries & Household . 7 Pharmacies, Convenience Stores & Shopping Centers . 8 Entertainment, Museums & Theatre . 9 Bars & Nightlife . 10 Barber Shops/Salons & Dry Cleaners . -

State Store Hours State Store Hours Al Brookwood

ALL HOURS APPLY TO LOCAL TIME ZONES STATE STORE HOURS STATE STORE HOURS AL BROOKWOOD VILLAGE 5-9pm MO NORTHPARK (MO) 5-9pm AL RIVERCHASE GALLERIA 5-9pm MO THE SHOPPES AT STADIUM (MO) 5-9pm AZ SCOTTSDALE FASHION SQUARE 5-9pm MT BOZEMAN GALLATIN VALLEY (MT) 5-9pm AZ BILTMORE FASHION PARK 5-9pm MT HELENA NORTHSIDE CENTER (MT) 5-9pm AZ ARROWHEAD TOWNE CENTER 5-9pm NC CRABTREE VALLEY 5-9pm AZ CHANDLER FASHION CENTER 5-9pm NC STREETS AT SOUTHPOINT 5-9pm AZ PARADISE VALLEY (AZ) 5-9pm NC CROSS CREEK (NC) 5-9pm AZ TUCSON MALL 5-9pm NC FRIENDLY CENTER 5-9pm AZ TUCSON PARK PLACE 5-9pm NC NORTHLAKE (NC) 5-9pm AZ SANTAN VILLAGE 5-9pm NC SOUTHPARK (NC) 5-9pm CA CONCORD 5-9:30pm NC TRIANGLE TOWN CENTER 5-9pm CA CONCORD SUNVALLEY 5-9pm NC CAROLINA PLACE (NC) 5-9pm CA WALNUT CREEK BROADWAY PLAZA 5-9pm NC HANES 5-9pm CA SANTA ROSA PLAZA 5-9pm NC WENDOVER 5-9pm CA FAIRFIELD SOLANO 5-9pm ND WEST ACRES (ND) 5-9pm CA NORTHGATE (CA) 5-9pm ND COLUMBIA (ND) 5-9pm CA PLEASANTON STONERIDGE 5-9pm NH MALL OF NEW HAMPSHIRE 5-9:30pm CA MODESTO VINTAGE FAIR 5-9pm NH BEDFORD (NH) 5-9pm CA NEWPARK 5-9pm NH MALL AT ROCKINGHAM PARK 5-9:30pm CA STOCKTON SHERWOOD 5-9pm NH FOX RUN (NH) 5-9pm CA FRESNO FASHION FAIR 5-9pm NH PHEASANT LANE (NH) 5-9:30pm CA SHOPS AT RIVER PARK 5-9pm NJ MENLO PARK 5-9:30pm CA SACRAMENTO DOWNTOWN PLAZA 5-9pm NJ WOODBRIDGE CENTER 5-9:30pm CA ROSEVILLE GALLERIA 5-9pm NJ FREEHOLD RACEWAY 5-9:30pm CA SUNRISE (CA) 5-9pm NJ MONMOUTH 5-9:30pm CA REDDING MT. -

Chapter 3: Socioeconomic Conditions

Chapter 3: Socioeconomic Conditions A. INTRODUCTION This chapter assesses the proposed project’s potential impacts on the socioeconomic character of the area within and surrounding the project site, and within a broader retail trade area. As described in the City Environmental Quality Review (CEQR) Technical Manual, the socioeconomic character of an area includes its population, housing, and economic activities. Socioeconomic changes may occur when a project directly or indirectly affects any of these elements. The proposed project would result in the enlargement an existing commercial center known as the Staten Island Mall (the Mall) with the development of approximately 426,576 gross square feet (gsf) of new uses. As described in Chapter 1, “Project Description,” the Reasonable Worst- Case Development Scenario (RWCDS) for the proposed project includes 298,711-gsf of local and destination retail uses and 54,488 gsf of cinema space. Under the RWCDS, the additional space would be occupied by 33,665 gsf of restaurant space, 50,000 gsf of supermarket space, 75,000 gsf of additional space for the existing Macy’s, and 54,488 gsf of cinema space. In conjunction with the retail enlargement, the proposed project includes the development of a new parking structure, as well as exterior landscape improvements. The overall number of parking spaces provided on the project site would decrease from an existing 5,844 spaces to the proposed 5,477 spaces. In accordance with CEQR Technical Manual guidelines, this analysis considers whether development of the proposed project could result in significant adverse socioeconomic impacts due to: (1) direct displacement of residential population from a project site; (2) indirect displacement of residential population in a study area; (3) direct displacement of existing businesses from a project site; (4) indirect displacement of businesses in a study area due to increased rents; (5) indirect business displacement within a primary trade area due to retail market saturation; and (6) adverse effects on specific industries. -

SOLSTICE Los Angeles, California

SOLSTICE Los Angeles, California EXPERIENCE OUR PROPERTY: SOLSTICE Situated on North La Cienega Boulevard just one block from Beverly Center in the highly sought after West Hollywood submarket will be a high profile, mixed-use development with prime first floor retail opportunities. The property will feature five floors of luxury one- and two-bedroom apartments along with first class amenities, including a rooftop pool and lounge as well as underground parking. WEST HOLLYWOOD 101 BEVERLY LOCATION 405 HILLS 431 N. La Cienega Blvd Los Angeles, CA 90048 PROPERTY SUMMARY 10 32,574 LOT SF 0.75 ACRES 110 DEMOGRAPHICS 3-MILE 5-MILE 10-MILE POPULATION 277,827 871,346 3,055,143 HOUSEHOLDS 139,492 377,108 1,171,361 SOLSTICE | Los Angeles, CA LOCATION 431 N. La Cienega Blvd Los Angeles, CA 90048 PROPERTY SUMMARY 32,574 LOT SF 0.75 ACRES Underground Underground Ground Residential (Typical Floor) Roof Parking (-2) Parking (-1) Floor 20,680 SF GROSS (includes balconies) Level 16,160 SF RENTABLE (does not include balconies) 77 SPACES 60 SPACES 20,484 SF GROSS 19,550 SF GROSS 34,665 SF GROSS 32,000 SF GROSS 9,895 SF RETAIL (14) 1 BR • (2) 2 BR • (3) STUDIO 19 UNITS / FLOOR SM it’s all about the experience STARK ENTERPRISES, headquartered in Cleveland, Ohio, is a full service real estate development company with the highest level of expertise in acquisition, development, leasing, property management, construction, architectural design, landscape architecture and marketing. Balancing new urbanist principles and sustainability practices with economic viability, Stark Enterprises delivers remarkably progressive, next generation mixed-use properties.