July 3, 2017 Dear Governor Inslee, We the Undersigned Request That

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Elway Poll: Two-Thirds of Washingtonians Support Raising Tobacco Sale Age to 21

atg.wa.gov http://www.atg.wa.gov/news/news-releases/elway-poll-two-thirds-washingtonians-support-raising-tobacco-sale-age-21 Elway Poll: Two-thirds of Washingtonians support raising tobacco sale age to 21 Attorney General Bob Ferguson speaks at a press conference announcing an Elway Poll showing overwhelming support among Washingtonians for raising the purchase age for tobacco. Poll finds widespread bipartisan support for AG legislative proposal to combat youth smoking OLYMPIA — A Stuart Elway poll released today shows an overwhelming 65 percent of Washingtonians support raising the sale age of tobacco to 21. This result shows clear public support for Washington State Attorney General Bob Ferguson’s proposal to raise the legal age to purchase tobacco and vapor products to 21. The poll, commissioned by the Campaign for Tobacco-Free Kids and issued by Elway Research, an independent research firm, surveyed 500 registered voters in Washington state from Dec. 28-30, 2015. The results show strong support among both men and women and in every region of the state. Support in Eastern Washington (66 percent) was similar to support in Western Washington (70 percent). Additionally, the poll found strong support across political ideology, with 66 percent of Republicans and 72 percent of Democrats supporting increasing the tobacco sale age. “Smoking is the number one cause of preventable death in the United States,” said Ferguson. “Elway’s poll proves Washingtonians agree: It is time to make this common-sense change to state law and save kids’ lives.” Washington has long been at the forefront of the fight to protect youth from the dangers of smoking . -

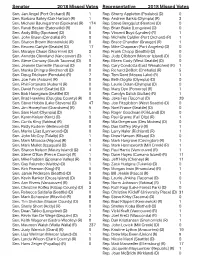

Senator 2018 Missed Votes Representative 2018 Missed Votes Sen

Senator 2018 Missed Votes Representative 2018 Missed Votes Sen. Jan Angel (Port Orchard) (R) 1 Rep. Sherry Appleton (Poulsbo) (D) 0 Sen. Barbara Bailey (Oak Harbor) (R) 1 Rep. Andrew Barkis (Olympia) (R) 3 Sen. Michael Baumgartner (Spokane) (R) 174 Rep. Steve Bergquist (Renton) (D) 0 Sen. Randi Becker (Eatonville) (R) 0 Rep. Brian Blake (Longview) (D) 0 Sen. Andy Billig (Spokane) (D) 0 Rep. Vincent Buys (Lynden) (R) 1 Sen. John Braun (Centralia) (R) 0 Rep. Michelle Caldier (Port Orchard) (R) 1 Sen. Sharon Brown (Kennewick) (R) 0 Rep. Bruce Chandler (Granger) (R) 1 Sen. Reuven Carlyle (Seattle) (D) 17 Rep. Mike Chapman (Port Angeles) (D) 0 Sen. Maralyn Chase (Shoreline) (D) 3 Rep. Frank Chopp (Seattle) (D) 0 Sen. Annette Cleveland (Vancouver) (D) 1 Rep. Judy Clibborn (Mercer Island) (D) 0 Sen. Steve Conway (South Tacoma) (D) 0 Rep. Eileen Cody (West Seattle) (D) 0 Sen. Jeannie Darneille (Tacoma) (D) 0 Rep. Cary Condotta (East Wenatchee) (R) 1 Sen. Manka Dhingra (Redmond) (D) 0 Rep. Richard DeBolt (Chehalis) (R) 5 Sen. Doug Ericksen (Ferndale) (R) 7 Rep. Tom Dent (Moses Lake) (R) 1 Sen. Joe Fain (Auburn) (R) 0 Rep. Beth Doglio (Olympia) (D) 0 Sen. Phil Fortunato (Auburn) (R) 0 Rep. Laurie Dolan (Olympia) (D) 0 Sen. David Frockt (Seattle) (D) 0 Rep. Mary Dye (Pomeroy) (R) 1 Sen. Bob Hasegawa (Seattle) (D) 0 Rep. Carolyn Eslick (Sultan) (R) 1 Sen. Brad Hawkins (Douglas County) (R) 0 Rep. Jake Fey (Tacoma) (D) 29 Sen. Steve Hobbs (Lake Stevens) (D) 47 Rep. Joe Fitzgibbon (West Seattle) (D) 0 Sen. -

August 24, 2020 Larry Carpenter, Chairman Washington Fish And

August 24, 2020 Larry Carpenter, Chairman Kelly Susewind, Director Washington Fish and Wildlife Commission Washington Fish and Wildlife Commission 600 Capitol Way N 600 Capitol Way N Olympia, WA 98501 Olympia, WA 98501 [email protected] [email protected] RE: Columbia River Basin Salmon Management Policy (C-3620) Chairman Carpenter and Director Susewind: We have serious concerns with proposed changes to the Commission’s Columbia River Basin Salmon Management Policy (C-3620) that would undo efforts to enhance the conservation and selectivity of Columbia River salmon fisheries under the Oregon-Washington Columbia River reforms. The Commission’s recent actions to undermine the bi-state reforms by returning non-tribal gillnets to the mainstem lower Columbia River have been immensely unpopular with our constituents and comes as several salmon and steelhead populations are in steep decline. The actions have also cost the Department critical support from recreational anglers – a stakeholder group that is key to the long-term financial solvency of the Washington Department of Fish and Wildlife (WDFW). Columbia River basin fisheries require careful, proactive management with 13 species of salmon and steelhead listed under the federal Endangered Species Act (ESA) along with federal requirements dictating the harvest or removal of excess hatchery fish as a condition of continued hatchery operations. These challenges have driven the transition to fishing methods more capable of selectively harvesting hatchery-reared salmon while also providing increased escapement of ESA-listed and weak wild stocks. By design, gillnets are ill-suited for meeting these challenges in the mainstem lower Columbia River’s mixed-stock fisheries where wild and ESA-listed salmon and steelhead are intermingled with fin-clipped hatchery-reared salmon. -

2019 U.S. Political Contribution and Expenditure Policy and Statement

2019 U.S. Political Contribution and Expenditure Policy and Statement The Company’s policy is to participate in public policymaking by informing government officials about our positions on issues significant to the Company and our customers. These issues are discussed in the context of existing and proposed laws, legislation, regulations, and policy initiatives, and include, for example, commerce, intellectual property, trade, data privacy, transportation, and web services. Relatedly, the Company constructively and responsibly participates in the U.S. political process. The goal of the Company’s political contributions and expenditures is to promote the interests of the Company and our customers, and the Company makes such decisions in accordance with the processes described in this political contribution and expenditure policy and statement, without regard to the personal political preferences of the Company’s directors, officers, or employees. Click here for archives of previous statements. Approval Process The Company’s Vice President of Public Policy reviews and approves each political contribution and expenditure made with Company funds or resources to, or in support of, any political candidate, political campaign, political party, political committee, or public official in any country, or to any other organization for use in making political expenditures, to ensure that it is lawful and consistent with the Company’s business objectives and public policy priorities. The Company’s Senior Vice President for Global Corporate Affairs and the Senior Vice President and General Counsel review all political expenditures. In addition, the Audit Committee of the Board of Directors annually reviews this political contribution and expenditure policy and statement and a report on all of the Company’s political contributions and expenditures, including any contributions made to trade associations or 501(c)(4) social welfare organizations. -

Gun Responsibility Scorecard !

Paid for by Alliance for Gun Responsibility | PO Box 21712 | Seattle, WA 98111 | (206) 659-6737 | [email protected] Prsrt Std US Postage PAID Publishers Mailing Service UNPRECEDENTED PROGRESS IN 2017 In 2017, a record number of bi-partisan legislators sponsored gun responsibility legislation. Two of our priority bills, including Law Enforcement and Victim Safety, passed with overwhelming majorities and have been signed into law. Looking to the future, we need to build on this momentum in partnership with our legislative champions, to create a gun responsibility majority in the Legislature and pass commonsense laws that help make our communities and families safe. THANK YOU TO OUR STARS! These Legislators Were True Leaders In Prime Sponsoring Gun Responsibility Legislation. Sen. Jamie Pedersen Sen. Patty Kudererr Sen. David Frockter Sen. Guy Palumboer 2017 Rep. Ruth Kagi Rep. Laurie Jinkins Rep. Drew Hansen Rep. Dave Hayes Rep. Tann Senn To Learn More Or Get Involved, Visit GUN RESPONSIBILITY gunresponsibility.org SCORECARD Paid for by Alliance for Gun Responsibility | PO Box 21712 | Seattle, WA 98111 | (206) 659-6737 | [email protected] 2017 GUN RESPONSIBILITY Senator LD VOTE Sponsorship Legislative Community Overall Grade State Representative LD VOTE Sponsorship Legislative Community Overall Grade State Representative LD VOTE Sponsorship Legislative Community Overall Grade Grade Grade Grade Grade Grade Trajectory Grade Grade Grade Grade Grade Trajectory Grade Grade Grade Grade Grade Trajectory LEGISLATIVE SCORECARD Guy Palumbo 1 100.00% 15.00 15.00 15.00 A+ n/a Derek Stanford 1 100.00% 13.50 14.25 15.00 A Joyce McDonald 25 100.00% 15.00 15.00 15.00 D n/a Randi Becker 2 100.00% N/A 9.00 0.00 C Shelley Kloba 1 100.00% 12.75 14.25 14.25 A n/a Melanie Stambaugh 25 100.00% N./A 0.00 0.00 D Andy Billig 3 100.00% 14.25 14.40 14.25 A Andrew Barkis 2 100.00% N/A 9.00 0.00 C n/a Michelle Caldier 26 100.00% N/A 7.50 9.00 B 2017 LEGISLATOR GRADES – Legislative leadership Mike Padden 4 100.00% N/A 9.00 0.00 C J.T. -

Child Care in COVID-19 Economic Relief

Legislative Building Washington State Legislature Olympia, WA 98504-0600 March 23, 2020 The Honorable Patty Murray, U.S. Senator The Honorable Maria Cantwell, U.S. Senator The Honorable Suzan DelBene, U.S. Rep. The Honorable Derek Kilmer, U.S. Rep. The Honorable Rick Larsen, U.S. Rep. The Honorable Pramila Jayapal, U.S. Rep. The Honorable Jaime Herrera Beutler, U.S. Rep. The Honorable Kim Schrier, U.S. Rep. The Honorable Dan Newhouse, U.S. Rep. The Honorable Adam Smith, U.S. Rep. The Honorable Cathy McMorris Rodgers, U.S. Rep. The Honorable Denny Heck, U.S. Rep. United States Senate House of Representatives U.S. Capitol U.S. Capitol Washington, DC 20510 Washington, DC 20515 Dear Colleagues in Washington State’s Congressional Delegation: Thank you for all you are doing in this unprecedented time. As you consider any additional COVID-19 economic relief packages, we, the undersigned elected leaders of Washington State, write to respectfully request significant investments in and attention to the challenges facing child care. Here in Washington State and across the country, the child care industry is providing critical services enabling medical professionals, first responders, and other essential workers to provide for communities in our time of greatest need. And yet, the infrastructure of this critical system is crumbling in front of us and threatening our ability to recover from COVID-19 now and in the future. According to Child Care Aware of Washington, our state has already lost 143 child care centers, 105 family child care homes, and 19 school-age-only child care programs to COVID-19 related closures -- totaling a loss of 12,000 child care slots. -

State Small Dollar Rule Comments

State Small Dollar Rule Comments All State Commenters State Associations Florida, Georgia, Indiana, Kansas, Louisiana, Nebraska, Nevada, North Dakota, Oklahoma, • AL // Alabama Consumer Finance Association South Carolina, South Dakota, Tennessee, Texas, • GA // Georgia Financial Services Association Utah, West Virginia, Wisconsin • ID // Idaho Financial Services Association • IL // Illinois Financial Services Association State Legislators • IN // Indiana Financial Services Association • MN // Minnesota Financial Services Association • MO // Missouri Installment Lenders Association; • AZ // Democratic House group letter: Rep. Stand Up Missouri Debbie McCune Davis, Rep. Jonathan Larkin, • NC // Resident Lenders of North Carolina Rep. Eric Meyer, Rep. Rebecca Rios, Rep. Richard • OK // Independent Finance Institute of Andrade, Rep. Reginald Bolding Jr., Rep. Ceci Oklahoma Velasquez, Rep. Juan Mendez, Rep. Celeste • OR // Oregon Financial Services Association Plumlee, Rep. Lela Alston, Rep. Ken Clark, Rep. • SC // South Carolina Financial Services Mark Cardenas, Rep. Diego Espinoza, Rep. Association Stefanie Mach, Rep. Bruce Wheeler, Rep. Randall • TN // Tennessee Consumer Finance Association Friese, Rep. Matt Kopec, Rep. Albert Hale, Rep. • TX // Texas Consumer Finance Association Jennifer Benally, Rep. Charlene Fernandez, Rep. • VA // Virginia Financial Services Association Lisa Otondo, Rep. Macario Saldate, Rep. Sally Ann • WA // Washington Financial Services Association Gonzales, Rep. Rosanna Gabaldon State Financial Services Regulators -

2016 Lilly Report of Political Financial Support

16 2016 Lilly Report of Political Financial Support 1 16 2016 Lilly Report of Political Financial Support Lilly employees are dedicated to innovation and the discovery of medicines to help people live longer, healthier and more active lives, and more importantly, doing their work with integrity. LillyPAC was established to work to ensure that this vision is also shared by lawmakers, who make policy decisions that impact our company and the patients we serve. In a new political environment where policies can change with a “tweet,” we must be even more vigilant about supporting those who believe in our story, and our PAC is an effective way to support those who share our views. We also want to ensure that you know the story of LillyPAC. Transparency is an important element of our integrity promise, and so we are pleased to share this 2016 LillyPAC annual report with you. LillyPAC raised $949,267 through the generous, voluntary contributions of 3,682 Lilly employees in 2016. Those contributions allowed LillyPAC to invest in 187 federal candidates and more than 500 state candidates who understand the importance of what we do. You will find a full financial accounting in the following pages, as well as complete lists of candidates and political committees that received LillyPAC support and the permissible corporate contributions made by the company. In addition, this report is a helpful guide to understanding how our PAC operates and makes its contribution decisions. On behalf of the LillyPAC Governing Board, I want to thank everyone who has made the decision to support this vital program. -

Washington State Legislature Olympia, WA 98504-0482

Legislative Building Washington State Legislature Olympia, WA 98504-0482 September 28, 2016 Richard Cordray, Director Consumer Financial Protection Bureau 1700 G Street N.W. Washington D.C. 20552 Dear Director Cordray, RE: Docket No. CFPB-2016-0025 or RIN 3170-AA40 Thank you for your leadership of the Consumer Financial Protection Bureau. Your agency has helped millions of consumers in the financial sector who just need a fair playing field. We appreciate your work and your focus to your mission. We greatly appreciate the recent release of draft rules concerning small loans and we applaud your goal of “proposing strong protections aimed at ending payday debt traps.” As you know, Washington State reformed our payday lending regulations in 2009 with our law going in to effect in 2010. Since that time, according to the Department of Financial Institutions 2014 report, consumers in Washington have saved over $666 million in fees that would have otherwise been paid to payday lenders. These savings are the result of consumers being able to escape the cycle of debt often caused by payday loans. The Washington law curbs the worst elements of debt traps; loan volume, time in debt, and loan size are all down from pre-reform levels. Payday loan volume has fallen by over 75%, and the amount of time that a typical borrower is indebted has fallen by 50% (down from 161 days in 2009 to 83 days in 2014). Although Washington payday loans can be as large as $700, the typical loan size has continued to fall since the enactment of the reforms (from $412 in 2009 to $389 in 2014). -

2017 Regular Session

Legislative Hotline & ADA Information Telephone Directory and Committee Assignments of the Washington State Legislature Sixty–fifth Legislature 2017 Regular Session Washington State Senate Cyrus Habib . .President of the Senate Tim Sheldon . .President Pro Tempore Jim Honeyford . Vice President Pro Tempore Hunter G . Goodman . Secretary of the Senate Pablo G . Campos . .Deputy Secretary of the Senate Washington House of Representatives Frank Chopp . Speaker Tina Orwall . Speaker Pro Tempore John Lovick . Deputy Speaker Pro Tempore Bernard Dean . Chief Clerk Nona Snell . Deputy Chief Clerk 65th Washington State Legislature 1 Members by District District 1 District 14 Sen . Guy Palumbo, D Sen . Curtis King, R Rep . Derek Stanford, D Rep . Norm Johnson, R Rep . Shelley Kloba, D Rep . Gina R . McCabe, R District 2 District 15 Sen . Randi Becker, R Sen . Jim Honeyford, R Rep . Andrew Barkis, R Rep . Bruce Chandler, R Rep . J T. Wilcox, R Rep . David Taylor, R District 3 District 16 Sen . Andy Billig, D Sen . Maureen Walsh, R Rep . Marcus Riccelli, D Rep . William Jenkin, R Rep . Timm Ormsby, D Rep . Terry Nealey, R District 4 District 17 Sen . Mike Padden, R Sen . Lynda Wilson, R Rep . Matt Shea, R Rep . Vicki Kraft, R Rep . Bob McCaslin, R Rep . Paul Harris, R District 5 District 18 Sen . Mark Mullet, D Sen . Ann Rivers, R Rep . Jay Rodne, R Rep . Brandon Vick, R Rep . Paul Graves, R Rep . Liz Pike, R District 6 District 19 Sen . Michael Baumgartner, R Sen . Dean Takko, D Rep . Mike Volz, R Rep . Jim Walsh, R Rep . Jeff Holy, R Rep . Brian Blake, D District 7 District 20 Sen . -

WSLC Legislative Report Washington State Labor Council Report and Voting Record from the 2014 Session of the State Legislature

Washington State Labor Council, AFL-CIO Non-Profit Org. 314 First Avenue West US Postage PAID Seattle, WA 98119 AFL-CIO Seattle, WA Permit No. 1850 2014 WSLC Legislative Report Washington State Labor Council report and voting record from the 2014 session of the State Legislature Senate GOP, GRIDLOCK AGAIN Tom just say ‘no’ In 2013, two erstwhile Democrats wage theft to electricians’ certification, bipartisan 90-7 vote. to progress, jobs traded control of the Washington State in most cases without a public hearing. Instead, Senate Republicans spent Senate to Republicans in exchange for For a second straight session, Senate the 2014 session launching aggressive The highlight of the 2014 legisla- better job titles and bigger offices. Republicans refused to allow a vote on attacks on labor standards and public tive session was Feb. 26 when Gov. In 2014, the real consequences of a desperately needed House-approved employees. Pushed by national right- Jay Inslee signed the “DREAM Act” those partisan political machinations are transportation package. GOP leaders wing groups, these bills had little chance into law. This creates the opportunity clearer than ever. Progressive policies talked (a lot) about “reforming” trans- of passage in blue Washington. It was all for children of undocumented immi- and job-creating infrastructure invest- portation first, but never produced a pro- about election-year posturing. grant workers to receive State Need ments supported by both Gov. Jay Inslee posal their own caucus could support. As you’ll read throughout this WSLC Grants to attend and the Democratic-controlled House Right up to the session’s final day, Legislative Report, voters in Washington public institu- were blocked by Senate Republicans. -

2020 Election – FINAL RESULTS

2020 Election – FINAL RESULTS In the 2020 Washington State elections, Grandmothers Against Gun Violence endorsed Gov. Inslee, Attorney General Bob Ferguson, 58 incumbents and 35 challengers for the House and Senate. They all have demonstrated by words and actions their commitment to finding ways to reduce gun violence. The following is a list of the 67 successful candidates in the State Legislature. Location: Counties LD - Chamber Position Name LD01 - HOUSE 1 Davina Duerr Western: King and LD01 - HOUSE 2 Shelley Kloba Snohomish LD01 - SENATE S Derek Stanford LD03 - HOUSE 1 Marcus Riccelli Eastern: Spokane LD03 - HOUSE 2 Timm Ormsby LD03 - SENATE S Andy Billig LD05 - HOUSE 1 Bill Ramos Western: King LD05 - HOUSE 2 Lisa Callan LD05 - SENATE S Mark Mullet LD11 - HOUSE 1 David Hackney Western: King LD11 - HOUSE 2 Steve Bergquist LD11 - SENATE S Bob Hasegawa Western: LD21 - HOUSE 1 Strom Peterson Snohomish LD21 - HOUSE 2 Lillian Ortiz-Self LD22 - HOUSE 1 Laurie Dolan Western: Thurston LD22 - HOUSE 2 Jessica Bateman LD22 - SENATE S Sam Hunt LD23 - HOUSE 1 Tarra Simmons Western: Kitsap LD23 - HOUSE 2 Drew Hansen LD23 - SENATE S Christine Rolfes Western: Clallam, LD24 - HOUSE 1 Mike Chapman Jefferson LD24 - HOUSE 2 Steve Tharinger Location: Counties LD – Chamber Position Name LD27 - HOUSE 1 Laurie Jinkins Western: Pierce LD27 - HOUSE 2 Jake Fey LD27 - SENATE S Jeannie Darneille LD28 - HOUSE 2 Daniel Bronoske Western: Pierce LD28 - SENATE S T'wina Nobles LD29 - HOUSE 1 Melanie Morgan Western: Pierce LD29 - HOUSE 2 Steve Kirby Western: King, LD30